Deck 10: Partnership Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 10: Partnership Taxation

1

On August 31,2011,Roberta acquired a 20 percent interest in Zelkova Company,a partnership,by contributing property with an adjusted basis of $8,500 and a fair market value of $15,000.The property was subject to a mortgage of $10,000,which was assumed by Zelkova Company.What is Roberta's basis in her partnership interest in Zelkova Company immediately after the partnership contribution?

A)$500

B)$3,000

C)$6,500

D)$7,000

E)$8,500

A)$500

B)$3,000

C)$6,500

D)$7,000

E)$8,500

A

2

On September 30,2011,Amber was admitted to partnership in the firm of Waves and Grain.Her contribution to capital consisted of 1,000 shares of stock in Biotech Corporation,which she bought in 2002 for $15,000 and which had a fair market value of $45,000 on September 30,2011.Amber's interest in the partnership's capital and profits is 40 percent.On September 30,2011,the fair market value of the partnership's net assets (after Amber was admitted)was $112,500,and profit for the 3 months ended December 31,2011 was $6,000.What is Amber's taxable gain in 2011 on the exchange of stock for her partnership interest?

A)$12,000

B)$30,000 ordinary income

C)$30,000 long-term capital gain

D)$2,400

E)$0 gain or loss

A)$12,000

B)$30,000 ordinary income

C)$30,000 long-term capital gain

D)$2,400

E)$0 gain or loss

E

3

An equal partnership is formed by Romero and Geraldo.Romero contributes cash of $20,000 and a building with a fair market value of $135,000,adjusted basis of $65,000,and subject to a liability of $80,000.Geraldo contributes cash of $75,000.What amount of gain must Romero recognize as a result of this transaction and what is Romero's basis in his partnership interest immediately after formation of the partnership?

A)$5,000 and $85,000

B)$5,000 and $45,000

C)$0 and $45,000

D)$0 and $85,000

E)$85,000 and $42,500

A)$5,000 and $85,000

B)$5,000 and $45,000

C)$0 and $45,000

D)$0 and $85,000

E)$85,000 and $42,500

C

4

An advantage of a limited liability corporation (LLC)is:

A)The treatment of limited liability corporations is the same no matter what state it operates in.

B)The income and losses are taxed to the LLC.

C)There are a limited number of court cases to provide guidance on the tax treatment of the LLC.

D)For security law purposes,many of the accounting and legal requirements are avoided.

A)The treatment of limited liability corporations is the same no matter what state it operates in.

B)The income and losses are taxed to the LLC.

C)There are a limited number of court cases to provide guidance on the tax treatment of the LLC.

D)For security law purposes,many of the accounting and legal requirements are avoided.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Sagretia Associates is a partnership with a September 30 year end.For the fiscal year ended September 30,2011,Sagretia Associates reported ordinary income of $120,000,after deducting guaranteed payments.South,a calendar year taxpayer,is a 25 percent partner in the partnership and received $2,500 monthly as a guaranteed payment for the calendar year 2010,and $2,800 monthly for the calendar year 2011.What is the total income from the partnership that South should report on his 2011 individual income tax return?

A)$30,000

B)$60,000

C)$62,400

D)$62,700

E)$63,600

A)$30,000

B)$60,000

C)$62,400

D)$62,700

E)$63,600

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Each of the following items needs to be reported separately to the partners of a partnership,except for:

A)Depreciation expense.

B)Charitable contributions.

C)Dividend income.

D)Capital losses.

A)Depreciation expense.

B)Charitable contributions.

C)Dividend income.

D)Capital losses.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Partnerships:

A)Must register in the state in which they are formed if they are general partnerships.

B)Are classified as limited partnerships when they have at least one general partner and at least one limited partner.

C)Are taxed at the partnership level and then at the partners' level.

D)Income is taxed to the partners when the partnership distributes cash to its partners.

A)Must register in the state in which they are formed if they are general partnerships.

B)Are classified as limited partnerships when they have at least one general partner and at least one limited partner.

C)Are taxed at the partnership level and then at the partners' level.

D)Income is taxed to the partners when the partnership distributes cash to its partners.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Choose the correct statement.

A)Qualified nonrecourse debt on real estate is considered an amount that is at risk.

B)Any partnership losses not allowed in the current year may be carried back 2 years and forward 5 years.

C)Nonrecourse debt is debt for which a taxpayer is personally liable.

D)In general,partners are allowed losses from a business activity equal to their cash and property contributions,plus any profit retained in the business less any liabilities for which the taxpayer is personally liable.

A)Qualified nonrecourse debt on real estate is considered an amount that is at risk.

B)Any partnership losses not allowed in the current year may be carried back 2 years and forward 5 years.

C)Nonrecourse debt is debt for which a taxpayer is personally liable.

D)In general,partners are allowed losses from a business activity equal to their cash and property contributions,plus any profit retained in the business less any liabilities for which the taxpayer is personally liable.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Sam and Steve have equal interests in the capital and profits of the S&S Partnership and are unrelated.On August 31,2011,Sam sold 250 shares of Tourmaline Corporation to the partnership for its fair market value of $7,500.Sam had bought the stock in 2000 at a cost of $12,000.What is Sam's deductible loss for 2011 as a result of the sale of this stock?

A)$0

B)$2,250 long-term capital loss

C)$4,500 long-term capital loss

D)$2,250 ordinary loss

E)$4,500 ordinary loss

A)$0

B)$2,250 long-term capital loss

C)$4,500 long-term capital loss

D)$2,250 ordinary loss

E)$4,500 ordinary loss

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Bonbon receives a current distribution consisting of $5,000 cash plus other property with an adjusted basis to the partnership of $6,000 and a fair market value on the date of the distribution of $12,000.Bonbon has a 10 percent interest in the partnership and her basis in her partnership interest immediately prior to the distribution is $15,000.What is Bonbon's basis in the non-cash property received in the current distribution?

A)$4,000

B)$5,000

C)$6,000

D)$11,000

E)$12,000

A)$4,000

B)$5,000

C)$6,000

D)$11,000

E)$12,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

Roger is a 51 percent partner of Ralph & Associates.Roger sells a building to the partnership for $80,000.If the building had an adjusted basis to Roger of $105,000,how much gain or loss does Roger recognize on this transaction?

A)$25,000 gain

B)$12,750 gain

C)$12,750 loss

D)$25,000 loss

E)$0 gain or loss

A)$25,000 gain

B)$12,750 gain

C)$12,750 loss

D)$25,000 loss

E)$0 gain or loss

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

Casey is a partner in the Slugger Partnership.The partnership sent Casey a Schedule K-1 for its year-ended on September 30,2011.The Schedule K-1 reported Casey's share of net income after guaranteed payments of $60,000 and guaranteed payments to Casey of $6,000 ($500 per month).Casey's share of the partnership's income after guaranteed payments for October 1,2011 through December 31,2011 was $6,000.Also,Casey's guaranteed payments for that time period was $3,000 ($1,000 per month).How much income from the partnership should Casey report on his 2011 individual income tax return?

A)$58,500

B)$66,000

C)$67,500

D)$75,000

A)$58,500

B)$66,000

C)$67,500

D)$75,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

The return for a partnership which has a December 31 year-end is due on:

A)January 31.

B)February 28.

C)March 15.

D)April 15.

A)January 31.

B)February 28.

C)March 15.

D)April 15.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

At the beginning of the year,Leilani contributes property to a partnership in exchange for a 20 percent partnership interest.The property contributed has a fair market value of $60,000 and a basis of $40,000 on the date of the contribution to the partnership.In addition,Leilani receives a 10 percent partnership interest,valued at $30,000,in exchange for services rendered to the partnership in the prior year.The partnership earned $90,000 during the year.What is Leilani's basis in her partnership interest at the beginning of the year and at the end of the year?

A)$40,000 and $70,000

B)$90,000 and 117,000

C)$70,000 and $88,000

D)$70,000 and $97,000

E)$40,000 and $97,000

A)$40,000 and $70,000

B)$90,000 and 117,000

C)$70,000 and $88,000

D)$70,000 and $97,000

E)$40,000 and $97,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Daniel is a 30 percent general partner in ABC Gum.His basis in his partnership interest at the beginning of the year was $1,000.The partnership had no debt at the beginning of the year.This year,the partnership reported a net loss of $10,000.The partnership also took out a $3,000 recourse loan during the year.How much of the loss may Daniel deduct on his tax return?

A)$0

B)$1,000

C)$1,900

D)$3,000

A)$0

B)$1,000

C)$1,900

D)$3,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Manny,a 15 percent partner,Moe,a 30 percent partner,Jack,a 50 percent partner,and Henry,a 5 percent partner,own an auto repair shop together.During 2011,Manny and Moe work in the shop and receive guaranteed payments of $40,000 and $20,000 respectively.Before the guaranteed payment,the auto shop's 2011 net income was $160,000.Please choose the correct statement below.

A)Manny should report total income from the partnership of $40,000 for 2011.

B)Moe should report total income from the partnership of $30,000 for 2011.

C)Jack should report total income from the partnership of $80,000 for 2011.

D)Henry should report total income from the partnership of $5,000 for 2011.

A)Manny should report total income from the partnership of $40,000 for 2011.

B)Moe should report total income from the partnership of $30,000 for 2011.

C)Jack should report total income from the partnership of $80,000 for 2011.

D)Henry should report total income from the partnership of $5,000 for 2011.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is a partnership?

A)A man and a woman who have a common-law marriage and decide to file their tax returns together.

B)Dentists who have decided to share office space.

C)Two gentlemen who have verbally decided to operate a barbershop together.

D)Jim pools his money with his friends to purchase a rental unit near the local college.

A)A man and a woman who have a common-law marriage and decide to file their tax returns together.

B)Dentists who have decided to share office space.

C)Two gentlemen who have verbally decided to operate a barbershop together.

D)Jim pools his money with his friends to purchase a rental unit near the local college.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Bill has basis in his partnership interest of $15,000 before any distributions.The partnership made the following distributions to Bill: $5,000 in cash,a computer system worth $1,000 in which the partnership has basis of $7,000,and a truck worth $10,000 in which the partnership has basis of $21,000.Bill:

A)Needs to report a gain from the distribution of $1,000.

B)Has a basis in his partnership interest of zero after the distributions.

C)Has a basis in the computer of $1,000.

D)Has a basis in the truck of $21,000

A)Needs to report a gain from the distribution of $1,000.

B)Has a basis in his partnership interest of zero after the distributions.

C)Has a basis in the computer of $1,000.

D)Has a basis in the truck of $21,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

John owns a 20 percent interest in J&B Interests,a partnership.His brother,Brian,owns a 35 percent interest in that same partnership,and the remaining 45 percent is owned by an unrelated individual.During 2011,John sells a classic automobile from his personal collection with a basis of $80,000 to J&B Interests for $110,000.The partnership intends to hold the auto as part of its inventory for resale.What is the amount and nature of John's gain or loss on this transaction?

A)$30,000 long-term capital loss

B)$0 gain or loss

C)$30,000 long-term capital gain

D)$30,000 ordinary income

E)$24,000 ordinary income

A)$30,000 long-term capital loss

B)$0 gain or loss

C)$30,000 long-term capital gain

D)$30,000 ordinary income

E)$24,000 ordinary income

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

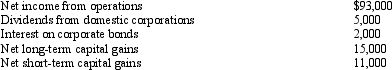

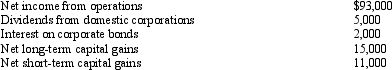

20

The partnership of Nixon and Whittier realized the following items of income during the year ended December 31,2011:  Both of the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for 2011?

Both of the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for 2011?

A)$126,000

B)$100,000

C)$93,000

D)$74,000

E)$60,000

Both of the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for 2011?

Both of the partners are on a calendar year basis.What is the total income which should be reported as ordinary income from business activities of the partnership for 2011?A)$126,000

B)$100,000

C)$93,000

D)$74,000

E)$60,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck