Deck 12: Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/59

Play

Full screen (f)

Deck 12: Not-For-Profit Organizations

1

FASB standards require not-for-profit organizations to classify their resources into three categories: unrestricted,temporarily restricted,and permanently restricted.

True

2

The primary source of authoritative accounting and financial reporting guidance for a private college is the AICPA.

False

3

In accounting for investments,not-for-profits,like businesses,must report their investments at fair value and classify the investments as trading,or available-for-sale,or held-to-maturity.

False

4

FASB Statement No.95 requires not-for-profits to use the direct method in their statements of cash flows.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

5

The basis of accounting used by not-for-profit organizations in their external financial reports is

A)Industry-specific basis of accounting.

B)Cash basis of accounting.

C)Modified accrual basis of accounting.

D)Accrual basis of accounting.

A)Industry-specific basis of accounting.

B)Cash basis of accounting.

C)Modified accrual basis of accounting.

D)Accrual basis of accounting.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

6

FASB Statement No.117 directs that revenues and expenses be reported in a statement of financial position.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

7

FASB Statement No.93 makes the recognition of depreciation on plant and equipment assets optional at the discretion of the not-for-profit.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

8

All not-for-profit organizations,including city-owned museums and two-year community colleges,must adhere to FASB accounting and financial reporting standards.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

9

Whether a not-for-profit's resources are classified as restricted or unrestricted depends on the presence or absence of donor stipulations.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

10

Restricted contributions may be reported as unrestricted if the restriction has been met in the same period as the contribution is made.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

11

Traditional financial ratios,such as measures of liquidity and debt burden,are seldom useful for assessing the fiscal health of not-for-profits.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

12

In the statement of activities,FASB Statement No.117 requires revenues to be reported as increases in one of the three categories of net assets,depending on donor-imposed restrictions;however,all expenses should be reported as decreases in unrestricted net assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

13

Temporarily restricted funds related to plant and equipment generally account only for resources restricted to their purchase or construction,not for the plant and equipment itself,which are typically reported in the unrestricted fund.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

14

Revenues of a not-for-profit organization should be reported as

A)Increases in one of the three categories of net assets.

B)Increases in unrestricted net assets.

C)Increases in temporarily restricted net assets.

D)Increases in permanently restricted net assets.

A)Increases in one of the three categories of net assets.

B)Increases in unrestricted net assets.

C)Increases in temporarily restricted net assets.

D)Increases in permanently restricted net assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

15

Expenses incurred by not-for-profit organizations should be reported as

A)Decreases in one of the three categories of net assets.

B)Decreases in unrestricted net assets.

C)Decreases in temporarily restricted net assets.

D)Decreases in permanently restricted net assets.

A)Decreases in one of the three categories of net assets.

B)Decreases in unrestricted net assets.

C)Decreases in temporarily restricted net assets.

D)Decreases in permanently restricted net assets.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

16

Unlike governments,not-for-profits should not recognize contributions of art collections as revenue unless they capitalize them.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

17

Expenses should be classified as unrestricted or temporarily restricted,consistent with the classification of the resources used to finance them.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

18

Not-for-profits generally should not recognize as revenues contributions that they have agreed to pass along to other specific beneficiaries.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

19

The FASB requires external financial reports to provide information about

A)Donor-imposed restrictions on resources.

B)All restrictions on resources.

C)Donor and creditor restrictions on resources.

D)None of the above.

A)Donor-imposed restrictions on resources.

B)All restrictions on resources.

C)Donor and creditor restrictions on resources.

D)None of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

20

The FASB requires the balance sheets of not-for-profits to display

A)Net assets in four separate categories-unrestricted,temporarily restricted,permanently restricted,and restricted by creditors.

B)Three separate funds-unrestricted,temporarily restricted,and permanently restricted net assets.

C)Six totals-total assets,total liabilities,total net assets,total unrestricted net assets,total temporarily restricted net assets,and total permanently restricted net assets.

D)Unrestricted,temporarily restricted,and permanently restricted retained earnings.

A)Net assets in four separate categories-unrestricted,temporarily restricted,permanently restricted,and restricted by creditors.

B)Three separate funds-unrestricted,temporarily restricted,and permanently restricted net assets.

C)Six totals-total assets,total liabilities,total net assets,total unrestricted net assets,total temporarily restricted net assets,and total permanently restricted net assets.

D)Unrestricted,temporarily restricted,and permanently restricted retained earnings.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

21

In 2014,the change in unrestricted net assets is

A)$0

B)$200,000 increase.

C)$200,000 decrease.

D)$1,000,000 increase.

A)$0

B)$200,000 increase.

C)$200,000 decrease.

D)$1,000,000 increase.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following characteristics most clearly distinguishes an exchange transaction from a contribution?

A)A contribution is always in cash.

B)An exchange transaction is a reciprocal transfer of resources.

C)An exchange transaction is a nonreciprocal transfer of assets.

D)Contributions of assets always have restrictions attached as to their use.

A)A contribution is always in cash.

B)An exchange transaction is a reciprocal transfer of resources.

C)An exchange transaction is a nonreciprocal transfer of assets.

D)Contributions of assets always have restrictions attached as to their use.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

23

Not-for-profit organizations should report interest and dividends earned and restricted for long-term purposes in which of the following cash flows categories?

A)Operating

B)Financing.

C)Capital financing.

D)Investing.

A)Operating

B)Financing.

C)Capital financing.

D)Investing.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

24

In the current year National Pet Charities,which uses fund-type accounting to maintain its books and records,received a $30,000 contribution to help educate people on responsible pet ownership.During the current year,the entry to record this donation is

A)UNRESTRICTED FUND.No entry. RESTRICTED FUND.Debit Cash $30,000;Credit Revenues $30,000.

B)UNRESTRICTED FUND.No entry. RESTRICTED FUND.Debit Cash $30,000;Credit Net assets $30,000.

C)UNRESTICTED FUND.Debit Cash $30,000;Credit Revenues $30,000. RESTRICTED FUND.No entry.

D)UNRESTRICTED FUND.Debit Cash $30,000;Credit Net assets $30,000.

A)UNRESTRICTED FUND.No entry. RESTRICTED FUND.Debit Cash $30,000;Credit Revenues $30,000.

B)UNRESTRICTED FUND.No entry. RESTRICTED FUND.Debit Cash $30,000;Credit Net assets $30,000.

C)UNRESTICTED FUND.Debit Cash $30,000;Credit Revenues $30,000. RESTRICTED FUND.No entry.

D)UNRESTRICTED FUND.Debit Cash $30,000;Credit Net assets $30,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

25

Restricted gifts to not-for-profit organizations

A)Must always be shown as an increase in restricted net assets.

B)Must always be shown as an increase in unrestricted net assets.

C)May be shown as an increase in unrestricted net assets if the restriction is met in the same period.

D)May be shown as an increase in unrestricted net assets at the discretion of management.

A)Must always be shown as an increase in restricted net assets.

B)Must always be shown as an increase in unrestricted net assets.

C)May be shown as an increase in unrestricted net assets if the restriction is met in the same period.

D)May be shown as an increase in unrestricted net assets at the discretion of management.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

26

Revenue from an exchange transaction may be classified as an increase in which class of net assets?

A)Unrestricted net assets.

B)Temporarily restricted net assets.

C)Permanently restricted net assets.

D)Any of the above.

A)Unrestricted net assets.

B)Temporarily restricted net assets.

C)Permanently restricted net assets.

D)Any of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

27

St.Mary's Extended Care Center,a not-for-profit entity,enjoys the services of a group of high-school-age people who each agree to work three afternoons a week for three hours each afternoon performing a variety of patient-related services,such as writing letters for those who are unable to do so,delivering mail to the patient rooms,and pushing wheel-chair patients across the grounds.The services rendered by these young people enhance the quality of life for the residents.They could not be provided if they were not donated because there are not enough resources to do so.The past year the young people donated 5,000 hours in total.The services would have cost $6.00 per hour if they had been purchased but they were worth $10 an hour to St.Mary's.What is the amount of contributed revenue that should be recognized by St.Mary's related to these services?

A)$50,000.

B)$30,000

C)$0.

D)Cannot determine.

A)$50,000.

B)$30,000

C)$0.

D)Cannot determine.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

28

Grace Church,a not-for-profit entity,operates a school in connection with the church.This year members of the church decided to construct a new wing on the school with six classrooms.The church hired an architect and a construction supervisor.The bulk of the labor for construction was donated by church members who were willing workers but not necessarily skilled carpenters.Materials for the construction cost $600,000 and the paid labor was $200,000.The fair value of the completed building is $2 million.When the building is completed what should be the balance in the asset account "Building" and the account "Contributed revenue"?

A)Building $800,000;Contributed Revenue $0.

B)Building $800,000;Contributed Revenue $1,200,000.

C)Building $2 million;Contributed Revenue $1,200,000.

D)Building $2 million;Contributed Revenue $0.

A)Building $800,000;Contributed Revenue $0.

B)Building $800,000;Contributed Revenue $1,200,000.

C)Building $2 million;Contributed Revenue $1,200,000.

D)Building $2 million;Contributed Revenue $0.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

29

The account titled "Resources released from restriction" is reported by a "restricted fund" as a

A)Revenue account.

B)Contra-revenue account.

C)Expense account.

D)Contra-expense account.

A)Revenue account.

B)Contra-revenue account.

C)Expense account.

D)Contra-expense account.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

30

Not-for-profit organizations report their cash flows in which of the following categories?

A)Operating,noncapital financing,capital financing,investing.

B)Operating,noncapital financing,investing.

C)Operating,capital financing,investing.

D)Operating,financing,investing.

A)Operating,noncapital financing,capital financing,investing.

B)Operating,noncapital financing,investing.

C)Operating,capital financing,investing.

D)Operating,financing,investing.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

31

In the current year a not-for-profit entity received a contribution of $100,000 to use for scholarships.The entity had budgeted $400,000 for scholarships in the current year and it disbursed $350,000 for scholarships.The amount the entity can consider as 'released from restriction' in the current year is

A)$0.

B)$100,000.

C)$350,000.

D)$400,000.

A)$0.

B)$100,000.

C)$350,000.

D)$400,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

32

The increase in unrestricted net assets in 2013 as a result of the fund-raising drive is

A)$1,200,000.

B)$1,050,000.

C)$800,000.

D)$250,000.

A)$1,200,000.

B)$1,050,000.

C)$800,000.

D)$250,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

33

The account titled "Resources released from restriction" is reported by an "unrestricted fund" as a

A)Revenue account.

B)Contra-revenue account.

C)Expense account.

D)Contra-expense account.

A)Revenue account.

B)Contra-revenue account.

C)Expense account.

D)Contra-expense account.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

34

The National Association for the Preservation of Wildlife received $10,000 from a benefactor to support the overall objective of the organization.This amount will be recognized as revenue

A)In the period received.

B)In the period spent.

C)Never,because it is not earned.

D)In the period it becomes susceptible to accrual.

A)In the period received.

B)In the period spent.

C)Never,because it is not earned.

D)In the period it becomes susceptible to accrual.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

35

During the annual fund-raising drive,the Cancer Society raised $900,000 in pledges of financial support for general operations.By fiscal year-end,the society had collected $600,000 of the pledges.The society estimates that 10% of the remaining pledges will be uncollectible.The NET amount of revenue the society should recognize during the current year from this pledge drive is

A)$900,000.

B)$870,000.

C)$810,000.

D)$600,000.

A)$900,000.

B)$870,000.

C)$810,000.

D)$600,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

36

The increase in temporarily restricted net assets in 2013 as a result of the fund-raising drive is

A)$1,200,000.

B)$1,050,000.

C)$800,000.

D)$250,000.

A)$1,200,000.

B)$1,050,000.

C)$800,000.

D)$250,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

37

Not-for-profit organizations should report contributions restricted for long-term purposes in which of the following cash flows categories?

A)Operating

B)Financing.

C)Capital financing.

D)Investing.

A)Operating

B)Financing.

C)Capital financing.

D)Investing.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

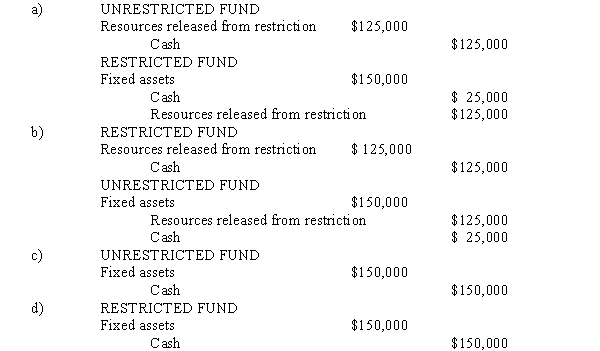

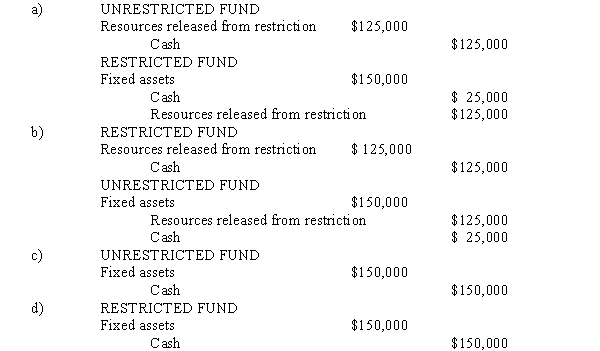

38

In a prior year,United Charities received a $125,000 gift to be used to acquire vans to provide transportation for physically challenged adults.During the current year,United acquired two vans at a cost of $75,000 each.The appropriate entryies)to record the acquisition is

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

39

In 2014,the change in temporarily restricted net assets is

A)$0

B)$200,000 decrease.

C)$200,000 increase.

D)$1,000,000 decrease.

A)$0

B)$200,000 decrease.

C)$200,000 increase.

D)$1,000,000 decrease.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

40

The FASB requires that all not-for-profit organizations report expenses

A)By object.

B)By function.

C)By natural classification.

D)By budget code.

A)By object.

B)By function.

C)By natural classification.

D)By budget code.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

41

"Net assets released from restriction" for a not-for-profit organization is comparable to which of the following for a government?

A)Other financing sources uses)-Nonreciprocal transfer

B)Expenditures

C)Expenses

D)Unassigned fund balance

A)Other financing sources uses)-Nonreciprocal transfer

B)Expenditures

C)Expenses

D)Unassigned fund balance

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

42

During the year,a not-for-profit entity received $30,000 in dividends and $24,000 in interest on its investment portfolio.The entity also accrued $6,000 in interest on the portfolio.The increase in fair value of the portfolio during the year was $8,000.How much should the entity report as investment earnings during the year?

A)$62,000.

B)$54,000.

C)$8,000.

D)$0.

A)$62,000.

B)$54,000.

C)$8,000.

D)$0.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

43

Open Air Conservatory,a not-for-profit entity,held a fund-raising drive to raise money to buy land to provide a habitat for the endangered Sleepy Eagle.A donor pledged $1 million to the project provided that Open Air Conservatory was able to raise an additional $1.5 million from other sources.What entry should Open Air Conservatory make at the time of the $1 million pledge?

A)Debit Pledge receivable $1 million;Credit Unrestricted revenue $1 million.

B)Debit Pledges receivable $1 million;Credit Temporarily restricted revenue $1 million.

C)Debit Pledges receivable $1 million;Credit Temporarily restricted net assets $1 million.

D)No entry is made at the time of the pledge.

A)Debit Pledge receivable $1 million;Credit Unrestricted revenue $1 million.

B)Debit Pledges receivable $1 million;Credit Temporarily restricted revenue $1 million.

C)Debit Pledges receivable $1 million;Credit Temporarily restricted net assets $1 million.

D)No entry is made at the time of the pledge.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

44

The Midwest Circulatory Diseases Society placed an advertisement in prominent publications in the region.The advertisement provided information about symptoms of the diseases and offered practical advice for controlling their immediate effects.The society's accountants estimate that about 75 percent of the advertising copy was devoted to information about the disease and the remainder was an appeal for funds.The advertisement cost $20,000.Using the physical units method of separating joint costs,how much of the cost of the advertisement should be reported as program costs?

A)$20,000.

B)$15,000.

C)$10,000.

D)$5,000.

A)$20,000.

B)$15,000.

C)$10,000.

D)$5,000.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

45

A not-for-profit art museum that has elected not to capitalize its art collection receives a donation of a rare piece of Tlinket Indian art.The donor paid $8,000 for the piece several years ago.Today the piece has an estimated fair value of $50,000.What entry should the art museum make upon receipt of this donation?

A)Debit Collection items $50,000;Credit Donated revenue $50,000.

B)Debit Collection items $8,000;Credit Donated revenue $8,000.

C)Debit Collection items $50,000;Credit Unrestricted net assets $50,000.

D)No entry required.

A)Debit Collection items $50,000;Credit Donated revenue $50,000.

B)Debit Collection items $8,000;Credit Donated revenue $8,000.

C)Debit Collection items $50,000;Credit Unrestricted net assets $50,000.

D)No entry required.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

46

Nelson County Historical museum,a not-for-profit entity that capitalizes its collection items,received a gift of several Civil War artifacts to be used for display and research.The donor found these items while cleaning out the closet of an old house.The fair value is hard to estimate but a dealer in these types of artifacts estimates their value at $2,000.The entry to record this donation is

A)Debit Collection expense,$2,000;Credit Contributions revenue $2,000.

B)Debit Collection items $2,000;Credit Contributions revenue $2,000.

C)No entry is required because the cost to the donor was $0.

D)No entry required because the value of the items is estimated.

A)Debit Collection expense,$2,000;Credit Contributions revenue $2,000.

B)Debit Collection items $2,000;Credit Contributions revenue $2,000.

C)No entry is required because the cost to the donor was $0.

D)No entry required because the value of the items is estimated.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following entities should recognize depreciation expense on its operating statement?

A)Not-for-profit university.

B)Not-for-profit foundation.

C)Not-for-profit hospital.

D)All of the above.

A)Not-for-profit university.

B)Not-for-profit foundation.

C)Not-for-profit hospital.

D)All of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

48

When should a not-for-profit entity recognize pledge revenue that is contingent upon raising a matching amount?

A)When the pledge is made.

B)When the cash is received.

C)When the matching funds have been raised.

D)When the project is completed.

A)When the pledge is made.

B)When the cash is received.

C)When the matching funds have been raised.

D)When the project is completed.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

49

How should receipt of the grant be recorded?

A)Debit Cash;Credit Revenue from contributions unrestricted fund)

B)Debit Cash;Credit Revenue from contributions temporarily restricted fund)

C)Debit Cash;Credit Revenue from contributions permanently restricted fund)

D)No entry required until the grant funds are spent.

A)Debit Cash;Credit Revenue from contributions unrestricted fund)

B)Debit Cash;Credit Revenue from contributions temporarily restricted fund)

C)Debit Cash;Credit Revenue from contributions permanently restricted fund)

D)No entry required until the grant funds are spent.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

50

Music Lovers Foundation,a not-for-profit governed by an independent board,was founded to support the Northern State University Choir until such time as the state legislature adequately funds the choir.When the choir is adequately funded by appropriation,the Foundation may direct resources to other music projects that it deems acceptable.When Music Lovers accepts a contribution from a donor it should debit cash and/or other assets and credit

A)Unrestricted revenue.

B)Temporarily restricted revenue.

C)Liability.

D)It should not make an entry.

A)Unrestricted revenue.

B)Temporarily restricted revenue.

C)Liability.

D)It should not make an entry.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

51

According to AICPA guidance,a not-for-profit organization X)is required to consolidate a related not-for-profit organization Y)in its financial statements when

A)The relationship results from a merger of X and Y.

B)X has a controlling financial interest in Y through direct or indirect ownership of a majority voting interest.

C)X can control Y through a contract or affiliation agreement,even though X does not have a majority ownership or voting interest.

D)Any of the above.

A)The relationship results from a merger of X and Y.

B)X has a controlling financial interest in Y through direct or indirect ownership of a majority voting interest.

C)X can control Y through a contract or affiliation agreement,even though X does not have a majority ownership or voting interest.

D)Any of the above.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

52

The Save the Animals Foundation received a gift of $500,000 from a donor who wanted the gift used to acquire habitat for endangered snails.The money may be invested but all earnings are restricted to habitat acquisition.During the year the entire gift was invested in corporate securities.At year-end,the securities had a value of $501,000.The appropriate way to recognize the change in fair value is

A)Debit Investments $1,000;Credit Unrestricted revenue $1,000.

B)Debit Investments $1,000;Credit Temporarily restricted revenue $1,000.

C)Debit Investments $1,000;Credit Permanently restricted revenue $1,000.

D)No entry should be made until the securities are sold.

A)Debit Investments $1,000;Credit Unrestricted revenue $1,000.

B)Debit Investments $1,000;Credit Temporarily restricted revenue $1,000.

C)Debit Investments $1,000;Credit Permanently restricted revenue $1,000.

D)No entry should be made until the securities are sold.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

53

In a not-for-profit organization,wages and salaries should be recorded

A)As expenses in either a temporarily restricted or an unrestricted fund,depending on the source of the resources.

B)As expenses in a temporarily restricted fund.

C)As expenses in an unrestricted fund.

D)As expenses in an unrestricted fund,with a credit to net assets released from restrictions.

A)As expenses in either a temporarily restricted or an unrestricted fund,depending on the source of the resources.

B)As expenses in a temporarily restricted fund.

C)As expenses in an unrestricted fund.

D)As expenses in an unrestricted fund,with a credit to net assets released from restrictions.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

54

A not-for-profit would include which of the following financial statements in its basic financial statements?

A)Statement of financial position and statement of activities.

B)Statement of financial position,statement of activities,and statement of cash flows.

C)Statement of financial position,statement of activities,statement of cash flows,and statement of functional expenses.

D)Statement of financial position,statement of activities,and statement of functional expenses.

A)Statement of financial position and statement of activities.

B)Statement of financial position,statement of activities,and statement of cash flows.

C)Statement of financial position,statement of activities,statement of cash flows,and statement of functional expenses.

D)Statement of financial position,statement of activities,and statement of functional expenses.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

55

Simplex Games,a not-for-profit entity organized to provide athletic competition opportunities for high school students,utilizes a number of volunteers in carrying out its mission.At the 2014 Games 50 volunteers provided a total of 1,000 hours of service performing tasks such as picking up litter and delivering water to the athletes.A local CPA firm donates its services to prepare the annual tax return and other federal and state required paperwork which must be filed to maintain its status as a tax-exempt organization.During 2014 the CPA firm provided 50 hours of service.If purchased,the CPA services would have cost $60 per hour and the game workers would have cost $6 per hour.How much contributed service revenue should Simplex Games recognize in 2014?

A)$9,000.

B)$6,000.

C)$3,000.

D)$0.

A)$9,000.

B)$6,000.

C)$3,000.

D)$0.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

56

United Charities accepted a contribution from a donor and agreed to transfer the assets to Aid for Friends,a not-for-profit that provides temporary shelter to the homeless.United Charities should debit cash or other assets and credit

A)Unrestricted revenue.

B)Temporarily restricted revenue.

C)Liability to Aid for Friends.

D)United Charities should not make an entry.

A)Unrestricted revenue.

B)Temporarily restricted revenue.

C)Liability to Aid for Friends.

D)United Charities should not make an entry.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

57

A donor pledges $100,000 to the Shakespeare Foundation to be used only to support the summer Shakespeare Theater-an event that has been held every summer for 38 years.This is an example of a

A)Conditional Contribution.

B)Unconditional contribution.

C)Restricted contribution.

D)Unrestricted contribution.

A)Conditional Contribution.

B)Unconditional contribution.

C)Restricted contribution.

D)Unrestricted contribution.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

58

Native Art Museum,a not-for-profit entity that elects not to capitalize its collection items,purchased for $10,000 a wonderful totem pole for display near the door of the museum.As a result of this transaction,which of the following entries should be made?

A)Debit Collection items $10,000;Credit Cash $10,000.

B)Debit Collection expense $10,000;Credit Cash $10,000.

C)Debit Unrestricted net assets $10,000;Credit Cash $10,000.

D)No entry is required.

A)Debit Collection items $10,000;Credit Cash $10,000.

B)Debit Collection expense $10,000;Credit Cash $10,000.

C)Debit Unrestricted net assets $10,000;Credit Cash $10,000.

D)No entry is required.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck

59

The Friends of the Library FOL),a not-for-profit entity,received a gift restricted to the acquisition of a special piece of equipment used to restore books.Late last year FOL acquired the machine at a total cost of $19,000.The machine is estimated to have a useful life of eight years and a salvage value of $3,000.In what fund should FOL make the entry to record the depreciation for the current year?

A)Unrestricted fund.

B)Temporarily restricted fund.

C)Permanently restricted fund.

D)FOL should not recognize depreciation.

A)Unrestricted fund.

B)Temporarily restricted fund.

C)Permanently restricted fund.

D)FOL should not recognize depreciation.

Unlock Deck

Unlock for access to all 59 flashcards in this deck.

Unlock Deck

k this deck