Deck 32: Financial Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 32: Financial Markets

1

The function of financial intermediaries is to transfer purchasing power from

A)Dissavers to consumers.

B)Consumers to savers.

C)Savers to dissavers.

A)Dissavers to consumers.

B)Consumers to savers.

C)Savers to dissavers.

Savers to dissavers.

2

Higher interest rates

A)Reflect a higher opportunity cost of money.

B)Raise the present value of future payments.

C)Lower the future value of current dollars.

A)Reflect a higher opportunity cost of money.

B)Raise the present value of future payments.

C)Lower the future value of current dollars.

Reflect a higher opportunity cost of money.

3

Present discounted value refers to the

A)Future value of today's dollars.

B)Value today of future payments adjusted for inflation.

C)Value today of future payments adjusted for interest accrual.

A)Future value of today's dollars.

B)Value today of future payments adjusted for inflation.

C)Value today of future payments adjusted for interest accrual.

Value today of future payments adjusted for interest accrual.

4

As long as interest-earning opportunities exist,present dollars are worth

A)More than future dollars.

B)Less than future dollars.

C)More than previous periods' dollars.

A)More than future dollars.

B)Less than future dollars.

C)More than previous periods' dollars.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

If the interest rate is 8 percent,then the present discounted value of $100 to be received two years from now is closest to

A)$128.00.

B)$116.00.

C)$86.00.

A)$128.00.

B)$116.00.

C)$86.00.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

The risk premium is the

A)Interest rate paid to savers.

B)Interest rate charged to borrowers.

C)Difference in rates of return on safe and risky investments.

A)Interest rate paid to savers.

B)Interest rate charged to borrowers.

C)Difference in rates of return on safe and risky investments.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

Financial intermediaries make the allocation of resources more efficient by

A)Transferring purchasing power from savers to dissavers.

B)Lending or investing the savings they hold.

C)Reducing search and information costs for savers and investors.

A)Transferring purchasing power from savers to dissavers.

B)Lending or investing the savings they hold.

C)Reducing search and information costs for savers and investors.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

The present discounted value of $100 to be received one year from now,if the interest rate is 2.5 percent,is closest to

A)$98.

B)$100.

C)$103.

A)$98.

B)$100.

C)$103.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

The present discounted value of a future payment will decrease when the

A)Interest rate increases.

B)Future payment is closer to the present.

C)Risk of nonpayment increases.

A)Interest rate increases.

B)Future payment is closer to the present.

C)Risk of nonpayment increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

Market participants are likely to save a portion of current income if they

A)Place a higher value on future consumption than on current consumption.

B)Place a higher value on current consumption than on future consumption.

C)Believe that banks might fail.

A)Place a higher value on future consumption than on current consumption.

B)Place a higher value on current consumption than on future consumption.

C)Believe that banks might fail.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

Risk premiums do all of the following except

A)Help explain why banks charge different customers different interest rates.

B)Allocate limited resources only to the safest investors.

C)Are the difference in the rates of return on risky and safe investments.

A)Help explain why banks charge different customers different interest rates.

B)Allocate limited resources only to the safest investors.

C)Are the difference in the rates of return on risky and safe investments.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

Financial intermediaries

A)Increase search and information costs for savers and investors.

B)Transfer purchasing power from spenders to savers.

C)Spread the risk of investment failure over many individuals.

A)Increase search and information costs for savers and investors.

B)Transfer purchasing power from spenders to savers.

C)Spread the risk of investment failure over many individuals.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

The present discounted value of a future payment will increase when the

A)Interest rate decreases.

B)Future payment is moved further into the future.

C)Risk of nonpayment increases.

A)Interest rate decreases.

B)Future payment is moved further into the future.

C)Risk of nonpayment increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

The supply of loanable funds is determined by all of the following except

A)Time preferences.

B)Demand for loanable funds.

C)Interest rates.

A)Time preferences.

B)Demand for loanable funds.

C)Interest rates.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

Higher interest rates

A)Decrease the quantity of loanable funds.

B)Decrease the level of risk.

C)Increase the quantity of loanable funds.

A)Decrease the quantity of loanable funds.

B)Decrease the level of risk.

C)Increase the quantity of loanable funds.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

The present discounted value of $60,000 to be received at the end of three years when the interest rate is 10 percent is closest to

A)$45,079.

B)$49,587.

C)$60,000.

A)$45,079.

B)$49,587.

C)$60,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

An institution that makes savings available to investors is known as

A)A financial repository.

B)An independent financial association.

C)A financial intermediary.

A)A financial repository.

B)An independent financial association.

C)A financial intermediary.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is an example of a financial intermediary?

A)Banks.

B)The Federal Reserve.

C)The U.S.Treasury.

A)Banks.

B)The Federal Reserve.

C)The U.S.Treasury.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

Lower interest rates

A)Lower the present value of future payments.

B)Raise the future value of current dollars.

C)Reflect a lower opportunity cost of money.

A)Lower the present value of future payments.

B)Raise the future value of current dollars.

C)Reflect a lower opportunity cost of money.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is an example of a financial intermediary?

A)Stock markets.

B)Flea markets.

C)Real estate markets.

A)Stock markets.

B)Flea markets.

C)Real estate markets.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

The owners of which type of firm have the most liability?

A)Corporation.

B)Partnership.

C)Proprietorship.

A)Corporation.

B)Partnership.

C)Proprietorship.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

If the expected rate of return decreases

A)The demand for loanable funds will increase.

B)The demand for loanable funds will decrease.

C)Market participants will save less money.

A)The demand for loanable funds will increase.

B)The demand for loanable funds will decrease.

C)Market participants will save less money.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

The price paid for the use of money is defined as the

A)Rental rate.

B)Interest rate.

C)Profit rate.

A)Rental rate.

B)Interest rate.

C)Profit rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

The intersection of the demand for loanable funds and the supply of loanable funds determines the

A)Real interest rate.

B)Par value.

C)Prevailing interest rate.

A)Real interest rate.

B)Par value.

C)Prevailing interest rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

As the interest rate increases,ceteris paribus,the trade-off between present and future consumption

A)Makes it more appealing to sacrifice current consumption.

B)Is not affected.

C)Encourages less saving.

A)Makes it more appealing to sacrifice current consumption.

B)Is not affected.

C)Encourages less saving.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

In which form of business is a single individual responsible for the repayment of any debts?

A)Proprietorship.

B)Corporation.

C)Partnership.

A)Proprietorship.

B)Corporation.

C)Partnership.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

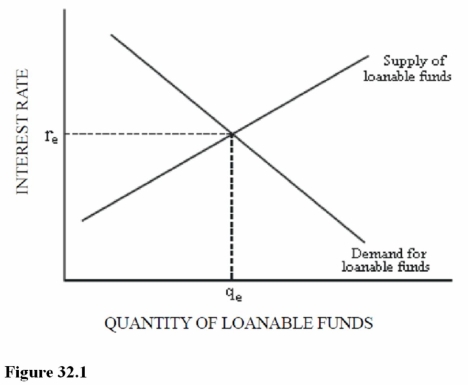

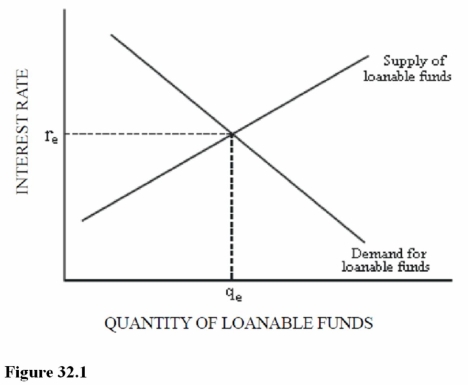

Figure 32.1 represents the market for loanable funds.Which of the following is true at the equilibrium interest rate?

A)The rate of return on capital equals the interest rate.

B)The rate of return on capital is less than the interest rate.

C)The rate of return on capital is greater than the interest rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is the equation for determining an expected value?

A)(1 - Risk factor)× PDV.

B)(Risk factor - 1)× PDV.

C)(1 - Risk factor)÷ PDV.

A)(1 - Risk factor)× PDV.

B)(Risk factor - 1)× PDV.

C)(1 - Risk factor)÷ PDV.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

If the present discounted value of a payment is $1,000,000 and there is a 40 percent chance that the payment will not occur,then the expected value is

A)$600,000.

B)$400,000.

C)$1,000,000.

A)$600,000.

B)$400,000.

C)$1,000,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose Carlos has a 60 percent chance of not collecting $100,000 when his rich uncle dies in 10 years.Juanita wants to buy the rights to this possible inheritance from Carlos.How much is the possible inheritance currently worth to Carlos? Assume the interest rate is 9 percent.

A)$94,695.

B)$25,345.

C)$16,896.

A)$94,695.

B)$25,345.

C)$16,896.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following will cause the demand for loanable funds to increase?

A)The expected profitability of a project declines.

B)The cost of funds increases.

C)The expected rate of return increases.

A)The expected profitability of a project declines.

B)The cost of funds increases.

C)The expected rate of return increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose Regis has a 25 percent chance of not collecting $1,000 in one year.If the interest rate is 10 percent,what is the expected value of the future payment?

A)$750.

B)$682.

C)$227.

A)$750.

B)$682.

C)$227.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

The expected value of a future payment differs from the present discounted value in that the expected value

A)Takes into account the possibility of nonpayment.

B)Uses a lower interest rate in its calculation.

C)Uses a higher interest rate in its calculation.

A)Takes into account the possibility of nonpayment.

B)Uses a lower interest rate in its calculation.

C)Uses a higher interest rate in its calculation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

The owners of which type of firm have the least liability?

A)Corporation.

B)Partnership.

C)Proprietorship.

A)Corporation.

B)Partnership.

C)Proprietorship.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

Figure 32.1 represents the market for loanable funds.The equilibrium interest rate

A)Is less than the rate of return on capital.

B)Is greater than the rate of return on capital.

C)Represents the price paid for the use of money.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

In the loanable funds market,

A)The price is the interest rate.

B)The demand curve reflects the behavior of lenders.

C)The supply curve reflects the behavior of borrowers.

A)The price is the interest rate.

B)The demand curve reflects the behavior of lenders.

C)The supply curve reflects the behavior of borrowers.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

The owners of a corporation are

A)Liable for its debts.

B)Those people who own the bonds issued by the corporation.

C)The shareholders of the corporation's stock.

A)Liable for its debts.

B)Those people who own the bonds issued by the corporation.

C)The shareholders of the corporation's stock.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

As the prevailing interest rate decreases,the opportunity cost of money

A)Increases for both lender and borrower.

B)Increases for the borrower and decreases for the lender.

C)Decreases for both lender and borrower.

A)Increases for both lender and borrower.

B)Increases for the borrower and decreases for the lender.

C)Decreases for both lender and borrower.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

Expected value refers to the

A)Future value of a current payment.

B)Present value of a future payment.

C)Probable value of a future payment.

A)Future value of a current payment.

B)Present value of a future payment.

C)Probable value of a future payment.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

As the uncertainty attached to a future payment _______,the expected value _______.

A)decreases;decreases

B)increases;stays the same

C)decreases;increases

A)decreases;decreases

B)increases;stays the same

C)decreases;increases

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

The price of a stock will increase,ceteris paribus,when

A)Future earnings expectations increase.

B)The interest rate increases.

C)The supply of the stock increases.

A)Future earnings expectations increase.

B)The interest rate increases.

C)The supply of the stock increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

Shares of ownership in a corporation are known as

A)Corporate stock.

B)Corporate bonds.

C)Retained earnings.

A)Corporate stock.

B)Corporate bonds.

C)Retained earnings.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

The most important determinant of how much an individual will pay for a share of stock is

A)The average daily volume for the corporation's shares.

B)The expectation of future profit.

C)How well the CEO is compensated.

A)The average daily volume for the corporation's shares.

B)The expectation of future profit.

C)How well the CEO is compensated.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

The price of a stock will decrease,ceteris paribus,when

A)There is a shortage of the stock at the current price.

B)The interest rate increases.

C)The supply of the stock decreases.

A)There is a shortage of the stock at the current price.

B)The interest rate increases.

C)The supply of the stock decreases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

A corporation can elect to allocate corporate profits into either

A)Interest payments or dividends.

B)Bonds or stocks.

C)Dividends or retained earnings.

A)Interest payments or dividends.

B)Bonds or stocks.

C)Dividends or retained earnings.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

The Dow Jones Industrial Average is an arithmetic average of _____ blue-chip industrial stocks.

A)30

B)50

C)75

A)30

B)50

C)75

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

Dividends are

A)The amount of corporate profit paid out for each share of stock.

B)Profits used for investment in new plants and equipment.

C)An increase in the market value of an asset.

A)The amount of corporate profit paid out for each share of stock.

B)Profits used for investment in new plants and equipment.

C)An increase in the market value of an asset.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

An initial public offering

A)Allows a company to borrow funds for investment and growth.

B)Allows a company to raise money without increasing debt.

C)Indicates the demand for a company's new product.

A)Allows a company to borrow funds for investment and growth.

B)Allows a company to raise money without increasing debt.

C)Indicates the demand for a company's new product.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

A motivation for holding stock is

A)To receive interest payments on the firm's debt.

B)The anticipation of capital gains.

C)To have a direct role in the operation of the corporation.

A)To receive interest payments on the firm's debt.

B)The anticipation of capital gains.

C)To have a direct role in the operation of the corporation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

Ceteris paribus,the price of a stock will definitely increase when the

A)Supply of the stock increases.

B)Prevailing interest rate increases.

C)Demand for the stock increases.

A)Supply of the stock increases.

B)Prevailing interest rate increases.

C)Demand for the stock increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not a reason to hold stock?

A)To receive payments on the firm's debt.

B)To receive potential capital gains.

C)To take part in the selection of the board of directors.

A)To receive payments on the firm's debt.

B)To receive potential capital gains.

C)To take part in the selection of the board of directors.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

The primary economic role of financial markets is to

A)Gain profits for investors.

B)Allocate resources to profitable businesses and away from businesses with losses.

C)Earn dividends for shareholders.

A)Gain profits for investors.

B)Allocate resources to profitable businesses and away from businesses with losses.

C)Earn dividends for shareholders.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

The price of a stock will increase,ceteris paribus,when

A)Future earnings expectations decrease.

B)Consumer confidence increases.

C)The interest rate increases.

A)Future earnings expectations decrease.

B)Consumer confidence increases.

C)The interest rate increases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

Bonds may be issued by the U.S.

A)Congress.

B)Treasury.

C)Federal Reserve Bank.

A)Congress.

B)Treasury.

C)Federal Reserve Bank.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Large swings in stock prices are usually caused by

A)A decrease in interest rates.

B)Widespread changes in expectations.

C)A decrease in the supply of stocks.

A)A decrease in interest rates.

B)Widespread changes in expectations.

C)A decrease in the supply of stocks.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

An increase in the value of an asset,such as a stock,is called

A)Interest.

B)Profit.

C)A capital gain.

A)Interest.

B)Profit.

C)A capital gain.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

The amount of corporate profits not paid out in dividends is known as

A)The par value.

B)Retained earnings.

C)The price/earnings ratio.

A)The par value.

B)Retained earnings.

C)The price/earnings ratio.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

The price of a stock will decrease,ceteris paribus,when

A)Future earnings expectations increase.

B)People move money out of the bond market and look for other options.

C)Terrorists cause people to be fearful.

A)Future earnings expectations increase.

B)People move money out of the bond market and look for other options.

C)Terrorists cause people to be fearful.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

Capital gains are

A)The only motive for purchasing stock.

B)Profits used for investment in new plants and equipment.

C)An increase in the market value of an asset.

A)The only motive for purchasing stock.

B)Profits used for investment in new plants and equipment.

C)An increase in the market value of an asset.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

The first sale to the general public of stock in a corporation is referred to as

A)An original public sale.

B)An initial public offering.

C)A public bond offering.

A)An original public sale.

B)An initial public offering.

C)A public bond offering.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

An In the News article is titled "Where Do Start-ups Get Their Money?" Venture capital is important to an economy because it

A)Slows the pace of innovation and economic growth.

B)Increases the pace of innovation and economic growth.

C)Slows the growth of technology,which serves as an important correction for the economy.

A)Slows the pace of innovation and economic growth.

B)Increases the pace of innovation and economic growth.

C)Slows the growth of technology,which serves as an important correction for the economy.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

As the price of an existing bond increases,

A)The current yield decreases.

B)The par value decreases.

C)The coupon rate decreases.

A)The current yield decreases.

B)The par value decreases.

C)The coupon rate decreases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

Treasury bonds typically have lower coupon rates than corporate bonds because

A)The U.S.Treasury does not earn profits.

B)There is a lower risk that the U.S.Treasury will default.

C)Government regulations keep interest rates on Treasury bonds below market rates.

A)The U.S.Treasury does not earn profits.

B)There is a lower risk that the U.S.Treasury will default.

C)Government regulations keep interest rates on Treasury bonds below market rates.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

Par value is the

A)Face value of a bond.

B)Increase in the market value of an asset.

C)Rate of return on a share of stock.

A)Face value of a bond.

B)Increase in the market value of an asset.

C)Rate of return on a share of stock.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

Suppose a company's bond sold for $100 last month and this month the price is $90.The annual interest payment is $18.The current yield on this bond is

A)20 percent.

B)18 percent.

C)1.8 percent.

A)20 percent.

B)18 percent.

C)1.8 percent.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

How does a recession impact the financial markets?

A)It decreases loanable funds.

B)It increases loanable funds.

C)It decreases risk.

A)It decreases loanable funds.

B)It increases loanable funds.

C)It decreases risk.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

Liquidity is

A)The ability of an asset to be converted to cash.

B)Directly affected by the coupon rate.

C)Not important for bondholders.

A)The ability of an asset to be converted to cash.

B)Directly affected by the coupon rate.

C)Not important for bondholders.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

Changes in expectations or opportunity costs

A)Shift the bond supply and demand curves.

B)Shift the bond supply curve but not the bond demand curve.

C)Shift the bond demand curve but not the bond supply curve.

A)Shift the bond supply and demand curves.

B)Shift the bond supply curve but not the bond demand curve.

C)Shift the bond demand curve but not the bond supply curve.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is true if investors expect greater future profits from a company?

A)The demand for the company's bonds decreases.

B)The price of the company's bonds decreases.

C)The current yield on the company's bonds decreases.

A)The demand for the company's bonds decreases.

B)The price of the company's bonds decreases.

C)The current yield on the company's bonds decreases.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

If a corporation issues bonds that it cannot sell,this is an indication that

A)Expectations of future sales are low.

B)Dividends are too low.

C)The coupon rate is too low.

A)Expectations of future sales are low.

B)Dividends are too low.

C)The coupon rate is too low.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

Venture capitalists

A)Share in the risks but not the rewards of entrepreneurial ideas.

B)Provide entrepreneurial ideas.

C)Are a critical link between entrepreneurial ideas and market reality.

A)Share in the risks but not the rewards of entrepreneurial ideas.

B)Provide entrepreneurial ideas.

C)Are a critical link between entrepreneurial ideas and market reality.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

When a corporation issues a bond,it is

A)Issuing dividends to shareholders.

B)Lending money to the owners of the corporation.

C)Borrowing funds from the initial buyer of the bond.

A)Issuing dividends to shareholders.

B)Lending money to the owners of the corporation.

C)Borrowing funds from the initial buyer of the bond.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

The interest rate set for a bond at the time of issuance is the

A)Coupon rate.

B)Par value.

C)Liquidity rate.

A)Coupon rate.

B)Par value.

C)Liquidity rate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

In return for their financial backing,venture capitalists

A)Are exempt from risk.

B)Share in the profits that may result.

C)Are guaranteed a return on their investment.

A)Are exempt from risk.

B)Share in the profits that may result.

C)Are guaranteed a return on their investment.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

Default refers to the

A)Rate of interest to be paid on a bond.

B)Amount to be repaid when the bond is due.

C)Failure to make interest or principal payments on a bond.

A)Rate of interest to be paid on a bond.

B)Amount to be repaid when the bond is due.

C)Failure to make interest or principal payments on a bond.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

An increased willingness to lend money to a company can be shown by the

A)Demand for loanable funds shifting to the right.

B)Demand for loanable funds shifting to the left.

C)Supply of loanable funds shifting to the right.

A)Demand for loanable funds shifting to the right.

B)Demand for loanable funds shifting to the left.

C)Supply of loanable funds shifting to the right.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

The annual interest payment divided by the bond's price is the

A)Market price.

B)Current yield.

C)Default value.

A)Market price.

B)Current yield.

C)Default value.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

Par value is the

A)Rate of interest to be paid on a bond.

B)Increase in the market value of an asset.

C)Amount to be repaid when the bond is due.

A)Rate of interest to be paid on a bond.

B)Increase in the market value of an asset.

C)Amount to be repaid when the bond is due.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

The initial bond purchaser

A)Earns par value on the bond.

B)Borrows funds directly from the bond issuer.

C)Lends funds directly to the bond issuer.

A)Earns par value on the bond.

B)Borrows funds directly from the bond issuer.

C)Lends funds directly to the bond issuer.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

The advantage to a corporation of issuing bonds instead of stock is that

A)The owners keep control of the company.

B)Bond prices do not fluctuate.

C)The owners do not have to make interest payments on the loan.

A)The owners keep control of the company.

B)Bond prices do not fluctuate.

C)The owners do not have to make interest payments on the loan.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck