Deck 25: Oligopoly

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

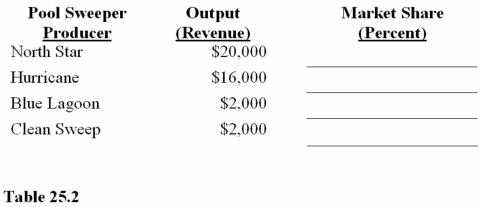

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 25: Oligopoly

1

Concentration ratios tend to overstate the power of some corporations to influence economic outcomes because they measure output

A)For single firms rather than markets.

B)For the whole United States,which is too large a geographic market for some firms or industries.

C)Only for domestic production when the true market boundaries are international for some markets.

A)For single firms rather than markets.

B)For the whole United States,which is too large a geographic market for some firms or industries.

C)Only for domestic production when the true market boundaries are international for some markets.

Only for domestic production when the true market boundaries are international for some markets.

2

The correct ranking of degree of market power (from highest to lowest)is

A)Monopoly,monopolistic competition,perfect competition,oligopoly.

B)Monopoly,monopolistic competition,oligopoly,perfect competition.

C)Monopoly,oligopoly,monopolistic competition,perfect competition.

A)Monopoly,monopolistic competition,perfect competition,oligopoly.

B)Monopoly,monopolistic competition,oligopoly,perfect competition.

C)Monopoly,oligopoly,monopolistic competition,perfect competition.

Monopoly,oligopoly,monopolistic competition,perfect competition.

3

The only market structure in which there is significant interdependence among firms with regard to their pricing and output decisions is

A)Monopolistic competition.

B)Monopoly.

C)Oligopoly.

A)Monopolistic competition.

B)Monopoly.

C)Oligopoly.

Oligopoly.

4

Market power is the ability of a firm to

A)Advertise.

B)Act as a price taker.

C)Control the price and quantity supplied.

A)Advertise.

B)Act as a price taker.

C)Control the price and quantity supplied.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

The concentration ratio measures the

A)Number of plants owned by an oligopoly.

B)Percentage of total profits made by a firm in a specific market.

C)Proportion of total output produced by the four largest producers in a specific market.

A)Number of plants owned by an oligopoly.

B)Percentage of total profits made by a firm in a specific market.

C)Proportion of total output produced by the four largest producers in a specific market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

The soft drink market is dominated by Coke,Pepsi,and very few other firms.The firms often start price wars.The market can best be classified as

A)Perfect competition.

B)Monopolistic competition.

C)Oligopoly.

A)Perfect competition.

B)Monopolistic competition.

C)Oligopoly.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

If an oligopoly market is contestable and new firms enter,the

A)Market power of the former oligopolists will be reduced.

B)Number of firms in the industry will decrease.

C)Former oligopolists will raise their prices.

A)Market power of the former oligopolists will be reduced.

B)Number of firms in the industry will decrease.

C)Former oligopolists will raise their prices.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

A nationwide concentration ratio is likely to understate market power when

A)Firms sell nationally.

B)The true markets are local and small.

C)There is extensive foreign competition.

A)Firms sell nationally.

B)The true markets are local and small.

C)There is extensive foreign competition.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

It is most difficult for new firms to enter

A)A perfectly competitive market.

B)An oligopolistic market.

C)A monopolistically competitive market.

A)A perfectly competitive market.

B)An oligopolistic market.

C)A monopolistically competitive market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following may not characterize an oligopoly?

A)A few firms.

B)No market power.

C)High barriers to entry.

A)A few firms.

B)No market power.

C)High barriers to entry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

A contestable market is

A)A perfectly competitive market.

B)An imperfectly competitive situation that is subject to entry.

C)An imperfectly competitive situation with high barriers to entry.

A)A perfectly competitive market.

B)An imperfectly competitive situation that is subject to entry.

C)An imperfectly competitive situation with high barriers to entry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following industries is likely to have the highest concentration ratio?

A)Corn production.

B)Clothing manufacturing.

C)Video game systems.

A)Corn production.

B)Clothing manufacturing.

C)Video game systems.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following may characterize a monopoly?

A)Substantial market power.

B)Low barriers to entry.

C)Many firms.

A)Substantial market power.

B)Low barriers to entry.

C)Many firms.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

When firms are interdependent,

A)One firm can ignore other companies in the market when making decisions.

B)The profit of one firm depends on how its rivals respond to its strategic decisions.

C)They can act independently of one another.

A)One firm can ignore other companies in the market when making decisions.

B)The profit of one firm depends on how its rivals respond to its strategic decisions.

C)They can act independently of one another.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

The goal of a company in an oligopoly industry is to

A)Increase market share and profits.

B)Obtain the highest price possible.

C)Always follow rivals if they raise price.

A)Increase market share and profits.

B)Obtain the highest price possible.

C)Always follow rivals if they raise price.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

It is easiest for new firms to enter a

A)Perfectly competitive market.

B)Duopoly market.

C)Oligopoly market.

A)Perfectly competitive market.

B)Duopoly market.

C)Oligopoly market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

The number of firms in an oligopoly must be

A)Four.

B)Large enough so that firms cannot coordinate.

C)Small enough so that one firm's decisions have a significant impact on the decisions of the other firms in the industry.

A)Four.

B)Large enough so that firms cannot coordinate.

C)Small enough so that one firm's decisions have a significant impact on the decisions of the other firms in the industry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

There are many corn farmers,each of whom produces the same product.The corn market can best be classified as

A)Monopolistic competition.

B)Perfect competition.

C)Oligopoly.

A)Monopolistic competition.

B)Perfect competition.

C)Oligopoly.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

An industry's market structure refers to

A)The number and size of the firms in the industry.

B)How much firms spend on advertising.

C)What types of products are produced in that industry.

A)The number and size of the firms in the industry.

B)How much firms spend on advertising.

C)What types of products are produced in that industry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is the critical determinant of market power?

A)The number of producers.

B)The size of each firm.

C)The extent of barriers to entry.

A)The number of producers.

B)The size of each firm.

C)The extent of barriers to entry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

Product differentiation

A)Involves charging different prices to different customers.

B)Is commonly practiced in perfect competition and monopoly markets.

C)Involves advertising unique product features.

A)Involves charging different prices to different customers.

B)Is commonly practiced in perfect competition and monopoly markets.

C)Involves advertising unique product features.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose there are only three firms in a market.The largest firm has sales of $500 million,the second-largest has sales of $300 million,and the smallest has sales of $200 million.The market share of the largest firm is

A)50 percent.

B)100 percent.

C)60 percent.

A)50 percent.

B)100 percent.

C)60 percent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

The kinked demand curve explains the observation that in oligopoly markets

A)Rivals match price increases.

B)Rivals do not match price reductions.

C)Prices may not change even in the face of cost increases.

A)Rivals match price increases.

B)Rivals do not match price reductions.

C)Prices may not change even in the face of cost increases.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

If a firm in an oligopoly expands its market share at prevailing prices,its competitors

A)Lose market share.

B)Increase their market share.

C)Ignore the expansion.

A)Lose market share.

B)Increase their market share.

C)Ignore the expansion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

The concentration ratio for an oligopoly is

A)Under 40 percent.

B)Over 60 percent.

C)90 percent.

A)Under 40 percent.

B)Over 60 percent.

C)90 percent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

Market share can be computed by dividing

A)The amount that a buyer buys by the total amount that is produced in the market.

B)Profit by total cost.

C)The amount sold by a single firm by the total sold in the market.

A)The amount that a buyer buys by the total amount that is produced in the market.

B)Profit by total cost.

C)The amount sold by a single firm by the total sold in the market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is true about the kink in the demand curve?

A)It is the result of different rival responses to price increases and reductions.

B)It leads to an explanation of price flexibility.

C)It occurs because rivals do not respond to price reductions.

A)It is the result of different rival responses to price increases and reductions.

B)It leads to an explanation of price flexibility.

C)It occurs because rivals do not respond to price reductions.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

If oligopolists start cutting prices to capture a larger market share,the result will be a

A)Movement up the market demand curve.

B)Movement down the market demand curve.

C)Leftward shift of the market demand curve.

A)Movement up the market demand curve.

B)Movement down the market demand curve.

C)Leftward shift of the market demand curve.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Suppose the larger firm of a duopoly has sales of $400 million and the smaller firm has sales of $100 million.The market share of the larger firm is

A)80 percent.

B)40 percent.

C)20 percent.

A)80 percent.

B)40 percent.

C)20 percent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose the larger firm of a duopoly has sales of $900 million and the smaller firm has sales of $100 million.The market share of the larger firm is

A)90 percent.

B)80 percent.

C)10 percent.

A)90 percent.

B)80 percent.

C)10 percent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

What is the most likely response by rivals when an oligopolist cuts its price to increase its sales?

A)Raise their prices.

B)Ignore the change.

C)Cut their prices.

A)Raise their prices.

B)Ignore the change.

C)Cut their prices.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

RC Cola lost market share in the 1980s due to

A)Its decision not to advertise.

B)Consumers not liking the taste of its colas.

C)Wasting precious resources on advertising.

A)Its decision not to advertise.

B)Consumers not liking the taste of its colas.

C)Wasting precious resources on advertising.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

When a business advertises that its product has unique features that make it superior to other similar products,it is engaging in

A)Price competition.

B)Predatory pricing.

C)Product differentiation.

A)Price competition.

B)Predatory pricing.

C)Product differentiation.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

If a firm is producing at the kink in its demand curve and it decides to decrease its price,according to the kinked demand model

A)It will gain market share.

B)It will lose market share to the firms that do not follow the price decrease.

C)Its market share will not be affected.

A)It will gain market share.

B)It will lose market share to the firms that do not follow the price decrease.

C)Its market share will not be affected.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

The demand curve will be kinked if rival oligopolists

A)Match price increases but not price reductions.

B)Match price reductions but not price increases.

C)Match both price increase and price reductions.

A)Match price increases but not price reductions.

B)Match price reductions but not price increases.

C)Match both price increase and price reductions.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

If a firm is producing at the kink in its demand curve and it decides to increase its price,according to the kinked demand model

A)It will gain market share.

B)It will lose market share to the firms that do not follow the price increase.

C)Its market share will not be affected.

A)It will gain market share.

B)It will lose market share to the firms that do not follow the price increase.

C)Its market share will not be affected.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following industries has the highest concentration ratio?

A)Satellite radio.

B)Cameras.

C)Detergents.

A)Satellite radio.

B)Cameras.

C)Detergents.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

The kinked demand curve explains

A)The consequences of the interdependent behavior of oligopolists.

B)Why oligopolists are more sensitive to cost changes than are competitive markets.

C)Price-fixing along the elastic part of the demand curve and predatory pricing on the inelastic portion.

A)The consequences of the interdependent behavior of oligopolists.

B)Why oligopolists are more sensitive to cost changes than are competitive markets.

C)Price-fixing along the elastic part of the demand curve and predatory pricing on the inelastic portion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

If an oligopolist is going to change its price or output,its initial concern is

A)The response of its competitors.

B)A change in its cost structure.

C)The concentration ratio.

A)The response of its competitors.

B)A change in its cost structure.

C)The concentration ratio.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

Market share is the percentage of total

A)Market output produced by the largest firm in an industry.

B)Market output produced by a single firm.

C)Market output produced by the four largest firms in an industry.

A)Market output produced by the largest firm in an industry.

B)Market output produced by a single firm.

C)Market output produced by the four largest firms in an industry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

Oligopolists have a mutual interest in coordinating production decisions in order to maximize joint

A)Costs.

B)Profits.

C)Revenues.

A)Costs.

B)Profits.

C)Revenues.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

If rival oligopolists completely ignore Mitchell's Tool Company's price changes,then Mitchell's Tool Company's

A)Demand curve will not have a kink.

B)Most profitable strategy will be to raise its price.

C)Demand curve will be less elastic than if rivals matched price changes.

A)Demand curve will not have a kink.

B)Most profitable strategy will be to raise its price.

C)Demand curve will be less elastic than if rivals matched price changes.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

The goal of an oligopoly is to maximize

A)Market share to achieve long-run economic profit.

B)Short-run profit to achieve long-run maximum revenue.

C)Short-run profit to achieve long-run market share.

A)Market share to achieve long-run economic profit.

B)Short-run profit to achieve long-run maximum revenue.

C)Short-run profit to achieve long-run market share.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

General Electric and Westinghouse were convicted of

A)Price-fixing.

B)Marginal cost pricing.

C)Price leadership.

A)Price-fixing.

B)Marginal cost pricing.

C)Price leadership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

The pricing strategy in which one firm is allowed by its rivals to establish the market price for all firms in the market is called

A)Overt collusion.

B)Price leadership.

C)Pattern pricing.

A)Overt collusion.

B)Price leadership.

C)Pattern pricing.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

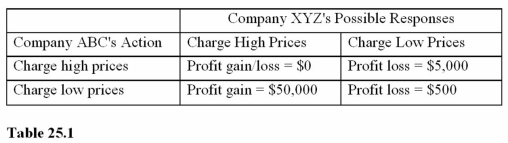

Given the payoff matrix in Table 25.1,if the probability of rivals reducing their price even though you don't is 10 percent,what is the expected payoff for Company ABC not cutting prices?

A)$0.

B)$5.

C)-$500.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

The potential for maximizing total industry profits is greater in oligopolies than in perfect competition because

A)There are fewer firms and each is dependent on the actions of rivals.

B)Firms in an oligopoly are more profitable.

C)There are independent firms in an oligopoly.

A)There are fewer firms and each is dependent on the actions of rivals.

B)Firms in an oligopoly are more profitable.

C)There are independent firms in an oligopoly.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

A payoff matrix shows

A)The profits or losses that result from strategic decisions of one firm and another firm.

B)The payoffs of one firm always choosing to price low.

C)What companies will do no matter what the other firm does.

A)The profits or losses that result from strategic decisions of one firm and another firm.

B)The payoffs of one firm always choosing to price low.

C)What companies will do no matter what the other firm does.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Game theory is

A)The study of price-fixing and collusion.

B)The study of how decisions are made when interdependence exists between firms.

C)An explanation of how oligopolists become monopolists.

A)The study of price-fixing and collusion.

B)The study of how decisions are made when interdependence exists between firms.

C)An explanation of how oligopolists become monopolists.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Sky-High Skywriters raises its price,and the other four firms in the industry raise their prices in response.Coordination in this industry is accomplished by

A)Predatory pricing.

B)Retaliation.

C)Price-fixing.

A)Predatory pricing.

B)Retaliation.

C)Price-fixing.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

Price leadership is a method by which oligopolies can

A)Increase prices without explicit price-fixing.

B)Illegally raise prices.

C)Maintain the "kink" in their demand curves.

A)Increase prices without explicit price-fixing.

B)Illegally raise prices.

C)Maintain the "kink" in their demand curves.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

Open and explicit agreements concerning pricing and output shares transform an oligopoly into a

A)Monopoly.

B)Cartel.

C)Differentiated oligopoly.

A)Monopoly.

B)Cartel.

C)Differentiated oligopoly.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

The pricing strategy in which one firm is allowed to establish the market price for all firms in the market is called

A)Price discrimination.

B)Price leadership.

C)The profit-maximizing rule.

A)Price discrimination.

B)Price leadership.

C)The profit-maximizing rule.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

The study of how decisions are made when strategic interaction between firms exists is known as

A)Game theory.

B)Contestable market theory.

C)Market power theory.

A)Game theory.

B)Contestable market theory.

C)Market power theory.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

Price leadership

A)Results in inflexible prices.

B)Accounts for kinked oligopoly behavior.

C)Helps achieve monopoly profit for the market.

A)Results in inflexible prices.

B)Accounts for kinked oligopoly behavior.

C)Helps achieve monopoly profit for the market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

Temporary price reductions intended to drive out competition are referred to as

A)Predatory pricing.

B)Price-fixing.

C)Price leadership.

A)Predatory pricing.

B)Price-fixing.

C)Price leadership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

Given the payoff matrix in Table 25.1,if the probability of rivals matching a price reduction is 99 percent,what is the expected payoff for a price cut by Company ABC?

A)$0.

B)$5.

C)-$500.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

Borden,Inc. ,which sold milk to Texas Tech University,public schools,and hospitals,paid $8 million in fines for

A)Price-fixing.

B)Marginal cost pricing.

C)Price leadership.

A)Price-fixing.

B)Marginal cost pricing.

C)Price leadership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

If a market changes from oligopoly to perfect competition,then as a result

A)Output should increase in the long run.

B)Fewer resources will be allocated to the market.

C)Profitability should rise in the long run.

A)Output should increase in the long run.

B)Fewer resources will be allocated to the market.

C)Profitability should rise in the long run.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

The pricing strategy in which there is an explicit agreement among producers regarding price is called

A)Price discrimination.

B)Price-fixing.

C)Price leadership.

A)Price discrimination.

B)Price-fixing.

C)Price leadership.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

When oligopoly firms collude to raise prices,

A)Each firm benefits,but society loses.

B)Both the colluding firms and society benefit.

C)Everyone is eventually a loser.

A)Each firm benefits,but society loses.

B)Both the colluding firms and society benefit.

C)Everyone is eventually a loser.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

For an oligopoly,a few firms cannot dominate in the long run unless

A)A cartel is formed.

B)A firm has a high concentration ratio.

C)Barriers to entry exist.

A)A cartel is formed.

B)A firm has a high concentration ratio.

C)Barriers to entry exist.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

When U.S.government regulations that prevent goods from being imported are relaxed,this

A)Causes oligopoly profits to increase.

B)Causes U.S.cartels to become even stronger.

C)Reduces the barriers to entry into U.S.markets.

A)Causes oligopoly profits to increase.

B)Causes U.S.cartels to become even stronger.

C)Reduces the barriers to entry into U.S.markets.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

The Herfindahl-Hirshman Index is

A)Used to identify cases worthy of antitrust concern.

B)A barrier to entry.

C)An example of government failure.

A)Used to identify cases worthy of antitrust concern.

B)A barrier to entry.

C)An example of government failure.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

An imperfection in the market mechanism that prevents optimal outcomes is called

A)Antitrust behavior.

B)Collusion.

C)Market failure.

A)Antitrust behavior.

B)Collusion.

C)Market failure.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

Often antitrust enforcers

A)Lack the resources to prosecute anticompetitive behavior.

B)Prefer to break up companies that violate antitrust laws.

C)Lack a legal structure to prosecute companies for monopoly behavior.

A)Lack the resources to prosecute anticompetitive behavior.

B)Prefer to break up companies that violate antitrust laws.

C)Lack a legal structure to prosecute companies for monopoly behavior.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

How might an oligopolist increase total revenue without changing price?

A)Reduce output.

B)Reduce marketing efforts.

C)Through nonprice competition.

A)Reduce output.

B)Reduce marketing efforts.

C)Through nonprice competition.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

A firm cannot maintain above-normal profits over the long run

A)Without the existence of a cartel.

B)Unless barriers to entry exist.

C)Unless predatory pricing occurs.

A)Without the existence of a cartel.

B)Unless barriers to entry exist.

C)Unless predatory pricing occurs.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

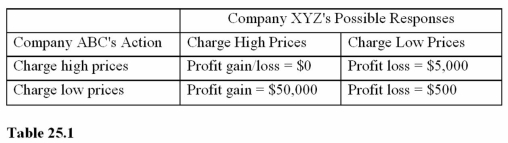

Refer to Table 25.2.Assume there are only four firms in the pool sweeper industry.If Clean Sweep manages to increase its sales to $3,000 per week at the current price and the size of the market does not change,the combined weekly sales of the three other firms will

A)Fall by $3,000 per week.

B)Also rise.

C)Not change.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

The most common form of nonprice competition is

A)Collusion.

B)Advertising.

C)Patents.

A)Collusion.

B)Advertising.

C)Patents.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is not an argument to have less antitrust enforcement?

A)Global competitors put pressure on U.S.oligopoly industries.

B)There is always a chance that new innovators will replace oligopoly firms.

C)Oligopolies can lead to less output and higher prices.

A)Global competitors put pressure on U.S.oligopoly industries.

B)There is always a chance that new innovators will replace oligopoly firms.

C)Oligopolies can lead to less output and higher prices.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

Oligopolistic behavior includes

A)Tacit collusion.

B)High concentration ratios.

C)High barriers to entry.

A)Tacit collusion.

B)High concentration ratios.

C)High barriers to entry.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

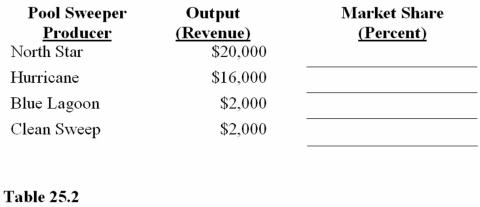

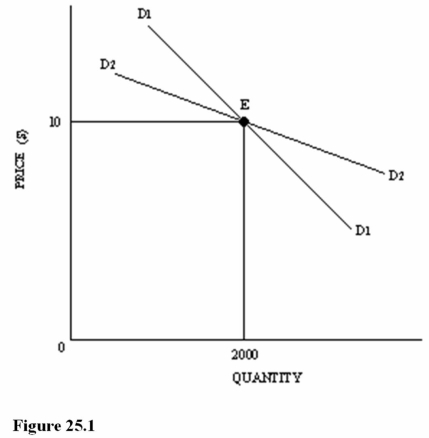

Refer to Figure 25.1 for an oligopoly firm.Assume that the existing price and quantity are $10 and 2,000 units.Which of the following statements is most likely correct?

Refer to Figure 25.1 for an oligopoly firm.Assume that the existing price and quantity are $10 and 2,000 units.Which of the following statements is most likely correct?A)Demand curves D1 and D2 both assume that rivals will not match any price changes.

B)Demand curves D1 and D2 both assume that rivals match any price changes.

C)Demand curve D1 assumes that rivals match any price changes.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

The Herfindahl-Hirshman Index is the sum of the

A)Squared market shares of the firms in the market.

B)Market shares of all the firms in the market.

C)Market shares of the top four firms in the market.

A)Squared market shares of the firms in the market.

B)Market shares of all the firms in the market.

C)Market shares of the top four firms in the market.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Market power leads to market failure when it results in

A)Decreased market output.

B)Lower market prices.

C)Normal economic profits.

A)Decreased market output.

B)Lower market prices.

C)Normal economic profits.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

Refer to Table 25.2.Assume there are only four firms in the pool sweeper industry.What is the market share for North Star?

A)20 percent.

B)50 percent.

C)10 percent.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

In the long run,an oligopolist is most likely to

A)Experience economic profits because of barriers to entry.

B)Experience zero economic profits because barriers to entry do not exist in the long run.

C)Produce at the most technically efficient output level due to long-run competition.

A)Experience economic profits because of barriers to entry.

B)Experience zero economic profits because barriers to entry do not exist in the long run.

C)Produce at the most technically efficient output level due to long-run competition.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

If all of your friends use the same instant messaging service provider,you are likely to use it too.This behavior may create

A)Cartels.

B)Nonprice competition.

C)A network economy.

A)Cartels.

B)Nonprice competition.

C)A network economy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

The demand curve facing an oligopoly firm is kinked because

A)Its competitors will match only price hikes.

B)It is most likely that rivals will match price cuts but not price increases.

C)The demand curve that is most inelastic is the most probable situation facing the company.

A)Its competitors will match only price hikes.

B)It is most likely that rivals will match price cuts but not price increases.

C)The demand curve that is most inelastic is the most probable situation facing the company.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Sky-High Skywriters temporarily reduces its price when a new firm called The Sky's the Limit Skywriting enters the industry.Sky-High Skywriters is practicing

A)Retaliation.

B)Price leadership.

C)Predatory pricing.

A)Retaliation.

B)Price leadership.

C)Predatory pricing.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck