Deck 7: Corporate Acquisitions and Reorganizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 7: Corporate Acquisitions and Reorganizations

1

Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

True

2

In a Type B reorganization, the acquiring corporation obtains substantially all of the target corporation's assets in exchange for its voting stock and a limited amount of other consideration.

False

3

A Type C reorganization is a change in identity, legal form, or state of incorporation in which the shareholders retain the same equity interest.

False

4

Identify which of the following statements is false.

A) A taxable acquisition of the assets of a target corporation that is subsequently liquidated, results in a loss of the target corporation's tax attributes.

B) A taxable acquisition of the assets of a target corporation, that is subsequently liquidated, results in the target corporation's shareholders recognizing gain or loss on the surrender of their target stock.

C) An acquiring corporation in a tax-free or a taxable acquisition transaction does not recognize gain or loss when its stock is issued in exchange for property.

D) An acquiring corporation in a taxable acquisition transaction must acquire all of the assets and liabilities of the target corporation.

A) A taxable acquisition of the assets of a target corporation that is subsequently liquidated, results in a loss of the target corporation's tax attributes.

B) A taxable acquisition of the assets of a target corporation, that is subsequently liquidated, results in the target corporation's shareholders recognizing gain or loss on the surrender of their target stock.

C) An acquiring corporation in a tax-free or a taxable acquisition transaction does not recognize gain or loss when its stock is issued in exchange for property.

D) An acquiring corporation in a taxable acquisition transaction must acquire all of the assets and liabilities of the target corporation.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

The Sec. 338 deemed sale rules require that 70% of the target corporation's stock be owned.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

Identify which of the following statements is true.

A) A deemed liquidation election is available when a target corporation is liquidated into its parent corporation.

B) Corporate purchasers generally prefer Sec. 338 treatment because of the significant tax savings originating from the step-up in basis.

C) The Sec. 338 deemed liquidation rules require that 100% of the target corporation's stock be purchased.

D) All of the above are false.

A) A deemed liquidation election is available when a target corporation is liquidated into its parent corporation.

B) Corporate purchasers generally prefer Sec. 338 treatment because of the significant tax savings originating from the step-up in basis.

C) The Sec. 338 deemed liquidation rules require that 100% of the target corporation's stock be purchased.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Axle Corporation acquires 100% of Drexel Corporation's stock from Drexel's shareholders for $500,000 cash. Drexel Corporation has assets with a $600,000 adjusted basis and an $800,000 FMV. The assets are subject to $200,000 in liabilities. Drexel Corporation shareholders purchased their stock eight years ago for $300,000. Axle Corporation's basis in the Drexel Corporation stock is

A) $800,000.

B) $600,000.

C) $500,000.

D) $300,000.

A) $800,000.

B) $600,000.

C) $500,000.

D) $300,000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

Tax attributes of the target corporation are lost when a Sec. 338 deemed liquidation election is made.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

In a nontaxable reorganization, the acquiring corporation has a holding period for the acquired assets that begins on the day after the transaction date.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

In a triangular Type A merger, the acquiring subsidiary corporation must obtain substantially all of the target corporation's assets.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

Identify which of the following statements is false.

A) Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

B) The tax-free reorganization rules are an example of the wherewithal to pay concept.

C) A taxable acquisition of a target corporation's assets results in the nonrecognition of gain or loss on the disposition of each individual asset.

D) Sales of depreciable assets as part of a taxable acquisition result in depreciation recapture.

A) Taxable acquisition transactions can either be a purchase of assets or a purchase of stock.

B) The tax-free reorganization rules are an example of the wherewithal to pay concept.

C) A taxable acquisition of a target corporation's assets results in the nonrecognition of gain or loss on the disposition of each individual asset.

D) Sales of depreciable assets as part of a taxable acquisition result in depreciation recapture.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

In a nontaxable reorganization, the holding period for the stock received by the target shareholders includes the holding period of the stock surrendered.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

In a nontaxable reorganization, shareholders of the target corporation recognize gain or loss.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

In a Type B reorganization, the target corporation exchange their stock for the acquiring corporation's voting stock, and the target corporation remains in existence as the acquiring corporation's subsidiary.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Identify which of the following statements is false.

A) A Sec. 338 election usually triggers taxation to the target corporation.

B) A Sec. 338 election must be made not later than the fifteenth day of the ninth month following the first stock acquisition in a series of acquisitions that leads to 80% or more stock ownership.

C) When a Sec. 338 election is made, the target corporation is treated as having sold all of its assets at their FMV at the close of the acquisition date.

D) In a Sec. 338 deemed sale election, the shareholders of the target corporation sell their stock to the acquiring corporation.

A) A Sec. 338 election usually triggers taxation to the target corporation.

B) A Sec. 338 election must be made not later than the fifteenth day of the ninth month following the first stock acquisition in a series of acquisitions that leads to 80% or more stock ownership.

C) When a Sec. 338 election is made, the target corporation is treated as having sold all of its assets at their FMV at the close of the acquisition date.

D) In a Sec. 338 deemed sale election, the shareholders of the target corporation sell their stock to the acquiring corporation.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

Type A reorganizations include mergers and consolidations.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

In a taxable asset acquisition, the purchaser does not acquire unknown and contingent liabilities.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

Identify which of the following statements is true.

A) Acquisition of the stock of a target corporation in a taxable acquisition transaction is reflected in an increased basis for the target corporation's assets on its books.

B) Acquisition of 100% of the stock of a target corporation in a taxable transaction followed by a tax-free liquidation of the target corporation permits a step-up in the basis of the target corporation's assets to their FMV.

C) Usually when 100% of the stock of a target corporation is purchased by an acquiring corporation, the basis of the assets of the target corporation reflects the purchase price of the target stock.

D) All of the above are false.

A) Acquisition of the stock of a target corporation in a taxable acquisition transaction is reflected in an increased basis for the target corporation's assets on its books.

B) Acquisition of 100% of the stock of a target corporation in a taxable transaction followed by a tax-free liquidation of the target corporation permits a step-up in the basis of the target corporation's assets to their FMV.

C) Usually when 100% of the stock of a target corporation is purchased by an acquiring corporation, the basis of the assets of the target corporation reflects the purchase price of the target stock.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

Advance rulings are required for all reorganizations.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

The acquiring corporation does not recognize gain or loss in a reorganization where it receives boot.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Rocky is a party to a tax-free asset-for-stock reorganization. As part of the transaction, Rocky exchanges 100% of the Hope Corporation stock with a $40,000 basis and a $50,000 FMV for Moth Corporation stock worth $40,000 and $10,000 cash. Hope Corporation is subsequently liquidated as part of the reorganization, with Moth receiving the Hope assets and liabilities. Rocky is

A) not required to recognize any gain or loss.

B) required to recognize capital gain or dividend income of $10,000, depending on Hope Corporation's current and accumulated E&P and Rocky's postacquisition interest in Moth Corporation.

C) required to recognize dividend income of $10,000 if Hope Corporation's current and accumulated E&P is at least $10,000.

D) able to recognize capital gain income of $10,000 without regard to his post-acquisition interest in Moth Corporation.

A) not required to recognize any gain or loss.

B) required to recognize capital gain or dividend income of $10,000, depending on Hope Corporation's current and accumulated E&P and Rocky's postacquisition interest in Moth Corporation.

C) required to recognize dividend income of $10,000 if Hope Corporation's current and accumulated E&P is at least $10,000.

D) able to recognize capital gain income of $10,000 without regard to his post-acquisition interest in Moth Corporation.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

Buddy owns 100 of the outstanding shares of Binder Corporation stock. Buddy's basis in his Binder Corporation stock is $100,000. Binder Corporation is merged with Clipper Corporation in a tax-free reorganization. Buddy receives 50 shares of Clipper stock worth $150,000 and $150,000 cash. The remaining 100 shares of Binder stock were owned by Bruce who received the same consideration for his Binder stock. Binder and Clipper have E&P balances of $250,000 and $500,000, respectively. Buddy and Bruce each own 25% of Clipper Corporation's 200 shares of stock after the reorganization. Which of the following is correct?

A) Buddy recognizes $200,000 as dividend income.

B) Buddy recognizes $200,000 as a capital gain.

C) Buddy recognizes $150,000 as dividend income.

D) Buddy recognizes $150,000 as a capital gain.

A) Buddy recognizes $200,000 as dividend income.

B) Buddy recognizes $200,000 as a capital gain.

C) Buddy recognizes $150,000 as dividend income.

D) Buddy recognizes $150,000 as a capital gain.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Identify which of the following statements is true.

A) In a tax-free reorganization, the acquiring corporation's holding period for the acquired properties includes the period of time the target corporation held the properties.

B) In a tax-free reorganization, if the acquiring corporation uses nonmonetary boot property, gains or losses will be recognized by the acquiring corporation.

C) The receipt of cash by a shareholder results in the recognition of all of his or her realized gain even if the transaction qualifies as a tax-free reorganization.

D) All of the above are false.

A) In a tax-free reorganization, the acquiring corporation's holding period for the acquired properties includes the period of time the target corporation held the properties.

B) In a tax-free reorganization, if the acquiring corporation uses nonmonetary boot property, gains or losses will be recognized by the acquiring corporation.

C) The receipt of cash by a shareholder results in the recognition of all of his or her realized gain even if the transaction qualifies as a tax-free reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Identify which of the following statements is true.

A) When the acquiring corporation makes the Sec. 338 election, the target corporation is treated in many respects as a new corporation.

B) A Sec. 338 election requires the adoption of the old target corporation's tax year by the new target corporation.

C) Tax attributes of the target corporation are not lost when a Sec. 338 deemed liquidation election is made.

D) All of the above are false.

A) When the acquiring corporation makes the Sec. 338 election, the target corporation is treated in many respects as a new corporation.

B) A Sec. 338 election requires the adoption of the old target corporation's tax year by the new target corporation.

C) Tax attributes of the target corporation are not lost when a Sec. 338 deemed liquidation election is made.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

When gain is realized by a target corporation from disposing of its assets in a tax-free reorganization, the gain is

A) recognized if boot is received and immediately distributed to its shareholders.

B) recognized without exception.

C) recognized if boot is received and retained.

D) never recognized.

A) recognized if boot is received and immediately distributed to its shareholders.

B) recognized without exception.

C) recognized if boot is received and retained.

D) never recognized.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Identify which of the following statements is false.

A) The acquiring corporation does not recognize gains or losses under Sec. 1001 when it transfers noncash boot property to the target corporation or its shareholders.

B) Gain recognized by a shareholder in a tax-free reorganization may be characterized as a dividend.

C) If no gain or loss is recognized by a stock or security holder in a tax-free reorganization, the stock or securities received take a substituted basis equal to the basis of the shares or securities surrendered.

D) Tax-free reorganizations generally do not involve actual redemptions of the stock of the target corporation's shareholders.

A) The acquiring corporation does not recognize gains or losses under Sec. 1001 when it transfers noncash boot property to the target corporation or its shareholders.

B) Gain recognized by a shareholder in a tax-free reorganization may be characterized as a dividend.

C) If no gain or loss is recognized by a stock or security holder in a tax-free reorganization, the stock or securities received take a substituted basis equal to the basis of the shares or securities surrendered.

D) Tax-free reorganizations generally do not involve actual redemptions of the stock of the target corporation's shareholders.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

Identify which of the following statements is true.

A) The target corporation in a tax-free reorganization generally recognizes no gain or loss when boot property is received in exchange for assets because such property is usually distributed to its shareholders and creditors when the target corporation is liquidated.

B) In tax-free reorganizations, one transaction cannot qualify for more than one type of tax-free reorganization.

C) The Sec. 1245 recapture rules override the nonrecognition of gain or loss rules for an asset-for-stock tax-free reorganization.

D) All of the above are false.

A) The target corporation in a tax-free reorganization generally recognizes no gain or loss when boot property is received in exchange for assets because such property is usually distributed to its shareholders and creditors when the target corporation is liquidated.

B) In tax-free reorganizations, one transaction cannot qualify for more than one type of tax-free reorganization.

C) The Sec. 1245 recapture rules override the nonrecognition of gain or loss rules for an asset-for-stock tax-free reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following definitions of Sec. 338 property classes is not correct?

A) Class I: cash, demand deposits, and similar accounts in banks, savings and loan associations, etc.

B) Class II: actively traded personal property such as publicly traded securities

C) Class III: covenants not to compete, similar restrictions on trade, etc.

D) Class IV: inventory or other property held primarily for sale to customers

A) Class I: cash, demand deposits, and similar accounts in banks, savings and loan associations, etc.

B) Class II: actively traded personal property such as publicly traded securities

C) Class III: covenants not to compete, similar restrictions on trade, etc.

D) Class IV: inventory or other property held primarily for sale to customers

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Identify which of the following statements is true.

A) The total basis of the target corporation's assets following a Sec. 338 election in general equals the amount paid for the target corporation's stock minus the target corporation's liabilities.

B) The residual method ensures that any premium paid for the target stock is reflected in depreciable assets.

C) The allocation of the total basis of the target corporation's assets to the individual assets following a Sec. 338 election occurs under the residual method.

D) All of the above are false.

A) The total basis of the target corporation's assets following a Sec. 338 election in general equals the amount paid for the target corporation's stock minus the target corporation's liabilities.

B) The residual method ensures that any premium paid for the target stock is reflected in depreciable assets.

C) The allocation of the total basis of the target corporation's assets to the individual assets following a Sec. 338 election occurs under the residual method.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

A stock acquisition that is not treated as a purchase for purposes of meeting the Sec. 338 rules is

A) stock whose adjusted basis is determined by its basis in the hands of the person from whom it was acquired.

B) stock acquired from a decedent.

C) stock acquired in a tax-free reorganization.

D) All of the above are correct.

A) stock whose adjusted basis is determined by its basis in the hands of the person from whom it was acquired.

B) stock acquired from a decedent.

C) stock acquired in a tax-free reorganization.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

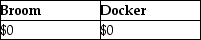

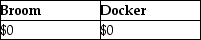

31

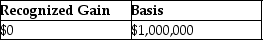

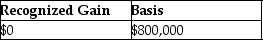

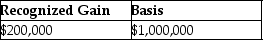

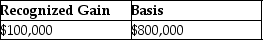

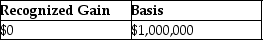

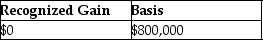

Bob exchanges 4000 shares of Beetle Corporation stock that he had purchased for $800,000 for 6000 shares of Butterfly Corporation common stock with a fair market value of $1,000,000. What is Bob's recognized gain on the exchange and his basis in the Butterfly stock?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV) of securities. The assets have an adjusted basis of $600,000 and an FMV of $1,500,000. In addition, Acme Corporation assumes $500,000 of Fisher's liabilities. At the time of the transfer, Acme's E&P is $400,000. Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock. After the reorganization, Barbara owns 25% of Acme's stock. Barbara has an adjusted basis of $400,000 in her Fisher stock. Barbara's basis for her Acme securities is

A) 0.

B) $200,000.

C) $350,000.

D) $400,000.

A) 0.

B) $200,000.

C) $350,000.

D) $400,000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

Identify which of the following statements is true.

A) Depreciation recapture rules do not override the nonrecognition of gain or loss rules.

B) The acquisition of liabilities by an acquiring corporation will trigger a gain.

C) A target corporation will recognize a gain when it distributes stock to its shareholders.

D) The basis of property acquired in a reorganization is its FMV.

A) Depreciation recapture rules do not override the nonrecognition of gain or loss rules.

B) The acquisition of liabilities by an acquiring corporation will trigger a gain.

C) A target corporation will recognize a gain when it distributes stock to its shareholders.

D) The basis of property acquired in a reorganization is its FMV.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

Jersey Corporation purchased 50% of Target Corporation's single class of stock on June 1 of this year. They purchased an additional 40% on November 20 of this year. The Sec. 338 election must be made on or before

A) June 30 of this year.

B) November 30 of this year.

C) August 15 of next year.

D) June 30 of next year.

A) June 30 of this year.

B) November 30 of this year.

C) August 15 of next year.

D) June 30 of next year.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV) of securities. The assets have an adjusted basis of $600,000 and an FMV of $1,500,000. In addition, Acme Corporation assumes $500,000 of Fisher's liabilities. At the time of the transfer, Acme's E&P is $400,000. Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock. After the reorganization, Barbara owns 25% of Acme's stock. Barbara has an adjusted basis of $400,000 in her Fisher stock. Barbara must recognize a gain of

A) $0.

B) $200,000 dividend income.

C) $200,000 capital gain.

D) $650,000 capital gain.

A) $0.

B) $200,000 dividend income.

C) $200,000 capital gain.

D) $650,000 capital gain.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

Melon Corporation makes its first purchase of 30% of Hill Corporation stock on July 31 of this year. Melon Corporation uses a calendar tax year. To use the Sec. 338 election, Melon Corporation must purchase

A) an additional 50% of Hill Corporation stock by December 31 of this year.

B) an additional 50% of Hill Corporation stock by July 30 of next year.

C) an additional 51% of Hill Corporation stock by December 31 of this year.

D) an additional 51% of Hill Corporation stock by July 30 of next year.

A) an additional 50% of Hill Corporation stock by December 31 of this year.

B) an additional 50% of Hill Corporation stock by July 30 of next year.

C) an additional 51% of Hill Corporation stock by December 31 of this year.

D) an additional 51% of Hill Corporation stock by July 30 of next year.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

In a Sec. 338 election, the target corporation

A) will no longer file a separate return.

B) must use the preacquisition tax year.

C) will have a holding period for assets beginning on the day after the acquisition date.

D) is considered to be a continuation of the old target corporation for purposes of the tax attribute carryover rules.

A) will no longer file a separate return.

B) must use the preacquisition tax year.

C) will have a holding period for assets beginning on the day after the acquisition date.

D) is considered to be a continuation of the old target corporation for purposes of the tax attribute carryover rules.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

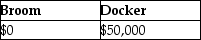

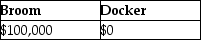

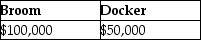

38

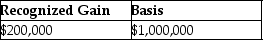

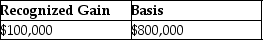

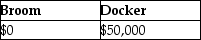

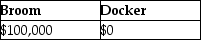

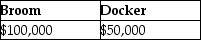

Broom Corporation transfers assets with an adjusted basis of $300,000 and an FMV of $400,000 to Docker Corporation in exchange for $400,000 of Docker Corporation stock as part of a tax-free reorganization. The Docker stock had been purchased from its shareholders one year earlier for $350,000. How much gain do Broom and Docker Corporations recognize on the asset transfer?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

Paper Corporation adopts a plan of reorganization and exchanges 1,000 shares of its voting stock and $50,000 in cash for Chase Corporation's assets having a $200,000 adjusted basis and a $275,000 FMV. Chase Corporation is subsequently liquidated. What is Paper Corporation's basis in the assets acquired in the exchange?

A) $200,000

B) $250,000

C) $275,000

D) $50,000

A) $200,000

B) $250,000

C) $275,000

D) $50,000

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

American Corporation acquires the noncash assets of Utech Corporation in exchange for $700,000 of its voting stock plus $50,000 of cash. Utech Corporation assets are worth $750,000. Utech Corporation does not distribute the stock and cash but instead holds the stock as an investment. Utech will use the American cash along with the cash it retained to start a new business. The transaction can be classified as a

A) Type A reorganization.

B) Type B reorganization.

C) Type C reorganization.

D) The transaction does not qualify as a tax-free reorganization.

A) Type A reorganization.

B) Type B reorganization.

C) Type C reorganization.

D) The transaction does not qualify as a tax-free reorganization.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

Identify which of the following statements is true.

A) A split-off Type D reorganization occurs when part of the assets of one corporation are transferred to a controlled corporation in exchange for its stock, and shares of the controlled corporation's stock are distributed to all of the distributing corporation's shareholders without having them surrender any of their stock in the distributing corporation.

B) In a Type D reorganization, the existence of a good corporate business purpose is necessary before the stock of a controlled subsidiary can be distributed to the shareholders of the distributing corporation.

C) A distribution of a controlled corporation's stock can be a tax-free Type D reorganization, even if none of the distributing corporation's assets are transferred to the controlled corporation.

D) All of the above are false.

A) A split-off Type D reorganization occurs when part of the assets of one corporation are transferred to a controlled corporation in exchange for its stock, and shares of the controlled corporation's stock are distributed to all of the distributing corporation's shareholders without having them surrender any of their stock in the distributing corporation.

B) In a Type D reorganization, the existence of a good corporate business purpose is necessary before the stock of a controlled subsidiary can be distributed to the shareholders of the distributing corporation.

C) A distribution of a controlled corporation's stock can be a tax-free Type D reorganization, even if none of the distributing corporation's assets are transferred to the controlled corporation.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

Identify which of the following statements is true.

A) To qualify as a Type A reorganization, the IRS currently requires at least 40% of the total consideration used must be acquiring corporation stock.

B) A Type A reorganization has the advantage of avoiding the acquisition of unknown and contingent liabilities.

C) A merger usually involves the approval of all of the shareholders of both corporations.

D) All of the above are false.

A) To qualify as a Type A reorganization, the IRS currently requires at least 40% of the total consideration used must be acquiring corporation stock.

B) A Type A reorganization has the advantage of avoiding the acquisition of unknown and contingent liabilities.

C) A merger usually involves the approval of all of the shareholders of both corporations.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

Identify which of the following statements is true.

A) A Type B reorganization must be accomplished in one transaction.

B) "Creeping acquisitions" are not allowed in a Type B reorganization.

C) Boxer Corporation acquires 81% of Excel Corporation's stock in a Type B reorganization. When Boxer Corporation acquires an additional 11% of Excel Corporation's stock two years later in exchange for Boxer stock, the second acquisition is also treated as a Type B reorganization.

D) All of the above are false.

A) A Type B reorganization must be accomplished in one transaction.

B) "Creeping acquisitions" are not allowed in a Type B reorganization.

C) Boxer Corporation acquires 81% of Excel Corporation's stock in a Type B reorganization. When Boxer Corporation acquires an additional 11% of Excel Corporation's stock two years later in exchange for Boxer stock, the second acquisition is also treated as a Type B reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

In which of the following reorganizations does the distributing corporation transfer all of its assets to two controlled corporations before the distributing corporation dissolves?

A) split-off

B) spin-off

C) split-up

D) Type C reorganization

A) split-off

B) spin-off

C) split-up

D) Type C reorganization

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

Rock Corporation acquires all of the assets of Stone Corporation using only its voting stock. Stone Corporation distributes the Rock stock to its shareholders pursuant to its liquidation. After the acquisition, Stone Corporation's shareholders own 20% of the Rock stock (by voting power and value). The transaction is classified as a

A) Type B reorganization.

B) Type C reorganization.

C) Type D reorganization.

D) The transaction does not qualify as a tax-free reorganization.

A) Type B reorganization.

B) Type C reorganization.

C) Type D reorganization.

D) The transaction does not qualify as a tax-free reorganization.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

Identify which of the following statements is true.

A) A tax-free spin-off coming under Sec. 355 occurs when a parent corporation distributes stock in a controlled subsidiary corporation in exchange for some of its own stock.

B) Tax-free split-offs and spin-offs coming under Sec. 355 require the surrender of shareholder stock.

C) When boot is received in a Sec. 355 spin-off transaction, the FMV of the boot will be a dividend to the extent of the shareholder's ratable share of the distributing corporation's E&P.

D) All of the above are false.

A) A tax-free spin-off coming under Sec. 355 occurs when a parent corporation distributes stock in a controlled subsidiary corporation in exchange for some of its own stock.

B) Tax-free split-offs and spin-offs coming under Sec. 355 require the surrender of shareholder stock.

C) When boot is received in a Sec. 355 spin-off transaction, the FMV of the boot will be a dividend to the extent of the shareholder's ratable share of the distributing corporation's E&P.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

Identify which of the following statements is true.

A) Able Corporation (New York) transfers its assets to Able Corporation (Delaware) in exchange for all of its stock. Able Corporation (New York) is liquidated. This exchange is a Type F reorganization.

B) Strict adherence to legislative guidelines with regard to reorganizations is sufficient for tax-free treatment.

C) A suitable business purpose for a tax-free reorganization is to permit the minimization of shareholder taxes.

D) All of the above are false.

A) Able Corporation (New York) transfers its assets to Able Corporation (Delaware) in exchange for all of its stock. Able Corporation (New York) is liquidated. This exchange is a Type F reorganization.

B) Strict adherence to legislative guidelines with regard to reorganizations is sufficient for tax-free treatment.

C) A suitable business purpose for a tax-free reorganization is to permit the minimization of shareholder taxes.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

Identify which of the following statements is true.

A) The control requirement for Sec. 355 differs from the control requirement under Sec. 351.

B) Aspect Corporation transfers assets to newly created Expert Corporation in exchange for all of Expert's stock. Shortly after the transfer, Aspect exchanges one-half of the Expert stock that it receives for land. The individuals transferring the land have never been Aspect shareholders. This transaction qualifies as a divisive Type D reorganization and is tax-free to all parties.

C) Common stock can be exchanged for preferred stock in the same corporation as a Type E reorganization.

D) All of the above are false.

A) The control requirement for Sec. 355 differs from the control requirement under Sec. 351.

B) Aspect Corporation transfers assets to newly created Expert Corporation in exchange for all of Expert's stock. Shortly after the transfer, Aspect exchanges one-half of the Expert stock that it receives for land. The individuals transferring the land have never been Aspect shareholders. This transaction qualifies as a divisive Type D reorganization and is tax-free to all parties.

C) Common stock can be exchanged for preferred stock in the same corporation as a Type E reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Acquiring Corporation acquires all of the stock of Target Corporation in a Type B (stock-for-stock) reorganization. Both corporations have always filed separate tax returns. Which one of the following statements regarding the acquisition is correct?

A) Acquiring and Target Corporations can elect to file a consolidated tax return.

B) Acquiring and Target Corporations must file a consolidated tax return.

C) Acquiring Corporation assumes all of the tax attributes of Target Corporation.

D) Acquiring Corporation must step up or step down the basis of the Target Corporation's assets to their FMV on the acquisition date?

A) Acquiring and Target Corporations can elect to file a consolidated tax return.

B) Acquiring and Target Corporations must file a consolidated tax return.

C) Acquiring Corporation assumes all of the tax attributes of Target Corporation.

D) Acquiring Corporation must step up or step down the basis of the Target Corporation's assets to their FMV on the acquisition date?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

Roby Corporation, a Tennessee corporation, decides to change its state of incorporation to Delaware to take advantage of its more favorable state corporation laws. Roby Corporation can take advantage of the Type F reorganization rules by

A) exchanging the Tennessee corporation's assets for the Delaware corporation's stock and liquidating the Tennessee corporation.

B) liquidating the Tennessee corporation and reincorporating in Delaware.

C) merging the Tennessee corporation stock into an existing Delaware corporation.

D) recapitalizing the Tennessee corporation.

A) exchanging the Tennessee corporation's assets for the Delaware corporation's stock and liquidating the Tennessee corporation.

B) liquidating the Tennessee corporation and reincorporating in Delaware.

C) merging the Tennessee corporation stock into an existing Delaware corporation.

D) recapitalizing the Tennessee corporation.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Grand Corporation transfers 40% of its assets having an adjusted basis of $600,000 and an FMV of $800,000 to New Corporation in exchange for 75% of its single class of stock. Grand Corporation is owned equally by Annie and Betsy who are unrelated. Annie's basis for her Grand stock is $300,000 and Betsy's basis is $400,000. Annie exchanges all of her Grand stock for all of the New stock received in the exchange. Which of the following statements is correct concerning these transactions?

A) Grand Corporation does not recognize a gain on the asset transfer to New Corporation or the stock distribution to Annie.

B) Annie recognizes a $500,000 capital gain on the exchange of the Grand stock for the New stock.

C) Annie's basis in the New stock is $300,000.

D) Grand's basis for the New assets is $600,000.

A) Grand Corporation does not recognize a gain on the asset transfer to New Corporation or the stock distribution to Annie.

B) Annie recognizes a $500,000 capital gain on the exchange of the Grand stock for the New stock.

C) Annie's basis in the New stock is $300,000.

D) Grand's basis for the New assets is $600,000.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

In a Type B reorganization, the 1. stock of the target corporation is acquired solely for the voting stock of either the acquiring corporation or its parent.

2) acquiring corporation must have control of the target corporation immediately after the acquisition.

A) Only statement 1 is correct.

B) Only statement 2 is correct.

C) Both statements are correct.

D) Neither statement is correct.

2) acquiring corporation must have control of the target corporation immediately after the acquisition.

A) Only statement 1 is correct.

B) Only statement 2 is correct.

C) Both statements are correct.

D) Neither statement is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

Identify which of the following statements is false.

A) In a Type C reorganization, the acquired corporation must distribute stock, securities, and other property it receives to its shareholders.

B) A Type C reorganization is less flexible than a Type A reorganization because of the solely-for-voting stock requirement of a Type C.

C) To qualify as a Type C reorganization, the target corporation must be formally dissolved.

D) In a Type C reorganization, shareholders of the acquiring corporation generally do not have to approve the acquisition.

A) In a Type C reorganization, the acquired corporation must distribute stock, securities, and other property it receives to its shareholders.

B) A Type C reorganization is less flexible than a Type A reorganization because of the solely-for-voting stock requirement of a Type C.

C) To qualify as a Type C reorganization, the target corporation must be formally dissolved.

D) In a Type C reorganization, shareholders of the acquiring corporation generally do not have to approve the acquisition.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Table Corporation transfers one-half of its assets to Chair Corporation in exchange for 100% of Chair Corporation's single class of stock. Following the exchange, Table Corporation distributes the Chair stock ratably to its shareholders. This transaction will constitute a

A) Type A reorganization.

B) Type C reorganization.

C) divisive Type D reorganization.

D) acquisitive Type D reorganization.

A) Type A reorganization.

B) Type C reorganization.

C) divisive Type D reorganization.

D) acquisitive Type D reorganization.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

Identify which of the following statements is true.

A) Both a Type B reorganization or a reverse triangular merger will not allow the target corporation to remain in existence.

B) Andrews Corporation gives 10% of its stock worth $200,000 and Andrews notes worth $10,000 in exchange for 80% of Baxter Corporation's stock. The exchange qualifies as a Type B reorganization.

C) In a Type B reorganization, with minor exceptions only voting stock can be used by the acquiring corporation to acquire the target corporation's stock.

D) All of the above are false.

A) Both a Type B reorganization or a reverse triangular merger will not allow the target corporation to remain in existence.

B) Andrews Corporation gives 10% of its stock worth $200,000 and Andrews notes worth $10,000 in exchange for 80% of Baxter Corporation's stock. The exchange qualifies as a Type B reorganization.

C) In a Type B reorganization, with minor exceptions only voting stock can be used by the acquiring corporation to acquire the target corporation's stock.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

Midnight Corporation transferred part of its assets to Noon Corporation in exchange for all of Noon's stock. Midnight distributed all of Noon's stock pro rate to Midnight's shareholders. What is this type of reorganization?

A) split-off

B) spin-off

C) split-up

D) dividend distribution

A) split-off

B) spin-off

C) split-up

D) dividend distribution

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

Identify which of the following statements is true.

A) The acquired corporation in a Type C reorganization may retain its corporation charter.

B) Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and $25,000 in cash. Beta is subsequently liquidated. This exchange qualifies as a Type C reorganization.

C) Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and the assumption of $25,000 of Beta liabilities. Beta is subsequently liquidated. This exchange does not qualify as a Type C reorganization.

D) All of the above are false.

A) The acquired corporation in a Type C reorganization may retain its corporation charter.

B) Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and $25,000 in cash. Beta is subsequently liquidated. This exchange qualifies as a Type C reorganization.

C) Alpha Corporation acquires 100% of the assets of Beta Corporation in exchange for $75,000 of Alpha stock and the assumption of $25,000 of Beta liabilities. Beta is subsequently liquidated. This exchange does not qualify as a Type C reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

Shareholders in Boxer Corporation exchange all of their nonvoting Class B common stock for additional shares of Boxer's Class A common stock. Which of the following statements is correct?

A) If boot is added to the exchange, the entire gain realized on the exchange is recognized in full.

B) The exchange is a Type F reorganization, assuming all requirements are met.

C) The exchange is tax-free even if no plan of reorganization has been created.

D) The basis of the Class A common stock received is equal to its FMV.

A) If boot is added to the exchange, the entire gain realized on the exchange is recognized in full.

B) The exchange is a Type F reorganization, assuming all requirements are met.

C) The exchange is tax-free even if no plan of reorganization has been created.

D) The basis of the Class A common stock received is equal to its FMV.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

Identify which of the following statements is true.

A) Ann, Dewey Corporation's sole shareholder, exchanges her Dewey stock having a $400,000 FMV and a $175,000 adjusted basis for $350,000 of Heider Corporation stock and $50,000 cash. Ann realizes a $225,000 gain on the stock transfer, none of which is recognized.

B) A Type B reorganization can be accomplished without formal shareholder approval.

C) The target corporation's tax attributes are lost in a Type B reorganization.

D) All of the above are false.

A) Ann, Dewey Corporation's sole shareholder, exchanges her Dewey stock having a $400,000 FMV and a $175,000 adjusted basis for $350,000 of Heider Corporation stock and $50,000 cash. Ann realizes a $225,000 gain on the stock transfer, none of which is recognized.

B) A Type B reorganization can be accomplished without formal shareholder approval.

C) The target corporation's tax attributes are lost in a Type B reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

If the FMV of the stock received in a Type E reorganization does not equal the FMV of the stock surrendered, the difference may be

A) a contribution to capital.

B) compensation for services.

C) a dividend.

D) All of the above are correct.

A) a contribution to capital.

B) compensation for services.

C) a dividend.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

Pacific Corporation acquires 80% of the stock of Jackson Corporation for $3,000,000 in the current year. Jackson's assets have a basis of $2,000,000 and its liabilities are $800,000. The assets are worth $3,500,000. What gain is recognized by Jackson Corporation on the deemed sale of its assets if a Sec. 338 election is made?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

Dreyer Corporation purchased 5% of Willy Corporation's stock five years ago for $100,000. Dreyer then decides to purchase an additional 80% of the Willy stock for $1,000,000 on April 15 of the current year. On the acquisition date, Willy Corporation's liabilities are $150,000. A $300,000 tax liability is incurred by Willy on the Sec. 338 deemed sale. What is the total basis of Willy Corporation's assets for Sec. 338 basis allocation purposes?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

Parent Corporation purchases all of Target Corporation's stock for $200,000 and makes a deemed liquidation election. Target Corporation has Class I assets with an adjusted basis of $55,000 and an FMV of $55,000; Class II assets with an adjusted basis of $40,000 and an FMV of $60,000; and Class V assets with an adjusted basis of $70,000 and an FMV of $100,000. The Class V assets are subject to a $20,000 liability. Assume a 34% corporate tax rate. What is the adjusted grossed-up basis of Target Corporation's stock?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

Martha owns Gator Corporation stock having an adjusted basis of $21,000. As part of a tax-free reorganization involving Gator and Baker Corporations, Martha exchanges her Gator stock for $18,000 of Baker stock and $6,000 (face amount and FMV) of Baker securities. What is Martha's basis in the Baker stock?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

Acquiring Corporation is 100%-owned by Peter Hart. Target Corporation is 100% owned by Dick Weber. The two individuals are not related. Target Corporation has $400,000 of NOL carryovers at the time Acquiring Corporation is considering making a cash acquisition of part or all of Target Corporation's stock. What is the maximum amount of Target stock that can be acquired in a single transaction without the Sec. 382 loss limitation rules applying to the NOLs?

A) 49%

B) 50%

C) 80%

D) Any acquisition of Target stock will cause the Sec. 382 loss limitation to apply.

A) 49%

B) 50%

C) 80%

D) Any acquisition of Target stock will cause the Sec. 382 loss limitation to apply.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

Brown Corporation has assets with a $650,000 basis and an $800,000 FMV. The assets are subject to $250,000 in liabilities. Clark Corporation acquires all of Brown's assets and liabilities for $600,000 in cash. Brown Corporation then liquidates. What is Clark Corporation's basis in the acquired assets?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

The acquiring corporation does not obtain the target corporation's tax attributes in

A) a Type A reorganization.

B) a Type B reorganization.

C) an acquisitive Type C reorganization.

D) an acquisitive Type D reorganization.

A) a Type A reorganization.

B) a Type B reorganization.

C) an acquisitive Type C reorganization.

D) an acquisitive Type D reorganization.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

Acme Corporation acquires Fisher Corporation's assets in a Type A reorganization for $800,000 of Acme's nonvoting preferred stock and $200,000 (face amount and FMV) of securities. The assets have an adjusted basis of $600,000 and an FMV of $1,500,000. In addition, Acme Corporation assumes $500,000 of Fisher's liabilities. At the time of the transfer, Acme's E&P is $400,000. Fisher distributes the stock and securities to its sole shareholder Barbara for all of her Fisher stock. After the reorganization, Barbara owns 25% of Acme's stock. Barbara has an adjusted basis of $400,000 in her Fisher stock. What is Barbara's basis for her Acme stock?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

Identify which of the following statements is true.

A) The step-transaction doctrine has always been used by the IRS to convert a tax-free transaction into a taxable transaction.

B) Tax attributes carry over from the target corporation to the acquiring corporation in all acquisitive reorganizations.

C) In a Type A reorganization, the net operating loss carryover can be used by the acquiring corporation without limitation in its first tax year that ends after the acquisition date.

D) All of the above are false.

A) The step-transaction doctrine has always been used by the IRS to convert a tax-free transaction into a taxable transaction.

B) Tax attributes carry over from the target corporation to the acquiring corporation in all acquisitive reorganizations.

C) In a Type A reorganization, the net operating loss carryover can be used by the acquiring corporation without limitation in its first tax year that ends after the acquisition date.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

Parent Corporation purchases all of Target Corporation's stock for $200,000 and makes a deemed liquidation election. Target Corporation has Class I assets with an adjusted basis of $55,000 and an FMV of $55,000; Class II assets with an adjusted basis of $40,000 and an FMV of $60,000; and Class V assets with an adjusted basis of $70,000 and an FMV of $100,000. The Class V assets are subject to a $20,000 liability. Assume a 34% corporate tax rate.

Assuming that the adjusted grossed-up basis is $237,000 ($200,000 + $20,000 + $17,000 federal income taxes), what is the allocation of adjusted grossed-up basis to Class VI assets?

Assuming that the adjusted grossed-up basis is $237,000 ($200,000 + $20,000 + $17,000 federal income taxes), what is the allocation of adjusted grossed-up basis to Class VI assets?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

The assets of Bold Corporation have a $1,000,000 basis and a $3,000,000 FMV. Its liabilities are $500,000. Tidel Corporation acquires 80% of the Bold Corporation stock for $2,000,000. What gain is recognized by Bold Corporation if a timely Sec. 338 election is made by Tidel Corporation? What is the total basis of the assets to Bold Corporation following the deemed sale? Assume a 34% corporate tax rate.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

Acquiring Corporation acquires all of the assets of Target Corporation in exchange for $3,000,000 of Acquiring common stock and the assumption of $2,000,000 of Target's liabilities. The assets had a $2,300,000 adjusted basis to Target. Target's sole shareholder, Paula, had a $1,000,000 adjusted basis for her stock. Target Corporation had $600,000 of E&P on the acquisition date. Paula receives all of the Acquiring common stock in the liquidation of Target. What are the tax consequences of the acquisition to: Acquiring, Target, and Paula?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

Zebra Corporation transfers assets with a $120,000 basis and a $250,000 FMV to Hat Corporation for common stock worth $200,000 and cash of $50,000. The exchange qualifies as a tax-free reorganization. Zebra Corporation distributes the stock and cash to its shareholders pursuant to its liquidation. How much gain must Zebra Corporation recognize?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

Grant Corporation transfers highly appreciated stock to Subsidiary Corporation in exchange for all of its stock. The Subsidiary Corporation stock is distributed to its sole shareholder, Peter. Three weeks after the distribution of the Subsidiary stock, Subsidiary Corporation liquidates. Peter then sells the appreciated stock that he received in the liquidation. This series of transactions

A) does not meet the statutory definition of a divisive Type D reorganization.

B) fails the business purpose requirement.

C) results in a capital gain to Peter.

D) None of the above is correct.

A) does not meet the statutory definition of a divisive Type D reorganization.

B) fails the business purpose requirement.

C) results in a capital gain to Peter.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

Identify which of the following statements is true.

A) A plan of reorganization must be a written document.

B) Advance rulings are required for all reorganizations.

C) The IRS will issue an advance ruling on any proposed tax-free reorganization.

D) All of the above are false.

A) A plan of reorganization must be a written document.

B) Advance rulings are required for all reorganizations.

C) The IRS will issue an advance ruling on any proposed tax-free reorganization.

D) All of the above are false.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

Brad exchanges 1,000 shares of Goodyear Corporation stock having a $15,000 basis for Atlas Corporation stock having a $25,000 FMV as part of a Type A tax-free reorganization. Brad also receives $6,000 cash as part of the reorganization. How much gain must Brad recognize?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

Roger transfers assets from his sole proprietorship to his 100%-owned Motor Corporation. Immediately after the incorporation, Motor Corporation transfers all of its assets to Blue Corporation for 10% of Blue's stock. Motor Corporation is liquidated. Which of the following statements is correct?

A) The asset transfer by Motor Corporation meets the statutory Type C reorganization requirements.

B) The IRS may collapse the two transactions into a single transaction, resulting in denial of tax-free reorganization treatment.

C) The IRS may apply the step transaction doctrine.

D) All of the above statements are correct.

A) The asset transfer by Motor Corporation meets the statutory Type C reorganization requirements.

B) The IRS may collapse the two transactions into a single transaction, resulting in denial of tax-free reorganization treatment.

C) The IRS may apply the step transaction doctrine.

D) All of the above statements are correct.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

Identify which of the following statements is false.

A) When determining the use of an NOL carryover following a change of ownership, the old loss corporation and the new loss corporation may be the same for Sec. 382 purposes.

B) A new loss corporation that does not continue the business enterprise of the old loss corporation during the two-year period beginning on the date of the stock ownership change cannot use the net operating loss carryover.

C) One advantage of a tax-free reorganization is that losses realized as part of a tax-free reorganization are not recognized.

D) For purposes of Sec. 382, ownership changes are tested any time a 5% shareholder has a stock transaction affecting his ownership.

A) When determining the use of an NOL carryover following a change of ownership, the old loss corporation and the new loss corporation may be the same for Sec. 382 purposes.

B) A new loss corporation that does not continue the business enterprise of the old loss corporation during the two-year period beginning on the date of the stock ownership change cannot use the net operating loss carryover.

C) One advantage of a tax-free reorganization is that losses realized as part of a tax-free reorganization are not recognized.

D) For purposes of Sec. 382, ownership changes are tested any time a 5% shareholder has a stock transaction affecting his ownership.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

Marty is a party to a tax-free reorganization. He has a basis of $22,000 in his Van Corporation stock that has an FMV of $35,000. Marty exchanges the Van stock for Young Corporation stock worth $29,000 and Young securities with a face amount of $7,000 and an FMV of $6,000. What is Marty's basis in the Young securities?

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

Which one of the following is not a corporate reorganization as defined in the Internal Revenue Code?

A) recapitalization

B) mere change in identity

C) merger

D) stock redemption

A) recapitalization

B) mere change in identity

C) merger

D) stock redemption

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck