Deck 31: Government Debt and Deficits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/125

Play

Full screen (f)

Deck 31: Government Debt and Deficits

1

The government's primary budget deficit (or surplus)is the difference between the

A)non-interest expenditures and interest payments.

B)interest payments and revenues.

C)overall budget deficit (or surplus)and debt-service payments.

D)overall budget deficit (or surplus)between one year and the next.

E)overall government expenditures and revenues.

A)non-interest expenditures and interest payments.

B)interest payments and revenues.

C)overall budget deficit (or surplus)and debt-service payments.

D)overall budget deficit (or surplus)between one year and the next.

E)overall government expenditures and revenues.

overall budget deficit (or surplus)and debt-service payments.

2

If we want to know whether tax revenues are sufficient to finance the discretionary part of government expenditure,which of the following measures should we analyze?

A)the cyclically adjusted deficit/surplus

B)the government's budget constraint

C)the debt-to-GDP ratio

D)the government's primary deficit/surplus

E)the interest rate on government bonds compared to the growth rate of real GDP

A)the cyclically adjusted deficit/surplus

B)the government's budget constraint

C)the debt-to-GDP ratio

D)the government's primary deficit/surplus

E)the interest rate on government bonds compared to the growth rate of real GDP

the government's primary deficit/surplus

3

The government's primary budget deficit (or surplus)is the

A)non-interest expenditures and interest payments.

B)sum of total government expenditures and revenues.

C)sum of interest payments and revenues.

D)overall budget deficit between two fiscal years.

E)overall budget deficit (or surplus)excluding debt-service payments.

A)non-interest expenditures and interest payments.

B)sum of total government expenditures and revenues.

C)sum of interest payments and revenues.

D)overall budget deficit between two fiscal years.

E)overall budget deficit (or surplus)excluding debt-service payments.

overall budget deficit (or surplus)excluding debt-service payments.

4

Consider the following variables: G = government purchases

I = interest rate on government debt

D = stock of government debt

T = net tax revenue

The government's budget deficit can be expressed as

A)ΔD = (G + iD)- T.

B)ΔD = (G - iD)+ T.

C)deficit = D - (G + iD)+ T.

D)deficit = D - T + (G + iD).

E)T = ΔD - (G + iD).

I = interest rate on government debt

D = stock of government debt

T = net tax revenue

The government's budget deficit can be expressed as

A)ΔD = (G + iD)- T.

B)ΔD = (G - iD)+ T.

C)deficit = D - (G + iD)+ T.

D)deficit = D - T + (G + iD).

E)T = ΔD - (G + iD).

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

5

Consider the following variables: G = government purchases

I = interest rate on government debt

D = stock of government debt

T = net tax revenue

The government's budget constraint can be expressed as

A)(G + iD)= borrowing - T.

B)(G + iD)- T = borrowing.

C)(G + iD)+ T = borrowing.

D)G - T - (iD)= borrowing.

E)(G - iD)= borrowing + T.

I = interest rate on government debt

D = stock of government debt

T = net tax revenue

The government's budget constraint can be expressed as

A)(G + iD)= borrowing - T.

B)(G + iD)- T = borrowing.

C)(G + iD)+ T = borrowing.

D)G - T - (iD)= borrowing.

E)(G - iD)= borrowing + T.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

6

A simple equation describing the government's budget constraint is

A)government expenditure = tax revenue - borrowing.

B)government expenditure = tax revenue + borrowing.

C)government expenditure = tax revenue + debt-service payments.

D)tax revenue = government expenditure + borrowing.

E)tax revenue = borrowing - government expenditure.

A)government expenditure = tax revenue - borrowing.

B)government expenditure = tax revenue + borrowing.

C)government expenditure = tax revenue + debt-service payments.

D)tax revenue = government expenditure + borrowing.

E)tax revenue = borrowing - government expenditure.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

7

If voters want to know how their tax dollars are being spent and how the federal government is managing its current spending,they should look at

A)federal/provincial tax transfers.

B)changes in the money supply.

C)the primary budget balance.

D)the overall budget balance.

E)the inflation adjusted deficit.

A)federal/provincial tax transfers.

B)changes in the money supply.

C)the primary budget balance.

D)the overall budget balance.

E)the inflation adjusted deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

8

In any given year,the government's debt-service payments are

A)equal to the annual budget deficit.

B)equal to the annual primary budget deficit.

C)the interest payments on the outstanding stock of government debt.

D)not related to the government deficit.

E)not required unless the debt is held by foreigners.

A)equal to the annual budget deficit.

B)equal to the annual primary budget deficit.

C)the interest payments on the outstanding stock of government debt.

D)not related to the government deficit.

E)not required unless the debt is held by foreigners.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

9

Suppose that in Year 2 there was a higher federal budget deficit than in Year 1.This could be explained by ________ in Year 2.

A)lower real interest rates

B)higher real GDP (with fiscal policy constant)

C)lower real GDP (with fiscal policy constant)

D)lower government expenditure (with real GDP constant)

E)a lower primary budget surplus

A)lower real interest rates

B)higher real GDP (with fiscal policy constant)

C)lower real GDP (with fiscal policy constant)

D)lower government expenditure (with real GDP constant)

E)a lower primary budget surplus

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

10

What is the difference between the government's debt and the government's deficit?

A)The debt is the annual shortfall of revenues minus disbursements whereas the deficit is the accumulation of past debts.

B)The debt is the amount the government pays in interest payments whereas the deficit has not yet incurred interest charges.

C)The debt is the amount payable to the Bank of Canada whereas the deficit is the annual shortfall of revenue minus disbursements.

D)The debt is the accumulation of past deficits whereas the deficit is the annual shortfall between revenues and disbursements.

E)The debt is the difference between tax revenues and government expenditures whereas the deficit is the difference between tax revenues and borrowing.

A)The debt is the annual shortfall of revenues minus disbursements whereas the deficit is the accumulation of past debts.

B)The debt is the amount the government pays in interest payments whereas the deficit has not yet incurred interest charges.

C)The debt is the amount payable to the Bank of Canada whereas the deficit is the annual shortfall of revenue minus disbursements.

D)The debt is the accumulation of past deficits whereas the deficit is the annual shortfall between revenues and disbursements.

E)The debt is the difference between tax revenues and government expenditures whereas the deficit is the difference between tax revenues and borrowing.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

11

The extent to which tax revenues are able to finance the discretionary part of total government expenditure is best measured by the

A)cyclically adjusted deficit/surplus.

B)government's current fiscal policy.

C)debt-to-GDP ratio.

D)government's primary budget deficit or surplus.

E)tax-to-GDP ratio.

A)cyclically adjusted deficit/surplus.

B)government's current fiscal policy.

C)debt-to-GDP ratio.

D)government's primary budget deficit or surplus.

E)tax-to-GDP ratio.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

12

Suppose the stock of government debt in Canada at the end of fiscal Year 1 is $475 billion.If the stock of debt falls to $461 billion by the end of fiscal Year 2,then we know that during Year 2

A)the government had a primary budget surplus of $14 billion.

B)the government had a primary budget deficit of $14 billion.

C)tax revenues increased by $14 billion.

D)the government had an annual budget surplus of $14 billion.

E)debt-service payments fell by $14 billion.

A)the government had a primary budget surplus of $14 billion.

B)the government had a primary budget deficit of $14 billion.

C)tax revenues increased by $14 billion.

D)the government had an annual budget surplus of $14 billion.

E)debt-service payments fell by $14 billion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

13

In any given year,the government's debt-service payments are equal to

A)(fiscal borrowing)× (the interest rate).

B)(government spending)× (the interest rate).

C)(government spending - tax revenue)× (the interest rate).

D)(total outstanding government debt)× (the interest rate).

E)(government spending + tax revenue)× (the interest rate).

A)(fiscal borrowing)× (the interest rate).

B)(government spending)× (the interest rate).

C)(government spending - tax revenue)× (the interest rate).

D)(total outstanding government debt)× (the interest rate).

E)(government spending + tax revenue)× (the interest rate).

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

14

Do we get a useful and meaningful statistic by dividing the national debt by the GDP?

A)No - we are essentially "dividing apples by oranges," which is unhelpful.

B)No - the GDP is not a meaningful measure of the well-being of the economy.

C)Yes - we can then see how much of the national debt is owed by each individual citizen.

D)Yes - we can see the burden of the debt in relation to the size of the economy.

E)No - dividing a stock by a flow can never be sensible.

A)No - we are essentially "dividing apples by oranges," which is unhelpful.

B)No - the GDP is not a meaningful measure of the well-being of the economy.

C)Yes - we can then see how much of the national debt is owed by each individual citizen.

D)Yes - we can see the burden of the debt in relation to the size of the economy.

E)No - dividing a stock by a flow can never be sensible.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

15

Consider the federal government's budget constraint.If the government's overall budget deficit is $27 billion and its debt-service payments are $29 billion,then its

A)primary budget deficit is $2 billion.

B)primary budget deficit is $56 billion.

C)primary budget surplus is $2 billion.

D)primary budget surplus is $56 billion.

E)Not enough information to determine.

A)primary budget deficit is $2 billion.

B)primary budget deficit is $56 billion.

C)primary budget surplus is $2 billion.

D)primary budget surplus is $56 billion.

E)Not enough information to determine.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

16

Consider the government's budget constraint.The accumulated stock of government debt will begin to fall

A)if the government's debt-service payments are zero.

B)if the government does not borrow money.

C)if the growth rate of real GDP is higher than the real interest rate.

D)when the government's annual budget is in deficit.

E)when the government's annual budget is in surplus.

A)if the government's debt-service payments are zero.

B)if the government does not borrow money.

C)if the growth rate of real GDP is higher than the real interest rate.

D)when the government's annual budget is in deficit.

E)when the government's annual budget is in surplus.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

17

Suppose the stock of government debt in Canada at the end of fiscal Year 1 is $475 billion.If the stock of debt falls to $461 billion by the end of fiscal Year 2,and debt-service payments during Year 2 were $38 billion,then we know that the government had

A)a primary budget surplus of $52 billion.

B)a primary budget surplus of $14 billion.

C)a primary budget surplus of $24 billion.

D)an annual budget surplus of $38 billion.

E)an annual budget deficit of $14 billion.

A)a primary budget surplus of $52 billion.

B)a primary budget surplus of $14 billion.

C)a primary budget surplus of $24 billion.

D)an annual budget surplus of $38 billion.

E)an annual budget deficit of $14 billion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

18

What is the federal government's "primary budget deficit"?

A)the overall budget deficit,but excluding foreign borrowing costs

B)the overall budget deficit,but excluding debt-service payments

C)the amount of government borrowing in a fiscal year

D)the amount of tax revenue minus the amount of interest paid on the public debt

E)the most important indicator of the level of government spending

A)the overall budget deficit,but excluding foreign borrowing costs

B)the overall budget deficit,but excluding debt-service payments

C)the amount of government borrowing in a fiscal year

D)the amount of tax revenue minus the amount of interest paid on the public debt

E)the most important indicator of the level of government spending

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

19

The government's annual primary budget deficit is equal to the

A)accumulation of government borrowing.

B)decrease in the stock of government debt during the course of a year.

C)excess of government's program expenditures over tax revenues in a given fiscal year.

D)total amount of government spending on program expenses,personnel,and capital outlays.

E)excess of current revenue over current expenditure.

A)accumulation of government borrowing.

B)decrease in the stock of government debt during the course of a year.

C)excess of government's program expenditures over tax revenues in a given fiscal year.

D)total amount of government spending on program expenses,personnel,and capital outlays.

E)excess of current revenue over current expenditure.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

20

When a government changes its fiscal policy,what is it doing?

A)changing the exchange rates to influence national income

B)increasing the money supply to increase national income

C)changing government spending and/or tax rates to achieve some objective

D)using government spending and taxes together with changing the money supply in order to achieve full employment

E)buying and selling government securities to increase or decrease the overnight lending rate

A)changing the exchange rates to influence national income

B)increasing the money supply to increase national income

C)changing government spending and/or tax rates to achieve some objective

D)using government spending and taxes together with changing the money supply in order to achieve full employment

E)buying and selling government securities to increase or decrease the overnight lending rate

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

21

Suppose during one fiscal year,government purchases are $195 billion,debt-service payments are $22 billion and net tax revenues are $208 billion.What is the annual budget deficit/surplus?

A)budget surplus of $22 billion

B)budget deficit of $13 billion

C)budget surplus of $13 billion

D)budget deficit of $9 billion

E)budget surplus of $9 billion

A)budget surplus of $22 billion

B)budget deficit of $13 billion

C)budget surplus of $13 billion

D)budget deficit of $9 billion

E)budget surplus of $9 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

22

Suppose the stock of government debt in Canada at the end of one fiscal year (Year 1)is $475 billion.During the following year (Year 2),government purchases were $180 billion,debt-service payments were $25 billion,and net tax revenues were $208 billion.What is the stock of debt at the end of Year 2?

A)$422 billion

B)$457 billion

C)$472 billion

D)$475 billion

E)$478 billion

A)$422 billion

B)$457 billion

C)$472 billion

D)$475 billion

E)$478 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

23

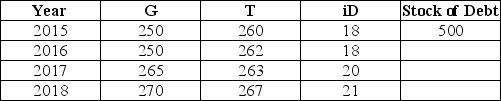

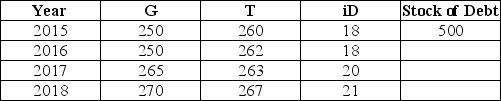

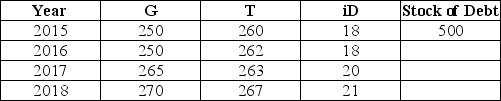

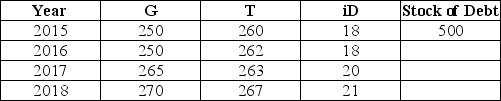

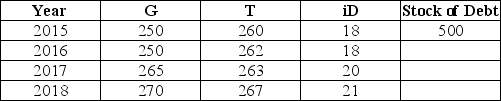

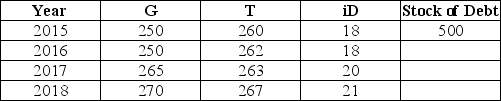

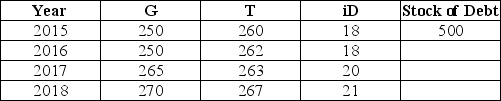

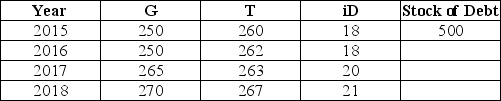

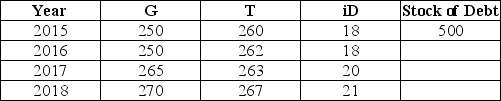

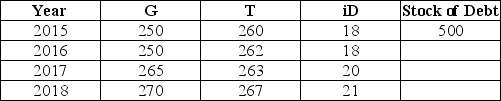

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2018?

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2018?

A)$494 billion

B)$500 billion

C)$506 billion

D)$528 billion

E)$552 billion

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2018?

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2018?A)$494 billion

B)$500 billion

C)$506 billion

D)$528 billion

E)$552 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

24

Suppose during one fiscal year,government purchases are $195 billion,debt-service payments are $22 billion and net tax revenues are $208 billion.What is the government's primary budget deficit/surplus?

A)primary budget surplus of $22 billion

B)primary budget deficit of $13 billion

C)primary budget surplus of $13 billion

D)primary budget deficit of $9 billion

E)primary budget surplus of $9 billion

A)primary budget surplus of $22 billion

B)primary budget deficit of $13 billion

C)primary budget surplus of $13 billion

D)primary budget deficit of $9 billion

E)primary budget surplus of $9 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

25

If the government's total budget surplus is $10 billion and its debt-service payments are $8 billion,then its primary budget surplus is

A)$2 billion.

B)$8 billion.

C)$10 billion.

D)$18 billion.

E)-$2 billion.

A)$2 billion.

B)$8 billion.

C)$10 billion.

D)$18 billion.

E)-$2 billion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

26

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2018?

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2018?

A)-$24 billion

B)$24 billion

C)-$3 billion

D)$3 billion

E)$21 billion

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2018?

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2018?A)-$24 billion

B)$24 billion

C)-$3 billion

D)$3 billion

E)$21 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

27

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2016?

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2016?

A)-$12 billion

B)$12 billion

C)-$6 billion

D)$6 billion

E)There is no primary budget deficit.

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2016?

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2016?A)-$12 billion

B)$12 billion

C)-$6 billion

D)$6 billion

E)There is no primary budget deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

28

Suppose the stock of government debt in Canada at the end of fiscal Year 1 is $475 billion.If the stock of debt rises to $482 billion by the end of fiscal Year 2,then we know that during Year 2

A)debt-service payments rose by $7 billion.

B)the government had a primary budget surplus of $7 billion.

C)the government had an annual budget deficit of $7 billion.

D)the government had a primary budget deficit of $7 billion.

E)tax revenues decreased by $7 billion.

A)debt-service payments rose by $7 billion.

B)the government had a primary budget surplus of $7 billion.

C)the government had an annual budget deficit of $7 billion.

D)the government had a primary budget deficit of $7 billion.

E)tax revenues decreased by $7 billion.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

29

Consider two economies,A and B.Economy A has a stock of government debt equal to $800 billion and a debt-to-GDP ratio of 10%.Economy B has a stock of government debt equal to $22 billion and a debt-to-GDP ratio of 80%.What is the GDP for each economy?

A)Economy A: GDP = $8 trillion Economy B: GDP = $27.5 billion

B)Economy A: GDP = $80 billion Economy B: GDP = $18.7 billion

C)Economy A: GDP = $80 trillion Economy B: GDP = $275 billion

D)Economy A: GDP = $800 billion Economy B: GDP = $22 billion

E)Economy A: GDP = $8 trillion Economy B: GDP = $2.75 billion

A)Economy A: GDP = $8 trillion Economy B: GDP = $27.5 billion

B)Economy A: GDP = $80 billion Economy B: GDP = $18.7 billion

C)Economy A: GDP = $80 trillion Economy B: GDP = $275 billion

D)Economy A: GDP = $800 billion Economy B: GDP = $22 billion

E)Economy A: GDP = $8 trillion Economy B: GDP = $2.75 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

30

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2016?

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2016?

A)$488 billion

B)$494 billion

C)$500 billion

D)$506 billion

E)$512 billion

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2016?

TABLE 31-1 Refer to Table 31-1.What is the stock of debt at the end of 2016?A)$488 billion

B)$494 billion

C)$500 billion

D)$506 billion

E)$512 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

31

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2015?

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2015?

A)$18 billion

B)-$8 billion

C)$8 billion.

D)-$10 billion

E)$10 billion

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2015?

TABLE 31-1 Refer to Table 31-1.What is the overall budget deficit in 2015?A)$18 billion

B)-$8 billion

C)$8 billion.

D)-$10 billion

E)$10 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

32

The Canadian federal government's debt-to-GDP ratio climbed steadily from

A)1939 to the late 1980s.

B)1960 to the late 1990s.

C)1975 to the mid-1990s.

D)1995 to 2009.

E)2000 to 2015.

A)1939 to the late 1980s.

B)1960 to the late 1990s.

C)1975 to the mid-1990s.

D)1995 to 2009.

E)2000 to 2015.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

33

Consider two economies,A and B.Economy A has a stock of government debt equal to $800 billion,while Economy B has a stock of government debt equal to $22 billion.In order to determine the economic importance of these government debt loads in the respective economies,it is necessary to know ________ for each economy.

A)the level of government expenditures

B)the net tax rate

C)the primary budget deficit

D)the GDP

E)the stance of monetary policy

A)the level of government expenditures

B)the net tax rate

C)the primary budget deficit

D)the GDP

E)the stance of monetary policy

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

34

The government's current spending and taxation policies cannot affect the

A)primary budget deficit.

B)annual budget deficit.

C)size of its transfers.

D)change in the stock of government debt.

E)existing stock of government debt.

A)primary budget deficit.

B)annual budget deficit.

C)size of its transfers.

D)change in the stock of government debt.

E)existing stock of government debt.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

35

The Canadian federal debt-to-GDP ratio reached a post Second World War high of about ________% in 1996.By 2020,the debt-to GDP ratio is forecast to be about ________%.

A)80; 110

B)50; 0

C)40; 10

D)110; 50

E)70; 30

A)80; 110

B)50; 0

C)40; 10

D)110; 50

E)70; 30

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

36

If the government's total budget deficit is $24 billion and its debt-service payments are $20 billion,then its ________ is $4 billion.

A)cyclically adjusted deficit

B)primary budget deficit

C)primary budget surplus

D)government expenditure

E)total tax revenue

A)cyclically adjusted deficit

B)primary budget deficit

C)primary budget surplus

D)government expenditure

E)total tax revenue

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

37

The stock of government debt will continue to rise unless the government

A)increases its taxes.

B)decreases its expenditures.

C)decreases the size of its transfers.

D)runs a budget surplus.

E)runs a budget deficit.

A)increases its taxes.

B)decreases its expenditures.

C)decreases the size of its transfers.

D)runs a budget surplus.

E)runs a budget deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

38

In every year between 1998 and 2008,the Canadian federal government had a

A)budget deficit,indicating that even deep cuts in government spending were not sufficient to alleviate the problem.

B)primary deficit,indicating that tax revenues were insufficient to cover discretionary government expenditures.

C)budget deficit,which contributed to a growing stock of government debt.

D)primary surplus but overall deficit,indicating that tax revenues were more than sufficient to cover discretionary government expenditures.

E)budget surplus,indicating that tax revenues were more than sufficient to cover total government expenditures.

A)budget deficit,indicating that even deep cuts in government spending were not sufficient to alleviate the problem.

B)primary deficit,indicating that tax revenues were insufficient to cover discretionary government expenditures.

C)budget deficit,which contributed to a growing stock of government debt.

D)primary surplus but overall deficit,indicating that tax revenues were more than sufficient to cover discretionary government expenditures.

E)budget surplus,indicating that tax revenues were more than sufficient to cover total government expenditures.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

39

The table below shows government purchases (G),net tax revenues (T),and debt-service payments (iD)over a 4-year period for a hypothetical economy.All figures are in billions of dollars.Assume the stock of debt at the end of 2015 is $500 billion.  TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2017?

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2017?

A)$22 billion

B)-$22 billion

C)$21 billion

D)$2 billion

E)-$2 billion

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2017?

TABLE 31-1 Refer to Table 31-1.What is the primary budget deficit in 2017?A)$22 billion

B)-$22 billion

C)$21 billion

D)$2 billion

E)-$2 billion

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

40

The Canadian federal government's net debt as a percentage of GDP reached a historic high of

A)70% in 1996 due to large and persistent deficits throughout the 1970s.

B)70% in 1982 due to the OPEC oil shock in the mid-1970s and the severe inflation that followed.

C)110% in 1946 as a result of Canada's participation in the Second World War.

D)52% in 2012 due to the fiscal expansion following the global financial crisis.

E)90% in the late 1960s due to massive infrastructure projects in progress across Canada.

A)70% in 1996 due to large and persistent deficits throughout the 1970s.

B)70% in 1982 due to the OPEC oil shock in the mid-1970s and the severe inflation that followed.

C)110% in 1946 as a result of Canada's participation in the Second World War.

D)52% in 2012 due to the fiscal expansion following the global financial crisis.

E)90% in the late 1960s due to massive infrastructure projects in progress across Canada.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

41

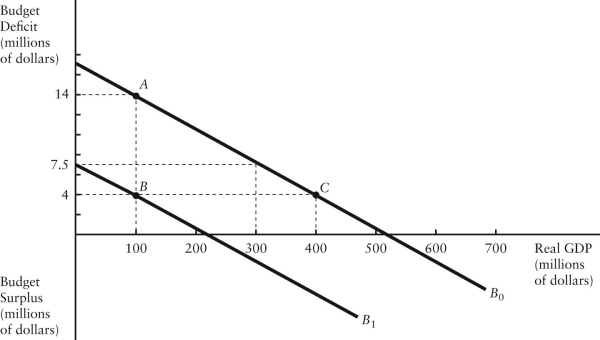

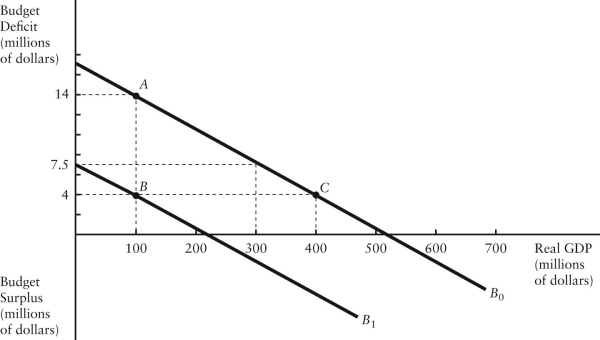

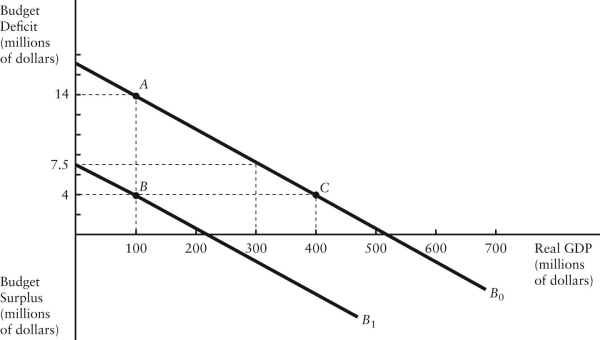

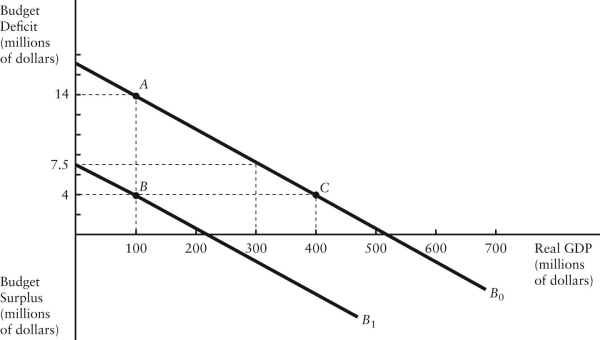

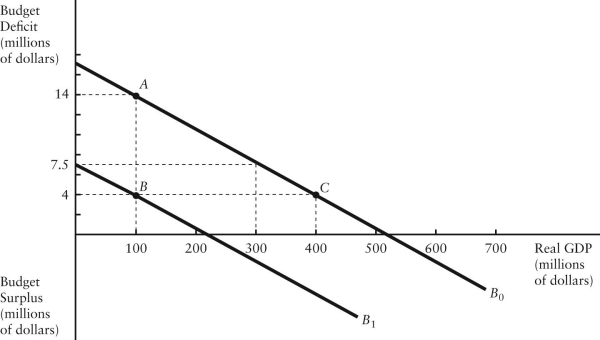

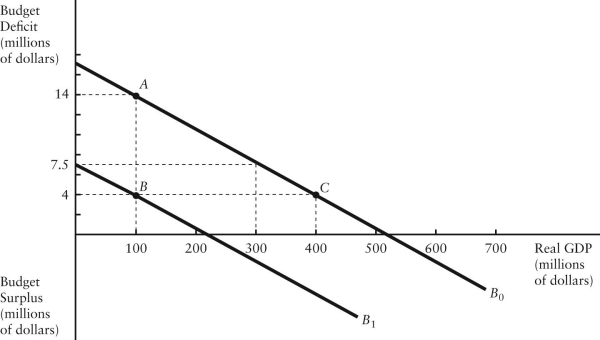

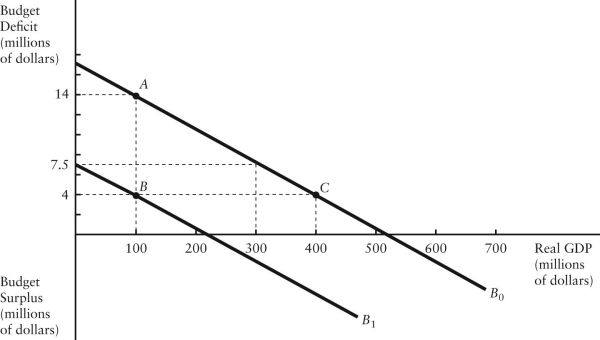

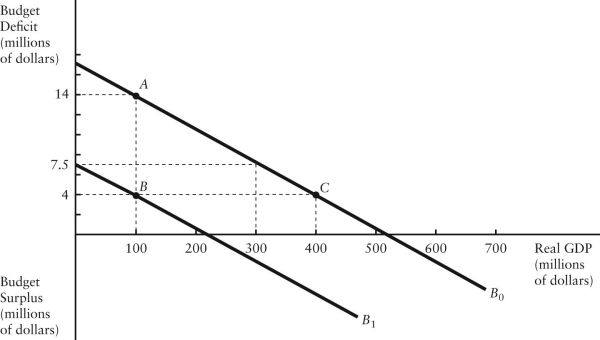

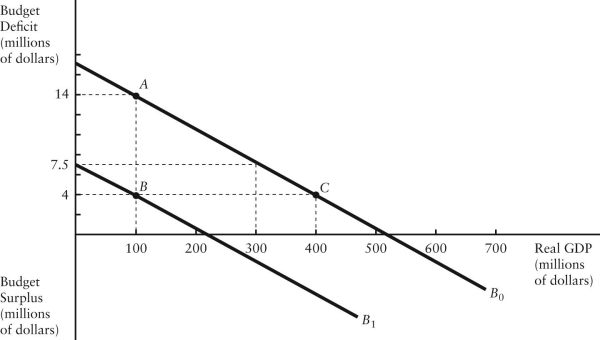

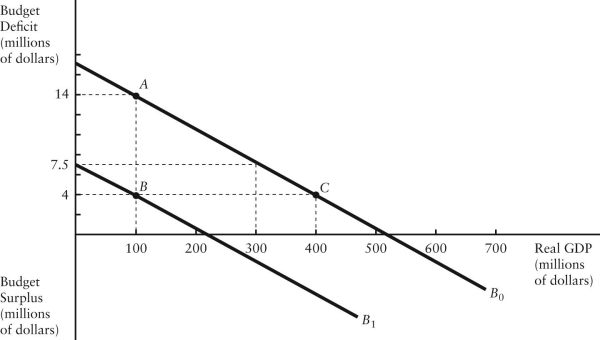

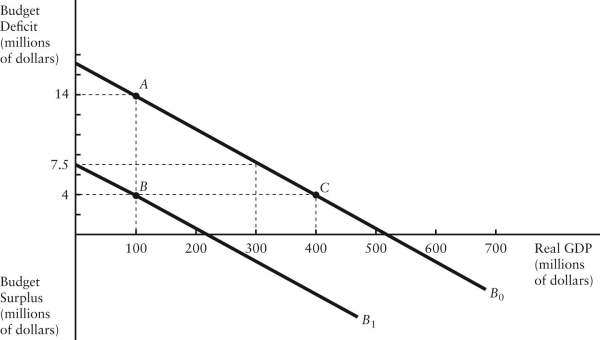

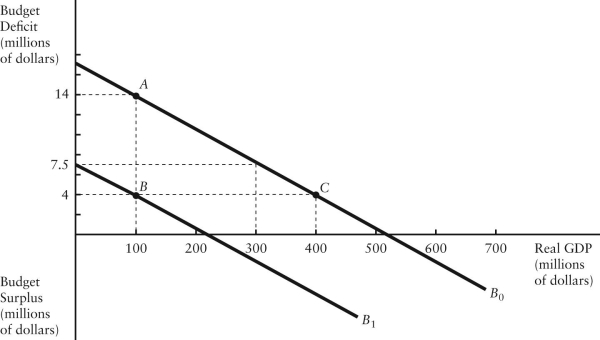

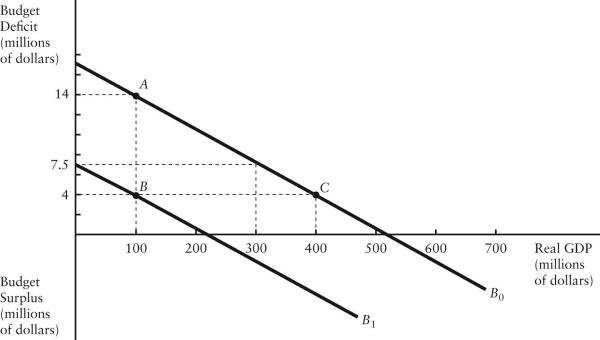

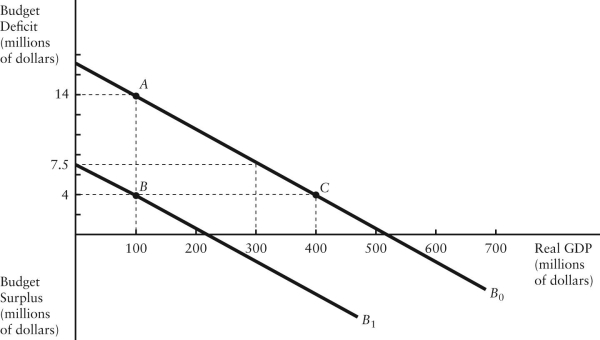

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A.If the government were to then implement a fiscal expansion,the structural budget deficit would be

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A.If the government were to then implement a fiscal expansion,the structural budget deficit would be

A)$4 million.

B)$6 million.

C)$7 million.

D)$10 million.

E)Insufficient information to know.

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A.If the government were to then implement a fiscal expansion,the structural budget deficit would be

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A.If the government were to then implement a fiscal expansion,the structural budget deficit would beA)$4 million.

B)$6 million.

C)$7 million.

D)$10 million.

E)Insufficient information to know.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

42

The budget deficit function is graphed with the budget deficit on the vertical axis and ________ on the horizontal axis,and is ________.

A)real GDP; downward sloping

B)real GDP; upward sloping

C)the interest rate; downward sloping

D)the interest rate; upward sloping

E)the interest rate; horizontal

A)real GDP; downward sloping

B)real GDP; upward sloping

C)the interest rate; downward sloping

D)the interest rate; upward sloping

E)the interest rate; horizontal

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

43

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

A)$4 million.

B)$6.5 million.

C)$7.5 million.

D)$14 million.

E)Insufficient information to know.

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would beA)$4 million.

B)$6.5 million.

C)$7.5 million.

D)$14 million.

E)Insufficient information to know.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

44

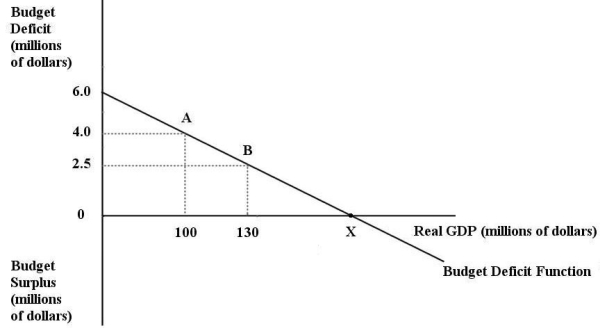

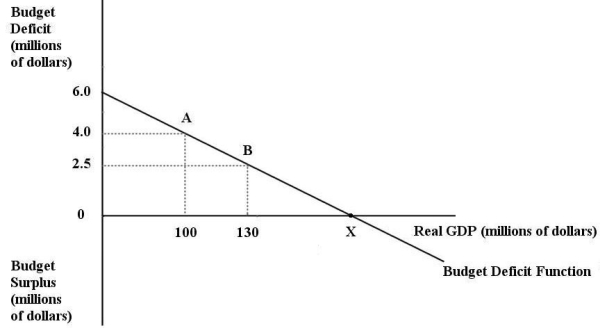

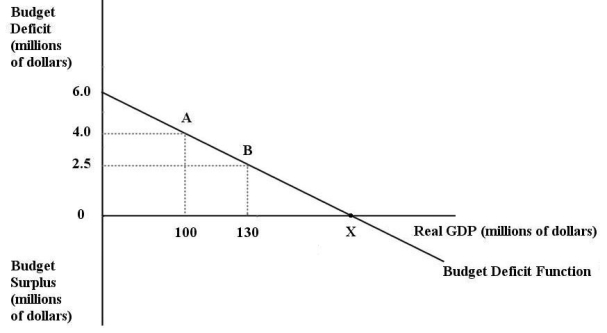

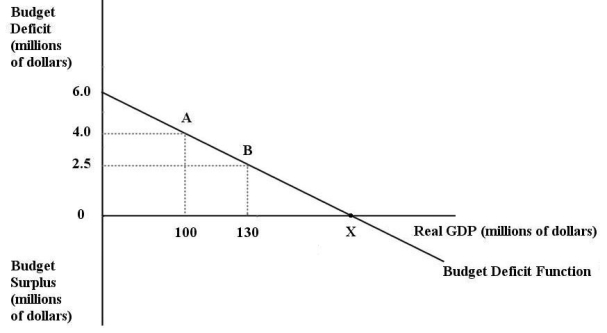

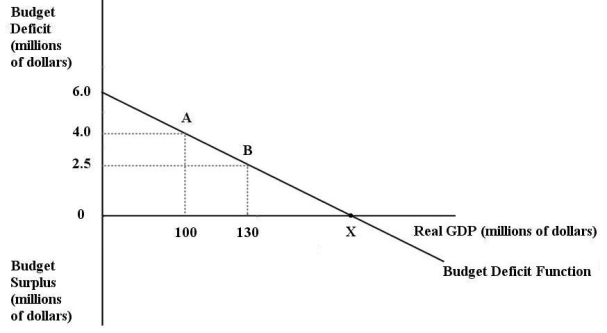

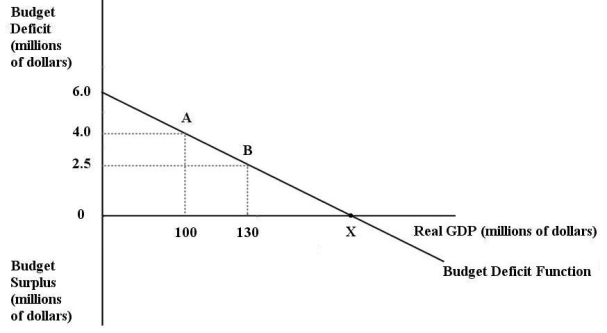

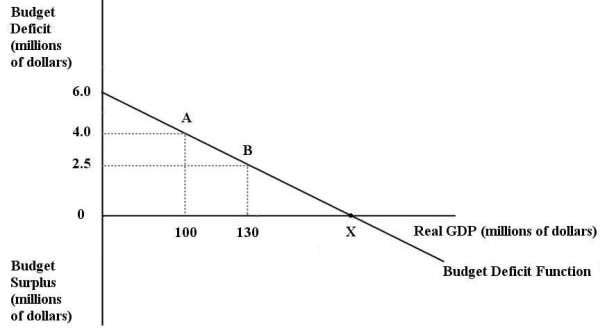

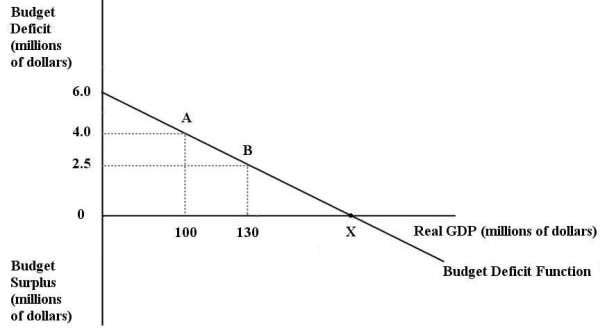

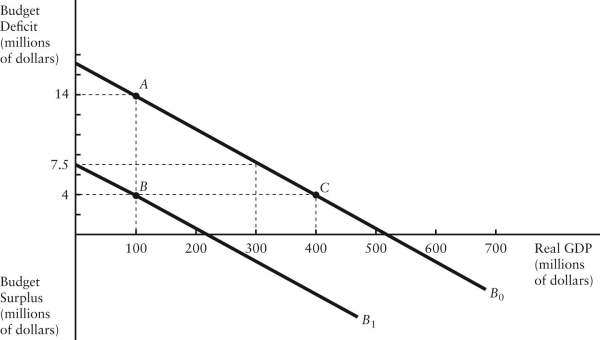

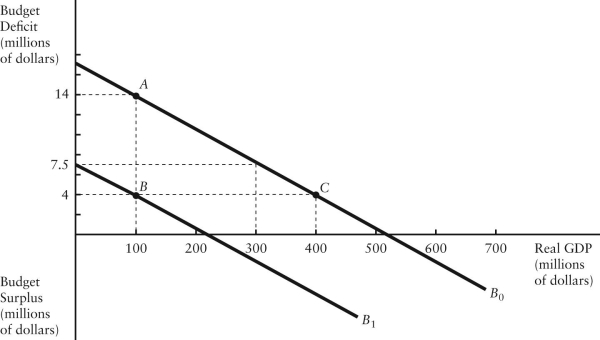

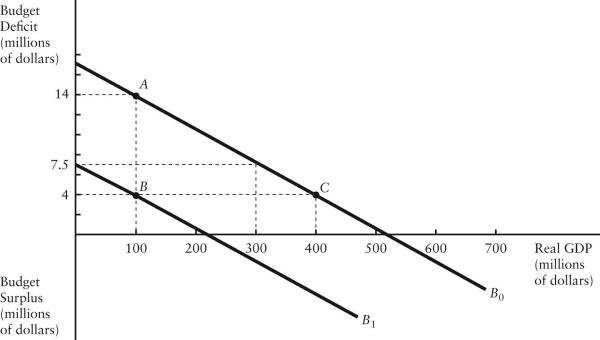

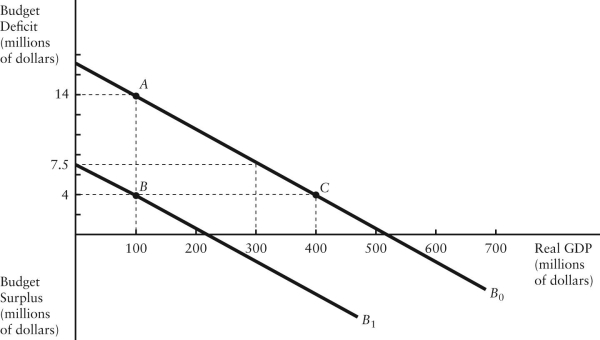

The diagram below shows the budget deficit function for a government in a hypothetical economy.  FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A on the graph.Which of the following is consistent with a move from point A to point B?

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A on the graph.Which of the following is consistent with a move from point A to point B?

A)implementation of an expansionary fiscal policy

B)implementation of a contractionary fiscal policy

C)implementation of a contractionary monetary policy

D)the economy entering into a recession

E)the economy entering into a boom

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A on the graph.Which of the following is consistent with a move from point A to point B?

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A on the graph.Which of the following is consistent with a move from point A to point B?A)implementation of an expansionary fiscal policy

B)implementation of a contractionary fiscal policy

C)implementation of a contractionary monetary policy

D)the economy entering into a recession

E)the economy entering into a boom

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

45

Consider the government's budget deficit function,graphed with dollars on the vertical axis and real GDP on the horizontal axis.This function is downward sloping because as real GDP

A)falls,the budget deficit function shifts down.

B)falls,tax revenues rise,decreasing the deficit or increasing the surplus.

C)rises,tax revenues rise,decreasing the deficit or increasing the surplus.

D)rises,tax revenues fall,decreasing the deficit or increasing the surplus.

E)rises,it leads to increasing debt-service payments.

A)falls,the budget deficit function shifts down.

B)falls,tax revenues rise,decreasing the deficit or increasing the surplus.

C)rises,tax revenues rise,decreasing the deficit or increasing the surplus.

D)rises,tax revenues fall,decreasing the deficit or increasing the surplus.

E)rises,it leads to increasing debt-service payments.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

46

Consider the government's budget deficit function.If the economy goes into a recession,a government budget deficit is most likely to

A)increase,because government expenditures and tax revenues will both rise.

B)increase,because government expenditures will rise and tax revenues will decline.

C)remain unchanged,although there will be a primary budget surplus.

D)remain unchanged,because changes in government expenditures and tax revenues will balance each other out.

E)decrease,because government expenditures will decrease and tax revenues will rise.

A)increase,because government expenditures and tax revenues will both rise.

B)increase,because government expenditures will rise and tax revenues will decline.

C)remain unchanged,although there will be a primary budget surplus.

D)remain unchanged,because changes in government expenditures and tax revenues will balance each other out.

E)decrease,because government expenditures will decrease and tax revenues will rise.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

47

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the cyclical component of the actual budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the cyclical component of the actual budget deficit would be

A)$4 million.

B)$6.5 million.

C)$7.5 million.

D)$14 million.

E)Insufficient information to know.

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the cyclical component of the actual budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the cyclical component of the actual budget deficit would beA)$4 million.

B)$6.5 million.

C)$7.5 million.

D)$14 million.

E)Insufficient information to know.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

48

Consider the government's budget deficit function over a two-year time span - Years 1 and 2.Suppose in Year 2 there was a lower federal budget deficit than in Year 1.This could be explained by ________ in Year 2.

A)higher government expenditures (with constant real GDP)

B)higher real GDP (with constant fiscal policy)

C)lower real GDP (with constant fiscal policy)

D)a higher stock of government debt

E)an upward shift of the budget deficit function

A)higher government expenditures (with constant real GDP)

B)higher real GDP (with constant fiscal policy)

C)lower real GDP (with constant fiscal policy)

D)a higher stock of government debt

E)an upward shift of the budget deficit function

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

49

Consider the budget deficit function.With an unchanged fiscal policy by government,an increase in national income causes ________ the budget deficit function.

A)an upward movement along

B)a downward movement along

C)an upward shift of

D)a downward shift of

E)a downward rotation in

A)an upward movement along

B)a downward movement along

C)an upward shift of

D)a downward shift of

E)a downward rotation in

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

50

Consider the government's budget deficit function.Other things being equal,an autonomous increase in government purchases causes ________ the budget deficit function.

A)an upward movement along

B)a downward movement along

C)an upward shift of

D)a downward shift of

E)no change in

A)an upward movement along

B)a downward movement along

C)an upward shift of

D)a downward shift of

E)no change in

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

51

The diagram below shows the budget deficit function for a government in a hypothetical economy.  FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements a contractionary fiscal policy by decreasing its purchases of goods and services,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements a contractionary fiscal policy by decreasing its purchases of goods and services,then

A)the budget deficit function would shift up.

B)the budget deficit function would shift down.

C)the budget deficit function would become steeper.

D)the budget deficit function would become flatter.

E)the size of the budget deficit would decrease as we move from point A to point B.

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements a contractionary fiscal policy by decreasing its purchases of goods and services,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements a contractionary fiscal policy by decreasing its purchases of goods and services,thenA)the budget deficit function would shift up.

B)the budget deficit function would shift down.

C)the budget deficit function would become steeper.

D)the budget deficit function would become flatter.

E)the size of the budget deficit would decrease as we move from point A to point B.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

52

As of 2018 the Canadian federal government had run a budget deficit each year since ________.

A)1945

B)1987

C)1998

D)2009

E)2015

A)1945

B)1987

C)1998

D)2009

E)2015

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

53

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

A)$2 million.

B)$14 million.

C)measured by the vertical distance between the horizontal axis and (at real GDP = 300).

(at real GDP = 300).

D)measured by the vertical distance between point A and the budget deficit that would exist at real GDP = 300 million.

E)Insufficient information to know.

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,the structural budget deficit would beA)$2 million.

B)$14 million.

C)measured by the vertical distance between the horizontal axis and

(at real GDP = 300).

(at real GDP = 300).D)measured by the vertical distance between point A and the budget deficit that would exist at real GDP = 300 million.

E)Insufficient information to know.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

54

Consider the government's budget deficit function.With an unchanged fiscal policy by government,an increase in GDP tends to ________ net tax revenues and thus ________ the budget deficit.

A)raise; raise

B)raise; lower

C)lower; raise

D)lower; lower

E)lower; leave unchanged

A)raise; raise

B)raise; lower

C)lower; raise

D)lower; lower

E)lower; leave unchanged

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

55

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point B?

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point B?

A)the implementation of an expansionary fiscal policy

B)the implementation of a contractionary fiscal policy

C)the implementation of an expansionary monetary policy

D)the implementation of a contractionary monetary policy

E)the economy entering into a boom

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point B?

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point B?A)the implementation of an expansionary fiscal policy

B)the implementation of a contractionary fiscal policy

C)the implementation of an expansionary monetary policy

D)the implementation of a contractionary monetary policy

E)the economy entering into a boom

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

56

The diagram below shows the budget deficit function for a government in a hypothetical economy.  FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by decreasing lump-sum taxes,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by decreasing lump-sum taxes,then

A)the budget deficit function would shift up.

B)the budget deficit function would shift down.

C)the budget deficit function would become steeper.

D)the budget deficit function would become flatter.

E)the size of the budget deficit would decrease as we move from point A to point B.

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by decreasing lump-sum taxes,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by decreasing lump-sum taxes,thenA)the budget deficit function would shift up.

B)the budget deficit function would shift down.

C)the budget deficit function would become steeper.

D)the budget deficit function would become flatter.

E)the size of the budget deficit would decrease as we move from point A to point B.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

57

Suppose the government's budget deficit falls from one year to the next,but there has been no change in the government's fiscal policy.The change in the budget deficit can be explained by

A)a rising real interest rate.

B)a change in the stance of fiscal policy.

C)a rising real GDP.

D)a rise in the cyclically adjusted deficit.

E)a rise in the primary budget deficit.

A)a rising real interest rate.

B)a change in the stance of fiscal policy.

C)a rising real GDP.

D)a rise in the cyclically adjusted deficit.

E)a rise in the primary budget deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

58

The diagram below shows the budget deficit function for a government in a hypothetical economy.  FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by increasing its purchases of goods and services,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by increasing its purchases of goods and services,then

A)the budget deficit function would shift down.

B)the budget deficit function would become steeper.

C)the budget deficit function would become flatter.

D)the budget deficit function would shift up.

E)the size of the budget deficit would decrease as we move from point A to point B.

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by increasing its purchases of goods and services,then

FIGURE 31-1 Refer to Figure 31-1.Initially,suppose real GDP is $100 million and the budget deficit is $4 million,as shown by point A.If the government implements an expansionary fiscal policy by increasing its purchases of goods and services,thenA)the budget deficit function would shift down.

B)the budget deficit function would become steeper.

C)the budget deficit function would become flatter.

D)the budget deficit function would shift up.

E)the size of the budget deficit would decrease as we move from point A to point B.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

59

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point C?

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point C?

A)a fiscal expansion and an increase in GDP

B)a fiscal contraction and an increase in GDP

C)a fiscal expansion and a decrease in GDP

D)a fiscal contraction and a decrease in GDP

E)an increase in GDP with no change in fiscal policy

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point C?

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose real GDP is $100 million and the budget deficit is $14 million,as shown by point A.Which of the following events could result in a move from point A to point C?A)a fiscal expansion and an increase in GDP

B)a fiscal contraction and an increase in GDP

C)a fiscal expansion and a decrease in GDP

D)a fiscal contraction and a decrease in GDP

E)an increase in GDP with no change in fiscal policy

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

60

Consider the government's budget deficit function,graphed with the budget deficit on the vertical axis and real GDP on the horizontal axis.The vertical position (or height)of the budget deficit function is determined by

A)the government's fiscal policies.

B)nominal GDP.

C)the interest rate times taxes.

D)the purchase and sale of government securities on the open market.

E)the stock of government debt minus government spending.

A)the government's fiscal policies.

B)nominal GDP.

C)the interest rate times taxes.

D)the purchase and sale of government securities on the open market.

E)the stock of government debt minus government spending.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

61

Consider a government with a positive stock of debt,and suppose the real interest rate on government bonds equals the rate of growth of real GDP.In this case,the government's debt-to-GDP ratio will rise only if

A)the debt-to-GDP ratio is already high.

B)the primary budget surplus exceeds the overall budget surplus.

C)the real interest rate is high.

D)there is an overall budget deficit.

E)there is a primary budget deficit.

A)the debt-to-GDP ratio is already high.

B)the primary budget surplus exceeds the overall budget surplus.

C)the real interest rate is high.

D)there is an overall budget deficit.

E)there is a primary budget deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

62

The best measure of the change in the stance of a government's fiscal policy is

A)the actual budget deficit.

B)the cyclically adjusted deficit.

C)the change in the structural budget deficit.

D)the change in the actual budget deficit.

E)the change in the primary budget deficit.

A)the actual budget deficit.

B)the cyclically adjusted deficit.

C)the change in the structural budget deficit.

D)the change in the actual budget deficit.

E)the change in the primary budget deficit.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

63

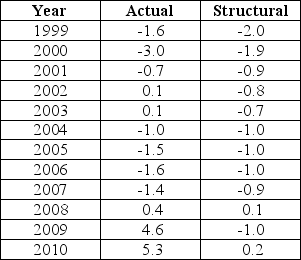

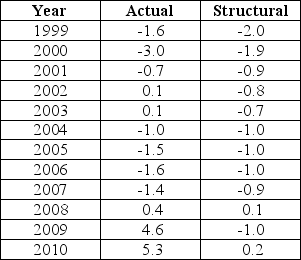

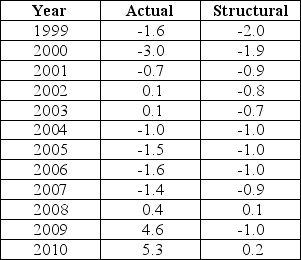

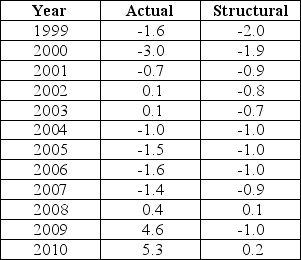

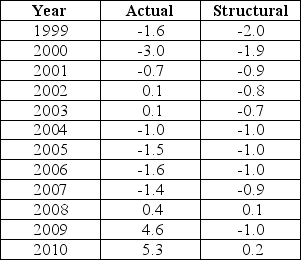

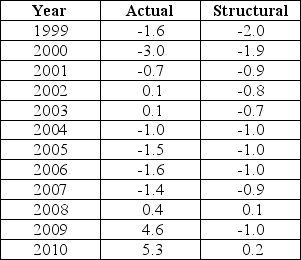

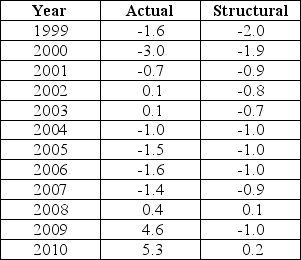

The data below provides the Actual and Structural Budget Deficits,as a percentage of real GDP,for Canada between 1999 and 2010.Note that a negative value in the table indicates a budget surplus.  TABLE 31-2 Refer to Table 31-2.Based on the data in the table,over which of the following intervals was fiscal policy expansionary?

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,over which of the following intervals was fiscal policy expansionary?

A)1999-2003 because the structural budget deficit is falling

B)1999-2003 because the structural budget deficit is rising

C)2008-2010 because the actual deficit is greater than zero

D)2004-2007 because the structural budget deficit is fairly stable

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,over which of the following intervals was fiscal policy expansionary?

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,over which of the following intervals was fiscal policy expansionary?A)1999-2003 because the structural budget deficit is falling

B)1999-2003 because the structural budget deficit is rising

C)2008-2010 because the actual deficit is greater than zero

D)2004-2007 because the structural budget deficit is fairly stable

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

64

Suppose the change in the government's debt-to-GDP ratio in a given year is 0.026.This figure tells us that the government's debt-to-GDP ratio has

A)fallen by 0.026%.

B)risen by 0.026%.

C)risen by 2.6 percentage points.

D)fallen by 2.6 percentage points.

E)risen by 0.026 percentage points.

A)fallen by 0.026%.

B)risen by 0.026%.

C)risen by 2.6 percentage points.

D)fallen by 2.6 percentage points.

E)risen by 0.026 percentage points.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

65

The data below provides the Actual and Structural Budget Deficits,as a percentage of real GDP,for Canada between 1999 and 2010.Note that a negative value in the table indicates a budget surplus.  TABLE 31-2 Refer to Table 31-2.Consider the years 2008-2010.The fact that the actual budget deficit in each year was greater than the structural budget deficit reflects the fact that

TABLE 31-2 Refer to Table 31-2.Consider the years 2008-2010.The fact that the actual budget deficit in each year was greater than the structural budget deficit reflects the fact that

A)output was equal to potential.

B)fiscal policy was contractionary over that time.

C)fiscal policy was expansionary over that time.

D)actual GDP was less than potential in each of those years.

E)actual GDP was greater than potential in each of those years.

TABLE 31-2 Refer to Table 31-2.Consider the years 2008-2010.The fact that the actual budget deficit in each year was greater than the structural budget deficit reflects the fact that

TABLE 31-2 Refer to Table 31-2.Consider the years 2008-2010.The fact that the actual budget deficit in each year was greater than the structural budget deficit reflects the fact thatA)output was equal to potential.

B)fiscal policy was contractionary over that time.

C)fiscal policy was expansionary over that time.

D)actual GDP was less than potential in each of those years.

E)actual GDP was greater than potential in each of those years.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

66

If the economy goes into a recession,the structural budget deficit is most likely to

A)increase,because government expenditures and tax revenues will both rise.

B)increase,because government expenditures will rise and tax revenues will decline.

C)remain unchanged,although there will be a primary budget surplus.

D)remain unchanged,unless government actively changes its fiscal policy.

E)decrease,because government expenditures will decrease and tax revenues will rise.

A)increase,because government expenditures and tax revenues will both rise.

B)increase,because government expenditures will rise and tax revenues will decline.

C)remain unchanged,although there will be a primary budget surplus.

D)remain unchanged,unless government actively changes its fiscal policy.

E)decrease,because government expenditures will decrease and tax revenues will rise.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

67

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,how much of the actual budget deficit is due to the underlying structure of fiscal policy and is therefore independent of the current level of GDP?

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,how much of the actual budget deficit is due to the underlying structure of fiscal policy and is therefore independent of the current level of GDP?

A)$4 million

B)$6.5 million

C)$7.5 million

D)$14 million

E)Insufficient information to know

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,how much of the actual budget deficit is due to the underlying structure of fiscal policy and is therefore independent of the current level of GDP?

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $300 million,how much of the actual budget deficit is due to the underlying structure of fiscal policy and is therefore independent of the current level of GDP?A)$4 million

B)$6.5 million

C)$7.5 million

D)$14 million

E)Insufficient information to know

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

68

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $400 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $400 million,the structural budget deficit would be

A)$14 million.

B)$4 million.

C)negative.

D)-$10 million.

E)$0.

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the level of potential output (Y*)were $400 million,the structural budget deficit would be

.Real GDP (Y)is $100 million.If the level of potential output (Y*)were $400 million,the structural budget deficit would beA)$14 million.

B)$4 million.

C)negative.

D)-$10 million.

E)$0.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

69

Consider changes in the government's debt-to-GDP ratio.Suppose that over a one year period the government has a primary budget surplus,and the real interest rate on government bonds is higher than the growth rate of real GDP.What is the effect on the debt-to-GDP ratio?

A)It will rise.

B)It will fall.

C)Uncertain - it is necessary to know the relative size of the different effects.

D)It will remain stable - the two effects cancel each other out.

A)It will rise.

B)It will fall.

C)Uncertain - it is necessary to know the relative size of the different effects.

D)It will remain stable - the two effects cancel each other out.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

70

The data below provides the Actual and Structural Budget Deficits,as a percentage of real GDP,for Canada between 1999 and 2010.Note that a negative value in the table indicates a budget surplus.  TABLE 31-2 Refer to Table 31-2.Based on the data in the table,in which of the following years was output greater than potential?

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,in which of the following years was output greater than potential?

A)1999

B)2004

C)2000

D)2008

E)2010

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,in which of the following years was output greater than potential?

TABLE 31-2 Refer to Table 31-2.Based on the data in the table,in which of the following years was output greater than potential?A)1999

B)2004

C)2000

D)2008

E)2010

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

71

The data below provides the Actual and Structural Budget Deficits,as a percentage of real GDP,for Canada between 1999 and 2010.Note that a negative value in the table indicates a budget surplus.  TABLE 31-2 Refer to Table 31-2.Consider the year 2004.Based on the data in the table we can conclude that

TABLE 31-2 Refer to Table 31-2.Consider the year 2004.Based on the data in the table we can conclude that

A)fiscal policy was expansionary in that year.

B)real output was less than potential in that year.

C)real output was equal to potential in that year.

D)real output was greater than potential in that year.

E)monetary policy was expansionary in that year.

TABLE 31-2 Refer to Table 31-2.Consider the year 2004.Based on the data in the table we can conclude that

TABLE 31-2 Refer to Table 31-2.Consider the year 2004.Based on the data in the table we can conclude thatA)fiscal policy was expansionary in that year.

B)real output was less than potential in that year.

C)real output was equal to potential in that year.

D)real output was greater than potential in that year.

E)monetary policy was expansionary in that year.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

72

Suppose the government's actual budget deficit is equal to the structural budget deficit.Then it must be the case that

A)the primary budget deficit is zero.

B)the overall government budget is balanced.

C)the debt-to-GDP ratio is stable.

D)real GDP is equal to potential GDP.

E)the government is not reporting all of its expenses.

A)the primary budget deficit is zero.

B)the overall government budget is balanced.

C)the debt-to-GDP ratio is stable.

D)real GDP is equal to potential GDP.

E)the government is not reporting all of its expenses.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

73

Suppose the real interest rate on government bonds is 5% while the growth rate of real GDP is 4%,and that the government's current debt-to-GDP ratio is 30%.If the government has a primary budget balance of zero in the current year,the debt-to-GDP ratio will

A)rise by 3.0 percentage points.

B)rise by 0.3 percentage points.

C)remain unchanged.

D)fall by 3.0 percentage points.

E)fall by 0.3 percentage points.

A)rise by 3.0 percentage points.

B)rise by 0.3 percentage points.

C)remain unchanged.

D)fall by 3.0 percentage points.

E)fall by 0.3 percentage points.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

74

Suppose the government's debt-to-GDP ratio on January 1 of Year 1 is 32%.The change in the debt-to-GDP ratio during Year 1 is -0.037.On January 1 of Year 2,the government's debt-to-GDP ratio is

A)31.963%.

B)32.037%.

C)28.3%.

D)35.7%.

E)Not enough information to determine.

A)31.963%.

B)32.037%.

C)28.3%.

D)35.7%.

E)Not enough information to determine.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

75

Suppose the change in the government's debt-to-GDP ratio in a given year is -0.018.This figure tells us that the government's debt-to-GDP ratio has

A)fallen by 0.018%.

B)risen by 0.018%.

C)risen by 1.8 percentage points.

D)fallen by 1.8 percentage points.

E)risen by 0.018 percentage points.

A)fallen by 0.018%.

B)risen by 0.018%.

C)risen by 1.8 percentage points.

D)fallen by 1.8 percentage points.

E)risen by 0.018 percentage points.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

76

The government's structural budget deficit adjusts for

A)any primary budget surplus or deficit incurred by the federal government.

B)changes in investment to smooth fluctuations in national income.

C)changes in spending or tax revenues caused by deviations in national income from potential output.

D)increases in the money supply in excess of the real growth in the economy.

E)interest rate changes that affect the absolute amount of debt-service payments.

A)any primary budget surplus or deficit incurred by the federal government.

B)changes in investment to smooth fluctuations in national income.

C)changes in spending or tax revenues caused by deviations in national income from potential output.

D)increases in the money supply in excess of the real growth in the economy.

E)interest rate changes that affect the absolute amount of debt-service payments.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

77

The government's structural budget deficit is the budget deficit that would exist

A)if real GDP were equal to potential GDP.

B)with taxes and expenditures measured at the equilibrium level of GDP.

C)if policy were changed to eliminate the business cycle.

D)if tax rates were set to maximize tax revenues.

E)if there were no discretionary fiscal interventions in the economy.

A)if real GDP were equal to potential GDP.

B)with taxes and expenditures measured at the equilibrium level of GDP.

C)if policy were changed to eliminate the business cycle.

D)if tax rates were set to maximize tax revenues.

E)if there were no discretionary fiscal interventions in the economy.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

78

Consider a government with a positive stock of debt.If the growth rate of real GDP exceeds the real rate of interest on government bonds,then to keep the debt-to-GDP ratio constant the

A)government must have a primary budget deficit.

B)government must have a primary budget surplus.

C)government must implement an expansionary fiscal policy.

D)money supply should be increased at a constant rate.

E)nominal interest rate must be constant.

A)government must have a primary budget deficit.

B)government must have a primary budget surplus.

C)government must implement an expansionary fiscal policy.

D)money supply should be increased at a constant rate.

E)nominal interest rate must be constant.

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

79

The diagram below shows two budget deficit functions for a hypothetical economy.  FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the government implements a fiscal policy that causes the budget deficit function to shift to

.Real GDP (Y)is $100 million.If the government implements a fiscal policy that causes the budget deficit function to shift to  ,we can conclude that the policy was ________ and the structural deficit will be ________ than previously.

,we can conclude that the policy was ________ and the structural deficit will be ________ than previously.

A)expansionary; smaller

B)expansionary; larger

C)contractionary; larger

D)contractionary; smaller

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function

FIGURE 31-2 Refer to Figure 31-2.Initially,suppose the economy is at point A on budget deficit function  .Real GDP (Y)is $100 million.If the government implements a fiscal policy that causes the budget deficit function to shift to

.Real GDP (Y)is $100 million.If the government implements a fiscal policy that causes the budget deficit function to shift to  ,we can conclude that the policy was ________ and the structural deficit will be ________ than previously.

,we can conclude that the policy was ________ and the structural deficit will be ________ than previously.A)expansionary; smaller

B)expansionary; larger

C)contractionary; larger

D)contractionary; smaller

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck

80

Consider the following variables,defined as follows: d = debt-to-GDP ratio

X = primary budget deficit as a percentage of GDP

R = real interest rate on government bonds

G = growth rate of real GDP

Which of the following expressions correctly describes the change in the debt-to-GDP ratio?

A)Δd = x + (r - g)+ d

B)Δd = x + (r - g)× d

C)Δd = x(r - g)+ d

D)Δd = x(g - r)- d

E)Δd = x + (g - r)× d

X = primary budget deficit as a percentage of GDP

R = real interest rate on government bonds

G = growth rate of real GDP

Which of the following expressions correctly describes the change in the debt-to-GDP ratio?

A)Δd = x + (r - g)+ d

B)Δd = x + (r - g)× d

C)Δd = x(r - g)+ d

D)Δd = x(g - r)- d

E)Δd = x + (g - r)× d

Unlock Deck

Unlock for access to all 125 flashcards in this deck.

Unlock Deck

k this deck