Deck 1: An Introduction to Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/104

Play

Full screen (f)

Deck 1: An Introduction to Taxation

1

Gifts between spouses are generally exempt from transfer taxes.

True

2

Property is generally included on an estate tax return at its historical cost basis.

False

3

The unified transfer tax system, comprised of the gift and estate taxes, is based upon the total property transfers an individual makes during lifetime and at death.

True

4

All states impose a state income tax which is generally based on an individual's federal adjusted gross income (AGI)with minor adjustments.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

5

If a taxpayer's total tax liability is $30,000, taxable income is $100,000, and economic income is $120,000, the average tax rate is 30 percent.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

6

The federal income tax is the dominant form of taxation by the federal government.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

7

The terms "progressive tax" and "flat tax" are synonymous.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

8

An individual will be subject to gift tax on gifts made to a charity greater than $14,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

9

The Sixteenth Amendment permits the passage of a federal income tax.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

10

The marginal tax rate is useful in tax planning because it measures the tax effect of a proposed transaction.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

11

The largest source of federal revenues is the corporate income tax.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

12

A taxpayer's average tax rate is the tax rate applied to an incremental amount of taxable income that is added to the tax base.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

13

Regressive tax rates decrease as the tax base increases.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

14

Property transferred to the decedent's spouse is exempt from the estate tax because of the estate tax marital deduction provision.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

15

For gift tax purposes, a $14,000 annual exclusion per donee is permitted.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

16

If a taxpayer's total tax liability is $4,000, taxable income is $20,000, and total economic income is $40,000, then the effective tax rate is 20 percent.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

17

A progressive tax rate structure is one where the rate of tax increases as the tax base increases.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

18

The primary liability for payment of the gift tax is imposed upon the donee.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

19

When a change in the tax law is deemed necessary by Congress, the entire Internal Revenue Code must be revised.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

20

A proportional tax rate is one where the rate of the tax is the same for all taxpayers, regardless of income levels.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

21

S Corporations result in a single level of taxation.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

22

Generally, tax legislation is introduced first in the Senate and referred to the Senate Finance Committee.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

23

The various entities in the federal income tax system may be classified into two general categories, taxpaying entities (such as individuals and C [regular] corporations)and flow-through entities such as sole proprietorships, partnerships, S corporations, and limited liability companies.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

24

Adam Smith's canons of taxation are equity, certainty, convenience and economy.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

25

Generally, the statute of limitations is three years from the later of the date the tax return is filed or the due date.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

26

In a limited liability partnership, a partner is not liable for his partner's acts of negligence or misconduct.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following taxes is progressive?

A)sales tax

B)excise tax

C)property tax

D)federal income tax

A)sales tax

B)excise tax

C)property tax

D)federal income tax

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

28

Limited liability company members (owners)are responsible for the liabilities of their limited liability company.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

29

The largest source of revenues for the federal government comes from

A)individual income taxes.

B)corporate income taxes.

C)Social Security and Medicare taxes (FICA).

D)estate and gift taxes.

A)individual income taxes.

B)corporate income taxes.

C)Social Security and Medicare taxes (FICA).

D)estate and gift taxes.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

30

Gifts made during a taxpayer's lifetime may affect the amount of estate tax paid by the taxpayer's estate.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

31

The tax law encompasses administrative and judicial interpretations, such as Treasury regulations, revenue rulings, revenue procedures, and court decisions, as well as statutes.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

32

Flow-through entities do not have to file tax returns since they are not taxable entities.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

33

The Internal Revenue Service is the branch of the Treasury Department responsible for administering the federal tax law.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

34

Limited liability companies may elect to be taxed as corporations.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

35

While federal and state income taxes as well as the federal gift and estate taxes are generally progressive in nature, property taxes are proportional.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

36

Individuals are the principal taxpaying entities in the federal income tax system.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following taxes is proportional?

A)gift tax

B)income tax

C)sales tax

D)Federal Insurance Contributions Act (FICA)

A)gift tax

B)income tax

C)sales tax

D)Federal Insurance Contributions Act (FICA)

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

38

The primary objective of the federal income tax law is to achieve various economic and social policy objectives.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

39

Dividends paid from most U.S. corporations are taxed at the same rate as the recipients' salaries and wages.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

40

Arthur pays tax of $5,000 on taxable income of $50,000 while taxpayer Barbara pays tax of $12,000 on $120,000. The tax is a

A)progressive tax.

B)proportional tax.

C)regressive tax.

D)None of the above.

A)progressive tax.

B)proportional tax.

C)regressive tax.

D)None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is incorrect?

A)Property taxes are levied on real estate.

B)Excise taxes are assessed on items such as gasoline and telephone use.

C)Gift taxes are imposed on the recipient of a gift.

D)The estate tax is based on the fair market value of property at death or the alternate valuation date.

A)Property taxes are levied on real estate.

B)Excise taxes are assessed on items such as gasoline and telephone use.

C)Gift taxes are imposed on the recipient of a gift.

D)The estate tax is based on the fair market value of property at death or the alternate valuation date.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

42

Thomas dies in the current year and has a gross estate valued at $3,000,000. During his lifetime (but after 1976)Thomas had made taxable gifts of $400,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Thomas' debts which amount to $300,000. Thomas bequeaths $500,000 to his wife. What is the amount of Thomas' tax base, the amount on which the estate tax is computed?

A)$2,100,000

B)$2,500,000

C)$2,600,000

D)$3,400,000

A)$2,100,000

B)$2,500,000

C)$2,600,000

D)$3,400,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

43

Martha is self-employed in 2014. Her business profits are $140,000. What is her self-employment tax?

A)$21,420

B)$18,568

C)$18,159

D)None of the above.

A)$21,420

B)$18,568

C)$18,159

D)None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

44

Horizontal equity means that

A)taxpayers with the same amount of income pay the same amount of tax.

B)taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.

C)all taxpayers should pay the same tax.

D)none of the above.

A)taxpayers with the same amount of income pay the same amount of tax.

B)taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.

C)all taxpayers should pay the same tax.

D)none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

45

Charlie makes the following gifts in the current year: $40,000 to his spouse, $30,000 to his church, $18,000 to his nephew, and $25,000 to a friend. Assuming Charlie does not elect gift splitting with his wife, his taxable gifts in the current year will be

A)$13,000.

B)$15,000.

C)$25,000.

D)$41,000.

A)$13,000.

B)$15,000.

C)$25,000.

D)$41,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

46

Shaquille buys new cars for five of his friends. Each car cost $70,000. What is the amount of Shaquille's taxable gifts?

A)$0

B)$280,000

C)$336,000

D)$350,000

A)$0

B)$280,000

C)$336,000

D)$350,000

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is not one of Adam Smith's canons of taxation?

A)equity

B)convenience

C)certainty

D)paid by all citizens

A)equity

B)convenience

C)certainty

D)paid by all citizens

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

48

In 2014, an estate is not taxable unless the sum of the taxable estate and taxable gifts made after 1976 exceeds

A)$1,000,000.

B)$3,500,000.

C)$5,000,000.

D)$5,340,000.

A)$1,000,000.

B)$3,500,000.

C)$5,000,000.

D)$5,340,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following taxes is regressive?

A)Federal Insurance Contributions Act (FICA)

B)excise tax

C)property tax

D)gift tax

A)Federal Insurance Contributions Act (FICA)

B)excise tax

C)property tax

D)gift tax

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

50

Charlotte pays $16,000 in tax deductible property taxes. Charlotte's marginal tax rate is 28%, effective tax rate is 22% and average rate is 25%. Charlotte's tax savings from paying the property tax is

A)$3,520.

B)$4,000.

C)$4,480.

D)$11,520.

A)$3,520.

B)$4,000.

C)$4,480.

D)$11,520.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

51

Eric dies in the current year and has a gross estate valued at $6,500,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Eric's debts which amount to $250,000. Eric bequeaths $600,000 to his wife. Eric made no taxable transfers during his life. Eric's taxable estate will be

A)$210,000.

B)$5,550,000.

C)$6,150,000.

D)$6,500,000.

A)$210,000.

B)$5,550,000.

C)$6,150,000.

D)$6,500,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

52

Helen, who is single, is considering purchasing a residence that will provide a $28,000 tax deduction for property taxes and mortgage interest. If her marginal tax rate is 25% and her effective tax rate is 20%, what is the amount of Helen's tax savings from purchasing the residence?

A)$5,600

B)$7,000

C)$21,000

D)$22,400

A)$5,600

B)$7,000

C)$21,000

D)$22,400

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

53

The unified transfer tax system

A)imposes a single tax upon transfers of property during an individual's lifetime only.

B)imposes a single tax upon transfers of property during an individual's life and at death.

C)imposes a single tax upon transfers of property only at an individual's death.

D)none of above.

A)imposes a single tax upon transfers of property during an individual's lifetime only.

B)imposes a single tax upon transfers of property during an individual's life and at death.

C)imposes a single tax upon transfers of property only at an individual's death.

D)none of above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

54

Sarah contributes $25,000 to a church. Sarah's marginal tax rate is 35% while her average tax rate is 25%. After considering her tax savings, Sarah's contribution costs

A)$6,250.

B)$8,750.

C)$16,250.

D)$18,750.

A)$6,250.

B)$8,750.

C)$16,250.

D)$18,750.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

55

When property is transferred, the gift tax is based on

A)replacement cost of the transferred property.

B)fair market value on the date of transfer.

C)the transferor's original cost of the transferred property.

D)the transferor's depreciated cost of the transferred property.

A)replacement cost of the transferred property.

B)fair market value on the date of transfer.

C)the transferor's original cost of the transferred property.

D)the transferor's depreciated cost of the transferred property.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

56

Vertical equity means that

A)taxpayers with the same amount of income pay the same amount of tax.

B)taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.

C)all taxpayers should pay the same tax.

D)none of the above.

A)taxpayers with the same amount of income pay the same amount of tax.

B)taxpayers with larger amounts of income should pay more tax than taxpayer's with lower amounts of income.

C)all taxpayers should pay the same tax.

D)none of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

57

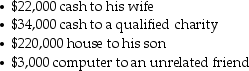

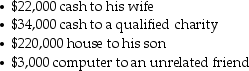

Paul makes the following property transfers in the current year:  The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

A)$206,000.

B)$214,000.

C)$234,000.

D)$279,000.

The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax is

The total of Paul's taxable gifts, assuming he does not elect gift splitting with his spouse, subject to the unified transfer tax isA)$206,000.

B)$214,000.

C)$234,000.

D)$279,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

58

Jillian, a single individual, earns $230,000 in 2014 through her job as an accounting manager. What is her FICA tax?

A)$10,859

B)$17,595

C)$10,589

D)$8,951

A)$10,859

B)$17,595

C)$10,589

D)$8,951

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

59

Anne, who is single, has taxable income for the current year of $38,000 while total economic income is $43,000 resulting in a total tax of $5,356. Anne's average tax rate and effective tax rate are, respectively,

A)14.09% and 12.46%.

B)12.46% and 14.09%.

C)14.09% and 25%.

D)12.46% and 25%.

A)14.09% and 12.46%.

B)12.46% and 14.09%.

C)14.09% and 25%.

D)12.46% and 25%.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

60

Denzel earns $130,000 in 2014 through his job as a sales manager. What is his FICA tax?

A)$9,139

B)$8,951

C)$8,698

D)$9,945

A)$9,139

B)$8,951

C)$8,698

D)$9,945

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

61

All of the following are classified as flow-through entities for tax purposes except

A)partnerships.

B)C corporations.

C)S corporations.

D)limited liability companies.

A)partnerships.

B)C corporations.

C)S corporations.

D)limited liability companies.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

62

When returns are processed, they are scored to determine their potential for yielding additional tax revenues. This program is called

A)Taxpayer Compliance Measurement Program.

B)Discriminant Function System.

C)Standard Audit Program.

D)Field Audit Program.

A)Taxpayer Compliance Measurement Program.

B)Discriminant Function System.

C)Standard Audit Program.

D)Field Audit Program.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following individuals is most likely to be audited?

A)Lola has AGI of $35,000 from wages and uses the standard deduction.

B)Marvella has a $145,000 net loss from her unincorporated business (a horse farm). She also received $950,000 salary as a CEO of a corporation.

C)Melvin is retired and receives Social Security benefits.

D)Jerry is a school teacher with two children earning $55,000 a year. He also receives $200 in interest income on a bank account.

A)Lola has AGI of $35,000 from wages and uses the standard deduction.

B)Marvella has a $145,000 net loss from her unincorporated business (a horse farm). She also received $950,000 salary as a CEO of a corporation.

C)Melvin is retired and receives Social Security benefits.

D)Jerry is a school teacher with two children earning $55,000 a year. He also receives $200 in interest income on a bank account.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

64

All of the following are executive (administrative)sources of tax law except

A)Internal Revenue Code.

B)Income Tax Regulations.

C)Revenue Rulings.

D)Revenue Procedures.

A)Internal Revenue Code.

B)Income Tax Regulations.

C)Revenue Rulings.

D)Revenue Procedures.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following steps, related to a tax bill, occurs first?

A)signature or veto by the President of the United States

B)consideration by the Senate

C)consideration by the House Ways and Means Committee

D)consideration by the Joint Conference Committee

A)signature or veto by the President of the United States

B)consideration by the Senate

C)consideration by the House Ways and Means Committee

D)consideration by the Joint Conference Committee

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is not an objective of the federal income tax law?

A)Stimulate private investment.

B)Reduce employment.

C)Encourage research and development activities.

D)Prevent taxpayers from paying a higher percentage of their income in personal income taxes due to inflation.

A)Stimulate private investment.

B)Reduce employment.

C)Encourage research and development activities.

D)Prevent taxpayers from paying a higher percentage of their income in personal income taxes due to inflation.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

67

What is an important aspect of a limited liability partnership?

A)It is the same as a limited partnership where the general partner has unlimited liability.

B)A partner has unlimited liability arising from his or her own acts of negligence or misconduct or similar acts of any person under his or her direct supervision, but does not have unlimited liability in other matters.

C)All partners have limited liability regarding all partnership activities.

D)All partners have unlimited liability.

A)It is the same as a limited partnership where the general partner has unlimited liability.

B)A partner has unlimited liability arising from his or her own acts of negligence or misconduct or similar acts of any person under his or her direct supervision, but does not have unlimited liability in other matters.

C)All partners have limited liability regarding all partnership activities.

D)All partners have unlimited liability.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following serves as the highest authority for tax research, planning, and compliance activities?

A)Internal Revenue Code

B)Income Tax Regulations

C)Revenue Rulings

D)Revenue Procedures

A)Internal Revenue Code

B)Income Tax Regulations

C)Revenue Rulings

D)Revenue Procedures

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not a social objective of the tax law?

A)prohibition of a deduction for illegal bribes, fines and penalties

B)a deduction for charitable contributions

C)an exclusion for interest earned by large businesses

D)creation of tax-favored pension plans

A)prohibition of a deduction for illegal bribes, fines and penalties

B)a deduction for charitable contributions

C)an exclusion for interest earned by large businesses

D)creation of tax-favored pension plans

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

70

When new tax legislation is being considered by Congress,

A)the tax bill will usually originate in the Senate.

B)different versions of the House and Senate bills are reconciled by the Speaker of the House and the President of the Senate.

C)different versions of the House and Senate bills are reconciled by a Joint Conference Committee.

D)after the President of the U.S. approves a tax bill, the Joint Conference Committee must then vote on passage of the bill.

A)the tax bill will usually originate in the Senate.

B)different versions of the House and Senate bills are reconciled by the Speaker of the House and the President of the Senate.

C)different versions of the House and Senate bills are reconciled by a Joint Conference Committee.

D)after the President of the U.S. approves a tax bill, the Joint Conference Committee must then vote on passage of the bill.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

71

All of the following statements are true except

A)the net income earned by a sole proprietorship is reported on the owner's individual income tax return.

B)the net income of an S corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the S corporation to individual shareholders are also taxed.

C)the net income of C corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the C corporation to individual shareholders is also taxed.

D)LLCs are generally taxed as partnerships.

A)the net income earned by a sole proprietorship is reported on the owner's individual income tax return.

B)the net income of an S corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the S corporation to individual shareholders are also taxed.

C)the net income of C corporation is subject to double taxation because it is taxed at the entity level and dividends paid from the C corporation to individual shareholders is also taxed.

D)LLCs are generally taxed as partnerships.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

72

Which of the following is not a taxpaying entity?

A)Corporation

B)Partnership

C)Individual

D)All of the above are taxpayers.

A)Corporation

B)Partnership

C)Individual

D)All of the above are taxpayers.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

73

In an S corporation, shareholders

A)are taxed on their proportionate share of earnings.

B)are taxed only on dividends.

C)may allocate income among themselves in order to consider special contributions.

D)are only taxed on salaries.

A)are taxed on their proportionate share of earnings.

B)are taxed only on dividends.

C)may allocate income among themselves in order to consider special contributions.

D)are only taxed on salaries.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

74

AB Partnership earns $500,000 in the current year. Partners A and B are equal partners who do not receive any distributions during the year. How much income does partner A report from the partnership?

A)$0

B)$250,000

C)$500,000

D)None of the above.

A)$0

B)$250,000

C)$500,000

D)None of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

75

Alan files his 2014 tax return on April 1, 2015. His return contains no misstatements or omissions of income. The statute of limitations for changes to the return expires

A)April 1, 2018.

B)April 15, 2018.

C)April 15, 2017.

D)The statute of limitations never expires.

A)April 1, 2018.

B)April 15, 2018.

C)April 15, 2017.

D)The statute of limitations never expires.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

76

Rocky and Charlie form RC Partnership as equal partners. Rocky contributes $100,000 into RC while Charlie contributes real estate with a fair market value of $100,000. During the current year, RC earned net income of $600,000. The partnership distributes $200,000 to each partner. The amount that Rocky should report on his individual tax return is

A)$0.

B)$100,000.

C)$200,000.

D)$300,000.

A)$0.

B)$100,000.

C)$200,000.

D)$300,000.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

77

A tax bill introduced in the House of Representatives is then

A)referred to the House Ways and Means Committee for hearings and approval.

B)referred to the full House for hearings.

C)forwarded to the Senate Finance Committee for consideration.

D)voted upon by the full House.

A)referred to the House Ways and Means Committee for hearings and approval.

B)referred to the full House for hearings.

C)forwarded to the Senate Finance Committee for consideration.

D)voted upon by the full House.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following is not an advantage of a limited liability company (LLC)?

A)limited liability for all members of a LLC

B)ability to choose between taxation as a partnership or corporation

C)default tax treatment as a corporation, unless otherwise elected

D)All of the above are advantages of an LLC.

A)limited liability for all members of a LLC

B)ability to choose between taxation as a partnership or corporation

C)default tax treatment as a corporation, unless otherwise elected

D)All of the above are advantages of an LLC.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

79

The term "tax law" includes

A)Internal Revenue Code.

B)Treasury Regulations.

C)judicial decisions.

D)all of the above.

A)Internal Revenue Code.

B)Treasury Regulations.

C)judicial decisions.

D)all of the above.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck

80

The Senate equivalent of the House Ways and Means Committee is the Senate

A)Joint Committee on Taxation.

B)Ways and Means Committee.

C)Finance Committee.

D)Joint Conference Committee.

A)Joint Committee on Taxation.

B)Ways and Means Committee.

C)Finance Committee.

D)Joint Conference Committee.

Unlock Deck

Unlock for access to all 104 flashcards in this deck.

Unlock Deck

k this deck