Deck 10: Depreciation, Cost Recovery, Amortization, and Depletion

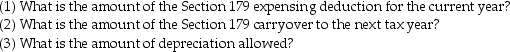

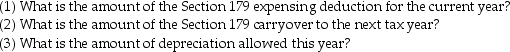

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 10: Depreciation, Cost Recovery, Amortization, and Depletion

1

The Section 179 expensing election is available on an annual basis for property purchased during the year.

True

2

Personal property used in a rental activity held for investment qualifies for the Section 179 expensing election.

False

3

The mid-quarter convention applies to personal and real property.

False

4

Under MACRS, tangible personal property used in trade or business purchased and placed into service on March 1, 2014 should be depreciated for 10 months in 2014. Assume the business uses a calendar tax year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

Land, buildings, equipment, and stock are examples of tangible property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

Under the MACRS rules, salvage value is not considered in the computation of the cost-recovery or depreciation amount.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

In computing MACRS depreciation in the year of disposition of personal property used in a trade or business, the half-year convention must be applied to the amounts in the tables if the half-year convention was used in the year the asset was placed into service.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

If personal-use property is converted to trade or business use, the basis for depreciation is the lesser of adjusted basis or FMV on the date of conversion.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

On its tax return, a corporation will use the same depreciation, amortization and depletion methods used in its financial statements issued to shareholders.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

Under the MACRS system, automobiles and computers are classified as seven-year property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

The basis of an asset must be reduced by the depreciation allowable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

Under the MACRS system, if the aggregate basis of all personal property placed in service during the last three months of the year exceeds 40% of the cost of all personal property placed in service during the tax year, the mid-quarter convention is required.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

In order for an asset to be depreciated in the year of purchase, it must be placed in service before year's end.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

Any Section 179 deduction that is not allowed currently due to the taxable income limitation may be carried over and deducted in future years.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

Under the MACRS system, depreciation rates for real property must always use the mid-month convention in the year of acquisition.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

Section 179 allows taxpayers to immediately expense up to $25,000 (for 2014), subject to limitations, of the cost of real and personal property placed into service in a trade or business.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

Intangible assets are subject to MACRS depreciation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

Depreciable property includes business, investment, and personal-use assets.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

MACRS recovery property includes tangible personal and real property that is used in a trade or business.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

Sec. 179 tax benefits are recaptured if at any time an asset is converted to personal use.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

The MACRS system requires that residential real property and nonresidential rental property be depreciated using the straight-line method.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

When a taxpayer leases an automobile for 100% business purposes, the entire lease payment is deductible.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

A large SUV is place in service in 2014. MACRS depreciation on an SUV weighing over 6,000 pounds is limited to $3,160 for the first year placed in service.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

The straight-line method may be elected for depreciating tangible personal property placed in service after 1986.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

Once the business use of listed property falls to 50% or below, the alternative depreciation system must be used for the current year and all subsequent years, even if the business use percentage increases to more than 50% in a subsequent year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

Unless an election is made to expense or defer and amortize research and experimental expenditures, these costs must be capitalized.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

A taxpayer owns an economic interest in an oil and gas property. She is allowed to deduct the smaller of cost depletion or percentage depletion.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

Most taxpayers elect to expense R&E expenditures because of the immediate tax benefit.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

Amounts paid in connection with the acquisition of a business which represent a covenant not to compete are amortizable over the covenant's remaining life.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

30

If the business use of listed property decreases to 50% or less of the total usage, the property is subject to depreciation recapture.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

Off-the-shelf computer software that is purchased for use in the taxpayer's trade or business is amortized over 36 months, or it can be immediately expensed under a Sec. 179 election.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

Residential rental property is defined as property from which more than 80% of the gross rental income is rental income from dwelling units.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

If the business use of listed property is 50% or less of the total usage, the alternative depreciation system must be used.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

Expenditures that enlarge a building, any elevator or escalator, any structural component that benefits a common area or the internal structural framework are not considered qualified leasehold improvement property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

If a new luxury automobile is used 100% for business and placed in service in 2014, the maximum MACRS depreciation on the vehicle for 2014 is $3,160.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

If a company acquires goodwill in connection with the acquisition of a business, the goodwill is amortizable over a 60-month period.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

The election to use ADS is made on a year-by-year, property-class by property-class basis for real and personal property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

Capital improvements to real property must be depreciated over the remaining life of the property on which the improvements were made.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

Taxpayers are entitled to a depletion deduction if they have an economic interest in the natural resource property.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

Under the MACRS system, the same convention that applies in the year of acquisition (e.g., half-year, mid-quarter, or mid-month)also applies in the year of disposition.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

When depreciating 5-year property, the final year of depreciation will be year

A)3)

B)4)

C)5)

D)6)

A)3)

B)4)

C)5)

D)6)

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

In April 2014, Emma acquired a machine for $60,000 for use in her business. The machine is classified as 7-year property. Emma does not expense the asset under Sec. 179. Emma's depreciation on the machine this year is

A)$30,000.

B)$60,000.

C)$6,428.

D)$8,574.

A)$30,000.

B)$60,000.

C)$6,428.

D)$8,574.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

On April 12, 2013, Suzanne bought a computer for $20,000 for business use. This was the only purchase for that year. Suzanne used the most accelerated depreciation method available but did not elect Sec. 179. Bonus depreciation was not available. Suzanne sells the machine in 2014. The depreciation on the computer for 2014 is

A)$2,000.

B)$3,200.

C)$4,000.

D)$6,400.

A)$2,000.

B)$3,200.

C)$4,000.

D)$6,400.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

On October 2, 2014, Dave acquired and placed into service 5-year business equipment costing $70,000. No other acquisitions were made during the year. Dave does not use Sec. 179 expensing. The depreciation for this year is using the most accelerated method possible is

A)$0.

B)$3,500.

C)$7,000.

D)$10,003.

A)$0.

B)$3,500.

C)$7,000.

D)$10,003.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

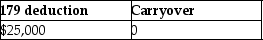

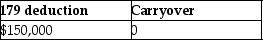

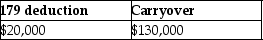

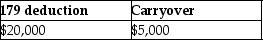

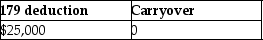

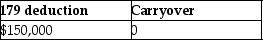

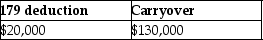

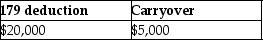

Cate purchases and places in service property costing $150,000 in 2014. She wants to elect the maximum Sec. 179 deduction allowed. Her business income is $20,000. What is the amount of her allowable Sec. 179 deduction and carryover, if any?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

In May 2014, Cassie acquired a machine for $30,000 to use in her business. The machine is classified as 5-year property. Cassie does not expense the property under Sec. 179. Cassie's depreciation on the machine this year is

A)$3,000.

B)$6,000.

C)$12,000.

D)$15,000.

A)$3,000.

B)$6,000.

C)$12,000.

D)$15,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

Prithi acquired and placed in service $190,000 of equipment on August 1, 2014 for use in her sole proprietorship. The equipment is 5-year recovery property. No other acquisitions are made during the year. Prithi elects to expense the maximum amount under Sec. 179. Prithi's total deductions for the year (including Sec. 179 and depreciation)are

A)$38,000.

B)$25,000.

C)$63,000.

D)$58,000.

A)$38,000.

B)$25,000.

C)$63,000.

D)$58,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

Ilene owns an unincorporated manufacturing business. In 2014, she purchases and places in service $206,000 of qualifying five-year equipment for use in her business. Her taxable income from the business before any Sec. 179 deduction is $17,000. Elaine takes the maximum allowable deduction under section 179. Which of the following statements is true regarding the Sec. 179 election?

A)Ilene can deduct $25,000 as a section 179 deduction in 2014, with no carryover to next year.

B)Ilene can deduct $19,000 as a section 179 deduction in 2014.

C)IIene can deduct $17,000 as a section 179 deduction in 2014; $2,000 may be carried over to next year.

D)Ilene can deduct $17,000 as a section 179 deduction in 2014 ,with no carryover to next year.

A)Ilene can deduct $25,000 as a section 179 deduction in 2014, with no carryover to next year.

B)Ilene can deduct $19,000 as a section 179 deduction in 2014.

C)IIene can deduct $17,000 as a section 179 deduction in 2014; $2,000 may be carried over to next year.

D)Ilene can deduct $17,000 as a section 179 deduction in 2014 ,with no carryover to next year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

In November 2014, Kendall purchases a computer for $4,000. She does not use Sec. 179 expensing. She only uses the most accelerated depreciation method possible. The computer is the only personal property which she places in service during the year. What is her total depreciation deduction for 2014?

A)$200

B)$572

C)$800

D)$1,000

A)$200

B)$572

C)$800

D)$1,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

On January 3, 2011, John acquired and placed into service business tools costing $10,000. The tools have a 3-year class life. No other assets were purchased during that year. The depreciation in 2014 for those tools is (Sec. 179 and bonus depreciation were not applied)

A)$0.

B)$741.

C)$1,920.

D)$3,333.

A)$0.

B)$741.

C)$1,920.

D)$3,333.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

For real property placed in service after 1986, depreciation under the MACRS system is calculated using the

A)straight-line method and a half-year convention in the year of acquisition and in the year of disposition.

B)straight-line method and a mid-month convention in the year of acquisition and in the year of disposition.

C)200% DB method and a mid-month convention in the year of acquisition and in the year of disposition.

D)200% DB method and a half-year convention in the year of acquisition and in the year of disposition.

A)straight-line method and a half-year convention in the year of acquisition and in the year of disposition.

B)straight-line method and a mid-month convention in the year of acquisition and in the year of disposition.

C)200% DB method and a mid-month convention in the year of acquisition and in the year of disposition.

D)200% DB method and a half-year convention in the year of acquisition and in the year of disposition.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

Intangible drilling and development costs (IDCs)may be deducted as an expense or may be capitalized.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

Joan bought a business machine for $15,000 on January 1, 2013, and later sold the machine for $12,800 when the total allowable depreciation is $8,500. The depreciation actually taken on the tax returns totaled $8,000. Joan must recognize a gain (or loss)of

A)no gain or loss.

B)($3,200).

C)$6,800.

D)$6,300.

A)no gain or loss.

B)($3,200).

C)$6,800.

D)$6,300.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

Paul bought a computer for $15,000 for business use on March 18, 2012. This was his only purchase for that year. Paul used the most accelerated depreciation method available, but did not elect Sec. 179. Bonus depreciation was not available. Paul sells the machine in 2014. The depreciation on the computer for 2014 is

A)$0.

B)$1,440.

C)$1,500.

D)$2,880.

A)$0.

B)$1,440.

C)$1,500.

D)$2,880.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

Harrison acquires $65,000 of 5-year property in June 2012 that is required to be depreciated using the mid-quarter convention (because of other purchases that year). He did not elect Sec. 179 immediate expensing. Bonus depreciation was not available. If Harrison sells the property on August 23, 2014, what is the amount of depreciation claimed in 2014?

A)$6,500.00

B)$7,312.50

C)$11,700.00

D)$9,289.00

A)$6,500.00

B)$7,312.50

C)$11,700.00

D)$9,289.00

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

Terra Corporation, a calendar-year taxpayer, purchases and places into service machinery with a 7-year life that cost $125,000. The mid-quarter convention does not apply. Terra elects to depreciate the maximum under Sec. 179. Terra's taxable income for the year before the Sec. 179 deduction is $700,000. What is Terra's total depreciation deduction related to this property?

A)$17,863

B)$42,863

C)$25,000

D)$39,290

A)$17,863

B)$42,863

C)$25,000

D)$39,290

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

Tessa owns an unincorporated manufacturing business. In 2014, she purchases and places in service $207,000 of qualifying five-year equipment for use in her business. Her taxable income from the business before any Sec. 179 deduction is $15,000. Tessa elects to expense the maximum under Sec. 179. What is Tessa's maximum total cost recovery deduction for 2014?

A)$53,400

B)$52,800

C)$15,000

D)$41,400

A)$53,400

B)$52,800

C)$15,000

D)$41,400

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following statements regarding Sec. 179 is true?

A)If a taxpayer places in service property costing more than the Sec. 179 ceiling on the amount of property placed in service, the excess can be carried over to subsequent years.

B)Amounts of the Sec. 179 election in excess of the taxable income limitation are carried forward.

C)Sec. 179 carryforwards expire after five years.

D)All of the above statements are true.

A)If a taxpayer places in service property costing more than the Sec. 179 ceiling on the amount of property placed in service, the excess can be carried over to subsequent years.

B)Amounts of the Sec. 179 election in excess of the taxable income limitation are carried forward.

C)Sec. 179 carryforwards expire after five years.

D)All of the above statements are true.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

On November 3, this year, Kerry acquired and placed into service 7-year business equipment costing $80,000. In addition, on May 5th of this year, Kerry had also placed in business use 5-year recovery property costing $15,000. Kerry did not elect Sec. 179 immediate expensing. No other assets were purchased during the year. The depreciation for this year is

A)$3,606.

B)$6,606.

C)$13,576.

D)$14,432.

A)$3,606.

B)$6,606.

C)$13,576.

D)$14,432.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

Fred purchases and places in service in 2014 personal property costing $221,000. What is the maximum Sec. 179 deduction that Fred can deduct, ignoring any taxable income limitation?

A)$25,000

B)$21,000

C)$4,000

D)$200,000

A)$25,000

B)$21,000

C)$4,000

D)$200,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

In July of 2014, Pat acquired a new automobile for $28,000 and used the automobile 80% for business. No election is made regarding Sec. 179. Assuming her business use remains at 80%, Pat can take a maximum depreciation deduction in 2014 of

A)$2,528.

B)$3,160.

C)$5,600.

D)$4,480.

A)$2,528.

B)$3,160.

C)$5,600.

D)$4,480.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

In calculating depletion of natural resources each period,

A)cost depletion must be used.

B)percentage depletion must be used.

C)the greater of cost depletion or percentage depletion must be used.

D)the smaller of cost depletion or percentage depletion must be used.

A)cost depletion must be used.

B)percentage depletion must be used.

C)the greater of cost depletion or percentage depletion must be used.

D)the smaller of cost depletion or percentage depletion must be used.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

In the current year George, a college professor, acquired a computer system (5-year property)for $1,000 and used the computer 80% for teaching and research-related activities and the remaining 20% for personal use. Because George's employer provides him with a computer in his office at the university, the employer does not require him to have a computer at home. No election was made regarding Sec. 179. The maximum depreciation deduction is

A)$0.

B)$200.

C)$160.

D)$800.

A)$0.

B)$200.

C)$160.

D)$800.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

In August 2014, Tianshu acquires and places into service 7-year business equipment (tangible personal property qualifying under Sec. 179)for $70,000. This is the only asset that she purchased during the year; her taxable income from her trade or business is $23,000. She decides to limit her 179 election to the maximum amount currently deductible in her business for the current year. What is her maximum cost recovery (Sec. 179 and depreciation)deduction for 2014?

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

If the business usage of listed property is less than or equal to 50% of its total usage, depreciation is calculated using the

A)regular MACRS tables.

B)alternative depreciation system.

C)it may not be depreciated.

D)regular MACRS tables and a mid-month convention.

A)regular MACRS tables.

B)alternative depreciation system.

C)it may not be depreciated.

D)regular MACRS tables and a mid-month convention.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

In accounting for research and experimental expenditures, all of the following alternatives are available with the exception of

A)expense R&E costs in the year paid or incurred.

B)expense R&E costs in the year in which a product or process becomes marketable.

C)defer and amortize R&E costs as a ratable deduction over a period of 60 months or more.

D)capitalize and write off R&E costs only when the research project is abandoned or is worthless.

A)expense R&E costs in the year paid or incurred.

B)expense R&E costs in the year in which a product or process becomes marketable.

C)defer and amortize R&E costs as a ratable deduction over a period of 60 months or more.

D)capitalize and write off R&E costs only when the research project is abandoned or is worthless.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

In April of 2013, Brandon acquired five-year listed property (not an automobile)for $30,000 and used it 70% for business. No election was made regarding Sec. 179 and bonus depreciation was not available. In 2014, his business use of the property dropped to 40%. Which of the following statements is true?

A)The change does not affect Brandon's previous depreciation.

B)Brandon must recapture $2,100 as ordinary income.

C)Brandon must recapture $4,200 as ordinary income.

D)Brandon must amend the previous tax return and recompute depreciation.

A)The change does not affect Brandon's previous depreciation.

B)Brandon must recapture $2,100 as ordinary income.

C)Brandon must recapture $4,200 as ordinary income.

D)Brandon must amend the previous tax return and recompute depreciation.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

Atiqa took out of service and sold a residential rental property on October 31 of this year. She had originally acquired the property ten years ago. The building (excluding the value of the land)cost $1,000,000. How much is her current year depreciation deduction?

A)$30,300

B)$36,360

C)$18,182

D)$28,785

A)$30,300

B)$36,360

C)$18,182

D)$28,785

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

Eric is a self-employed consultant. In May of the current year, Eric acquired a computer system (5-year property)for $6,000 and used the computer 80% for business and 20% for personal purposes. Eric does not take any Sec. 179 deduction. The maximum depreciation deduction for is

A)$600.

B)$800.

C)$960.

D)$1,200.

A)$600.

B)$800.

C)$960.

D)$1,200.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

Galaxy Corporation purchases specialty software from a software development firm for use in its business as of January 1 of the current year at a cost of $90,000. No hardware was acquired. How much of the cost can Galaxy deduct this year?

A)$18,000

B)$15,000

C)$30,000

D)$90,000

A)$18,000

B)$15,000

C)$30,000

D)$90,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

Lincoln purchases nonresidential real property costing $300,000 and places it in service in March 2013. What is Lincoln's 2014 depreciation on the property?

A)$6,099

B)$7,692

C)$8,637

D)$10,908

A)$6,099

B)$7,692

C)$8,637

D)$10,908

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

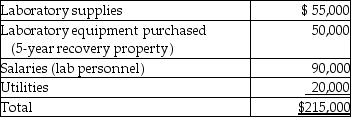

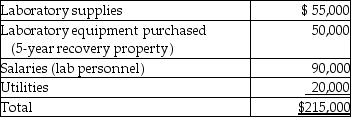

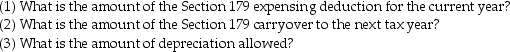

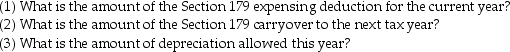

This year Bauer Corporation incurs the following costs in development of new products:  No benefits are realized from the research expenditures until next year. If Bauer Corporation elects to expense the research expenditures, the deduction is

No benefits are realized from the research expenditures until next year. If Bauer Corporation elects to expense the research expenditures, the deduction is

A)$10,000 this year and $175,000 next year.

B)$175,000 next year.

C)$175,000 this year.

D)$215,000 this year.

No benefits are realized from the research expenditures until next year. If Bauer Corporation elects to expense the research expenditures, the deduction is

No benefits are realized from the research expenditures until next year. If Bauer Corporation elects to expense the research expenditures, the deduction isA)$10,000 this year and $175,000 next year.

B)$175,000 next year.

C)$175,000 this year.

D)$215,000 this year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

All of the following are true with regard to the alternative depreciation system except

A)the principal type of property for which ADS is required is any tangible property which is used predominantly outside of the United States.

B)the ADS election is available to real property on a property by property basis.

C)the ADS election is available to personal property on a property by property basis.

D)once the ADS election is made for specified property, it is irrevocable.

A)the principal type of property for which ADS is required is any tangible property which is used predominantly outside of the United States.

B)the ADS election is available to real property on a property by property basis.

C)the ADS election is available to personal property on a property by property basis.

D)once the ADS election is made for specified property, it is irrevocable.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

Eric is a self-employed consultant. In May of the current year, Eric acquired a computer system (5-year property)for $7,000 and used the computer 30% for business. Eric does not use Sec. 179. The maximum depreciation deduction for is

A)$210.

B)$420.

C)$700.

D)$2,100.

A)$210.

B)$420.

C)$700.

D)$2,100.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

J.R. acquires an oil and gas property interest for $300,000. J.R. expects to recover 50,000 barrels of oil. Intangible drilling and development costs are $80,000 and are charged to expense. Other expenses are $20,000. During the year, 13,000 barrels of oil are sold for $170,000. J.R.'s depletion deduction is

A)$25,500.

B)$35,000.

C)$70,000.

D)$78,000.

A)$25,500.

B)$35,000.

C)$70,000.

D)$78,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

Everest Corp. acquires a machine (seven-year property)on January 10, 2014 at a cost of $212,000. Everest makes the election to expense the maximum amount under Sec. 179.

a. Assume that the taxable income from trade or business is $500,000.

b. Assume instead that the taxable income from trade or business is $10,000.

b. Assume instead that the taxable income from trade or business is $10,000.

a. Assume that the taxable income from trade or business is $500,000.

b. Assume instead that the taxable income from trade or business is $10,000.

b. Assume instead that the taxable income from trade or business is $10,000.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

On January l Grace leases and places into service an automobile with a FMV of $39,000. The business use of the automobile is 60%. The "inclusion amount" for the initial year of the lease from the IRS tables is $20. The annual lease payments are $8,000. What are the tax consequences of this lease?

A)deduction for lease payments of $4,782

B)deduction for lease payments of $4,800

C)deduction for lease payments of $6,000

D)deduction for lease payment of $8,982

A)deduction for lease payments of $4,782

B)deduction for lease payments of $4,800

C)deduction for lease payments of $6,000

D)deduction for lease payment of $8,982

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

On August 11, 2014, Nancy acquired and placed into service residential rental property, which cost $430,000; the cost of the land has been excluded. Nancy annually elects the maximum allowed Sec. 179 deduction. The total depreciation for the year is (rounded)

A)$5,865.

B)$4,141.

C)$5,117.

D)$15,636.

A)$5,865.

B)$4,141.

C)$5,117.

D)$15,636.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

Costs that qualify as research and experimental expenditures include all of the following except

A)depreciation of laboratory equipment.

B)management studies.

C)costs incurred in developing product improvements.

D)costs of obtaining a patent such as attorney fees.

A)depreciation of laboratory equipment.

B)management studies.

C)costs incurred in developing product improvements.

D)costs of obtaining a patent such as attorney fees.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

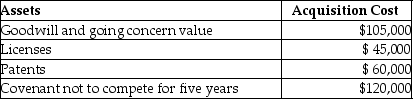

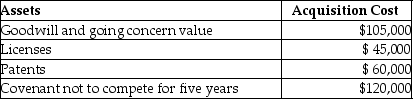

On January 1, 2014, Charlie Corporation acquires all of the net assets of Rocky Corporation for $2,000,000. The following intangible assets are included in the purchase agreement:  What is the total amount of amortization allowed in 2014?

What is the total amount of amortization allowed in 2014?

A)$15,000

B)$22,000

C)$31,000

D)$38,000

What is the total amount of amortization allowed in 2014?

What is the total amount of amortization allowed in 2014?A)$15,000

B)$22,000

C)$31,000

D)$38,000

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck