Deck 23: Fiscal Policy and the Federal Budget

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/40

Play

Full screen (f)

Deck 23: Fiscal Policy and the Federal Budget

1

Discretionary spending by the government would include

A)lengthening or shortening the length of time the government pays unemployment insurance benefits

B)education

C)national defense

D)all of the above are discretionary spending

A)lengthening or shortening the length of time the government pays unemployment insurance benefits

B)education

C)national defense

D)all of the above are discretionary spending

D

2

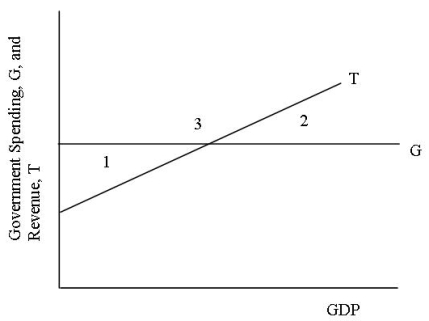

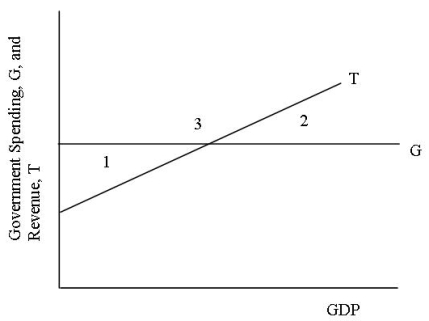

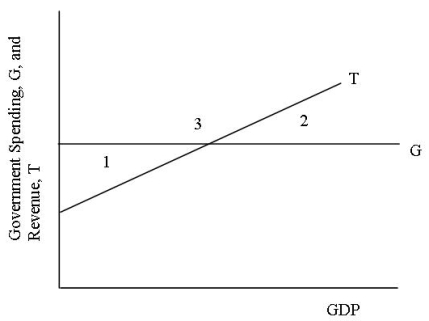

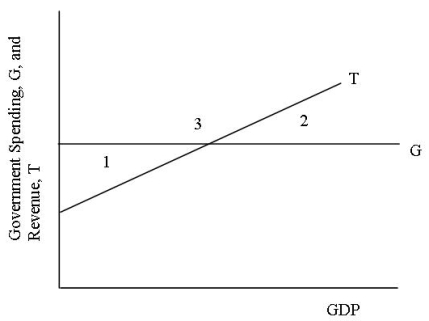

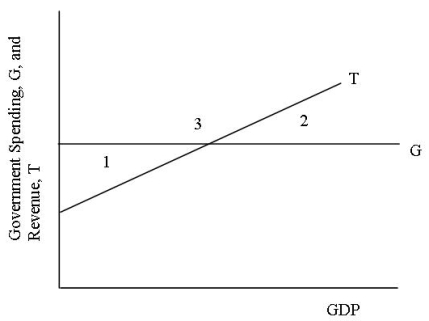

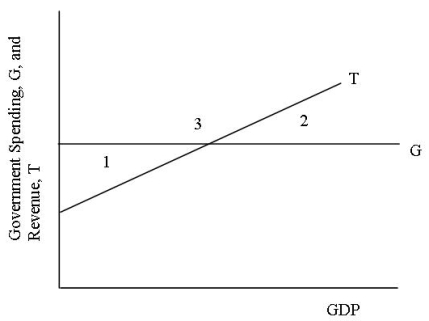

Reference: Use the graph for questions 13-15.

**Consider the graph where G represents government spending and T represents government revenue.Which of the following statement is true?

A)Tax revenue is inversely related to GDP

B)Government spending is inversely related to GDP

C)Tax revenue is positively related to GDP

D)Government spending is inversely related to tax revenue

**Consider the graph where G represents government spending and T represents government revenue.Which of the following statement is true?

A)Tax revenue is inversely related to GDP

B)Government spending is inversely related to GDP

C)Tax revenue is positively related to GDP

D)Government spending is inversely related to tax revenue

C

3

Fiscal policy

A)uses government spending and transfers to influence the economy

B)uses government spending and taxes to provide more equality of income and wealth

C)uses government spending and taxes to influence the economy

D)uses taxes and transfers to insure economic health

A)uses government spending and transfers to influence the economy

B)uses government spending and taxes to provide more equality of income and wealth

C)uses government spending and taxes to influence the economy

D)uses taxes and transfers to insure economic health

C

4

In 2012 borrowing made up ____________ percent of the federal revenue compared to __________ percent in 1970.

A)34.5; 4.6

B)26.1; 7.7

C)23.9; 5.6

D)9.5; 16.1

A)34.5; 4.6

B)26.1; 7.7

C)23.9; 5.6

D)9.5; 16.1

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

5

Reference: Use the graph for questions 13-15.

**Consider the graph where G represents government spending and T represents government revenue.A budget deficit would be associated with areas)

A)1

B)2

C)3

D)1 and 3

**Consider the graph where G represents government spending and T represents government revenue.A budget deficit would be associated with areas)

A)1

B)2

C)3

D)1 and 3

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

6

If you earn less than $10,000 you have a 10% tax obligation.If you earn an income between $10,000 and $35,000 your tax obligation is 15%.Income in the range of $35,001 and $60,000 has a tax obligation of $25%.Income in the range of $60,001 and $85,000 has a tax obligation of 28%.Income greater than $85,000 has a tax obligation of 33%.Last year you earned $62,000.Your tax obligation is

A)$10,560

B)$12,060

C)$20,460

D)$20,790

A)$10,560

B)$12,060

C)$20,460

D)$20,790

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

7

The federal debt includes each of the following except

A)publically-held debt from the sale of U.S.Treasuries

B)government held debt

C)Social Security Trust Fund

D)Federal Reserve Notes

A)publically-held debt from the sale of U.S.Treasuries

B)government held debt

C)Social Security Trust Fund

D)Federal Reserve Notes

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

8

If you earn less than $10,000 you have a 10% tax obligation.If you earn an income between $10,000 and $35,000 your tax obligation is 15%.Income in the range of $35,001 and $60,000 has a tax obligation of $25%.Income in the range of $60,001 and $85,000 has a tax obligation of 28%.Income greater than $85,000 has a tax obligation of 33%.Last year you earned $62,000.Your marginal tax rate is

A).15%

B).25%

C).28%

D).33%

A).15%

B).25%

C).28%

D).33%

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

9

Types of government spending includes

A)spending determined by current obligations

B)spending determined by policymaker choices

C)spending determined by current obligations and policymaker choices

D)spending determined by Congress

A)spending determined by current obligations

B)spending determined by policymaker choices

C)spending determined by current obligations and policymaker choices

D)spending determined by Congress

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

10

In 2012 the third largest source of revenue for the federal government was from

A)individual income tax

B)excise taxes

C)social insurance and retirement taxes

D)borrowing

A)individual income tax

B)excise taxes

C)social insurance and retirement taxes

D)borrowing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

11

Nondiscretionary spending by the government would include all of the following except

A)Social Security

B)National defense

C)Food stamps

D)Interest on the national debt

A)Social Security

B)National defense

C)Food stamps

D)Interest on the national debt

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

12

Federal debt is

A)an accumulation of deficit borrowing that has not been paid off

B)the difference between federal spending and revenue for a specific period of time

C)the total of all past deficits

D)the difference between federal borrowing and federal spending

A)an accumulation of deficit borrowing that has not been paid off

B)the difference between federal spending and revenue for a specific period of time

C)the total of all past deficits

D)the difference between federal borrowing and federal spending

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

13

A federal deficit occurs when

A)federal spending is less than federal revenue

B)federal spending is greater than federal revenue

C)federal borrowing is greater than federal revenue

D)federal revenue is greater than federal borrowing

A)federal spending is less than federal revenue

B)federal spending is greater than federal revenue

C)federal borrowing is greater than federal revenue

D)federal revenue is greater than federal borrowing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

14

The largest source of revenue for the government is from

A)Social insurance and retirement taxes

B)Corporate income taxes

C)Individual income taxes

D)Borrowing

A)Social insurance and retirement taxes

B)Corporate income taxes

C)Individual income taxes

D)Borrowing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

15

The _______________ is a level of income that is taxed at a different ___________.

A)Corporate tax; average tax rate

B)Corporate tax; marginal tax rate

C)Income tax bracket; average tax rate

D)Income tax bracket; marginal tax rate

A)Corporate tax; average tax rate

B)Corporate tax; marginal tax rate

C)Income tax bracket; average tax rate

D)Income tax bracket; marginal tax rate

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

16

The federal government raises revenue primarily from

A)Social Security

B)Taxes

C)Borrowing from the public

D)Both taxes and borrowing from the public

A)Social Security

B)Taxes

C)Borrowing from the public

D)Both taxes and borrowing from the public

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

17

Reference: Use the graph for questions 13-15.

**Consider the graph where G represents government spending and T represents government revenue.A budget surplus would be associated with areas)

A)1

B)2

C)3

D)1 and 3

**Consider the graph where G represents government spending and T represents government revenue.A budget surplus would be associated with areas)

A)1

B)2

C)3

D)1 and 3

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

18

In year one the federal government experienced a deficit of $25 million.This was followed by two years of surpluses of $30 million and $40 million, respectively.However, in year four the federal government again experienced deficit spending of $35 million.If budget surpluses are used to pay down the debt.At the end of these four years, the federal debt would have

A)increased $10 million

B)decreased $10 million

C)increased $20 million

D)stayed the same

A)increased $10 million

B)decreased $10 million

C)increased $20 million

D)stayed the same

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

19

Discretionary accounts for approximately __________ percent of spending in the federal budget.

A).25

B).33

C).4

D).6

A).25

B).33

C).4

D).6

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

20

Nondiscretionary government spending accounts for approximately what proportion of government spending?

A).25

B).33

C).4

D).6

A).25

B).33

C).4

D).6

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

21

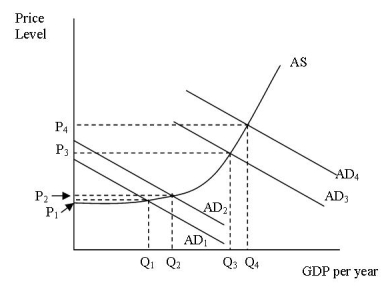

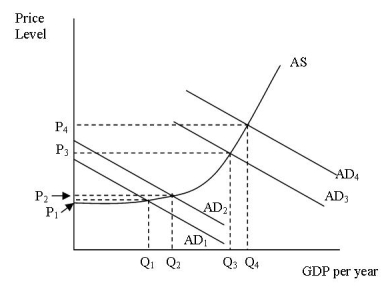

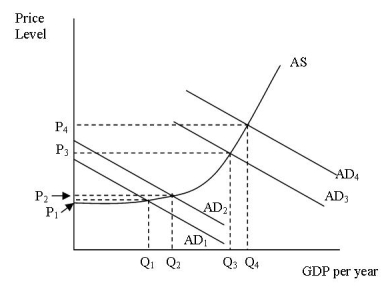

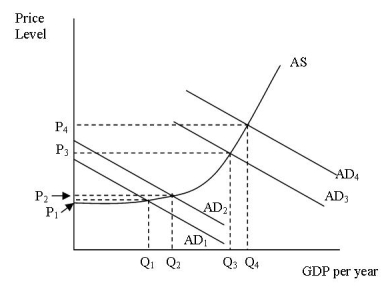

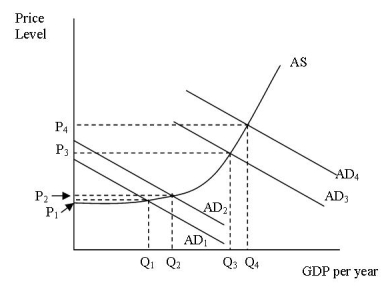

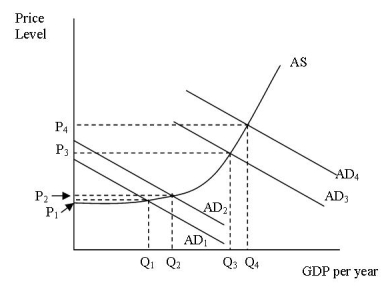

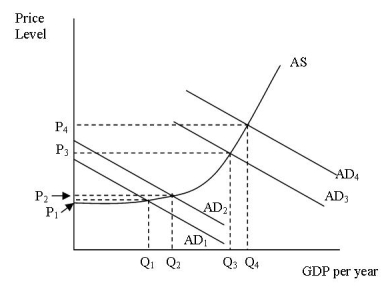

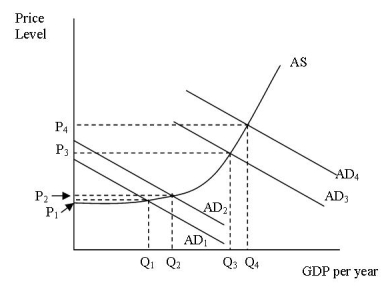

Reference: Use the graph to answer questions 32-35.

**What type of fiscal policy would shift aggregate demand from AD3 to AD2?

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

**What type of fiscal policy would shift aggregate demand from AD3 to AD2?

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

22

Discretionary fiscal policy

A)does not require specific action or policy changes

B)changes with levels of GDP

C)requires action taken in conjunction with the Federal Reserve System.

D)requires specific action by Congress to change taxes and government spending

A)does not require specific action or policy changes

B)changes with levels of GDP

C)requires action taken in conjunction with the Federal Reserve System.

D)requires specific action by Congress to change taxes and government spending

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

23

Federal policy changes that uses automatically changes taxes and/or government spending to help stabilize the economy are known as

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

24

Reference: Use the graph to answer questions 32-35.

**Which of the following statements is true?

A)Increasing taxes while decreasing government spending would result in a shift of the aggregate demand from AD1 to AD2.

B)Decreasing taxes would result in a shift of the aggregate demand from AD2 to AD1.

C)Increasing taxes would result in a shift of the aggregate demand from AD3 to AD4.

D)Decreasing taxes while increasing government spending would result in a shift of the aggregate demand from AD3 to AD4.

**Which of the following statements is true?

A)Increasing taxes while decreasing government spending would result in a shift of the aggregate demand from AD1 to AD2.

B)Decreasing taxes would result in a shift of the aggregate demand from AD2 to AD1.

C)Increasing taxes would result in a shift of the aggregate demand from AD3 to AD4.

D)Decreasing taxes while increasing government spending would result in a shift of the aggregate demand from AD3 to AD4.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

25

Fiscal policy used to expand aggregate demand is

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

26

Contractionary fiscal policy

A)includes cuts in government spending and increases in taxes and is designed to slow down the economy.

B)reduces aggregate demand and shifts the aggregate demand curve inward

C)includes increases in government spending and decreases in taxes and is designed to stimulate the economy

D)Both "a" and "b"

A)includes cuts in government spending and increases in taxes and is designed to slow down the economy.

B)reduces aggregate demand and shifts the aggregate demand curve inward

C)includes increases in government spending and decreases in taxes and is designed to stimulate the economy

D)Both "a" and "b"

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

27

Reference: Use the graph to answer questions 32-35.

**What type of fiscal policy would shift aggregate demand from AD3 to AD4?

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

**What type of fiscal policy would shift aggregate demand from AD3 to AD4?

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

28

Reference: Use the graph to answer questions 32-35.

**Which of the following fiscal policy options would have greater potential of causing inflation?

A)An expansionary policy shifting aggregate demand from AD1 to AD2

B)A contractionary policy shifting aggregate demand from AD4 to AD3

C)An expansionary policy shifting aggregate demand from AD3 to AD4

D)A contractionary policy shifting aggregate demand from AD2 to AD1

**Which of the following fiscal policy options would have greater potential of causing inflation?

A)An expansionary policy shifting aggregate demand from AD1 to AD2

B)A contractionary policy shifting aggregate demand from AD4 to AD3

C)An expansionary policy shifting aggregate demand from AD3 to AD4

D)A contractionary policy shifting aggregate demand from AD2 to AD1

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

29

A potential tradeoff for reducing pressure on price levels associated with contractionary fiscal policy is

A)loss of output

B)gain of output

C)increase of aggregate demand

D)stagflation

A)loss of output

B)gain of output

C)increase of aggregate demand

D)stagflation

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

30

When expansionary fiscal policy is used to stimulate the economy a potential trade off may be

A)loss of output

B)stagflation

C)inflationary pressure

D)recession

A)loss of output

B)stagflation

C)inflationary pressure

D)recession

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

31

A trade off for contractionary fiscal policy may be

A)pressure on prices

B)inflation

C)unemployment

D)increases in output

A)pressure on prices

B)inflation

C)unemployment

D)increases in output

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

32

________________ is used when policymakers actively change government spending or taxation in response to changes in the economy.

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

33

Fiscal policy used to decrease aggregate demand is

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

34

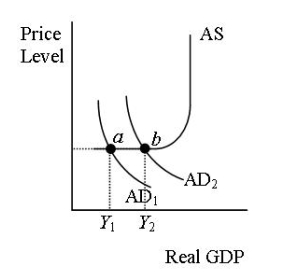

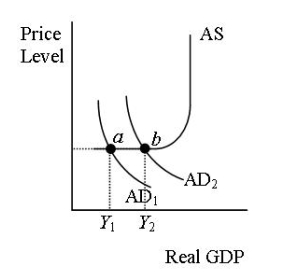

If the economy is at point "a" with an output of Y1 what type of fiscal policy would be used to increase output to Y2?

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

A)Contractionary

B)Expansionary

C)Reactionary

D)Stabilizing

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following is true concerning contractionary fiscal policy?

A)Contractionary fiscal policy is necessary to manipulate aggregate supply and maintain output.

B)Contractionary fiscal policy results in recession.

C)The purpose of contractionary fiscal policy is to slow down the economy by shifting the aggregate demand curve inward and removing pressure on price levels.

D)Contractionary fiscal policy is appropriate when an output gap is being experienced.

A)Contractionary fiscal policy is necessary to manipulate aggregate supply and maintain output.

B)Contractionary fiscal policy results in recession.

C)The purpose of contractionary fiscal policy is to slow down the economy by shifting the aggregate demand curve inward and removing pressure on price levels.

D)Contractionary fiscal policy is appropriate when an output gap is being experienced.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

36

The economy is "heating up" and price pressure is being reported.Which of the following would be appropriate?

A)cutting taxes

B)increasing taxes

C)increasing government spending

D)increasing government spending and cutting taxes

A)cutting taxes

B)increasing taxes

C)increasing government spending

D)increasing government spending and cutting taxes

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is true concerning expansionary fiscal policy?

A)Expansionary fiscal policy is designed to control aggregate demand using increases of taxes and cuts in government spending

B)Expansionary fiscal policy causes an outward shift of the aggregate demand curve resulting in an increase in output.

C)Expansionary fiscal policy results in inflation when employed at relatively low levels of GDP.

D)Expansionary fiscal policy is a last-resort policy used by the Federal Reserve System.

A)Expansionary fiscal policy is designed to control aggregate demand using increases of taxes and cuts in government spending

B)Expansionary fiscal policy causes an outward shift of the aggregate demand curve resulting in an increase in output.

C)Expansionary fiscal policy results in inflation when employed at relatively low levels of GDP.

D)Expansionary fiscal policy is a last-resort policy used by the Federal Reserve System.

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

38

A follower of John Maynard Keynes would recommend which of the following during economic slowdowns?

A)increasing taxes and government spending

B)increasing taxes and decreasing government spending

C)decreasing taxes and increasing government spending

D)decreasing taxes and decreasing government spending

A)increasing taxes and government spending

B)increasing taxes and decreasing government spending

C)decreasing taxes and increasing government spending

D)decreasing taxes and decreasing government spending

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

39

This is built into our progressive tax structure and income-based welfare system

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

A)discretionary fiscal policy

B)nondiscretionary fiscal policy

C)expansionary fiscal policy

D)contractionary fiscal policy

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck

40

Classical economic theories such as those prior to the Great Depression supported balanced budgets and limited government involvement in the markets.Economists who favor this school of thought would support

A)tax cuts during economic downturns and the reduction of government spending

B)tax increases during economic downturns with increases in government spending

C)tax cuts during economic downturns

D)tax increases during periods of expansion

A)tax cuts during economic downturns and the reduction of government spending

B)tax increases during economic downturns with increases in government spending

C)tax cuts during economic downturns

D)tax increases during periods of expansion

Unlock Deck

Unlock for access to all 40 flashcards in this deck.

Unlock Deck

k this deck