Deck 7: Global Bond Investing

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/53

Play

Full screen (f)

Deck 7: Global Bond Investing

1

You purchase a Eurobond in euros, at a quoted price of 101.5%. The annual coupon on the bond is 6%, and we are exactly one month after the past coupon date. You buy €100,000 of nominal value of this bond. What is your total expense?

The clean price of the bond is 101.5%. Accrued interest is equal to one month of coupon, or 30/360 *6%, given convention on the Eurobond market. Hence your total expense is:

(101.5% + 30/360*6%) *100,000€ =102,000 euros.

(101.5% + 30/360*6%) *100,000€ =102,000 euros.

2

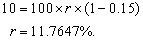

To provide full protection against unexpected tax imposition, all Eurobond contracts have a covenant stating that the issuer will increase the interest payments to make up for any tax imposed. Assume that Paf Inc. has issued a Eurobond with a coupon of $10 per $100 bond. For some reason, Paf Inc. is forced by its government to transfer 15% of the coupon as withholding tax, so that the net coupon paid to the bondholder is only $8.50. What should Paf Inc. do, according to the bond covenant?

The coupon must be increased so that the net receipt by the bondholder is still $10 per $100 bond. Hence, the new coupon rate, r, must verify:

3

The market price of a two-year bond is 105% of its nominal value. The annual coupon to be paid in exactly one year is 7%. Its yield-to-maturity (European method) is 4.336%.

a. Calculate its duration.

b. Calculate its simple yield.

c. Calculate its semiannual yield (U.S. method).

a. Calculate its duration.

b. Calculate its simple yield.

c. Calculate its semiannual yield (U.S. method).

We verify that:

with a. Macaulay duration Duration: D = 1.936/1.04336 =1.86.

b. Simple yield c. or where r' is the semiannual yield (U.S. YTM) and r is the annual yield (European YTM).

r' = 4.29%.

with a. Macaulay duration Duration: D = 1.936/1.04336 =1.86.

b. Simple yield c. or where r' is the semiannual yield (U.S. YTM) and r is the annual yield (European YTM).

r' = 4.29%.

4

Take the example of two straight yen Eurobonds with the same maturity of five years. Bond A has a coupon of 12% and Bond B a coupon of 8%. The current market interest rate on yen bonds is 9%. These two bonds have the same yield-to-maturity of 10% and are correctly priced at 111.67% for Bond A and 96.11% for Bond B. What would be the yield-to-maturity indicated by the simple yield calculation?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

5

Why did U.S. commercial banks have an interest in the development of the Eurobond market?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

6

What are the annual yield-to-maturity and duration for the following bonds:

a. A zero-coupon bond reimbursed at $100 in ten years and currently selling at $38.

b. A straight bond reimbursed at $100 in ten years, with an annual coupon of 10% and selling

at $110.

c. A perpetual bond with an annual coupon of $8 and currently selling at $110.

a. A zero-coupon bond reimbursed at $100 in ten years and currently selling at $38.

b. A straight bond reimbursed at $100 in ten years, with an annual coupon of 10% and selling

at $110.

c. A perpetual bond with an annual coupon of $8 and currently selling at $110.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

7

A bond has been issued in euros with an annual coupon rate of 10%. The previous coupon has just been paid. This bond has a sinking fund provision: Half of the issue is reimbursed in two years and half in three years. You hold €10 million of nominal value of this bond.

a. Write the three future annual cash flows in euros, assuming that the previous coupon has just been paid.

b. The yield curve is currently flat at 9%. What is the value of the bond, its yield-to-maturity, its duration, and its modified duration?

c. How much do you stand to lose if the yield curve moves uniformly from 9% to 9.1% within

one day?

a. Write the three future annual cash flows in euros, assuming that the previous coupon has just been paid.

b. The yield curve is currently flat at 9%. What is the value of the bond, its yield-to-maturity, its duration, and its modified duration?

c. How much do you stand to lose if the yield curve moves uniformly from 9% to 9.1% within

one day?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

8

There is a 0.5% probability of default by the year-end on a one-year bond issued at par by a particular corporation. If the corporation defaults, the investor will not get anything. Assuming that a default-free bond exists with identical cash flows and liquidity, and the one-year yield on this bond is 4%.

a. What yield should be required by risk-neutral investors on the corporate bond?

b. What should the credit spread be?

a. What yield should be required by risk-neutral investors on the corporate bond?

b. What should the credit spread be?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

9

Give at least two reasons why Eurobonds are issued in bearer form.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

10

You hold a bond with a duration of 17. Its yield is 6% while the cash (one-year) rate is 4%. You expect yields to move down by 10 basis points over the year.

a. Give a rough estimate of your expected return.

b. What is the risk premium on this bond?

a. Give a rough estimate of your expected return.

b. What is the risk premium on this bond?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

11

Discuss the differences between a par and a discount Brady bond.

a. Take the viewpoint of the emerging country.

b. Take the viewpoint of the bondholder.

a. Take the viewpoint of the emerging country.

b. Take the viewpoint of the bondholder.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

12

Two bond indexes of the same market tend to give the similar total return indications even if their composition is quite different. Why?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

13

A one-year bond is issued by a corporation with a 5% probability of default by year-end. In case of default, the investor will recover nothing. The one-year yield for default-free bonds is 10%.

a. What yield should be required by investors on these corporate bonds if they are risk neutral?

b. What should the credit spread be?

a. What yield should be required by investors on these corporate bonds if they are risk neutral?

b. What should the credit spread be?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

14

A zero-coupon bond with a five-year maturity is worth 68.06% of its final reimbursement value.

a. Verify that its actuarial yield-to-maturity is equal to 8% by compounding 8% over five years.

b. What is the simple yield of this bond, and why is it so different from the actuarial yield?

a. Verify that its actuarial yield-to-maturity is equal to 8% by compounding 8% over five years.

b. What is the simple yield of this bond, and why is it so different from the actuarial yield?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

15

What are the potential biases of the simple yield calculation? Take the example of two straight yen Eurobonds with the same maturity of five years. Bond A has a coupon of 12% and Bond B, a coupon of 8%. The current market yield on yen bonds is 10%. These two bonds have the same yield-to-maturity of 10% and are correctly priced at 107.58% for Bond A and 92.42% for Bond B. What would be the yield-to-maturity indicated by the simple yield calculation?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

16

List three differences between dollar Eurobonds and Yankee bonds.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

17

Assume that you are an international bank that has lent money to some Latin American countries. Because of the nonpayment of interest due, you have already taken substantial reserves against these nonperforming loans. Why would you be willing to exchange these loans for Brady bonds?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

18

A straight bond with an annual coupon of 9% will be reimbursed 100% in three years. The previous coupon has just been paid and this bond currently trades at 105.25%. Its European yield-to-maturity is 7%.

a. What is its modified duration?

b. What is its semiannual yield-to-maturity?

c. What is its simple yield?

a. What is its modified duration?

b. What is its semiannual yield-to-maturity?

c. What is its simple yield?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

19

Let's consider the NKK dual-currency bond shown in Exhibit 7.3. It is a bond quoted in yen at 101%. What would happen to the market price if the following scenarios took place?

a. The market interest rate on (newly issued) yen bonds drops significantly.

b. The dollar drops in value relative to the yen.

c. The market interest rate on (newly issued) dollar bonds drops significantly.

d. Would you give the same answers if the same bonds were quoted in dollars?

a. The market interest rate on (newly issued) yen bonds drops significantly.

b. The dollar drops in value relative to the yen.

c. The market interest rate on (newly issued) dollar bonds drops significantly.

d. Would you give the same answers if the same bonds were quoted in dollars?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

20

What is the difference between a foreign bond and a Eurobond?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

21

The yields on zero-coupon bonds are as follows:

A young investment banker considers issuing a $/yen dual-currency bond for ¥100 million. It is a bond with interest paid in yen and principal repaid in dollars. The current spot exchange rate is

$1= ¥100. The bond will be reimbursed for $1 million in two years. The interest is paid on year

one and year two. What should the interest paid in yen be?

A young investment banker considers issuing a $/yen dual-currency bond for ¥100 million. It is a bond with interest paid in yen and principal repaid in dollars. The current spot exchange rate is

$1= ¥100. The bond will be reimbursed for $1 million in two years. The interest is paid on year

one and year two. What should the interest paid in yen be?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

22

An FRN is a bond that pays a quarterly or semiannual coupon indexed on a short-term interest rate such as the LIBOR.

a. Why does it make sense to use a short-term interest rate as the index?

b. Why are banks heavy issuers of FRNs?

a. Why does it make sense to use a short-term interest rate as the index?

b. Why are banks heavy issuers of FRNs?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

23

A company without default risk has issued a perpetual Eurodollar FRN at LIBOR. The coupon is paid and reset semiannually. It is certain that the issuer will never have default risk, and will always be able to borrow at LIBOR. The FRN is issued on March 1, 2002, when the six-month LIBOR is at 5%. The Eurodollar yield curve on September 1, 2002, and December 1, 2002, is as follows.

a. What is the coupon paid on September 1, 2002, per $1,000 FRN?

b. What is the new value of the coupon set on the FRN on September 1, 2002?

c. What is the new value and clean price of the FRN on December 1, 2002?

a. What is the coupon paid on September 1, 2002, per $1,000 FRN?

b. What is the new value of the coupon set on the FRN on September 1, 2002?

c. What is the new value and clean price of the FRN on December 1, 2002?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

24

The yield curves in U.S. dollars and Swiss francs are as follows:

These are yields for zero-coupon bonds of one- and two-year maturities. The spot exchange rate is SF/$ = 1.5.

a. What are the implied one-year and two-year forward exchange rates?

b. You contemplate issuing a dual-currency bond. You could issue zero-coupon bonds in both currencies at the interest rates above. Instead, you wish to issue bonds of SF 150 with a coupon C in Swiss francs, paid each year for two years, and reimbursed for $100 at the end of two years. What is the interest rate c% (c = C/150) on the bond that would be consistent with the yield curves above?

c. You contemplate issuing a two-year currency option bond. The bond is issued for $100 and gives the option to receive the coupons and principal payment in either dollars or Swiss francs at a fixed exchange rate of SF/$51.5. A bank gives you quotes on the premiums for SF calls with a strike price of 1/1.5 = 0.66666 US$. The premium for a one-year call is 4 U.S. cents (per Swiss franc) and for a two-year call is 7 U.S. cents. What coupon rate should you set on your currency option bond?

These are yields for zero-coupon bonds of one- and two-year maturities. The spot exchange rate is SF/$ = 1.5.

a. What are the implied one-year and two-year forward exchange rates?

b. You contemplate issuing a dual-currency bond. You could issue zero-coupon bonds in both currencies at the interest rates above. Instead, you wish to issue bonds of SF 150 with a coupon C in Swiss francs, paid each year for two years, and reimbursed for $100 at the end of two years. What is the interest rate c% (c = C/150) on the bond that would be consistent with the yield curves above?

c. You contemplate issuing a two-year currency option bond. The bond is issued for $100 and gives the option to receive the coupons and principal payment in either dollars or Swiss francs at a fixed exchange rate of SF/$51.5. A bank gives you quotes on the premiums for SF calls with a strike price of 1/1.5 = 0.66666 US$. The premium for a one-year call is 4 U.S. cents (per Swiss franc) and for a two-year call is 7 U.S. cents. What coupon rate should you set on your currency option bond?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

25

A young investment banker considers issuing a DM/$ currency option bond for a AAA client and wonders about its pricing. He knows that currency options are available on the market and that they could help set the conditions on the bond issue. As a first step, he decides to study a simple case: a one-year bond. The current market conditions are as follows:

One-year dollar interest rate: 10%.

One-year Deutsche mark interest rate: 7%.

Spot DM/$ exchange rate: $1 =DM 2.

The banker could issue a bond in dollars at 10%, a bond in DM at 7%, or a currency option bond at an interest rate to be determined. One-year currency options are negotiated on the over-the-counter market. A one-year currency option to exchange one dollar for two Deutsche marks is quoted at 4%, that is, four cents per dollar. This is a European option, which can be exercised only at maturity. The one-year forward exchange rate is: a. Given these data, what should the interest rate be on a one-year DM/$ bond?

b. How would you determine how to set the interest rate on an n-year currency bond?

One-year dollar interest rate: 10%.

One-year Deutsche mark interest rate: 7%.

Spot DM/$ exchange rate: $1 =DM 2.

The banker could issue a bond in dollars at 10%, a bond in DM at 7%, or a currency option bond at an interest rate to be determined. One-year currency options are negotiated on the over-the-counter market. A one-year currency option to exchange one dollar for two Deutsche marks is quoted at 4%, that is, four cents per dollar. This is a European option, which can be exercised only at maturity. The one-year forward exchange rate is: a. Given these data, what should the interest rate be on a one-year DM/$ bond?

b. How would you determine how to set the interest rate on an n-year currency bond?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

26

A company is deciding whether to issue a one-year dual-currency bond or a one-year currency option bond.

The dual-currency bond would be issued in CHF (Swiss francs) with a principal of 100 CHF per bond, with interest payable in CHF and principal repaid in U.S. dollars ($50). Denote x the interest at which this bond is issued.

The currency option bond is issued in CHF (100 CHF), and the interest and principal are repaid in CHF or $ at the option of the bondholder. The principal repaid is either 100 CHF or $50, and the interest rate is either y CHF or 1/2y dollars.

As you guessed, the current spot exchange rate is 2 CHF/$. The current one-year market interest rates are 6% in CHF and 10% in $. One-year currency options are quoted in Chicago. A put CHF is quoted at 1.2 U.S. cents per CHF; this option premium is for one CHF, with a strike price of 50 U.S. cents.

a. What is the fair interest rate x on the dual-currency bond?

b. What is the fair interest rate y on the currency option bond?

The dual-currency bond would be issued in CHF (Swiss francs) with a principal of 100 CHF per bond, with interest payable in CHF and principal repaid in U.S. dollars ($50). Denote x the interest at which this bond is issued.

The currency option bond is issued in CHF (100 CHF), and the interest and principal are repaid in CHF or $ at the option of the bondholder. The principal repaid is either 100 CHF or $50, and the interest rate is either y CHF or 1/2y dollars.

As you guessed, the current spot exchange rate is 2 CHF/$. The current one-year market interest rates are 6% in CHF and 10% in $. One-year currency options are quoted in Chicago. A put CHF is quoted at 1.2 U.S. cents per CHF; this option premium is for one CHF, with a strike price of 50 U.S. cents.

a. What is the fair interest rate x on the dual-currency bond?

b. What is the fair interest rate y on the currency option bond?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

27

Fuji Bank issued convertible Eurobonds in January 1989. Convertible bonds were a popular way for Japanese banks to raise funds while the Tokyo stock market was booming in the 1980s. The lure of capital gains from converting the bonds to equity allowed the banks to issue the securities with a very low interest rate.

Fuji Bank Eurobond was a 500-million Swiss franc zero-coupon bond, issued at par with a maturity of five years. A bond with a face value of 100 Swiss francs could be converted into two shares of Fuji Bank at any time starting in 1991. At time of issue, Fuji's stock was worth 3,590 yen, and a Swiss franc was worth 80 yen. The bond also had a put option that could be exercised at the start of 1991 (and only at that time). Bondholders had the option of redeeming the bond at a premium of 2.625% over its face value. In other words, bondholders could obtain 102.625 francs for each bond. On January 14, 1991, the Tokyo stock market and the yen dropped. A stock of Fuji Bank was worth

2,400 yen, and a Swiss franc was worth 95 yen. Yields on Swiss franc bonds were around 4%. Most bonds were presented for early redemption.

a. Why was it advantageous for a bondholder to exercise the put option?

b. What was the total yen loss for Fuji Bank?

Fuji Bank Eurobond was a 500-million Swiss franc zero-coupon bond, issued at par with a maturity of five years. A bond with a face value of 100 Swiss francs could be converted into two shares of Fuji Bank at any time starting in 1991. At time of issue, Fuji's stock was worth 3,590 yen, and a Swiss franc was worth 80 yen. The bond also had a put option that could be exercised at the start of 1991 (and only at that time). Bondholders had the option of redeeming the bond at a premium of 2.625% over its face value. In other words, bondholders could obtain 102.625 francs for each bond. On January 14, 1991, the Tokyo stock market and the yen dropped. A stock of Fuji Bank was worth

2,400 yen, and a Swiss franc was worth 95 yen. Yields on Swiss franc bonds were around 4%. Most bonds were presented for early redemption.

a. Why was it advantageous for a bondholder to exercise the put option?

b. What was the total yen loss for Fuji Bank?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

28

In March 1993, the Student Loan Marketing Association (Sallie Mae) issued five-year notes with a coupon set at 4.5% in the first year and reset quarterly subsequently. The floating quarterly coupon rate was set to be the higher of either 4.125% or 50% of the rate on ten-year Treasury notes plus 1.25%. At time of issue, the interest rates for all maturities were well below 4%, and investors were attracted by the high current yield (4.5%) compared to other straight bonds available.

Assume that in March 1994, interest rates have risen dramatically and that the U.S. Treasury yield curve is now flat at 7% for all maturities.

a. What is the new coupon rate set on the Sallie Mae bond?

b. Why is the Sallie Mae bond now trading at a hefty discount?

Assume that in March 1994, interest rates have risen dramatically and that the U.S. Treasury yield curve is now flat at 7% for all maturities.

a. What is the new coupon rate set on the Sallie Mae bond?

b. Why is the Sallie Mae bond now trading at a hefty discount?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

29

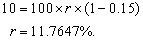

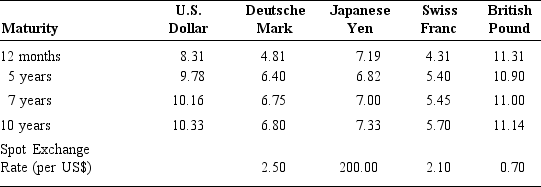

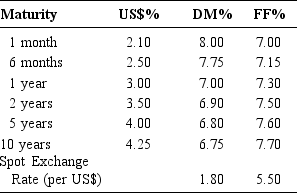

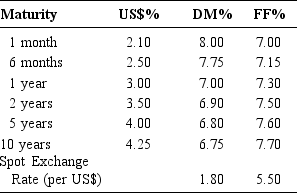

Back in 1985, when the Deutsche mark still existed, the yield curves were as follows:

Calculate the implied forward exchange rates, assuming that yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that yields on zero-coupon bonds (European convention) for maturities of more than one year.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

30

The current dollar yield curve on the Eurobond market is flat at 7% for top-quality borrowers. A French company of good standing can issue plain-vanilla straight and floating-rate dollar Eurobonds at the following conditions:

Bond A: Straight bond. Five-year straight dollar Eurobond with a coupon of 7.25%.

Bond B: FRN. Five-year dollar FRN with a semiannual coupon set at LIBOR plus ¼% and a cap of 14%. The cap means that the coupon rate is limited at 14% even if the LIBOR passes 13.75%.

An investment banker proposes to the French company to issue bull and/or bear FRNs at the following conditions:

Bond C: Bull FRN. Five-year FRN with a semiannual coupon set at: 13.75%-LIBOR.

Bond D: Bear FRN. Five-year FRN with a semiannual coupon set at: 2 * LIBOR - 7%.

The coupon on a bull FRN will increase when LIBOR drops. This is sometimes known as a reverse floater. The coupon on the bull FRN cannot be negative, so it has a floor of zero. The bear FRN will benefit from a rise in interest rates. The coupon on the bear FRN is set with a cap of 20.50%.

a. Explain why a bull FRN could be attractive to some investors.

b. Explain why a bear FRN could be attractive to some investors.

c. Explain why it would be attractive to the French company to issue these FRNs compared to current market conditions for plain-vanilla straight Eurobonds and FRNs. The company assumes that LIBOR can never be below 3.5% or above 13.75%.

Bond A: Straight bond. Five-year straight dollar Eurobond with a coupon of 7.25%.

Bond B: FRN. Five-year dollar FRN with a semiannual coupon set at LIBOR plus ¼% and a cap of 14%. The cap means that the coupon rate is limited at 14% even if the LIBOR passes 13.75%.

An investment banker proposes to the French company to issue bull and/or bear FRNs at the following conditions:

Bond C: Bull FRN. Five-year FRN with a semiannual coupon set at: 13.75%-LIBOR.

Bond D: Bear FRN. Five-year FRN with a semiannual coupon set at: 2 * LIBOR - 7%.

The coupon on a bull FRN will increase when LIBOR drops. This is sometimes known as a reverse floater. The coupon on the bull FRN cannot be negative, so it has a floor of zero. The bear FRN will benefit from a rise in interest rates. The coupon on the bear FRN is set with a cap of 20.50%.

a. Explain why a bull FRN could be attractive to some investors.

b. Explain why a bear FRN could be attractive to some investors.

c. Explain why it would be attractive to the French company to issue these FRNs compared to current market conditions for plain-vanilla straight Eurobonds and FRNs. The company assumes that LIBOR can never be below 3.5% or above 13.75%.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

31

Several years ago, when the Deutsche mark and French franc still existed, the yield curves were as follows:

Calculate the implied forward exchange rates, assuming that the interest rates are international money rates (linear convention) for maturities of less than a year and yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that the interest rates are international money rates (linear convention) for maturities of less than a year and yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that the interest rates are international money rates (linear convention) for maturities of less than a year and yields on zero-coupon bonds (European convention) for maturities of more than one year.

Calculate the implied forward exchange rates, assuming that the interest rates are international money rates (linear convention) for maturities of less than a year and yields on zero-coupon bonds (European convention) for maturities of more than one year.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

32

A corporation rated AA issues a five-year FRN Eurobond in euros on November 1, 2005. The coupon is paid quarterly and is equal to euro-LIBOR plus a spread of ½ %. On November 1, the three-month euro LIBOR is at 4%. The issuer remains rated at AA during the life of the bond.

a. Three months later (February 1, 2006), the three-month euro-LIBOR has moved to 4.5%, and the market-required spread for AA borrowers has remained at ½ %. What should the value of the bond on reset date be?

b. Three months later (May 1, 2006), the three-month euro-LIBOR is still at 4.5%, but the market-required spread for AA borrowers has increased to ¾%. Give some estimation of the new value of the FRN on the reset date.

a. Three months later (February 1, 2006), the three-month euro-LIBOR has moved to 4.5%, and the market-required spread for AA borrowers has remained at ½ %. What should the value of the bond on reset date be?

b. Three months later (May 1, 2006), the three-month euro-LIBOR is still at 4.5%, but the market-required spread for AA borrowers has increased to ¾%. Give some estimation of the new value of the FRN on the reset date.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

33

A company without default risk can issue a ten-year FRN at LIBOR. The coupon is paid and reset semiannually. It is certain that the issuer will never have default risk and will always be able to borrow at LIBOR. The FRN is issued on November 1, 2005, when the six-month LIBOR is at 4.5%. Here are the dollar yield curves on two different dates:

a. What should the value of the FRN be on May 1?

b. What should the value and the clean price of the FRN be August 1, 2006?

a. What should the value of the FRN be on May 1?

b. What should the value and the clean price of the FRN be August 1, 2006?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

34

The current euro yield curve on the euro Eurobond market is flat at 4% for top-quality borrowers. A French company of good standing can issue plain-vanilla straight and floating-rate dollar Eurobonds at the following conditions:

Bond A: Straight bond. Five-year straight dollar Eurobond with a coupon of 4%.

Bond B: Floating rate note (FRN). Five-year dollar FRN with a semiannual coupon set at London InterBank Offered Rate (LIBOR).

An investment banker proposes to the French company to issue bull and/or bear FRNs at the following conditions:

Bond C: Bull FRN. Five-year FRN with a semiannual coupon set at:

7.60% - LIBOR.

Bond D: Bear FRN. Five-year FRN with a semiannual coupon set at:

2* LIBOR -4.2%.

The floor on all coupons is zero. The investment bank also proposes a five-year floor option at 2.1%. This floor will pay to the French company the difference between 2.1% and LIBOR, if it is positive, or zero if LIBOR is above 2.1%. The cost of this floor is spread over the payment dates and set at an annual 0.05%. The bank also proposes a five-year cap at 7.60%. The annual premium on the cap is 0.1%. The company can also enter in a five-year interest-rate swap of 4% fixed against LIBOR.

a. Assume that the French company issues Bonds C and D in equal proportions. Is it more advantageous than issuing Bonds A and B in equal proportion and why?

b. Find out the borrowing cost reduction that can be achieved by issuing the bull Note C compared to issuing a fixed-coupon straight Bond A at 4%.

c. Find out the borrowing cost reduction that can be achieved by issuing the bull Note C compared to issuing a plain-vanilla FRN B at LIBOR.

d. Find out the borrowing cost reduction that can be achieved by issuing the bear Note D compared to issuing a fixed-coupon straight Bond A at 4%.

e. Find out the borrowing cost reduction that can be achieved by issuing the bear Note D compared to issuing a plain-vanilla FRN B at LIBOR.

Bond A: Straight bond. Five-year straight dollar Eurobond with a coupon of 4%.

Bond B: Floating rate note (FRN). Five-year dollar FRN with a semiannual coupon set at London InterBank Offered Rate (LIBOR).

An investment banker proposes to the French company to issue bull and/or bear FRNs at the following conditions:

Bond C: Bull FRN. Five-year FRN with a semiannual coupon set at:

7.60% - LIBOR.

Bond D: Bear FRN. Five-year FRN with a semiannual coupon set at:

2* LIBOR -4.2%.

The floor on all coupons is zero. The investment bank also proposes a five-year floor option at 2.1%. This floor will pay to the French company the difference between 2.1% and LIBOR, if it is positive, or zero if LIBOR is above 2.1%. The cost of this floor is spread over the payment dates and set at an annual 0.05%. The bank also proposes a five-year cap at 7.60%. The annual premium on the cap is 0.1%. The company can also enter in a five-year interest-rate swap of 4% fixed against LIBOR.

a. Assume that the French company issues Bonds C and D in equal proportions. Is it more advantageous than issuing Bonds A and B in equal proportion and why?

b. Find out the borrowing cost reduction that can be achieved by issuing the bull Note C compared to issuing a fixed-coupon straight Bond A at 4%.

c. Find out the borrowing cost reduction that can be achieved by issuing the bull Note C compared to issuing a plain-vanilla FRN B at LIBOR.

d. Find out the borrowing cost reduction that can be achieved by issuing the bear Note D compared to issuing a fixed-coupon straight Bond A at 4%.

e. Find out the borrowing cost reduction that can be achieved by issuing the bear Note D compared to issuing a plain-vanilla FRN B at LIBOR.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

35

A corporation rated A has issued a semiannual FRN in dollars. This is a perpetual bond, which will pay coupons indefinitely if the corporation does not default. The coupon is set at six-month LIBOR plus a spread of ¾%. The six-month dollar LIBOR is equal to 5%.

Six months later, the six-month dollar LIBOR has remained at 5%, but the market-required spread for A-rated corporations on long-term FRNs has moved to 1%. Give some estimation of the new value of the FRN on the reset date.

Six months later, the six-month dollar LIBOR has remained at 5%, but the market-required spread for A-rated corporations on long-term FRNs has moved to 1%. Give some estimation of the new value of the FRN on the reset date.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

36

A young investment banker meets one of its clients, SOSO Inc. that is based in Sydney, Australia.

Current market conditions are the following:

FX Spot rate: AU$/$ =2.

Interest rate (zero-coupon):

Quote in U.S.$ cents for options (strike price: 50 cents per AU$).

For example a PUT AU$, traded in Chicago, gives the right to sell 1 Australian dollar (AU$) at

50 cents in a year. Its current price is 2.5 cents per AU$.

SOSO would like to issue a bond paying a fixed annual coupon of 6 AU$ and to be reimbursed in a year 100 AU$ or 50$ at the bearer's choice.

a. Assuming that the bond is actually issued at 105 AU$, what is the implicit price of the option linked to that bond? Would you recommend that bond to an investor?

b. If the market was efficient, what is the normal issue price for such a bond?

After many thoughts, SOSO agrees to issue instead a dual-currency bond with an annual coupon in AU$ and a nominal to be reimbursed in US$ with the following characteristics:

- Issue Price: 100 AU$.

- Reimbursement Price: 50$

- Maturity: 2 years.

- Annual Coupon: C AU$.

c. Under current market conditions, at what level should Coupon C on the dual-currency

bond be set?

Current market conditions are the following:

FX Spot rate: AU$/$ =2.

Interest rate (zero-coupon):

Quote in U.S.$ cents for options (strike price: 50 cents per AU$).

For example a PUT AU$, traded in Chicago, gives the right to sell 1 Australian dollar (AU$) at

50 cents in a year. Its current price is 2.5 cents per AU$.

SOSO would like to issue a bond paying a fixed annual coupon of 6 AU$ and to be reimbursed in a year 100 AU$ or 50$ at the bearer's choice.

a. Assuming that the bond is actually issued at 105 AU$, what is the implicit price of the option linked to that bond? Would you recommend that bond to an investor?

b. If the market was efficient, what is the normal issue price for such a bond?

After many thoughts, SOSO agrees to issue instead a dual-currency bond with an annual coupon in AU$ and a nominal to be reimbursed in US$ with the following characteristics:

- Issue Price: 100 AU$.

- Reimbursement Price: 50$

- Maturity: 2 years.

- Annual Coupon: C AU$.

c. Under current market conditions, at what level should Coupon C on the dual-currency

bond be set?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

37

Titi, a Japanese company, issued a six-year Eurobond in dollars convertible to shares of the Japanese company. At time of issue, the long-term bond yield on straight dollar bonds was 10% for such an issuer. Instead, Titi issued bonds at 8%. Each $1,000 par bond is convertible into 100 shares of Titi. At time of issue, the stock price of Titi is 1,600 yen and the exchange rate is 100 yen =0.5 dollar

($/Y = 0.005).

a. Why can the bond be issued with a yield of only 8%?

b. What would happen if:

The stock price of Titi increases?

The yen appreciates?

The market interest rate of dollar bonds drops?

c. A year later, the new market conditions are as follows:

The yield on straight dollar bonds of similar quality has risen from 10% to 11%.

Titi stock price has moved up to Y 2000.

The exchange rate is $/Y = 0.006.

What would be a minimum price for the Titi convertible bond?

d. Could you try to assess the theoretical value of this convertible bond as a package of other securities such as a straight bond issued by Titi, options or warrants on the yen value of Titi stock, an futures and options on the dollar/yen exchange rate?

($/Y = 0.005).

a. Why can the bond be issued with a yield of only 8%?

b. What would happen if:

The stock price of Titi increases?

The yen appreciates?

The market interest rate of dollar bonds drops?

c. A year later, the new market conditions are as follows:

The yield on straight dollar bonds of similar quality has risen from 10% to 11%.

Titi stock price has moved up to Y 2000.

The exchange rate is $/Y = 0.006.

What would be a minimum price for the Titi convertible bond?

d. Could you try to assess the theoretical value of this convertible bond as a package of other securities such as a straight bond issued by Titi, options or warrants on the yen value of Titi stock, an futures and options on the dollar/yen exchange rate?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

38

Bank PAPOUF decides to issue two bonds and wonders what should be the fair interest rate on these bonds:

- Bond A: A two-year €/$ dual-currency bond with interest in € and principal in $. The bond is issued for 100 € and pays an interest rate of i €, each year for two years. The principal is reimbursed at $50.

- Bond B: A two-year currency option bond. The bond is issued in $ with a face value of $ 100. The bondholder can choose to have the coupons and principal paid in dollars or in €, at a specified exchange rate of €/$ =2, that is, receive either $100 or €200 as principal repayment, or receive either $C or €2C as interest if C is the coupon set in dollars.

Current market conditions are as follows:

Spot exchange rate: S = €/$ F= 2.

a. What should be the coupon i set on Bond A consistent with current market conditions?

b. What should be the coupon C set on Bond B consistent with current market conditions?

- Bond A: A two-year €/$ dual-currency bond with interest in € and principal in $. The bond is issued for 100 € and pays an interest rate of i €, each year for two years. The principal is reimbursed at $50.

- Bond B: A two-year currency option bond. The bond is issued in $ with a face value of $ 100. The bondholder can choose to have the coupons and principal paid in dollars or in €, at a specified exchange rate of €/$ =2, that is, receive either $100 or €200 as principal repayment, or receive either $C or €2C as interest if C is the coupon set in dollars.

Current market conditions are as follows:

Spot exchange rate: S = €/$ F= 2.

a. What should be the coupon i set on Bond A consistent with current market conditions?

b. What should be the coupon C set on Bond B consistent with current market conditions?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

39

A company without default risk can issue a perpetual FRN at LIBOR. The coupon is paid and reset semiannually. It is certain that the issuer will never have default risk and will always be able to borrow at LIBOR. The FRN is issued on November 1, 2005, when the six-month LIBOR is at 4.5%. On May 1, 2006, the six-month LIBOR is at 5%.

a. What is the coupon paid on May 1, 2006, per $1,000 bond?

b. What is the new value of the coupon set on the bond?

c. On May 2, 2006, the six-month LIBOR has dropped to 4.9%. What is the new value of the FRN?

a. What is the coupon paid on May 1, 2006, per $1,000 bond?

b. What is the new value of the coupon set on the bond?

c. On May 2, 2006, the six-month LIBOR has dropped to 4.9%. What is the new value of the FRN?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

40

A company without default risk can issue a five-year dollar FRN at LIBOR. The coupon is paid and reset semiannually. It is certain that the issuer will never have default risk and will always be able to borrow at LIBOR. The FRN is issued on November 1, 2005, when the six-month LIBOR is at 5%. Here are the dollar yield curves on two different dates:

a. What should the value of the FRN be on May 1?

b. What should the value and the clean price of the FRN be August 1, 2006?

a. What should the value of the FRN be on May 1?

b. What should the value and the clean price of the FRN be August 1, 2006?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

41

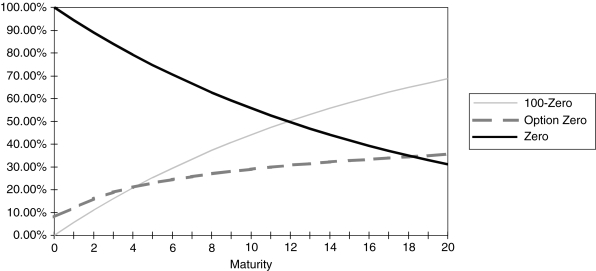

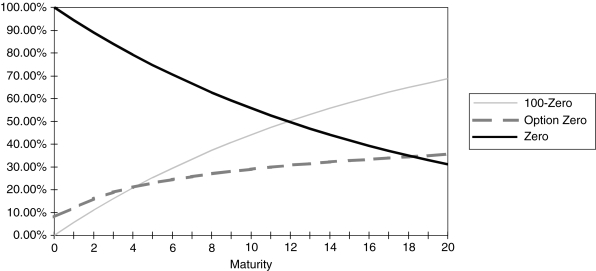

You're a banker. A client wishes to buy a guaranteed note with a 100% indexation to the stock index's growth. In other words, he does not want any coupon but requires 100% of the index growth. You wonder about the maturity of such a note. You check the prices of various index calls traded on the market for different maturities. Their strike is the current index level and their price is expressed as a percentage of this level. (For instance, if the CAC is worth 3,000, the strike is 3,000, and the one-year maturity call trades at 11% of 3,000. You also check the price of a zero-coupon in percentage for various maturities. The following graph shows, for each a maturity, the price of the option, that of the zero-coupon and 100%-zero.  a. What is the maturity of the guaranteed note (Coupon = 0%, indexation = 100%)? Justify.

a. What is the maturity of the guaranteed note (Coupon = 0%, indexation = 100%)? Justify.

b. If as a banker, you want to make a profit, should you lengthen or shorten the maturity of that note? Explain why.

c. Everything remaining constant (i.e., same volatility and interest rate), should the maturity of the guaranteed note be shorter or longer if the index pays a low dividend rather than a high one? Why?

a. What is the maturity of the guaranteed note (Coupon = 0%, indexation = 100%)? Justify.

a. What is the maturity of the guaranteed note (Coupon = 0%, indexation = 100%)? Justify.b. If as a banker, you want to make a profit, should you lengthen or shorten the maturity of that note? Explain why.

c. Everything remaining constant (i.e., same volatility and interest rate), should the maturity of the guaranteed note be shorter or longer if the index pays a low dividend rather than a high one? Why?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

42

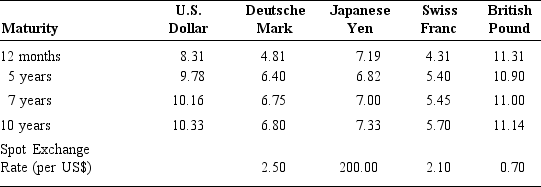

The Kingdom of Papou issues a very-bull bond with a coupon equal to:

14.6 - 2 * LIBOR.

Of course, the coupon cannot be negative.

The Kingdom could have issued a FRN at LIBOR + ¼%, or a straight bond at 5.30%.

The current market conditions for swaps are 5% against LIBOR.

You could also trade in CAPS and FLOORS with different exercise prices (these are levels of interest rates). The premiums are paid annually.

![The Kingdom of Papou issues a very-bull bond with a coupon equal to: 14.6 - 2 * LIBOR. Of course, the coupon cannot be negative. The Kingdom could have issued a FRN at LIBOR + ¼%, or a straight bond at 5.30%. The current market conditions for swaps are 5% against LIBOR. You could also trade in CAPS and FLOORS with different exercise prices (these are levels of interest rates). The premiums are paid annually. a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors? b. Assume that the Kingdom actually wanted to issue a straight bond (fixed coupon). The bank will put in place a de-mining portfolio with swaps and options so that this very-bull bond plus the de-mining portfolio is equivalent to a straight bond. What is exactly the de-mining portfolio? [Be very precise and tell us if the Kingdom must pay fixed, receive LIBOR or vice versa, etc. ...] c. What is the cost advantage for the Kingdom compared to issuing bonds @ 5.30 %? d. Same question assuming that the Kingdom wanted to issue an FRN @LIBOR + ¼ %?](https://d2lvgg3v3hfg70.cloudfront.net/TB7821/11eac6a3_52b2_0a25_af59_e39fa52f79a2_TB7821_00.jpg) a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors?

a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors?

b. Assume that the Kingdom actually wanted to issue a straight bond (fixed coupon). The bank will put in place a "de-mining" portfolio with swaps and options so that this very-bull bond plus the "de-mining" portfolio is equivalent to a straight bond. What is exactly the "de-mining" portfolio? [Be very precise and tell us if the Kingdom must pay fixed, receive LIBOR or vice versa, etc. ...]

c. What is the cost advantage for the Kingdom compared to issuing bonds @ 5.30 %?

d. Same question assuming that the Kingdom wanted to issue an FRN @LIBOR + ¼ %?

14.6 - 2 * LIBOR.

Of course, the coupon cannot be negative.

The Kingdom could have issued a FRN at LIBOR + ¼%, or a straight bond at 5.30%.

The current market conditions for swaps are 5% against LIBOR.

You could also trade in CAPS and FLOORS with different exercise prices (these are levels of interest rates). The premiums are paid annually.

![The Kingdom of Papou issues a very-bull bond with a coupon equal to: 14.6 - 2 * LIBOR. Of course, the coupon cannot be negative. The Kingdom could have issued a FRN at LIBOR + ¼%, or a straight bond at 5.30%. The current market conditions for swaps are 5% against LIBOR. You could also trade in CAPS and FLOORS with different exercise prices (these are levels of interest rates). The premiums are paid annually. a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors? b. Assume that the Kingdom actually wanted to issue a straight bond (fixed coupon). The bank will put in place a de-mining portfolio with swaps and options so that this very-bull bond plus the de-mining portfolio is equivalent to a straight bond. What is exactly the de-mining portfolio? [Be very precise and tell us if the Kingdom must pay fixed, receive LIBOR or vice versa, etc. ...] c. What is the cost advantage for the Kingdom compared to issuing bonds @ 5.30 %? d. Same question assuming that the Kingdom wanted to issue an FRN @LIBOR + ¼ %?](https://d2lvgg3v3hfg70.cloudfront.net/TB7821/11eac6a3_52b2_0a25_af59_e39fa52f79a2_TB7821_00.jpg) a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors?

a. You are a buyer of this very-bull bond. Tell us what it is equivalent to, in terms of buying/selling: FRN, straight bonds, caps or floors?b. Assume that the Kingdom actually wanted to issue a straight bond (fixed coupon). The bank will put in place a "de-mining" portfolio with swaps and options so that this very-bull bond plus the "de-mining" portfolio is equivalent to a straight bond. What is exactly the "de-mining" portfolio? [Be very precise and tell us if the Kingdom must pay fixed, receive LIBOR or vice versa, etc. ...]

c. What is the cost advantage for the Kingdom compared to issuing bonds @ 5.30 %?

d. Same question assuming that the Kingdom wanted to issue an FRN @LIBOR + ¼ %?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

43

A nine-year bond has a yield-to-maturity of 10% and a modified duration of 6.54 years. If the market yield changes by 50 basis points, the bond's expected price change is:

a. 3.27%

b. 3.66%

c. 5.00%

d. 6.54%

a. 3.27%

b. 3.66%

c. 5.00%

d. 6.54%

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

44

Strumpf Ltd. decides to issue a convertible bond with a maturity of two years. Each bond is issued with a nominal value of £100 and an annual coupon C; of course, C has to be determined. Each bond can be redeemed for £100 or converted into one share of Strumpf at the option of the bondholder.

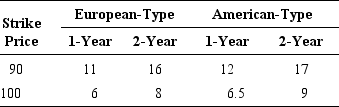

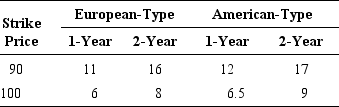

The current stock price of Strumpf is £90. The yield curve for an issuer like Strumpf is flat at 6%. Barings is ready to issue long-term options on Strumpf shares. The premiums on calls with one-year and two-year expirations are given below:

a. American-type calls are more expensive than European-type calls. Is it reasonable?

a. American-type calls are more expensive than European-type calls. Is it reasonable?

b. Assume that the bond can only be converted at maturity, after payment of the second coupon. What should be the fair coupon rate C, consistent with the above market conditions?

c. Assume that the bond is issued with the coupon rate determined above. The yield curve suddenly moves from 6% to 6.1% and the option premiums stay the same. What should be the new market price of the convertible bond?

d. Assume now that the bond can be converted on two dates (rather than one as above). These dates are the first year (right after the first coupon payment) and the second year as above. It is not possible to convert the two-year bond at any other date. Is it possible to construct an arbitrage portfolio allowing to price the fair coupon C with the above data? Be precise in your explanation and state what type of options you would need to price the bond.

The current stock price of Strumpf is £90. The yield curve for an issuer like Strumpf is flat at 6%. Barings is ready to issue long-term options on Strumpf shares. The premiums on calls with one-year and two-year expirations are given below:

a. American-type calls are more expensive than European-type calls. Is it reasonable?

a. American-type calls are more expensive than European-type calls. Is it reasonable?b. Assume that the bond can only be converted at maturity, after payment of the second coupon. What should be the fair coupon rate C, consistent with the above market conditions?

c. Assume that the bond is issued with the coupon rate determined above. The yield curve suddenly moves from 6% to 6.1% and the option premiums stay the same. What should be the new market price of the convertible bond?

d. Assume now that the bond can be converted on two dates (rather than one as above). These dates are the first year (right after the first coupon payment) and the second year as above. It is not possible to convert the two-year bond at any other date. Is it possible to construct an arbitrage portfolio allowing to price the fair coupon C with the above data? Be precise in your explanation and state what type of options you would need to price the bond.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

45

On April 1, 2000, a corporation rated AA has issued a semiannual FRN in dollars. This is a perpetual bond, which will pay coupons indefinitely if the corporation does not default. The coupon is set at six-month LIBOR plus a spread of ½ %. The six-month dollar LIBOR is equal to 5%.

a. Three months later (July 1, 2000), the corporation is still rated AA and the market-required credit spread for AA is still at ½%. We observe the following LIBOR rates:

Give an estimation of the total value of the bond. What should be its quoted price?

b. Three months later (October 1, 2000), the coupon has just been paid. The six-month dollar LIBOR is again at 5%, but the market-required spread for AA-rated corporations on long-term FRNs has moved to 1%. Give some estimation of the new value of the FRN on reset date.

a. Three months later (July 1, 2000), the corporation is still rated AA and the market-required credit spread for AA is still at ½%. We observe the following LIBOR rates:

Give an estimation of the total value of the bond. What should be its quoted price?

b. Three months later (October 1, 2000), the coupon has just been paid. The six-month dollar LIBOR is again at 5%, but the market-required spread for AA-rated corporations on long-term FRNs has moved to 1%. Give some estimation of the new value of the FRN on reset date.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

46

Guaranteed note.

You are a young banker offering a client to issue a guaranteed note. The yield curve is flat at 9% for each maturity. Options on the stock index are offered by banks. An at-the-money call with a two-year maturity trades at 12% of the index value, whereas a three-year call is worth 15% of the index.

You wonder about the characteristics of the bond. If you offer a high coupon, the indexation will be low. Therefore, you decide to compute the indexation levels in accordance to the current market conditions for maturities of two and three years and coupon levels of 0%, 2%, and 5%.

You are a young banker offering a client to issue a guaranteed note. The yield curve is flat at 9% for each maturity. Options on the stock index are offered by banks. An at-the-money call with a two-year maturity trades at 12% of the index value, whereas a three-year call is worth 15% of the index.

You wonder about the characteristics of the bond. If you offer a high coupon, the indexation will be low. Therefore, you decide to compute the indexation levels in accordance to the current market conditions for maturities of two and three years and coupon levels of 0%, 2%, and 5%.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

47

Inflation indexed bonds.

Many countries, among which the United Kingdom, the United States, and France, have issued inflation indexed bonds. Coupons and reimbursement value depend on the price index at the time of payment. Let's assume that a bond has been issued for 100 at time 0, with a maturity n and a real coupon equal to 0 . Let It be the price index at time t. The coupon paid at t will be:

Ct= 0 * It/I0.

And the reimbursement value at maturity n will be:

Rn= 100 * In/I0.

Since the reimbursement is also indexed on the price index, we can easily check that the actual yield is equal to the real coupon accrued by the inflation rate.

However, the real interest rate required by the market fluctuates with time. Knowing the market price of an inflation indexed bond and its real coupon, we can easily compute (using a discounting method) its real yield at any time t.

If the indexed bond still has n years to maturity, we just have to use the discounting method for a real cash-flow bond: Knowing the real interest rate we can compare it with the nominal interest rate r on classic bonds.

a. In terms of risk, what is the interest of such bonds? What kind of investors is it aimed at?

b. In terms of return, assume that yield curves r and are flat and that we expect the inflation level to remain constant for the coming years. You expect an annual inflation rate of . In what case do you prefer an inflation-indexed bond to a straight bond? [Find the relation between r, and ]

Many countries, among which the United Kingdom, the United States, and France, have issued inflation indexed bonds. Coupons and reimbursement value depend on the price index at the time of payment. Let's assume that a bond has been issued for 100 at time 0, with a maturity n and a real coupon equal to 0 . Let It be the price index at time t. The coupon paid at t will be:

Ct= 0 * It/I0.

And the reimbursement value at maturity n will be:

Rn= 100 * In/I0.

Since the reimbursement is also indexed on the price index, we can easily check that the actual yield is equal to the real coupon accrued by the inflation rate.

However, the real interest rate required by the market fluctuates with time. Knowing the market price of an inflation indexed bond and its real coupon, we can easily compute (using a discounting method) its real yield at any time t.

If the indexed bond still has n years to maturity, we just have to use the discounting method for a real cash-flow bond: Knowing the real interest rate we can compare it with the nominal interest rate r on classic bonds.

a. In terms of risk, what is the interest of such bonds? What kind of investors is it aimed at?

b. In terms of return, assume that yield curves r and are flat and that we expect the inflation level to remain constant for the coming years. You expect an annual inflation rate of . In what case do you prefer an inflation-indexed bond to a straight bond? [Find the relation between r, and ]

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following statements about the Macaulay duration of a zero-coupon bond is true? The Macaulay duration of a zero-coupon bond:

a. Is equal to the bond's maturity in years.

b. Is equal to one-half the bond's maturity in years.

c. Is equal to the bond's maturity in years divided by its yield-to-maturity.

d. Cannot be calculated because of the lack of coupons.

a. Is equal to the bond's maturity in years.

b. Is equal to one-half the bond's maturity in years.

c. Is equal to the bond's maturity in years divided by its yield-to-maturity.

d. Cannot be calculated because of the lack of coupons.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

49

The French luxury-goods company LVMH, Louis Vuitton-Moët Hennesy, issued a series of perpetual floating-rate notes on the international capital market in the 1990s. These bonds have the advantage of being quasi-equity, while benefiting from favorable tax treatment. Pioneered by state-owned French firms that cannot sell stock to the public, and subsequently used by a number of private European companies that were reluctant to dilute their stocks, the subordinated perpetual floating-rate note is an instrument that remains outstanding in name only. These securities are called instantly repackaged perpetuals, or IRPs.

After a 5-billion franc issue in 1990, LVMH sold, in March 1992, 1.5 billion francs of IRPs. The company received 1.1 billion francs, the remaining 400 million being transferred to an offshore trust. The trust used the proceeds to buy fifteen-year zero-coupon bonds issued by banks underwriting the LVMH issue or by sovereign borrowers such as Denmark and Austria. The 400-million investment in zero-coupon bonds will be redeemed for 1.5 billion in fifteen years. The IRPs have the peculiarity that they pay interest only for the first fifteen years; the interest becomes nil thereafter. After these fifteen years, the trust is committed to repurchase the perpetuals at their face value of 1.5 billion francs. The trust, especially set up for this purpose, will then hold the IRPs forever, but their market value has become zero as they are perpetuals, which pay no interest. The semiannual coupon was set at six-month PIBOR (Paris InterBank Offer Rate) plus ½%.

From an accounting viewpoint, these IRPs are treated as new equity of LVMH, because they are perpetual. From a tax viewpoint, the interest paid on the IRPs during fifteen years can be deducted as interest expense (while dividend payments are not tax deductible).

a. Assume that you are an investment banker proposing such an IRP to a potential client. Explain in detail the advantage of such a package relative to a plain-vanilla fifteen-year FRN, or relative to a new stock issue.

b. In 1990, the French tax authorities decided to allow a write-off of interest expense for only the net amount of capital that the issuer actually takes on its books (1.1 billion for LVMH). Why does this decision reduce the attraction of issuing IRPs?

c. Following the 1992 LVMH issue, the tax authorities decide to introduce a new regulation for trusts, whereby capital gains would be taxed at the normal income tax rate. In effect, the trust would make a capital gains equal to the difference between the face value of the zero-coupon bonds and their issue price. This basically shut the market for IRPs. Why?

After a 5-billion franc issue in 1990, LVMH sold, in March 1992, 1.5 billion francs of IRPs. The company received 1.1 billion francs, the remaining 400 million being transferred to an offshore trust. The trust used the proceeds to buy fifteen-year zero-coupon bonds issued by banks underwriting the LVMH issue or by sovereign borrowers such as Denmark and Austria. The 400-million investment in zero-coupon bonds will be redeemed for 1.5 billion in fifteen years. The IRPs have the peculiarity that they pay interest only for the first fifteen years; the interest becomes nil thereafter. After these fifteen years, the trust is committed to repurchase the perpetuals at their face value of 1.5 billion francs. The trust, especially set up for this purpose, will then hold the IRPs forever, but their market value has become zero as they are perpetuals, which pay no interest. The semiannual coupon was set at six-month PIBOR (Paris InterBank Offer Rate) plus ½%.

From an accounting viewpoint, these IRPs are treated as new equity of LVMH, because they are perpetual. From a tax viewpoint, the interest paid on the IRPs during fifteen years can be deducted as interest expense (while dividend payments are not tax deductible).

a. Assume that you are an investment banker proposing such an IRP to a potential client. Explain in detail the advantage of such a package relative to a plain-vanilla fifteen-year FRN, or relative to a new stock issue.

b. In 1990, the French tax authorities decided to allow a write-off of interest expense for only the net amount of capital that the issuer actually takes on its books (1.1 billion for LVMH). Why does this decision reduce the attraction of issuing IRPs?

c. Following the 1992 LVMH issue, the tax authorities decide to introduce a new regulation for trusts, whereby capital gains would be taxed at the normal income tax rate. In effect, the trust would make a capital gains equal to the difference between the face value of the zero-coupon bonds and their issue price. This basically shut the market for IRPs. Why?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

50

You are a U.S. investor considering purchase of one of the following securities. Assume that the currency risk of the German government bond will be hedged, and the six-month discount on Deutsche mark forward contracts is -0.75% versus the U.S. dollar.

You do not expect any price change in U.S. bond prices in the next six months. Calculate the expected price change required in the German government bond, which would result in the two bonds having equal total returns in U.S. dollars over a six-month horizon.

You do not expect any price change in U.S. bond prices in the next six months. Calculate the expected price change required in the German government bond, which would result in the two bonds having equal total returns in U.S. dollars over a six-month horizon.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

51

A bond with annual coupon payments has the following characteristics:

The bond's modified duration (in years) is:

A) 8.18 years.

B) 8.33 years.

C) 9.78 years.

D) 10.00 years.

The bond's modified duration (in years) is:

A) 8.18 years.

B) 8.33 years.

C) 9.78 years.

D) 10.00 years.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following bonds has the longest duration?

a. 8-year maturity; 6% coupon.

b. 8-year maturity; 11% coupon.

c. 15-year maturity; 6% coupon.

d. 15-year maturity; 11% coupon.

a. 8-year maturity; 6% coupon.

b. 8-year maturity; 11% coupon.

c. 15-year maturity; 6% coupon.

d. 15-year maturity; 11% coupon.

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck

53

The investment fund of Lemon County of California is investing $1 billion in a leveraged-bond hedge fund. This hedge fund has the following structure:

$4 billion invested in a reverse-floater (also called bull FRN). This is a five-year bond with a coupon set at: 9% minus three-month LIBOR.

$3 billion borrowed at: three-month LIBOR.

The current yield curve is flat at 4.5%. The reverse floater is currently priced at 100%.

a. Estimate the yield-enhancement over LIBOR that the hedge fund would provide if the yield curve drops uniformly by 10 basis points (0.1%).

Actually, the whole yield curved moved up to 7% within a few days.

b. What would be the new income (coupon rate) on this $1 billion investment made by Lemon County?

c. Can you provide some rough estimate of the new market value of this $1 billion investment?

$4 billion invested in a reverse-floater (also called bull FRN). This is a five-year bond with a coupon set at: 9% minus three-month LIBOR.

$3 billion borrowed at: three-month LIBOR.

The current yield curve is flat at 4.5%. The reverse floater is currently priced at 100%.

a. Estimate the yield-enhancement over LIBOR that the hedge fund would provide if the yield curve drops uniformly by 10 basis points (0.1%).

Actually, the whole yield curved moved up to 7% within a few days.

b. What would be the new income (coupon rate) on this $1 billion investment made by Lemon County?

c. Can you provide some rough estimate of the new market value of this $1 billion investment?

Unlock Deck

Unlock for access to all 53 flashcards in this deck.

Unlock Deck

k this deck