Deck 18: Accounting for Leases

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/95

Play

Full screen (f)

Deck 18: Accounting for Leases

1

Which will decrease the "agency cost of leasing"?

A)Leased assets that are easy to damage.

B)Leased assets that require no maintenance and care by the lessee.

C)Having lease terms that cover small portions of the asset's useful life.

D)Having an unguaranteed residual value by the lessee.

A)Leased assets that are easy to damage.

B)Leased assets that require no maintenance and care by the lessee.

C)Having lease terms that cover small portions of the asset's useful life.

D)Having an unguaranteed residual value by the lessee.

B

2

Which condition would not result in a finance lease?

A)Risk of breakage is with the lessee.

B)Reward of high resale value is with the lessor.

C)Risk of change in rental rates is with the lessee.

D)Reward of longer than expected useful life for the leased asset is with the lessee.

A)Risk of breakage is with the lessee.

B)Reward of high resale value is with the lessor.

C)Risk of change in rental rates is with the lessee.

D)Reward of longer than expected useful life for the leased asset is with the lessee.

B

3

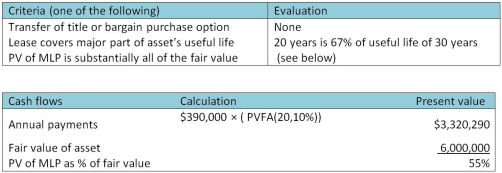

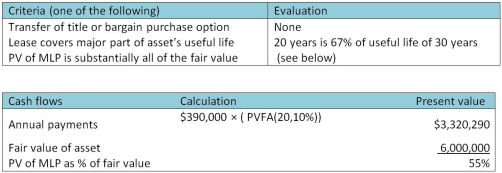

On January 1,2011,Travic Company entered a lease to rent office space.The lease requires Travic to pay $390,000 per year,at the end of each year,for 20 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 30 years,and its current fair value is estimated to be $6 million.Travic's incremental borrowing rate is 10%.

Requirement:

Classify this lease for Travic Company and record the journal entries for the first year of the lease.

Requirement:

Classify this lease for Travic Company and record the journal entries for the first year of the lease.

This is an operating lease because it does not transfer substantially all risks and rewards of ownership.Evaluation of the specific indicators is as follows:  Journal entries for first year of lease:

Journal entries for first year of lease:

Journal entries for first year of lease:

Journal entries for first year of lease: 4

The following are the characteristics of a lease:

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

5

Which will not reduce the "agency cost of leasing"?

A)Maintenance requirements by lessee over the leased asset.

B)Regulations to require a degree of care over the leased asset.

C)Bargain purchase option.

D)Shorter lease terms

A)Maintenance requirements by lessee over the leased asset.

B)Regulations to require a degree of care over the leased asset.

C)Bargain purchase option.

D)Shorter lease terms

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

6

What are executory costs?

A)Maintenance costs that are applicable to only operating leases.

B)Maintenance costs that are incurred only when the asset is leased.

C)Maintenance costs that are incurred whether the asset is purchased or leased.

D)Maintenance costs that are applicable to only finance leases.

A)Maintenance costs that are applicable to only operating leases.

B)Maintenance costs that are incurred only when the asset is leased.

C)Maintenance costs that are incurred whether the asset is purchased or leased.

D)Maintenance costs that are applicable to only finance leases.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

7

Which statement is correct?

A)In an operating lease,the lessee uses the asset for most of the asset's useful life.

B)The lessee expenses the cost of the lease in the period the benefits are received in an operating lease.

C)An operating lease transfers the risks and rewards from the lessor to the lessee.

D)In an operating lease,the lessee records an asset for the property being used.

A)In an operating lease,the lessee uses the asset for most of the asset's useful life.

B)The lessee expenses the cost of the lease in the period the benefits are received in an operating lease.

C)An operating lease transfers the risks and rewards from the lessor to the lessee.

D)In an operating lease,the lessee records an asset for the property being used.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

8

Which will increase the "agency cost of leasing"?

A)Having a bargain purchase option in the lease agreement.

B)Having maintenance requirements for the leased asset.

C)Leasing assets that are easy to damage.

D)Having a guaranteed residual value by the lessee.

A)Having a bargain purchase option in the lease agreement.

B)Having maintenance requirements for the leased asset.

C)Leasing assets that are easy to damage.

D)Having a guaranteed residual value by the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

9

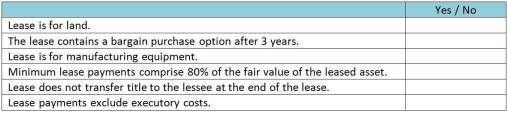

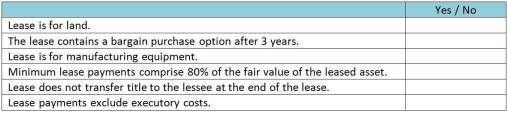

The following are the characteristics of a lease:

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

10

Identify whether the following characteristics/facts are relevant to a finance (capital)lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement is correct about "agency cost of leasing"?

A)Conditions can be added to the lease agreement to increase agency costs.

B)Agency costs are nil if the lease contract covers the entire useful life of the asset.

C)Assets that are difficult to damage are better candidates for leasing.

D)Assets that are difficult to damage have higher agency costs.

A)Conditions can be added to the lease agreement to increase agency costs.

B)Agency costs are nil if the lease contract covers the entire useful life of the asset.

C)Assets that are difficult to damage are better candidates for leasing.

D)Assets that are difficult to damage have higher agency costs.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

12

On January 1,2011,Rushabh Company entered a lease to rent office space.The lease requires Rushabh to pay $190,000 per year,at the end of each year,for 10 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 30 years,and its current fair value is estimated to be $6 million.Rushabh's incremental borrowing rate is 9%.

Requirement:

Classify this lease for Rushabh Company and record the journal entries for the first year of the lease.

Requirement:

Classify this lease for Rushabh Company and record the journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

13

On January 1,2011,Pelvisee Company entered a lease to rent office space.The lease requires Pelvisee to pay $390,000 per year,at the beginning of each year,for 15 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 30 years,and its current fair value is estimated to be $6 million.Pelvisee's incremental borrowing rate is 9%.

Requirement:

Classify this lease for Pelvisee Company and record the journal entries for the first year of the lease.

Requirement:

Classify this lease for Pelvisee Company and record the journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

14

Which statement is correct about "agency cost of leasing"?

A)The lease payments are lowered to compensate for the agency cost of leasing.

B)Shorter lease terms decrease the agency cost of leasing.

C)Agency cost of leasing is an illustration of the "moral hazard" problem.

D)Agency cost of leasing is an illustration of the "adverse selection" problem.

A)The lease payments are lowered to compensate for the agency cost of leasing.

B)Shorter lease terms decrease the agency cost of leasing.

C)Agency cost of leasing is an illustration of the "moral hazard" problem.

D)Agency cost of leasing is an illustration of the "adverse selection" problem.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

15

On January 1,2011,Troy Company entered a lease to rent office space.The lease requires Troy to pay $190,000 per year,at the beginning of each year,for 10 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 30 years,and its current fair value is estimated to be $6 million.Troy's incremental borrowing rate is 9%.

Requirement:

Classify this lease for Troy Company and record the journal entries for the first year of the lease.

Requirement:

Classify this lease for Troy Company and record the journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement is not correct?

A)A finance lease transfers risks and rewards from the lessor to the lessee.

B)The "lessor" is the owner of the asset in a lease arrangement.

C)A lease is a written contract that allows another party to use an owner's property.

D)The "lessee" is the renter of the asset in a lease arrangement.

A)A finance lease transfers risks and rewards from the lessor to the lessee.

B)The "lessor" is the owner of the asset in a lease arrangement.

C)A lease is a written contract that allows another party to use an owner's property.

D)The "lessee" is the renter of the asset in a lease arrangement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

17

Which statement is correct?

A)In a finance lease,the lessee uses the asset for only a short fraction of the asset's useful life.

B)The lessee expenses the cost of the lease in the period the benefits are received in a finance lease.

C)A finance lease transfers the risks and rewards from the lessee to the lessor.

D)In a finance lease,the lessee records an asset for the property being used.

A)In a finance lease,the lessee uses the asset for only a short fraction of the asset's useful life.

B)The lessee expenses the cost of the lease in the period the benefits are received in a finance lease.

C)A finance lease transfers the risks and rewards from the lessee to the lessor.

D)In a finance lease,the lessee records an asset for the property being used.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

18

Which condition would result in an operating lease?

A)Risk of breakage is with the lessee.

B)Reward of high resale value is with the lessor.

C)Risk of change in rental rates is with the lessee.

D)Reward of longer than expected useful life for the leased asset is with the lessee.

A)Risk of breakage is with the lessee.

B)Reward of high resale value is with the lessor.

C)Risk of change in rental rates is with the lessee.

D)Reward of longer than expected useful life for the leased asset is with the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

19

The following are the characteristics of a lease:

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Requirement:

Determine the present value of minimum lease payments (MLP)and the appropriate classification of this lease for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

20

Which is not an indicator to classify the lease as a "finance" lease?

A)Transfer of ownership to the lessee at the end of the lease term.

B)A lease term that is 51% of the of asset's useful life.

C)A lease term that contains a bargain purchase option.

D)Minimum lease payments comprising 90% or more of the asset's fair value.

A)Transfer of ownership to the lessee at the end of the lease term.

B)A lease term that is 51% of the of asset's useful life.

C)A lease term that contains a bargain purchase option.

D)Minimum lease payments comprising 90% or more of the asset's fair value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

21

Which entries are not needed by the lessee for a finance lease?

A)Recording of interest expense.

B)Recording of the lease obligation.

C)Recording of rental expense.

D)Recording of depreciation expense.

A)Recording of interest expense.

B)Recording of the lease obligation.

C)Recording of rental expense.

D)Recording of depreciation expense.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

22

Channel leased equipment to Montage Company on November I,2010.The terms of the lease are as follows:

Montage uses straight-line depreciation for its property,plant,and equipment.

Requirements:

Prepare the journal entries for the lease from November 1 through December 31,2010.

Montage uses straight-line depreciation for its property,plant,and equipment.

Requirements:

Prepare the journal entries for the lease from November 1 through December 31,2010.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

23

What entry is required for the lessor in a operating lease?

A)Gain/loss on asset sale.

B)Loan receivable.

C)Interest income.

D)Depreciation expense.

A)Gain/loss on asset sale.

B)Loan receivable.

C)Interest income.

D)Depreciation expense.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

24

On July 1,2010,Jupiter Company leased equipment to Planet Company.The terms of the lease are as follows:

Planet uses straight-line depreciation for its property,plant,and equipment,and its year -end is December 31.

Requirement:

Prepare the journal entries for the lease from July 1 through December 31,2010.

Planet uses straight-line depreciation for its property,plant,and equipment,and its year -end is December 31.

Requirement:

Prepare the journal entries for the lease from July 1 through December 31,2010.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

25

On January 1,2011,Granite Company entered a lease to rent office space.The lease requires $350,000 per year,at the beginning of each year,for 20 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 30 years,and its current fair value is estimated to be $6 million.The incremental borrowing rate is 5%.

Requirement:

Classify this lease and record the journal entries for the first year of the lease.

Requirement:

Classify this lease and record the journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

26

Chambers leased equipment to Montga Company on November I,2010.The terms of the lease are as follows:

Montga uses straight-line depreciation for its property,plant,and equipment.

Requirements:

a.Prepare the journal entries for the lease from November 1 through December 31,2010.

b.You and the director of finance for Montga Company.You are concerned about the impact the lease will have on your key performance indicator,the total debt to total assets ratio.Discuss the impact the lease will have on this performance indicator.

Montga uses straight-line depreciation for its property,plant,and equipment.

Requirements:

a.Prepare the journal entries for the lease from November 1 through December 31,2010.

b.You and the director of finance for Montga Company.You are concerned about the impact the lease will have on your key performance indicator,the total debt to total assets ratio.Discuss the impact the lease will have on this performance indicator.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

27

Here are the terms of a lease agreement:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

28

When would lessor classify the lease as an operating lease?

A)Lessor retains risk of breakage to leased asset.

B)Lessor has reward of high resale value.

C)Lessor does not have risk of change in demand for the leased asset.

D)Lessor does not have guaranteed residual value.

A)Lessor retains risk of breakage to leased asset.

B)Lessor has reward of high resale value.

C)Lessor does not have risk of change in demand for the leased asset.

D)Lessor does not have guaranteed residual value.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

29

What entry is required for the lessor in a finance lease?

A)Loan receivable.

B)Rental income.

C)Interest expense.

D)Depreciation expense.

A)Loan receivable.

B)Rental income.

C)Interest expense.

D)Depreciation expense.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

30

On July 1,2011,Janus Company leased equipment to Pluto Company.The terms of the lease are as follows:

Pluto uses straight-line depreciation for its property,plant,and equipment,and its year-end is December 31.

Requirement:

Prepare the journal entries for the lease from July 1 through December 31.

Pluto uses straight-line depreciation for its property,plant,and equipment,and its year-end is December 31.

Requirement:

Prepare the journal entries for the lease from July 1 through December 31.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

31

Which entry is needed by the lessee for an operating lease?

A)Recording of interest expense.

B)Recording of the lease obligation.

C)Recording of rental expense.

D)Recording of depreciation expense.

A)Recording of interest expense.

B)Recording of the lease obligation.

C)Recording of rental expense.

D)Recording of depreciation expense.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

32

What is the meaning of "minimum lease payments"?

A)Payments over the lease term including executory costs.

B)Payments over the lease term excluding executory costs.

C)Payments over the lease term until the bargain purchase option is exercised.

D)Payments over the lease term until guaranteed residual value is received.

A)Payments over the lease term including executory costs.

B)Payments over the lease term excluding executory costs.

C)Payments over the lease term until the bargain purchase option is exercised.

D)Payments over the lease term until guaranteed residual value is received.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

33

What is the incremental borrowing rate?

A)The interest rate that the lessor would have to pay on a similar lease or loan.

B)The interest rate that the lessee would have to pay on a similar lease or loan.

C)The risk adjusted interest rate from the cash flow stream expected by the lessor.

D)The risk adjusted interest rate from the cash flow stream expected by the lessee.

A)The interest rate that the lessor would have to pay on a similar lease or loan.

B)The interest rate that the lessee would have to pay on a similar lease or loan.

C)The risk adjusted interest rate from the cash flow stream expected by the lessor.

D)The risk adjusted interest rate from the cash flow stream expected by the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

34

The following are characteristics of a lease:

Requirement

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Requirement

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

35

The following are characteristics of a lease:

Requirement:

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Requirement:

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

36

Which statement is correct about the "guaranteed residual value"?

A)It is assurance that the lessee will take care of the property.

B)It is provided by the lessor.

C)Lessor assumes the risk of the property falling below the guaranteed amount.

D)It is not included in the minimum lease payment calculation.

A)It is assurance that the lessee will take care of the property.

B)It is provided by the lessor.

C)Lessor assumes the risk of the property falling below the guaranteed amount.

D)It is not included in the minimum lease payment calculation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

37

Which statement is correct about the "guaranteed residual value"?

A)It is included in the minimum lease payment calculation.

B)Lessee assumes the risk of the property falling below the guaranteed amount.

C)Lessor assumes the risk of the property falling below the guaranteed amount.

D)It is an executory cost in the lease arrangement.

A)It is included in the minimum lease payment calculation.

B)Lessee assumes the risk of the property falling below the guaranteed amount.

C)Lessor assumes the risk of the property falling below the guaranteed amount.

D)It is an executory cost in the lease arrangement.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

38

Which statement is correct about the bargain purchase option (BPO)?

A)It is cash that the lessee will receive at the end of the lease.

B)It cannot be assumed that the BPO will be exercised.

C)It is excluded in the minimum lease payment calculation.

D)It means that ownership will transfer to the lessee.

A)It is cash that the lessee will receive at the end of the lease.

B)It cannot be assumed that the BPO will be exercised.

C)It is excluded in the minimum lease payment calculation.

D)It means that ownership will transfer to the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

39

On January 1,2011,Brownee Company entered a lease to rent office space.The lease requires $350,000 per year,at the end of each year,for 20 years.The lease is non-cancellable and non-renewable.The building's estimated useful life is 40 years,and its current fair value is estimated to be $6 million.The incremental borrowing rate is 5%.

Requirement:

Classify this lease for and record the journal entries for the first year of the lease.

Requirement:

Classify this lease for and record the journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

40

The following are characteristics of a lease:

Requirement:

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Requirement:

Determine the appropriate classification for this lease for the lessor (who is not the manufacturer)and record the journal entries for the lessor for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

41

Here are the terms of a lease agreement:

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

42

Here are the terms of a lease agreement:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

43

Here are the terms of a lease agreement:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

44

Under IFRS,assuming all information is available,which rate is used by the lessee in the minimum lease calculation?

A)Implicit borrowing rate.

B)Lessee's incremental borrowing rate.

C)Lower of the incremental and implicit rate.

D)Either the incremental or implicit rate.

A)Implicit borrowing rate.

B)Lessee's incremental borrowing rate.

C)Lower of the incremental and implicit rate.

D)Either the incremental or implicit rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

45

Here are the terms of a lease agreement:

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

46

Salisbury Creamery leases its ice cream making equipment from Little Rock Finance Company under the following lease terms:

• The lease term is five years,non-cancellable,and requires equal rental payments of $56,926 due at the beginning of each year starting January 1,2011.

• Upon inception of the lease on January 1,2011,Little Rock purchased the equipment at its fair value of $280,000 and immediately transferred it to Salisbury Creamery.The equipment has an estimated economic life of five years,and a $20,000 residual value that is guaranteed by Salisbury Creamery.

• The lease contains no renewal options,and the equipment reverts to Little Rock Finance Company upon termination of the lease.

• Salisbury's incremental borrowing rate is 4%; the rate implicit in the lease is also 4%.

• Salisbury depreciates similar equipment that it owns on a straight-line basis.

• Both companies have December 31 year-ends.

Requirements:

a.Evaluate how the lessee should account for the lease transaction.

b.Evaluate how the lessor should account for the lease transaction.

c.Prepare the lessee's amortization schedule for this lease.

d.Prepare the journal entries on January 1,2011 for both parties.

e.Prepare the journal entries on December 31,2011 and January 1,2012 for both parties.

• The lease term is five years,non-cancellable,and requires equal rental payments of $56,926 due at the beginning of each year starting January 1,2011.

• Upon inception of the lease on January 1,2011,Little Rock purchased the equipment at its fair value of $280,000 and immediately transferred it to Salisbury Creamery.The equipment has an estimated economic life of five years,and a $20,000 residual value that is guaranteed by Salisbury Creamery.

• The lease contains no renewal options,and the equipment reverts to Little Rock Finance Company upon termination of the lease.

• Salisbury's incremental borrowing rate is 4%; the rate implicit in the lease is also 4%.

• Salisbury depreciates similar equipment that it owns on a straight-line basis.

• Both companies have December 31 year-ends.

Requirements:

a.Evaluate how the lessee should account for the lease transaction.

b.Evaluate how the lessor should account for the lease transaction.

c.Prepare the lessee's amortization schedule for this lease.

d.Prepare the journal entries on January 1,2011 for both parties.

e.Prepare the journal entries on December 31,2011 and January 1,2012 for both parties.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

47

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

48

Zarlon Leasing Company agrees on January 1,2012 to rent Killington Winery the equipment that Killington requires to expand its production capacity to meet customers' demands for its products.The lease agreement calls for five annual lease payments of $11 0,000 at the end of each year.Killington has identified this as a finance lease.Furthermore,the company has determined that the present value of the lease payments,discounted at 4%,is $489,700.The leased equipment has an estimated useful life of five years and no residual value.Killington uses the straight-line method for depreciating similar equipment that it owns.

Requirements:

a.Prepare a lease amortization schedule for this lease.

b.Prepare the necessary journal entries for the first year of the lease.

Requirements:

a.Prepare a lease amortization schedule for this lease.

b.Prepare the necessary journal entries for the first year of the lease.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

49

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

50

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or finance.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

51

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or capital lease using the quantitative guidelines in ASPE.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or capital lease using the quantitative guidelines in ASPE.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

52

Here are the terms of a lease agreement:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

53

What is the implicit rate?

A)The interest rate that the lessor would have to pay on a similar lease or loan.

B)The interest rate that the lessee would have to pay on a similar lease or loan.

C)The risk adjusted interest rate from the cash flow stream expected by the lessor.

D)The risk adjusted interest rate from the cash flow stream expected by the lessee.

A)The interest rate that the lessor would have to pay on a similar lease or loan.

B)The interest rate that the lessee would have to pay on a similar lease or loan.

C)The risk adjusted interest rate from the cash flow stream expected by the lessor.

D)The risk adjusted interest rate from the cash flow stream expected by the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is correct for the lessee?

A)Using the higher of the incremental or implicit rate maximizes the minimum lease payment calculation.

B)Using the lower of the incremental or implicit rate maximizes the minimum lease payment calculation.

C)Using the incremental rate maximizes the minimum lease payment calculation.

D)Using the implicit rate maximizes the minimum lease payment calculation.

A)Using the higher of the incremental or implicit rate maximizes the minimum lease payment calculation.

B)Using the lower of the incremental or implicit rate maximizes the minimum lease payment calculation.

C)Using the incremental rate maximizes the minimum lease payment calculation.

D)Using the implicit rate maximizes the minimum lease payment calculation.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

55

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or capital lease using the quantitative guidelines in ASPE.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

c.Compute the present value of minimum lease payments for the lessor.

d.Evaluate whether the lessee should classify the lease as operating or capital lease using the quantitative guidelines in ASPE.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

56

Here are the terms of a lease agreement:

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

57

Which statement is correct for the lessee?

A)If the minimum lease payments exceed fair value of the leased asset,the asset will be recorded on the balance sheet at the higher amount.

B)If the minimum lease payments exceed fair value of the leased asset,the asset will be recorded on the balance sheet at the fair value amount.

C)If the minimum lease payments are lower that the fair value of the leased asset,the asset will be recorded on the balance sheet at the unguaranteed residual value amount.

D)If the minimum lease payments are lower that the fair value of the leased asset,the implicit rate must be used.

A)If the minimum lease payments exceed fair value of the leased asset,the asset will be recorded on the balance sheet at the higher amount.

B)If the minimum lease payments exceed fair value of the leased asset,the asset will be recorded on the balance sheet at the fair value amount.

C)If the minimum lease payments are lower that the fair value of the leased asset,the asset will be recorded on the balance sheet at the unguaranteed residual value amount.

D)If the minimum lease payments are lower that the fair value of the leased asset,the implicit rate must be used.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

58

The following are some of the characteristics of an asset available for lease:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

59

Here are the terms of a lease agreement:

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Requirements:

a.Determine the amount of lease payment that the lessor would require to lease the asset.

b.Compute the present value of minimum lease payments for the lessee.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

60

Here are the terms of a lease agreement:

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Requirement:

Determine the amount of lease payment that the lessor would require to lease the asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

61

For the following lease,determine the minimum lease payments for the lessee.

A)92,431

B)97,516

C)99,237

D)104,989

A)92,431

B)97,516

C)99,237

D)104,989

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

62

Under ASPE,assuming all information is available,which rate is used by the lessee in the minimum lease calculation?

A)Implicit borrowing rate.

B)Lessee's incremental borrowing rate.

C)Lower of the incremental and implicit rate.

D)Either the incremental or implicit rate.

A)Implicit borrowing rate.

B)Lessee's incremental borrowing rate.

C)Lower of the incremental and implicit rate.

D)Either the incremental or implicit rate.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

63

Assume that Speery agrees to lease a new machine from LEERY on January 1,2011,for $30,000 per year,paid in advance (i.e.,at the beginning of the year).The lease term is 10 years and the asset's useful life is 8 years.There is no bargain purchase option.The unguaranteed residual value is $10,000.Which statement is correct?

A)The unguaranteed residual will be recorded on Speery's balance sheet.

B)The lease is an operating lease.

C)The lease is a finance lease.

D)More information is needed to determine the accounting treatment.

A)The unguaranteed residual will be recorded on Speery's balance sheet.

B)The lease is an operating lease.

C)The lease is a finance lease.

D)More information is needed to determine the accounting treatment.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

64

For the following lease,determine the minimum lease payments for the lessor.

A)91,832

B)102,711

C)105,444

D)108,846

A)91,832

B)102,711

C)105,444

D)108,846

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

65

For the following lease,determine the minimum lease payments for the lessee.

A)64,443

B)67,876

C)83,397

D)87,840

A)64,443

B)67,876

C)83,397

D)87,840

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

66

For the following lease,determine the minimum lease payments for the lessee.

A)87,582

B)93,792

C)100,001

D)106,210

A)87,582

B)93,792

C)100,001

D)106,210

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

67

For the following lease,determine the minimum lease payments for the lessor.

A)81,310

B)85,572

C)118,269

D)124,469

A)81,310

B)85,572

C)118,269

D)124,469

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

68

For the following lease,determine the minimum lease payments for the lessee.

A)86,502

B)91,243

C)95,816

D)101,451

A)86,502

B)91,243

C)95,816

D)101,451

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

69

Assume that Souse agrees to lease a new machine from LAIRD on January 1,2011,for $40,000 per year,paid in advance (i.e.,at the beginning of the year).Executory costs are $1,000.The lease term is 11 years and the asset's useful life is 10 years.There is no bargain purchase option.The guaranteed residual value is $10,000.Which statement is correct?

A)The executor costs will be included in the minimum lease payments.

B)The guaranteed residual will be excluded in the minimum lease payments.

C)This is an operating lease because there is no bargain purchase option.

D)This is a finance lease since the lease term is for most of the economic life of the asset.

A)The executor costs will be included in the minimum lease payments.

B)The guaranteed residual will be excluded in the minimum lease payments.

C)This is an operating lease because there is no bargain purchase option.

D)This is a finance lease since the lease term is for most of the economic life of the asset.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

70

What entry is needed by the lessor for a finance lease?

A)Obligation for lease.

B)Interest expense.

C)Depreciation expense.

D)Lease receivable.

A)Obligation for lease.

B)Interest expense.

C)Depreciation expense.

D)Lease receivable.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

71

For the following lease,determine the minimum lease payments for the lessee.

A)83,400

B)92,711

C)98,048

D)102,304

A)83,400

B)92,711

C)98,048

D)102,304

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

72

For the following lease,determine the minimum lease payments for the lessor.

A)83,400

B)92,711

C)98,048

D)102,304

A)83,400

B)92,711

C)98,048

D)102,304

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

73

For the following lease,determine the minimum lease payments for the lessor.

A)113,723

B)119,781

C)131,109

D)138,838

A)113,723

B)119,781

C)131,109

D)138,838

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

74

For the following lease,determine the minimum lease payments for the lessee.

A)99,053

B)100,001

C)105,859

D)106,210

A)99,053

B)100,001

C)105,859

D)106,210

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

75

For the following lease,determine the minimum lease payments for the lessee.

A)91,832

B)102,711

C)105,444

D)108,847

A)91,832

B)102,711

C)105,444

D)108,847

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

76

Which statement is correct?

A)Lessees prefer finance leases.

B)Lessees prefer operating leases.

C)Operating leases are more favourable to the lessor in the short term.

D)Finance leases are more favourable to the lessee in the short term.

A)Lessees prefer finance leases.

B)Lessees prefer operating leases.

C)Operating leases are more favourable to the lessor in the short term.

D)Finance leases are more favourable to the lessee in the short term.

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

77

For the following lease,determine the minimum lease payments for the lessee.

A)94,305

B)96,884

C)102,505

D)105,309

A)94,305

B)96,884

C)102,505

D)105,309

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

78

For the following lease,determine the minimum lease payments for the lessee.

A)113,723

B)119,781

C)131,109

D)138,838

A)113,723

B)119,781

C)131,109

D)138,838

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

79

For the following lease,determine the minimum lease payments for the lessor.

A)67,548

B)71,279

C)86,502

D)91,243

A)67,548

B)71,279

C)86,502

D)91,243

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck

80

For the following lease,determine the minimum lease payments for the lessor.

A)86,502

B)91,243

C)95,816

D)101,451

A)86,502

B)91,243

C)95,816

D)101,451

Unlock Deck

Unlock for access to all 95 flashcards in this deck.

Unlock Deck

k this deck