Deck 7: Pensions and Other Employee Future Benefits

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/96

Play

Full screen (f)

Deck 7: Pensions and Other Employee Future Benefits

1

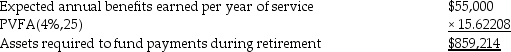

Sally is currently 30 years old and is planning for her retirement. She would like to have an income of $55,000 per year during her retirement,which she anticipates will last for another 25 years. Assume that she receives the retirement income at the end of each of the 25 years.

Required:

Determine the amount of money Sally will need to have accumulated by the time she starts her retirement. Assume a discount rate of 4%.

Required:

Determine the amount of money Sally will need to have accumulated by the time she starts her retirement. Assume a discount rate of 4%.

Using BAII Plus financial calculator: 25N,4 I/Y,55000 PMT,CPT PV

Using BAII Plus financial calculator: 25N,4 I/Y,55000 PMT,CPT PV 2

Which statement about "defined contribution plans" is not correct?

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost may be capitalized to the cost of inventory.

D)Pension cost may be capitalized to the construction cost of property,plant and equipment.

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost may be capitalized to the cost of inventory.

D)Pension cost may be capitalized to the construction cost of property,plant and equipment.

B

3

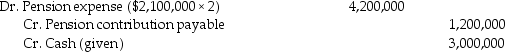

Tener Company sponsors a defined contribution pension plan for its employees. The plan specifies that the company will contribute $2 for every dollar that an employee contributes to the plan. Employees are eligible to contribute up to 7% of their salary to the pension plan. During 2012,employees covered by the pension plan earned salaries totalling $42 million. Employee contributions to the pension totalled $2.1 million. Tener contributed $3 million to the plan during the year.

Requirement:

Provide the summary journal entry for Tener's pension plan for 2012.

Requirement:

Provide the summary journal entry for Tener's pension plan for 2012.

4

Wags Inc Company sponsors a defined contribution pension plan for its employees. The plan specifies that the company will match the amount each employee contributes to the plan. Employees are eligible to contribute up to 4% of their salary to the pension plan. During 2012,employees covered by the pension plan earned salaries totalling $30 million. Employee contributions to the pension totalled $3 million. Wags Inc contributed $2 million to the plan during the year.

Requirement:

Provide the summary journal entry for Wags Inc's pension plan for 2012.

Requirement:

Provide the summary journal entry for Wags Inc's pension plan for 2012.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

5

Saul is currently 30 years old and he plans to retire early,in 20 years' time. He would like to have an income of $60,000 per year during his retirement,which he anticipates will last for another 40 years. Assume that he receives the retirement income at the end of each of the 40 years.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

6

KitKat Singh is currently 30 years old and he plans to retire early,in 25 years' time. He would like to have an income of $50,000 per year during his retirement,which he anticipates will last for another 30 years. Assume that he receives the retirement income at the end of each of the 30 years.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money he will need to have accumulated by the time he starts his retirement. Assume a discount rate of 5%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

7

A pension plan promises to pay $75,000 at the end of each year of the retirement period.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 9% and a retirement period of 30 years; or

b. discount rate of 9% and a retirement period of 40 years.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 9% and a retirement period of 30 years; or

b. discount rate of 9% and a retirement period of 40 years.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

8

Katherina is currently 30 years old and plans to retire later in life. She would like to have an income of $35,000 per year during her retirement,which she anticipates will last for another 25 years. Assume that she receives the retirement income at the end of each of the 25 years.

Required:

Determine the amount of money Katherina will need to have accumulated by the time she starts her retirement. Assume a discount rate of 5%.

Required:

Determine the amount of money Katherina will need to have accumulated by the time she starts her retirement. Assume a discount rate of 5%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

9

What is the pension expense for the following plan? "The plan requires the company to contribute $500 for each of its 1,000 employees. The plan hopes to accumulate enough funds so that retirees receive $20,000 in the future; the company has no obligation to guarantee the investment returns."

A)$500

B)$20,000

C)$500,000

D)$20,000,000

A)$500

B)$20,000

C)$500,000

D)$20,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

10

Heidi Jackson has a twin brother,Phil,who works for the Government of Alberta. Phil is covered by a defined benefit pension plan. Phil just turned 45 years old,and expects to retire at age 65. At that time,the pension plan will pay Phil annual pension payments equal to 2% of his final year's salary for each year of services rendered. The pension payments will continue until Phil's death,which actuaries expect to be when he turns 95 years old. For the current year,Phil will earn $55,000,and this rate is expected to increase by 5% per year. Assume that the Alberta Government uses a 10% interest rate for its pension obligations.

Requirement:

Determine the current service cost for Phil Jackson's pension for the past year (the year just before he turned 45).

Requirement:

Determine the current service cost for Phil Jackson's pension for the past year (the year just before he turned 45).

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following best describes a "defined benefit plan"?

A)High returns in the pension plan result in higher benefit payments to the employees in the future.

B)A pension plan that specifies how much funds the employee needs to contribute.

C)A plan that requires the employer to contribute $10 per hour worked by an employee.

D)A plan that specifies how much in pension payments employees will receive in their retirement.

A)High returns in the pension plan result in higher benefit payments to the employees in the future.

B)A pension plan that specifies how much funds the employee needs to contribute.

C)A plan that requires the employer to contribute $10 per hour worked by an employee.

D)A plan that specifies how much in pension payments employees will receive in their retirement.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

12

A pension plan promises to pay $70,000 at the end of each year for 10 years of the retirement period.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 12%; or

b. discount rate of 9%.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 12%; or

b. discount rate of 9%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

13

Peter is currently 30 years old and he plans to retire early,in 20 years' time. He would like to have an income of $50,000 per year during his retirement,which he anticipates will last for another 40 years. Assume that Peter receives the retirement income at the end of each of the 40 years.

Required:

Determine the amount of money Peter will need to have accumulated by the time he starts his retirement. Assume a discount rate of 9%.

Required:

Determine the amount of money Peter will need to have accumulated by the time he starts his retirement. Assume a discount rate of 9%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

14

Orion Steel provides a defined benefit pension plan for its employees. One of its employees,Gail Camden,who just turned 45 years old,expects to retire at age 70. At that time,the pension plan will pay Gail annual pension payments equal to 5% of her final year's salary for each year of services rendered by Gail. The pension payments will continue until Gail's death,which actuaries expect to be when she turns 95 years old. Gail is currently earning $35,000 per year,and this rate is not expected to increase due to the poor state of the steel industry. Orion Steel uses an 8 % interest rate for its pension obligations.

Requirement:

Determine the current service cost for Gail Camden's pension for the past year (the year just before she turned 45).

Requirement:

Determine the current service cost for Gail Camden's pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

15

Othello Steel provides a defined benefit pension plan for its employees. One of its employees,Ginger Philips,who just turned 45 years old,expects to retire at age 70. At that time,the pension plan will pay Ginger annual pension payments equal to 10% of her final year's salary for each year of services rendered by Gail. The pension payments will continue until Gail's death,which actuaries expect to be when she turns 95 years old. Ginger is currently earning $75,000 per year,and this rate is not expected to increase due to the poor state of the steel industry. Orion Steel uses a 6 % interest rate for its pension obligations.

Requirement:

Determine the current service cost for Ginger Philips's pension for the past year (the year just before she turned 45).

Requirement:

Determine the current service cost for Ginger Philips's pension for the past year (the year just before she turned 45).

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

16

Which statement explains the risk involved in "defined contribution plans"?

A)Poor returns on the pension investments reduce the benefits for future retirees.

B)High returns on the pension investments increase the benefit payments for the employer.

C)The plan specifies the fixed benefits that future retirees will receive.

D)The plan provides benefits to future retirees depending on their years of service.

A)Poor returns on the pension investments reduce the benefits for future retirees.

B)High returns on the pension investments increase the benefit payments for the employer.

C)The plan specifies the fixed benefits that future retirees will receive.

D)The plan provides benefits to future retirees depending on their years of service.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

17

Which statement explains the risk involved in "defined benefit plans"?

A)The plan places investment risk on employees since the future benefits are pre-specified.

B)The plan sponsor never needs to increase its contributions to the pension trust.

C)The plan may require the employee to pay $200 per month for each year of service.

D)The plan specifies the eventual outflows from the pension trust to future retirees.

A)The plan places investment risk on employees since the future benefits are pre-specified.

B)The plan sponsor never needs to increase its contributions to the pension trust.

C)The plan may require the employee to pay $200 per month for each year of service.

D)The plan specifies the eventual outflows from the pension trust to future retirees.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following best describes a "defined contribution plan"?

A)A pension plan where the employer can reduce its contributions if it is overfunded.

B)A pension plan that place investment risk on the employees.

C)A pension plan that place investment risk on the employers.

D)A pension plan where the employee can decrease its contributions if it is overfunded.

A)A pension plan where the employer can reduce its contributions if it is overfunded.

B)A pension plan that place investment risk on the employees.

C)A pension plan that place investment risk on the employers.

D)A pension plan where the employee can decrease its contributions if it is overfunded.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

19

A pension plan promises to pay $75,000 at the end of each year for 25 years of the retirement period.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 5%; or

b. discount rate of 4%.

Requirements:

Compute the funds required to fund this pension plan at the start of the retirement period assuming:

a. discount rate of 5%; or

b. discount rate of 4%.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

20

If a pension plan is non-contributory,who makes the contributions?

A)Both the employer and employee.

B)Only the employee.

C)Only the employer.

D)No one.

A)Both the employer and employee.

B)Only the employee.

C)Only the employer.

D)No one.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

21

Which statement about "defined contribution plans" is correct?

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost cannot be capitalized to the cost of inventory.

D)Pension cost may not be capitalized to the construction cost of property,plant and equipment.

A)Pension expense equals the contributions made based on the plan formula.

B)Pension expense equals the present value of the future benefits to be paid to the retiree.

C)Pension cost cannot be capitalized to the cost of inventory.

D)Pension cost may not be capitalized to the construction cost of property,plant and equipment.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

22

Dunder Mae Products has a defined contribution pension plan for its employees. The plan requires the company to contribute 8% of these employees' salaries to the pension. In 2013,total salary for employees covered by the pension plan totalled $70 million,of which 85% is attributable to employees involved in manufacturing while the remaining 15% of salaries relate to administrative staff. The company contributed $3 million to the pension during the year.

Requirement:

Provide the summary journal entry for Dunder Mae's pension plan for 2013.

Requirement:

Provide the summary journal entry for Dunder Mae's pension plan for 2013.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following component does NOT relate to the assets/liabilities held in the pension trust for a defined benefit plan?

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of actuarial gains and losses.

D)Amortization of past service cost.

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of actuarial gains and losses.

D)Amortization of past service cost.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following component refers to the services provided by the employees in the current period in a defined benefit plan?

A)Current service cost.

B)Interest cost on pension obligations.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

A)Current service cost.

B)Interest cost on pension obligations.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following component does NOT relate to the assets/liabilities held in the pension trust for a defined benefit plan?

A)Interest cost on pension obligations.

B)Current service cost.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

A)Interest cost on pension obligations.

B)Current service cost.

C)Income from plan assets.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

26

What is the pension expense for the following plan? "The company must contribute $100/year for each of its 500 employees. The plan hopes to accumulate enough funds so that retirees receive $10,000 in the future; the plan does not guarantee the investment returns to the employees."

A)$100

B)$10,000

C)$50,000

D)$5,000,000

A)$100

B)$10,000

C)$50,000

D)$5,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

27

Which statement best explains the meaning of "current service cost"?

A)The present value of pension benefits that employees have earned.

B)The increase in the present value of obligations from services rendered in the current period.

C)The amount of funds deposited with the pension trust in the year.

D)The annual contribution required by the employer as specified in the pension plan agreement.

A)The present value of pension benefits that employees have earned.

B)The increase in the present value of obligations from services rendered in the current period.

C)The amount of funds deposited with the pension trust in the year.

D)The annual contribution required by the employer as specified in the pension plan agreement.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

28

What is the pension expense for the following plan after 10 years? "The company must contribute $100/year for each of its 500 employees. The plan hopes to accumulate enough funds so that retirees receive $10,000 in the future; the plan does not guarantee the investment returns to the employees."

A)$1,000

B)$100,000

C)$500,000

D)$5,000,000

A)$1,000

B)$100,000

C)$500,000

D)$5,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following component refers to the benefits earned by employees in a defined benefit plan?

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of past service cost.

D)Amortization of actuarial gains and losses.

A)Interest cost on pension obligations.

B)Income from plan assets.

C)Amortization of past service cost.

D)Amortization of actuarial gains and losses.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

30

What are actuarial losses or gains in a defined benefit plan?

A)Difference arising between the actual and the expected value of plan contributions.

B)Expected income earned on the pension plan assets.

C)Plan amendments that retrospectively improve pension plan benefits.

D)Differences arising between the actual and expected values of the obligation.

A)Difference arising between the actual and the expected value of plan contributions.

B)Expected income earned on the pension plan assets.

C)Plan amendments that retrospectively improve pension plan benefits.

D)Differences arising between the actual and expected values of the obligation.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

31

What are the components of the pension expense in a defined benefit plan? Briefly explain the meaning of each component.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

32

What is the total pension expense for the following plan after 5 years? "The plan requires the company to contribute $500 for each of its 1,000 employees. The plan hopes to accumulate enough funds so that retirees receive $20,000 in the future; the company has no obligation to guarantee the investment returns."

A)$2,500

B)$100,000

C)$2,500,000

D)$20,000,000

A)$2,500

B)$100,000

C)$2,500,000

D)$20,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

33

In pension accounting,how are past service costs accounted for under ASPE?

A)Recognized in the balance sheet as a liability for the full amount.

B)Recognized in the income statement as an expense for the full amount.

C)Not recognized,but disclosed in a note.

D)Amortized over a specified period and included as part of pension expense.

A)Recognized in the balance sheet as a liability for the full amount.

B)Recognized in the income statement as an expense for the full amount.

C)Not recognized,but disclosed in a note.

D)Amortized over a specified period and included as part of pension expense.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

34

Gander Products has a defined contribution pension plan for its employees. The plan requires the company to contribute 6% of these employees' salaries to the pension. In 2013,total salary for employees covered by the pension plan totalled $40 million,of which 75% is attributable to employees involved in manufacturing while the remaining 25% of salaries relate to administrative staff. The company contributed $500,000 to the pension during the year.

Requirement:

Provide the summary journal entry for Gander's pension plan for 2013.

Requirement:

Provide the summary journal entry for Gander's pension plan for 2013.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

35

A company reported $430,000 of pension expense in its income statement. The balance sheet showed that the pension liability increased by $29,000 over the year.

Requirement:

How much cash was paid to the pension trustee during the period?

Requirement:

How much cash was paid to the pension trustee during the period?

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

36

A company reported $350,000 of pension expense in its income statement. The balance sheet showed that the pension liability increased by $20,000 over the year. The company was hoping to contribute $30,000. How much cash was paid to the pension trustee during the period?

A)$320,000

B)$330,000

C)$350,000

D)$370,000

A)$320,000

B)$330,000

C)$350,000

D)$370,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

37

Explain the accounting for defined contribution plans and also discuss why it is straight-forward.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

38

Discuss why accounting for "defined benefit plans" is so complex and the types of estimates required.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

39

Which is not a component of pension expense under IFRS?

A)Employer contributions.

B)Investment income from plan assets.

C)Amortization of actuarial losses.

D)Amortization of past service costs.

A)Employer contributions.

B)Investment income from plan assets.

C)Amortization of actuarial losses.

D)Amortization of past service costs.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

40

What are actuarial losses or gains in a defined benefit plan?

A)Plan amendments that retrospectively improve pension plan benefits.

B)Expected income earned on the pension plan assets.

C)Difference arising between the actual and the expected value of plan assets.

D)Differences arising between the actual and expected values of the pension contributions.

A)Plan amendments that retrospectively improve pension plan benefits.

B)Expected income earned on the pension plan assets.

C)Difference arising between the actual and the expected value of plan assets.

D)Differences arising between the actual and expected values of the pension contributions.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

41

A company has a defined benefit pension asset of $1,050,000 at the beginning of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

42

A company has a defined benefit pension liability of $750,000 at the beginning of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

43

A company has a defined benefit pension asset of $750,000 at the beginning of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

44

A company has a defined benefit pension liability of $3,750,000 at the end of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Requirement:

Determine the value of the defined benefit pension liability at the beginning of the year.

Requirement:

Determine the value of the defined benefit pension liability at the beginning of the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

45

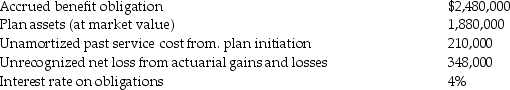

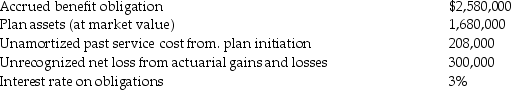

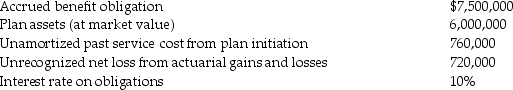

Axel Corporation has a defined benefit pension plan. At January 1,2012,the following balances exist:

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Prepare the journal entry to record pension expense for 2012.

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2012,the current service cost as determined by an appropriate actuarial cost method was $265,000. A change in actuarial assumptions created a gain of $16,000 in 2012. The expected return on plan assets was $65,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2012 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 20 years. Axel paid $220,700 to the pension trustee in December 2012. The company recognizes only the minimum amount of corridor amortization.Requirement:

Prepare the journal entry to record pension expense for 2012.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

46

At the beginning of the current year,a pension has assets of $84,500,000 and accrued benefit obligation of $87,500,000. At this time,unamortized actuarial losses were $6,750,000 on plan assets and $2,800,000 on plan obligations. The expected average remaining service lives (EARSL)of current employees is 10 years.

Requirement:

Compute the minimum corridor amortization.

Requirement:

Compute the minimum corridor amortization.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

47

A company reported $430,000 of pension expense in its income statement. The balance sheet showed that the pension asset increased by $29,000 over the year.

Requirement:

How much cash was paid to the pension trustee during the period?

Requirement:

How much cash was paid to the pension trustee during the period?

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

48

What are past service costs in a defined benefit plan?

A)Plan amendments that retrospectively improve pension plan benefits.

B)Difference arising between the actual and the expected value of plan assets.

C)Expected interest,dividend or income earned on the pension plan assets.

D)Differences arising between the actual and expected values of the pension obligations.

A)Plan amendments that retrospectively improve pension plan benefits.

B)Difference arising between the actual and the expected value of plan assets.

C)Expected interest,dividend or income earned on the pension plan assets.

D)Differences arising between the actual and expected values of the pension obligations.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

49

A company's defined benefit pension plan incurs current service cost of $8,000,000. Expected income on the pension plan's assets amounted to $7,800,000,while actual income was $9,900,000. The interest on the pension obligation was $9,000,000,which matched the actuarial estimates. The pension plan has no past service costs,and unamortized actuarial gains or losses at the beginning of the year are within the corridor limit.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

50

Current service cost for a defined benefit pension plan amounted to $8,800,000. This pension plan's assets generated $6,500,000 of income,which exceeded expectations by $500,000. Pension obligations incurred interest cost of $5,000,000,which were above expectations by $280,000. Amortizations during the year included $600,000 for past service cost and $67,000 of corridor amortization relating to actuarial gains.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

51

At the beginning of the current year,a pension has assets of $74,500,000 and accrued benefit obligation of $77,500,000. At this time,unamortized actuarial gains were $750,000 on plan assets and $800,000 on plan obligations. The expected average remaining service lives (EARSL)of current employees is 25 years.

Requirement:

Compute the minimum corridor amortization.

Requirement:

Compute the minimum corridor amortization.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

52

A company has a defined benefit pension liability of $1,650,000 at the end of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Requirement:

Determine the value of the defined benefit pension liability at beginning of the year.

Requirement:

Determine the value of the defined benefit pension liability at beginning of the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

53

At the beginning of the current year,a pension has assets of $74,500,000 and accrued benefit obligation of $77,500,000. At this time,unamortized actuarial losses were $6,750,000 on plan assets and $2,800,000 on plan obligations. The expected average remaining service lives (EARSL)of current employees is 18 years.

Requirement:

Compute the minimum corridor amortization.

Requirement:

Compute the minimum corridor amortization.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

54

A company's defined benefit pension plan incurs current service cost of $3,700,000. Expected income on the pension plan's assets amounted to $9,100,000,while actual income was $9,900,000. The interest on the pension obligation was $8,300,000,which matched the actuarial estimates. The pension plan has no past service costs,and unamortized actuarial gains or losses at the beginning of the year are within the corridor limit.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

55

Current service cost for a defined benefit pension plan amounted to $7,800,000. This pension plan's assets generated $6,500,000 of income,which exceeded expectations by $550,000. Pension obligations incurred interest cost of $5,500,000,which were above expectations by $280,000. Amortizations during the year included $400,000 for past service cost and $57,000 of corridor amortization relating to actuarial gains.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

56

Current service cost for a defined benefit pension plan amounted to $7,800,000. This pension plan's assets generated $6,500,000 of income,which exceeded expectations by $570,000. Pension obligations incurred interest cost of $5,000,000,which were above expectations by $280,000. Amortizations during the year included $400,000 for past service cost and $57,000 of corridor amortization relating to actuarial gains.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

57

A company has a defined benefit pension asset of $1,050,000 at the end of the year. The company contributes $2,500,000 to the pension during the year and records a pension expense of $2,200,000.

Requirement:

Determine the value of the defined benefit pension liability at the beginning of the year.

Requirement:

Determine the value of the defined benefit pension liability at the beginning of the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

58

A company's defined benefit pension plan incurs current service cost of $3,000,000. Expected income on the pension plan's assets amounted to $9,800,000,while actual income was $9,900,000. The interest on the pension obligation was $10,000,000,which matched the actuarial estimates. The pension plan has no past service costs,and unamortized actuarial gains or losses at the beginning of the year are within the corridor limit.

Requirement:

Compute the amount of pension expense for the year.

Requirement:

Compute the amount of pension expense for the year.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

59

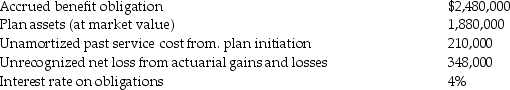

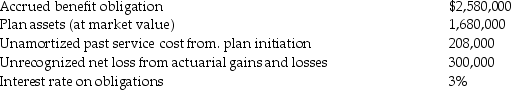

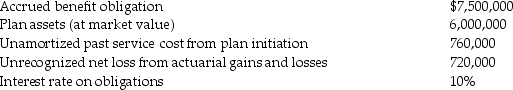

AMA Corporation has a defined benefit pension plan. At January 1,2010,the following balances exist:

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Prepare the journal entry to record pension expense for 2010.

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

For the year ended December 31,2010,the current service cost as determined by an appropriate actuarial cost method was $280,000. A change in actuarial assumptions created a gain of$16,000 in 2010. The expected return on plan assets was $67,200; however,the actual return is $63,700. The expected period of full eligibility at January 1,2010 (i.e.,the vesting period)is 8 years,while the expected average remaining service life is 28 years. AMA paid $227,700 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.Requirement:

Prepare the journal entry to record pension expense for 2010.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

60

A company has a defined benefit pension liability of $1,050,000 at the beginning of the year. The company contributes $5,500,000 to the pension during the year and records a pension expense of $8,200,000.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Requirement:

Determine the value of the defined benefit pension liability at year-end.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

61

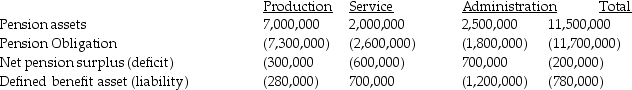

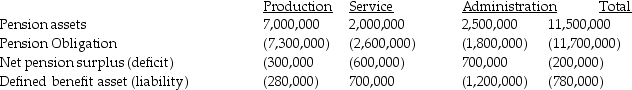

Reagan Air Conditioning Company has three pension plans for three groups of employees: production,service,and administration. Information for the three plans is as follows:

Requirement

Requirement

Provide an excerpt of Reagan's balance sheet showing the presentation of its pension plans.

Requirement

RequirementProvide an excerpt of Reagan's balance sheet showing the presentation of its pension plans.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

62

What amount is included in the pension reconciliation for the income statement?

A)Fair value of plan assets.

B)Unamortized actuarial gains.

C)Benefit paid.

D)Contributions paid.

A)Fair value of plan assets.

B)Unamortized actuarial gains.

C)Benefit paid.

D)Contributions paid.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

63

What is an actuarial loss?

A)An unfavourable difference between actual and expected amounts for pension assets.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension obligations.

A)An unfavourable difference between actual and expected amounts for pension assets.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension obligations.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

64

Which statement is not correct?

A)If an enterprise has a pension plan with a defined benefit liability and another plan with a defined benefit asset,the two amounts would be shown net in the balance sheet.

B)If an enterprise has a pension plan with a defined benefit liability and another plan with a defined benefit asset,the two amounts would be shown separately in the balance sheet.

C)Two plans that both have net liability positions can be combined.

D)Two plans that both have net asset positions can be combined.

A)If an enterprise has a pension plan with a defined benefit liability and another plan with a defined benefit asset,the two amounts would be shown net in the balance sheet.

B)If an enterprise has a pension plan with a defined benefit liability and another plan with a defined benefit asset,the two amounts would be shown separately in the balance sheet.

C)Two plans that both have net liability positions can be combined.

D)Two plans that both have net asset positions can be combined.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

65

Masons' balance sheet shows a defined benefit asset of $740,000. Records show that there are $89,000 of past service costs and $610,000 of actuarial losses that remain unamortized.

Requirement:

Using the pension reconciliation required in the company's note disclosures,determine the pension plan's surplus or deficit.

Requirement:

Using the pension reconciliation required in the company's note disclosures,determine the pension plan's surplus or deficit.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

66

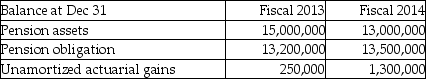

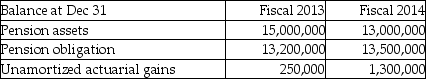

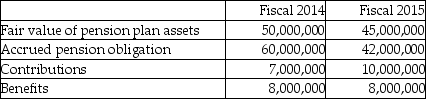

What is the corridor limit for fiscal 2013?

A)$250,000

B)$1,250,000

C)$1,320,000

D)$1,500,000

A)$250,000

B)$1,250,000

C)$1,320,000

D)$1,500,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

67

Bram Masons' balance sheet shows a defined benefit liability of $740,000. Records show that there are $89,000 of past service costs and $610,000 of actuarial gains that remain unamortized.

Requirement:

Using the pension reconciliation required in Bram's note disclosures,determine the pension plan's surplus or deficit.

Requirement:

Using the pension reconciliation required in Bram's note disclosures,determine the pension plan's surplus or deficit.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

68

Feldman has a defined benefit pension plan. The company's balance sheet shows a defined benefit asset of $770,000 at year-end. The company's records show that the company had amended the pension plan two years ago,giving rise to $600,000 of additional benefits to employees. These additional benefits vest 10 years after the plan amendment. The balance of unamortized actuarial losses at year-end is $340,000. The pension plan has $35,000,000 of assets at market value.

Requirement:

Determine the value of the accrued benefit obligation for Feldman's pension plan.

Requirement:

Determine the value of the accrued benefit obligation for Feldman's pension plan.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

69

What amount is included in the pension reconciliation for the balance sheet?

A)Current service cost.

B)Unamortized actuarial gains.

C)Benefit paid.

D)Contributions paid.

A)Current service cost.

B)Unamortized actuarial gains.

C)Benefit paid.

D)Contributions paid.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

70

Feldman has a defined benefit pension plan. The company's balance sheet shows a defined benefit liability of $770,000 at year-end. The company's records show that the company had amended the pension plan two years ago,giving rise to $600,000 of additional benefits to employees. These additional benefits vest 10 years after the plan amendment. The balance of unamortized actuarial gains at year-end is $340,000. The pension plan has $35,000,000 of assets at market value.

Requirement:

Determine the value of the accrued benefit obligation for Feldman's pension plan.

Requirement:

Determine the value of the accrued benefit obligation for Feldman's pension plan.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

71

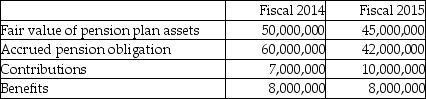

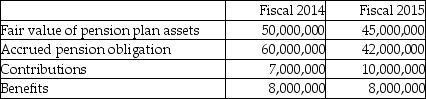

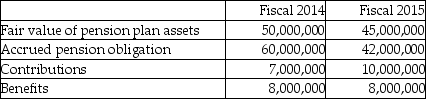

What amount will be presented on the balance sheet for fiscal 2014?

A)$5,000,000 surplus

B)$5,000,000 deficit

C)$7,000,000

D)$60,000,000

A)$5,000,000 surplus

B)$5,000,000 deficit

C)$7,000,000

D)$60,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

72

Humming Furnishings produces quality household furniture. The company has only one defined benefit pension plan,which covers its 30 carpenters. The company has completed its accounting for the year and closed its books. The draft financial statements show a defined benefit liability of $90,000. Your review of the company's records shows that the pension plan has a deficit of $250,000. The company's working papers show that $80,000 of actuarial losses remain unamortized at year-end,and $16,000 of past service cost was amortized during the year.

Requirement:

Determine the number of years that remain until employees are entitled to receive the additional benefits related to the past service cost.

Requirement:

Determine the number of years that remain until employees are entitled to receive the additional benefits related to the past service cost.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

73

Humid Furnishings produces quality household furniture. The company has only one defined benefit pension plan,which covers its 30 carpenters. The company has completed its accounting for the year and closed its books. The draft financial statements show a defined benefit asset of $90,000. Your review of the company's records shows that the pension plan has a deficit of $50,000. The company's working papers show that $80,000 of actuarial losses remain unamortized at year-end,and $16,000 of past service cost was amortized during the year.

Requirement:

Determine the number of years that remain until employees are entitled to receive the additional benefits related to the past service cost.

Requirement:

Determine the number of years that remain until employees are entitled to receive the additional benefits related to the past service cost.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

74

Which statement is correct for the treatment of actuarial gains under IFRS?

A)These must be accounted for under the corridor method.

B)A minimum amount must be expensed each year through comprehensive income.

C)These must be expensed immediately through income.

D)These may be expensed immediately through other comprehensive income.

A)These must be accounted for under the corridor method.

B)A minimum amount must be expensed each year through comprehensive income.

C)These must be expensed immediately through income.

D)These may be expensed immediately through other comprehensive income.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

75

What is an actuarial gain?

A)An unfavourable difference between actual and expected amounts for pension obligations.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension contributions.

A)An unfavourable difference between actual and expected amounts for pension obligations.

B)A favourable difference between actual and expected amounts for pension assets.

C)An unfavourable difference between actual and expected amounts for pension contributions.

D)A favourable difference between actual and expected amounts for pension contributions.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

76

Cup of Joe Corporation provides its employees with a defined benefit pension plan. As of January 1,2011,the following balances exist:

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.

However,the actual return is $341,000. The expected period of full eligibility at January 1,2011 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 15 years. Cup of Joe paid $996,000 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Calculate the pension expense for 2011 and determine the carry forward amount for unrecognized actuarial gains or losses at the end of 20ll.

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.

For the year ended December 31,2011,the current service cost,as determined by an appropriate actuarial cost method,was $440,000. A change in actuarial assumptions created a loss of $12,000 in 2011. The expected return on plan assets was $360,000.However,the actual return is $341,000. The expected period of full eligibility at January 1,2011 (i.e.,the vesting period)is 10 years,while the expected average remaining service life is 15 years. Cup of Joe paid $996,000 to the pension trustee in December 2010. The company recognizes only the minimum amount of corridor amortization.

Requirement:

Calculate the pension expense for 2011 and determine the carry forward amount for unrecognized actuarial gains or losses at the end of 20ll.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

77

What amount will be presented on the balance sheet for fiscal 2015?

A)$3,000,000 surplus

B)$3,000,000 deficit

C)$5,000,000

D)$8,000,000

A)$3,000,000 surplus

B)$3,000,000 deficit

C)$5,000,000

D)$8,000,000

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

78

Which statement best explains the "corridor limit"?

A)This is the lesser of 10% of the pension plan assets and 10% of the pension obligations.

B)This is the greater of 10% of the pension plan assets or 10% of the pension obligations.

C)This is the lesser of 10% of the pension plan assets or 10% of the pension obligations.

D)This is the greater of 10% of the pension plan assets and 10% of the pension obligations.

A)This is the lesser of 10% of the pension plan assets and 10% of the pension obligations.

B)This is the greater of 10% of the pension plan assets or 10% of the pension obligations.

C)This is the lesser of 10% of the pension plan assets or 10% of the pension obligations.

D)This is the greater of 10% of the pension plan assets and 10% of the pension obligations.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

79

Which statement is correct?

A)The defined benefit liability or asset must be separately identified on the income statement.

B)The components of pension expense must be disclosed in the notes to the statements.

C)The defined benefit liability or asset must be separately identified on the balance sheet.

D)Pension asset/liability amounts can be offset if a company has more than one benefit plan.

A)The defined benefit liability or asset must be separately identified on the income statement.

B)The components of pension expense must be disclosed in the notes to the statements.

C)The defined benefit liability or asset must be separately identified on the balance sheet.

D)Pension asset/liability amounts can be offset if a company has more than one benefit plan.

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck

80

Odakota Canoes has had a defined benefit pension plan for three decades. Two years ago,the company improved the benefits at a cost of $1,000,000. These benefits vest to employees five years after the plan amendment. At the beginning of the current year,the company had unamortized actuarial gains of $10,400,000. Pension plan assets were $95,200,000 while pension obligations were $93,200,000 at the beginning of the year.

For the current year,Odakota's pension plan incurred current service cost of $6,100,000 and interest of $7,456,000. The pension's assets earned $7,316,000,which is $300,000 below expectations. The expected average remaining service lives (EARSL)of current employees is 8 years.

Requirement:

Compute the pension expense assuming Odakota treats unamortized actuarial gains and losses either (i)using the corridor approach or (ii)flowing the gains and losses through other comprehensive income (OCI).

For the current year,Odakota's pension plan incurred current service cost of $6,100,000 and interest of $7,456,000. The pension's assets earned $7,316,000,which is $300,000 below expectations. The expected average remaining service lives (EARSL)of current employees is 8 years.

Requirement:

Compute the pension expense assuming Odakota treats unamortized actuarial gains and losses either (i)using the corridor approach or (ii)flowing the gains and losses through other comprehensive income (OCI).

Unlock Deck

Unlock for access to all 96 flashcards in this deck.

Unlock Deck

k this deck