Deck 5: Earnings Per Share

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

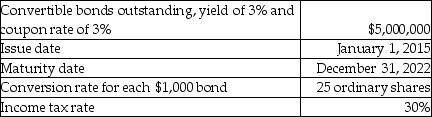

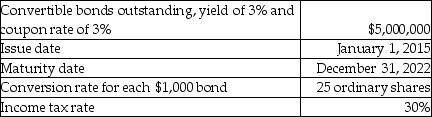

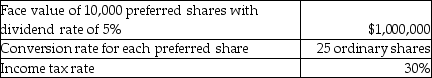

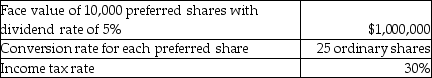

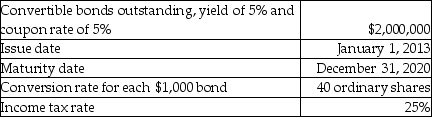

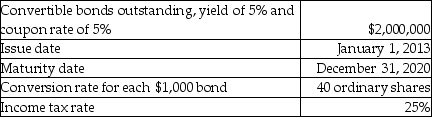

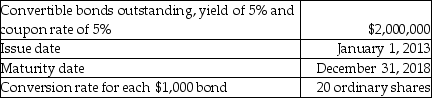

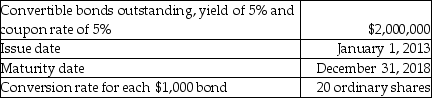

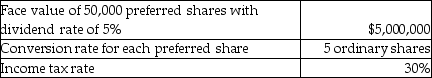

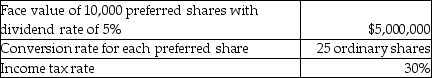

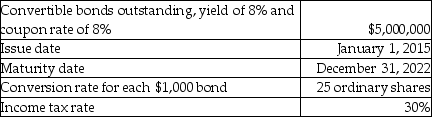

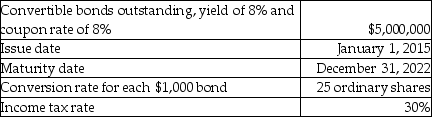

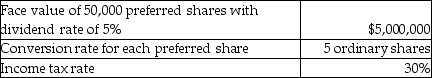

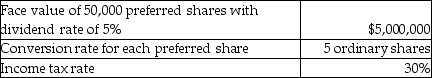

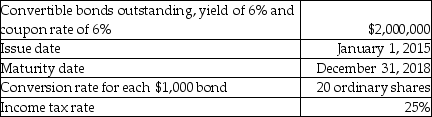

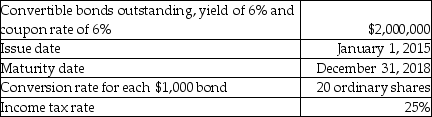

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/98

Play

Full screen (f)

Deck 5: Earnings Per Share

1

Which of the following is correct about the difference between basic earnings per share (EPS)and diluted earnings per share?

A)Basic EPS uses total common shares outstanding,whereas diluted EPS uses the weighted-average number of common shares.

B)Basic EPS is not a required disclosure,whereas diluted EPS is required disclosure.

C)Basic EPS is not adjusted for the potential dilutive effects of complex financial structures,whereas diluted EPS is adjusted.

D)Basic EPS uses comprehensive income in its calculation,whereas diluted EPS does not.

A)Basic EPS uses total common shares outstanding,whereas diluted EPS uses the weighted-average number of common shares.

B)Basic EPS is not a required disclosure,whereas diluted EPS is required disclosure.

C)Basic EPS is not adjusted for the potential dilutive effects of complex financial structures,whereas diluted EPS is adjusted.

D)Basic EPS uses comprehensive income in its calculation,whereas diluted EPS does not.

C

2

Explain the difference between basic and diluted EPS.

Basic EPS communicates "ownership" of earnings based on the average number of ordinary shares actually outstanding during the period. An indicator of profitability that measures how much of the company's earnings are attributable (belong)to each ordinary share. Diluted EPS is more abstract in nature as it conveys the hypothetical worst-case scenario that considers the effect of potentially dilutive securities-securities that could lead to the issuance of additional ordinary shares. Examples of securities that are potentially dilutive include convertible securities and stock options. Measures the amount of the company's earnings attributable to each ordinary shareholder in a hypothetical scenario in which all dilutive securities are converted to ordinary shares.

3

Which statement is correct?

A)A complex capital structure includes potentially dilutive securities.

B)A complex capital structure excludes potentially dilutive securities.

C)EPS applies only to a company with a complex capital structure.

D)A company with a complex capital structure calculates only basic EPS.

A)A complex capital structure includes potentially dilutive securities.

B)A complex capital structure excludes potentially dilutive securities.

C)EPS applies only to a company with a complex capital structure.

D)A company with a complex capital structure calculates only basic EPS.

A

4

Which statement is correct?

A)Companies with a simple capital structure must disclose diluted EPS.

B)Companies with a complex capital structure must disclose diluted EPS.

C)Companies with a simple capital structure do not need to disclose basic EPS.

D)Companies with a complex capital structure do not need to disclose diluted EPS.

A)Companies with a simple capital structure must disclose diluted EPS.

B)Companies with a complex capital structure must disclose diluted EPS.

C)Companies with a simple capital structure do not need to disclose basic EPS.

D)Companies with a complex capital structure do not need to disclose diluted EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

5

Which statement is correct?

A)A simple capital structure includes potentially dilutive securities.

B)A simple capital structure excludes potentially dilutive securities.

C)EPS applies only to a company with a simple capital structure.

D)A company with a simple capital structure does not need to calculate EPS.

A)A simple capital structure includes potentially dilutive securities.

B)A simple capital structure excludes potentially dilutive securities.

C)EPS applies only to a company with a simple capital structure.

D)A company with a simple capital structure does not need to calculate EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

6

What is the meaning of "net income attributable to ordinary shareholders"?

A)It means net income plus dividends on common and preferred shares.

B)It means net income less dividends on preferred shares.

C)It means net income plus dividends on common shares.

D)It means net income less dividends on common and preferred shares.

A)It means net income plus dividends on common and preferred shares.

B)It means net income less dividends on preferred shares.

C)It means net income plus dividends on common shares.

D)It means net income less dividends on common and preferred shares.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

7

Which statement is correct about basic EPS?

A)It indicates the net income before tax attributable to a company's ordinary shares.

B)It indicates the net income before tax attributable to a company's preferred shares.

C)It indicates the net income attributable to a company's preferred shares.

D)It indicates the net income attributable to a company's ordinary shares.

A)It indicates the net income before tax attributable to a company's ordinary shares.

B)It indicates the net income before tax attributable to a company's preferred shares.

C)It indicates the net income attributable to a company's preferred shares.

D)It indicates the net income attributable to a company's ordinary shares.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

8

Explain why the IASB requires the disclosure of basic and diluted EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

9

Which statement is correct?

A)Diluted EPS assumes that all dilutive securities are converted.

B)Diluted EPS assumes that all anti-dilutive and dilutive securities are converted.

C)Diluted EPS assumes that all ordinary securities are converted.

D)Diluted EPS assumes that all ordinary and dilutive securities are converted.

A)Diluted EPS assumes that all dilutive securities are converted.

B)Diluted EPS assumes that all anti-dilutive and dilutive securities are converted.

C)Diluted EPS assumes that all ordinary securities are converted.

D)Diluted EPS assumes that all ordinary and dilutive securities are converted.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

10

Which statement is correct about basic EPS?

A)It indicates the profitability attributable to a company's dilutive shares.

B)It indicates the profitability attributable to a company's ordinary shares.

C)It indicates the market price attributable to a company's ordinary shares.

D)It indicates the market price attributable to a company's dilutive shares.

A)It indicates the profitability attributable to a company's dilutive shares.

B)It indicates the profitability attributable to a company's ordinary shares.

C)It indicates the market price attributable to a company's ordinary shares.

D)It indicates the market price attributable to a company's dilutive shares.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement is correct about earnings per share (EPS)?

A)A company's total earning is more meaningful than its EPS.

B)EPS represents the total amount of earnings of a company.

C)EPS represents an ordinary share's interest in the company.

D)The EPS is directly correlated with the company's stock price.

A)A company's total earning is more meaningful than its EPS.

B)EPS represents the total amount of earnings of a company.

C)EPS represents an ordinary share's interest in the company.

D)The EPS is directly correlated with the company's stock price.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

12

Which statement is correct about basic EPS?

A)It is calculated on the shares outstanding at the beginning of the year.

B)It is calculated on the shares outstanding at the end of the year.

C)It is calculated on the shares issued during the year.

D)It is calculated on the shares outstanding during the year.

A)It is calculated on the shares outstanding at the beginning of the year.

B)It is calculated on the shares outstanding at the end of the year.

C)It is calculated on the shares issued during the year.

D)It is calculated on the shares outstanding during the year.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

13

Which statement is correct about the "net income attributable to ordinary shareholders"?

A)Other comprehensive income (OCI)is included in this calculation.

B)Other comprehensive income (OCI)is excluded from this calculation.

C)Dividends to preferred shareholders are added to the net income.

D)Dividends to common shareholders are added to the net income

A)Other comprehensive income (OCI)is included in this calculation.

B)Other comprehensive income (OCI)is excluded from this calculation.

C)Dividends to preferred shareholders are added to the net income.

D)Dividends to common shareholders are added to the net income

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

14

Which statement is correct?

A)Basic EPS is based on the dilutive shares outstanding at the end of the year.

B)Basic EPS is based on the dilutive shares outstanding during the year.

C)Basic EPS is based on the ordinary shares outstanding at during the year.

D)Basic EPS is based on the ordinary shares outstanding at the end of the year.

A)Basic EPS is based on the dilutive shares outstanding at the end of the year.

B)Basic EPS is based on the dilutive shares outstanding during the year.

C)Basic EPS is based on the ordinary shares outstanding at during the year.

D)Basic EPS is based on the ordinary shares outstanding at the end of the year.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

15

Which statement is correct about earnings per share (EPS)?

A)EPS does not need to be disclosed under IFRS.

B)EPS needs to be disclosed under IFRS.

C)EPS is calculated for preferred shares.

D)EPS is a ratio used to assess leverage.

A)EPS does not need to be disclosed under IFRS.

B)EPS needs to be disclosed under IFRS.

C)EPS is calculated for preferred shares.

D)EPS is a ratio used to assess leverage.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

16

What is the meaning of "net income attributable to ordinary shareholders"?

A)This is not used in the EPS calculation.

B)This refers to the numerator of the EPS calculation.

C)This refers to the denominator of the EPS calculation.

D)This is the not used in the diluted EPS calculation.

A)This is not used in the EPS calculation.

B)This refers to the numerator of the EPS calculation.

C)This refers to the denominator of the EPS calculation.

D)This is the not used in the diluted EPS calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

17

Which statement is correct about earnings per share (EPS)?

A)EPS does not provide decision-useful information to investors.

B)EPS represents the ordinary share's market value.

C)EPS represents the company's market value.

D)EPS can be used to predict future earnings by analysts.

A)EPS does not provide decision-useful information to investors.

B)EPS represents the ordinary share's market value.

C)EPS represents the company's market value.

D)EPS can be used to predict future earnings by analysts.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

18

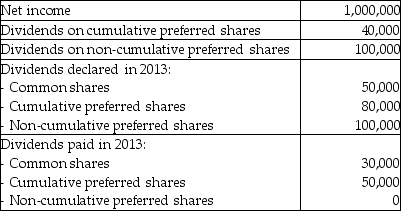

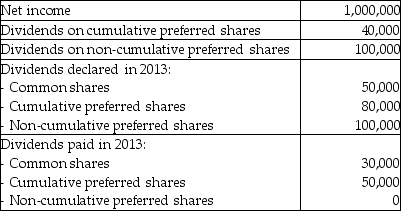

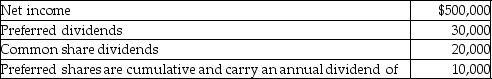

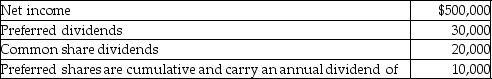

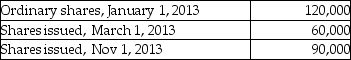

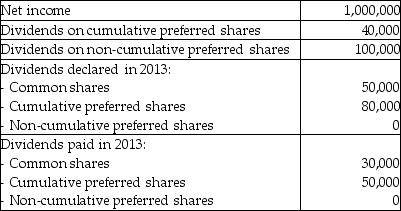

Use the following information to calculate the "net income available to ordinary shareholders":

A)$820,000

B)$860,000

C)$950,000

D)$960,000

A)$820,000

B)$860,000

C)$950,000

D)$960,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

19

Which statement is correct?

A)Diluted EPS decreases the comparability of financial statements.

B)Diluted EPS decreases the understandability of financial statements.

C)Diluted EPS addresses the moral hazard information asymmetry.

D)Diluted EPS is calculated in the same manner as basic EPS.

A)Diluted EPS decreases the comparability of financial statements.

B)Diluted EPS decreases the understandability of financial statements.

C)Diluted EPS addresses the moral hazard information asymmetry.

D)Diluted EPS is calculated in the same manner as basic EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

20

Which statement is correct?

A)Basic EPS increases the understandability of financial statements.

B)Basic EPS decreases the understandability of financial statements.

C)Basic EPS addresses the moral hazard information asymmetry.

D)Basic EPS can be calculated in different ways by different companies.

A)Basic EPS increases the understandability of financial statements.

B)Basic EPS decreases the understandability of financial statements.

C)Basic EPS addresses the moral hazard information asymmetry.

D)Basic EPS can be calculated in different ways by different companies.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

21

Explain how the dividends on cumulative preferred shares are adjusted in the EPS calculation. What is the underlying logic for this adjustment?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

22

Explain how the dividends on cumulative preferred shares are adjusted in the EPS calculation. What is the underlying logic for this adjustment?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

23

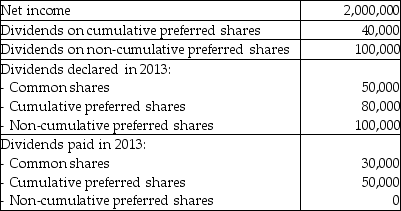

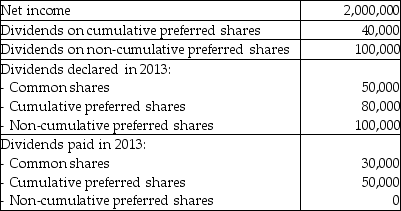

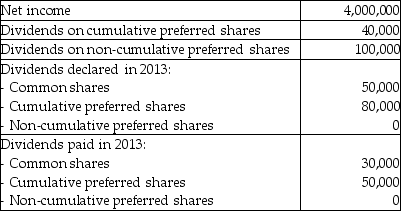

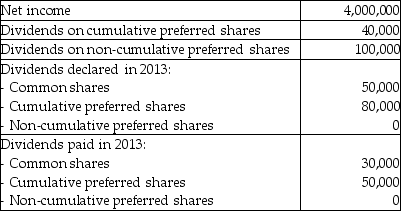

Use the following information to calculate the "net income available to ordinary shareholders":

A)$1,820,000

B)$1,860,000

C)$1,950,000

D)$1,960,000

A)$1,820,000

B)$1,860,000

C)$1,950,000

D)$1,960,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

24

What is the meaning of "weighted average number of ordinary shares outstanding"?

A)This is not used in the EPS calculation.

B)This refers to the numerator of the EPS calculation.

C)This refers to the denominator of the EPS calculation.

D)This is the not used in the diluted EPS calculation.

A)This is not used in the EPS calculation.

B)This refers to the numerator of the EPS calculation.

C)This refers to the denominator of the EPS calculation.

D)This is the not used in the diluted EPS calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

25

XYZ Company has 500,000 common shares outstanding and 50,000,$4,cumulative,participating preferred shares outstanding. Preferred shareholders receive dividends once the common shareholders have received $2 per share. No dividends were declared last year; however,$2,000,000 in dividends were declared this year. How much of the dividend amount is allocated to preferred shareholders?

A)$460,000.00

B)$466,666.67

C)$500,000.00

D)$571,428.57

A)$460,000.00

B)$466,666.67

C)$500,000.00

D)$571,428.57

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

26

Which statement is correct about "weighted average number of ordinary shares outstanding"?

A)Treasury shares that are cancelled are adjusted in this calculation.

B)Treasury shares that are not cancelled are adjusted in this calculation.

C)Treasury shares that are repurchased are adjusted in this calculation.

D)Treasury shares are ignored for purposes of this calculation.

A)Treasury shares that are cancelled are adjusted in this calculation.

B)Treasury shares that are not cancelled are adjusted in this calculation.

C)Treasury shares that are repurchased are adjusted in this calculation.

D)Treasury shares are ignored for purposes of this calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

27

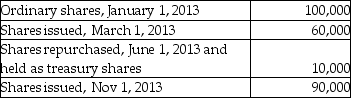

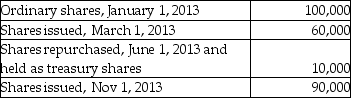

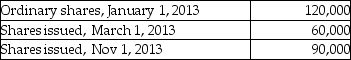

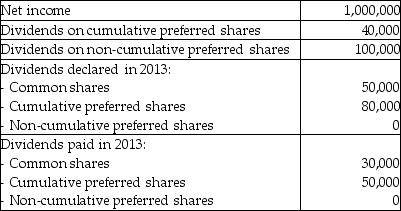

Use the following information to calculate the "weighted average number of ordinary shares outstanding" (WASO)?

A)104,170

B)159,167

C)164,830

D)190,000

A)104,170

B)159,167

C)164,830

D)190,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

28

Which statement is correct about the "weighted average number of ordinary shares outstanding" (WASO)?

A)It is used only in the numerator of the EPS calculation.

B)The weighted average is the number of shares outstanding at the beginning of the year.

C)The weighted average accounts for changes in shares issued or cancelled during the year.

D)It is used only in the denominator of the diluted EPS calculation.

A)It is used only in the numerator of the EPS calculation.

B)The weighted average is the number of shares outstanding at the beginning of the year.

C)The weighted average accounts for changes in shares issued or cancelled during the year.

D)It is used only in the denominator of the diluted EPS calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

29

For stock splits and stock dividends,while it is possible to state the number of shares as beginning-of-year equivalents,it makes more sense to use end-of-year equivalents because financial statement readers are evaluating EPS after the end of the year. Explain why the adjustment for stock splits and stock dividends is standardized.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

30

Use the following information to calculate the "weighted average number of ordinary shares outstanding" (WASO)?

A)112,500

B)152,500

C)157,500

D)170,000

A)112,500

B)152,500

C)157,500

D)170,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

31

Which statement is correct?

A)Share issuances increase the EPS denominator.

B)Stock splits have the same effect on EPS as share issuances.

C)Stock dividends have the same effect on EPS as share issuances.

D)Share issuances decrease the EPS denominator.

A)Share issuances increase the EPS denominator.

B)Stock splits have the same effect on EPS as share issuances.

C)Stock dividends have the same effect on EPS as share issuances.

D)Share issuances decrease the EPS denominator.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

32

Which statement is correct about the "weighted average number of ordinary shares outstanding" (WASO)?

A)Stock repurchases do not impact the WASO.

B)The actual date of share issuances is ignored in the WASO.

C)The actual date of stock splits is ignored in the WASO.

D)Stock dividends do not impact the WASO.

A)Stock repurchases do not impact the WASO.

B)The actual date of share issuances is ignored in the WASO.

C)The actual date of stock splits is ignored in the WASO.

D)Stock dividends do not impact the WASO.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

33

Explain why dividends to preferred shareholders are adjusted in the numerator of the EPS calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

34

Ned Company reported the following information for its fiscal year:  The preferred dividends listed above include the current year and prior accumulated dividends. What is the amount of net income available to common shareholders?

The preferred dividends listed above include the current year and prior accumulated dividends. What is the amount of net income available to common shareholders?

A)$440,000

B)$450,000

C)$470,000

D)$490,000

The preferred dividends listed above include the current year and prior accumulated dividends. What is the amount of net income available to common shareholders?

The preferred dividends listed above include the current year and prior accumulated dividends. What is the amount of net income available to common shareholders?A)$440,000

B)$450,000

C)$470,000

D)$490,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to calculate the "net income available to ordinary shareholders":

A)$3,860,000

B)$3,870,000

C)$3,950,000

D)$3,960,000

A)$3,860,000

B)$3,870,000

C)$3,950,000

D)$3,960,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

36

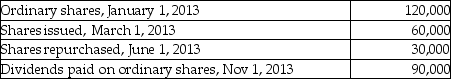

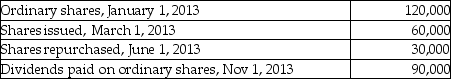

Use the following information to calculate the "weighted average number of ordinary shares outstanding" (WASO)?

A)120,000

B)165,000

C)185,000

D)270,000

A)120,000

B)165,000

C)185,000

D)270,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

37

Which statement is correct?

A)Share issuances decrease the EPS numerator.

B)Stock splits have the same effect on EPS as share issuances.

C)Share issuances increase number of shares.

D)Share issuances decrease the EPS denominator.

A)Share issuances decrease the EPS numerator.

B)Stock splits have the same effect on EPS as share issuances.

C)Share issuances increase number of shares.

D)Share issuances decrease the EPS denominator.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to calculate the "net income available to ordinary shareholders":

A)$860,000

B)$870,000

C)$950,000

D)$960,000

A)$860,000

B)$870,000

C)$950,000

D)$960,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

39

Use the following information to calculate the "weighted average number of ordinary shares outstanding" (WASO)?

A)104,170

B)159,167

C)164,830

D)190,000

A)104,170

B)159,167

C)164,830

D)190,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

40

Explain why other comprehensive income is excluded from the numerator of the EPS calculation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

41

Accu Tech Renovations Corp. (ATRC)was incorporated on January I,2014. At that time it issued 100,000 ordinary shares; 80,000,$20,3% preferred shares "A"; and 40,000,$20,6% preferred shares "B." Net income for the year ended December 31,2014 was $1,800,000. ATRC declares and pays total of $238,000 in dividends. The series A preferred shares arc cumulative and the series B preferred shares are non-cumulative. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

42

Tropical Island Inc. (TIl)was incorporated on January I,2014. At that time it issued 300,000 ordinary shares; 10,000,$10,8% preferred shares "A"; and 100,000,$10,9% preferred shares "B." Net income for the year ended December 31,2014 was $1,600,000. TIl declares and pays a total of $68,000 in dividends. Both the preferred shares series A and B are non-cumulative in nature. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

43

For the year ended December 31,2015,Jovial Productions Inc. earned $13,000,000. Outstanding preferred shares included $1,500,000 in 9% cumulative preferred shares issued on January 1,2012 and 32,000 $160 non-cumulative preferred shares issued on January 1,2014 that are each entitled to dividends of $7 per annum. Dividends were neither declared nor paid on either class of the preferred shares in 2013 or 2014. On December 15,2015,the company declared and paid the $270,000 dividends in arrears on the 9% cumulative preferred shares. The company also declared and paid $224,000 dividends on the non-cumulative preferred shares.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

44

Summer Surprise Ltd. (SSL)was incorporated on January 1,2014. At that time,it issued 210,000 ordinary shares; 95,000,$65,2% preferred shares "A"; and 85,000,$65,4% preferred shares "B." Net income for the year ended December 31,2014 was $500,000. SSL neither declares nor pays dividends during the year. iii. Both the preferred shares series A and B are non-cumulative in nature. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

45

For the year ended December 31,2015,Jovial Productions Inc. earned $13,000,000. Outstanding preferred shares included $1,500,000 in 9% cumulative preferred shares issued on January 1,2012 and 32,000 $160 non-cumulative preferred shares issued on January 1,2014 that are each entitled to dividends of $7 per annum. Dividends were neither declared nor paid on either class of the preferred shares in 2013 or 2014. On December 15,2015,the company declared $150,000 dividends on the 4% cumulative preferred shares and $150,000 in dividends on the non-cumulative preferred shares,both payable on January 15,2016.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

46

Tropical Island Inc. (TIl)was incorporated on January I,2014. At that time it issued 300,000 ordinary shares; 10,000,$10,8% preferred shares "A"; and 100,000,$10,9% preferred shares "B." Net income for the year ended December 31,2014 was $1,600,000. TIl declares and pays a total of $68,000 in dividends. The series A preferred shares are cumulative and the series B preferred shares are non-cumulative. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

47

For the year ended December 31,2015,Jovial Productions Inc. earned $13,000,000. Outstanding preferred shares included $1,500,000 in 9% cumulative preferred shares issued on January 1,2012 and 32,000 $160 non-cumulative preferred shares issued on January 1,2014 that are each entitled to dividends of $7 per annum. Dividends were neither declared nor paid on either class of the preferred shares in 2013 or 2014. On December 15,2015,the company declared and paid $140,000 of the dividends in arrears on the 4% cumulative preferred shares.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2015.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

48

For the year ended December 31,2011,Harvest Productions Inc. earned $4,000,000. Outstanding preferred shares included $400,000 in 3% cumulative preferred shares issued on January 1,2010 and $500,000 in 2% non-cumulative preferred shares issued on January 1,2011. Dividends on the cumulative preferred shares were not declared in 2010. On December 15,2011,Harvest declared $10,000 in dividends on the non-cumulative preferred shares,payable on January 15,2012. Dividends on the cumulative preferred shares are neither declared nor paid.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

49

Summer Surprise Ltd. (SSL)was incorporated on January 1,2014. At that time,it issued 210,000 ordinary shares; 95,000,$65,2% preferred shares "A"; and 85,000,$65,4% preferred shares "B." Net income for the year ended December 31,2014 was $500,000. SSL neither declares nor pays dividends during the year. ii. The series A preferred shares are cumulative and the series B preferred shares are non-cumulative. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

50

Hamm Corporation had 200,000 ordinary shares outstanding on January 1,2011. On April 1,2011,Hamm issued an additional 120,000 shares. On July 1,2011,Hamm repurchased 20,000 ordinary shares and cancelled them. On October 1,2011,Hamm issued an additional 50,000 ordinary shares.

Requirements:

a. What was the weighted average number of ordinary shares outstanding in 2011 ?

b. Assume that on July 1,2011 Hamm repurchased the shares and held them as treasury shares. Will the weighted average number of ordinary shares outstanding in 2011 change from the amount in part a? Why or why not?

Requirements:

a. What was the weighted average number of ordinary shares outstanding in 2011 ?

b. Assume that on July 1,2011 Hamm repurchased the shares and held them as treasury shares. Will the weighted average number of ordinary shares outstanding in 2011 change from the amount in part a? Why or why not?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

51

Accu Tech Renovations Corp. (ATRC)was incorporated on January I,2014. At that time it issued 100,000 ordinary shares; 80,000,$20,3% preferred shares "A"; and 40,000,$20,6% preferred shares "B." Net income for the year ended December 31,2014 was $1,800,000. ATRC declares and pays total of $238,000 in dividends. Both the preferred shares series A and B are non-cumulative in nature. Series A must be fully paid their current entitlement before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

52

Accu Tech Renovations Corp. (ATRC)was incorporated on January I,2014. At that time it issued 100,000 ordinary shares; 80,000,$20,3% preferred shares "A"; and 40,000,$20,6% preferred shares "B." Net income for the year ended December 31,2014 was $1,800,000. ATRC declares and pays total of $238,000 in dividends. Both the preferred shares series A and B are cumulative in nature. Series A must be fully paid their current entitlement as well as any arrears before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

53

Summer Surprise Ltd. (SSL)was incorporated on January 1,2014. At that time,it issued 210,000 ordinary shares; 95,000,$65,2% preferred shares "A"; and 85,000,$65,4% preferred shares "B." Net income for the year ended December 31,2014 was $500,000. SSL neither declares nor pays dividends during the year. Both the preferred shares series A and B are cumulative in nature. Series A must be fully paid their current entitlement as well as any arrears before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

54

Which statement is correct?

A)The numerator for diluted EPS is the same as the numerator for basic EPS.

B)Potential ordinary shares are derivative instruments that entitle the holder to commodities.

C)Potential ordinary shares are financial instruments that entitle the holder to ordinary shares.

D)The numerator for diluted EPS is always greater than the numerator for basic EPS.

A)The numerator for diluted EPS is the same as the numerator for basic EPS.

B)Potential ordinary shares are derivative instruments that entitle the holder to commodities.

C)Potential ordinary shares are financial instruments that entitle the holder to ordinary shares.

D)The numerator for diluted EPS is always greater than the numerator for basic EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

55

For the year ended December 31,2011,Harvest Productions Inc. earned $4,000,000. Outstanding preferred shares included $400,000 in 3% cumulative preferred shares issued on January 1,2010 and $500,000 in 2% non-cumulative preferred shares issued on January 1,2011. Dividends on the cumulative preferred shares were not declared in 2010.

a. On December 15,2011,Harvest declared and paid $24,000 in dividends on the 3% cumulative shares including the arrears. Harvest also declared and paid the $10,000 dividends on the non-cumulative shares.

b. Harvest did not declare any dividends during 2011.

c. On December 15,2011,Harvest declared $10,000 in dividends on the non-cumulative preferred shares,payable on January 15,2012. Dividends on the cumulative preferred shares are neither declared nor paid.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

a. On December 15,2011,Harvest declared and paid $24,000 in dividends on the 3% cumulative shares including the arrears. Harvest also declared and paid the $10,000 dividends on the non-cumulative shares.

b. Harvest did not declare any dividends during 2011.

c. On December 15,2011,Harvest declared $10,000 in dividends on the non-cumulative preferred shares,payable on January 15,2012. Dividends on the cumulative preferred shares are neither declared nor paid.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

56

Tropical Island Inc. (TIl)was incorporated on January I,2014. At that time it issued 300,000 ordinary shares; 10,000,$10,8% preferred shares "A"; and 100,000,$10,9% preferred shares "B." Net income for the year ended December 31,2014 was $1,600,000. TIl declares and pays a total of $68,000 in dividends. Both the preferred shares series A and B are cumulative in nature. Series A must be fully paid their current entitlement as well as any arrears before any monies are paid to the Series B shareholders.

Requirement:

Compute basic BPS.

Requirement:

Compute basic BPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

57

Which statement is correct?

A)Diluted EPS will always be less than basic EPS.

B)Diluted EPS will always be greater than basic EPS.

C)Diluted EPS will always be equal to EPS.

D)Diluted EPS will be less than or equal to basic EPS.

A)Diluted EPS will always be less than basic EPS.

B)Diluted EPS will always be greater than basic EPS.

C)Diluted EPS will always be equal to EPS.

D)Diluted EPS will be less than or equal to basic EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

58

For the year ended December 31,2011,Harvest Productions Inc. earned $4,000,000. Outstanding preferred shares included $400,000 in 3% cumulative preferred shares issued on January 1,2010 and $500,000 in 2% non-cumulative preferred shares issued on January 1,2011. Dividends on the cumulative preferred shares were not declared in 2010. On December 15,2011,Harvest declared and paid $24,000 in dividends on the 3% cumulative shares including the arrears. Harvest also declared and paid the $10,000 dividends on the non-cumulative shares.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

Requirement:

Determine the net income available to ordinary shareholders for the year ended December 31,2011.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

59

Traditional Bathrooms Inc. (TBI)had 80,000 ordinary shares outstanding on January 1,2015. Transactions throughout 2015 affecting its shareholdings follow.

• February 1: TBI issued 200,000,$10,cumulative 10% preferred shares.

• March 1: TBI issued 40,000 ordinary shares.

• April l: TBI declared and issued a 8% stock dividend on the ordinary shares.

• July 1: TBI repurchased and cancelled 30,000 ordinary shares.

• October 1: TBI declared and issued a 3-for-l stock split on the ordinary shares.

• December 31: TBI declared and paid $99,600 in dividends on the ordinary shares.

• Net income for the year ended December 31,2015 was $600,000. Its tax rate was 40%.

Requirements:

a. What was weighted average number of ordinary shares outstanding in 2015?

b. What was basic EPS in 20151

c. If the preferred shares issued on February 1,2015 were non-cumulative,what would basic BPS for 2015 have been?

• February 1: TBI issued 200,000,$10,cumulative 10% preferred shares.

• March 1: TBI issued 40,000 ordinary shares.

• April l: TBI declared and issued a 8% stock dividend on the ordinary shares.

• July 1: TBI repurchased and cancelled 30,000 ordinary shares.

• October 1: TBI declared and issued a 3-for-l stock split on the ordinary shares.

• December 31: TBI declared and paid $99,600 in dividends on the ordinary shares.

• Net income for the year ended December 31,2015 was $600,000. Its tax rate was 40%.

Requirements:

a. What was weighted average number of ordinary shares outstanding in 2015?

b. What was basic EPS in 20151

c. If the preferred shares issued on February 1,2015 were non-cumulative,what would basic BPS for 2015 have been?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

60

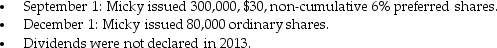

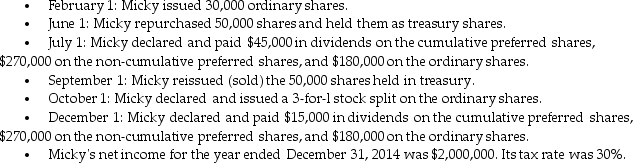

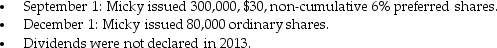

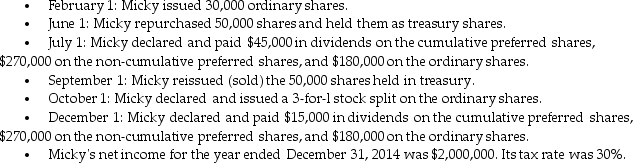

Micky and Donald Corp. was founded on January I,2013. At that time it issued 120,000 ordinary shares and 20,000,$30,cumulative 5% preferred shares. Subsequent transactions affecting its shareholdings follow.

2013

2014

2014

Requirements:

Requirements:

a. What was Micky's weighted average number of ordinary shares outstanding in 2014?

b. What was Micky's basic BPS in 2014?

2013

2014

2014 Requirements:

Requirements:a. What was Micky's weighted average number of ordinary shares outstanding in 2014?

b. What was Micky's basic BPS in 2014?

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

61

Which statement is correct about the "if-converted" method for EPS?

A)This method assumes the convertible security is converted into ordinary shares at the end of the fiscal period.

B)This method assumes the convertible security is converted into ordinary shares at the beginning of the fiscal period.

C)This method assumes the convertible security is converted into ordinary shares evenly over the fiscal period.

D)This method assumes the convertible security is converted into ordinary shares at the mid-point of the fiscal period.

A)This method assumes the convertible security is converted into ordinary shares at the end of the fiscal period.

B)This method assumes the convertible security is converted into ordinary shares at the beginning of the fiscal period.

C)This method assumes the convertible security is converted into ordinary shares evenly over the fiscal period.

D)This method assumes the convertible security is converted into ordinary shares at the mid-point of the fiscal period.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

62

What is the meaning of "out-of-the-money warrants"?

A)Warrants are out-of-the-money if the market price of the share exceeds the exercise price.

B)Warrants are out-of-the-money if the market price of the share is less than the exercise price.

C)Warrants are out-of-the-money if the market price of the share equals the exercise price.

D)Warrants are out-of-the-money when the market price means that it will be exercised.

A)Warrants are out-of-the-money if the market price of the share exceeds the exercise price.

B)Warrants are out-of-the-money if the market price of the share is less than the exercise price.

C)Warrants are out-of-the-money if the market price of the share equals the exercise price.

D)Warrants are out-of-the-money when the market price means that it will be exercised.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

63

Calculate the incremental EPS for the following instrument:

A)$0.36

B)$0.84

C)$40.00

D)$105,000

A)$0.36

B)$0.84

C)$40.00

D)$105,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

64

Calculate the incremental EPS for the following instrument:

A)$0.14

B)$0.20

C)$1.40

D)$2.00

A)$0.14

B)$0.20

C)$1.40

D)$2.00

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

65

Calculate the share effect on the incremental EPS for the following instrument:

A)0)63

B)1)88

C)75,000

D)80,000

A)0)63

B)1)88

C)75,000

D)80,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

66

What is the meaning of "at-the-money options"?

A)An option is at-the-money when the market price means that it will be exercised.

B)An option is at-the-money if the market price of the share equals the exercise price.

C)An option is at-the-money if the market price of the share is less than the exercise price.

D)An option is at-the-money if the market price of the share exceeds the exercise price.

A)An option is at-the-money when the market price means that it will be exercised.

B)An option is at-the-money if the market price of the share equals the exercise price.

C)An option is at-the-money if the market price of the share is less than the exercise price.

D)An option is at-the-money if the market price of the share exceeds the exercise price.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

67

Which statement is correct about the "if-converted" method for EPS?

A)This method assumes the interest is paid on the convertible security until it was converted into ordinary shares.

B)This method assumes the interest is paid on the convertible security for one-half of the year.

C)This method assumes the interest is paid on the convertible security for the period after its issue date.

D)This method assumes the no interest is paid on the convertible security for the entire year.

A)This method assumes the interest is paid on the convertible security until it was converted into ordinary shares.

B)This method assumes the interest is paid on the convertible security for one-half of the year.

C)This method assumes the interest is paid on the convertible security for the period after its issue date.

D)This method assumes the no interest is paid on the convertible security for the entire year.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

68

Calculate the incremental EPS for the following instrument:

A)0)63

B)1)88

C)40,000

D)75,000

A)0)63

B)1)88

C)40,000

D)75,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

69

Which statement is correct about potential ordinary shares (POS)?

A)Dilutive POS decrease EPS.

B)Dilutive POS increase EPS.

C)Anti-dilutive POS decrease EPS

D)Anti-dilutive POS are included in EPS.

A)Dilutive POS decrease EPS.

B)Dilutive POS increase EPS.

C)Anti-dilutive POS decrease EPS

D)Anti-dilutive POS are included in EPS.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

70

What is the meaning of "in the money options"?

A)An option is in-the-money when the market price means that it will expire un-exercised.

B)An option is in-the-money if the market price of the share equals the exercise price.

C)An option is in-the-money if the market price of the share is less than the exercise price.

D)An option is in-the-money if the market price of the share exceeds the exercise price.

A)An option is in-the-money when the market price means that it will expire un-exercised.

B)An option is in-the-money if the market price of the share equals the exercise price.

C)An option is in-the-money if the market price of the share is less than the exercise price.

D)An option is in-the-money if the market price of the share exceeds the exercise price.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

71

Which statement is correct about the "share effect" on EPS?

A)This is the incremental before-tax income available to ordinary shareholders.

B)This is the incremental after-tax income available to ordinary shareholders.

C)This is the incremental number of ordinary shares outstanding before conversion.

D)This is the incremental number of ordinary shares outstanding after conversion.

A)This is the incremental before-tax income available to ordinary shareholders.

B)This is the incremental after-tax income available to ordinary shareholders.

C)This is the incremental number of ordinary shares outstanding before conversion.

D)This is the incremental number of ordinary shares outstanding after conversion.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

72

Calculate the income effect on the incremental EPS for the following instrument:

A)$1.00

B)$75,000

C)$175,000

D)$250,000

A)$1.00

B)$75,000

C)$175,000

D)$250,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

73

Calculate the incremental EPS for the following instrument:

A)$0.30

B)$0.70

C)$1.00

D)$2.00

A)$0.30

B)$0.70

C)$1.00

D)$2.00

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

74

Two different companies have many similarities,including the following:

• They all earned net income of $3,500,000 for the year ended December 31,2017;

• They are all subject to a 35% tax rate;

• The average price of the companies' ordinary shares during the year was $26; and

• Each company had 1,400,000 ordinary shares outstanding during the year.

They do have slightly different complex capital structures,however. Specifically:

• Company Black had stock options outstanding the entire year that allowed employees to buy 10,000 ordinary shares for $22 each between January 1,2018 and December 31,2019.

• Company Clark had $4,000,000 in 4% non-cumulative preferred shares outstanding the entire year. Each $100 share is convertible into three ordinary shares. Dividends were not declared in 2017.

Requirements:

a. Calculate the basic EPS of the four companies.

b. Prepare a schedule that sets out the income effect,share effect,and incremental EPS for each company's security that is convertible into ordinary shares.

c. Consider each company's POS and determine whether it is dilutive or anti-dilutive.

• They all earned net income of $3,500,000 for the year ended December 31,2017;

• They are all subject to a 35% tax rate;

• The average price of the companies' ordinary shares during the year was $26; and

• Each company had 1,400,000 ordinary shares outstanding during the year.

They do have slightly different complex capital structures,however. Specifically:

• Company Black had stock options outstanding the entire year that allowed employees to buy 10,000 ordinary shares for $22 each between January 1,2018 and December 31,2019.

• Company Clark had $4,000,000 in 4% non-cumulative preferred shares outstanding the entire year. Each $100 share is convertible into three ordinary shares. Dividends were not declared in 2017.

Requirements:

a. Calculate the basic EPS of the four companies.

b. Prepare a schedule that sets out the income effect,share effect,and incremental EPS for each company's security that is convertible into ordinary shares.

c. Consider each company's POS and determine whether it is dilutive or anti-dilutive.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

75

Which statement is correct about the "income effect" on EPS?

A)This is the incremental before-tax income available to ordinary shareholders.

B)This is the incremental after-tax income available to ordinary shareholders.

C)This is the incremental number of ordinary shares outstanding before conversion.

D)This is the incremental number of ordinary shares outstanding after conversion.

A)This is the incremental before-tax income available to ordinary shareholders.

B)This is the incremental after-tax income available to ordinary shareholders.

C)This is the incremental number of ordinary shares outstanding before conversion.

D)This is the incremental number of ordinary shares outstanding after conversion.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

76

Explain why only in-the-money options need be considered in the diluted EPS calculations.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

77

Two different companies have many similarities,including the following:

• They all earned net income of $3,500,000 for the year ended December 31,2017;

• They are all subject to a 35% tax rate;

• The average price of the companies' ordinary shares during the year was $26; and

• Each company had 1,400,000 ordinary shares outstanding during the year.

They do have slightly different complex capital structures,however. Specifically:

• Company ACE had stock options outstanding the entire year that allowed employees to buy 50,000 ordinary shares for $20 each until December 31,2019.

• Company DUECE had $600,000 in 5% bonds maturing on December 31,2019 that were outstanding the entire year. Each $1,000 bond is convertible into 5 ordinary shares any time before expiry.

Requirements:

a. Calculate the basic EPS of the four companies.

b. Prepare a schedule that sets out the income effect,share effect,and incremental EPS for each company's security that is convertible into ordinary shares.

c. Consider each company's POS and determine whether it is dilutive or anti-dilutive. For company D assume that the effective rate of interest on the bonds equals the coupon rate and ignore the equity component of the conversion option.

• They all earned net income of $3,500,000 for the year ended December 31,2017;

• They are all subject to a 35% tax rate;

• The average price of the companies' ordinary shares during the year was $26; and

• Each company had 1,400,000 ordinary shares outstanding during the year.

They do have slightly different complex capital structures,however. Specifically:

• Company ACE had stock options outstanding the entire year that allowed employees to buy 50,000 ordinary shares for $20 each until December 31,2019.

• Company DUECE had $600,000 in 5% bonds maturing on December 31,2019 that were outstanding the entire year. Each $1,000 bond is convertible into 5 ordinary shares any time before expiry.

Requirements:

a. Calculate the basic EPS of the four companies.

b. Prepare a schedule that sets out the income effect,share effect,and incremental EPS for each company's security that is convertible into ordinary shares.

c. Consider each company's POS and determine whether it is dilutive or anti-dilutive. For company D assume that the effective rate of interest on the bonds equals the coupon rate and ignore the equity component of the conversion option.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

78

Calculate the income effect on the incremental EPS for the following instrument:

A)$0.96

B)$2.24

C)$120,000

D)$280,000

A)$0.96

B)$2.24

C)$120,000

D)$280,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

79

Calculate the share effect on the incremental EPS for the following instrument:

A)5

B)25,000

C)50,000

D)250,000

A)5

B)25,000

C)50,000

D)250,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

80

Calculate the income effect on the incremental EPS for the following instrument:

A)0)75

B)2)25

C)40,000

D)90,000

A)0)75

B)2)25

C)40,000

D)90,000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck