Deck 30: Consolidation: Other Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 30: Consolidation: Other Issues

1

In a situation where a parent acquires shares in a subsidiary, and the subsidiary later acquires a controlling interest in another entity, the ownership structure is:

A) ordered.

B) random.

C) sequential.

D) non-sequential.

A) ordered.

B) random.

C) sequential.

D) non-sequential.

C

2

An ownership structure in which Opal Limited acquires shares in Pearl Limited before Pearl Limited acquires shares in Quartz Limited is known as:

A) a sequential acquisition.

B) a consequential acquisition.

C) an aggregate acquisition.

D) a multiple acquisition.

A) a sequential acquisition.

B) a consequential acquisition.

C) an aggregate acquisition.

D) a multiple acquisition.

A

3

When calculating the direct non-controlling interest share of equity, consolidation adjustments are needed to:

A) eliminate intragroup advances.

B) recognise profits made on intragroup services.

C) partially eliminate profits on intragroup services.

D) remove unrealised profits or losses from intragroup transactions.

A) eliminate intragroup advances.

B) recognise profits made on intragroup services.

C) partially eliminate profits on intragroup services.

D) remove unrealised profits or losses from intragroup transactions.

D

4

In order to consolidate a 60% interest in a subsidiary, the Morgan Group prepared the following pre-acquisition entry: DR Retained earnings $14 000

DR Share capital $25 000

DR General reserve $6 000

CR Investment in subsidiary $45 000

The interest in equity attributable to the direct non-controlling interest is:

A) $30 000.

B) $15 000.

C) $25 000.

D) $20 000.

DR Share capital $25 000

DR General reserve $6 000

CR Investment in subsidiary $45 000

The interest in equity attributable to the direct non-controlling interest is:

A) $30 000.

B) $15 000.

C) $25 000.

D) $20 000.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

Katie Limited has a 90% ownership interest in Max Limited. Max Limited has a 60% ownership interest in Josie Limited. As a result of these ownership interests, there is an indirect NCI in Josie Limited of:

A) 6%

B) 10%

C) 40%

D) 54%

A) 6%

B) 10%

C) 40%

D) 54%

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

When calculating the direct non-controlling interest share of equity, consolidation adjustments are needed to:

A) eliminate any realised profits or losses from inventory transfers.

B) partially eliminate any unrealised profits from inventory transfers.

C) recognise any unrealised profits or losses from intragroup service transfers.

D) fully eliminate any unrealised profits or losses from intragroup transactions.

A) eliminate any realised profits or losses from inventory transfers.

B) partially eliminate any unrealised profits from inventory transfers.

C) recognise any unrealised profits or losses from intragroup service transfers.

D) fully eliminate any unrealised profits or losses from intragroup transactions.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

Dion Ltd acquired a 60% ownership interest in Sean Ltd on 30 June 2021. On the same day, Sean Ltd acquired a 70% ownership interest in Jayden Ltd. The following inter-entity transactions have taken place between the entities in the group during the years ended 30 June 2022 and 30 June 2023.

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

The effect of the interest paid by Sean to Jayden on the NCI of Sean for the year ended 30 June 2023 is:

A) an increase in NCI of $2 400

B) an increase in NCI of $3 200

C) an increase in NCI of $4 640

D) nil.

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

The effect of the interest paid by Sean to Jayden on the NCI of Sean for the year ended 30 June 2023 is:

A) an increase in NCI of $2 400

B) an increase in NCI of $3 200

C) an increase in NCI of $4 640

D) nil.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

The pre-acquisition entry for the Riley group in order to consolidate a 75% interest in a subsidiary contained the following debits: Retained earnings $16 000, share capital $80 000, general reserve $30 000, BCVR $12 000. The direct non-controlling interest's share of the subsidiary's equity at the date of acquisition is:

A) $184 000

B) $46 000

C) $138 000

D) $34 500

A) $184 000

B) $46 000

C) $138 000

D) $34 500

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

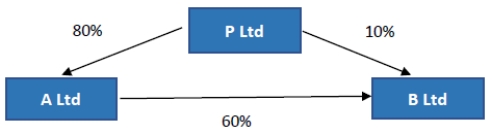

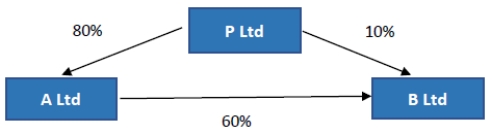

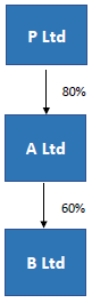

9

Consider the following economic entity structure.  The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?

The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?

The direct non-controlling interests (DNCI) and indirect non-controlling interests (INCI) are which of the following?A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following are other issues to consider in the preparation of the consolidated financial statements?

I. when a parent acquires a subsidiary after that subsidiary has acquired its own subsidiary.

II. when the parent changes its ownership interest in a subsidiary after the consolidation group has been formed.

III. where the parent has control over two subsidiaries but only has an ownership interest in one of those subsidiaries.

A) I, II and III

B) I and II only

C) II and III only

D) I and III only

I. when a parent acquires a subsidiary after that subsidiary has acquired its own subsidiary.

II. when the parent changes its ownership interest in a subsidiary after the consolidation group has been formed.

III. where the parent has control over two subsidiaries but only has an ownership interest in one of those subsidiaries.

A) I, II and III

B) I and II only

C) II and III only

D) I and III only

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

Dion Ltd acquired a 60% ownership interest in Sean Ltd on 30 June 2021. On the same day, Sean Ltd acquired a 70% ownership interest in Jayden Ltd. The following inter-entity transactions have taken place between the entities in the group during the years ended 30 June 2022 and 30 June 2023.

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

The NCI share of profit in Jayden for the year ended 30 June 2023 is:

A) $23 200.

B) $21 000.

C) $40 600.

D) $28 000.

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

The NCI share of profit in Jayden for the year ended 30 June 2023 is:

A) $23 200.

B) $21 000.

C) $40 600.

D) $28 000.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

Koala Limited acquired a 75% ownership interest in Kookaburra Limited on 30 June 2021. On the same day, Kookaburra Limited acquired a 60% ownership interest in Kangaroo Limited. The following inter-entity transactions have taken place between the entities in the group during the years ended 30 June 2022 and 30 June 2023:

-On 1 July 2021 Kangaroo sold an item of plant to Koala for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 2 years.

-On 1 September 2021, Kangaroo paid a dividend of $80 000 from profits earned prior to 30 June 2021.

-Koala lent $200 000 to Kangaroo on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $10 000 and for the year ended 30 June 2023 was $20 000.

-On 31 May 2023 Kookaburra sold inventories to Kangaroo for $10 000. Profit earned on the sale was $2 000. Kangaroo sold the inventories to external parties on 1 August 2023.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the year ended 30 June 2022, the dividend paid by Kangaroo effects the NCI of Kangaroo by:

A) nil.

B) $12 000

C) $20 000

D) $32 000

-On 1 July 2021 Kangaroo sold an item of plant to Koala for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 2 years.

-On 1 September 2021, Kangaroo paid a dividend of $80 000 from profits earned prior to 30 June 2021.

-Koala lent $200 000 to Kangaroo on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $10 000 and for the year ended 30 June 2023 was $20 000.

-On 31 May 2023 Kookaburra sold inventories to Kangaroo for $10 000. Profit earned on the sale was $2 000. Kangaroo sold the inventories to external parties on 1 August 2023.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the year ended 30 June 2022, the dividend paid by Kangaroo effects the NCI of Kangaroo by:

A) nil.

B) $12 000

C) $20 000

D) $32 000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

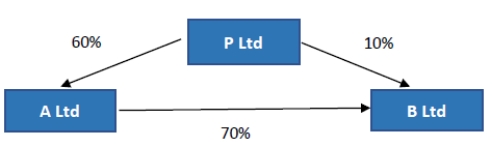

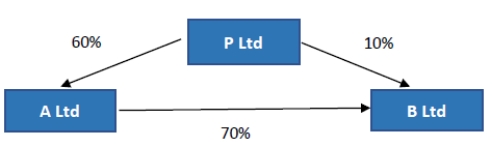

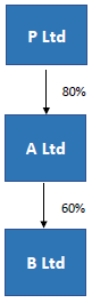

13

Consider the following economic entity structure.  The indirect NCI in B Ltd is the same group of shareholders as the:

The indirect NCI in B Ltd is the same group of shareholders as the:

A) shareholders in P Ltd.

B) direct NCI in B Ltd.

C) indirect NCI in A Ltd.

D) direct NCI in A Ltd.

The indirect NCI in B Ltd is the same group of shareholders as the:

The indirect NCI in B Ltd is the same group of shareholders as the:A) shareholders in P Ltd.

B) direct NCI in B Ltd.

C) indirect NCI in A Ltd.

D) direct NCI in A Ltd.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

Kate Limited has an 80% ownership interest in Harry Limited. Harry Limited has a 60% ownership interest in William Limited. As a result of these ownership interests, there is a direct ownership interest in William Limited amounting to:

A) 12%.

B) 20%.

C) 40%.

D) 80%.

A) 12%.

B) 20%.

C) 40%.

D) 80%.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

In a group that has a multiple subsidiary structure, the indirect non-controlling interest is entitled to:

A) no share of post-acquisition equity.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of post-acquisition equity only.

D) no share of either pre-acquisition or post-acquisition equity.

A) no share of post-acquisition equity.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of post-acquisition equity only.

D) no share of either pre-acquisition or post-acquisition equity.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

Koala Limited acquired a 75% ownership interest in Kookaburra Limited on 30 June 2021. On the same day, Kookaburra Limited acquired a 60% ownership interest in Kangaroo Limited. The following inter-entity transactions have taken place between the entities in the group during the years ended 30 June 2022 and 30 June 2023:

-On 1 July 2021 Kangaroo sold an item of plant to Koala for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 2 years.

-On 1 September 2021, Kangaroo paid a dividend of $80 000 from profits earned prior to 30 June 2021.

-Koala lent $200 000 to Kangaroo on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $10 000 and for the year ended 30 June 2023 was $20 000.

-On 31 May 2023 Kookaburra sold inventories to Kangaroo for $10 000. Profit earned on the sale was $2 000. Kangaroo sold the inventories to external parties on 1 August 2023.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the year ended 30 June 2023, the effect of the inter-entity sale of inventories on the NCI of Kangaroo Limited is:

A) Nil.

B) $350

C) $210

D) $560

-On 1 July 2021 Kangaroo sold an item of plant to Koala for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 2 years.

-On 1 September 2021, Kangaroo paid a dividend of $80 000 from profits earned prior to 30 June 2021.

-Koala lent $200 000 to Kangaroo on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $10 000 and for the year ended 30 June 2023 was $20 000.

-On 31 May 2023 Kookaburra sold inventories to Kangaroo for $10 000. Profit earned on the sale was $2 000. Kangaroo sold the inventories to external parties on 1 August 2023.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the year ended 30 June 2023, the effect of the inter-entity sale of inventories on the NCI of Kangaroo Limited is:

A) Nil.

B) $350

C) $210

D) $560

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

Dion Ltd acquired a 60% ownership interest in Sean Ltd on 30 June 2021. On the same day, Sean Ltd acquired a 70% ownership interest in Jayden Ltd. The following inter-entity transactions have taken place between the entities in the group during the years ended 30 June 2022 and 30 June 2023.

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the sale of plant on 1 July 2021, what is the net NCI adjustment for the year ending 30 June 2022?

A) $7 000

B) $8 400

C) $10 000

D) $11 200

i. On 1 July 2021 Sean sold an item of plant to Jayden for a profit of $40 000. The remaining useful life of the plant at the date of transfer was 4 years.

ii. On 1 September 2021, Jayden paid a dividend of $50 000 from profits earned since 30 June 2021.

iii. Dion lent $60 000 to Sean on 1 January 2022. Interest charged on the loan for the year ended 30 June 2022 was $4000 and for the year ended 30 June 2023 was $8000.

iv. On 31 May 2022 Dion sold inventories to Jayden for $30 000. Profit earned on the sale was $4000. Jayden sold the inventories to external parties on 1 August 2022.

Details of profits earned by entities within the group for the years ended 30 June 2022 and 30 June 2023 are:

The tax rate is 30%.

For the sale of plant on 1 July 2021, what is the net NCI adjustment for the year ending 30 June 2022?

A) $7 000

B) $8 400

C) $10 000

D) $11 200

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

Consider the following economic entity structure:  The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?

A) I.

B) II.

C) III.

D) IV.

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?

The direct non-controlling interest (DNCI) and indirect non-controlling interest (INCI) are which of the following?A) I.

B) II.

C) III.

D) IV.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

An indirect non-controlling interest arises:

A) when a partly owned subsidiary owns shares in the parent entity.

B) when a wholly owned subsidiary owns shares in the parent entity.

C) only when a partly owned subsidiary holds shares in another subsidiary.

D) only when a wholly owned subsidiary owns shares in another subsidiary.

A) when a partly owned subsidiary owns shares in the parent entity.

B) when a wholly owned subsidiary owns shares in the parent entity.

C) only when a partly owned subsidiary holds shares in another subsidiary.

D) only when a wholly owned subsidiary owns shares in another subsidiary.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

In a group that has a multiple subsidiary structure, the direct non-controlling interest is entitled to:

A) no share of post-acquisition equity.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of post-acquisition equity only.

D) a proportionate share of both pre-acquisition and post-acquisition equity.

A) no share of post-acquisition equity.

B) a proportionate share of pre-acquisition equity only.

C) a proportionate share of post-acquisition equity only.

D) a proportionate share of both pre-acquisition and post-acquisition equity.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

Erin Limited acquired shares in James Limited. At the time of this acquisition James Limited already held shares in Cameron Limited. This form of acquisition of an indirect ownership interest, by Erin Limited in Cameron Limited, is known as a/an:

A) unorthodox acquisition.

B) indirect acquisition.

C) non-sequential acquisition.

D) inconsequential acquisition.

A) unorthodox acquisition.

B) indirect acquisition.

C) non-sequential acquisition.

D) inconsequential acquisition.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

22

In a multiple subsidiary structure, the indirect non-controlling interest is entitled to a proportionate share of:

A) pre-acquisition equity.

B) post-acquisition equity only.

C) both pre- and post-acquisition equity.

D) neither pre- nor post-acquisition equity.

A) pre-acquisition equity.

B) post-acquisition equity only.

C) both pre- and post-acquisition equity.

D) neither pre- nor post-acquisition equity.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

In a multiple subsidiary structure, the direct non-controlling interest is entitled to a proportionate share of:

A) pre-acquisition equity only.

B) post-acquisition amounts of equity only.

C) pre- and post-acquisition amounts of equity.

D) post-acquisition balance of retained earnings only.

A) pre-acquisition equity only.

B) post-acquisition amounts of equity only.

C) pre- and post-acquisition amounts of equity.

D) post-acquisition balance of retained earnings only.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following can result in a loss of control by a parent over a subsidiary?

I. The parent sells some of the shares in the subsidiary.

II. There is a change in the dispersion in the holding of shares by entities comprising the NCI.

III. There may be a change in a contractual arrangement.

A) I, II and III

B) I and II only

C) I and III only

D) II only

I. The parent sells some of the shares in the subsidiary.

II. There is a change in the dispersion in the holding of shares by entities comprising the NCI.

III. There may be a change in a contractual arrangement.

A) I, II and III

B) I and II only

C) I and III only

D) II only

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

25

Where a change in ownership interest results in the loss of control of a subsidiary:

A) the gain or loss will be recorded in other comprehensive income.

B) the gain or loss in the parent's records will equal the consolidated gain or loss.

C) the remaining investment will be recorded at fair value in accordance with AASB 9 Financial Instruments.

D) the remaining investment will be accounted for in accordance with AASB 127 Separate Financial Statements.

A) the gain or loss will be recorded in other comprehensive income.

B) the gain or loss in the parent's records will equal the consolidated gain or loss.

C) the remaining investment will be recorded at fair value in accordance with AASB 9 Financial Instruments.

D) the remaining investment will be accounted for in accordance with AASB 127 Separate Financial Statements.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

Phillip Limited has an ownership interest of 75% in a subsidiary Jacob Limited. Jacob Limited owns 80% of Baxter Limited. At acquisition date the retained earnings of Baxter Limited were $300 000. At consolidation date, the retained earnings of Baxter Limited were $840 000. The indirect non-controlling interest in the retained earnings of Baxter Limited is:

A) $0

B) $108 000

C) $168 000

D) $324 000

A) $0

B) $108 000

C) $168 000

D) $324 000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

Robinson Group had the following debits in the pre-acquisition entry used to consolidate an 80% direct ownership interest in a subsidiary: Retained earnings $240 000, Share capital $360 000, General Reserve $40 000, BCVR $28 000. The amount attributable to the direct non-controlling interest is:

A) $72 000

B) $133 600

C) $150 000

D) $167 000

A) $72 000

B) $133 600

C) $150 000

D) $167 000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

Merrivale Limited has an ownership interest of 80% in a subsidiary Bairnsdale Limited. Bairnsdale owns 60% of Clairmont Limited. Since acquisition date the retained earnings of Clairmont Limited have increased from $100 000 to $250 000. The direct non-controlling interest in the retained earnings of Clairmont is:

A) $0.

B) $12 000.

C) $60 000.

D) $100 000.

A) $0.

B) $12 000.

C) $60 000.

D) $100 000.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

When preparing consolidation adjustment entries to affect a consolidation of a multiple subsidiary structure, intragroup transactions:

A) are not eliminated.

B) are eliminated in full.

C) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction.

D) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction.

A) are not eliminated.

B) are eliminated in full.

C) are partially eliminated to the extent of the ownership interest of the parent entity to each transaction.

D) are ignored as it is impractical to attempt to determine the size of the ownership interest relating to each transaction.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck