Deck 7: Impairment of Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/23

Play

Full screen (f)

Deck 7: Impairment of Assets

1

How often must an impairment test be applied to tangible assets?

A) every two years.

B) at the end of each financial year.

C) only when there is an indication that the asset may be impaired.

D) at each reporting date including interim reporting dates such as half-year.

A) every two years.

B) at the end of each financial year.

C) only when there is an indication that the asset may be impaired.

D) at each reporting date including interim reporting dates such as half-year.

C

2

In relation to the reversal of an impairment loss of an individual asset, which of the following is incorrect?

A) When reversing an impairment loss, the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had no impairment loss been recognised.

B) Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the carrying amount of the asset to recoverable amount.

C) For a depreciable asset, there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

D) If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss.

A) When reversing an impairment loss, the carrying amount cannot be increased to an amount in excess of the carrying amount that would have been determined had no impairment loss been recognised.

B) Where the recoverable amount is less than the carrying amount of an individual asset, the reversal of a previous impairment loss requires adjusting the carrying amount of the asset to recoverable amount.

C) For a depreciable asset, there needs to be a calculation of carrying amount using the depreciation variables applied before the impairment loss to determine what the carrying amount would have been if there had been no impairment loss.

D) If the individual asset is recorded under the cost model, then the increase in the carrying amount is recognised immediately in profit or loss.

B

3

At reporting date Guzzle Limited estimated an impairment loss of $50 000 against its single cash-generating unit. The company had the following assets: headquarters building $200 000; plant $120 000; equipment $40 000. The net carrying amount of the headquarters building after allocation of the impairment loss is:

A) $103 333

B) $150 000

C) $160 000

D) $172 222

A) $103 333

B) $150 000

C) $160 000

D) $172 222

D

4

Berry Pty Ltd has two cash generating units. CGU A had a carrying amount of $1700 and value in use of $1750. CGU B has a carrying amount of $1900 and a value in use of $1800. The carrying amount of the head office assets is $1400. CGU A and B utilise the head office services equally. The impairment loss for CGU A is:

A) $0.

B) $650.

C) $800.

D) $1350.

A) $0.

B) $650.

C) $800.

D) $1350.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

5

When evaluating whether an asset has been impaired, the carrying amount of the asset must be compared to its recoverable amount. Recoverable amount is the higher of:

A) initial cost: and, fair value.

B) original cost: and, net present value.

C) value in use: and, original cost.

D) fair value less costs to sell: and, value in use.

A) initial cost: and, fair value.

B) original cost: and, net present value.

C) value in use: and, original cost.

D) fair value less costs to sell: and, value in use.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

6

An impairment loss occurs when:

A) the asset has a residual value of zero.

B) the recoverable amount of an asset exceeds the carrying amount.

C) the carrying amount of an asset exceeds the recoverable amount.

D) the recoverable amount of an asset exceeds its initial cost.

A) the asset has a residual value of zero.

B) the recoverable amount of an asset exceeds the carrying amount.

C) the carrying amount of an asset exceeds the recoverable amount.

D) the recoverable amount of an asset exceeds its initial cost.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

7

When an asset is measured using the revaluation model, any impairment loss is treated as:

A) a revaluation decrement.

B) a revaluation increment.

C) an off-set against depreciation expense.

D) an addition to depreciation expense.

A) a revaluation decrement.

B) a revaluation increment.

C) an off-set against depreciation expense.

D) an addition to depreciation expense.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

8

Parkes Limited recognised an impairment loss of $20 000 against a cash-generating unit containing the following assets: buildings $50 000; roads $110 000; equipment $40 000. The net carrying amount of the roads after allocation of the impairment loss is:

A) $ 90 000

B) $ 45 000

C) $ 99 000

D) $ 36 000

A) $ 90 000

B) $ 45 000

C) $ 99 000

D) $ 36 000

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

9

If an entity does not expect to recover the carrying amount of an asset, the entity has incurred a/an:

A) depreciation expense.

B) amortisation cost.

C) loss on disposal.

D) impairment loss.

A) depreciation expense.

B) amortisation cost.

C) loss on disposal.

D) impairment loss.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

10

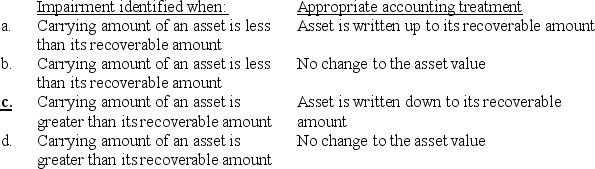

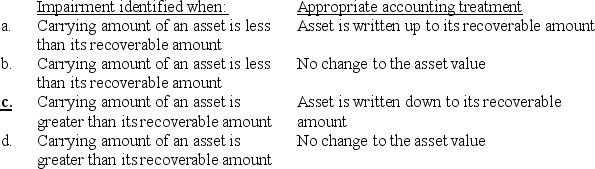

Which of the following identifies an impairment of an asset and describes the appropriate accounting treatment using the cost model as per AASB 136 Impairment of Assets?

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

11

AASB 136 defines value in use as the:

A) amount obtainable from the disposal of an asset, excluding any selling costs.

B) initial cost of an asset less any expected disposal costs.

C) incremental costs directly attributable to the disposal of an asset or cash-generating unit, excluding finance costs and income tax expense.

D) present value of the future cash flows expected to be derived from an asset or cash-generating unit.

A) amount obtainable from the disposal of an asset, excluding any selling costs.

B) initial cost of an asset less any expected disposal costs.

C) incremental costs directly attributable to the disposal of an asset or cash-generating unit, excluding finance costs and income tax expense.

D) present value of the future cash flows expected to be derived from an asset or cash-generating unit.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

12

Lacey Limited expected future cash flows from the use of plant as follows: End of Year 1 $14 000; End of Year 2 $15 000; End of Year 3 $12 000. The discount rate was determined as 9%. The value in use of the plant is:

A) $41 000

B) $34 735

C) $37 862

D) $Nil.

A) $41 000

B) $34 735

C) $37 862

D) $Nil.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

13

Compose Limited estimated an impairment loss of $2 500 000 against its single cash-generating unit. The company had the following assets: headquarters building $3 000 000; plant $1 600 000; equipment $1 400 000. The net carrying amount of the plant after allocation of the impairment loss is:

A) $Nil

B) $933

C) $817

D) $1750

A) $Nil

B) $933

C) $817

D) $1750

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

14

Goodwill acquired under a business combination is subject to an impairment test every:

A) year.

B) two years.

C) three years.

D) five years.

A) year.

B) two years.

C) three years.

D) five years.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

15

When an asset is measured using the cost model, an impairment loss is:

A) set off against the balance of revenue.

B) recognised directly in equity.

C) accumulated in a separate 'accumulated impairment losses' account.

D) included in the balance of the accumulated depreciation and impairment losses account for that asset.

A) set off against the balance of revenue.

B) recognised directly in equity.

C) accumulated in a separate 'accumulated impairment losses' account.

D) included in the balance of the accumulated depreciation and impairment losses account for that asset.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

16

Under the cost model, an impairment loss would be recorded as:

A) DR Sales, CR Impairment loss.

B) DR Impairment loss, CR Accumulated depreciation and impairment losses.

C) DR Accumulated impairment losses, CR Impairment loss.

D) DR Accumulated impairment losses, CR Asset revaluation (equity).

A) DR Sales, CR Impairment loss.

B) DR Impairment loss, CR Accumulated depreciation and impairment losses.

C) DR Accumulated impairment losses, CR Impairment loss.

D) DR Accumulated impairment losses, CR Asset revaluation (equity).

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

17

As per AASB 136 Impairment of Assets, the recoverable amount test requires an entity to compare the fair value of an asset less costs to sell, with:

A) its disposal value.

B) its value in use.

C) the amount obtainable from the sale of the asset.

D) the costs directly attributable to the liquidation of the asset.

A) its disposal value.

B) its value in use.

C) the amount obtainable from the sale of the asset.

D) the costs directly attributable to the liquidation of the asset.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

18

When assessing the recoverable amount of assets that have previously been subject to an impairment loss, which of the following indicators assist in providing external evidence that an impairment loss has reversed:

A) a decrease in market interest rates during the period.

B) a significant decrease in the asset's market value during the period.

C) an adverse effect on the entity from significant changes that have taken place.

D) internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

A) a decrease in market interest rates during the period.

B) a significant decrease in the asset's market value during the period.

C) an adverse effect on the entity from significant changes that have taken place.

D) internal reporting sources indicate that the economic performance of the asset will not be as good as expected.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following assets need to be tested for impairment every year? I intangible assets with indefinite useful lives

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A) I, II and III only.

B) II, III and IV only.

C) I, III and IV only.

D) I, II and IV only.

II intangible assets not yet available for use

III intangible assets accounted for under the revaluation method

IV goodwill acquired in a business combination

A) I, II and III only.

B) II, III and IV only.

C) I, III and IV only.

D) I, II and IV only.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

20

Noble Limited estimated that it would receive future cash flows from the use of equipment as follows: End of Year 1 $20 000

End of Year 2 $70 000

End of Year 3 $40 000

End of Year 4 $30 000

The discount rate was determined as 5%. The 'value in use' of the equipment is:

A) $141 774

B) $160 000

C) $142 727

D) unable to determine from the information provided.

End of Year 2 $70 000

End of Year 3 $40 000

End of Year 4 $30 000

The discount rate was determined as 5%. The 'value in use' of the equipment is:

A) $141 774

B) $160 000

C) $142 727

D) unable to determine from the information provided.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

21

During 2021, Simpson Limited estimated that the carrying amount of goodwill was impaired by $20 000. In 2022, the company reassessed goodwill and determined that the goodwill initially acquired still existed. The appropriate accounting treatment in 2022 is:

A) reverse the previous goodwill impairment loss.

B) recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account.

C) increase goodwill by an adjustment to retained earnings.

D) ignore the reversal as it is prohibited by AASB 136 Impairment of Assets.

A) reverse the previous goodwill impairment loss.

B) recognise the revalued amount of goodwill by an adjustment against the asset revaluation surplus account.

C) increase goodwill by an adjustment to retained earnings.

D) ignore the reversal as it is prohibited by AASB 136 Impairment of Assets.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

22

AASB 136 Impairment of Assets requires which of the following disclosures for each class of assets: I The line item(s) of the statement of profit or loss and other comprehensive income in which impairment losses are included.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in other comprehensive income.

IV The beginning and ending balances of any accumulated impairment account.

A) I, II and III only.

B) I, II, III and IV.

C) II and IV only.

D) IV only.

II The amount of reversals of impairment losses during the period.

III The amount of impairment losses recognised directly in other comprehensive income.

IV The beginning and ending balances of any accumulated impairment account.

A) I, II and III only.

B) I, II, III and IV.

C) II and IV only.

D) IV only.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following is required to be disclosed for each class of assets? I the amount of impairment losses recognised in profit or loss during the period.

II the amount of reversals of impairment losses recognised in profit or loss during the period.

III the amount of impairment losses on revalued assets recognised in other comprehensive income during the period.

IV the amount of reversals of impairment losses on revalued assets recognised directly in other comprehensive income during the period.

A) III and IV only.

B) I, II and III only.

C) I, II, III and IV

D) I and II only.

II the amount of reversals of impairment losses recognised in profit or loss during the period.

III the amount of impairment losses on revalued assets recognised in other comprehensive income during the period.

IV the amount of reversals of impairment losses on revalued assets recognised directly in other comprehensive income during the period.

A) III and IV only.

B) I, II and III only.

C) I, II, III and IV

D) I and II only.

Unlock Deck

Unlock for access to all 23 flashcards in this deck.

Unlock Deck

k this deck