Deck 5: Capital Budgeting: Further Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/50

Play

Full screen (f)

Deck 5: Capital Budgeting: Further Issues

1

Exclusive Fashions Pty Ltd is considering establishing a new high- end retail fashion outlet in Double Bay,Sydney.The outlet will be established in a vacant building owned by the company.Ms Chevalier de Grammont,the CEO of Exclusive Fashions,expects the initial outlay for refurbishment and stock to total $3,450,000.None of the initial outlay can be depreciated for tax purposes.The outlet is forecast to turnover $1,580,000 per year in EBDIT for the next 7 years.At that time the outlet will be sold to a third party for an estimated $2,500,000.The building in which the outlet will be housed was purchased by Exclusive Fashions 6 years ago for $2,750,000 and has been fully depreciated for tax purposes.If Exclusive is subject to a tax rate of 30% and has a cost of capital of 15% p.a. ,what is the NPV of this project?

A)$4,063,305.78

B)- $4,551,603.06

C)$1,151,424.23

D)$1,809,314.05

A)$4,063,305.78

B)- $4,551,603.06

C)$1,151,424.23

D)$1,809,314.05

$1,809,314.05

2

Cash flows used in capital budgeting should include which of the following items?

A)Depreciation expense

B)Opportunity costs

C)Sunk costs

D)Financing charges

A)Depreciation expense

B)Opportunity costs

C)Sunk costs

D)Financing charges

Opportunity costs

3

Waugh Corp is evaluating the construction of a new factory on land it bought several years ago for $7.5 million.In this evaluation,the cost of the land is treated as a(n).

A)Opportunity cost

B)Cash flow

C)Sunk cost

D)Initial outlay

A)Opportunity cost

B)Cash flow

C)Sunk cost

D)Initial outlay

Sunk cost

4

measures the risk of a capital budgeting project by estimating the NPVs relating to a best case,base case and worst case cash flow estimates.

A)Monte Carlo analysis

B)Sensitivity analysis

C)Multiple regression analysis

D)Scenario analysis

A)Monte Carlo analysis

B)Sensitivity analysis

C)Multiple regression analysis

D)Scenario analysis

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following forms of tax does not directly affect cash flows but rather only affects them via its effect on demand (except for the banking and finance industry)?

A)Fringe Benefits Tax (FBT)

B)Capital Gains Tax (CGT)

C)Goods and Services Tax (GST)

D)Corporate Income Tax

A)Fringe Benefits Tax (FBT)

B)Capital Gains Tax (CGT)

C)Goods and Services Tax (GST)

D)Corporate Income Tax

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

6

What is the value of the depreciation tax shield where a company purchases equipment for $490,000 and depreciates it for tax purposes over its useful life of 7 years? Company tax rate is 21%.

A)$14,700

B)$49,000

C)$34,300

D)Cannot be determined

A)$14,700

B)$49,000

C)$34,300

D)Cannot be determined

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

7

Jolly Roger Beverages Pty Ltd is considering purchasing one of two new rum fermenting machines to use at its Nowra distillery.The MegaDistiller 3000 costs $390,000 and is expected to have operating costs $33,000 per year for five years at which time it is considered worthless.The LiteBrewer 409 costs $350,000 and is expected to have operating costs of $29,500 per year for four years at which time it is considered worthless.Both machines perform the same function.The appropriate discount rate for the company is 10%.Based on an NPV analysis what should Jolly Roger Beverages do?

A)The company should buy the MegaDistiller 3000.

B)The company should buy the LiteBrewer 409.

C)Both have negative NPVs and therefore both should be rejected.

D)We do not have any information on revenues and therefore cannot make a decision.

A)The company should buy the MegaDistiller 3000.

B)The company should buy the LiteBrewer 409.

C)Both have negative NPVs and therefore both should be rejected.

D)We do not have any information on revenues and therefore cannot make a decision.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

8

Tisdall Lawnmowers Manufacturing (TLM)Ltd is looking to expand its production facilities in Geelong.Mr Neil Gunpri,the finance manager of TLM,estimates the new facilities will require an initial outlay of $9.2 million and will generate EBDIT of $3.4 million each year for 5 years.There is expected to be no salvage value.Furthermore,$2 million of the initial outlay is depreciable for tax purposes on a straight- line basis over 5 years.The company pays tax at a rate of 30% and has a cost of capital of 12.5% p.a.What is the NPV of the project?

A)- $298,579

B)$2,905,932

C)$698,780

D)- $725,847

A)- $298,579

B)$2,905,932

C)$698,780

D)- $725,847

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following would not constitute a sunk cost?

A)The purchase price of $250,000 for a new printing machine after a successful bid for additional advertising print work that will generate for the printing company an estimated $430,000 in net cash flows per year for the next 3 years.

B)The clean- up costs of $450,000 on a block of industrial land contaminated by industrial waste ordered by the Environment Protection Agency (EPA).This land could then be used to build twelve luxury townhouses at a cost of $3.8 million which would then be sold one year later (after they are constructed)for $930,000 each.

C)A fee of $50,000 paid to a marketing company for assessing the feasibility of a potential casino project that has an outlay of $250 million and is expected to produce net cash flows of $10.3 million per year for 20 years.

D)The purchase price of $1.23 million for block of land five years ago that could be used for a new factory costing $2.35 million to construct and which is expected to produce net cash flows of $0.945 million per year for 5 years.

A)The purchase price of $250,000 for a new printing machine after a successful bid for additional advertising print work that will generate for the printing company an estimated $430,000 in net cash flows per year for the next 3 years.

B)The clean- up costs of $450,000 on a block of industrial land contaminated by industrial waste ordered by the Environment Protection Agency (EPA).This land could then be used to build twelve luxury townhouses at a cost of $3.8 million which would then be sold one year later (after they are constructed)for $930,000 each.

C)A fee of $50,000 paid to a marketing company for assessing the feasibility of a potential casino project that has an outlay of $250 million and is expected to produce net cash flows of $10.3 million per year for 20 years.

D)The purchase price of $1.23 million for block of land five years ago that could be used for a new factory costing $2.35 million to construct and which is expected to produce net cash flows of $0.945 million per year for 5 years.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is not a technique to assess the risk level of a project's NPV?

A)Scenario analysis

B)Monte Carlo analysis

C)Correlation analysis

D)Sensitivity analysis

A)Scenario analysis

B)Monte Carlo analysis

C)Correlation analysis

D)Sensitivity analysis

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

11

Bosworth Industries has decided to terminate a table manufacturing project and sell the machine used to produce the tables.The machine was purchased five years ago for $280,000.It has been depreciated using straight- line depreciation over a seven- year period.Bosworth has an offer from another table manufacturer to purchase the machine for $90,000.If Bosworth pays 30% company tax,what will be the after- tax cash flow generated by the sale of the machine?

A)$87,000

B)$97,000

C)$90,000

D)$63,000

A)$87,000

B)$97,000

C)$90,000

D)$63,000

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

12

Trade Federation Manufacturers (TFM)Ltd is looking to expand its production facilities in Hong Kong.Mr Nute Gunray,the finance manager of TFM,estimates the new facilities will require an initial outlay of $9.2 million and will generate EBDIT of $3.4 million each year for 5 years.There is expected to be no salvage value.Furthermore,$4 million of the initial outlay is depreciable for tax purposes on a straight- line basis over 5 years.The company pays tax at a rate of 30% and has a cost of capital of 11.5% p.a.Mr Gunray expects to finance the project using a mix of debt and equity and has determined that the interest expenses will be $0.8 million per year.What is the NPV of the project?

A)$1,238,650.64

B)- $513,290.72

C)- $1,681,251.63

D)$362,679.95

A)$1,238,650.64

B)- $513,290.72

C)- $1,681,251.63

D)$362,679.95

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

13

Morgan Infrastructure Group Ltd owns an office block they are considering using for a new project.Currently the office block is being leased out to Blackbeard Caribbean Travel Pty Ltd.The new project however will require all of the office block's available space and hence,if it is undertaken then the lease will have to be terminated.The rent from lease of the existing office space should be considered as in evaluating the new project.

A)A sunk cost

B)An opportunity cost

C)A set- up cost

D)A side effect

A)A sunk cost

B)An opportunity cost

C)A set- up cost

D)A side effect

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

14

Risk analysis in capital budgeting is concerned about:

A)The actual lost sales of existing products

B)The random choice of variables

C)The uncertainty of the project's cash flow

D)All of the above

A)The actual lost sales of existing products

B)The random choice of variables

C)The uncertainty of the project's cash flow

D)All of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

15

When examining the change in NPV using scenario analysis,reducing sales by 10%,increasing operating costs by 10%,increasing lost sales by 10%,increasing selling and admin costs by 10%,and increasing working capital by 10% would probably represent which type of scenario?

A)'Base' case

B)'Best' case

C)'Normal' case

D)'Worst' case

A)'Base' case

B)'Best' case

C)'Normal' case

D)'Worst' case

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

16

Capital Mines NL is examining establishing a copper mine on Bougainville Island.The mine will cost $250 million to establish.It is expected that the mine will yield $25.4 million next year in revenue,growing at 3% p.a.thereafter.Demand for copper is expected to be high and the mine is expected to operate at full capacity for the foreseeable future.Because the mine uses cyanide in the smelting process the company has agreed to pay compensation of $2.4 million next year to the local people to pay for cleaning the waste up and for social development.This compensation will grow in line with revenue growth.If Capital Mines has a cost of capital of 12%,what is the NPV of the project?

A)- $58,333,333.33

B)$32,222,222.22

C)$5,555,555.55

D)$12,222,222.22

A)- $58,333,333.33

B)$32,222,222.22

C)$5,555,555.55

D)$12,222,222.22

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

17

Capital set aside to ensure the smooth running of the project at the time of investment that is subsequently recovered at the end of the projects life is known as:

A)An opportunity cost

B)A side effect of the project

C)A sunk cost

D)Working capital

A)An opportunity cost

B)A side effect of the project

C)A sunk cost

D)Working capital

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

18

If one variable in a net present value analysis scenario is changed,you would be undertaking:

A)Sensitivity analysis

B)Simulation analysis

C)Scenario analysis

D)None of the above

A)Sensitivity analysis

B)Simulation analysis

C)Scenario analysis

D)None of the above

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

19

LeoVinci Gallery Ltd owns a building in North Sydney that houses their fine arts business.At present the gallery leases out the ground floor of the building to Young Artists Trust for a rental income of $4,800 per month.However,Sir Michael Rose,the curator of the gallery would like to expand the galleries bustling fine arts auction business by taking over the ground floor and running an additional auction house.This would necessitate terminating Young Artist Trust's lease and would incur an immediate penalty of $10,000.Sir Michael has estimated the initial outlay setting up the ground floor auction house will be $150,000 and that it will yield a cash flow of $9,600 per month for the next four years.At that time they will review the project.If LeoVinci has a required return of 1% per month,what is the NPV of the project?

A)$22,275.01

B)$214,550.01

C)$32,275.01

D)$204,550.01

A)$22,275.01

B)$214,550.01

C)$32,275.01

D)$204,550.01

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

20

Monte Carlo analysis is also known as:

A)Scenario analysis

B)Simulation analysis

C)Sensitivity analysis

D)Risk analysis

A)Scenario analysis

B)Simulation analysis

C)Sensitivity analysis

D)Risk analysis

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

21

ABC accounting firm estimates that new bookkeeping software will increase sales of its accounting services by $450,000 per year for the next 5 years,after which time the software will be outdated and useless.The company has forecast its operating expenses from this new project at $230,000 per year.The licence fees and installation costs on the new software will amount to $640,000,which can be depreciated on a straight- line basis over the five- year life of the project.There is expected to be no salvage value.ABC pays company tax at a rate of 30% and has no interest expenses.ABC has a cost of capital of 10% p.a.What would be the increase/decrease in NPV of the investment if sales increased by 8% each year and operating expenses increased by 11% each year?

A)+$28,393

B)- $117,173

C)+$51,665

D)- $51,665

A)+$28,393

B)- $117,173

C)+$51,665

D)- $51,665

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

22

Sunk costs are avoidable cash flows,or cash flows that have been incurred in the past.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

23

Generally speaking,interest expenses should be included in the cash flows for capital budgeting evaluation as they represent a cash outflow.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

24

An example of a real option embedded in a project is the abandonment option.This option would allow a manager to terminate an unsuccessful project at the expiration of its useful life.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

25

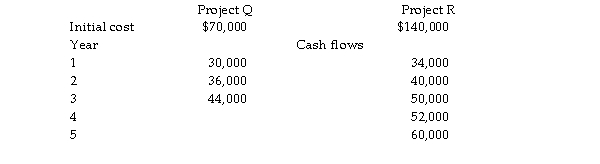

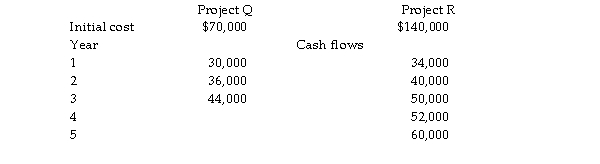

Ponsford Ltd is evaluating two projects,A and B.The relevant cash flows for each project are set out below.Both projects are similar in risk and their applicable cost of capital is 12%.  Which project should Ponsford Ltd chose?

Which project should Ponsford Ltd chose?

Which project should Ponsford Ltd chose?

Which project should Ponsford Ltd chose?

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

26

Woodfull Corporation bought an empty warehouse building two years ago for $300,000.Management is currently evaluating a project to convert the building into a cricket bat manufacturing plant.Alternatively,the building could be leased for $100,000 per annum.If the evaluation,the cost of the building should be treated as a(n)and the lease rental as a(n) .

A)Initial cost,cash flow

B)Sunk cost,opportunity cost

C)Opportunity cost,sunk cost

D)Initial cost,sunk cost

A)Initial cost,cash flow

B)Sunk cost,opportunity cost

C)Opportunity cost,sunk cost

D)Initial cost,sunk cost

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

27

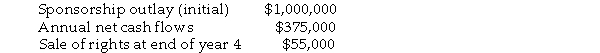

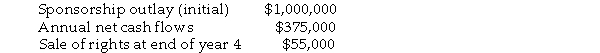

Jeremy's Sports Equipment is considering sponsoring a 4- year tournament which is expected to produce the following cash flows:  If Jeremy's cost of capital is 12%,what is the NPV of this project?

If Jeremy's cost of capital is 12%,what is the NPV of this project?

A)$201,568

B)$321,456

C)$173,855

D)$138,875

If Jeremy's cost of capital is 12%,what is the NPV of this project?

If Jeremy's cost of capital is 12%,what is the NPV of this project?A)$201,568

B)$321,456

C)$173,855

D)$138,875

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

28

The cash flows used in the capital budgeting will be certain to occur.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

29

What is the size of the depreciation tax shield where a company purchases equipment for $350,000 and depreciates it for tax purposes over its useful life of 7 years?

A)$15,000

B)$105,000

C)$50,000

D)$35,000

A)$15,000

B)$105,000

C)$50,000

D)$35,000

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

30

Rogers Printing Pty Ltd is considering purchasing one of two new printing machines to use at its Nowra factory.The Megaprinter 3000 costs $580,000 and is expected to have net cash flows of $43,000 per year for six years at which time it is considered worthless.The Liteprinter 409 costs

$450,000 and is expected to have net cash flows of $32,500 per year for four years at which time it is considered worthless.Both machines perform the same function.The appropriate discount rate for the company is 10%.Based on an NPV analysis what should Rogers Printing do?

A)The company should buy the Megaprinter 3000.

B)The company should buy the Liteprinter 409

C)Both have negative NPVs and therefore both should be rejected.

D)We do not have any information on revenues and therefore cannot make a decision.

$450,000 and is expected to have net cash flows of $32,500 per year for four years at which time it is considered worthless.Both machines perform the same function.The appropriate discount rate for the company is 10%.Based on an NPV analysis what should Rogers Printing do?

A)The company should buy the Megaprinter 3000.

B)The company should buy the Liteprinter 409

C)Both have negative NPVs and therefore both should be rejected.

D)We do not have any information on revenues and therefore cannot make a decision.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

31

Cash flows used in capital budgeting should exclude which of the following items?

A)Opportunity costs

B)Taxation

C)Sunk costs

D)Side effects

A)Opportunity costs

B)Taxation

C)Sunk costs

D)Side effects

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

32

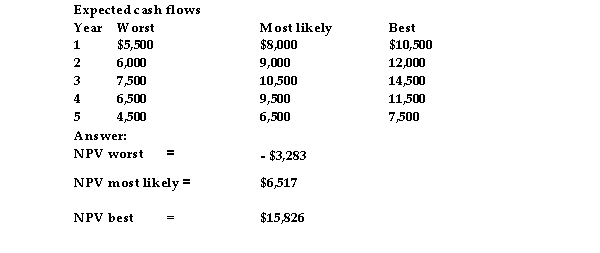

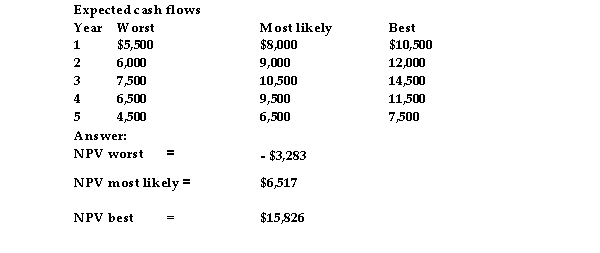

O'Reilly Ltd is considering purchasing a spinning machine which will cost $25,000.It has a five- year life and will be worthless after that.O'Reilly's cost of capital is 12%.Because of uncertainty in the economic situation the after- tax cash inflows for each of the five years are uncertain.The company has estimated expected cash flows,as shown below,for three possible economic results: worst case,most likely case and best case.Calculate the NPVs for each of the possible economic results.Is this project very risky?  Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Range is $15,826 - (- $3,283)= $19,109 which suggests the project is quite risky.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following has the effect of reducing the amount of tax paid on a project?

A)A tax shield

B)EBIT

C)A side effect

D)EBDIT

A)A tax shield

B)EBIT

C)A side effect

D)EBDIT

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

34

When examining the change in NPV using scenario analysis,increasing sales by 10%,reducing operating costs by 10%,reducing lost sales by 10%,reducing selling and admin costs by 10%,and reducing working capital by 10% would probably represent which type of scenario?

A)'Best' case

B)'Worst' case

C)'Normal' case

D)'Base' case

A)'Best' case

B)'Worst' case

C)'Normal' case

D)'Base' case

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

35

XHZ accounting firm estimates that new bookkeeping software will increase sales of its accounting services by $450,000 per year for the next 5 years,after which time the software will be outdated and useless.The company has forecast its operating expenses from this new project at $230,000 per year.The licence fees and installation costs on the new software will amount to $640,000,which can be depreciated on a straight- line basis over the five- year life of the project.There is expected to be no salvage value.XHZ pays company tax at a rate of 30% and has no interest expenses.XHZ has a cost of capital of 10% p.a.What would be the increase/decrease in NPV of the investment if sales were 8% higher and operating expenses were 11% higher?

A)+$117,173.22

B)- $117,173.22

C)+$28,392.99

D)- $28,392.99

A)+$117,173.22

B)- $117,173.22

C)+$28,392.99

D)- $28,392.99

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

36

When considering the taxation impact on capital budgeting decisions,which of the following statements is true?

A)Non- cash expenses do not form part of allowable tax deductions.

B)Allowable deductions are never taken into account.

C)Goods and services tax can be ignored most of the time.

D)None of these statements are true.

A)Non- cash expenses do not form part of allowable tax deductions.

B)Allowable deductions are never taken into account.

C)Goods and services tax can be ignored most of the time.

D)None of these statements are true.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

37

Lightweight Industries is considering purchasing a new forklift that,if adopted,is expected to yield an EBDIT of $23,000 per year for the next five years.The forklift will cost the company $100,000 and is expected to be depreciated for tax and accounting purposes on a straight- line basis over a five- year life.The company tax rate is 30% per annum.The company's cost of capital is 12.5% p.a.How much is the cash flow per annum generated by this project in years one through five?

A)$21,350.00

B)$16,100.00

C)$20,088.00

D)$22,100.00

A)$21,350.00

B)$16,100.00

C)$20,088.00

D)$22,100.00

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

38

Why is the Fisher effect a useful expression in NPV calculations?

A)It can be used to convert nominal interest rates to real interest rates.

B)It can be used to convert real interest rates to nominal interest rates.

C)It incorporates purchasing power parity into the interest rate.

D)Both A and B

A)It can be used to convert nominal interest rates to real interest rates.

B)It can be used to convert real interest rates to nominal interest rates.

C)It incorporates purchasing power parity into the interest rate.

D)Both A and B

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

39

Accounting income represent actual flows of cash to and from the real assets underlying a project.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not likely to produce a side effect which should be evaluated in the context of capital budgeting?

A)The introduction of property management services in a sales- only office of a real estate agent.

B)A major super market chain opens a new store across the road from another of its stores.

C)An accounting firm trains several of its staff to qualify as financial planners.

D)A print and copy shop acquires a second bulk print machine due to increased demand

A)The introduction of property management services in a sales- only office of a real estate agent.

B)A major super market chain opens a new store across the road from another of its stores.

C)An accounting firm trains several of its staff to qualify as financial planners.

D)A print and copy shop acquires a second bulk print machine due to increased demand

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

41

Simulation analysis involves looking at the change in the value of an NPV for a best case situation and a worst case situation relative to a base case situation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

42

Nominal cash flows discounted at a nominal discount rate should yield the same NPV as real cash flows discounted at a real discount rate.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

43

The real rate of return is less than the arithmetic difference between the inflation rate and the nominal rate of return.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

44

Monte Carlo analysis normally involves increasing or decreasing the values of different variables of the projects in a random manner based upon the assumption of mathematical distribution of these variables.This generates a large number of NPVs and enables the distribution of the NPVs to be seen.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

45

Sensitivity analysis normally involves looking at the change in the value of an NPV for a best case situation and a worst case situation relative to a base case situation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

46

Tax depreciation is a non- cash item that should be included in calculating the tax expense in capital budgeting calculations.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

47

Cash flows forecast in nominal terms must also be discounted using a nominal discount rate.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

48

When calculating net cash flows it is important to use the accounting income.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

49

Interest expenses and loan repayments are excluded from the free cash flow calculation.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck

50

Working capital will typically involve a positive cash inflow in time 0 and a negative cash outflow at the end of the project's life.

Unlock Deck

Unlock for access to all 50 flashcards in this deck.

Unlock Deck

k this deck