Deck 10: The Pricing Efficiency of Capital Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/54

Play

Full screen (f)

Deck 10: The Pricing Efficiency of Capital Markets

1

Which of the following describes a strong- form efficient market?

A)Share prices reflect all available information.

B)Share prices reflect all publicly available information.

C)Share prices reflect all previous price information.

D)None of the above

A)Share prices reflect all available information.

B)Share prices reflect all publicly available information.

C)Share prices reflect all previous price information.

D)None of the above

Share prices reflect all available information.

2

Market efficiency refers to how quickly securities prices may react to what?

A)New dividend information

B)New cash flow information

C)New earnings information

D)All of the above

A)New dividend information

B)New cash flow information

C)New earnings information

D)All of the above

All of the above

3

On 1 July 2006 Maxicorp Holdings Ltd announced an increase in EPS for 20% for the financial year 2005/2006.This increase was already predicted by market analysts.What will be the likely impact upon Maxicorp's share price immediately after this announcement?

A)The price will likely fall after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely remain unchanged after the announcement.

D)Any of the above reactions is equally likely.

A)The price will likely fall after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely remain unchanged after the announcement.

D)Any of the above reactions is equally likely.

The price will likely remain unchanged after the announcement.

4

According to Aitken,Brown,Frino and Walter (1995),how long should it take for the share price of large stocks to fully impound new earnings information?

A)10 minutes

B)60 minutes

C)90 minutes

D)30 minutes

A)10 minutes

B)60 minutes

C)90 minutes

D)30 minutes

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following describes a semi- strong form efficient market?

A)Share prices reflect all available information.

B)Share prices reflect all publicly available information.

C)Share prices reflect all previous price information.

D)None of the above

A)Share prices reflect all available information.

B)Share prices reflect all publicly available information.

C)Share prices reflect all previous price information.

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

6

When price movements follow an unpredictable pattern it is known as what?

A)A head and shoulders chart

B)A straddle

C)A random walk

D)None of the above

A)A head and shoulders chart

B)A straddle

C)A random walk

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

7

A mechanical trading rule that generates a buy signal if the price of the security moves by more than a pre- established percentage from its previous lowest price and a sell signal if it again moves by the same percentage from its previous highest price is known as what?

A)A technical rule

B)A block rule

C)A filter rule

D)A fundamental rule

A)A technical rule

B)A block rule

C)A filter rule

D)A fundamental rule

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

8

Assuming semi- strong form efficiency,which of the following statements is incorrect?

A)Even though a company's share price has increased in each of the past 6 months,this does not indicate that the price will also increase during the current month.

B)Investors cannot consistently beat the market by relying on information disclosed in companies' most recent annual reports.

C)An investor cannot consistently beat the market by solely using information published in The Australian Financial Review.

D)Managers who have information not available to the public cannot consistently earn abnormal returns.

A)Even though a company's share price has increased in each of the past 6 months,this does not indicate that the price will also increase during the current month.

B)Investors cannot consistently beat the market by relying on information disclosed in companies' most recent annual reports.

C)An investor cannot consistently beat the market by solely using information published in The Australian Financial Review.

D)Managers who have information not available to the public cannot consistently earn abnormal returns.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

9

In a strong- form efficient market,which of the following may still allow a trader to generate abnormal returns?

A)Buying shares after the announcement of an increase in earnings

B)Buying shares after hearing form a friend in the company that a merger will soon be announced

C)Identifying previous share price trends and then trading on them

D)None of the above

A)Buying shares after the announcement of an increase in earnings

B)Buying shares after hearing form a friend in the company that a merger will soon be announced

C)Identifying previous share price trends and then trading on them

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

10

Ball (1978)attempted to determine whether can be used to generate profits.

A)Paper analysis

B)Systematic rules

C)Fundamental rules

D)Trading rules

A)Paper analysis

B)Systematic rules

C)Fundamental rules

D)Trading rules

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

11

Repeated patterns or seasonal behaviours in stock prices are known as what?

A)Regularities

B)Irregularities

C)Anomalies

D)Both A and B

E)Both A and C

A)Regularities

B)Irregularities

C)Anomalies

D)Both A and B

E)Both A and C

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

12

The study by Aitken,Brown,Frino and Walter (1995)into speed of adjustment following earnings announcements found that which type of stocks had the longest period of adjustment?

A)Large stocks

B)Small stocks

C)Medium stocks

D)Index stocks

A)Large stocks

B)Small stocks

C)Medium stocks

D)Index stocks

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following statements is correct?

A)In a semi- strong- form efficient market,the expected returns on shares and bonds must be the same

B)It is possible to have some irrational investors in a rational market even though the theory of market efficiency assumes that markets behave as if all investors are rational

C)In a strong- form efficient market,high beta shares must have the same expected return as low beta shares

D)In a weak- form efficient market,an investor cannot outperform the market even with private information

A)In a semi- strong- form efficient market,the expected returns on shares and bonds must be the same

B)It is possible to have some irrational investors in a rational market even though the theory of market efficiency assumes that markets behave as if all investors are rational

C)In a strong- form efficient market,high beta shares must have the same expected return as low beta shares

D)In a weak- form efficient market,an investor cannot outperform the market even with private information

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

14

The theory of market efficiency assumes that:

A)Investors have differing ideas about future share prices

B)Investors are always irrational

C)Investors are always rational

D)None of the above

A)Investors have differing ideas about future share prices

B)Investors are always irrational

C)Investors are always rational

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

15

When the market adjusts to new information,investors will buy shares where:

A)There is no uncertainty about future returns left to be exploited

B)Expected return is more than the required return

C)Expected return is less than the required return

D)All of the above

A)There is no uncertainty about future returns left to be exploited

B)Expected return is more than the required return

C)Expected return is less than the required return

D)All of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

16

Ball (1978)tested a trading strategy known as .

A)Filter rules

B)Gann analysis

C)Margin analysis

D)Retracement rules

A)Filter rules

B)Gann analysis

C)Margin analysis

D)Retracement rules

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is not a previously identified market anomaly?

A)December effect

B)Beginning- of- day effect

C)End- of- tax- year effect

D)All of the above

E)None of the above

A)December effect

B)Beginning- of- day effect

C)End- of- tax- year effect

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

18

According to the theory of market efficiency,

A)Prices of actively traded shares will be overvalued in an efficient market

B)Prices of actively traded shares will be undervalued in an efficient market

C)Prices of actively traded shares will be the same as their true values in an efficient market

D)Prices of actively traded shares can be undervalued or overvalued in an efficient market

A)Prices of actively traded shares will be overvalued in an efficient market

B)Prices of actively traded shares will be undervalued in an efficient market

C)Prices of actively traded shares will be the same as their true values in an efficient market

D)Prices of actively traded shares can be undervalued or overvalued in an efficient market

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

19

Aitken and Frino (1996)examined the price reactions to 'block trades' on the ASX.They found it takes on average trades for the market to impound the information contained in such transactions.

A)3

B)5

C)10

D)2

A)3

B)5

C)10

D)2

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

20

On 6 January 2009 Fine Textiles (FTX)Ltd announces its interim dividend payment.The interim dividend paid will be 20 per cent lower than last year.The market had expected a decline of 30 per cent relative to last year.What will be the likely impact of this news on Fine Textile's share price?

A)The price will likely remain unchanged after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely fall after the announcement.

D)Any of the above reactions is equally likely.

A)The price will likely remain unchanged after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely fall after the announcement.

D)Any of the above reactions is equally likely.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

21

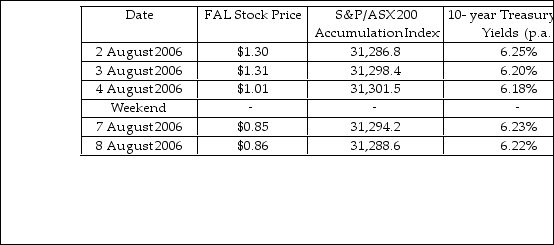

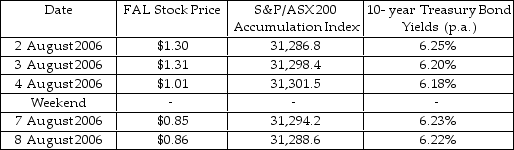

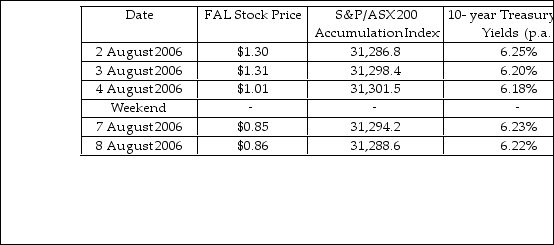

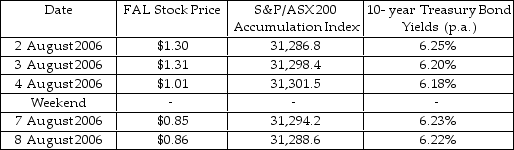

Falcon Technologies (FAL)Ltd announced at 10:15am on the 4 August 2006 an increase in EPS of 10% relative to the previous year.The following table shows the share price of FAL and the value of the S&P/ASX 200 index around the time of the announcement.

The beta of FAL is 1.8.

The beta of FAL is 1.8.

Using this information answer the following questions:

a)What are the abnormal returns surrounding the earnings announcement of Falcon Technologies?

b)How has the market reacted to the earnings announcement? How can you explain this reaction?

c)Are the abnormal returns generated by FAL around its EPS announcement consistent with the concept of market efficiency? What level of efficiency does this example allow us to comment upon? Explain.

The beta of FAL is 1.8.

The beta of FAL is 1.8.Using this information answer the following questions:

a)What are the abnormal returns surrounding the earnings announcement of Falcon Technologies?

b)How has the market reacted to the earnings announcement? How can you explain this reaction?

c)Are the abnormal returns generated by FAL around its EPS announcement consistent with the concept of market efficiency? What level of efficiency does this example allow us to comment upon? Explain.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following describes a weak form efficient market?

A)Share prices reflect all publicly available information.

B)Share prices reflect all previous price information.

C)Share prices reflect all available information.

D)None of the above

A)Share prices reflect all publicly available information.

B)Share prices reflect all previous price information.

C)Share prices reflect all available information.

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

23

On 6 January 2006 Fine Textiles (FTX)Ltd announces its interim dividend payment.The interim dividend paid will be $0.18.The market had a dividend of $0.22.On 5 January 2006 FTX shares closed at $5.46.On 6 January FTX shares closed at $5.65 (trading cum- dividend).FTX has a beta of 1.2.If the yield on 10- year Treasury bonds on the 6 January was 6.75% p.a.and the S&P/ASX 200 index generated a return of 0.48%,what was the abnormal return generated by FTX shares on the day of the announcement?

A)4)07 per cent

B)6)02 per cent

C)2)72 per cent

D)7)37 per cent

E)8)10 per cent

A)4)07 per cent

B)6)02 per cent

C)2)72 per cent

D)7)37 per cent

E)8)10 per cent

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

24

You have been following an investment strategy that involves applying the following filter rule: (a)buy $10,000 worth of all shares that decline in price by more than 5% over the past week;and (b)sell (short)$10,000 worth of all shares that have risen in price by more than 5% over the past week.Over the past year,the return on this strategy has been 30%,while the return on the ASX 200 Index over the year was 12%.Does this demonstrate that the market is not semi- strong- form efficient? Discuss.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a previously identified market anomaly?

A)January effect

B)Day- end effect

C)Midday effect

D)Tuesday effect

E)Size effect

A)January effect

B)Day- end effect

C)Midday effect

D)Tuesday effect

E)Size effect

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

26

On 30 December 2009 BMP Ltd releases its half- yearly earnings figures.It announces its earnings are down 20 per cent compared to the market expectation of a decline in earnings of 20 per cent.What will be the likely impact of this announcement on BMP's share price?

A)A decrease in the share price

B)No change in the share price

C)An increase in the share price

D)Any of the above

A)A decrease in the share price

B)No change in the share price

C)An increase in the share price

D)Any of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements about efficient markets is correct?

A)In strong- form efficiency,all available information is rapidly incorporated into market prices.However,superior returns can consistently be earned on a share through lots of hard analytical work.

B)In strong- form efficiency,the returns on a firm's bonds and shares should be identical.

C)In weak- form efficiency,all public information is rapidly incorporated into market prices.

D)In weak- form efficiency,analysing past price history of a company's shares will not enable an investor to earn an above- normal rate of return on the shares in the future.

A)In strong- form efficiency,all available information is rapidly incorporated into market prices.However,superior returns can consistently be earned on a share through lots of hard analytical work.

B)In strong- form efficiency,the returns on a firm's bonds and shares should be identical.

C)In weak- form efficiency,all public information is rapidly incorporated into market prices.

D)In weak- form efficiency,analysing past price history of a company's shares will not enable an investor to earn an above- normal rate of return on the shares in the future.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

28

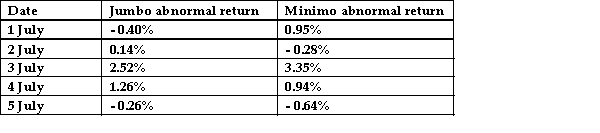

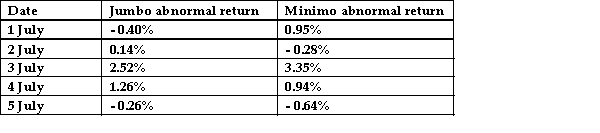

Jumbo Ltd and Minimo Ltd announced their earnings figures on 3 July.The pattern in their abnormal returns is provided below.  Jumbo Ltd is a large company with shares that trade regularly on ASX with an average

Jumbo Ltd is a large company with shares that trade regularly on ASX with an average

bid- ask spread of 0.6%.Minimo Ltd is small company with infrequently traded shares and an average bid- ask spread of 3.6%.Assuming you can accurately predict the earnings figures,could you earn an abnormal profit on either of these companies? Discuss.

Jumbo Ltd is a large company with shares that trade regularly on ASX with an average

Jumbo Ltd is a large company with shares that trade regularly on ASX with an averagebid- ask spread of 0.6%.Minimo Ltd is small company with infrequently traded shares and an average bid- ask spread of 3.6%.Assuming you can accurately predict the earnings figures,could you earn an abnormal profit on either of these companies? Discuss.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

29

Assume you are the financial manager for a company.It has come to your attention that a competitor will soon make a takeover bid for your company.The offer is likely to include a substantial premium on the current share price.What is the effect of buying shares in your company today?

A)You stand to lose money if the share price falls.

B)Other market participants might get a 'hint' of the takeover bid.

C)You could make a profit when the takeover bid was made.

D)You would commit an offence under the Corporations Act 2001.

A)You stand to lose money if the share price falls.

B)Other market participants might get a 'hint' of the takeover bid.

C)You could make a profit when the takeover bid was made.

D)You would commit an offence under the Corporations Act 2001.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

30

How long should it take a semi- strong- form efficient market to react to information that is released to the market?

A)Immediately

B)Within days

C)Within hours

D)There would be no reaction.

A)Immediately

B)Within days

C)Within hours

D)There would be no reaction.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following situations is consistent with the strong- form version of the efficient markets hypothesis?

A)Evidence indicates that,on average,investment fund managers do not consistently earn abnormal returns.

B)You make consistent abnormal profits by trading stocks before the announcement of an unexpected rise in earnings.

C)You make consistent abnormal losses by trading stocks before the announcement of an unexpected rise in earnings.

D)You make consistent abnormal profits by trading stocks after the announcement of an unexpected rise in earnings.

A)Evidence indicates that,on average,investment fund managers do not consistently earn abnormal returns.

B)You make consistent abnormal profits by trading stocks before the announcement of an unexpected rise in earnings.

C)You make consistent abnormal losses by trading stocks before the announcement of an unexpected rise in earnings.

D)You make consistent abnormal profits by trading stocks after the announcement of an unexpected rise in earnings.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

32

A study that examines market- pricing behaviour around informational announcements is known as what?

A)An event study

B)A trend study

C)A pricing study

D)A filter study

A)An event study

B)A trend study

C)A pricing study

D)A filter study

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

33

What are Fama's three levels of market efficiency?

A)Strong,moderate,weak

B)Strong,semi- strong,weak

C)Strong,semi- weak,weak

D)Strong,semi- moderate,moderate

A)Strong,moderate,weak

B)Strong,semi- strong,weak

C)Strong,semi- weak,weak

D)Strong,semi- moderate,moderate

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

34

On 30 December 2009 MXM Group releases its half- yearly earnings figures.These figures prove to be lower than market expectations.What will be the likely impact of this announcement on MXM's share price?

A)The price will likely fall after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely remain unchanged after the announcement.

D)Any of the above reactions is equally likely.

A)The price will likely fall after the announcement.

B)The price will likely rise after the announcement.

C)The price will likely remain unchanged after the announcement.

D)Any of the above reactions is equally likely.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

35

The anomaly that recognises that returns on small stocks tend to be larger than returns on large stocks is known as the:

A)Size effect

B)Return effect

C)Timing effect

D)Day- end effect

E)Hurdle effect

A)Size effect

B)Return effect

C)Timing effect

D)Day- end effect

E)Hurdle effect

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

36

Abnormal returns are defined only as those returns that are larger than the expected returns.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

37

Under the efficient markets hypothesis,what type of information is relevant in the efficient pricing of securities?

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

38

Balls (1978)study on filter rules concluded .

A)Filter rules generated an abnormal profit and hence the market was weak- form efficient

B)Filter rules failed to generated an abnormal profit and hence the market was semi- strong form efficient

C)Filter rules failed to generated an abnormal profit and hence the market was weak- form efficient

D)Filter rules generated an abnormal profit and hence the market was semi- strong form efficient

A)Filter rules generated an abnormal profit and hence the market was weak- form efficient

B)Filter rules failed to generated an abnormal profit and hence the market was semi- strong form efficient

C)Filter rules failed to generated an abnormal profit and hence the market was weak- form efficient

D)Filter rules generated an abnormal profit and hence the market was semi- strong form efficient

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

39

In a semi- strong form efficient market,which of the following may still allow a trader to generate abnormal returns?

A)Buying shares after the announcement of an increase in earnings

B)Identifying previous share price trends and then trading on them

C)Buying shares after hearing form a friend in the company that a merger will soon be announced

D)None of the above

A)Buying shares after the announcement of an increase in earnings

B)Identifying previous share price trends and then trading on them

C)Buying shares after hearing form a friend in the company that a merger will soon be announced

D)None of the above

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

40

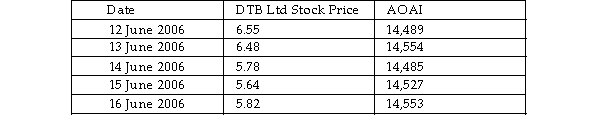

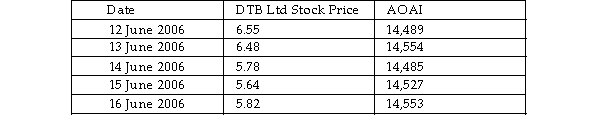

Compute the abnormal returns for DTB Ltd based upon the following information:  DTB announced a decline in earnings of around 25% on 14 June 2006.The beta of DTB Ltd is 0.7 and 10- year Government Bonds are yielding approximately 5.50% p.a.around the time of the announcement.

DTB announced a decline in earnings of around 25% on 14 June 2006.The beta of DTB Ltd is 0.7 and 10- year Government Bonds are yielding approximately 5.50% p.a.around the time of the announcement.

DTB announced a decline in earnings of around 25% on 14 June 2006.The beta of DTB Ltd is 0.7 and 10- year Government Bonds are yielding approximately 5.50% p.a.around the time of the announcement.

DTB announced a decline in earnings of around 25% on 14 June 2006.The beta of DTB Ltd is 0.7 and 10- year Government Bonds are yielding approximately 5.50% p.a.around the time of the announcement.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

41

The 'January effect' refers to evidence that stock prices will tend to rise in January.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

42

Block trades are information events because it is argued that large traders are 'better informed' than small traders.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

43

The placement of orders by 'discount' or 'retail' brokers during the pre- opening phase and the price reaction following open appears to be a predictable pattern.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

44

Returns following block trades are used to test strong- form market efficiency.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

45

The 'day- end effect' refers to evidence that stock prices will tend to fall at the end of each day.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

46

Any study examining how quickly a market reacts to large trades can be interpreted as a test of how quickly a market reacts to a public information release.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

47

Strong- form market efficiency is the most difficult form of market efficiency to test.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

48

Prices follow a 'random walk' if the current price is unrelated to the previous price,or the value linking the two is a random number.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

49

A market is efficient when prices reflect all available information.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

50

A market that is semi- strong form efficient is also weak- form efficient but not necessarily strong- form efficient.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

51

The amount of information which is available to the market about a particular security is irrelevant in determining the level of market efficiency.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

52

The 'day- end effect' refers to evidence that stock prices will tend to rise at the end of each day.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

53

Ball (1978)used paired securities to test the ability of a trader to earn abnormal returns using a filter rule and found that the pair securities earned as much profit is the individual securities did and therefore that chance was responsible for the observed returns.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck

54

Aitken,Brown,Frino and Walter (1995)suggested that the market is more semi- strong- form efficient for small stocks than for large stocks.

Unlock Deck

Unlock for access to all 54 flashcards in this deck.

Unlock Deck

k this deck