Deck 32: Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/122

Play

Full screen (f)

Deck 32: Corporations

1

Partnerships,limited liability partnerships,limited liability companies,and C corporations are considered flow-through entities for tax purposes.

False

2

Corporations may deduct 65% of dividends received from a domestic corporation if the recipient corporation owns 20% or more and less than 80% of the voting power and value of the stock of the issuing corporation.

True

3

A corporation generates a net operating loss of $90,000 in 2018.The corporation's 2019 taxable income from 2019 activities is $95,000.The corporation will be able to deduct the $90,000 net operating loss in 2019.

False

4

If a corporation reports both a NLTCG and a NSTCG after netting all capital gains and losses,both the NLTCG and the NSTCG are subject to tax at rates applicable to ordinary income.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

5

Corporate charitable contributions are limited in any given year to 50% of taxable income.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

6

If a corporation receives dividends from an 80% or more owned affiliated corporation,the dividends-received deduction is 100%.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

7

Smith Corporation,a U.S.C corporation,owns 25% of Avanti Corporation,an Italian corporation that earns all of its income in Europe.Smith Corporation will not be allowed a deduction for dividends received from Avanti.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

8

All of the following are accurate statements about corporations,except

A)a corporation does not compute adjusted gross income.

B)a corporation is not allowed a standard deduction.

C)dividends received from a domestic corporation do not receive any preferential treatment.

D)the limit on the charitable contribution deduction is 10% of taxable income (with certain adjustments).

A)a corporation does not compute adjusted gross income.

B)a corporation is not allowed a standard deduction.

C)dividends received from a domestic corporation do not receive any preferential treatment.

D)the limit on the charitable contribution deduction is 10% of taxable income (with certain adjustments).

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

9

All of the following business forms offer limited liability except the

A)partnership.

B)corporation.

C)S corporation.

D)limited liability company.

A)partnership.

B)corporation.

C)S corporation.

D)limited liability company.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

10

A corporation incurs a net operating loss in 2019.The NOL can be carried back two years and forward for 20 years.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

11

Except for certain lines of business such as farming,C corporations can choose between the cash method and accrual method of accounting.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

12

For corporations,both NLTCLs and NSTCLs are eligible for a 3-year carryback and a 5-year carryforward as an offset against capital gains for those years.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

13

Corporations may be taxed on less than 100% of dividends received due to the dividends-received deduction,while individuals are taxed on all of their dividend income.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

14

In computing a corporation's NOL,the dividends-received deduction is allowed in full.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

15

If a corporation owns less than 20% of the stock of the distributing corporation,the dividends-received deduction is not allowed for the recipient corporation.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

16

A corporation realizes a NSTCL this year of $43,000.It will only be able to deduct $3,000 this year.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

17

Corporations must divide their deductions between deductions for and deductions from AGI.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

18

For corporations,NSTCLs and NLTCLs are treated as STCLs for purposes of the carryback and carryforward rules.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

19

Income of a C corporation is subject to an initial tax at the corporate level and the shareholders are subject to a second tax if the corporation pays dividends from its earnings and profits.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

20

A corporation realizes a NLTCL this year.The loss cannot be deducted in the current year.It must be carried back two years and then carried forward 20 years.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

21

Identify which of the following statements is true.

A)A corporate capital loss can be carried back three years,and then can be carried forward five years.

B)Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C)At the election of a corporation,a net capital loss carryback can be forgone and carried forward only.

D)All are false.

A)A corporate capital loss can be carried back three years,and then can be carried forward five years.

B)Corporate capital loss carrybacks can offset corporate ordinary income earned in previous years.

C)At the election of a corporation,a net capital loss carryback can be forgone and carried forward only.

D)All are false.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

22

Witte Corporation reported the following results for the current year: What is the amount of the charitable contribution carryover to next year?

A)$0

B)$14,000

C)$16,000

D)$30,000

A)$0

B)$14,000

C)$16,000

D)$30,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

23

If a corporation's charitable contributions exceed the deduction limitation in a particular year,the excess

A)is not deductible in any future year.

B)becomes a carryforward to a maximum of five succeeding years.

C)may be carried back to the third preceding year.

D)is carried over indefinitely.

A)is not deductible in any future year.

B)becomes a carryforward to a maximum of five succeeding years.

C)may be carried back to the third preceding year.

D)is carried over indefinitely.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

24

Charades Corporation is a publicly held company listed on the New York Stock Exchange.During the current year,its chief executive officer,Samantha Chen,receives the following compensation from the corporation: salary,$1,500,000; commissions based on sales generated by Samantha,$200,000; payments to a qualified pension plan,$30,000; and tax-free fringe benefits,$20,000.What is the total amount that Charades may deduct?

A)$1,000,000

B)$1,050,000

C)$1,500,000

D)$1,750,000

A)$1,000,000

B)$1,050,000

C)$1,500,000

D)$1,750,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

25

Unused charitable contributions of a corporation are carried forward ten years.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

26

A corporation which makes a charitable contribution of property for the care of the needy gets a deduction equal to the adjusted basis of the property.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

27

A corporation generates a $200,000 net operating loss in 2018.In 2019 its taxable income from 2019 activities is $220,000.The corporation will be allowed an NOL deduction of

A)$220,000.

B)$200,000.

C)$176,000.

D)$160,000.

A)$220,000.

B)$200,000.

C)$176,000.

D)$160,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

28

A corporation generates a net operating loss in 2019.Which of the following statements is correct regarding the corporation's ability to deduct the NOL?

A)The NOL can be carried back two years and carried forward 20 years,with any excess NOL lost.

B)The NOL can be carried back three years and carried forward five years,with any excess NOL lost.

C)The NOL can be carried forward five years,with any excess NOL lost.

D)The NOL can only be carried forward,but the carryover period is unlimited.

A)The NOL can be carried back two years and carried forward 20 years,with any excess NOL lost.

B)The NOL can be carried back three years and carried forward five years,with any excess NOL lost.

C)The NOL can be carried forward five years,with any excess NOL lost.

D)The NOL can only be carried forward,but the carryover period is unlimited.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

29

Montage Corporation has the following income and expense items during the current year: The allowed dividends-received deduction is

A)$120,000.

B)$234,000.

C)$156,000.

D)$240,000.

A)$120,000.

B)$234,000.

C)$156,000.

D)$240,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

30

A corporation has the following capital gains and losses during the current year: The tax result to the corporation is

A)$10,000 NLTCG included in gross income and taxed at the ordinary rate; $4,000 NSTCG included in gross income and taxed at reduced rates.

B)$14,000 included in gross income and taxed at reduced rates.

C)$14,000 included in gross income and taxed at the ordinary rate.

D)$10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at the ordinary rate.

A)$10,000 NLTCG included in gross income and taxed at the ordinary rate; $4,000 NSTCG included in gross income and taxed at reduced rates.

B)$14,000 included in gross income and taxed at reduced rates.

C)$14,000 included in gross income and taxed at the ordinary rate.

D)$10,000 NLTCG is included in gross income and taxed at reduced rates; and $4,000 NSTCG included in gross income and taxed at the ordinary rate.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

31

Jenkins Corporation has the following income and expense items during the current year: The allowed dividends-received deduction is

A)$81,250.

B)$97,500.

C)$125,000.

D)$150,000.

A)$81,250.

B)$97,500.

C)$125,000.

D)$150,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

32

Summer Corporation has the following capital gains and losses during the current year: The tax result to the corporation is

A)$6,000 NSTCG included in gross income.

B)$6,000 NLTCG included in gross income.

C)$10,000 NLTCG is included in gross income and $4,000 NSTCL is carried forward to the next year.

D)$10,000 NLTCG receives long-term capital gain treatment and $4,000 NSTCL included as ordinary loss.

A)$6,000 NSTCG included in gross income.

B)$6,000 NLTCG included in gross income.

C)$10,000 NLTCG is included in gross income and $4,000 NSTCL is carried forward to the next year.

D)$10,000 NLTCG receives long-term capital gain treatment and $4,000 NSTCL included as ordinary loss.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

33

Jones Corporation,a U.S.C corporation,owns 25% of the stock of Bien Corporation,French corporation that earns all of its income in Europe.Jones Corporation earned $1 million of operating income this year.In addition,it received a $500,000 dividend from Bien Corporation.Jones Corporation will be allowed a dividends-received deduction of

A)$500,000.

B)$0.

C)$250,000.

D)$325,000.

A)$500,000.

B)$0.

C)$250,000.

D)$325,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

34

With respect to charitable contributions by corporations,all of the following rules apply with the exception of

A)unused contributions are carried forward 5 years.

B)the amount of the contribution deduction is always the adjusted basis of the property contributed.

C)contributions are limited to 10% of taxable income,computed without regard to the charitable contribution deduction,NOL and capital loss carrybacks,or the dividends-received deduction.

D)accrual-basis corporations may accrue a contribution deduction in the year preceding payment if the board of directors authorizes such payment prior to the end of the tax year,and the payment is actually made within two and one-half months following the end of the tax year.

A)unused contributions are carried forward 5 years.

B)the amount of the contribution deduction is always the adjusted basis of the property contributed.

C)contributions are limited to 10% of taxable income,computed without regard to the charitable contribution deduction,NOL and capital loss carrybacks,or the dividends-received deduction.

D)accrual-basis corporations may accrue a contribution deduction in the year preceding payment if the board of directors authorizes such payment prior to the end of the tax year,and the payment is actually made within two and one-half months following the end of the tax year.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

35

A corporation has the following capital gains and losses during the current year: The tax result to the corporation is

A)deduct $3,000 of the STCL currently; carry forward the remaining $2,000 STCL and $6,000 LTCL.

B)deduct $5,000 STCL and $6,000 LTCL.

C)deduct nothing currently; carry back the $5,000 STCL and $6,000 LTCL for three years and carry forward for 5 years,if necessary.

D)deduct nothing currently; carry back the $11,000 STCL for three years and carry forward for 5 years,if necessary.

A)deduct $3,000 of the STCL currently; carry forward the remaining $2,000 STCL and $6,000 LTCL.

B)deduct $5,000 STCL and $6,000 LTCL.

C)deduct nothing currently; carry back the $5,000 STCL and $6,000 LTCL for three years and carry forward for 5 years,if necessary.

D)deduct nothing currently; carry back the $11,000 STCL for three years and carry forward for 5 years,if necessary.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

36

Louisiana Land Corporation reported the following results for the current year: What is the amount of the taxable income for the current year?

A)$240,000

B)$268,000

C)$294,000

D)$300,000

A)$240,000

B)$268,000

C)$294,000

D)$300,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

37

Musketeer Corporation has the following income and expense items during the current year: The allowed dividends-received deduction is

A)$120,000.

B)$180,000.

C)$156,000.

D)$240,000.

A)$120,000.

B)$180,000.

C)$156,000.

D)$240,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

38

Accrual-basis corporations may accrue a charitable contribution deduction in the year preceding payment if the payment is authorized by the board of directors prior to year-end and the contribution is made within 2 1/2 months following year-end.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

39

June Corporation has the following income and expense items during the current year: The allowed dividends-received deduction is

A)$65,000.

B)$0.

C)$156,000.

D)$240,000.

A)$65,000.

B)$0.

C)$156,000.

D)$240,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

40

A publicly held corporation is denied a deduction for compensation paid to its chief executive officer,its chief financial officer and its three highest compensated officers if the compensation amount for any individual exceeds $1,000,000 per year.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

41

For purposes of the accumulated earnings tax,reasonable needs of the business include providing working capital for the business.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

42

A controlled group of corporations must apportion tax benefits (e.g.,Sec.179 expense limitation)among the group members as if only one corporation existed.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

43

Trestle Corp.received $100,000 of dividend income from minor holdings (less than 20%)in U.S.publicly traded corporations.Determine the allowable dividend-received deduction under the following assumptions of net income from operations:

a.Net income from operations is $600,000.

b.Net income from operations is ($10,000).

c.Net income from operations is ($150,000).

a.Net income from operations is $600,000.

b.Net income from operations is ($10,000).

c.Net income from operations is ($150,000).

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

44

A family-owned corporation with substantial investment income could be subject to both the accumulated earnings tax and the personal holding company tax.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

45

Corporations that are members of a brother-sister affiliated group may file a consolidated return if the proper election is made.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

46

In a parent-subsidiary controlled group,the common parent corporation must own more than 50% of the stock of at least one subsidiary corporation.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

47

Concepts Corporation reported the following results for the current year:

Taxable income from operations $500,000

Dividend income 120,000

Charitable contributions 100,000

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Taxable income from operations $500,000

Dividend income 120,000

Charitable contributions 100,000

Taxable income from operations does not include the dividend income or the contributions.The dividend income is from minor investments in U.S.publicly traded stocks.Calculate Concept Corporation's taxable income and any carryovers that may be generated.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

48

One requirement of a personal holding company is that more than 50% of the value of the outstanding stock must be owned by five or fewer individuals at some time during the last 6 months of the tax year.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

49

A corporation has taxable income from operations of $1 million.In addition,it received $100,000 of dividend income from very minor holdings in publicly held corporations.The corporation will be have a tax liability of

A)$210,000.

B)$231,000.

C)$217,350.

D)$220,500.

A)$210,000.

B)$231,000.

C)$217,350.

D)$220,500.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

50

For purposes of the accumulated earnings tax,reasonable needs of the business include all of the following with the exception of

A)making loans to stockholders.

B)providing working capital for the business.

C)acquiring the assets or stock of another business.

D)reasonably anticipated expansion of the business and plant replacement.

A)making loans to stockholders.

B)providing working capital for the business.

C)acquiring the assets or stock of another business.

D)reasonably anticipated expansion of the business and plant replacement.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

51

In a parent-subsidiary controlled group,the common parent corporation must own at least 80% of the stock of each subsidiary corporation in the group.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

52

Twenty Corporation reports 2019 taxable income of $200,000.Twenty has a minimum tax credit carryover of $75,000.How much of the MTC carryover can Twenty Corporation use this year?

A)$75,000

B)$58,500

C)$42,000

D)$37,500

A)$75,000

B)$58,500

C)$42,000

D)$37,500

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

53

Charades Corporation is a publicly held company listed on the New York Stock Exchange.During the current year,its chief executive officer,Samantha Chen,receives the following compensation from the corporation: salary,$1,500,000; commissions based on sales generated by Samantha,$200,000; payments to a qualified pension plan,$30,000; and tax-free fringe benefits,$20,000.What is the total amount taxable to Samantha?

A)$1,000,000

B)$1,200,000

C)$1,500,000

D)$1,700,000

A)$1,000,000

B)$1,200,000

C)$1,500,000

D)$1,700,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

54

The accumulated earnings tax is imposed on all publicly held corporations.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

55

Corporations that are members of a parent-subsidiary affiliated group may file a consolidated return if the proper election is made.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

56

C corporations will calculate income tax

A)using a 15% tax rate.

B)using a 21% tax rate.

C)using a 35% tax rate.

D)using a progressive tax rate schedule with rates ranging from 15% to 35%.

A)using a 15% tax rate.

B)using a 21% tax rate.

C)using a 35% tax rate.

D)using a progressive tax rate schedule with rates ranging from 15% to 35%.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

57

A corporation has a minimum tax credit carryover remaining from 2017.It will be able to apply the MTC to offset up to 50% of its 2019 regular income tax liability.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

58

Indicators of possible exposure of accumulated earning tax risk would include all of the following except

A)substantial marketable securities held by the corporation.

B)loans to shareholders.

C)limited dividend paying history.

D)All of the above factors could indicate retention of earnings beyond business needs.

A)substantial marketable securities held by the corporation.

B)loans to shareholders.

C)limited dividend paying history.

D)All of the above factors could indicate retention of earnings beyond business needs.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

59

DEF Corporation and MNO Corporation are both C corporations.To date,DEF has earned $100,000 of taxable income,and MNO has earned $500,000.Each corporation expects to earn another $100,000 of taxable income before year-end.MNO will pay more tax on its incremental $100,000 of taxable income than will MNO.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

60

The purpose of the accumulated earnings tax is to discourage corporations from retaining excessive amounts of earnings if the funds are invested in assets unrelated to the business needs.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

61

A shareholder transfers a building subject to a mortgage in a Sec.351 transfer.The corporation assumes the mortgage,and no gain is recognized on the transfer under Sec.351.The transfer of the liabilities has no effect on the shareholder's stock basis.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the statements is inaccurate regarding requirements for nonrecognition of gain or loss upon the transfer of assets to a corporation in exchange for stock?

A)Depreciation recapture applies to a transfer which falls under Sec.351.

B)Property must be transferred to the corporation solely in exchange for stock of the corporation.

C)The transferor-shareholders must be in control (80%)of the corporation immediately after the exchange.

D)If property or money is received by the transferor,gain (but not loss)is recognized to the extent of the lesser of the boot received or the realized gain.

A)Depreciation recapture applies to a transfer which falls under Sec.351.

B)Property must be transferred to the corporation solely in exchange for stock of the corporation.

C)The transferor-shareholders must be in control (80%)of the corporation immediately after the exchange.

D)If property or money is received by the transferor,gain (but not loss)is recognized to the extent of the lesser of the boot received or the realized gain.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

63

Roscoe Corporation owns 85% of Vintage Corporation and 25% of Waxtin Corporation.Vintage owns 60% of Waxtin.Each corporation has only one class of stock.The three corporations form a(an)

A)parent-subsidiary controlled group.

B)brother-sister controlled group.

C)combined controlled group.

D)unrelated group of corporations.

A)parent-subsidiary controlled group.

B)brother-sister controlled group.

C)combined controlled group.

D)unrelated group of corporations.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

64

Peter transfers an office building into a new corporation in exchange for 100 percent of the stock.In addition,the corporation assumes the mortgage on the building.Peter will treat the debt relief as boot and have to recognize gain.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

65

If certain requirements are met,Sec.351 permits deferral of recognition of gain or loss on the transfer of property to a corporation solely in exchange for stock of the corporation.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

66

Individuals Rhett and Scarlet form Lady Corporation.Rhett transfers land and a building with a $140,000 adjusted basis and a $230,000 FMV in exchange for 50% of the stock of Lady Corporation worth $210,000 and a $20,000 note.Scarlet contributes cash of $230,000 for 50% of the stock of Lady Corporation worth $210,000 and a note of the Lady Corporation valued at $20,000.Rhett's recognized gain on the transfer is

A)$0.

B)$20,000.

C)$70,000.

D)$90,000.

A)$0.

B)$20,000.

C)$70,000.

D)$90,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

67

Montrose Corporation is classified as a personal holding company.It is almost year-end.The company's taxable income and regular federal income tax liability are expected to be $100,000 and $21,000,respectively.The company will claim a $20,000 dividends-received deduction and earlier in the year paid $25,000 of dividends to its shareholders.How much in additional dividends must be paid to shareholders in order to avoid the personal holding company tax?

A)$95,000

B)$54,000

C)$74,000

D)$99,000

A)$95,000

B)$54,000

C)$74,000

D)$99,000

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

68

Individuals Gayle and Marcus form GM Corporation.Gayle transfers land and a building with a $750,000 adjusted basis and a $830,000 FMV in exchange for 50% of the stock of the GM Corporation worth $800,000 and a $30,000 note.Marcus transfers cash of $830,000 for 50% of the stock worth $800,000 and a note of the GM Corporation valued at $30,000.The basis of the land and building to GM Corporation is

A)$750,000.

B)$780,000.

C)$830,000.

D)$860,000.

A)$750,000.

B)$780,000.

C)$830,000.

D)$860,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

69

In a Sec.351 transfer,the corporation takes the shareholder's adjusted basis in the contributed property,regardless of whether the property's FMV is greater than or less than its adjusted basis at the date of contribution.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

70

Individuals Bert and Tariq form Shark Corporation.Bert transfers equipment with a $290,000 adjusted basis and a $335,000 FMV for 50% of the stock worth $310,000 and a note of Shark Corporation valued at $25,000.Tariq transfers cash of $335,000 in exchange for 50% of the stock of Shark Corporation worth $310,000 and a $25,000 note.Bert's recognized gain is

A)$0.

B)$20,000.

C)$25,000.

D)$45,000.

A)$0.

B)$20,000.

C)$25,000.

D)$45,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

71

In order for the Sec.351 nonrecognition rules to apply,the transferor-shareholders in aggregate must control the transferee corporation by owning more than 50% of its stock immediately after the exchange.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

72

Dozen Corporation is owned equally by twelve unrelated individuals.Its taxable income this year is $100,000 and its regular federal income tax liability is $21,000.The company claims a $20,000 dividends-received deduction and pays $25,000 dividends to its shareholders.The corporation had accumulated earnings and profits of $900,000 at the end of the preceding year.The company has not documented any business needs for the accumulated profits.The accumulated earnings tax is

A)$19,000.

B)$10,800.

C)$14,800.

D)$19,800.

A)$19,000.

B)$10,800.

C)$14,800.

D)$19,800.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

73

Individuals Julie and Brandon form JB Corporation.Julie transfers cash of $425,000 in exchange for 50% of the stock of the JB Corporation worth $410,000 and a $15,000 note.Brandon transfers equipment with a $390,000 adjusted basis and a $425,000 FMV for 50% of the stock worth $410,000 and a note of the JB Corporation valued at $15,000.Brandon's basis in the stock received is

A)$350,000.

B)$390,000.

C)$410,000.

D)$425,000.

A)$350,000.

B)$390,000.

C)$410,000.

D)$425,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

74

Manatee Corporation,a retailer,is owned equally by twelve unrelated individuals.Its taxable income this year is $100,000 and its regular federal income tax liability is $21,000.The company claims a $20,000 dividends-received deduction and pays $25,000 dividends to its shareholders.The corporation had accumulated earnings and profits of $200,000 at the end of the preceding year.The company has reasonable needs of the business at year-end of $210,000.The accumulated earnings tax is

A)$12,800.

B)$9,800.

C)$4,800.

D)$9,000.

A)$12,800.

B)$9,800.

C)$4,800.

D)$9,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

75

The term "thin capitalization" means that the corporation is financed primarily with capital stock rather than debt.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

76

Depreciation recapture does not apply to a transfer coming under Sec.351 unless the transferor recognizes gain on depreciable property that is transferred.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

77

A corporation is classified as a personal holding company.Its taxable income is $300,000 and its regular federal income tax liability is $63,000.The company claims a $40,000 dividends-received deduction and pays $30,000 dividends to its shareholders.The personal holding company tax is

A)$49,400.

B)$62,000.

C)$41,400.

D)$61,400.

A)$49,400.

B)$62,000.

C)$41,400.

D)$61,400.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

78

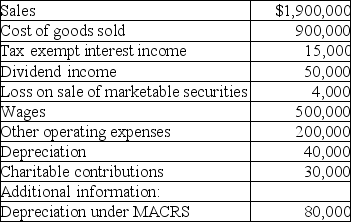

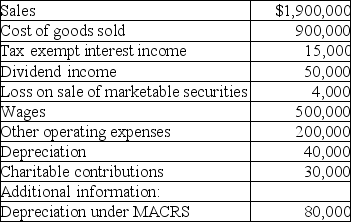

Bartlett Corporation,a U.S.manufacturer,reports the following results in its financial accounting records:

The dividend income is from very minor holdings in U.S.stocks.Calculate Bartlett's taxable income,income tax liability and any carryovers generated.

The dividend income is from very minor holdings in U.S.stocks.Calculate Bartlett's taxable income,income tax liability and any carryovers generated.

The dividend income is from very minor holdings in U.S.stocks.Calculate Bartlett's taxable income,income tax liability and any carryovers generated.

The dividend income is from very minor holdings in U.S.stocks.Calculate Bartlett's taxable income,income tax liability and any carryovers generated.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

79

Individuals Opal and Ben form OB Corporation.Opal transfers land and a building with a $550,000 adjusted basis and a $625,000 FMV in exchange for 50% of the stock of the OB Corporation worth $610,000 and a $15,000 note.Ben transfers cash of $625,000 for 50% of the stock worth $610,000 and a note of the OB Corporation valued at $15,000.Opal's basis in the stock received is

A)$550,000.

B)$560,000.

C)$610,000.

D)$625,000.

A)$550,000.

B)$560,000.

C)$610,000.

D)$625,000.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck

80

Evan owns 45% of Yolo Corporation and 40% of Xeqz Corporation.Farra owns 37% of Yolo Corporation and 48% of Xeqz Corporation.Gao owns 5% of Yolo Corporation but does not own any stock in Xeqz.Each corporation has only one class of stock.Yolo and Xeqz Corporations form a(an)

A)parent-subsidiary controlled group.

B)brother-sister controlled group.

C)combined controlled group.

D)unrelated group of corporations.

A)parent-subsidiary controlled group.

B)brother-sister controlled group.

C)combined controlled group.

D)unrelated group of corporations.

Unlock Deck

Unlock for access to all 122 flashcards in this deck.

Unlock Deck

k this deck