Deck 10: Special Partnership Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/76

Play

Full screen (f)

Deck 10: Special Partnership Issues

1

Tenika has a $10,000 basis in her interest in the TF Partnership and no remaining precontribution gain immediately before receiving a current distribution that consisted of $4,000 in money,plastic tubes held in inventory with a $3,000 basis to the partnership and an FMV of $3,375,and drip irrigation pipe held as inventory with a $6,000 basis to the partnership and an FMV of $5,000.What is the basis in Tenika's hands of the distributed property?

A)$10,000

B)$6,000

C)$9,000

D)$10,125

A)$10,000

B)$6,000

C)$9,000

D)$10,125

B

2

Identify which of the following statements is true.

A)The basis for property distributed by a partnership cannot be increased above the carryover basis amount when it is received by a partner in a nonliquidating distribution.

B)A partner's partnership capital account balance cannot be less than zero.

C)The length of time a partner owns a partnership interest is relevant when determining the holding period for distributed property.

D)All of the above are false.

A)The basis for property distributed by a partnership cannot be increased above the carryover basis amount when it is received by a partner in a nonliquidating distribution.

B)A partner's partnership capital account balance cannot be less than zero.

C)The length of time a partner owns a partnership interest is relevant when determining the holding period for distributed property.

D)All of the above are false.

A

3

A partnership cannot recognize a gain or loss on a current distribution.

False

4

Identify which of the following statements is true.

A)If a partnership asset with a deferred precontribution gain is distributed in a nonliquidating distribution to the partner who contributed the asset,the precontribution gain must be recognized by the partner.

B)The partner's basis in the partnership interest is normally reduced by the FMV of property distributed in a nonliquidating distribution.

C)When a current distribution from a partnership reduces the basis of the partnership interest to zero,the partner's interest in the partnership is terminated.

D)All of the above are false.

A)If a partnership asset with a deferred precontribution gain is distributed in a nonliquidating distribution to the partner who contributed the asset,the precontribution gain must be recognized by the partner.

B)The partner's basis in the partnership interest is normally reduced by the FMV of property distributed in a nonliquidating distribution.

C)When a current distribution from a partnership reduces the basis of the partnership interest to zero,the partner's interest in the partnership is terminated.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

5

Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago.This year the land is distributed to Sergio,another partner in the partnership.At the time of distribution,the land had a $12,000 FMV.What is the impact of the distribution on Mirabelle's partnership basis?

A)0

B)$4,000 increase

C)$4,000 decrease

D)$7,000 increase

A)0

B)$4,000 increase

C)$4,000 decrease

D)$7,000 increase

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

6

A new partner,Gary,contributes cash and assumes a share of partnership liabilities.Diane's capital,profits,and loss interest in the partnership is reduced by 5% due to the admission of Gary.The Sec.751 rules do not apply.Partnership liabilities at the time Gary is admitted are $200,000,and all of the liabilities are recourse debts for which the partners share the economic risk of loss in the same way they share partnership profits.Diane's basis in the partnership interest prior to Gary's admission is $5,000.Due to the admission of Gary,partner Diane has

A)no recognized gain or loss and a partnership interest basis of $10,000.

B)no recognized gain or loss.

C)a recognized gain of $5,000 and a partnership interest basis of zero.

D)a recognized gain of $5,000 and a partnership interest basis of $5,000.

A)no recognized gain or loss and a partnership interest basis of $10,000.

B)no recognized gain or loss.

C)a recognized gain of $5,000 and a partnership interest basis of zero.

D)a recognized gain of $5,000 and a partnership interest basis of $5,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

7

Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago.This year the land is distributed to Sergio,another partner in the partnership.At the time of distribution,the land had a $12,000 FMV.How much gain should Mirabelle and Sergio recognize?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

8

Helmut contributed land with a basis of $5,000 and an FMV of $10,000 to the HG Partnership five years ago to acquire a 50% partnership interest.This year the land is distributed to another partner,Gail,when its FMV is $11,000.No other distributions have been made since Helmut became a partner.When the land is distributed to Gail,Helmut recognizes a gain of

A)$0.

B)$2,500.

C)$3,000.

D)$5,000.

A)$0.

B)$2,500.

C)$3,000.

D)$5,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

9

John has a basis in his partnership interest of $30,000.He receives a current distribution of $6,000 cash,unrealized receivables (FMV $11,000,basis $10,000),inventory (FMV $8,000,basis $4,000),and investment land (FMV $7,000,basis $6,000).The partners' relative interest in the Sec.751 assets do not change as a result of the current distribution.His basis in the land is

A)$5,000.

B)$6,000.

C)$7,000.

D)$10,000.

A)$5,000.

B)$6,000.

C)$7,000.

D)$10,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

10

Bart has a partnership interest with a $32,000 basis.He receives a current distribution of $6,000 cash,unrealized receivables (FMV $9,000,basis $10,000),inventory (FMV $8,000,basis $4,000),investment land (FMV $7,000,basis $4,000),and building (FMV $20,000,basis $8,000).No depreciation recapture applies with respect to the building.The partners' relative interests in the Sec.751 assets do not change as a result of the current distribution.Bart's basis in the building is

A)$3,000.

B)$4,000.

C)$6,000.

D)$8,000.

A)$3,000.

B)$4,000.

C)$6,000.

D)$8,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

11

In a current distribution,the partner's basis in the partnership interest is reduced by the amount of money received and by the partnership's bases in the distributed property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

12

Danielle has a basis in her partnership interest of $12,000.She receives a current distribution of $8,000 cash and equipment with a basis of $7,000.There is no potential gain under Sec.737.What is her basis in the equipment?

A)$0

B)$4,000

C)$7,000

D)none of the above

A)$0

B)$4,000

C)$7,000

D)none of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

13

Becky has a $24,000 basis in her partnership interest.She receives a current distribution of $4,000 cash,unrealized receivables with a basis of $12,000 and an FMV of $16,000,and land held as an investment with a basis of $3,000 and an FMV of $8,000.The partners' relative interests in the Sec.751 assets do not change as a result of the current distribution.The basis of her partnership interest following the distribution is

A)$5,000.

B)$1,000.

C)$0.

D)($4,000).

A)$5,000.

B)$1,000.

C)$0.

D)($4,000).

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

14

Susan contributed land with a basis of $6,000 and an FMV of $10,000 to the SH Partnership two years ago to acquire her partnership interest.This year,the land is distributed to Harry when its FMV is $11,000.No other distributions have been made since Susan became a partner.When the land is distributed,the partnership's basis in the land immediately before distribution is increased by

A)$0.

B)$1,000.

C)$4,000.

D)$5,000.

A)$0.

B)$1,000.

C)$4,000.

D)$5,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

15

If a partnership asset with a deferred precontribution gain is distributed within seven years of acquisition in a nonliquidating distribution to a partner who did not contribute the asset,the precontribution gain must be recognized by the contributing partner.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

16

The total bases of all distributed property in the partner's hands following a nonliquidating distribution is limited to

A)the partner's predistribution basis in his partnership interest.

B)the FMV of the property distributed.

C)the partnership's bases in the distributed property.

D)the predistribution FMV of the partner's partnership interest.

A)the partner's predistribution basis in his partnership interest.

B)the FMV of the property distributed.

C)the partnership's bases in the distributed property.

D)the predistribution FMV of the partner's partnership interest.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

17

Tenika has a $10,000 basis in her interest in the TF Partnership and no remaining precontribution gain immediately before receiving a current distribution that consisted of $4,000 in money,plastic tubes held in inventory with a $3,000 basis to the partnership and an FMV of $3,375,and drip irrigation pipe held as inventory with a $6,000 basis to the partnership and an FMV of $5,000.What is Tenika's basis for the plastic tubes and drip irrigation pipe?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

18

Carlos has a basis in his partnership interest of $30,000.He receives a current distribution of $6,000 cash,unrealized receivables (FMV $11,000,basis $10,000),inventory (FMV $8,000,basis $4,000),land held as an investment (FMV $7,000,basis,$6,000),and building (FMV $21,000,basis $9,000).The partners' relative interests in the Sec.751 assets do not change as a result of the current distribution.Carlos's basis in the building is

A)$2,500.

B)$6,000.

C)$7,500.

D)$9,000.

A)$2,500.

B)$6,000.

C)$7,500.

D)$9,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

19

A partner's holding period for property distributed as a current distribution begins on the date of distribution.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

20

If a distribution occurs within ________ years of the contribution date,in a nonliquidating distribution that does not qualify for Sec.751 treatment,the distribution event may trigger a precontribution gain or loss.

A)three

B)five

C)seven

D)unlimited

A)three

B)five

C)seven

D)unlimited

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

21

The definition of "inventory" for purposes of Sec.751 includes

A)cash.

B)land held for investment.

C)marketable securities not held by dealers.

D)depreciation recapture potential on Sec.1231 assets.

A)cash.

B)land held for investment.

C)marketable securities not held by dealers.

D)depreciation recapture potential on Sec.1231 assets.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

22

For purposes of Sec.751,inventory includes all of the following except

A)capital assets or 1231 property.

B)items held for sale in the ordinary course of business.

C)accounts receivable.

D)All of the above are inventory per Sec.751.

A)capital assets or 1231 property.

B)items held for sale in the ordinary course of business.

C)accounts receivable.

D)All of the above are inventory per Sec.751.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

23

Under Sec.751,unrealized receivables include potential Section 1245 or 1250 recapture on the partnership's depreciable property.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

24

The definition of "unrealized receivable" does not include the

A)right to payment for services performed by a cash-basis taxpayer.

B)recapture potential on Sec.1245 property.

C)recapture potential on Sec.1250 property.

D)right to payment for services performed by an accrual-basis taxpayer.

A)right to payment for services performed by a cash-basis taxpayer.

B)recapture potential on Sec.1245 property.

C)recapture potential on Sec.1250 property.

D)right to payment for services performed by an accrual-basis taxpayer.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

25

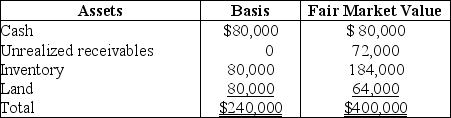

The XYZ Partnership owns the following assets on December 31: A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution of $10,000 cash.XYZ Partnership has no liabilities.His recognized gain is

A)$4,000 capital gain.

B)$3,000 capital gain and $1,000 ordinary income.

C)$3,000 ordinary income.

D)$3,000 ordinary income and $1,000 capital gain.

A)$4,000 capital gain.

B)$3,000 capital gain and $1,000 ordinary income.

C)$3,000 ordinary income.

D)$3,000 ordinary income and $1,000 capital gain.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

26

A partner can recognize gain,but not loss,on a liquidating distribution.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

27

The AB Partnership has a machine with an FMV of $25,000 and a basis of $20,000.The partnership has taken an $8,000 depreciation on the machine.The unrealized receivable related to the machine is

A)$0.

B)$5,000.

C)$8,000.

D)$20,000.

A)$0.

B)$5,000.

C)$8,000.

D)$20,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

28

What is the definition of "substantially appreciated inventory"?

A)inventory with a FMV greater than its basis

B)inventory and unrealized receivables with a FMV greater than their basis

C)inventory with a FMV greater than 120% of its basis

D)inventory and unrealized receivables with a FMV greater than 120% of their basis

A)inventory with a FMV greater than its basis

B)inventory and unrealized receivables with a FMV greater than their basis

C)inventory with a FMV greater than 120% of its basis

D)inventory and unrealized receivables with a FMV greater than 120% of their basis

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

29

The XYZ Partnership owns the following assets on December 31: By how much must XYZ reduce its unrealized receivables to avoid meeting the substantially appreciated inventory test?

A)$10,000

B)$14,000

C)$15,000

D)No amount of reduction of unrealized receivables will affect meeting the substantially appreciated inventory test.

A)$10,000

B)$14,000

C)$15,000

D)No amount of reduction of unrealized receivables will affect meeting the substantially appreciated inventory test.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

30

Identify which of the following statements is true.

A)A liquidating distribution that terminates a partnership interest cannot include more than one distribution.

B)A partnership with a large amount of unrealized receivables and substantially appreciated inventory items liquidated and distributed all of its assets in kind to each partner in proportion to their partnership interests.Each partner will report ordinary income at the time these assets are received equal to their FMV.

C)The rule for recognizing gain on a liquidating distribution is the same rule that is used for a current distribution.

D)All of the above are false.

A)A liquidating distribution that terminates a partnership interest cannot include more than one distribution.

B)A partnership with a large amount of unrealized receivables and substantially appreciated inventory items liquidated and distributed all of its assets in kind to each partner in proportion to their partnership interests.Each partner will report ordinary income at the time these assets are received equal to their FMV.

C)The rule for recognizing gain on a liquidating distribution is the same rule that is used for a current distribution.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

31

Identify which of the following statements is true.

A)When unrealized receivables are distributed in a liquidating distribution,the basis of the receivables will be increased.

B)The bases of unrealized receivables and inventory distributed by a partnership in liquidation of a partnership interest are never increased above their bases in the hands of the partnership.

C)The basis of the partnership interest is apportioned between all of the assets received in a liquidating distribution based on the relative FMVs of the assets.

D)All of the above are false.

A)When unrealized receivables are distributed in a liquidating distribution,the basis of the receivables will be increased.

B)The bases of unrealized receivables and inventory distributed by a partnership in liquidation of a partnership interest are never increased above their bases in the hands of the partnership.

C)The basis of the partnership interest is apportioned between all of the assets received in a liquidating distribution based on the relative FMVs of the assets.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

32

The Internal Revenue Code includes which of the following assets in the definition of Sec.751 properties?

A)inventory,which is substantially appreciated

B)cash

C)capital assets

D)Sec.1231 assets

A)inventory,which is substantially appreciated

B)cash

C)capital assets

D)Sec.1231 assets

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

33

Identify which of the following statements is true.

A)The depreciation recapture potential for a Sec.1245 property is not included in the definition of a Sec.751 asset.

B)For Sec.751 purposes,"substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

C)Inventory for Sec.751 purposes includes all property except cash,capital assets,and Sec.1231 assets.

D)All of the above are false.

A)The depreciation recapture potential for a Sec.1245 property is not included in the definition of a Sec.751 asset.

B)For Sec.751 purposes,"substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

C)Inventory for Sec.751 purposes includes all property except cash,capital assets,and Sec.1231 assets.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

34

Ted King's basis for his interest in the Troy Partnership is $24,000.In complete liquidation of his interest,King receives cash of $4,000 and real property (not a Sec.751 asset)having an FMV of $40,000.Troy's adjusted basis for this realty is $15,000.Section 736 does not apply.King's basis for this realty is

A)$15,000.

B)$20,000.

C)$36,000.

D)$40,000.

A)$15,000.

B)$20,000.

C)$36,000.

D)$40,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

35

The sale of a partnership interest always results in capital gain or loss rather than ordinary income.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

36

A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

37

Derrick's interest in the DEF Partnership is liquidated when his basis in the interest is $30,000.He receives a liquidating distribution of $20,000 cash and inventory with a basis of $8,000 and an FMV of $30,000.Derrick will recognize

A)no gain or loss.

B)$2,000 capital loss.

C)$2,000 ordinary loss.

D)$10,000 capital loss and $20,000 ordinary loss.

A)no gain or loss.

B)$2,000 capital loss.

C)$2,000 ordinary loss.

D)$10,000 capital loss and $20,000 ordinary loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

38

The ABC Partnership owns the following assets on December 31. The indication that ABC owns substantially appreciated inventory is

A)the total FMV of all assets except cash is greater than their total basis.

B)the FMV of all assets except land is $90,000 while their bases is $40,000.

C)the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

D)the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

A)the total FMV of all assets except cash is greater than their total basis.

B)the FMV of all assets except land is $90,000 while their bases is $40,000.

C)the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

D)the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

39

Identify which of the following statements is true.

A)If a partner sells property received in a partnership distribution for a gain and the property was inventory in the hands of the distributing partnership,the partner will always recognize ordinary income.

B)The primary purpose of Sec.751 is to prevent partnerships from converting capital gains into ordinary income.

C)Unrealized receivables include rights to payments on the sale of a capital asset.

D)All of the above are false.

A)If a partner sells property received in a partnership distribution for a gain and the property was inventory in the hands of the distributing partnership,the partner will always recognize ordinary income.

B)The primary purpose of Sec.751 is to prevent partnerships from converting capital gains into ordinary income.

C)Unrealized receivables include rights to payments on the sale of a capital asset.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

40

For Sec.751 purposes,"substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

41

For tax purposes,a partner who receives retirement payments ceases to be regarded as a partner

A)on the last day of the taxable year in which the partner retires.

B)on the last day of the month in which the partner retires.

C)on the day on which the partner retires.

D)only after the partner's last payment is received.

A)on the last day of the taxable year in which the partner retires.

B)on the last day of the month in which the partner retires.

C)on the day on which the partner retires.

D)only after the partner's last payment is received.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

42

When a retiring partner receives payments that exceed the value of that partner's partnership property,the excess payment is a guaranteed payment.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

43

Ten years ago,Latesha acquired a one-third interest in Dana Associates,a partnership,for $26,000 cash.This year,Latesha's entire interest in the partnership is liquidated when her basis is $24,000.Dana's assets consist of the following: cash,$20,000; inventory with a basis of $46,000 and an FMV of $40,000.Dana has no liabilities.Latesha receives the cash of $20,000 in liquidation of her entire interest.What is Latesha's recognized loss on the liquidation of her interest in Dana?

A)$0

B)$4,000 long-term capital loss

C)$4,000 short-term capital loss and $2,000 ordinary loss

D)$4,000 long-term capital loss and $2,000 ordinary loss

A)$0

B)$4,000 long-term capital loss

C)$4,000 short-term capital loss and $2,000 ordinary loss

D)$4,000 long-term capital loss and $2,000 ordinary loss

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

44

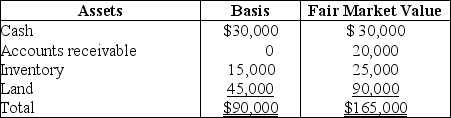

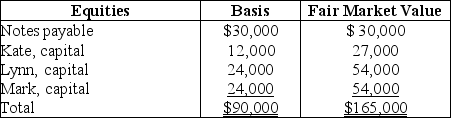

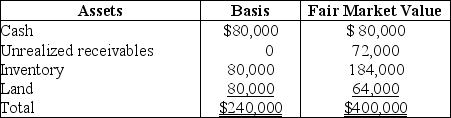

On December 31,Kate sells her 20% interest (with a basis of $18,000 which,of course,includes a share of partnership liabilities)in the KLM Partnership to Karl for $27,000 cash plus assumption of her $6,000 share of liabilities.On that date,the partnership has the following balance sheet:

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

45

Under the check-the-box rules,an LLC with more than one member is taxed as a partnership unless it elects to be taxed as a corporation.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

46

If a partnership chooses to form an LLC,under the check-the-box rules,and assuming no elections are made,the entity will be taxed as

A)a partnership if it has more than one member.

B)an S corporation.

C)a C corporation.

D)Unable to determine from the facts presented.

A)a partnership if it has more than one member.

B)an S corporation.

C)a C corporation.

D)Unable to determine from the facts presented.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

47

Identify which of the following statements is false.

A)On June 30 of the current year,James Roe sells his interest in the Roe & Doe Partnership for $30,000.Roe's adjusted basis in Roe & Doe at June 30 is $7,500 before apportionment of any partnership income for the current year.The Roe & Doe Partnership uses the calendar year as its tax year and has no liabilities on June 30.Roe's distributive share of partnership income up to June 30 is $22,500.Roe acquired his interest in the partnership five years ago.Roe will have a long-term capital gain on the sale of his interest of $22,500.

B)Section 751 assets include all inventory and all unrealized receivables in a sale or exchange situation.

C)When a partnership interest is sold,the buyer and seller can allocate the sale price among the Sec.751 assets and non-Sec.751 assets in any reasonable manner.

D)Statements B and C are true.

A)On June 30 of the current year,James Roe sells his interest in the Roe & Doe Partnership for $30,000.Roe's adjusted basis in Roe & Doe at June 30 is $7,500 before apportionment of any partnership income for the current year.The Roe & Doe Partnership uses the calendar year as its tax year and has no liabilities on June 30.Roe's distributive share of partnership income up to June 30 is $22,500.Roe acquired his interest in the partnership five years ago.Roe will have a long-term capital gain on the sale of his interest of $22,500.

B)Section 751 assets include all inventory and all unrealized receivables in a sale or exchange situation.

C)When a partnership interest is sold,the buyer and seller can allocate the sale price among the Sec.751 assets and non-Sec.751 assets in any reasonable manner.

D)Statements B and C are true.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

48

If a partner dies,his or her tax year closes

A)on the date of death.

B)on the day after death.

C)on the day before death.

D)on some other date.

A)on the date of death.

B)on the day after death.

C)on the day before death.

D)on some other date.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

49

Identify which of the following statements is true.

A)On December 31 of the current year,Max Curcio's adjusted basis for his interest in the Maduro & Motta Partnership is $36,000.Maduro & Motta distributes cash of $6,000 and a parcel of land held as an investment to Curcio in liquidation of his entire interest in the partnership.The land has an adjusted basis of $18,000 to the partnership and an FMV of $42,000.Curcio's basis in the land is $18,000.

B)Jake has a basis in his partnership interest of $40,000 before receiving a liquidating distribution of $5,000 cash,inventory with a basis of $4,000 and an FMV of $5,000,and land with a basis of $3,000 and an FMV of $6,000.Jake will receive no further distributions.He can recognize a loss of $28,000 at the time the liquidating distribution is received.

C)A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

D)All of the above are false.

A)On December 31 of the current year,Max Curcio's adjusted basis for his interest in the Maduro & Motta Partnership is $36,000.Maduro & Motta distributes cash of $6,000 and a parcel of land held as an investment to Curcio in liquidation of his entire interest in the partnership.The land has an adjusted basis of $18,000 to the partnership and an FMV of $42,000.Curcio's basis in the land is $18,000.

B)Jake has a basis in his partnership interest of $40,000 before receiving a liquidating distribution of $5,000 cash,inventory with a basis of $4,000 and an FMV of $5,000,and land with a basis of $3,000 and an FMV of $6,000.Jake will receive no further distributions.He can recognize a loss of $28,000 at the time the liquidating distribution is received.

C)A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

50

What conditions are required for a partner to recognize a loss upon receipt of a distribution from a partnership?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

51

Marc is a calendar-year taxpayer who owns a 30% capital and profits interest in the MN Partnership.Nancy sells the remaining 70% capital and profits interest to Henry on October 31.The partnership year-end is March 31 as permitted by the IRS for business purpose reasons.The MN Partnership

A)terminates on March 31.

B)terminates on October 31.

C)terminates on December 31.

D)does not terminate.

A)terminates on March 31.

B)terminates on October 31.

C)terminates on December 31.

D)does not terminate.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

52

A partnership terminates for tax purposes

A)only when it terminates under local partnership law.

B)when at least 50% of the total interest in partnership capital and profits changes hands by sale or exchange within twelve consecutive months.

C)when the sale of partnership assets is made only to an outsider(s)and not to an existing partner(s).

D)when a partnership tax return (Form 1065)ceases to be filed by the partnership.

A)only when it terminates under local partnership law.

B)when at least 50% of the total interest in partnership capital and profits changes hands by sale or exchange within twelve consecutive months.

C)when the sale of partnership assets is made only to an outsider(s)and not to an existing partner(s).

D)when a partnership tax return (Form 1065)ceases to be filed by the partnership.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

53

Identify which of the following statements is true.

A)Under the check-the-box rules,an LLC with more than one member is taxed as a corporation unless it elects to be taxed as a partnership.

B)The partnership's tax year closes with respect to a partner whose interest is transferred by gift.

C)An LLC has been taxed as a partnership for five years.Under the check-the-box rules,the LLC makes a timely election in 2019 to be taxed as a C corporation.The election of C corporation status is permitted and results in the LLC's assets being transferred from a partnership to a C corporation under the federal income tax rules.

D)All of the above are false.

A)Under the check-the-box rules,an LLC with more than one member is taxed as a corporation unless it elects to be taxed as a partnership.

B)The partnership's tax year closes with respect to a partner whose interest is transferred by gift.

C)An LLC has been taxed as a partnership for five years.Under the check-the-box rules,the LLC makes a timely election in 2019 to be taxed as a C corporation.The election of C corporation status is permitted and results in the LLC's assets being transferred from a partnership to a C corporation under the federal income tax rules.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

54

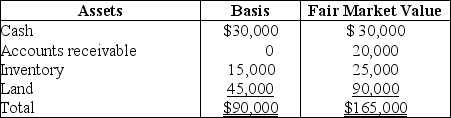

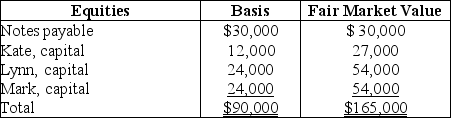

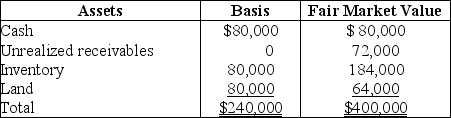

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash.At the time of the sale,the partnership has no liabilities and its assets are as follows: Kenya and Ebony have no agreement concerning the allocation of the sales price.Ordinary income recognized by Kenya as a result of the sale is

A)$6,000.

B)$12,000.

C)$14,000.

D)$16,000.

A)$6,000.

B)$12,000.

C)$14,000.

D)$16,000.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

55

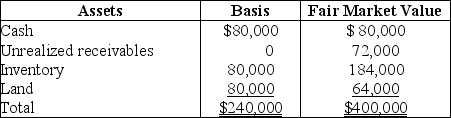

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What is the allocation of Tony's gain to the assets received?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

56

Before receiving a liquidating distribution,Kathy's basis in her interest in the KLM Partnership is $30,000.The distribution consists of $5,000 in money,inventory having a $1,000 basis to the partnership and a $2,000 FMV,and two parcels of undeveloped land (not held as inventory)having basis of $3,000 and $9,000 to the partnership with FMVs of $5,000 and $12,000,respectively.What is Kathy's basis in each parcel of land?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

57

Steve sells his 20% partnership interest having a $28,000 basis to Nancy for $40,000 cash.At the time of the sale,the partnership has no liabilities and its assets are as follows: The receivables and inventory are Sec.751 assets.There is no agreement concerning the allocation of the sales price.Steve must recognize

A)no gain or loss.

B)$12,000 ordinary income.

C)$12,000 capital gain.

D)$14,000 ordinary income and $2,000 capital loss.

A)no gain or loss.

B)$12,000 ordinary income.

C)$12,000 capital gain.

D)$14,000 ordinary income and $2,000 capital loss.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

58

Tony sells his one-fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date.Tony's basis in his partnership interest on the date of the sale is $60,000.What are the amount and character of Tony's gain?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

59

Identify which of the following statements is true.

A)John Albin is a retired partner of Brill & Crum,a personal service partnership.Albin has not rendered any services to Brill & Crum since his retirement six years ago.Under the provisions of Albin's retirement agreement,Brill & Crum is obligated to pay Albin 10% of the partnership's net income each year through the end of the current year.In compliance with the agreement,Brill & Crum pay Albin $25,000 in the current year.Albin should treat this $25,000 as a long-term capital gain.

B)An exchange of partnership interests in different partnerships qualifies under the like-kind exchange rules.

C)The payment for partnership property to a retiring partner is not deductible by the partnership and often not income to the retiring partner.

D)All of the above are false.

A)John Albin is a retired partner of Brill & Crum,a personal service partnership.Albin has not rendered any services to Brill & Crum since his retirement six years ago.Under the provisions of Albin's retirement agreement,Brill & Crum is obligated to pay Albin 10% of the partnership's net income each year through the end of the current year.In compliance with the agreement,Brill & Crum pay Albin $25,000 in the current year.Albin should treat this $25,000 as a long-term capital gain.

B)An exchange of partnership interests in different partnerships qualifies under the like-kind exchange rules.

C)The payment for partnership property to a retiring partner is not deductible by the partnership and often not income to the retiring partner.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

60

Can a partner recognize both a gain and a loss on the sale of a partnership interest? If so,under what conditions?

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

61

The STU Partnership,an electing Large Partnership,has no passive activities and reports the following transactions for the year: net long-term capital losses $50,000,Sec.1231 gain $60,000,ordinary income $20,000,charitable contributions $15,000,and tax-exempt income $2,000.How much will be reported as ordinary income to its partners?

A)$5,000

B)$17,000

C)$20,000

D)$22,000

A)$5,000

B)$17,000

C)$20,000

D)$22,000

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

62

A limited liability company is a form of business entity that combines the legal benefits of the corporate form with the tax benefits of the partnership form.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

63

Identify which of the following statements is false.

A)A sale or exchange of at least 50% of the capital and profits interest in a partnership within a 12- consecutive-month period will terminate the partnership and end all of the partnership's elections.

B)When using the 50% rule to terminate a partnership,if an interest is sold more than once during the 12-month period,each sale is counted separately.

C)A partner's individual income tax return,under some circumstances,may include the results of partnership operations for a period exceeding 12-months.

D)When several different transfers are made during a 12-month period,the partnership termination occurs on the date of the transfer that first crosses the 50% threshold.

A)A sale or exchange of at least 50% of the capital and profits interest in a partnership within a 12- consecutive-month period will terminate the partnership and end all of the partnership's elections.

B)When using the 50% rule to terminate a partnership,if an interest is sold more than once during the 12-month period,each sale is counted separately.

C)A partner's individual income tax return,under some circumstances,may include the results of partnership operations for a period exceeding 12-months.

D)When several different transfers are made during a 12-month period,the partnership termination occurs on the date of the transfer that first crosses the 50% threshold.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

64

When must a partnership make mandatory basis adjustments?

A)on any sale of a 20% or greater partnership interest

B)on any sale of a partnership interest for $250,000 or more

C)on any distribution of assets with a value of $250,000 or more

D)on any sale of a partnership interest where the partnership's adjusted basis in its assets exceeds their fair market value by $250,000 or more

A)on any sale of a 20% or greater partnership interest

B)on any sale of a partnership interest for $250,000 or more

C)on any distribution of assets with a value of $250,000 or more

D)on any sale of a partnership interest where the partnership's adjusted basis in its assets exceeds their fair market value by $250,000 or more

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

65

Patrick purchased a one-third interest in the PPP partnership for $600,000.At the time of the purchase,the partnership had a 754 election in effect and its only asset was land with a basis of $1,500,000.This year,PPP sells the land for $1,800,000.What is Patrick's recognized share of the gain on the sale of the land?

A)$0

B)$100,000

C)$300,000

D)none of the above

A)$0

B)$100,000

C)$300,000

D)none of the above

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

66

The AB,BC,and CD Partnerships merge into the ABCD Partnership.AB (owned by Austin and Ben)contributes assets worth $100,000.BC (owned by Ben and Charlie)contributes assets worth $200,000.CD (owned by Charlie and Dennis)contributes assets worth $300,000.The capital and profits interest in ABCD is owned by: Austin,10%; Ben,30%; Charlie,25%; and Dennis,35%.ABCD Partnership is a continuation of

A)AB.

B)BC.

C)CD.

D)none of the partnerships.

A)AB.

B)BC.

C)CD.

D)none of the partnerships.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

67

Identify which of the following statements is true.

A)The partnership tax year closes when a partner transfers his interest by gift.

B)If a partner dies in a two-member partnership,the partnership terminates on the date of death,even though the successor-in-interest continues to share in the profits and losses of the partnership business.

C)When the interest of a partner who owns 60% of a partnership is completely liquidated by a partnership distribution,the partnership is considered terminated,even though three other partners remain.

D)All of the above are false.

A)The partnership tax year closes when a partner transfers his interest by gift.

B)If a partner dies in a two-member partnership,the partnership terminates on the date of death,even though the successor-in-interest continues to share in the profits and losses of the partnership business.

C)When the interest of a partner who owns 60% of a partnership is completely liquidated by a partnership distribution,the partnership is considered terminated,even though three other partners remain.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

68

Identify which of the following statements is true.

A)When a partnership is divided into two or more new partnerships,all of the resulting partnerships must be considered new partnerships.

B)A partnership is "publicly traded" only if its interests are traded on an established securities exchange.

C)A limited liability company is a form of business entity that combines the legal benefits of the corporate form with the tax benefits of the partnership form.

D)All of the above are false.

A)When a partnership is divided into two or more new partnerships,all of the resulting partnerships must be considered new partnerships.

B)A partnership is "publicly traded" only if its interests are traded on an established securities exchange.

C)A limited liability company is a form of business entity that combines the legal benefits of the corporate form with the tax benefits of the partnership form.

D)All of the above are false.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following statements is correct?

A)A partnership may make an annual election to adjust the basis of its assets upon the sale of a partnership interest.

B)The Sec.754 election applies to both sales and distributions.

C)The Sec.754 election applies to only current and nonliquidating distributions.

D)A partnership can revoke a Sec.754 election every 5 years.

A)A partnership may make an annual election to adjust the basis of its assets upon the sale of a partnership interest.

B)The Sec.754 election applies to both sales and distributions.

C)The Sec.754 election applies to only current and nonliquidating distributions.

D)A partnership can revoke a Sec.754 election every 5 years.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

70

Patrick purchases a one-third interest in the PPP partnership for $600,000.The partnership has assets with a value of $1,500,000.PPP has a 754 election in effect.What is the amount of the basis adjustment?

A)$0

B)$300,000 increase in the basis of partnership assets

C)$100,000 increase in Patrick's basis in the partnership assets

D)$100,000 increase in Patrick's share of the basis in the partnership assets

A)$0

B)$300,000 increase in the basis of partnership assets

C)$100,000 increase in Patrick's basis in the partnership assets

D)$100,000 increase in Patrick's share of the basis in the partnership assets

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

71

A partnership terminates for federal income tax purposes if

A)a general partner who owns a majority interest dies.

B)state partnership law terminates the partnership.

C)a partnership interest of more than 50% is gifted.

D)within a 12-month period,there is a sale or exchange of at least 50% of the total interest in partnership capital and profits.

A)a general partner who owns a majority interest dies.

B)state partnership law terminates the partnership.

C)a partnership interest of more than 50% is gifted.

D)within a 12-month period,there is a sale or exchange of at least 50% of the total interest in partnership capital and profits.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

72

The LM Partnership terminates for tax purposes on July 15 when Latasha sells her 60% capital and profits interest to Zoe for $100,000.The partnership has no liabilities,and its assets at the time of termination are as follows: Marika,a 40% partner in the LM Partnership,has a $64,800 basis in her partnership interest (outside basis)at the time of the termination.She has held her LM Partnership interest for three years at the time of the termination.The basis of Marika and Zoe in the new LM Partnership is:

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

73

Which of the following is a valid reason for making a 754 election?

A)An incoming partner pays more for a partnership interest that his or her proportionate share of partnership assets.

B)Partners are able to increase their basis in the partnership interest upon the sale of a partnership interest.

C)Partnerships can increase,but not decrease,their basis in partnership assets.

D)A partnership can reduce its basis in assets upon cash distributions to partners.

A)An incoming partner pays more for a partnership interest that his or her proportionate share of partnership assets.

B)Partners are able to increase their basis in the partnership interest upon the sale of a partnership interest.

C)Partnerships can increase,but not decrease,their basis in partnership assets.

D)A partnership can reduce its basis in assets upon cash distributions to partners.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

74

Han purchases a 25% interest in the CHOP Partnership from Huang for $600,000.The partnership has assets with a basis of $1,600,000.What is the amount of the basis adjustment,if the partnership has a 754 election in place?

A)$0

B)$150,000 increase in Han's basis in his partnership interest

C)$200,000 increase in Han's share of the basis in partnership assets

D)$1,000,000 increase in partnership assets

A)$0

B)$150,000 increase in Han's basis in his partnership interest

C)$200,000 increase in Han's share of the basis in partnership assets

D)$1,000,000 increase in partnership assets

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

75

Sally is a calendar-year taxpayer who owns a 30% capital and profits interest in the SEM Partnership.Eric sells the remaining 70% capital and profits interest to Michelle on October 3.The partnership year-end is March 31 as permitted by the IRS for business purposes.Which of the following statements is correct?

A)Sally must conform her tax year with the partnership tax year.

B)The new partnership is a continuation of the old partnership.

C)Sally's tax return will include a partnership distributive share only for the period ending March 31.

D)Sally's tax return will include partnership distributive shares for periods ending March 31 and October 3.

A)Sally must conform her tax year with the partnership tax year.

B)The new partnership is a continuation of the old partnership.

C)Sally's tax return will include a partnership distributive share only for the period ending March 31.

D)Sally's tax return will include partnership distributive shares for periods ending March 31 and October 3.

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck

76

The STU Partnership,an electing Large Partnership,has no passive activities and reports the following transactions for the year: net long-term capital losses $50,000,Sec.1231 gain $60,000,ordinary income $20,000,charitable contributions $15,000,and tax-exempt income $2,000.How much will be reported as long-term capital gains to its partners?

A)$0

B)$10,000

C)$50,000

D)$60,000

A)$0

B)$10,000

C)$50,000

D)$60,000

Unlock Deck

Unlock for access to all 76 flashcards in this deck.

Unlock Deck

k this deck