Deck 10: Special Partnership Issues

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/101

Play

Full screen (f)

Deck 10: Special Partnership Issues

1

A partner's holding period for property distributed as a current distribution begins on the date of distribution.

False

2

Becky has a $24,000 basis in her partnership interest. She receives a current distribution of $4,000 cash, unrealized receivables with a basis of $12,000 and an FMV of $16,000, and land held as an investment with a basis of $3,000 and an FMV of $8,000. The partners' relative interests in the Sec. 751 assets do not change as a result of the current distribution. The basis of her partnership interest following the distribution is

A) ($4,000).

B) $1,000.

C) $5,000.

D) $0.

A) ($4,000).

B) $1,000.

C) $5,000.

D) $0.

C

3

If a distribution occurs within years of the contribution date, in a nonliquidating distribution that does not qualify for Sec. 751 treatment, the distribution event may trigger a precontribution gain or loss.

A) three

B) seven

C) five

D) unlimited

A) three

B) seven

C) five

D) unlimited

B

4

A partnership cannot recognize a gain or loss on a current distribution.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

5

Carlos has a basis in his partnership interest of $30,000. He receives a current distribution of $6,000 cash, unrealized receivables (FMV $11,000, basis $10,000), inventory (FMV $8,000, basis $4,000), land held as an investment (FMV $7,000, basis, $6,000), and building (FMV $21,000, basis $9,000). The partners' relative interests in the Sec. 751 assets do not change as a result of the current distribution. Carlos's basis in the building is

A) $6,000.

B) $9,000.

C) $7,500.

D) $2,500.

A) $6,000.

B) $9,000.

C) $7,500.

D) $2,500.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

6

Mirabelle contributed land with a $5,000 basis and a $9,000 FMV to MS Partnership four years ago. This year the land is distributed to Sergio, another partner in the partnership. At the time of distribution, the land had a $12,000 FMV. What is the impact of the distribution on Mirabelle's partnership basis?

A) 0

B) $7,000 increase

C) $4,000 increase

D) $4,000 decrease

A) 0

B) $7,000 increase

C) $4,000 increase

D) $4,000 decrease

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

7

John has a basis in his partnership interest of $30,000. He receives a current distribution of $6,000 cash, unrealized receivables (FMV $11,000, basis $10,000), inventory (FMV $8,000, basis $4,000), and investment land (FMV $7,000, basis $6,000). The partners' relative interest in the Sec. 751 assets do not change as a result of the current distribution. His basis in the land is

A) $7,000.

B) $5,000.

C) $6,000.

D) $10,000.

A) $7,000.

B) $5,000.

C) $6,000.

D) $10,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

8

Susan contributed land with a basis of $6,000 and an FMV of $10,000 to the SH Partnership two years ago to acquire her partnership interest. This year, the land is distributed to Harry when its FMV is $11,000. No other distributions have been made since Susan became a partner. When the land is distributed, the partnership's basis in the land immediately before distribution is increased by

A) $4,000.

B) $5,000.

C) $1,000.

D) $0.

A) $4,000.

B) $5,000.

C) $1,000.

D) $0.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

9

Helmut contributed land with a basis of $5,000 and an FMV of $10,000 to the HG Partnership five years ago to acquire a 50% partnership interest. This year the land is distributed to another partner, Gail, when its FMV is $11,000. No other distributions have been made since Helmut became a partner. When the land is distributed to Gail, Helmut recognizes a gain of

A) $5,000.

B) $0.

C) $2,500.

D) $3,000.

A) $5,000.

B) $0.

C) $2,500.

D) $3,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

10

If a partnership asset with a deferred precontribution gain is distributed within seven years of acquisition in a nonliquidating distribution to a partner who did not contribute the asset, the precontribution gain must be recognized by the contributing partner.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

11

In a current distribution, the partner's basis in the partnership interest is reduced by the amount of money received and by the partnership's bases in the distributed property.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

12

Danielle has a basis in her partnership interest of $12,000. She receives a current distribution of $8,000 cash and equipment with a basis of $7,000. There is no potential gain under Sec. 737. What is her basis in the equipment?

A) $0

B) $7,000

C) $4,000

D) none of the above

A) $0

B) $7,000

C) $4,000

D) none of the above

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

13

Identify which of the following statements is true.

A) The basis for property distributed by a partnership cannot be increased above the carryover basis amount when it is received by a partner in a nonliquidating distribution.

B) The length of time a partner owns a partnership interest is relevant when determining the holding period for distributed property.

C) A partner's partnership capital account balance cannot be less than zero.

D) All of the above are false.

A) The basis for property distributed by a partnership cannot be increased above the carryover basis amount when it is received by a partner in a nonliquidating distribution.

B) The length of time a partner owns a partnership interest is relevant when determining the holding period for distributed property.

C) A partner's partnership capital account balance cannot be less than zero.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

14

Identify which of the following statements is true.

A) The partner's basis in the partnership interest is normally reduced by the FMV of property distributed in a nonliquidating distribution.

B) When a current distribution from a partnership reduces the basis of the partnership interest to zero, the partner's interest in the partnership is terminated.

C) If a partnership asset with a deferred precontribution gain is distributed in a nonliquidating distribution to the partner who contributed the asset, the precontribution gain must be recognized by the partner.

D) All of the above are false.

A) The partner's basis in the partnership interest is normally reduced by the FMV of property distributed in a nonliquidating distribution.

B) When a current distribution from a partnership reduces the basis of the partnership interest to zero, the partner's interest in the partnership is terminated.

C) If a partnership asset with a deferred precontribution gain is distributed in a nonliquidating distribution to the partner who contributed the asset, the precontribution gain must be recognized by the partner.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

15

A new partner, Gary, contributes cash and assumes a share of partnership liabilities. Diane's capital, profits, and loss interest in the partnership is reduced by 5% due to the admission of Gary. The Sec. 751 rules do not apply. Partnership liabilities at the time Gary is admitted are $200,000, and all of the liabilities are recourse debts for which the partners share the economic risk of loss in the same way they share partnership profits. Diane's basis in the partnership interest prior to Gary's admission is $5,000. Due to the admission of Gary, partner Diane has

A) a recognized gain of $5,000 and a partnership interest basis of zero.

B) no recognized gain or loss.

C) no recognized gain or loss and a partnership interest basis of $10,000.

D) a recognized gain of $5,000 and a partnership interest basis of $5,000.

A) a recognized gain of $5,000 and a partnership interest basis of zero.

B) no recognized gain or loss.

C) no recognized gain or loss and a partnership interest basis of $10,000.

D) a recognized gain of $5,000 and a partnership interest basis of $5,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

16

Two years ago, Tom contributed investment land with a basis of $50,000 and an FMV of $62,000 to the RST Partnership. This year, Tom has a basis in his partnership interest of $53,000 when he receives a current distribution of $14,000 cash and inventory with a basis of $35,000 and an FMV of $52,000. (There is no Sec. 751 exchange in connection with the inventory distribution.) The partnership continues to hold the land Tom contributed. How much gain (if any) must Tom recognize as a result of this distribution?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

17

Bart has a partnership interest with a $32,000 basis. He receives a current distribution of $6,000 cash, unrealized receivables (FMV $9,000, basis $10,000), inventory (FMV $8,000, basis $4,000), investment land (FMV $7,000, basis $4,000), and building (FMV $20,000, basis $8,000). No depreciation recapture applies with respect to the building. The partners' relative interests in the Sec. 751 assets do not change as a result of the current distribution. Bart's basis in the building is

A) $4,000.

B) $3,000.

C) $8,000.

D) $6,000.

A) $4,000.

B) $3,000.

C) $8,000.

D) $6,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

18

On November 30, Teri received a current distribution of cash of $4,000, marketable securities with a basis of

$24,000 and an FMV of $30,000, and inventory with a basis of $2,000 and an FMV of $6,000. Prior to the distribution, Teri's basis in her interest in the partnership was $30,000. (There is no Sec. 751 exchange as a result of the distribution.) How much gain (if any) must Teri recognize as a result of the distribution?

$24,000 and an FMV of $30,000, and inventory with a basis of $2,000 and an FMV of $6,000. Prior to the distribution, Teri's basis in her interest in the partnership was $30,000. (There is no Sec. 751 exchange as a result of the distribution.) How much gain (if any) must Teri recognize as a result of the distribution?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

19

The total bases of all distributed property in the partner's hands following a nonliquidating distribution is limited to

A) the predistribution FMV of the partner's partnership interest.

B) the FMV of the property distributed.

C) the partner's predistribution basis in his partnership interest.

D) the partnership's bases in the distributed property.

A) the predistribution FMV of the partner's partnership interest.

B) the FMV of the property distributed.

C) the partner's predistribution basis in his partnership interest.

D) the partnership's bases in the distributed property.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

20

Tenika has a $10,000 basis in her interest in the TF Partnership and no remaining precontribution gain immediately before receiving a current distribution that consisted of $4,000 in money, plastic tubes held in inventory with a $3,000 basis to the partnership and an FMV of $3,375, and drip irrigation pipe held as inventory with a $6,000 basis to the partnership and an FMV of $5,000. What is the basis in Tenika's hands of the distributed property?

A) $6,000

B) $10,000

C) $10,125

D) $9,000

A) $6,000

B) $10,000

C) $10,125

D) $9,000

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

21

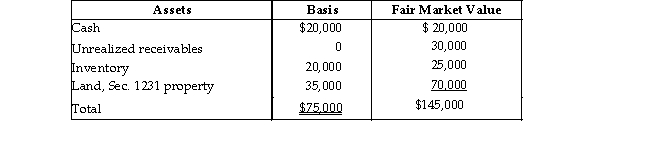

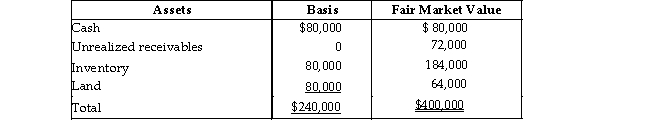

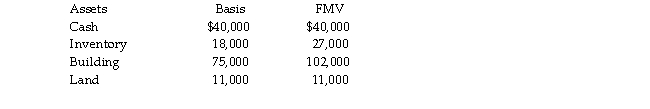

The Tandy Partnership owns the following assets on December 31:  Is the partnership's inventory considered to be substantially appreciated for purposes of Sec. 751? Show your work.

Is the partnership's inventory considered to be substantially appreciated for purposes of Sec. 751? Show your work.

Is the partnership's inventory considered to be substantially appreciated for purposes of Sec. 751? Show your work.

Is the partnership's inventory considered to be substantially appreciated for purposes of Sec. 751? Show your work.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

22

Under Sec. 751, unrealized receivables include potential Section 1245 or 1250 recapture on the partnership's depreciable property.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

23

Last year, Cara contributed investment land with an FMV of $24,000 and basis of $18,000 to the CDE Partnership. CDE made no distributions during last year, and Cara's basis in her partnership interest on December 31 of last year was $28,000. On January 1 of this year, the partnership distributed cash of $30,000 to Cara and distributed the land contributed by Cara to another partner, David. On the distribution date, the land had a $27,000 FMV. Assume the CDE Partnership reported no profit or loss this year. How much gain (if any) must Cara recognize as a result of the distributions? What is her basis in the partnership after the distributions?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

24

For Sec. 751 purposes, "substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

25

The TK Partnership has two assets: $20,000 cash and a machine having a $28,000 basis and a $40,000 FMV. The partnership has claimed $16,000 in depreciation on the machine since its purchase. If the machine is sold for its FMV, would TK Partnership have an unrealized receivable item?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

26

The ABC Partnership owns the following assets on December 31.

The indication that ABC owns substantially appreciated inventory is

A) the FMV of all assets except land is $90,000 while their bases is $40,000.

B) the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

C) the total FMV of all assets except cash is greater than their total basis.

D) the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

The indication that ABC owns substantially appreciated inventory is

A) the FMV of all assets except land is $90,000 while their bases is $40,000.

B) the FMV of the inventory is $30,000 while its adjusted basis is $20,000.

C) the total FMV of all assets except cash is greater than their total basis.

D) the FMV of the inventory and unrealized receivables is $70,000 while their adjusted bases is $20,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

27

What is included in the definition of unrealized receivables?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

28

For purposes of Sec. 751, inventory includes all of the following except

A) accounts receivable.

B) items held for sale in the ordinary course of business.

C) capital assets or 1231 property.

D) All of the above are inventory per Sec. 751.

A) accounts receivable.

B) items held for sale in the ordinary course of business.

C) capital assets or 1231 property.

D) All of the above are inventory per Sec. 751.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

29

What is the definition of "substantially appreciated inventory"?

A) inventory and unrealized receivables with a FMV greater than their basis

B) inventory and unrealized receivables with a FMV greater than 120% of their basis

C) inventory with a FMV greater than its basis

D) inventory with a FMV greater than 120% of its basis

A) inventory and unrealized receivables with a FMV greater than their basis

B) inventory and unrealized receivables with a FMV greater than 120% of their basis

C) inventory with a FMV greater than its basis

D) inventory with a FMV greater than 120% of its basis

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

30

Identify which of the following statements is true.

A) Unrealized receivables include rights to payments on the sale of a capital asset.

B) The primary purpose of Sec. 751 is to prevent partnerships from converting capital gains into ordinary income.

C) If a partner sells property received in a partnership distribution for a gain and the property was inventory in the hands of the distributing partnership, the partner will always recognize ordinary income.

D) All of the above are false.

A) Unrealized receivables include rights to payments on the sale of a capital asset.

B) The primary purpose of Sec. 751 is to prevent partnerships from converting capital gains into ordinary income.

C) If a partner sells property received in a partnership distribution for a gain and the property was inventory in the hands of the distributing partnership, the partner will always recognize ordinary income.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

31

The definition of "unrealized receivable" does not include the

A) right to payment for services performed by a cash- basis taxpayer.

B) right to payment for services performed by an accrual- basis taxpayer.

C) recapture potential on Sec. 1250 property.

D) recapture potential on Sec. 1245 property.

A) right to payment for services performed by a cash- basis taxpayer.

B) right to payment for services performed by an accrual- basis taxpayer.

C) recapture potential on Sec. 1250 property.

D) recapture potential on Sec. 1245 property.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

32

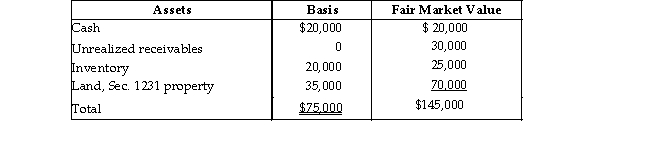

Jerry has a $50,000 basis for his interest in JJ Partnership before receiving a current distribution consisting of

$8,000 in money, accounts receivable having a zero basis to the partnership, and land having a $28,000 basis to the partnership. What will Jerry's basis be in these assets?

$8,000 in money, accounts receivable having a zero basis to the partnership, and land having a $28,000 basis to the partnership. What will Jerry's basis be in these assets?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

33

Identify which of the following statements is true.

A) For Sec. 751 purposes, "substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

B) Inventory for Sec. 751 purposes includes all property except cash, capital assets, and Sec. 1231 assets.

C) The depreciation recapture potential for a Sec. 1245 property is not included in the definition of a Sec. 751 asset.

D) All of the above are false.

A) For Sec. 751 purposes, "substantially appreciated inventory" means property held for sale to customers whose market value exceeds its adjusted basis.

B) Inventory for Sec. 751 purposes includes all property except cash, capital assets, and Sec. 1231 assets.

C) The depreciation recapture potential for a Sec. 1245 property is not included in the definition of a Sec. 751 asset.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

34

When Rachel's basis in her interest in the RST Partnership is $40,000, she receives a current distribution of office equipment. The equipment has an FMV of $60,000 and a basis of $50,000. Rachel will not use the office equipment in a business activity. What tax issues should Rachel consider with respect to the distribution?

When Rachel's basis in her interest in the RST Partnership is $40,000, she receives a current distribution of office equipment. The equipment has an FMV of $60,000 and a basis of $50,000. Rachel will not use the office equipment in a business activity. What tax issues should Rachel consider with respect to the distribution?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

35

The AB Partnership has a machine with an FMV of $25,000 and a basis of $20,000. The partnership has taken an $8,000 depreciation on the machine. The unrealized receivable related to the machine is

A) $20,000.

B) $0.

C) $5,000.

D) $8,000.

A) $20,000.

B) $0.

C) $5,000.

D) $8,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

36

The Internal Revenue Code includes which of the following assets in the definition of Sec. 751 properties?

A) capital assets

B) inventory, which is substantially appreciated

C) cash

D) Sec. 1231 assets

A) capital assets

B) inventory, which is substantially appreciated

C) cash

D) Sec. 1231 assets

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

37

The XYZ Partnership owns the following assets on December 31:

By how much must XYZ reduce its unrealized receivables to avoid meeting the substantially apprec inventory test?

A) $10,000

B) $15,000

C) $14,000

D) No amount of reduction of unrealized receivables will affect meeting the substantially appreciated inventory test.

By how much must XYZ reduce its unrealized receivables to avoid meeting the substantially apprec inventory test?

A) $10,000

B) $15,000

C) $14,000

D) No amount of reduction of unrealized receivables will affect meeting the substantially appreciated inventory test.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

38

Do most distributions made by a partnership require a Sec. 751 calculation?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

39

The definition of "inventory" for purposes of Sec. 751 includes

A) marketable securities not held by dealers.

B) land held for investment.

C) depreciation recapture potential on Sec. 1231 assets.

D) cash.

A) marketable securities not held by dealers.

B) land held for investment.

C) depreciation recapture potential on Sec. 1231 assets.

D) cash.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

40

The XYZ Partnership owns the following assets on December 31:

A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution

$10,000 cash. XYZ Partnership has no liabilities. His recognized gain is

A) $3,000 ordinary income.

B) $4,000 capital gain.

C) $3,000 ordinary income and $1,000 capital gain.

D) $3,000 capital gain and $1,000 ordinary income.

A partner has a 20% interest with a basis of $6,000 in XYZ before receiving a liquidating distribution

$10,000 cash. XYZ Partnership has no liabilities. His recognized gain is

A) $3,000 ordinary income.

B) $4,000 capital gain.

C) $3,000 ordinary income and $1,000 capital gain.

D) $3,000 capital gain and $1,000 ordinary income.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

41

Identify which of the following statements is true.

A) The basis of the partnership interest is apportioned between all of the assets received in a liquidating distribution based on the relative FMVs of the assets.

B) When unrealized receivables are distributed in a liquidating distribution, the basis of the receivables will be increased.

C) The bases of unrealized receivables and inventory distributed by a partnership in liquidation of a partnership interest are never increased above their bases in the hands of the partnership.

D) All of the above are false.

A) The basis of the partnership interest is apportioned between all of the assets received in a liquidating distribution based on the relative FMVs of the assets.

B) When unrealized receivables are distributed in a liquidating distribution, the basis of the receivables will be increased.

C) The bases of unrealized receivables and inventory distributed by a partnership in liquidation of a partnership interest are never increased above their bases in the hands of the partnership.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

42

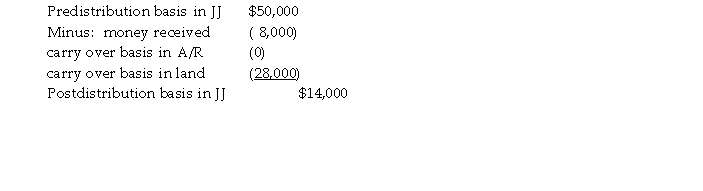

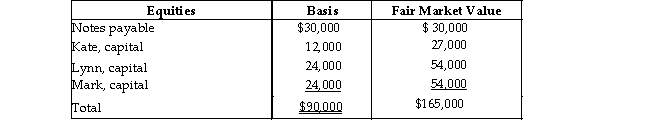

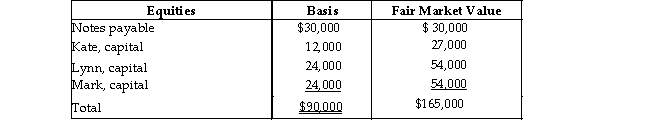

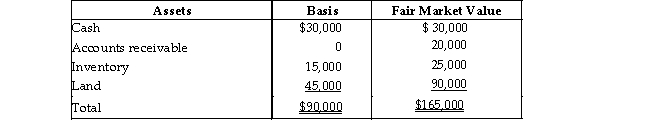

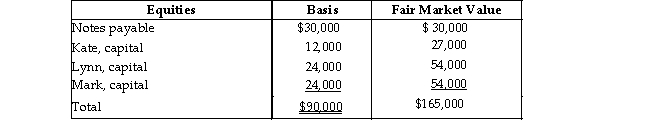

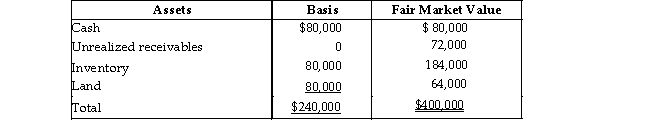

On December 31, Kate receives a $28,000 liquidating distribution from the KLM Partnership. On that date, Kate's basis in her limited partnership interest is $18,000 (which, of course, includes her share of partnership liabilities). The other partners assume her $6,000 share of liabilities. Just prior to the distribution, the partnership has the following balance sheet. Kate is leaving the partnership but the partnership is continuing.

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

What is the amount and character of the gain that Kate must recognize on the liquidating distribution?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

43

A partner can recognize gain, but not loss, on a liquidating distribution.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

44

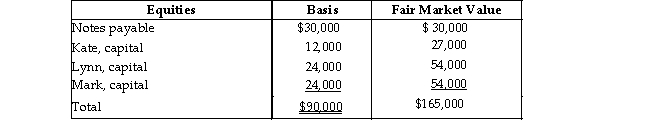

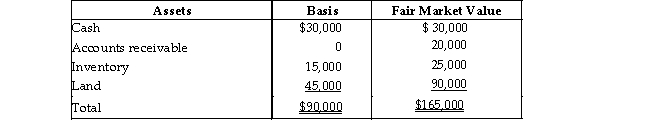

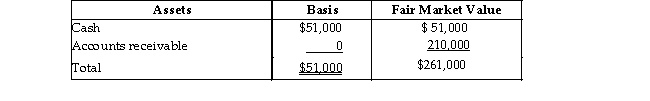

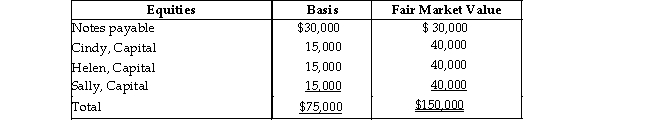

On December 31, Kate sells her 20% interest (with a basis of $18,000 which, of course, includes a share of partnership liabilities) in the KLM Partnership to Karl for $27,000 cash plus assumption of her $6,000 share of liabilities. On that date, the partnership has the following balance sheet:

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

What are the amount and character of the gain that Kate must recognize on the sale?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

45

Identify which of the following statements is true.

A) Jake has a basis in his partnership interest of $40,000 before receiving a liquidating distribution of $5,000 cash, inventory with a basis of $4,000 and an FMV of $5,000, and land with a basis of $3,000 and an FMV of $6,000. Jake will receive no further distributions. He can recognize a loss of $28,000 at the time the liquidating distribution is received.

B) On December 31 of the current year, Max Curcio's adjusted basis for his interest in the Maduro & Motta Partnership is $36,000. Maduro & Motta distributes cash of $6,000 and a parcel of land held as an investment to Curcio in liquidation of his entire interest in the partnership. The land has an adjusted basis of $18,000 to the partnership and an FMV of $42,000. Curcio's basis in the land is $18,000.

C) A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

D) All of the above are false.

A) Jake has a basis in his partnership interest of $40,000 before receiving a liquidating distribution of $5,000 cash, inventory with a basis of $4,000 and an FMV of $5,000, and land with a basis of $3,000 and an FMV of $6,000. Jake will receive no further distributions. He can recognize a loss of $28,000 at the time the liquidating distribution is received.

B) On December 31 of the current year, Max Curcio's adjusted basis for his interest in the Maduro & Motta Partnership is $36,000. Maduro & Motta distributes cash of $6,000 and a parcel of land held as an investment to Curcio in liquidation of his entire interest in the partnership. The land has an adjusted basis of $18,000 to the partnership and an FMV of $42,000. Curcio's basis in the land is $18,000.

C) A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

46

Identify which of the following statements is true.

A) The rule for recognizing gain on a liquidating distribution is the same rule that is used for a current distribution.

B) A liquidating distribution that terminates a partnership interest cannot include more than one distribution.

C) A partnership with a large amount of unrealized receivables and substantially appreciated inventory items liquidated and distributed all of its assets in kind to each partner in proportion to their partnership interests. Each partner will report ordinary income at the time these assets are received equal to their FMV.

D) All of the above are false.

A) The rule for recognizing gain on a liquidating distribution is the same rule that is used for a current distribution.

B) A liquidating distribution that terminates a partnership interest cannot include more than one distribution.

C) A partnership with a large amount of unrealized receivables and substantially appreciated inventory items liquidated and distributed all of its assets in kind to each partner in proportion to their partnership interests. Each partner will report ordinary income at the time these assets are received equal to their FMV.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

47

Adnan had an adjusted basis of $11,000 for his interest in the Adnan and Donnell Partnership on December 31. On this date, Adnan received from the partnership, in complete liquidation of his interest, $10,000 cash and land with a $2,000 basis to the partnership and a $3,000 FMV. What is Adnan's basis for the land distributed to him?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

48

Ted King's basis for his interest in the Troy Partnership is $24,000. In complete liquidation of his interest, King receives cash of $4,000 and real property (not a Sec. 751 asset) having an FMV of $40,000. Troy's adjusted basis for this realty is $15,000. Section 736 does not apply. King's basis for this realty is

A) $36,000.

B) $15,000.

C) $20,000.

D) $40,000.

A) $36,000.

B) $15,000.

C) $20,000.

D) $40,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

49

Ten years ago, Latesha acquired a one- third interest in Dana Associates, a partnership, for $26,000 cash. This year, Latesha's entire interest in the partnership is liquidated when her basis is $24,000. Dana's assets consist of the following: cash, $20,000; inventory with a basis of $46,000 and an FMV of $40,000. Dana has no liabilities. Latesha receives the cash of $20,000 in liquidation of her entire interest. What is Latesha's recognized loss on the liquidation of her interest in Dana?

A) $4,000 long- term capital loss

B) $4,000 long- term capital loss and $2,000 ordinary loss

C) $4,000 short- term capital loss and $2,000 ordinary loss

D) $0

A) $4,000 long- term capital loss

B) $4,000 long- term capital loss and $2,000 ordinary loss

C) $4,000 short- term capital loss and $2,000 ordinary loss

D) $0

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

50

Identify which of the following statements is false.

A) When a partnership interest is sold, the buyer and seller can allocate the sale price among the Sec. 751 assets and non- Sec. 751 assets in any reasonable manner.

B) On June 30 of the current year, James Roe sells his interest in the Roe & Doe Partnership for $30,000. Roe's adjusted basis in Roe & Doe at June 30 is $7,500 before apportionment of any partnership income for the current year. The Roe & Doe Partnership uses the calendar year as its tax year and has no liabilities on June 30. Roe's distributive share of partnership income up to June 30 is $22,500. Roe acquired his interest in the partnership five years ago. Roe will have a long- term capital gain on the sale of his interest of $22,500.

C) Section 751 assets include all inventory and all unrealized receivables in a sale or exchange situation.

D) Statements B and C are true.

A) When a partnership interest is sold, the buyer and seller can allocate the sale price among the Sec. 751 assets and non- Sec. 751 assets in any reasonable manner.

B) On June 30 of the current year, James Roe sells his interest in the Roe & Doe Partnership for $30,000. Roe's adjusted basis in Roe & Doe at June 30 is $7,500 before apportionment of any partnership income for the current year. The Roe & Doe Partnership uses the calendar year as its tax year and has no liabilities on June 30. Roe's distributive share of partnership income up to June 30 is $22,500. Roe acquired his interest in the partnership five years ago. Roe will have a long- term capital gain on the sale of his interest of $22,500.

C) Section 751 assets include all inventory and all unrealized receivables in a sale or exchange situation.

D) Statements B and C are true.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

51

Kenya sells her 20% partnership interest having a $28,000 basis to Ebony for $40,000 cash. At the tim the sale, the partnership has no liabilities and its assets are as follows: Kenya and Ebony have no agreement concerning the allocation of the sales price. Ordinary income recognized by Kenya as a result of the sale is

A) $12,000.

B) $16,000.

C) $6,000.

D) $14,000.

A) $12,000.

B) $16,000.

C) $6,000.

D) $14,000.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

52

Eicho's interest in the DPQ Partnership is terminated when her basis in the partnership is $70,000. She receives a liquidating distribution of $20,000 cash and inventory with a $24,000 basis and a $40,000 FMV. She also receives, as part of the distribution, a desk that has a $100 basis and a $200 FMV to the partnership. What is her gain or loss, and what is her basis in the items received?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

53

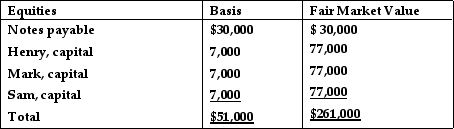

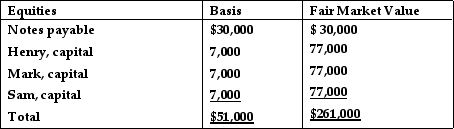

The HMS Partnership, a cash method of accounting entity, has the following balance sheet at December 31 of last year:

Sam, who has a one- third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for

Sam, who has a one- third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for

$77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Sam, who has a one- third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for

Sam, who has a one- third interest in profits, losses, and liabilities, sells his partnership interest to Beverly, for$77,000 cash on January 1 of this year. Sam's basis in his partnership interest (which, of course, includes a share of partnership liabilities) at the time of the sale was $17,000. In addition, Beverly assumes Sam's share of the partnership liabilities. What is the amount and character of the gain that Sam will recognize from this sale?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

54

The sale of a partnership interest always results in capital gain or loss rather than ordinary income.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

55

Derrick's interest in the DEF Partnership is liquidated when his basis in the interest is $30,000. He receives a liquidating distribution of $20,000 cash and inventory with a basis of $8,000 and an FMV of $30,000. Derrick will recognize

A) $2,000 ordinary loss.

B) $2,000 capital loss.

C) $10,000 capital loss and $20,000 ordinary loss.

D) no gain or loss.

A) $2,000 ordinary loss.

B) $2,000 capital loss.

C) $10,000 capital loss and $20,000 ordinary loss.

D) no gain or loss.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

56

Ed receives a $20,000 cash distribution from the EV Partnership, which reduces his partnership interest from one- third to one- fourth. The EV Partnership is a general partnership that uses the cash method of accounting and has substantial liabilities. EV's inventory has appreciated substantially since it was purchased. What issues should Ed consider with regard to the distribution?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

57

Eicho's interest in the DPQ Partnership is terminated when her basis in the partnership is $70,000. She receives a liquidating distribution of $20,000 cash and inventory with a $24,000 basis and a $40,000 FMV. What is her gain or loss, and what is her basis in the inventory received?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

58

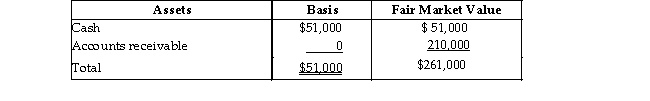

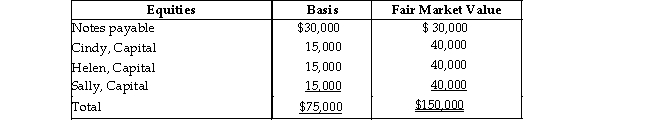

The CHS Partnership's balance sheet presented below is prepared on a cash basis at September 30 of the current year.

Cindy withdraws from the partnership under an agreement whereby she takes one- third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is

Cindy withdraws from the partnership under an agreement whereby she takes one- third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is

$25,000. What gain/loss should she report for tax purposes?

Cindy withdraws from the partnership under an agreement whereby she takes one- third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is

Cindy withdraws from the partnership under an agreement whereby she takes one- third of each of the three assets and assumes $10,000 of the notes payable. Her basis for the partnership interest before any distribution is$25,000. What gain/loss should she report for tax purposes?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

59

A partner's holding period for a partnership interest is never considered when determining the holding period for property distributed in a liquidating distribution.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

60

Steve sells his 20% partnership interest having a $28,000 basis to Nancy for $40,000 cash. At the time sale, the partnership has no liabilities and its assets are as follows: The receivables and inventory are Sec. 751 assets. There is no agreement concerning the allocation o sales price. Steve must recognize

A) $12,000 capital gain.

B) no gain or loss.

C) $12,000 ordinary income.

D) $14,000 ordinary income and $2,000 capital loss.

A) $12,000 capital gain.

B) no gain or loss.

C) $12,000 ordinary income.

D) $14,000 ordinary income and $2,000 capital loss.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

61

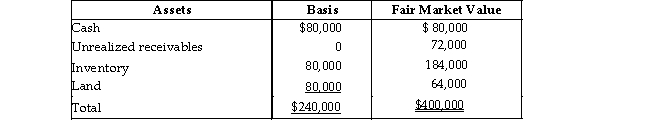

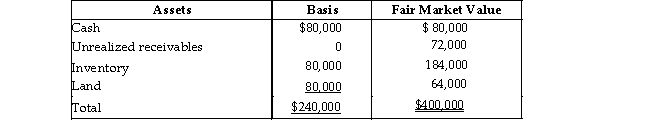

Tony sells his one- fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:  The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What is the amount of gain realized by Tony on the sale of his partnership interest?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

62

What conditions are required for a partner to recognize a loss upon receipt of a distribution from a partnership?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

63

What is the character of the gain/loss on the sale of a partnership interest?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

64

When a retiring partner receives payments that exceed the value of that partner's partnership property, the excess payment is a guaranteed payment.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

65

If a partner dies, his or her tax year closes

A) on the day before death.

B) on the day after death.

C) on some other date.

D) on the date of death.

A) on the day before death.

B) on the day after death.

C) on some other date.

D) on the date of death.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

66

Joshua is a 40% partner in the XY Partnership when he sells his entire interest to Stanley for $60,000 cash. At the time of the sale, Joshua's basis is $36,000, which includes his $10,000 share of partnership liabilities. The partnership has no Sec. 751 assets. Calculate Joshua's gain or loss on the sale.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

67

Tony sells his one- fourth interest in the WindyCity Partnership to Bill for $100,000 cash when the partnership's assets are as follows:  The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What are the amount and character of Tony's gain?

The partnership has no liabilities on the sale date. Tony's basis in his partnership interest on the date of the sale is $60,000. What are the amount and character of Tony's gain?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

68

Identify which of the following statements is true.

A) An exchange of partnership interests in different partnerships qualifies under the like- kind exchange rules.

B) John Albin is a retired partner of Brill & Crum, a personal service partnership. Albin has not rendered any services to Brill & Crum since his retirement six years ago. Under the provisions of Albin's retirement agreement, Brill & Crum is obligated to pay Albin 10% of the partnership's net income each year through the end of the current year. In compliance with the agreement, Brill & Crum pay Albin $25,000 in the current year. Albin should treat this $25,000 as a long- term capital gain.

C) The payment for partnership property to a retiring partner is not deductible by the partnership and often not income to the retiring partner.

D) All of the above are false.

A) An exchange of partnership interests in different partnerships qualifies under the like- kind exchange rules.

B) John Albin is a retired partner of Brill & Crum, a personal service partnership. Albin has not rendered any services to Brill & Crum since his retirement six years ago. Under the provisions of Albin's retirement agreement, Brill & Crum is obligated to pay Albin 10% of the partnership's net income each year through the end of the current year. In compliance with the agreement, Brill & Crum pay Albin $25,000 in the current year. Albin should treat this $25,000 as a long- term capital gain.

C) The payment for partnership property to a retiring partner is not deductible by the partnership and often not income to the retiring partner.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

69

Identify which of the following statements is true.

A) The partnership's tax year closes with respect to a partner whose interest is transferred by gift.

B) An LLC has been taxed as a partnership for five years. Under the check- the- box rules, the LLC makes a timely election in 2009 to be taxed as a C corporation. The election of C corporation status is permitted and results in the LLC's assets being transferred from a partnership to a C corporation under the federal income tax rules.

C) Under the check- the- box rules, an LLC with more than one member is taxed as a corporation unless it elects to be taxed as a partnership.

D) All of the above are false.

A) The partnership's tax year closes with respect to a partner whose interest is transferred by gift.

B) An LLC has been taxed as a partnership for five years. Under the check- the- box rules, the LLC makes a timely election in 2009 to be taxed as a C corporation. The election of C corporation status is permitted and results in the LLC's assets being transferred from a partnership to a C corporation under the federal income tax rules.

C) Under the check- the- box rules, an LLC with more than one member is taxed as a corporation unless it elects to be taxed as a partnership.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

70

Identify which of the following statements is true.

A) When the interest of a partner who owns 60% of a partnership is completely liquidated by a partnership distribution, the partnership is considered terminated, even though three other partners remain.

B) The partnership tax year closes when a partner transfers his interest by gift.

C) If a partner dies in a two- member partnership, the partnership terminates on the date of death, even though the successor- in- interest continues to share in the profits and losses of the partnership business.

D) All of the above are false.

A) When the interest of a partner who owns 60% of a partnership is completely liquidated by a partnership distribution, the partnership is considered terminated, even though three other partners remain.

B) The partnership tax year closes when a partner transfers his interest by gift.

C) If a partner dies in a two- member partnership, the partnership terminates on the date of death, even though the successor- in- interest continues to share in the profits and losses of the partnership business.

D) All of the above are false.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

71

Can a partner recognize both a gain and a loss on the sale of a partnership interest? If so, under what conditions?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

72

Under the check- the- box rules, an LLC with more than one member is taxed as a partnership unless it elects to be taxed as a corporation.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

73

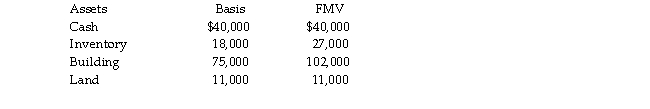

David sells his one- third partnership interest to Diana for $60,000 when his basis in the partnership interest is

$48,000. On the date of sale, the partnership has no liabilities and the following assets: The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

$48,000. On the date of sale, the partnership has no liabilities and the following assets:

The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

The building is depreciated on a straight- line basis. What tax issues should David and Diana consider with resp to the sale transaction?

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

74

Identify which of the following statements is false.

A) A partner's individual income tax return, under some circumstances, may include the results of partnership operations for a period exceeding 12- months.

B) When several different transfers are made during a 12- month period, the partnership termination occurs on the date of the transfer that first crosses the 50% threshold.

C) When using the 50% rule to terminate a partnership, if an interest is sold more than once during the 12- month period, each sale is counted separately.

D) A sale or exchange of at least 50% of the capital and profits interest in a partnership within a 12- consecutive- month period will terminate the partnership and end all of the partnership's elections.

A) A partner's individual income tax return, under some circumstances, may include the results of partnership operations for a period exceeding 12- months.

B) When several different transfers are made during a 12- month period, the partnership termination occurs on the date of the transfer that first crosses the 50% threshold.

C) When using the 50% rule to terminate a partnership, if an interest is sold more than once during the 12- month period, each sale is counted separately.

D) A sale or exchange of at least 50% of the capital and profits interest in a partnership within a 12- consecutive- month period will terminate the partnership and end all of the partnership's elections.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

75

Marc is a calendar- year taxpayer who owns a 30% capital and profits interest in the MN Partnership. Nancy sells the remaining 70% capital and profits interest to Henry on October 31. The partnership year- end is March 31 as permitted by the IRS for business purpose reasons. The MN Partnership

A) terminates on October 31.

B) terminates on December 31.

C) does not terminate.

D) terminates on March 31.

A) terminates on October 31.

B) terminates on December 31.

C) does not terminate.

D) terminates on March 31.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

76

Sally is a calendar- year taxpayer who owns a 30% capital and profits interest in the SEM Partnership. Eric sells the remaining 70% capital and profits interest to Michelle on October 3. The partnership year- end is March 31 as permitted by the IRS for business purposes. Which of the following statements is correct?

A) Sally must conform her tax year with the partnership tax year.

B) The new partnership is a continuation of the old partnership.

C) Sally's tax return will include partnership distributive shares for periods ending March 31 and October 3.

D) Sally's tax return will include a partnership distributive share only for the period ending March 31.

A) Sally must conform her tax year with the partnership tax year.

B) The new partnership is a continuation of the old partnership.

C) Sally's tax return will include partnership distributive shares for periods ending March 31 and October 3.

D) Sally's tax return will include a partnership distributive share only for the period ending March 31.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

77

A partnership terminates for federal income tax purposes if

A) within a 12- month period, there is a sale or exchange of at least 50% of the total interest in partnership capital and profits.

B) a general partner who owns a majority interest dies.

C) state partnership law terminates the partnership.

D) a partnership interest of more than 50% is gifted.

A) within a 12- month period, there is a sale or exchange of at least 50% of the total interest in partnership capital and profits.

B) a general partner who owns a majority interest dies.

C) state partnership law terminates the partnership.

D) a partnership interest of more than 50% is gifted.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

78

If a partnership chooses to form an LLC, under the check- the- box rules, and assuming no elections are made, the entity will be taxed as

A) a C corporation.

B) an S corporation.

C) a partnership if it has more than one member.

D) Unable to determine from the facts presented.

A) a C corporation.

B) an S corporation.

C) a partnership if it has more than one member.

D) Unable to determine from the facts presented.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

79

For tax purposes, a partner who receives retirement payments ceases to be regarded as a partner

A) on the day on which the partner retires.

B) on the last day of the month in which the partner retires.

C) on the last day of the taxable year in which the partner retires.

D) only after the partner's last payment is received.

A) on the day on which the partner retires.

B) on the last day of the month in which the partner retires.

C) on the last day of the taxable year in which the partner retires.

D) only after the partner's last payment is received.

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck

80

A partnership terminates for tax purposes

A) when at least 50% of the total interest in partnership capital and profits changes hands by sale or exchange within twelve consecutive months.

B) only when it terminates under local partnership law.

C) when a partnership tax return (Form 1065) ceases to be filed by the partnership.

D) when the sale of partnership assets is made only to an outsider(s) and not to an existing partner(s).

A) when at least 50% of the total interest in partnership capital and profits changes hands by sale or exchange within twelve consecutive months.

B) only when it terminates under local partnership law.

C) when a partnership tax return (Form 1065) ceases to be filed by the partnership.

D) when the sale of partnership assets is made only to an outsider(s) and not to an existing partner(s).

Unlock Deck

Unlock for access to all 101 flashcards in this deck.

Unlock Deck

k this deck