Deck 27: Money, Interest Rates, and Economic Activity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

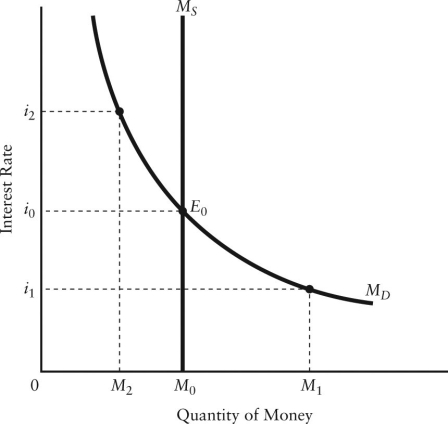

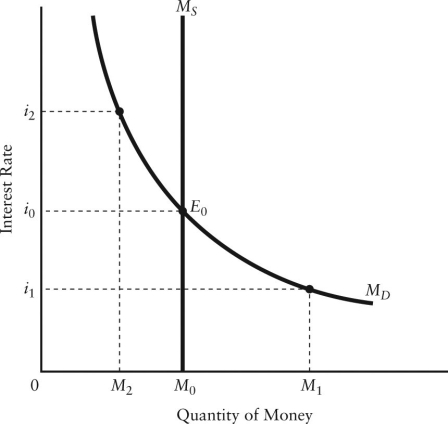

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

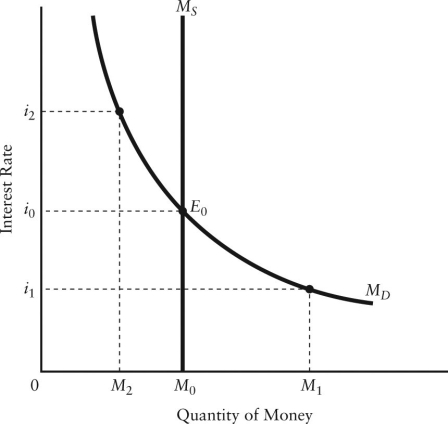

Question

Question

Question

Question

Question

Question

Question

Question

Question

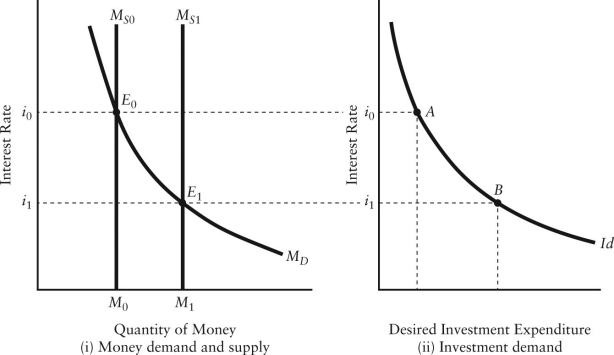

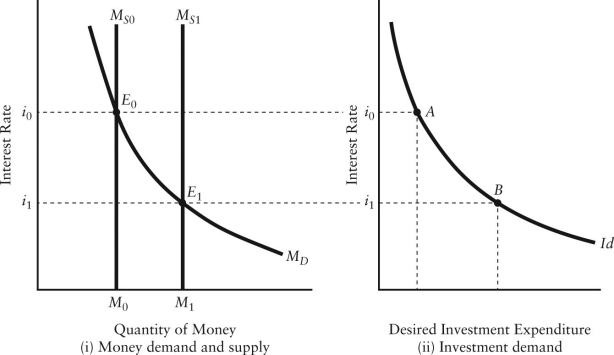

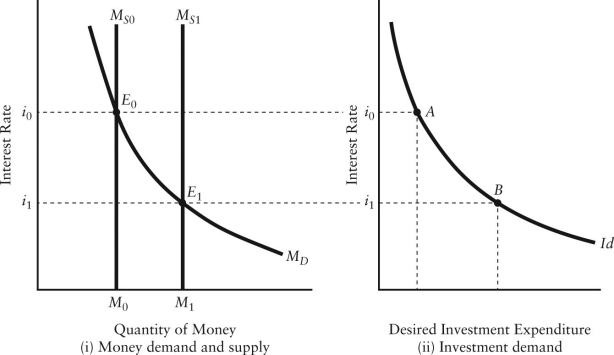

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/135

Play

Full screen (f)

Deck 27: Money, Interest Rates, and Economic Activity

1

Other things being equal, bond prices

A) are unaffected by changes in the demand for money.

B) are unaffected by interest-rate changes.

C) vary directly with interest rates.

D) vary inversely with interest rates.

E) vary proportionally with interest rates.

A) are unaffected by changes in the demand for money.

B) are unaffected by interest-rate changes.

C) vary directly with interest rates.

D) vary inversely with interest rates.

E) vary proportionally with interest rates.

D

2

The present value of a financial asset is

A) the most someone would be willing to pay upon maturity of the asset.

B) the most someone would be willing to pay today for the asset.

C) equivalent to the face value of the asset.

D) the amount someone would pay in the future to have the asset today.

E) the amount someone would pay in the future for the current stream of payments from the asset.

A) the most someone would be willing to pay upon maturity of the asset.

B) the most someone would be willing to pay today for the asset.

C) equivalent to the face value of the asset.

D) the amount someone would pay in the future to have the asset today.

E) the amount someone would pay in the future for the current stream of payments from the asset.

B

3

If the current market price of a bond is less than the present value of the income stream the bond will produce, the price will due to excess of/for the bond.

A) rise; supply

B) fall; supply

C) rise; demand

D) fall; demand

A) rise; supply

B) fall; supply

C) rise; demand

D) fall; demand

C

4

What is the present value of a bond that pays $121.00 one year from today if the interest rate is 10% per year?

A) $100.00

B) $110.00

C) $121.00

D) $133.10

E) $221.00

A) $100.00

B) $110.00

C) $121.00

D) $133.10

E) $221.00

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

5

Consider a bond that promises to make coupon payments of $100 each year for three years beginning in one yearʹs time) and also repays the face value of $2000 at the end of the third year. If the market interest rate is 6%, what is the present value of this bond?

A) $267.30

B) $283.02

C) $1763.22

D) $1854.67

E) $1946.53

A) $267.30

B) $283.02

C) $1763.22

D) $1854.67

E) $1946.53

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

6

The present value of a bond is determined by the

A) face value and the date of maturity.

B) rate of inflation.

C) market rate of interest only.

D) market rate of interest, the date of maturity, and the face value.

E) marginal rate of income tax.

A) face value and the date of maturity.

B) rate of inflation.

C) market rate of interest only.

D) market rate of interest, the date of maturity, and the face value.

E) marginal rate of income tax.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

7

Consider a Government of Canada bond with a face value of $1000, and a present value of $925. If this bond is offered for sale at $960, then

A) the excess demand for the bond at $960 will drive the price up to the face value of the bond.

B) individuals will purchase the bond at the offer price which will drive the market rate of interest up.

C) individuals will purchase the bond at the offer price which will drive the market rate of interest down.

D) the equilibrium market price of this bond has been achieved.

E) the lack of demand for this bond will drive the price down until it reaches its equilibrium market price of $925.

A) the excess demand for the bond at $960 will drive the price up to the face value of the bond.

B) individuals will purchase the bond at the offer price which will drive the market rate of interest up.

C) individuals will purchase the bond at the offer price which will drive the market rate of interest down.

D) the equilibrium market price of this bond has been achieved.

E) the lack of demand for this bond will drive the price down until it reaches its equilibrium market price of $925.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

8

When considering the present value of any financial asset that makes a stream of payments in the future, we know that if the market interest rate falls,

A) the present value of the asset will rise.

B) the future value of the asset will rise.

C) the current value of the asset will fall.

D) the present value of the asset will fall.

E) the present value of the asset is unaffected.

A) the present value of the asset will rise.

B) the future value of the asset will rise.

C) the current value of the asset will fall.

D) the present value of the asset will fall.

E) the present value of the asset is unaffected.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

9

In a competitive financial market, the equilibrium price of an asset will equal the

A) present value of the asset.

B) future value of the asset.

C) sum of present value of the asset multiplied by the interest rate.

D) future value of the asset multiplied by the interest rate.

E) issue price of the asset.

A) present value of the asset.

B) future value of the asset.

C) sum of present value of the asset multiplied by the interest rate.

D) future value of the asset multiplied by the interest rate.

E) issue price of the asset.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

10

If the annual interest rate is 3%, $10 000 received today has the same present value as received one year from now.

A) $10 000

B) $13 000

C) $300

D) $9707.74

E) $10 300

A) $10 000

B) $13 000

C) $300

D) $9707.74

E) $10 300

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

11

Consider a Hydro Quebec bond with a face value of $1000, and a present value of $1175. If this bond is offered for sale at $1025, then

A) excess supply of this bond will drive the price down until it reaches its face value.

B) individuals will purchase the bond at the offer price which will drive down the price further.

C) excess demand for this bond will drive the price up until it reaches its equilibrium market price of $1175.

D) the equilibrium market price of this bond has been achieved.

E) Hydro Quebec will be forced to change the face value of the bond.

A) excess supply of this bond will drive the price down until it reaches its face value.

B) individuals will purchase the bond at the offer price which will drive down the price further.

C) excess demand for this bond will drive the price up until it reaches its equilibrium market price of $1175.

D) the equilibrium market price of this bond has been achieved.

E) Hydro Quebec will be forced to change the face value of the bond.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

12

An analyst is considering the purchase of a Government of Canada bond that will pay its face value of $10 000 in one yearʹs time, but pay no direct interest. The market interest rate is 4% and the bond is being offered for sale at a price of $9800. The analyst should recommend

A) purchasing the bond because the buyer will earn a profit of $185.

B) purchasing the bond because the bond price is equal to its present value.

C) not purchasing the bond because the price is lower than its present value.

D) not purchasing the bond because the buyer could earn an additional $192 by investing the $9800 elsewhere.

E) not purchasing the bond because the buyer could earn an additional $392 by investing the $9800 elsewhere.

A) purchasing the bond because the buyer will earn a profit of $185.

B) purchasing the bond because the bond price is equal to its present value.

C) not purchasing the bond because the price is lower than its present value.

D) not purchasing the bond because the buyer could earn an additional $192 by investing the $9800 elsewhere.

E) not purchasing the bond because the buyer could earn an additional $392 by investing the $9800 elsewhere.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

13

Consider a bond that promises to make coupon payments of $100 each year for three years beginning in one yearʹs time) and also repays the face value of $2000 at the end of the third year. If the market interest rate is 4%, what is the present value of this bond?

A) $288.45

B) $1866.67

C) $1941.57

D) $1966.39

E) $2055.50

A) $288.45

B) $1866.67

C) $1941.57

D) $1966.39

E) $2055.50

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

14

When i is the annual interest rate, the formula for calculating the present value of a bond with a face value of R

Dollars, receivable in one year is

A) PV = 1 + i)/R.

B) PV = iR + i).

C) PV = R 1 + i).

D) PV = R/i.

E) PV = R/1 + i).

Dollars, receivable in one year is

A) PV = 1 + i)/R.

B) PV = iR + i).

C) PV = R 1 + i).

D) PV = R/i.

E) PV = R/1 + i).

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

15

If Robert expects interest rates to fall in the near future, he will probably be willing to

A) buy bonds now, and hold less money.

B) buy bonds now, but only if their price falls.

C) sell bonds now, and hold less money.

D) put his money under his mattress rather than buy bonds.

E) maintain only the current holding of bonds.

A) buy bonds now, and hold less money.

B) buy bonds now, but only if their price falls.

C) sell bonds now, and hold less money.

D) put his money under his mattress rather than buy bonds.

E) maintain only the current holding of bonds.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

16

If the annual interest rate is 8%, an asset that promises to pay $160 after each of the next two years has a present value of

A) $178.32.

B) $285.32.

C) $296.30.

D) $300.00.

E) $320.00.

A) $178.32.

B) $285.32.

C) $296.30.

D) $300.00.

E) $320.00.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

17

If the annual market rate of interest is 5%, an asset that promises to pay $100 after each of the next two years has a present value of

A) $90.70.

B) $95.24.

C) $181.40.

D) $185.94.

E) $200.00.

A) $90.70.

B) $95.24.

C) $181.40.

D) $185.94.

E) $200.00.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

18

When Janet expects interest rates to rise in the near future, she will probably be willing to

A) buy bonds now, and hold less money.

B) buy bonds now, but only if their price falls.

C) sell bonds now, and hold more money.

D) put her money under her mattress rather than in a bank account.

E) maintain only the current holding of bonds.

A) buy bonds now, and hold less money.

B) buy bonds now, but only if their price falls.

C) sell bonds now, and hold more money.

D) put her money under her mattress rather than in a bank account.

E) maintain only the current holding of bonds.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

19

Consider a bond with a face value of $10 000, a three -year term and a coupon payment of 6% made at the end of each year. The face value of the bond is repaid at the end of the term. Which of the following equations will correctly calculate the present value of the bond?

A) PV = $600 + $600 + $10 600 1.06 1.1236 1.1910

B) PV = $600 + $600 + $600 1.06 1.1236 1.1910

C) PV = $600 + $600 + $10 000

1)06

1)106

1)06

D) PV = $600 + $600 + $10 600 1.6 2.56 4.096

E) PV = $600 + $600 + $9400 1.06 1.06 1.1910

A) PV = $600 + $600 + $10 600 1.06 1.1236 1.1910

B) PV = $600 + $600 + $600 1.06 1.1236 1.1910

C) PV = $600 + $600 + $10 000

1)06

1)106

1)06

D) PV = $600 + $600 + $10 600 1.6 2.56 4.096

E) PV = $600 + $600 + $9400 1.06 1.06 1.1910

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

20

If the annual interest rate is 10%, $5.00 received today has the same present value as

A) $4.00 received one year from now.

B) $4.50 received one year from now.

C) $5.00 received one year from now.

D) $5.50 received one year from now.

E) $6.00 received one year form now.

A) $4.00 received one year from now.

B) $4.50 received one year from now.

C) $5.00 received one year from now.

D) $5.50 received one year from now.

E) $6.00 received one year form now.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

21

A firm that holds cash to avoid penalties associated with the late payment of bills is demonstrating which type of demand for money?

A) transactions demand

B) precautionary demand

C) speculative demand

D) present value demand

E) risk-return demand

A) transactions demand

B) precautionary demand

C) speculative demand

D) present value demand

E) risk-return demand

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

22

Consider two bonds, Bond A and Bond B, offered for sale in the same market for financial assets:

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond B has a higher present value than Bond A.

B) Bond A has a lower present value than Bond B.

C) The yield on Bond B is 3%; the yield on Bond A is 3%.

D) The yield on Bond A is 3%; the yield on Bond B is 8%.

E) There is a disequilibrium in this market for financial assets.

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond B has a higher present value than Bond A.

B) Bond A has a lower present value than Bond B.

C) The yield on Bond B is 3%; the yield on Bond A is 3%.

D) The yield on Bond A is 3%; the yield on Bond B is 8%.

E) There is a disequilibrium in this market for financial assets.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

23

The term ʺdemand for moneyʺ usually refers to the

A) aggregate demand for money balances in the economy.

B) average personʹs desire to hold cash.

C) cash and deposits actually held by firms.

D) sum of all desired holdings of cash.

E) sum of all desired assets, including cash, bonds, and real property.

A) aggregate demand for money balances in the economy.

B) average personʹs desire to hold cash.

C) cash and deposits actually held by firms.

D) sum of all desired holdings of cash.

E) sum of all desired assets, including cash, bonds, and real property.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

24

Consider two bonds, Bond A and Bond B, offered for sale in the same market for financial assets:

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond B has a higher present value than Bond A.

B) Bond A has a lower present value than Bond B.

C) Bond B has a higher yield than Bond A.

D) Bond A has a higher yield than Bond B.

E) There is a disequilibrium in this market for financial assets.

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond B has a higher present value than Bond A.

B) Bond A has a lower present value than Bond B.

C) Bond B has a higher yield than Bond A.

D) Bond A has a higher yield than Bond B.

E) There is a disequilibrium in this market for financial assets.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

25

Consider the demand for money. If real GDP falls, other things being equal, we can expect

A) an increase in the speculative demand for money.

B) an increase in the total demand for money.

C) a decrease in transactions demand for money.

D) an increase in transactions demand for money.

E) an increase in precautionary demand for money.

A) an increase in the speculative demand for money.

B) an increase in the total demand for money.

C) a decrease in transactions demand for money.

D) an increase in transactions demand for money.

E) an increase in precautionary demand for money.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

26

Suppose the market interest rate falls from 3% to 2%. This will lead to in bond prices and in bond yields.

A) a fall; a fall

B) a fall; a rise

C) a rise; a fall

D) a rise; a rise

E) no change; no change

A) a fall; a fall

B) a fall; a rise

C) a rise; a fall

D) a rise; a rise

E) no change; no change

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

27

Suppose a Government of Canada bond is being offered in financial markets at a price that is lower than its present value. We can expect that

A) the lack of demand for this bond will cause its present value to fall.

B) the price of the bond will fall further.

C) the relatively high demand for this bond will cause its price to rise.

D) the face value of the bond will be adjusted to a lower value.

E) the face value of the bond will be adjusted to a higher value.

A) the lack of demand for this bond will cause its present value to fall.

B) the price of the bond will fall further.

C) the relatively high demand for this bond will cause its price to rise.

D) the face value of the bond will be adjusted to a lower value.

E) the face value of the bond will be adjusted to a higher value.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

28

An analyst is considering the purchase of a Government of Canada bond that will pay its face value of $10 000 in one yearʹs time, but pay no direct interest. The market interest rate is 4% and the bond is being offered for sale at a price of $9400. The analyst should recommend

A) purchasing the bond because the purchase price is more than its present value and is therefore profitable.

B) purchasing the bond because the purchase price is less than its present value and is therefore profitable.

C) not purchasing the bond because the buyer could earn an additional $224 by investing the $9400 elsewhere.

D) not purchasing the bond because the buyer could earn an additional $376 by investing the $9400 elsewhere.

E) not purchasing the bond because the purchase price is less than its present value.

A) purchasing the bond because the purchase price is more than its present value and is therefore profitable.

B) purchasing the bond because the purchase price is less than its present value and is therefore profitable.

C) not purchasing the bond because the buyer could earn an additional $224 by investing the $9400 elsewhere.

D) not purchasing the bond because the buyer could earn an additional $376 by investing the $9400 elsewhere.

E) not purchasing the bond because the purchase price is less than its present value.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

29

In order to calculate the present value of the sum of future payments due from a bond, we use the interest rate to those future payments.

A) adjust

B) correct

C) discount

D) inflate

E) maximize

A) adjust

B) correct

C) discount

D) inflate

E) maximize

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

30

Suppose a Government of Canada bond is being offered in financial markets at a price that is higher than its present value. We can expect that

A) the price of the bond will rise further.

B) the face value of the bond will be adjusted to a lower value.

C) the relatively high demand for the bond will cause its present value to rise.

D) the lack of demand for this bond will cause its price to fall.

E) the face value of the bond will be adjusted to a lower value.

A) the price of the bond will rise further.

B) the face value of the bond will be adjusted to a lower value.

C) the relatively high demand for the bond will cause its present value to rise.

D) the lack of demand for this bond will cause its price to fall.

E) the face value of the bond will be adjusted to a lower value.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose the market interest rate is stable at 4% and we see a decline in bond prices and thus a rise in bond yields). One explanation for this is that

A) bond issuers are facing an excess demand for their bonds.

B) bond purchasers perceive a reduction in riskiness and thus a higher expected present value from those bonds.

C) there is no causal relationship between market interest rates and bond prices.

D) bond purchasers perceive an increase in riskiness and thus a lower expected present value from those bonds.

E) there is a positive relationship between interest rates and bond prices.

A) bond issuers are facing an excess demand for their bonds.

B) bond purchasers perceive a reduction in riskiness and thus a higher expected present value from those bonds.

C) there is no causal relationship between market interest rates and bond prices.

D) bond purchasers perceive an increase in riskiness and thus a lower expected present value from those bonds.

E) there is a positive relationship between interest rates and bond prices.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

32

Suppose an economic analyst suggests that investors should now hold cash instead of stocks or bonds. The analyst is probably encouraging an increase in money balances for which reason?

A) transaction demand

B) precautionary demand

C) speculative demand

D) present value demand

E) portfolio demand

A) transaction demand

B) precautionary demand

C) speculative demand

D) present value demand

E) portfolio demand

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

33

When the market price of a bond falls, ceteris paribus, then

A) the term to maturity of the bond increases.

B) the term to maturity of the bond decreases.

C) the yield on that bond rises.

D) the yield on that bond also falls.

E) the market interest rate rises.

A) the term to maturity of the bond increases.

B) the term to maturity of the bond decreases.

C) the yield on that bond rises.

D) the yield on that bond also falls.

E) the market interest rate rises.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

34

If a person is holding money for the purchase of goods and services, this demand for money is known as

A) speculative demand.

B) precautionary demand.

C) transactions demand.

D) real balance demand.

E) nominal balance demand.

A) speculative demand.

B) precautionary demand.

C) transactions demand.

D) real balance demand.

E) nominal balance demand.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

35

The opportunity cost of holding money rather than bonds is

A) the rate of interest earned on bonds.

B) the price level.

C) forgone consumption.

D) forgone liquidity.

E) zero there is no opportunity cost of holding money.

A) the rate of interest earned on bonds.

B) the price level.

C) forgone consumption.

D) forgone liquidity.

E) zero there is no opportunity cost of holding money.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

36

Other things being equal, the transactions demand for money tends to increase when

A) interest rates rise.

B) interest rates stop rising.

C) national income rises.

D) national income falls.

E) the price level falls.

A) interest rates rise.

B) interest rates stop rising.

C) national income rises.

D) national income falls.

E) the price level falls.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

37

The ʺprecautionary demandʺ for money arises from the

A) fear that interest rates will fall.

B) fear that interest rates will rise.

C) need to make predictable purchases of goods and services.

D) uncertainty about when some expenditures will be necessary.

E) desire to avoid paying interest on credit purchases.

A) fear that interest rates will fall.

B) fear that interest rates will rise.

C) need to make predictable purchases of goods and services.

D) uncertainty about when some expenditures will be necessary.

E) desire to avoid paying interest on credit purchases.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose the market interest rate rises from 3% to 4%. This will lead to in bond prices and in bond yields.

A) a fall; a fall

B) a fall; a rise

C) a rise; a fall

D) a rise; a rise

E) no change; no change

A) a fall; a fall

B) a fall; a rise

C) a rise; a fall

D) a rise; a rise

E) no change; no change

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

39

The ʺtransactions demandʺ for money arises from the fact that

A) there is uncertainty in the receipts of income.

B) there is uncertainty about the movement of interest rates.

C) households wish to have all their wealth in the form of money.

D) households decide to hold money in order to make purchases of goods and services.

E) households want to keep cash on had to buy bonds if bond prices drop.

A) there is uncertainty in the receipts of income.

B) there is uncertainty about the movement of interest rates.

C) households wish to have all their wealth in the form of money.

D) households decide to hold money in order to make purchases of goods and services.

E) households want to keep cash on had to buy bonds if bond prices drop.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

40

Consider two bonds, Bond A and Bond B, offered for sale in the same market for financial assets:

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond A is perceived as a riskier asset than Bond B.

B) Bond B is perceived as a riskier asset than Bond A.

C) Bond B has a higher present value than Bond A.

D) There is a disequilibrium in this market for financial assets.

- Bond A has a face value of $1000, a market price of $971, and matures in one year.

- Bond B has a face value of $1000, a market price of $926, and matures in one year. Which of the following statements about Bonds A and B are correct?

A) Bond A is perceived as a riskier asset than Bond B.

B) Bond B is perceived as a riskier asset than Bond A.

C) Bond B has a higher present value than Bond A.

D) There is a disequilibrium in this market for financial assets.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

41

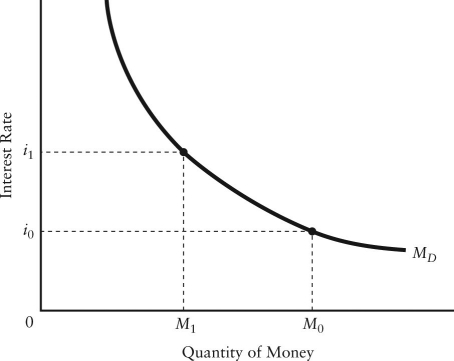

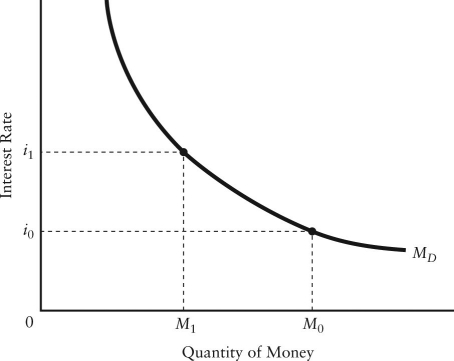

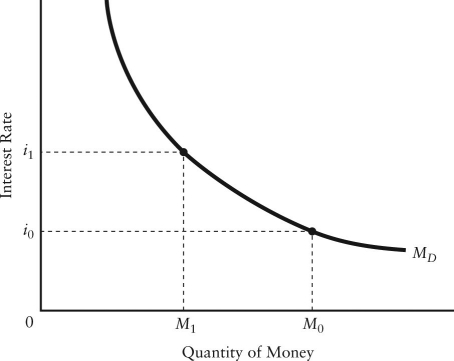

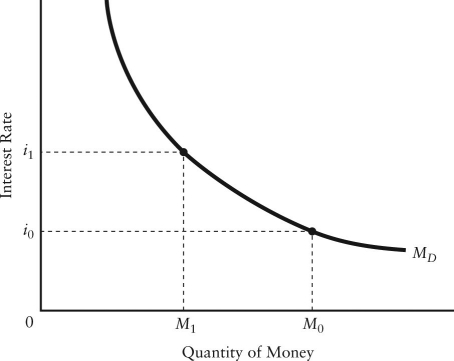

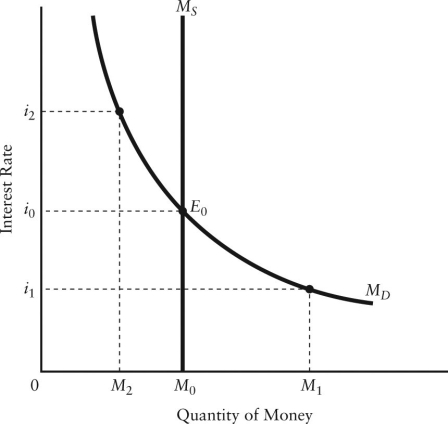

FIGURE 27-1

FIGURE 27-1Refer to Figure 27-1. A leftward shift in the money demand curve can be caused by by

A) an increase in the rate of interest.

B) a decrease in the rate of interest.

C) an increase in the price level.

D) a decrease in real GDP.

E) an increase in real GDP.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

42

FIGURE 27-1

FIGURE 27-1Refer to Figure 27-1. Given the money demand curve, MD, a decrease in the quantity of money demanded from M to M can be caused by

1

A) an increase in the price level.

B) a decrease in the price level.

C) an increase in real GDP.

D) an increase in the rate of interest.

E) a decrease in the rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

43

Ceteris paribus, a rightward shift of the money demand curve could indicate which of the following:

1) an increase in demand for bonds;

2) an increase in the price level;

3) an increase in real GDP.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2 only

E) 2 and 3 only

1) an increase in demand for bonds;

2) an increase in the price level;

3) an increase in real GDP.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2 only

E) 2 and 3 only

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

44

Consider a money market in which there is an excess supply of money at the prevailing interest rate. The likely response is

A) the corresponding excess supply for bonds will cause the price of bonds to increase, and the interest rate to fall, until the quantity demanded of money equals the quantity supplied of money.

B) the corresponding excess demand for bonds will cause the price of bonds to increase, and the interest rate to fall, until the quantity demanded of money equals the quantity supplied of money.

C) the money supply curve will shift to the left until the demand for money equals the supply.

D) the money supply curve will shift to the right until the demand for money equals the supply.

E) the money demand curve will shift to the right, causing the price of bonds to increase, and the interest rate to fall, until the demand for money equals the supply.

A) the corresponding excess supply for bonds will cause the price of bonds to increase, and the interest rate to fall, until the quantity demanded of money equals the quantity supplied of money.

B) the corresponding excess demand for bonds will cause the price of bonds to increase, and the interest rate to fall, until the quantity demanded of money equals the quantity supplied of money.

C) the money supply curve will shift to the left until the demand for money equals the supply.

D) the money supply curve will shift to the right until the demand for money equals the supply.

E) the money demand curve will shift to the right, causing the price of bonds to increase, and the interest rate to fall, until the demand for money equals the supply.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

45

Among other things, people hold cash balances for which of the following reasons?

1) to meet unforeseen emergencies

2) to maximize their returns on interest-earning assets

3) to guard against the uncertainty of the timing of receipts and payments

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 1 and 3

1) to meet unforeseen emergencies

2) to maximize their returns on interest-earning assets

3) to guard against the uncertainty of the timing of receipts and payments

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 1 and 3

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

46

When there is an excess demand for money balances, monetary equilibrium is established by a process that involves

1) movement down the money demand function;

2) interest rates falling;

3) the price of bonds falling.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 2 and 3

1) movement down the money demand function;

2) interest rates falling;

3) the price of bonds falling.

A) 1 only

B) 2 only

C) 3 only

D) 1 and 2

E) 2 and 3

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

47

Speculative demand for money arises from the desire by individuals and firms to hold cash balances

A) for speculative equity purchases.

B) in anticipation of changes in interest rates and bond prices.

C) to meet unforeseen business expenses.

D) in anticipation of investing in capital purchases for the firm.

E) to maintain adequate cash flow in case of inflation.

A) for speculative equity purchases.

B) in anticipation of changes in interest rates and bond prices.

C) to meet unforeseen business expenses.

D) in anticipation of investing in capital purchases for the firm.

E) to maintain adequate cash flow in case of inflation.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

48

FIGURE 27-1

FIGURE 27-1Refer to Figure 27-1. Given the money demand curve, MD, an increase in the quantity of money demanded from M1 to M0 can be caused by

A) an increase in the price level.

B) a decrease in the price level.

C) an increase in real GDP.

D) an increase in the rate of interest.

E) a decrease in the rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

49

According to the ʺliquidity preferenceʺ theory of the rate of interest, if the supply of money increases, then,

Ceteris paribus, bond prices will

A) fall as the rate of interest rises.

B) rise as the rate of interest rises.

C) fall as the rate of interest falls.

D) rise as the rate of interest falls.

E) stay the same.

Ceteris paribus, bond prices will

A) fall as the rate of interest rises.

B) rise as the rate of interest rises.

C) fall as the rate of interest falls.

D) rise as the rate of interest falls.

E) stay the same.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

50

Assume there are just two assets, money and bonds. We can expect that an individual with a given level of wealth will

A) hold less money when bond prices rise.

B) hold more money when the current interest rate is very low.

C) not hold money as long as bonds pay a positive rate of interest.

D) hold lots of money even at very high interest rates.

E) hold less money when the current interest rate is very low.

A) hold less money when bond prices rise.

B) hold more money when the current interest rate is very low.

C) not hold money as long as bonds pay a positive rate of interest.

D) hold lots of money even at very high interest rates.

E) hold less money when the current interest rate is very low.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

51

If the annual market interest rate is 20%, the annual opportunity cost of having $50 cash in your pocket is

A) $0.

B) $2.

C) $10.

D) $50.

E) $1000.

A) $0.

B) $2.

C) $10.

D) $50.

E) $1000.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

52

If the general price level were to increase, other things being equal, the money demand function would

A) not be affected.

B) shift to the left.

C) shift to the right.

D) shift, but the direction of the shift cannot be predicted.

E) become steeper but not shift.

A) not be affected.

B) shift to the left.

C) shift to the right.

D) shift, but the direction of the shift cannot be predicted.

E) become steeper but not shift.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

53

Consider the demand for money curve. As we move up and to the left along the curve, the opportunity cost of holding money

A) is increasing, so households and firms increase their desired money holdings.

B) is increasing, so households and firms decrease their desired money holdings.

C) is declining, so households and firms decrease their desired money holdings.

D) is declining, so households and firms increase their desired money holdings.

A) is increasing, so households and firms increase their desired money holdings.

B) is increasing, so households and firms decrease their desired money holdings.

C) is declining, so households and firms decrease their desired money holdings.

D) is declining, so households and firms increase their desired money holdings.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

54

The demand for money MD) function defines the relationship between

A) interest rates and bond prices.

B) inflation and bond prices.

C) interest rates and financial assets.

D) the quantity of money demanded and the price level.

E) the quantity of money demanded and the rate of interest.

A) interest rates and bond prices.

B) inflation and bond prices.

C) interest rates and financial assets.

D) the quantity of money demanded and the price level.

E) the quantity of money demanded and the rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

55

Suppose that at a given interest rate and money supply, all firms and households simultaneously try to add to their money balances. They do this by trying to , which causes an excess , which causes an)

, and finally an) in the interest rate.

A) sell bonds; supply of bonds; increase in the price of bonds; decrease

B) buy bonds; supply of bonds; decrease in the price of bonds; increase

C) sell bonds; demand for bonds; increase in the price of bonds; decrease

D) buy bonds; demand for bonds; increase in the price of bonds; decrease

E) sell bonds; supply of bonds; decrease in the price of bonds; increase

, and finally an) in the interest rate.

A) sell bonds; supply of bonds; increase in the price of bonds; decrease

B) buy bonds; supply of bonds; decrease in the price of bonds; increase

C) sell bonds; demand for bonds; increase in the price of bonds; decrease

D) buy bonds; demand for bonds; increase in the price of bonds; decrease

E) sell bonds; supply of bonds; decrease in the price of bonds; increase

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

56

Suppose that at a given interest rate and money supply, all firms and households simultaneously try to reduce their money balances. They do this by trying to , which causes an excess , which causes an)

, and finally an) in the interest rate.

A) sell bonds; supply of bonds; increase in the price of bonds; decrease

B) buy bonds; supply of bonds; decrease in the price of bonds; increase

C) sell bonds; demand for bonds; increase in the price of bonds; decrease

D) buy bonds; demand for bonds; increase in the price of bonds; decrease

E) sell bonds; supply of bonds; decrease in the price of bonds; increase

, and finally an) in the interest rate.

A) sell bonds; supply of bonds; increase in the price of bonds; decrease

B) buy bonds; supply of bonds; decrease in the price of bonds; increase

C) sell bonds; demand for bonds; increase in the price of bonds; decrease

D) buy bonds; demand for bonds; increase in the price of bonds; decrease

E) sell bonds; supply of bonds; decrease in the price of bonds; increase

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

57

In the basic AD/AS macro model, it is assumed that, for any given interest rate, the demand for money depends on the

A) aggregate demand for goods and services.

B) level of government spending.

C) rate of growth of real GDP.

D) level of taxes.

E) level of real GDP and the price level.

A) aggregate demand for goods and services.

B) level of government spending.

C) rate of growth of real GDP.

D) level of taxes.

E) level of real GDP and the price level.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

58

FIGURE 27-1

FIGURE 27-1Refer to Figure 27-1. A rightward shift of the money demand curve can be caused by

A) an increase in the price level.

B) a decrease in the price level.

C) a decrease in real GDP.

D) an increase in the rate of interest.

E) a decrease in the rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

59

Consider the demand for money curve. As we move down and to the right along the curve, the opportunity cost of holding money

A) is increasing, so households and firms increase their desired money holdings.

B) is increasing, so households and firms decrease their desired money holdings.

C) is declining, so households and firms decrease their desired money holdings.

D) is declining, so households and firms increase their desired money holdings.

A) is increasing, so households and firms increase their desired money holdings.

B) is increasing, so households and firms decrease their desired money holdings.

C) is declining, so households and firms decrease their desired money holdings.

D) is declining, so households and firms increase their desired money holdings.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

60

If there are just two assets, bonds and money, then an excess demand for money implies

A) an excess supply of bonds.

B) an excess demand for bonds.

C) equilibrium in the bond market.

D) an indeterminate equilibrium in the bond market.

E) nothing about conditions of demand for the other financial asset.

A) an excess supply of bonds.

B) an excess demand for bonds.

C) equilibrium in the bond market.

D) an indeterminate equilibrium in the bond market.

E) nothing about conditions of demand for the other financial asset.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

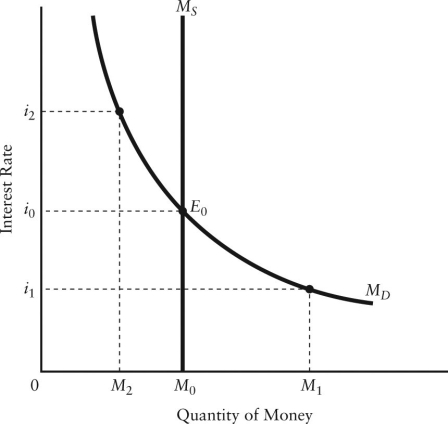

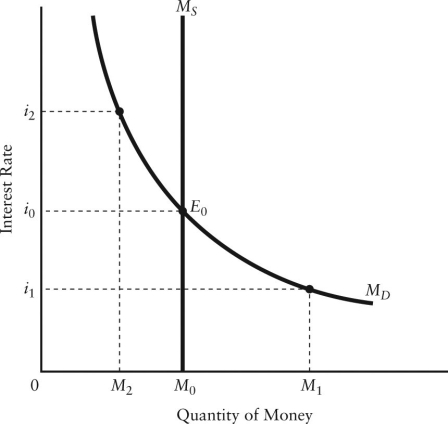

61

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. Starting at equilibrium E0, an increase in the supply of money will result in the

A) shift of the MS curve to the left and an increase in the interest rate.

B) shift of the MS curve to the right and a fall in the interest rate.

C) downward movement along the MD curve and a higher interest rate.

D) shift of the MD curve to the left and a fall in the interest rate.

E) upward movement along the MD curve and a lower interest rate.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

62

When there is an excess supply of money, monetary equilibrium is restored through

A) interest rates rising.

B) individuals attempting to sell bonds.

C) the price of bonds falling.

D) the price of bonds increasing.

E) the price level falling.

A) interest rates rising.

B) individuals attempting to sell bonds.

C) the price of bonds falling.

D) the price of bonds increasing.

E) the price level falling.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

63

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. If the interest rate is i1, the subsequent adjustment in the money market is as follows:

A) excess demand for money leads to a sale of bonds, which in turn causes the interest rate to rise.

B) the MS curve will shift to the left so as to maintain the interest rate at i2.

C) the interest rate will remain at i1 because the money market is in equilibrium at this interest rate.

D) excess supply of money leads to the purchase of bonds, which in turn causes the interest rate to fall.

E) excess demand for money leads to a purchase of bonds, which in turn causes the interest rate to rise.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

64

Other things being equal, a reduction in the money supply will lead to a

A) fall in the rate of interest and an increase in desired investment expenditure.

B) rise in the rate of interest and in increase in desired investment expenditure.

C) fall in the rate of interest and a decrease in desired investment expenditure.

D) rise in the rate of interest and a decrease in desired investment expenditure.

E) rise in the rate of interest and no change in desired investment expenditure.

A) fall in the rate of interest and an increase in desired investment expenditure.

B) rise in the rate of interest and in increase in desired investment expenditure.

C) fall in the rate of interest and a decrease in desired investment expenditure.

D) rise in the rate of interest and a decrease in desired investment expenditure.

E) rise in the rate of interest and no change in desired investment expenditure.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

65

How does monetary equilibrium re-establish itself when there is an excess supply of money balances?

A) the interest rate rises

B) individuals attempt to sell bonds

C) the price of bonds falls

D) the price of bonds increases

E) the price level falls

A) the interest rate rises

B) individuals attempt to sell bonds

C) the price of bonds falls

D) the price of bonds increases

E) the price level falls

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

66

If there are just two assets, bonds and money, then an equilibrium between the quantity demanded of money and the quantity supplied of money implies

A) an excess supply of bonds.

B) an excess demand for bonds.

C) equilibrium in the bond market.

D) an indeterminant equilibrium in the bond market.

E) nothing about conditions of demand for the other financial asset.

A) an excess supply of bonds.

B) an excess demand for bonds.

C) equilibrium in the bond market.

D) an indeterminant equilibrium in the bond market.

E) nothing about conditions of demand for the other financial asset.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

67

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. If the interest rate is i2, the subsequent adjustment in the money market is as follows:

A) excess demand for money leads to a sale of bonds, which in turn causes the interest rate to rise.

B) MS curve will shift to the left as to maintain the interest rate at i2.

C) the interest rate will remain at i2, because the money market is in equilibrium at this interest rate.

D) excess supply of money leads to the purchase of bonds, which in turn causes the interest rate to fall to i 0.

E) excess supply of money leads to the sale of bonds, which in turn causes the interest rate to fall.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

68

The economyʹs investment demand function describes the

A) positive relationship between desired investment, the rate of interest, and aggregate expenditure.

B) positive relationship between desired investment and the rate of interest.

C) negative relationship between the demand for money and the interest rate.

D) negative relationship between desired investment and aggregate expenditure.

E) negative relationship between the interest rate and desired investment.

A) positive relationship between desired investment, the rate of interest, and aggregate expenditure.

B) positive relationship between desired investment and the rate of interest.

C) negative relationship between the demand for money and the interest rate.

D) negative relationship between desired investment and aggregate expenditure.

E) negative relationship between the interest rate and desired investment.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

69

If the economy is currently in monetary equilibrium, an increase in the money supply will

A) not change the equilibrium conditions.

B) cause a reduction in the demand for money, leading to a higher rate of interest.

C) cause an excess demand for money and a decrease in the rate of interest.

D) cause an increase in the demand for money, leading to a lower rate of interest.

E) lead to a movement down the money demand curve to a lower rate of interest.

A) not change the equilibrium conditions.

B) cause a reduction in the demand for money, leading to a higher rate of interest.

C) cause an excess demand for money and a decrease in the rate of interest.

D) cause an increase in the demand for money, leading to a lower rate of interest.

E) lead to a movement down the money demand curve to a lower rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

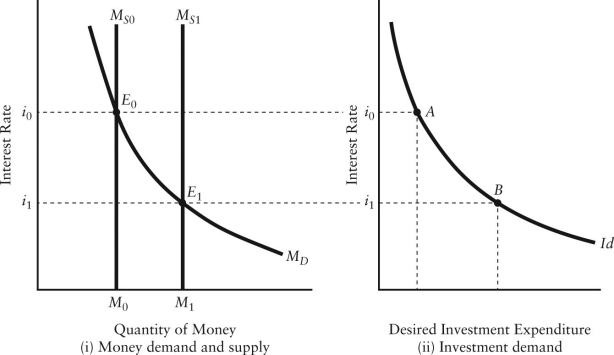

70

FIGURE 27-3

FIGURE 27-3Refer to Figure 27-3. Part i) of the figure shows the money market and the effect of an increase in the supply of money. The corresponding sequence of events in the bond market is as follows: The of money at i0 leads firms and households to bonds, which leads to an) in the price of bonds and a decrease in the interest rate.

A) excess demand; buy; increase

B) excess demand; sell; decrease

C) excess supply; buy; decrease

D) excess supply; sell; decrease

E) excess supply; buy; increase

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

71

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. Suppose the market interest rate is i1. The situation in this market is as follows:

A) firms and households are attempting to increase their money holdings by selling bonds.

B) firms and households are attempting to decrease their money holdings by selling bonds.

C) firms and households are attempting to increase their money holdings by buying bonds.

D) firms and households are attempting to decrease their money holdings by buying bonds.

E) the market is in equilibrium and no change will occur.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

72

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. Starting at equilibrium E0, an increase in real GDP will lead to a

A) shift of the MS curve to the left and an increase in the interest rate.

B) shift of the MS curve to the right and a fall in the interest rate.

C) downward movement along the MD curve and a lower interest rate.

D) shift of the MD curve to the left and a fall in the interest rate.

E) shift of the MD curve to the right and an increase in the interest rate.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

73

FIGURE 27-3

FIGURE 27-3Refer to Figure 27-3. The increase in the money supply from MS0 to MS1 shifts the monetary equilibrium from E0 to E1. The result is

A) a decrease in the interest rate and an increase in desired investment.

B) an increase in the interest rate and a decrease in desired investment.

C) sustained monetary disequilibrium.

D) a shift of the investment demand curve to the right.

E) a shift of the investment demand curve to the left.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

74

Consider a money market in which there is an excess demand for money at the prevailing interest rate. The likely response is until the quantity demanded of money equals the quantity supplied of money.

A) the corresponding excess demand of bonds will cause the price of bonds to decrease and the interest rate to rise

B) the money supply curve will shift to the left

C) the money supply curve will shift to the right

D) the money demand curve will shift to the right, causing the price of bonds to increase, and the interest rate to fall

E) the corresponding excess supply of bonds will cause the price of bonds to decrease and the interest rate to rise

A) the corresponding excess demand of bonds will cause the price of bonds to decrease and the interest rate to rise

B) the money supply curve will shift to the left

C) the money supply curve will shift to the right

D) the money demand curve will shift to the right, causing the price of bonds to increase, and the interest rate to fall

E) the corresponding excess supply of bonds will cause the price of bonds to decrease and the interest rate to rise

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

75

FIGURE 27-3

FIGURE 27-3Refer to Figure 27-3. The increase in desired investment expenditure, as shown by the movement from point A to point B, occurs because of

A) a fiscal policy designed to encourage investment.

B) an increase in the money supply.

C) a change in sales, which increases inventory investment.

D) an improvement in business confidence.

E) a tax-rate induced change in desired investment.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

76

FIGURE 27-3

FIGURE 27-3The monetary transmission mechanism can be set in motion when a rise in the price level causes

A) an increased demand for money balances, leading people to sell bonds, which in turn raises the interest rate.

B) an increased demand for money balances, leading people to sell bonds, which in turn decreases the interest rate.

C) an increased demand for money balances, leading people to buy bonds, which in turn decreases the interest rate.

D) a decreased demand for money balances, leading people to buy bonds, which in turn decreases the interest rate.

E) a decreased demand for money balances, leading people to sell bonds, which in turn raises the interest rate.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

77

Monetary equilibrium occurs when the

A) growth in the money supply is zero.

B) existing supply of money is willingly held by households and firms in the economy at the current rate of interest.

C) nominal rate of interest equals the real rate of interest.

D) the money supply is growing at a constant rate.

E) supply and demand for all goods in the economy are equal at the current rate of interest.

A) growth in the money supply is zero.

B) existing supply of money is willingly held by households and firms in the economy at the current rate of interest.

C) nominal rate of interest equals the real rate of interest.

D) the money supply is growing at a constant rate.

E) supply and demand for all goods in the economy are equal at the current rate of interest.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

78

The linkage between changes in monetary equilibrium and changes in aggregate demand is called the

A) monetary transmission mechanism.

B) simple multiplier.

C) equilibrium mechanism.

D) transactions mechanism.

E) liquidity preference function.

A) monetary transmission mechanism.

B) simple multiplier.

C) equilibrium mechanism.

D) transactions mechanism.

E) liquidity preference function.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

79

FIGURE 27-2

FIGURE 27-2Refer to Figure 27-2. Suppose the market interest rate is i2. The situation in this market is as follows:

A) firms and households are attempting to increase their money holdings by selling bonds.

B) firms and households are attempting to decrease their money holdings by selling bonds.

C) firms and households are attempting to increase their money holdings by buying bonds.

D) firms and households are attempting to decrease their money holdings by buying bonds.

E) the market is in equilibrium and no change will occur.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck

80

When the price level increases, ceteris paribus, it causes households and firms to try to

A) reduce money balances, which drives interest rates down.

B) reduce money balances, which drives interest rates up.

C) reduce money balances, which drives national income up.

D) increase money balances, which drives interest rates down.

E) increase money balances, which drives interest rates up.

A) reduce money balances, which drives interest rates down.

B) reduce money balances, which drives interest rates up.

C) reduce money balances, which drives national income up.

D) increase money balances, which drives interest rates down.

E) increase money balances, which drives interest rates up.

Unlock Deck

Unlock for access to all 135 flashcards in this deck.

Unlock Deck

k this deck