Deck 1: Financial Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/86

Play

Full screen (f)

Deck 1: Financial Reporting

1

Prior to 1973, generally accepted accounting principles were established

A) by the Financial Accounting Foundation.

B) by the Securities and Exchange Commission.

C) under the direction of the American Institute of Certified Public Accountants.

D) by the individual states.

A) by the Financial Accounting Foundation.

B) by the Securities and Exchange Commission.

C) under the direction of the American Institute of Certified Public Accountants.

D) by the individual states.

C

2

Which of the following is a characteristic of the Financial Accounting Standards Board?

A) The FASB is composed of five members.

B) FASB members must come from CPA firms.

C) FASB members are part-time.

D) FASB members may retain their positions with previous employers.

A) The FASB is composed of five members.

B) FASB members must come from CPA firms.

C) FASB members are part-time.

D) FASB members may retain their positions with previous employers.

A

3

A major difference between the Financial Accounting Standards Board (FASB) and its predecessor, the Accounting Principles Board (APB), is

A) all members of the FASB serve full time, are paid a salary, and are independent of any public or private enterprises.

B) over 50 percent of the members of the FASB are required to be Certified Public Accountants.

C) the FASB issues exposure drafts of proposed standards.

D) all members of the FASB possess experience in both public and corporate accounting.

A) all members of the FASB serve full time, are paid a salary, and are independent of any public or private enterprises.

B) over 50 percent of the members of the FASB are required to be Certified Public Accountants.

C) the FASB issues exposure drafts of proposed standards.

D) all members of the FASB possess experience in both public and corporate accounting.

A

4

Which of the following is not normally an objective of financial reporting?

A) To provide information about an entity's assets and claims against those assets

B) To provide information that is useful in assessing an entity's sources and uses of cash

C) To provide information that is useful in lending and investing decisions

D) To provide information about an entity's liquidation value

A) To provide information about an entity's assets and claims against those assets

B) To provide information that is useful in assessing an entity's sources and uses of cash

C) To provide information that is useful in lending and investing decisions

D) To provide information about an entity's liquidation value

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

5

Members of the Financial Accounting Standards Board are appointed by the

A) American Accounting Association.

B) Financial Accounting Foundation.

C) Securities and Exchange Commission.

D) American Institute of Certified Public Accountants.

A) American Accounting Association.

B) Financial Accounting Foundation.

C) Securities and Exchange Commission.

D) American Institute of Certified Public Accountants.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

6

The Financial Accounting Foundation oversees the

A) operations of the AICPA.

B) operations of the FASB.

C) AAA.

D) financial reporting arm of the SEC.

A) operations of the AICPA.

B) operations of the FASB.

C) AAA.

D) financial reporting arm of the SEC.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

7

Management accounting is the area of accounting that emphasizes

A) reporting financial information to external users.

B) reporting to the SEC.

C) combining accounting knowledge with an expertise in data processing.

D) developing accounting information for use within a company.

A) reporting financial information to external users.

B) reporting to the SEC.

C) combining accounting knowledge with an expertise in data processing.

D) developing accounting information for use within a company.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

8

Primary responsibility for GAAP and public reporting currently rests with the

A) SEC.

B) FASB.

C) Congress.

D) AICPA.

A) SEC.

B) FASB.

C) Congress.

D) AICPA.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

9

The responsibility of the Emerging Issues Task Force (EITF) is to

A) issue statements which reflect a consensus of the EITF on how to account for new financial reporting issues where guidance is needed quickly.

B) do research on financial reporting issues that are being addressed by the AICPA.

C) respond to groups lobbying the FASB on issues that affect a particular industry.

D) develop concept statements the AICPA can use as a frame of reference to solve future problems.

A) issue statements which reflect a consensus of the EITF on how to account for new financial reporting issues where guidance is needed quickly.

B) do research on financial reporting issues that are being addressed by the AICPA.

C) respond to groups lobbying the FASB on issues that affect a particular industry.

D) develop concept statements the AICPA can use as a frame of reference to solve future problems.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

10

Documents issued by the FASB include all of the following except

A) Statements of Financial Accounting Standards.

B) Interpretations of Statements of Financial Accounting Standards.

C) Statements of Financial Accounting Concepts.

D) Financial Reporting Releases.

A) Statements of Financial Accounting Standards.

B) Interpretations of Statements of Financial Accounting Standards.

C) Statements of Financial Accounting Concepts.

D) Financial Reporting Releases.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

11

Financial accounting is the area of accounting that emphasizes reporting to

A) management.

B) regulatory bodies.

C) internal auditors.

D) creditors and investors.

A) management.

B) regulatory bodies.

C) internal auditors.

D) creditors and investors.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

12

The overall objective of financial reporting is to provide information

A) that is useful for decision making.

B) about an enterprise's assets, liabilities, and owners' equity.

C) about an enterprise's financial performance during a period.

D) that allows owners to assess management's performance.

A) that is useful for decision making.

B) about an enterprise's assets, liabilities, and owners' equity.

C) about an enterprise's financial performance during a period.

D) that allows owners to assess management's performance.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

13

The Governmental Accounting Standards Board

A) was incorporated into the Financial Accounting Standards Board when the FASB was created.

B) addresses financial reporting issues of U.S. government treaties and treasury rulings.

C) addresses the financial reporting issues related to state and local governments.

D) addresses the governmental reporting activities of the SEC.

A) was incorporated into the Financial Accounting Standards Board when the FASB was created.

B) addresses financial reporting issues of U.S. government treaties and treasury rulings.

C) addresses the financial reporting issues related to state and local governments.

D) addresses the governmental reporting activities of the SEC.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is an internal user of a company's financial information?

A) Board of directors

B) Stockholders in the company

C) Holders of the company's bonds

D) Creditors with long-term contracts with the company

A) Board of directors

B) Stockholders in the company

C) Holders of the company's bonds

D) Creditors with long-term contracts with the company

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

15

The primary current source of generally accepted accounting principles for governmental operations is the

A) Financial Accounting Standards Board.

B) Securities and Exchange Commission.

C) Governmental Accounting Standards Board.

D) Government Accounting Office.

A) Financial Accounting Standards Board.

B) Securities and Exchange Commission.

C) Governmental Accounting Standards Board.

D) Government Accounting Office.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

16

Proper application of accounting principles is most dependent upon the

A) existence of specific guidelines.

B) oversight of regulatory bodies.

C) external audit function.

D) professional judgment of the accountant.

A) existence of specific guidelines.

B) oversight of regulatory bodies.

C) external audit function.

D) professional judgment of the accountant.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

17

The normal order followed by the FASB in publishing its standards is

A) statement, discussion memorandum, opinion.

B) discussion memorandum, interpretation, exposure draft, statement.

C) exposure draft, discussion memorandum, statement.

D) discussion memorandum, exposure draft, statement.

A) statement, discussion memorandum, opinion.

B) discussion memorandum, interpretation, exposure draft, statement.

C) exposure draft, discussion memorandum, statement.

D) discussion memorandum, exposure draft, statement.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

18

As independent (or external) auditors, CPAs are primarily responsible for

A) preparing financial statements in conformity with GAAP.

B) certifying the accuracy of financial statements.

C) expressing an opinion as to the fairness of financial statements.

D) filing financial statements with the SEC.

A) preparing financial statements in conformity with GAAP.

B) certifying the accuracy of financial statements.

C) expressing an opinion as to the fairness of financial statements.

D) filing financial statements with the SEC.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

19

The process of establishing financial accounting standards is

A) a democratic process in that a majority of practicing accountants must agree with a standard before it becomes implemented.

B) a legislative process based on rules promulgated by government agencies.

C) based solely on economic analysis of the effects each standard will have if it is implemented.

D) a social process which incorporates political actions of various interested user groups as well as professional research and logic.

A) a democratic process in that a majority of practicing accountants must agree with a standard before it becomes implemented.

B) a legislative process based on rules promulgated by government agencies.

C) based solely on economic analysis of the effects each standard will have if it is implemented.

D) a social process which incorporates political actions of various interested user groups as well as professional research and logic.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

20

The responsibility to review the work of the accountants and issue opinions as to the fairness of the financial statements rests with

A) the external auditor.

B) the board of directors.

C) the internal auditors.

D) management.

A) the external auditor.

B) the board of directors.

C) the internal auditors.

D) management.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

21

How many board members serve on the FASB?

A) 5

B) 7

C) 14

D) 20

A) 5

B) 7

C) 14

D) 20

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

22

Accountants prepare financial statements at arbitrary points in time during a company's lifetime in accordance with the accounting concept of

A) matching.

B) comparability.

C) accounting periods.

D) materiality.

A) matching.

B) comparability.

C) accounting periods.

D) materiality.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

23

When the FASB deliberates about an accounting standard, firms whose financial statements would be affected by that standard

A) are legally barred from lobbying the FASB.

B) are not allowed to lobby the FASB if the standard would have a negative impact on their financial statements.

C) are not allowed to lobby the FASB if the standard would have a positive impact on their financial statements.

D) are free to lobby for or against the standard.

A) are legally barred from lobbying the FASB.

B) are not allowed to lobby the FASB if the standard would have a negative impact on their financial statements.

C) are not allowed to lobby the FASB if the standard would have a positive impact on their financial statements.

D) are free to lobby for or against the standard.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

24

Important constraints underlying the qualitative characteristics of accounting information are

A) historical cost and going concern.

B) materiality, conservatism, and cost-effectiveness.

C) consistency, comparability, and conservatism.

D) verifiability, neutrality, and representational faithfulness.

A) historical cost and going concern.

B) materiality, conservatism, and cost-effectiveness.

C) consistency, comparability, and conservatism.

D) verifiability, neutrality, and representational faithfulness.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

25

Form 10-K is submitted to the

A) FASB.

B) GASB.

C) IRS.

D) SEC.

A) FASB.

B) GASB.

C) IRS.

D) SEC.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

26

The primary purpose of the Securities and Exchange Commission is to

A) regulate the issuance and trading of securities.

B) issue accounting and auditing regulations for publicly held companies.

C) prevent the trading of speculative securities.

D) enforce generally accepted accounting principles.

A) regulate the issuance and trading of securities.

B) issue accounting and auditing regulations for publicly held companies.

C) prevent the trading of speculative securities.

D) enforce generally accepted accounting principles.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

27

The International Accounting Standards Board was formed to

A) enforce FASB standards in foreign countries.

B) develop worldwide accounting standards.

C) establish accounting standards for U.S. multinational companies.

D) develop accounting standards for countries that do not have their own standard-setting bodies.

A) enforce FASB standards in foreign countries.

B) develop worldwide accounting standards.

C) establish accounting standards for U.S. multinational companies.

D) develop accounting standards for countries that do not have their own standard-setting bodies.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

28

When a large number of individuals, using the same measurement method, demonstrate that a high degree of consensus can be secured among independent measurers, then the result exhibits the characteristic of

A) verifiability.

B) neutrality.

C) relevance.

D) reliability.

A) verifiability.

B) neutrality.

C) relevance.

D) reliability.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

29

Once the FASB has established an accounting standard, the

A) standard is continually reviewed to see if modification is necessary.

B) standard is not reviewed unless the SEC makes a complaint.

C) task of reviewing the standard to see if modification is necessary is given to the AICPA.

D) principle of consistency requires that no revisions ever be made to the standard.

A) standard is continually reviewed to see if modification is necessary.

B) standard is not reviewed unless the SEC makes a complaint.

C) task of reviewing the standard to see if modification is necessary is given to the AICPA.

D) principle of consistency requires that no revisions ever be made to the standard.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

30

Which is the correct historical sequence of accounting rule-making bodies?

A) CAP, FASB, APB

B) CAP, APB, FASB

C) FASB, APB, CAP

D) APB, CAP, FASB

A) CAP, FASB, APB

B) CAP, APB, FASB

C) FASB, APB, CAP

D) APB, CAP, FASB

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following measurement attributes is not currently used in practice?

A) Present value

B) Net realizable value

C) Current replacement cost

D) Inflation-adjusted cost

A) Present value

B) Net realizable value

C) Current replacement cost

D) Inflation-adjusted cost

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

32

Pronouncements issued by the SEC include

A) Accounting Research Bulletins.

B) Statements on Accounting Principles.

C) Financial Accounting Standards.

D) Financial Reporting Releases.

A) Accounting Research Bulletins.

B) Statements on Accounting Principles.

C) Financial Accounting Standards.

D) Financial Reporting Releases.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

33

Congress

A) has legally barred the SEC from interfering with the work of the FASB.

B) is restricted from holding hearings concerning the accounting profession.

C) gave the SEC the power to establish accounting principles for corporations whose stock is sold and traded to the general public.

D) appoints two of the five members of the FASB.

A) has legally barred the SEC from interfering with the work of the FASB.

B) is restricted from holding hearings concerning the accounting profession.

C) gave the SEC the power to establish accounting principles for corporations whose stock is sold and traded to the general public.

D) appoints two of the five members of the FASB.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following items is nota modifying convention?

A) Matching

B) Materiality

C) Industry practices

D) Conservatism

A) Matching

B) Materiality

C) Industry practices

D) Conservatism

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

35

Generally accepted accounting principles

A) are accounting adaptations based on the laws of economic science.

B) derive their credibility and authority from legal rulings and court precedents.

C) derive their credibility and authority from the federal government through the financial reporting section of the SEC.

D) derive their credibility and authority from general recognition and acceptance by the accounting profession.

A) are accounting adaptations based on the laws of economic science.

B) derive their credibility and authority from legal rulings and court precedents.

C) derive their credibility and authority from the federal government through the financial reporting section of the SEC.

D) derive their credibility and authority from general recognition and acceptance by the accounting profession.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

36

The primary current source of generally accepted accounting principles for nongovernmental operations is the

A) American Institute of Certified Public Accountants.

B) Securities and Exchange Commission.

C) Financial Accounting Standards Board.

D) Governmental Accounting Standards Board.

A) American Institute of Certified Public Accountants.

B) Securities and Exchange Commission.

C) Financial Accounting Standards Board.

D) Governmental Accounting Standards Board.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

37

The assumed continuation of a business entity in the absence of evidence to the contrary is an example of the accounting concept of

A) accrual.

B) consistency.

C) comparability.

D) going concern.

A) accrual.

B) consistency.

C) comparability.

D) going concern.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

38

The Journal of Accountancy is published by the

A) American Accounting Association.

B) American Institute of Certified Public Accountants.

C) Financial Executives Institute.

D) Financial Accounting Standards Board.

A) American Accounting Association.

B) American Institute of Certified Public Accountants.

C) Financial Executives Institute.

D) Financial Accounting Standards Board.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

39

Primary responsibility for the preparation of financial statements in accordance with generally accepted accounting principles rests with

A) the internal auditors.

B) management.

C) the external auditors.

D) the board of directors.

A) the internal auditors.

B) management.

C) the external auditors.

D) the board of directors.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

40

A conceptual framework of accounting should

A) lead to uniformity of financial statements among companies within the same industry.

B) eliminate alternative accounting principles and methods.

C) guide the AICPA in developing generally accepted auditing standards.

D) define the basic objectives, terms, and concepts of accounting.

A) lead to uniformity of financial statements among companies within the same industry.

B) eliminate alternative accounting principles and methods.

C) guide the AICPA in developing generally accepted auditing standards.

D) define the basic objectives, terms, and concepts of accounting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is not an implication of the going-concern assumption?

A) The historical cost principle is credible.

B) Depreciation and amortization policies are justifiable and appropriate.

C) The current/noncurrent classification of assets and liabilities is justifiable and significant.

D) Amortizing research and development costs over multiple periods is justifiable and appropriate.

A) The historical cost principle is credible.

B) Depreciation and amortization policies are justifiable and appropriate.

C) The current/noncurrent classification of assets and liabilities is justifiable and significant.

D) Amortizing research and development costs over multiple periods is justifiable and appropriate.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a purpose of the conceptual framework of accounting?

A) To provide definitions of key terms and fundamental concepts

B) To provide specific guidelines for resolving situations not covered by existing accounting standards

C) To assist accountants and others in selecting among alternative accounting and reporting methods

D) To assist the FASB in the standard-setting process

A) To provide definitions of key terms and fundamental concepts

B) To provide specific guidelines for resolving situations not covered by existing accounting standards

C) To assist accountants and others in selecting among alternative accounting and reporting methods

D) To assist the FASB in the standard-setting process

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

43

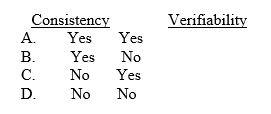

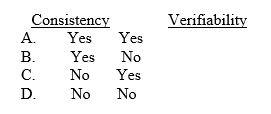

According to the FASB's conceptual framework, predictive and feedback values are ingredients of

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

44

The secondary qualitative characteristics of accounting information are

A) relevance and reliability.

B) comparability and consistency.

C) understandability and decision usefulness.

D) materiality and conservatism.

A) relevance and reliability.

B) comparability and consistency.

C) understandability and decision usefulness.

D) materiality and conservatism.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

45

Accounting for inventories by applying the lower-of-cost-or-market is an example of the application of

A) conservatism.

B) comparability.

C) consistency.

D) materiality.

A) conservatism.

B) comparability.

C) consistency.

D) materiality.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

46

Historical cost has been the valuation basis most commonly used in accounting because of its

A) timelessness.

B) conservatism.

C) reliability.

D) accuracy.

A) timelessness.

B) conservatism.

C) reliability.

D) accuracy.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

47

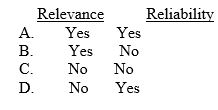

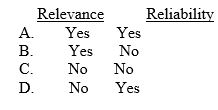

Under Statement of Financial Accounting Concepts No. 2, representational faithfulness is an ingredient of

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

48

According to Statement of Financial Accounting Concepts No. 2, neutrality is an ingredient of

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following is not one of the fundamental criteria for recognition?

A) Timeliness

B) Measurability

C) Relevance

D) Reliability

A) Timeliness

B) Measurability

C) Relevance

D) Reliability

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

50

An item would be considered material and therefore would be disclosed in the financial statements if the

A) expected benefits of disclosure exceed the additional costs.

B) impact on earnings is greater than 3 percent.

C) FASB definition of materiality is met.

D) omission of misstatement of the amount would make a difference to the users.

A) expected benefits of disclosure exceed the additional costs.

B) impact on earnings is greater than 3 percent.

C) FASB definition of materiality is met.

D) omission of misstatement of the amount would make a difference to the users.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

51

Financial information exhibits the characteristic of consistency when

A) accounting procedures are adopted which smooth net income and make results consistent between years.

B) extraordinary gains and losses are shown separately on the income statement.

C) accounting entities give similar events the same accounting treatment each period.

D) expenditures are reported as expenses and netted against revenue in the period in which they are paid.

A) accounting procedures are adopted which smooth net income and make results consistent between years.

B) extraordinary gains and losses are shown separately on the income statement.

C) accounting entities give similar events the same accounting treatment each period.

D) expenditures are reported as expenses and netted against revenue in the period in which they are paid.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following statements concerning the objectives of financial reporting is correct?

A) The objectives are intended to be specific in nature.

B) The objectives are directed primarily toward the needs of internal users of accounting information.

C) The objectives were the end result of the FASB's conceptual framework project.

D) The objectives encompass not only financial statement disclosures, but other information as well.

A) The objectives are intended to be specific in nature.

B) The objectives are directed primarily toward the needs of internal users of accounting information.

C) The objectives were the end result of the FASB's conceptual framework project.

D) The objectives encompass not only financial statement disclosures, but other information as well.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following elements of financial statements is not a component of comprehensive income?

A) Revenues

B) Expenses

C) Losses

D) Distributions to owners

A) Revenues

B) Expenses

C) Losses

D) Distributions to owners

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

54

The financial statements that are prepared for the business are separate and distinct from the owners according to the

A) going-concern assumption.

B) matching principle.

C) economic entity assumption.

D) full disclosure principle.

A) going-concern assumption.

B) matching principle.

C) economic entity assumption.

D) full disclosure principle.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

55

When financial reports from two different companies have been prepared and presented in a similar manner, the information exhibits the characteristic of

A) relevance.

B) reliability.

C) comparability.

D) consistency.

A) relevance.

B) reliability.

C) comparability.

D) consistency.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

56

Recording the purchase price of a pencil sharpener (with an estimated useful life of 10 years) as an expense of the current period is justified by the

A) going-concern assumption.

B) materiality constraint.

C) matching principle.

D) comparability principle.

A) going-concern assumption.

B) materiality constraint.

C) matching principle.

D) comparability principle.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

57

Conservatism is best described as selecting an accounting alternative that

A) understates assets and/or net income.

B) has the least favorable impact on owners' equity.

C) overstates, as opposed to understates, liabilities.

D) is least likely to mislead users of financial information.

A) understates assets and/or net income.

B) has the least favorable impact on owners' equity.

C) overstates, as opposed to understates, liabilities.

D) is least likely to mislead users of financial information.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

58

According to the FASB's conceptual framework, the process of reporting an item in the financial statements of an entity is

A) realization.

B) recognition.

C) matching.

D) allocation.

A) realization.

B) recognition.

C) matching.

D) allocation.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

59

The overriding qualitative characteristic of accounting information is

A) relevance.

B) understandability.

C) reliability.

D) decision usefulness.

A) relevance.

B) understandability.

C) reliability.

D) decision usefulness.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

60

What accounting concept justifies the use of accruals and deferrals?

A) Going-concern assumption

B) Corporate form of organization

C) Consistency characteristic

D) Arm's-length transactions

A) Going-concern assumption

B) Corporate form of organization

C) Consistency characteristic

D) Arm's-length transactions

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

61

The singularly unique function performed by certified public accountants in United States is

A) tax preparation.

B) management advisory services.

C) the attest function.

D) the preparation of financial statements.

A) tax preparation.

B) management advisory services.

C) the attest function.

D) the preparation of financial statements.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

62

The journal Accounting Horizons is published by which of the following organizations?

A) American Institute of Certified Public Accountants (AICPA)

B) American Accounting Association (AAA)

C) Securities and Exchange Commission (SEC)

D) Financial Accounting Standards Board (FASB)

A) American Institute of Certified Public Accountants (AICPA)

B) American Accounting Association (AAA)

C) Securities and Exchange Commission (SEC)

D) Financial Accounting Standards Board (FASB)

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

63

The branch of accounting that is concerned primarily with providing information for internal users is called

A) auditing.

B) managerial accounting.

C) financial accounting.

D) income tax accounting.

A) auditing.

B) managerial accounting.

C) financial accounting.

D) income tax accounting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

64

In providing information with the qualitative characteristics that render the information useful, the constraint of materiality may affect what is included and excluded from the financial information reported.

Explain the concept of materiality.

Explain the concept of materiality.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

65

Disclosure requirements for financial reporting are strictest in

A) the United Kingdom.

B) Germany.

C) the United States.

D) France.

A) the United Kingdom.

B) Germany.

C) the United States.

D) France.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

66

The mission statement of the Financial Accounting Standards Board includes a goal of promoting international comparability of accounting standards. Furthermore, the International Accounting Standards Board has begun over the last 20 years to issue international accounting standards designed to create a common set of international accounting and reporting standards.

Identify reasons why such a set of international accounting standards would be desirable.

Identify reasons why such a set of international accounting standards would be desirable.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

67

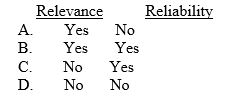

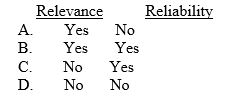

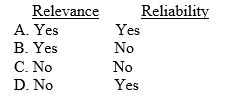

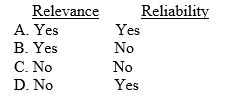

According to the FASB's conceptual framework, which of the following relates to both relevance and reliability?

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

68

The primary measurement basis currently used to value assets in external financial statements of an enterprise is the

A) current market price if the assets currently held by an enterprise were sold on the open market.

B) current market price if the assets held by an enterprise were purchased on the open market.

C) present value of the cash flows the assets are expected to generate over their remaining useful lives.

D) market price of the assets held by an enterprise at the date the assets were acquired (although some assets may be valued at their current selling price or net realizable value).

A) current market price if the assets currently held by an enterprise were sold on the open market.

B) current market price if the assets held by an enterprise were purchased on the open market.

C) present value of the cash flows the assets are expected to generate over their remaining useful lives.

D) market price of the assets held by an enterprise at the date the assets were acquired (although some assets may be valued at their current selling price or net realizable value).

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

69

The branch of accounting that is concerned with providing information to present and potential creditors of an enterprise is

A) auditing.

B) managerial accounting.

C) financial accounting.

D) income tax accounting.

A) auditing.

B) managerial accounting.

C) financial accounting.

D) income tax accounting.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

70

Financial statements issued for the use of parties external to the enterprise are the primary responsibility of the

A) management of the enterprise.

B) stockholders of the enterprise.

C) independent auditors of the enterprise.

D) creditors of the enterprise.

A) management of the enterprise.

B) stockholders of the enterprise.

C) independent auditors of the enterprise.

D) creditors of the enterprise.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is true about international accounting standards?

A) Significant differences exist between U.S. GAAP and GAAP of other countries.

B) Few differences exist between U.S. GAAP and GAAP of other countries.

C) The IASB is the standards-setting body of France.

D) It is unlikely that the differences between U.S. GAAP and GAAP of other countries will diminish over time.

A) Significant differences exist between U.S. GAAP and GAAP of other countries.

B) Few differences exist between U.S. GAAP and GAAP of other countries.

C) The IASB is the standards-setting body of France.

D) It is unlikely that the differences between U.S. GAAP and GAAP of other countries will diminish over time.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

72

The accrual basis of accounting is based primarily on

A) conservatism and revenue realization.

B) conservatism and matching.

C) consistency and matching.

D) revenue realization and matching.

A) conservatism and revenue realization.

B) conservatism and matching.

C) consistency and matching.

D) revenue realization and matching.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

73

The going-concern assumption holds that the business entity will continue its operations long enough to realize its projects, commitments, and ongoing activities. The assumption is that the entity is not expected to be liquidated in the foreseeable future or that the entity will continue for an indefinite period of time.

Explain the relationship between the going-concern assumption and the historical cost principle and the amortization of assets.

Explain the relationship between the going-concern assumption and the historical cost principle and the amortization of assets.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is not included in the highest authoritative level of GAAP?

A) FASB Statements

B) AICPA Statements of Position

C) FASB Staff Positions

D) Accounting Principles Board (APB) Opinions

A) FASB Statements

B) AICPA Statements of Position

C) FASB Staff Positions

D) Accounting Principles Board (APB) Opinions

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

75

The harmonization of world accounting standards is viewed by many accountants, analysts, standard setters, and others as being among the most important issues facing business throughout the world. Advocates of harmonization seek to establish a common set of international accounting and reporting standards. Such a task has proven formidable, however.

Identify factors that would hinder the process of harmonization of accounting standards.

Identify factors that would hinder the process of harmonization of accounting standards.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following is true?

A) Form 10-K is required under the FASB Conceptual Framework.

B) Form 10-Q is a quarterly report of significant events required by the SEC.

C) Form 8-K is a quarterly report of significant events required by the SEC.

D) Form 8-K is the annual report submitted by small businesses to the SEC.

A) Form 10-K is required under the FASB Conceptual Framework.

B) Form 10-Q is a quarterly report of significant events required by the SEC.

C) Form 8-K is a quarterly report of significant events required by the SEC.

D) Form 8-K is the annual report submitted by small businesses to the SEC.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

77

Many accountants argue that relevance and reliability often require trade-offs.

Define both relevance and reliability and explain what is meant by "trade-offs" between relevance and reliability. Include in your explanation a specific example of where trade-offs could occur.

Define both relevance and reliability and explain what is meant by "trade-offs" between relevance and reliability. Include in your explanation a specific example of where trade-offs could occur.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

78

The United States Securities and Exchange Commission

A) has recognized IASB standards as an acceptable alternative to U.S. GAAP.

B) requires foreign companies listing their shares on U.S. stock exchanges to restate their financial statements to U.S. GAAP.

C) has barred foreign companies from listing their shares on U.S. stock exchanges.

D) has no jurisdiction in the United States over foreign companies listing their shares on U.S. stock exchanges.

A) has recognized IASB standards as an acceptable alternative to U.S. GAAP.

B) requires foreign companies listing their shares on U.S. stock exchanges to restate their financial statements to U.S. GAAP.

C) has barred foreign companies from listing their shares on U.S. stock exchanges.

D) has no jurisdiction in the United States over foreign companies listing their shares on U.S. stock exchanges.

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following qualitative characteristics of financial information requires that information not be biased in favor of one group of users to the detriment of others?

A) Relevance

B) Reliability

C) Verifiability

D) Neutrality

A) Relevance

B) Reliability

C) Verifiability

D) Neutrality

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck

80

For which of the following reporting issues has the FASB adopted substantially the same approach as the IASB?

A) Segment reporting

B) Earnings per share

C) Statement of cash flows

D) Pension plans

A) Segment reporting

B) Earnings per share

C) Statement of cash flows

D) Pension plans

Unlock Deck

Unlock for access to all 86 flashcards in this deck.

Unlock Deck

k this deck