Deck 7: The Revenuereceivablescash Cycle

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/81

Play

Full screen (f)

Deck 7: The Revenuereceivablescash Cycle

1

When the direct write-off method of recognizing bad debt expense is used, the entry to write off a specific customer account would

A) increase net income.

B) have no effect on net income.

C) increase the accounts receivable balance and increase net income.

D) decrease the accounts receivable balance and decrease net income.

A) increase net income.

B) have no effect on net income.

C) increase the accounts receivable balance and increase net income.

D) decrease the accounts receivable balance and decrease net income.

D

2

If the balance shown on a company's bank statement is less than the correct cash balance, and neither the company nor the bank has made any errors, there must be

A) deposits credited by the bank but not yet recorded by the company.

B) outstanding checks.

C) bank charges not yet recorded by the company.

D) deposits in transit.

A) deposits credited by the bank but not yet recorded by the company.

B) outstanding checks.

C) bank charges not yet recorded by the company.

D) deposits in transit.

D

3

Which of the following items would be added to the book balance on a bank reconciliation?

A) Outstanding checks

B) A check written for $63 entered as $36 in the accounting records

C) Interest paid by the bank

D) Deposits in transit

A) Outstanding checks

B) A check written for $63 entered as $36 in the accounting records

C) Interest paid by the bank

D) Deposits in transit

C

4

When the allowance method of recognizing bad debt expense is used, the entry to record the write-off of a specific uncollectible account would decrease

A) allowance for doubtful accounts.

B) net income.

C) net realizable value of accounts receivable.

D) working capital.

A) allowance for doubtful accounts.

B) net income.

C) net realizable value of accounts receivable.

D) working capital.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

5

A discount given to a customer for purchasing a large volume of merchandise is typically referred to as a

A) quantity discount.

B) cash discount.

C) trade discount.

D) size discount.

A) quantity discount.

B) cash discount.

C) trade discount.

D) size discount.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

6

An operating cycle

A) is twelve months or less in length.

B) is the average time required for a company to collect its receivables.

C) is used to determine current assets when the operating cycle is longer than one year.

D) begins with inventory and ends with cash.

A) is twelve months or less in length.

B) is the average time required for a company to collect its receivables.

C) is used to determine current assets when the operating cycle is longer than one year.

D) begins with inventory and ends with cash.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

7

If the cash balance shown in a company's accounting records is less than the correct cash balance, and neither the company nor the bank has made any errors, there must be

A) deposits credited by the bank but not yet recorded by the company.

B) deposits in transit.

C) outstanding checks.

D) bank charges not yet recorded by the company.

A) deposits credited by the bank but not yet recorded by the company.

B) deposits in transit.

C) outstanding checks.

D) bank charges not yet recorded by the company.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

8

The amount reported as "Cash" on a company's balance sheet normally should exclude

A) postdated checks that are payable to the company.

B) cash in a payroll account.

C) undelivered checks written and signed by the company.

D) petty cash.

A) postdated checks that are payable to the company.

B) cash in a payroll account.

C) undelivered checks written and signed by the company.

D) petty cash.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following would not be classified as cash?

A) Personal checks

B) Travelers' checks

C) Cashiers' checks

D) Postdated checks

A) Personal checks

B) Travelers' checks

C) Cashiers' checks

D) Postdated checks

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

10

The FASB specified in Statement No. 140 three conditions that must be met if a transfer of receivables is to accounted for as a sale. Which of the following is not one of the three conditions specified?

A) The transferred assets have been isolated from the transferor.

B) The transferor's obligation under the recourse provisions can be reasonably estimated.

C) The transferee has the right to pledge or exchange the transferred assets.

D) The transferor does not maintain effective control over the assets through an agreement to repurchase the assets before their maturity.

A) The transferred assets have been isolated from the transferor.

B) The transferor's obligation under the recourse provisions can be reasonably estimated.

C) The transferee has the right to pledge or exchange the transferred assets.

D) The transferor does not maintain effective control over the assets through an agreement to repurchase the assets before their maturity.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

11

In calculating a company's accounts receivable turnover, which of the following sets of factors would be used?

A) Net income and average accounts receivable

B) Average accounts receivable and average total assets

C) Average accounts receivable and net credit sales

D) Net credit sales and average stockholders' equity

A) Net income and average accounts receivable

B) Average accounts receivable and average total assets

C) Average accounts receivable and net credit sales

D) Net credit sales and average stockholders' equity

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following statements is incorrect?

A) The accounting function should be separated from the custodianship of a company's assets.

B) Certain clerical personnel in a company should be rotated among various jobs.

C) The responsibility of receiving merchandise and paying for it usually should be given to one person.

D) A company's personnel should be given well-defined responsibilities.

A) The accounting function should be separated from the custodianship of a company's assets.

B) Certain clerical personnel in a company should be rotated among various jobs.

C) The responsibility of receiving merchandise and paying for it usually should be given to one person.

D) A company's personnel should be given well-defined responsibilities.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

13

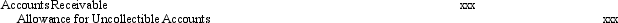

The entry

Would be made when

A) a customer pays its account balance.

B) a customer defaults on its account.

C) a previously defaulted customer pays its outstanding balance.

D) estimated uncollectible receivables are too low.

Would be made when

A) a customer pays its account balance.

B) a customer defaults on its account.

C) a previously defaulted customer pays its outstanding balance.

D) estimated uncollectible receivables are too low.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

14

When the allowance method of recognizing bad debt expense is used, the entries at the time of collection of a small account previously written off would

A) increase net income.

B) increase the allowance for doubtful accounts.

C) decrease net income.

D) decrease the allowance for doubtful accounts.

A) increase net income.

B) increase the allowance for doubtful accounts.

C) decrease net income.

D) decrease the allowance for doubtful accounts.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

15

When comparing the allowance method of accounting for bad debts with the direct write-off method, which of the following is true?

A) The direct write-off method is exact and also better illustrates the matching principle.

B) The allowance method is less exact but it better illustrates the matching principle.

C) The direct write-off method is theoretically superior.

D) The direct write-off method requires two separate entries to write off an uncollectible account.

A) The direct write-off method is exact and also better illustrates the matching principle.

B) The allowance method is less exact but it better illustrates the matching principle.

C) The direct write-off method is theoretically superior.

D) The direct write-off method requires two separate entries to write off an uncollectible account.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a basic characteristic of a system of cash control?

A) Use of a voucher system

B) Combined responsibility for handling and recording cash

C) Daily deposit of all cash received

D) Internal audits at irregular intervals

A) Use of a voucher system

B) Combined responsibility for handling and recording cash

C) Daily deposit of all cash received

D) Internal audits at irregular intervals

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

17

A method of estimating bad debts that focuses on the balance sheet rather than the income statement is the allowance method based on

A) direct write-off.

B) aging the trade receivable accounts.

C) credit sales.

D) specific accounts determined to be uncollectible.

A) direct write-off.

B) aging the trade receivable accounts.

C) credit sales.

D) specific accounts determined to be uncollectible.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is incorrect?

A) The operating cycle always is one year in duration.

B) The operating cycle sometimes is longer than one year in duration.

C) The operating cycle sometimes is shorter than one year in duration.

D) The operating cycle is a concept applicable both to manufacturing and retailing enterprises.

A) The operating cycle always is one year in duration.

B) The operating cycle sometimes is longer than one year in duration.

C) The operating cycle sometimes is shorter than one year in duration.

D) The operating cycle is a concept applicable both to manufacturing and retailing enterprises.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

19

Bank statements provide information about all of the following except

A) checks cleared during the period.

B) NSF checks.

C) bank charges for the period.

D) errors made by the company.

A) checks cleared during the period.

B) NSF checks.

C) bank charges for the period.

D) errors made by the company.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following factors are used to compute the number of days' sales in accounts receivable?

A) Inventory turnover and 365 days

B) Net sales and average inventory

C) Accounts receivable turnover and 365 days

D) Average accounts receivable and cost of goods sold

A) Inventory turnover and 365 days

B) Net sales and average inventory

C) Accounts receivable turnover and 365 days

D) Average accounts receivable and cost of goods sold

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

21

In preparing a monthly bank reconciliation, which of the following items would be added to the balance reported on the bank statement to arrive at the correct cash balance?

A) Outstanding checks

B) Bank service charge

C) Deposits in transit

D) A customer's note collected by the bank on behalf of the depositor

A) Outstanding checks

B) Bank service charge

C) Deposits in transit

D) A customer's note collected by the bank on behalf of the depositor

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

22

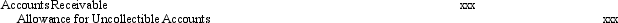

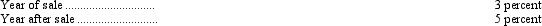

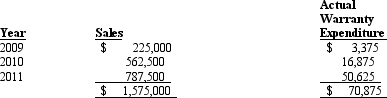

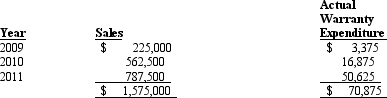

A new product introduced by Wilkenson Promotions carries a two-year warranty against defects. The estimated warranty costs related to dollar sales are as follows:

Sales and actual warranty expenditures for the years ended December 31, 2010 and 2011, are as follows:

What amount should Wilkenson report as its estimated liability as of December 31, 2011?

A) $4,000

B) $24,000

C) $54,000

D) $74,000

Sales and actual warranty expenditures for the years ended December 31, 2010 and 2011, are as follows:

What amount should Wilkenson report as its estimated liability as of December 31, 2011?

A) $4,000

B) $24,000

C) $54,000

D) $74,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

23

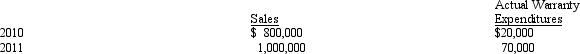

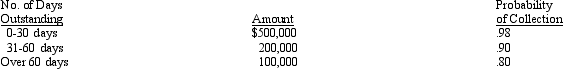

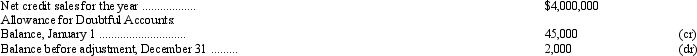

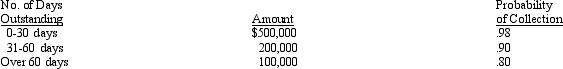

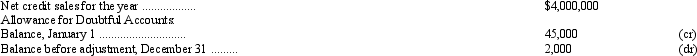

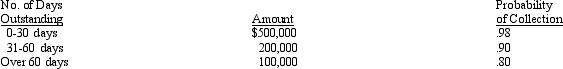

Richards Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year.

The following additional information is available for the current year:

See Richards Company information above. If Richards bases its estimate of bad debts on the aging of accounts receivable, doubtful accounts expense for the current year ending December 31 is

A) $47,000.

B) $48,000.

C) $50,000.

D) $52,000.

The following additional information is available for the current year:

See Richards Company information above. If Richards bases its estimate of bad debts on the aging of accounts receivable, doubtful accounts expense for the current year ending December 31 is

A) $47,000.

B) $48,000.

C) $50,000.

D) $52,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

24

Richards Company uses the allowance method of accounting for bad debts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year.

The following additional information is available for the current year:

See Richards Company information above. If Richards determines bad debt expense using 1.5 percent of net credit sales, the net realizable value of accounts receivable on the December 31 balance sheet will be

A) $738,000.

B) $740,000.

C) $742,000.

D) $750,000.

The following additional information is available for the current year:

See Richards Company information above. If Richards determines bad debt expense using 1.5 percent of net credit sales, the net realizable value of accounts receivable on the December 31 balance sheet will be

A) $738,000.

B) $740,000.

C) $742,000.

D) $750,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

25

An analysis and aging of accounts receivable of the Lucille Company at December 31, 2011, showed the following:

Compute the net realizable value of the accounts receivable of Lucille Company at December 31, 2011.

A) $804,000

B) $799,200

C) $763,200

D) $727,200

Compute the net realizable value of the accounts receivable of Lucille Company at December 31, 2011.

A) $804,000

B) $799,200

C) $763,200

D) $727,200

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

26

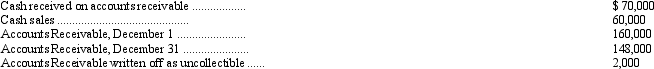

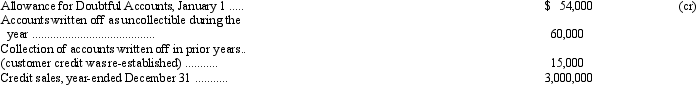

For the month of December, the records of Balin Corporation show the following information:

The corporation uses the direct write-off method in accounting for uncollectible accounts receivable. What are the gross sales for the month of December?

A) $118,000

B) $120,000

C) $130,000

D) $144,000

The corporation uses the direct write-off method in accounting for uncollectible accounts receivable. What are the gross sales for the month of December?

A) $118,000

B) $120,000

C) $130,000

D) $144,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

27

First Company sold merchandise on credit to Second Company for $1,000 on July 1, with terms of 2/10, net /30. On July 6, Second returned $200 worth of merchandise claiming the materials were defective. On July 8, First received a payment from Second and credited Accounts Receivable for $450. On July 24, Second Company paid the remaining balance on its account.

See First Company information above. How much was the total Sales Discounts given to Second during July?

A) $0

B) $9

C) $441

D) $2,441

See First Company information above. How much was the total Sales Discounts given to Second during July?

A) $0

B) $9

C) $441

D) $2,441

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

28

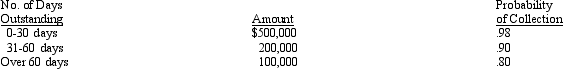

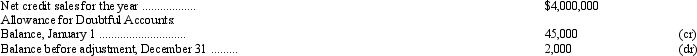

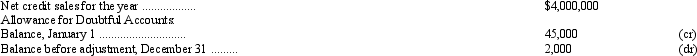

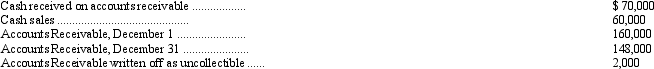

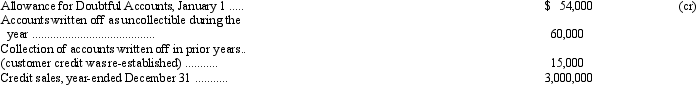

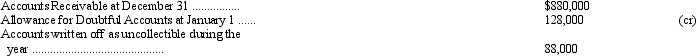

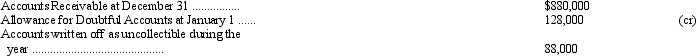

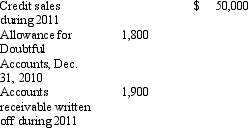

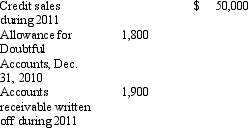

Maple Company provides for doubtful accounts expense at the rate of 3 percent of credit sales. The following data are available for last year:

The allowance for doubtful accounts balance at December 31, after adjusting entries, should be

A) $45,000.

B) $84,000.

C) $90,000.

D) $99,000.

The allowance for doubtful accounts balance at December 31, after adjusting entries, should be

A) $45,000.

B) $84,000.

C) $90,000.

D) $99,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

29

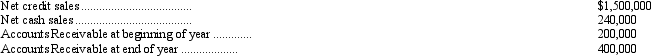

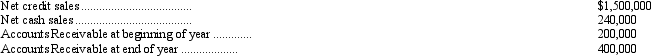

Millward Corporation's books disclosed the following information for the year ended December 31, 2011:

Millward's accounts receivable turnover is

A) 3.75 times.

B) 4.35 times.

C) 5.00 times.

D) 5.80 times.

Millward's accounts receivable turnover is

A) 3.75 times.

B) 4.35 times.

C) 5.00 times.

D) 5.80 times.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

30

The following information is from the records of Prosser, Inc. for the year ended December 31, 2011.

If the basis for estimating bad debts is 1 percent of net sales, the correct amount of doubtful accounts expense for 2011 is

A) $22,800.

B) $23,200.

C) $28,880.

D) $34,880.

If the basis for estimating bad debts is 1 percent of net sales, the correct amount of doubtful accounts expense for 2011 is

A) $22,800.

B) $23,200.

C) $28,880.

D) $34,880.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

31

In preparing a bank reconciliation, interest paid by the bank on the account is

A) added to the bank balance.

B) subtracted from the bank balance.

C) added to the book balance.

D) subtracted from the book balance.

A) added to the bank balance.

B) subtracted from the bank balance.

C) added to the book balance.

D) subtracted from the book balance.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

32

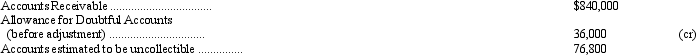

Based on the aging of its accounts receivable at December 31, Pribob Company determined that the net realizable value of the receivables at that date is $760,000. Additional information is as follows:

Pribob's doubtful accounts expense for the year ended December 31 is

A) $80,000.

B) $96,000.

C) $120,000.

D) $160,000.

Pribob's doubtful accounts expense for the year ended December 31 is

A) $80,000.

B) $96,000.

C) $120,000.

D) $160,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

33

First Company sold merchandise on credit to Second Company for $1,000 on July 1, with terms of 2/10, net /30. On July 6, Second returned $200 worth of merchandise claiming the materials were defective. On July 8, First received a payment from Second and credited Accounts Receivable for $450. On July 24, Second Company paid the remaining balance on its account.

See First Company information above. What was the total cash received from Second during July?

A) $441

B) $450

C) $791

D) $800

See First Company information above. What was the total cash received from Second during July?

A) $441

B) $450

C) $791

D) $800

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

34

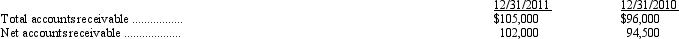

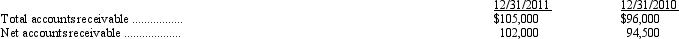

Gekko, Inc. reported the following balances (after adjustment) at the end of 2011 and 2010.

During 2011, Gekko wrote off customer accounts totaling $3,200 and collected $800 on accounts written off in previous years. Gekko's doubtful accounts expense for the year ending December 31, 2011 is

A) $1,500.

B) $2,400.

C) $3,000.

D) $3,900.

During 2011, Gekko wrote off customer accounts totaling $3,200 and collected $800 on accounts written off in previous years. Gekko's doubtful accounts expense for the year ending December 31, 2011 is

A) $1,500.

B) $2,400.

C) $3,000.

D) $3,900.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

35

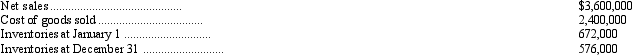

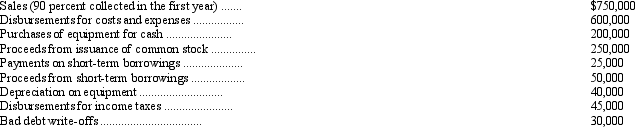

Selected information from the accounting records of Ellison Manufacturing Company follows:

What is the number of days' sales in average inventories for the year?

A) 102.2

B) 94.9

C) 87.6

D) 68.1

What is the number of days' sales in average inventories for the year?

A) 102.2

B) 94.9

C) 87.6

D) 68.1

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

36

Based on its past collection experience, Ace Company provides for bad debts at the rate of 2 percent of net credit sales. On January 1, 2011, the allowance for doubtful accounts credit balance was $10,000. During 2011, Ace wrote off $18,000 of uncollectible receivables and recovered $5,000 on accounts written off in prior years. If net credit sales for 2011 totaled $1,000,000, the doubtful accounts expense for 2011 should be

A) $17,000.

B) $20,000.

C) $23,000.

D) $35,000.

A) $17,000.

B) $20,000.

C) $23,000.

D) $35,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

37

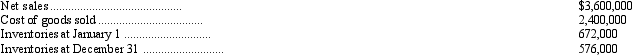

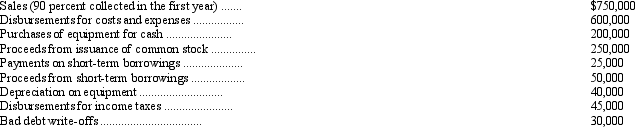

Berman Corporation had the following transactions in its first year of operations:

What is the cash balance at December 31 of the first year?

A) $75,000

B) $85,000

C) $105,000

D) $140,000

What is the cash balance at December 31 of the first year?

A) $75,000

B) $85,000

C) $105,000

D) $140,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

38

An analysis and aging of the accounts receivable of Shriner Company at December 31 revealed the following data:

The net realizable value of the accounts receivable at December 31 should be

A) $450,000.

B) $443,000.

C) $425,000.

D) $418,000.

The net realizable value of the accounts receivable at December 31 should be

A) $450,000.

B) $443,000.

C) $425,000.

D) $418,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

39

Bank reconciliations are normally prepared on a monthly basis to identify adjustments needed in the depositor's records and to identify bank errors. Adjustments should be recorded for

A) bank errors, outstanding checks, and deposits in transit.

B) all items except bank errors, outstanding checks, and deposits in transit.

C) book errors, bank errors, deposits in transit, and outstanding checks.

D) outstanding checks and deposits in transit.

A) bank errors, outstanding checks, and deposits in transit.

B) all items except bank errors, outstanding checks, and deposits in transit.

C) book errors, bank errors, deposits in transit, and outstanding checks.

D) outstanding checks and deposits in transit.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

40

National Appliance Center sells washing machines that carry a three-year warranty against manufacturer's defects. Based on company experience, warranty costs are estimated at $60 per machine. During the year, National sold 48,000 washing machines and paid warranty costs of $340,000. In its income statement for the year ended December 31, National should report warranty expense of

A) $680,000.

B) $960,000.

C) $2,200,000.

D) $2,880,000.

A) $680,000.

B) $960,000.

C) $2,200,000.

D) $2,880,000.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

41

A debit balance in the Allowance for Doubtful Accounts

A) should never occur.

B) is always the result of management not providing a large enough allowance in order to manage earnings.

C) may occur before the end-of-period adjustment for uncollectibles.

D) may exist even after the end-of-period adjustment for uncollectibles.

A) should never occur.

B) is always the result of management not providing a large enough allowance in order to manage earnings.

C) may occur before the end-of-period adjustment for uncollectibles.

D) may exist even after the end-of-period adjustment for uncollectibles.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following would be considered part of the category "trade receivables"?

A) Advances to employees

B) Income tax refunds receivable

C) Dividends receivable

D) Amounts due from customers

A) Advances to employees

B) Income tax refunds receivable

C) Dividends receivable

D) Amounts due from customers

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following accounts isnot affected when an account receivable written off as uncollectible is unexpectedly collected?

A) Cash

B) Accounts Receivable

C) Bad Debt Expense

D) Allowance for Bad Debts

A) Cash

B) Accounts Receivable

C) Bad Debt Expense

D) Allowance for Bad Debts

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

44

Estimation of uncollectible accounts receivable based on a percentage of sales

A) emphasizes measurement of the net realizable value of accounts receivable.

B) emphasizes measurement of bad debt expense.

C) emphasizes measurement of total assets.

D) is only acceptable for tax purposes.

A) emphasizes measurement of the net realizable value of accounts receivable.

B) emphasizes measurement of bad debt expense.

C) emphasizes measurement of total assets.

D) is only acceptable for tax purposes.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

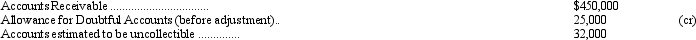

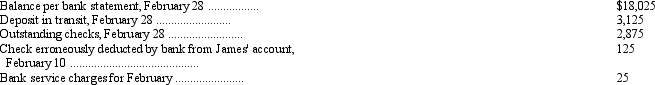

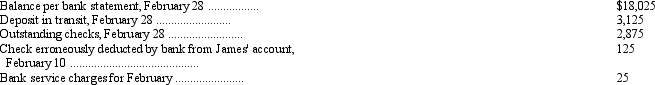

45

In preparing its bank reconciliation for the month of February, James Company has available the following information:

What is the corrected cash balance at February 28?

A) $18,125

B) $18,150

C) $18,275

D) $18,400

What is the corrected cash balance at February 28?

A) $18,125

B) $18,150

C) $18,275

D) $18,400

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

46

Jackson Company had the following cash balances at December 31, 2011:

Cash in banks includes $125,000 of compensating balances against short-term borrowing arrangements at December 31, 2011. The compensating balances are legally restricted as to withdrawal by Jackson. In the current asset section of Jackson's December 31, 2011, balance sheet, what total amount should be reported as Cash?

A) $380,000

B) $375,000

C) $255,000

D) $250,000

Cash in banks includes $125,000 of compensating balances against short-term borrowing arrangements at December 31, 2011. The compensating balances are legally restricted as to withdrawal by Jackson. In the current asset section of Jackson's December 31, 2011, balance sheet, what total amount should be reported as Cash?

A) $380,000

B) $375,000

C) $255,000

D) $250,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

47

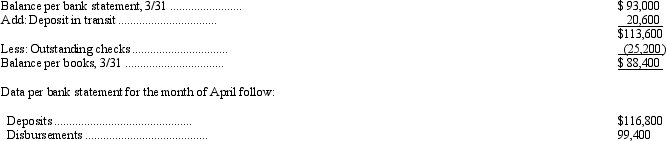

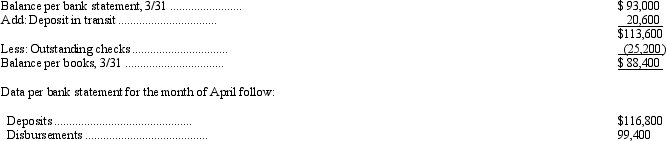

Ramos Company had the following bank reconciliation at March 31:

All reconciling items at March 31 cleared through the bank in April. Outstanding checks at April 30 totaled $15,000. What is the amount of cash disbursements per books in April?

A) $89,200

B) $99,400

C) $109,600

D) $114,400

All reconciling items at March 31 cleared through the bank in April. Outstanding checks at April 30 totaled $15,000. What is the amount of cash disbursements per books in April?

A) $89,200

B) $99,400

C) $109,600

D) $114,400

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

48

Arthur Company borrows $20,000 for one year a 9% interest, but must maintain a $1,600 compensating balance. The effective rate of interest on this loan is

A) 9.0%.

B) 17.0%.

C) 9.8%.

D) 8.0%.

A) 9.0%.

B) 17.0%.

C) 9.8%.

D) 8.0%.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

49

The following information is available for Thomas Company:

As a result of a review and aging of accounts receivable, it has been determined that the Allowance for Doubtful Accounts should show a balance of $2,100 at December 31, 2011. What amount should Thomas record as bad debt expense for the year ended December 31, 2011?

A) $2,200

B) $1,900

C) $2,100

D) $2,000

As a result of a review and aging of accounts receivable, it has been determined that the Allowance for Doubtful Accounts should show a balance of $2,100 at December 31, 2011. What amount should Thomas record as bad debt expense for the year ended December 31, 2011?

A) $2,200

B) $1,900

C) $2,100

D) $2,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

50

The August 31 bank statement of Kelvin Inc. showed a balance of $113,000. Deducted in arriving at this amount was a customer's NSF check for $2,400 that had been returned. Kelvin had received no prior notice concerning this check. In addition to the bank statement, other records showed there were deposits in transit totaling $17,200 and that outstanding checks totaled $10,800. What is the cash balance per books at August 31 (prior to adjustments)?

A) $121,800

B) $119,400

C) $117,000

D) $115,400

A) $121,800

B) $119,400

C) $117,000

D) $115,400

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not acceptable in estimating uncollectible accounts receivable under GAAP?

A) The estimate of uncollectible accounts is based on a percentage of sales for the period.

B) The estimate of uncollectible accounts is based on a percentage of the accounts receivable balance at the end of a period.

C) The estimate of uncollectible accounts is based on an aging schedule.

D) No estimate of uncollectible accounts is made; accounts are written off when it is determined they cannot be collected.

A) The estimate of uncollectible accounts is based on a percentage of sales for the period.

B) The estimate of uncollectible accounts is based on a percentage of the accounts receivable balance at the end of a period.

C) The estimate of uncollectible accounts is based on an aging schedule.

D) No estimate of uncollectible accounts is made; accounts are written off when it is determined they cannot be collected.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

52

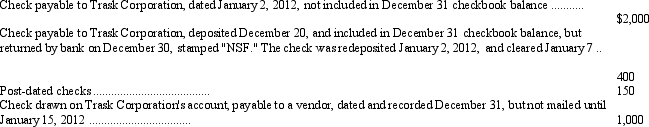

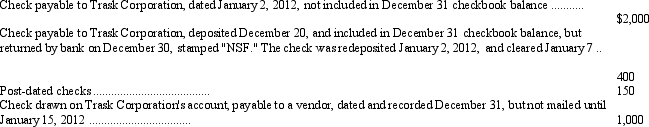

Trask Corporation's checkbook balance on December 31, 2011, was $8,000. In addition, Trask held the following items in its safe on December 31:

The proper amount to be shown as cash on Trask's balance sheet at December 31, 2011, is

A) $7,600.

B) $8,000.

C) $8,600.

D) $9,750.

The proper amount to be shown as cash on Trask's balance sheet at December 31, 2011, is

A) $7,600.

B) $8,000.

C) $8,600.

D) $9,750.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

53

Assume the following facts for Kurt Company: The month-end bank statement shows a balance of $40,000; outstanding checks total $2,000; a deposit of $8,000 is in transit at month-end; and a check for $400 was erroneously charged against the account by the bank. What is the correct cash balance at the end of the month?

A) $33,600

B) $34,400

C) $45,600

D) $46,400

A) $33,600

B) $34,400

C) $45,600

D) $46,400

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

54

On December 1, 2011, Barnes Company received a $10,000, 60-day, 6% note from a customer. On December 31, 2011, the company discounted the note at the bank. The bank's discount rate is 9%. What were the proceeds that Barnes received from the discounting of the note?

A) $10,024.25

B) $9,700.00

C) $9,924.25

D) $10,050.00

A) $10,024.25

B) $9,700.00

C) $9,924.25

D) $10,050.00

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

55

For tax purposes, an entry should be made to Bad Debt Expense

A) when an account is determined to be uncollectible.

B) in the period in which the sale that created the receivable was made.

C) when an account determined to be uncollectible is collected.

D) when an account with terms 2/10, n30 is still unpaid after thirty days.

A) when an account is determined to be uncollectible.

B) in the period in which the sale that created the receivable was made.

C) when an account determined to be uncollectible is collected.

D) when an account with terms 2/10, n30 is still unpaid after thirty days.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

56

The following information is available for Farr Company relative to 2011 operations:

What is Farr Company's accounts receivable balance at December 31, 2011?

A) $82,000

B) $62,000

C) $20,000

D) $146,000

What is Farr Company's accounts receivable balance at December 31, 2011?

A) $82,000

B) $62,000

C) $20,000

D) $146,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

57

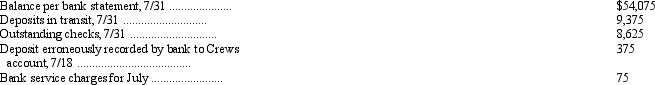

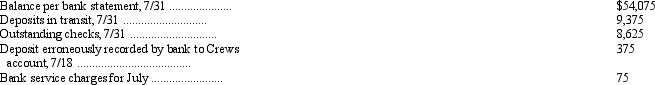

In preparing the bank reconciliation of Crews Company for the month of July, the following information is available:

What is the correct cash balance at July 31?

A) $52,875

B) $54,375

C) $54,450

D) $54,825

What is the correct cash balance at July 31?

A) $52,875

B) $54,375

C) $54,450

D) $54,825

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

58

Robb Corporation uses the allowance method of accounting for uncollectible accounts. During 2011, Robb had charged $80,000 to Bad Debt Expense, and wrote off accounts receivable of $90,000 as uncollectible. What was the amount of the decrease in working capital as a result of these entries?

A) $0

B) $90,000

C) $80,000

D) $10,000

A) $0

B) $90,000

C) $80,000

D) $10,000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

59

Under GAAP, an entry should be made to the Bad Debt Expense account

A) when an account receivable with terms 2/10, n30 is past thirty days due.

B) when an account receivable previously written off is determined to be collectible.

C) when an account receivable is determined not to be collectible and is written off.

D) in the period when a sale is made and not when the receivable associated with the sale is determined to be uncollectible.

A) when an account receivable with terms 2/10, n30 is past thirty days due.

B) when an account receivable previously written off is determined to be collectible.

C) when an account receivable is determined not to be collectible and is written off.

D) in the period when a sale is made and not when the receivable associated with the sale is determined to be uncollectible.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

60

During 2009, General Machinery company introduced a new line of machines that carry a three-year warranty against manufacturer's defects. Based on industry experience, warranty costs are estimated at 2% of sales in the year of sale, 4% in the year after sale, and 6% in the second year after sale. Sales and actual warranty expenditures for the first three-year period were as follows:

What amount should General Machinery report as a liability at December 31, 2011?

A) $0

B) $5,625

C) $76,500

D) $118, 125

What amount should General Machinery report as a liability at December 31, 2011?

A) $0

B) $5,625

C) $76,500

D) $118, 125

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

61

Carr Company sells specialized machinery and equipment. On January 1, 2011, the company sold equipment and received a two-year, $10,000 note with a 3 percent stated interest rate. Interest is payable each December 31, and the entire principal is payable December 31, 2012.

The equipment does not have a readily established market value. The market rate of interest for notes of this type and level of risk is 10 percent.

See Carr Company information above.

Required:

Prepare the entries on Carr Company's books to record the sale of the equipment.

Accounting Principles Board Opinion No. 21, "Interest on Receivables and Payables," requires that the note be accounted for at the market rate of interest appropriate for the transaction. In this case, that rate is 10 percent.

The equipment does not have a readily established market value. The market rate of interest for notes of this type and level of risk is 10 percent.

See Carr Company information above.

Required:

Prepare the entries on Carr Company's books to record the sale of the equipment.

Accounting Principles Board Opinion No. 21, "Interest on Receivables and Payables," requires that the note be accounted for at the market rate of interest appropriate for the transaction. In this case, that rate is 10 percent.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

62

Carr Company sells specialized machinery and equipment. On January 1, 2011, the company sold equipment and received a two-year, $10,000 note with a 3 percent stated interest rate. Interest is payable each December 31, and the entire principal is payable December 31, 2012.

The equipment does not have a readily established market value. The market rate of interest for notes of this type and level of risk is 10 percent.

See Carr Company information above.

Required:

Explain how and why this transaction was structured as it is.

The equipment does not have a readily established market value. The market rate of interest for notes of this type and level of risk is 10 percent.

See Carr Company information above.

Required:

Explain how and why this transaction was structured as it is.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

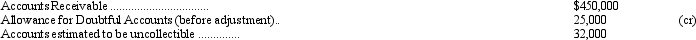

63

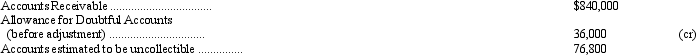

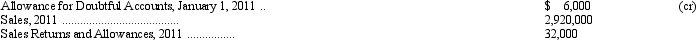

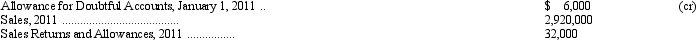

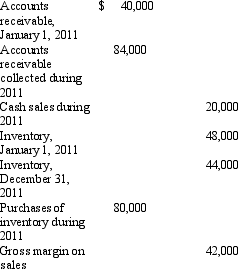

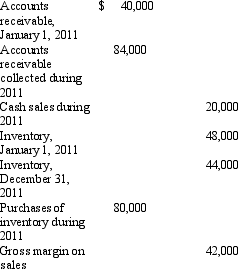

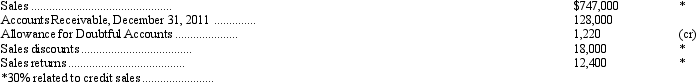

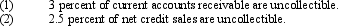

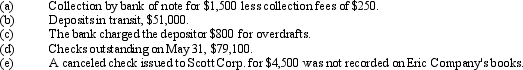

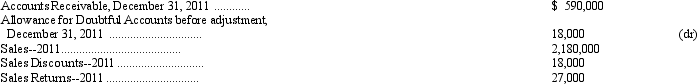

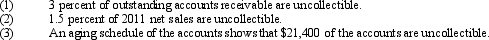

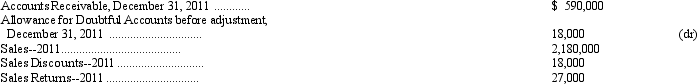

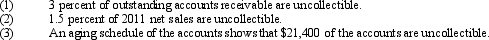

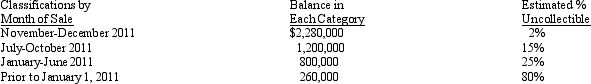

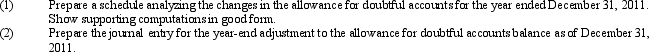

The following information was abstracted from the 2011 financial statements of Jennings Company:

Prepare the adjusting entry for doubtful accounts expense under each of the following assumptions:

Prepare the adjusting entry for doubtful accounts expense under each of the following assumptions:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

64

On August 1, a firm assigned $20,000 of its $56,000 of accounts receivable. The finance company advanced 90% of the assigned accounts less a $2,000 fee. Interest is 12% and payable monthly on the beginning-of-period loan balance. A loan payment is remitted at the end of each month. Each payment includes principal and interest. The amount of each loan payment equals the cash collected on receivables during the month plus interest on the loan balance.

If $8,000 was collected on accounts receivable during August, the entry for the first loan payment would include a

A) debit to Interest Expense of $180.

B) credit to Cash of $8,000.

C) credit to Account Receivable Assigned of $8,000.

D) debit to Notes Payable of $8,180.

If $8,000 was collected on accounts receivable during August, the entry for the first loan payment would include a

A) debit to Interest Expense of $180.

B) credit to Cash of $8,000.

C) credit to Account Receivable Assigned of $8,000.

D) debit to Notes Payable of $8,180.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

65

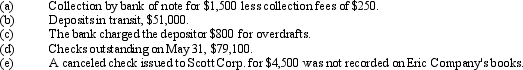

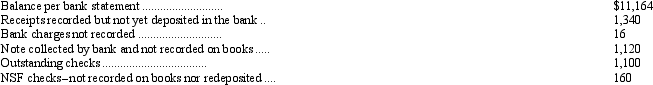

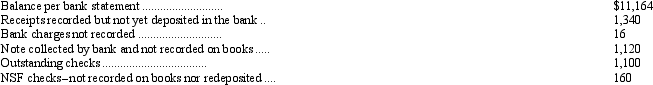

The Eric Manufacturing Company received its bank statement for the month ending May 31. The bank statement indicates a balance of $32,400. The cash account as of the close of business on May 31 has a balance of $8,350. In reconciling the balances, the following items are discovered.

Prepare a bank reconciliation statement. (Use the format of reconciling bank and depositor figures to corrected cash balance.)

Prepare a bank reconciliation statement. (Use the format of reconciling bank and depositor figures to corrected cash balance.)

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

66

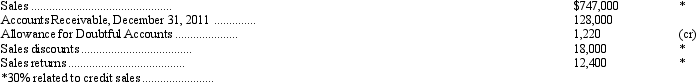

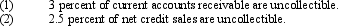

The following information was abstracted from the records of the Hooper Corporation:

Prepare the adjusting entry for doubtful accounts expense under each of the following assumptions:

Prepare the adjusting entry for doubtful accounts expense under each of the following assumptions:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

67

Which of the following is one of the two steps of the 2-step test for derecognition of receivables stated in IAS 39, International Accounting Standard 39, "Financial Instruments: Recognition and Measurement"?

A) The transferred assets have been isolated from the transferor such that the transferor and its creditors cannot access the assets.

B) The transferee has the right to pledge or exchange the transferred assets.

C) If the receivable transfer does not involve the transfer of substantially all the risks and rewards of ownership, then test to determine if the transferor maintains effective control over the assets through either an agreement to repurchase the assets before their maturity, or by the ability to cause the transferee to return specific assets.

D) Determine whether the receivable transfer involves a transfer of substantially all the risks and rewards of ownership of the receivable and, if so, account for the transfer as a sale of the receivable.

A) The transferred assets have been isolated from the transferor such that the transferor and its creditors cannot access the assets.

B) The transferee has the right to pledge or exchange the transferred assets.

C) If the receivable transfer does not involve the transfer of substantially all the risks and rewards of ownership, then test to determine if the transferor maintains effective control over the assets through either an agreement to repurchase the assets before their maturity, or by the ability to cause the transferee to return specific assets.

D) Determine whether the receivable transfer involves a transfer of substantially all the risks and rewards of ownership of the receivable and, if so, account for the transfer as a sale of the receivable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

68

Charles Company has two checking accounts. A special account is used for the weekly payroll only, and the general account is used for all other disbursements. Every week, a check in the amount of the net payroll is drawn on the general account and deposited in the payroll account. The company maintains a $5,000 minimum balance in the payroll account. On a monthly bank reconciliation, the payroll account should

A) reconcile to $5,000.

B) show a zero balance per the bank statement.

C) show a $5,000 balance per the bank statement.

D) be reconciled jointly with the general account in a single reconciliation.

A) reconcile to $5,000.

B) show a zero balance per the bank statement.

C) show a $5,000 balance per the bank statement.

D) be reconciled jointly with the general account in a single reconciliation.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

69

You are the auditor of Plastico, Inc., a manufacturer of plastic products. In reviewing the balance sheet of the company, you notice several receivables from the officers of the company. You report your findings to the president of the company and inform him that these receivables will be considered related party transactions for purposes of financial accounting and reporting. The president seems somewhat annoyed by your comments and asks you to explain what you mean by "related party" transactions and how the financial statements will be affected by these transactions. Prepare a brief response to the president's question.

Related party transactions occur when an enterprise engages in transactions in which one of the parties to the transaction has the ability to influence significantly the policies of the other, or in which one party to the transaction has the ability to influence the policies of the two transacting parties. The following are examples of related party transactions:

Related party transactions occur when an enterprise engages in transactions in which one of the parties to the transaction has the ability to influence significantly the policies of the other, or in which one party to the transaction has the ability to influence the policies of the two transacting parties. The following are examples of related party transactions:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

70

Accounts receivable usually are factored

A) with recourse on a notification basis.

B) without recourse on a notification basis.

C) with recourse on a nonotification basis.

D) without recourse on a nonotification basis.

A) with recourse on a notification basis.

B) without recourse on a notification basis.

C) with recourse on a nonotification basis.

D) without recourse on a nonotification basis.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

71

The plan of organization and all the methods and measures adopted within a business to safeguard its assets, check the accuracy of its accounting data, promote operational efficiency, and encourage adherence to managerial policies is called

A) accounting control.

B) administrative control.

C) managerial control.

D) internal control.

A) accounting control.

B) administrative control.

C) managerial control.

D) internal control.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

72

Receivables can be used to generate cash through two general categories of transactions:

1. A secured borrowing

2. A sale of the receivables.

Both of these types of transactions require a transfer of the receivables to a new holder, typically a financial institution.

Required:

Distinguish between a secured borrowing and a sale of receivables as regards the rights of the transferor and transferee as well as regards the accounting for each type of transaction.

1. A secured borrowing

2. A sale of the receivables.

Both of these types of transactions require a transfer of the receivables to a new holder, typically a financial institution.

Required:

Distinguish between a secured borrowing and a sale of receivables as regards the rights of the transferor and transferee as well as regards the accounting for each type of transaction.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

73

Western Company sells products covered by a 3-year warranty. Based on past experience of other entities in the industry, Western expects to incur warranty costs equal to 1% of sales. Western's sales were $40,000 in 2010 and $50,000 in 2011. In 2011, the company spent $200 to repair goods sold in 2010 and $300 to repair goods sold in 2011. Western received no warranty servicing demands from its customers in 2010, the company's first year of operations.

What is the balance in the warranty liability account on January 1, 2012?

A) $400

B) $500

C) $300

D) $0

What is the balance in the warranty liability account on January 1, 2012?

A) $400

B) $500

C) $300

D) $0

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following is not correct regarding IAS 39, International Accounting Standard 39, "Financial Instruments: Recognition and Measurement," and SFAS No. 140, Statement of Financial Accounting Standards No. 140, "Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities: A Replacement of FASB Statement No. 125"?

A) IAS 39 represents a principles-based approach to standard setting.

B) SFAS No. 140 represents a principles-based approach to standard setting.

C) SFAS No. 140 represents a rule-based approach to standard setting.

D) In the large majority of cases, application of the two standards will result in the same accounting treatment for a receivable transfer.

A) IAS 39 represents a principles-based approach to standard setting.

B) SFAS No. 140 represents a principles-based approach to standard setting.

C) SFAS No. 140 represents a rule-based approach to standard setting.

D) In the large majority of cases, application of the two standards will result in the same accounting treatment for a receivable transfer.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

75

Securitization is a widely-used arrangement for selling receivables. Many companies use credit card securitization and other forms of securitizations as part of their overall financing strategies.

Required:

Explain the nature of securitization, how it can be implemented, and the appropriate accounting procedures related to a securitization. Include in your discussion the effects of recourse provisions on the securitization.

Required:

Explain the nature of securitization, how it can be implemented, and the appropriate accounting procedures related to a securitization. Include in your discussion the effects of recourse provisions on the securitization.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

76

From inception of operations to December 31, 2010, Harris Corporation provided for uncollectible accounts receivable under the allowance method: Provisions were made monthly at 2 percent of credit sales; bad debts written off were charged to the allowance account; recoveries of bad debts previously written off were credited to the allowance account; and no year-end adjustments to the allowance account were made. Harris's usual credit terms are net 30 days.

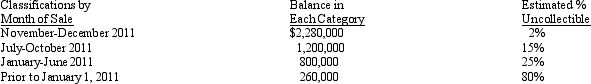

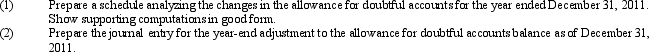

The credit balance in the allowance for doubtful accounts was $260,000 at January 1, 2011. During 2011, credit sales totaled $18,000,000, interim provisions for doubtful accounts were made at 2 percent of credit sales, $180,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $30,000. Harris installed a computer system in November 2011 and an aging of accounts receivable was prepared for the first time as of December 31, 2011. A summary of the aging is as follows:

Based on the review of collectibility of the account balances in the "prior to January 1, 2011" aging category, additional receivables totaling $120,000 were written off as of December 31, 2011. Effective with the year ended December 31, 2011, Harris adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

The credit balance in the allowance for doubtful accounts was $260,000 at January 1, 2011. During 2011, credit sales totaled $18,000,000, interim provisions for doubtful accounts were made at 2 percent of credit sales, $180,000 of bad debts were written off, and recoveries of accounts previously written off amounted to $30,000. Harris installed a computer system in November 2011 and an aging of accounts receivable was prepared for the first time as of December 31, 2011. A summary of the aging is as follows:

Based on the review of collectibility of the account balances in the "prior to January 1, 2011" aging category, additional receivables totaling $120,000 were written off as of December 31, 2011. Effective with the year ended December 31, 2011, Harris adopted a new accounting method for estimating the allowance for doubtful accounts at the amount indicated by the year-end aging analysis of accounts receivable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

77

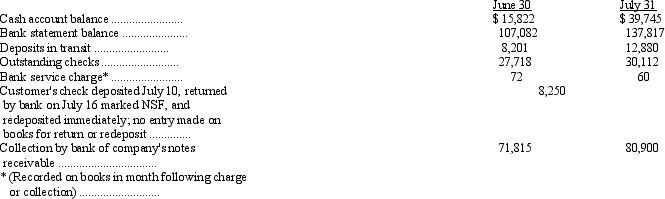

The information below is from the books of the Seminole Corporation on June 30:

Assuming no errors were made, compute the cash balance per books on June 30 before any reconciliation adjustments.

Assuming no errors were made, compute the cash balance per books on June 30 before any reconciliation adjustments.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

78

A firm factors $40,000 of accounts receivable without recourse. The factor agrees to provide financing based on these receivables, but imposes a 10% fee. In addition, the transferor and transferee agree that $3,000 of sales returns and allowances can be expected from these accounts. What is the loss or expense to recorded by the transferor?

A) $7,000

B) $4,000

C) $3,000

D) $0

A) $7,000

B) $4,000

C) $3,000

D) $0

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

79

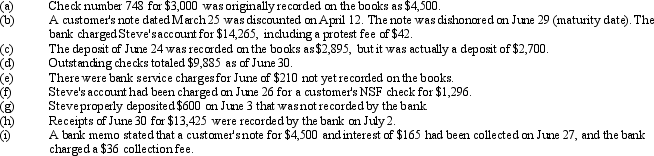

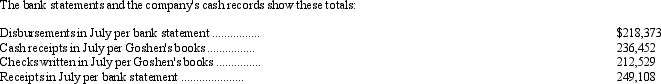

The books of Steve's Service, Inc. disclosed a cash balance of $68,757 on June 30. The bank statement as of June 30 showed a balance of $54,780. Additional information that might be useful in reconciling the two balances follows:

Prepare a bank reconciliation statement, using the form reconciling bank and book balances to the correct cash balance.

Prepare a bank reconciliation statement, using the form reconciling bank and book balances to the correct cash balance.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

80

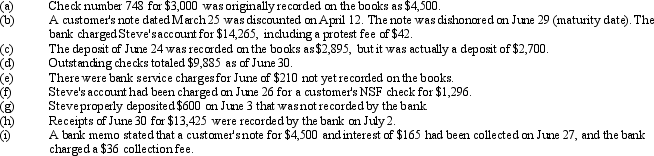

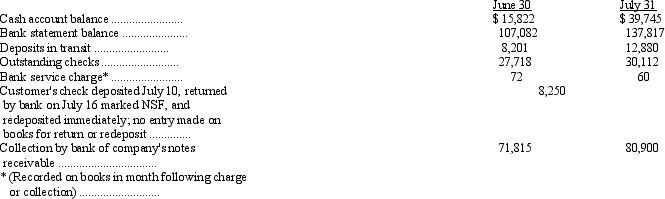

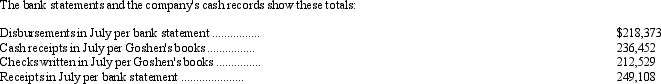

The accountant for the Goshen Company assembled the following data:

Prepare a 4-column bank reconciliation as of July 31, using the form that reconciles both the book and bank balances to a correct cash amount.

Prepare a 4-column bank reconciliation as of July 31, using the form that reconciles both the book and bank balances to a correct cash amount.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck