Deck 20: Accounting Changes and Error Corrections

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/74

Play

Full screen (f)

Deck 20: Accounting Changes and Error Corrections

1

Lexicon Inc. bought a patent for $600,000 on January 2, 2007, at which time the patent had an estimated useful life of ten years. On February 2, 2011, it was determined that the patent's useful life would expire at the end of 2013. How much would Lexicon record as amortization expense for this patent for the year ending December 31, 2011?

A) $140,000

B) $120,000

C) $105,000

D) $60,000

A) $140,000

B) $120,000

C) $105,000

D) $60,000

B

2

At the time Fisher Corporation became a subsidiary of Ashbury Corporation, Fisher switched depreciation of its plant assets from the straight-line method to the sum-of-the-years'-digits method used by Ashbury. With respect to Fisher, this change was a

A) change in an accounting estimate.

B) correction of an error.

C) change in accounting principle.

D) change in the reporting entity.

A) change in an accounting estimate.

B) correction of an error.

C) change in accounting principle.

D) change in the reporting entity.

C

3

Which of the following changes in accounting principle does not require the retrospective approach?

A) Change from the percentage-of-completion to the completed-contract method

B) Change of inventory method from LIFO to FIFO

C) Change of inventory method from FIFO to LIFO

D) All of these require retroactive adjustment.

A) Change from the percentage-of-completion to the completed-contract method

B) Change of inventory method from LIFO to FIFO

C) Change of inventory method from FIFO to LIFO

D) All of these require retroactive adjustment.

C

4

The correction of an error in the financial statements of a prior period should be reflected, net of applicable income taxes, in the current

A) income statement after income from continuing operations and before extraordinary items.

B) income statement after income from continuing operations and after extraordinary items.

C) retained earnings statement after net income but before dividends.

D) retained earnings statement as an adjustment of the opening balance.

A) income statement after income from continuing operations and before extraordinary items.

B) income statement after income from continuing operations and after extraordinary items.

C) retained earnings statement after net income but before dividends.

D) retained earnings statement as an adjustment of the opening balance.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

5

An example of an item that should be reported as a prior period adjustment is the

A) collection of previously written off accounts receivable.

B) payment of taxes resulting from examination of prior years' income tax returns.

C) correction of an error in financial statements of a prior year.

D) receipt of insurance proceeds for damage to a building sustained in a prior year.

A) collection of previously written off accounts receivable.

B) payment of taxes resulting from examination of prior years' income tax returns.

C) correction of an error in financial statements of a prior year.

D) receipt of insurance proceeds for damage to a building sustained in a prior year.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following isnot correct regarding the provisions of IAS No. 8 on accounting changes and error corrections?

A) Under IFRS No. 8, the recommended approach for a change in accounting principle is that results from prior periods should be restated.

B) IFRS No. 8 allows a change in accounting principle to be accounted for by reflecting the cumulative effect of the change in the income of the current period without restating prior-period results.

C) IFRS No. 8 requires that results from prior periods be presented for all changes in accounting principles.

D) IFRS No. 8 requires a change in accounting estimate to be reflected in the current and future periods.

A) Under IFRS No. 8, the recommended approach for a change in accounting principle is that results from prior periods should be restated.

B) IFRS No. 8 allows a change in accounting principle to be accounted for by reflecting the cumulative effect of the change in the income of the current period without restating prior-period results.

C) IFRS No. 8 requires that results from prior periods be presented for all changes in accounting principles.

D) IFRS No. 8 requires a change in accounting estimate to be reflected in the current and future periods.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following concepts or principles relates most directly to reporting accounting changes and errors?

A) Conservatism

B) Consistency

C) Objectivity

D) Materiality

A) Conservatism

B) Consistency

C) Objectivity

D) Materiality

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following isnot a change in accounting principle?

A) A change from FIFO to LIFO for inventory valuation

B) A change from completed-contracts to percentage-of-completion

C) A change from eight years to five years in the useful life of a depreciable asset

D) A change from double-declining-balance to straight-line depreciation

A) A change from FIFO to LIFO for inventory valuation

B) A change from completed-contracts to percentage-of-completion

C) A change from eight years to five years in the useful life of a depreciable asset

D) A change from double-declining-balance to straight-line depreciation

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is not a change in reporting entity?

A) A company acquires a subsidiary that is to be accounted for as a purchase.

B) A company presents consolidated or combined statements in place of statements of individual companies.

C) A company changes the companies included in combined financial statements.

D) A company changes the subsidiaries for which consolidated statements are presented.

A) A company acquires a subsidiary that is to be accounted for as a purchase.

B) A company presents consolidated or combined statements in place of statements of individual companies.

C) A company changes the companies included in combined financial statements.

D) A company changes the subsidiaries for which consolidated statements are presented.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is the proper time period in which to record a change in accounting estimate?

A) Current period and future periods

B) Current period and retroactively

C) Retroactively only

D) Current period only

A) Current period and future periods

B) Current period and retroactively

C) Retroactively only

D) Current period only

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following should be reported as a change in accounting estimate?

A) Change in the reported beginning inventory amount due to a discovery of a bookkeeping error

B) Change from the completed-contract method to the percentage-of- completion method for revenue recognition on long-term construction contracts

C) Increase in the rate applied to net credit sales from 1 percent to 1-1/2 percent in determining losses from uncollectible receivables

D) Change made to comply with a new FASB pronouncement

A) Change in the reported beginning inventory amount due to a discovery of a bookkeeping error

B) Change from the completed-contract method to the percentage-of- completion method for revenue recognition on long-term construction contracts

C) Increase in the rate applied to net credit sales from 1 percent to 1-1/2 percent in determining losses from uncollectible receivables

D) Change made to comply with a new FASB pronouncement

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

12

The effect of a change in accounting principle that is inseparable from the effect of a change in accounting estimate should be reported

A) in the period of change and future periods.

B) by restating the financial statements of all prior periods presented.

C) by showing the pro forma effects of retroactive application.

D) as a correction of an error.

A) in the period of change and future periods.

B) by restating the financial statements of all prior periods presented.

C) by showing the pro forma effects of retroactive application.

D) as a correction of an error.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following accounting treatments is proper for a change in reporting entity?

A) Restatement of all financial statements presented

B) Restatement of current period financial statements

C) Note disclosure and supplementary schedules

D) Adjustment to retained earnings and note disclosure

A) Restatement of all financial statements presented

B) Restatement of current period financial statements

C) Note disclosure and supplementary schedules

D) Adjustment to retained earnings and note disclosure

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not correct regarding the provisions of IAS No. 8 on accounting changes and error corrections?

A) A change in accounting estimate is reflected in the current and future periods.

B) A change in depreciation method (such as from an accelerated method to the straight-line method) is classified as a change in estimate.

C) A change in depreciation method (such as from accelerated method to the straight-line method) is classified as a change in accounting principle.

D) IFRS No. 8 generally reflects a preference for restating prior results to improve comparability of financial statements.

A) A change in accounting estimate is reflected in the current and future periods.

B) A change in depreciation method (such as from an accelerated method to the straight-line method) is classified as a change in estimate.

C) A change in depreciation method (such as from accelerated method to the straight-line method) is classified as a change in accounting principle.

D) IFRS No. 8 generally reflects a preference for restating prior results to improve comparability of financial statements.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following does not represent a change in reporting entity?

A) Changing the companies included in combined financial statements

B) Disposition of a subsidiary or other business unit

C) Presenting consolidated statements in place of the statements of individual companies

D) Changing specific subsidiaries that constitute the group of companies for which consolidated financial statements are presented

A) Changing the companies included in combined financial statements

B) Disposition of a subsidiary or other business unit

C) Presenting consolidated statements in place of the statements of individual companies

D) Changing specific subsidiaries that constitute the group of companies for which consolidated financial statements are presented

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is correct regarding the provisions of IFRS No. 8 on accounting changes and error corrections?

A) IFRS No. 8 requires that correction of an error be made only by restatement of all prior periods presented.

B) IFRS No. 8 allows correction of an error to be made either through restatement of all period periods presented or by reflecting the effect of the correction in income of the period in which the error was discovered without restating previously reported results.

C) IFRS No. 8 requires correction of an error to be made only by reflecting the effect of the correction in income of the period in which the error was discovered without restating previously reported results.

D) IFRS No. 8 reflects a preference for not restating prior results in reporting accounting changes and error corrections.

A) IFRS No. 8 requires that correction of an error be made only by restatement of all prior periods presented.

B) IFRS No. 8 allows correction of an error to be made either through restatement of all period periods presented or by reflecting the effect of the correction in income of the period in which the error was discovered without restating previously reported results.

C) IFRS No. 8 requires correction of an error to be made only by reflecting the effect of the correction in income of the period in which the error was discovered without restating previously reported results.

D) IFRS No. 8 reflects a preference for not restating prior results in reporting accounting changes and error corrections.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

17

An accounting change that requires the retrospective approach is a change in

A) the life of equipment from five to seven years.

B) depreciation method from straight-line to double-declining-balance.

C) the specific subsidiaries included in consolidated financial statements.

D) the percentage used to determine the allowance for bad debts.

A) the life of equipment from five to seven years.

B) depreciation method from straight-line to double-declining-balance.

C) the specific subsidiaries included in consolidated financial statements.

D) the percentage used to determine the allowance for bad debts.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

18

The cumulative effect on prior years' earnings of a change in accounting principle should be reported separately as an adjustment to retained earnings for the earliest period presented for all of the following changes except

A) completed-contract method of accounting for long-term construction-type contracts to the percentage-of-completion method.

B) percentage-of-completion method of accounting for long-term construction-type contracts to the completed-contract method.

C) FIFO method of inventory pricing to LIFO method.

D) LIFO method of inventory pricing to the weighted-average method.

A) completed-contract method of accounting for long-term construction-type contracts to the percentage-of-completion method.

B) percentage-of-completion method of accounting for long-term construction-type contracts to the completed-contract method.

C) FIFO method of inventory pricing to LIFO method.

D) LIFO method of inventory pricing to the weighted-average method.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

19

A company changes from an accounting principle that is notgenerally accepted to one that is generally accepted. The effect of the change should be reported as a

A) change in accounting principle.

B) change in accounting estimate

C) correction of an error.

D) change of accounting estimate effected by a change in accounting principle.

A) change in accounting principle.

B) change in accounting estimate

C) correction of an error.

D) change of accounting estimate effected by a change in accounting principle.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is not correct regarding a change in reporting entity?

A) Financial statements of the year in which the change in reporting entity is made should disclose the nature of the change and the reason for the change.

B) The effect of the change on income before extraordinary items, net income, and earnings per share amounts should be reported for all periods presented.

C) Financial statements presented for all prior periods must be restated.

D) The effect of the change on income before extraordinary items, net income, and earnings per share amounts should be reported for all periods presented and must be repeated in all periods subsequent to the period of the change.

A) Financial statements of the year in which the change in reporting entity is made should disclose the nature of the change and the reason for the change.

B) The effect of the change on income before extraordinary items, net income, and earnings per share amounts should be reported for all periods presented.

C) Financial statements presented for all prior periods must be restated.

D) The effect of the change on income before extraordinary items, net income, and earnings per share amounts should be reported for all periods presented and must be repeated in all periods subsequent to the period of the change.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

21

Wolverine Corporation purchased a machine for $132,000 on January 1, 2008, and depreciated it by the straight-line method using an estimated useful life of eight years with no salvage value. On January 1, 2011, Wolverine determined that the machine had a useful life of six years from the date of acquisition and will have a salvage value of $12,000. A change in estimate was made in 2011 to reflect these additional data. What amount should Wolverine record as the balance of the accumulated depreciation account for this machine at December 31, 2011?

A) $73,000

B) $77,000

C) $61,250

D) $63,600

A) $73,000

B) $77,000

C) $61,250

D) $63,600

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

22

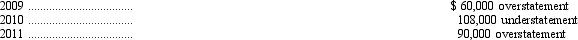

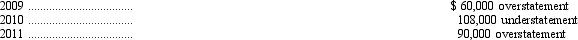

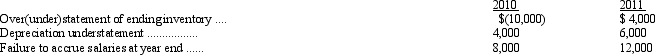

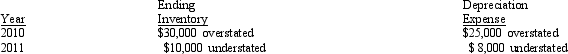

Koppell Co. made the following errors in counting its year-end physical inventories:

The entry to correct the accounts at the end of 2011 is

A) Retained Earnings ................... 48,000 Cost of Goods Sold .................. 42,000

Inventory ........................ 90,000

B) Retained Earnings ................... 18,000 Cost of Goods Sold .................. 72,000

Inventory ........................ 90,000

C) Inventory .......................... 90,000 Cost of Goods Sold ............... 18,000

Retained Earnings ............... 72,000

D) Cost of Goods Sold .................. 198,000 Retained Earnings ................ 108,000

Inventory ........................ 90,000

The entry to correct the accounts at the end of 2011 is

A) Retained Earnings ................... 48,000 Cost of Goods Sold .................. 42,000

Inventory ........................ 90,000

B) Retained Earnings ................... 18,000 Cost of Goods Sold .................. 72,000

Inventory ........................ 90,000

C) Inventory .......................... 90,000 Cost of Goods Sold ............... 18,000

Retained Earnings ............... 72,000

D) Cost of Goods Sold .................. 198,000 Retained Earnings ................ 108,000

Inventory ........................ 90,000

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

23

On December 31, 2011, Prince Company appropriately changed to the FIFO cost method from the weighted-average cost method for financial statement and income tax purposes. The change will result in a $700,000 increase in the beginning inventory at January 1, 2011. Assuming a 40 percent income tax rate and that no comparative financial statements for prior years are reported, the cumulative effect of this accounting change reported for the year ended December 31, 2011, is

A) $700,000.

B) $350,000.

C) $420,000.

D) $280,000.

A) $700,000.

B) $350,000.

C) $420,000.

D) $280,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

24

On January 2, 2009, McKell Company acquired machinery at a cost of $640,000. This machinery was being depreciated by the double-declining-balance method over an estimated useful life of eight years, with no residual value. At the beginning of 2011, McKell decided to change to the straight-line method of depreciation. Ignoring income tax considerations, the cumulative effect of this accounting change is

A) $0.

B) $120,000.

C) $130,000.

D) $280,000.

A) $0.

B) $120,000.

C) $130,000.

D) $280,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

25

A change in the unit depletion rate would be accounted for as a

A) correction of an accounting error.

B) change in accounting principle.

C) change in accounting estimate.

D) change in accounting estimate effected through a change in accounting principle.

A) correction of an accounting error.

B) change in accounting principle.

C) change in accounting estimate.

D) change in accounting estimate effected through a change in accounting principle.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

26

Effective January 2, 2011, Kincaid Co. adopted the accounting principle of expensing advertising and promotion costs as they are incurred. Previously, advertising and promotion costs applicable to future periods were recorded in prepaid expenses. Kincaid can justify the change, which was made for both financial statement and income tax reporting purposes. Kincaid's prepaid advertising and promotion costs totaled $250,000 at December 31, 2010. Assume that the income tax rate is 40 percent for 2010 and 2011. The adjustment for the effect of the change in accounting principle should result in a net charge against income in the income statement for 2011 of

A) $0.

B) $100,000.

C) $150,000.

D) $250,000.

A) $0.

B) $100,000.

C) $150,000.

D) $250,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

27

On January 1, 2008, Carnival Shipping bought a machine for $1,500,000. At that time, this machine had an estimated useful life of six years, with no salvage value. As a result of additional information, Carnival determined on January 1, 2011, that the machine had an estimated useful life of eight years from the date it was acquired, with no salvage value. Accordingly, the appropriate accounting change was made in 2011. How much depreciation expense for this machine should Carnival record for the year ended December 31, 2011, assuming Carnival uses the straight-line method of depreciation?

A) $125,000

B) $150,000

C) $187,500

D) $250,000

A) $125,000

B) $150,000

C) $187,500

D) $250,000

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

28

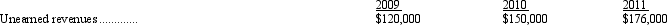

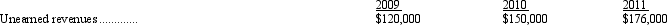

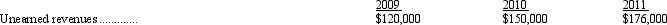

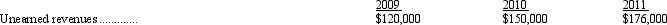

Barker, Inc. receives subscription payments for annual (one year) subscriptions to its magazine. Payments are recorded as revenue when received. Amounts received but unearned at the end of each of the last three years are shown below:

Barker failed to record the unearned revenues in each of the three years. As a result of the omission, 2011 income was

A) overstated by $146,000.

B) understated by $146,000.

C) understated by $26,000.

D) overstated by $26,000.

Barker failed to record the unearned revenues in each of the three years. As a result of the omission, 2011 income was

A) overstated by $146,000.

B) understated by $146,000.

C) understated by $26,000.

D) overstated by $26,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

29

Tyson Company bought a machine on January 1, 2009, for $24,000, at which time it had an estimated useful life of eight years, with no residual value. Straight-line depreciation is used for all of Tyson's depreciable assets. On January 1, 2011, the machine's estimated useful life was determined to be only six years from the acquisition date. Accordingly, the appropriate accounting change was made in 2011. Tyson's income tax rate was 40 percent in all the affected years. In Tyson's 2011 financial statements, how much should be reported as the cumulative effect on prior years because of the change in the estimated useful life of the machine?

A) $0

B) $1,200

C) $2,000

D) $2,800

A) $0

B) $1,200

C) $2,000

D) $2,800

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

30

Rodney Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $3,600 was prepaid in 2010 covering the years 2010, 2011, and 2012. The entire amount was charged to expense in 2010. In addition, on December 31, 2011, fully depreciated machinery was sold for $6,400 cash, but the sale was not recorded until 2012. There were no other errors during 2010 or 2011, and no corrections have been made for any of the errors. Ignore income tax considerations. What is the total effect of the errors on 2011 net income?

A) Net income is understated by $12,800.

B) Net income is overstated by $3,600.

C) Net income is understated by $1,600.

D) Net income is overstated by $2,400.

An insurance premium of $3,600 was prepaid in 2010 covering the years 2010, 2011, and 2012. The entire amount was charged to expense in 2010. In addition, on December 31, 2011, fully depreciated machinery was sold for $6,400 cash, but the sale was not recorded until 2012. There were no other errors during 2010 or 2011, and no corrections have been made for any of the errors. Ignore income tax considerations. What is the total effect of the errors on 2011 net income?

A) Net income is understated by $12,800.

B) Net income is overstated by $3,600.

C) Net income is understated by $1,600.

D) Net income is overstated by $2,400.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

31

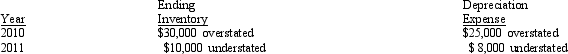

Koppell Co. made the following errors in counting its year-end physical inventories:

As a result of the above undetected errors, 2011 income was

A) understated by $18,000.

B) overstated by $198,000.

C) overstated by $18,000.

D) understated by $198,000.

As a result of the above undetected errors, 2011 income was

A) understated by $18,000.

B) overstated by $198,000.

C) overstated by $18,000.

D) understated by $198,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

32

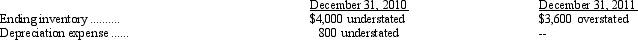

Biden Corp. reports on a calendar-year basis. Its 2010 and 2011 financial statements contained the following errors:

As a result of the above errors, 2011 income would be

A) overstated by $4,000.

B) overstated by $24,000.

C) overstated by $22,000.

D) overstated by $16,000.

As a result of the above errors, 2011 income would be

A) overstated by $4,000.

B) overstated by $24,000.

C) overstated by $22,000.

D) overstated by $16,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

33

On January 1, 2008, Grayson Company purchased for $240,000 a machine with a useful life of ten years and no salvage value. The machine was depreciated by the double-declining-balance method, and the carrying amount of the machine was $153,600 on December 31, 2009. Grayson changed to the straight-line method on January 1, 2010. Grayson can justify the change. What should be the depreciation expense on this machine for the year ended December 31, 2011?

A) $15,360

B) $19,200

C) $24,000

D) $30,720

A) $15,360

B) $19,200

C) $24,000

D) $30,720

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following statements is not correct?

A) A change from an inappropriate accounting principle to a proper one should be accounted for as an accounting error.

B) A change from an inappropriate accounting principle to a proper one should be accounted for as a change in accounting principle.

C) A change from an inappropriate accounting principle to a proper one should be accounted for retrospectively.

D) A change from an inappropriate accounting principle to a proper one may require an adjustment to beginning retained earnings for the earliest year reported.

A) A change from an inappropriate accounting principle to a proper one should be accounted for as an accounting error.

B) A change from an inappropriate accounting principle to a proper one should be accounted for as a change in accounting principle.

C) A change from an inappropriate accounting principle to a proper one should be accounted for retrospectively.

D) A change from an inappropriate accounting principle to a proper one may require an adjustment to beginning retained earnings for the earliest year reported.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

35

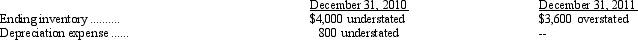

Coombs, Inc. is a calendar-year corporation whose financial statements for 2010 and 2011 included errors as follows:

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2010, or December 31, 2011. Ignoring income taxes, by how much should Coombs's retained earnings be retroactively adjusted at January 1, 2012?

A) $27,000 increase

B) $27,000 decrease

C) $7,000 decrease

D) $3,000 decrease

Assume that purchases were recorded correctly and that no correcting entries were made at December 31, 2010, or December 31, 2011. Ignoring income taxes, by how much should Coombs's retained earnings be retroactively adjusted at January 1, 2012?

A) $27,000 increase

B) $27,000 decrease

C) $7,000 decrease

D) $3,000 decrease

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

36

Kentucky Enterprises purchased a machine on January 2, 2010, at a cost of $120,000. An additional $50,000 was spent for installation, but this amount was charged erroneously to repairs expense. The machine has a useful life of five years and a salvage value of $20,000. As a result of the error,

A) retained earnings at December 31, 2011, was understated by $30,000 and 2011 income was overstated by $6,000.

B) retained earnings at December 31, 2011, was understated by $38,000 and 2011 income was overstated by $6,000.

C) retained earnings at December 31, 2011, was understated by $30,000 and 2011 income was overstated by $10,000.

D) 2010 income was understated by $50,000.

A) retained earnings at December 31, 2011, was understated by $30,000 and 2011 income was overstated by $6,000.

B) retained earnings at December 31, 2011, was understated by $38,000 and 2011 income was overstated by $6,000.

C) retained earnings at December 31, 2011, was understated by $30,000 and 2011 income was overstated by $10,000.

D) 2010 income was understated by $50,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

37

Badger Corporation purchased a machine for $150,000 on January 1, 2010. Badger will depreciate the machine using the straight-line method using a five-year period with no residual value. As a result of an error in its purchasing records, Badger did not recognize any depreciation for the machine in its 2010 financial statements. Badger discovered the problem during the preparation of its 2011 financial statements. What amount should Badger record for depreciation expense on this machine for 2011?

A) $0

B) $30,000

C) $37,500

D) $60,000

A) $0

B) $30,000

C) $37,500

D) $60,000

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

38

Barker, Inc. receives subscription payments for annual (one year) subscriptions to its magazine. Payments are recorded as revenue when received. Amounts received but unearned at the end of each of the last three years are shown below.

Barker failed to record the unearned revenues in each of the three years. The entry needed to correct the above errors is

A) Retained Earnings .................. 150,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 176,000

B) Retained Earnings .................. 30,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 56,000

C) Subscription Revenues .............. 176,000 Unearned Revenues ............... 176,000

D) Subscription Revenues .............. 150,000 Retained Earnings .................. 26,000

Unearned Revenues ............... 176,000

Barker failed to record the unearned revenues in each of the three years. The entry needed to correct the above errors is

A) Retained Earnings .................. 150,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 176,000

B) Retained Earnings .................. 30,000 Subscription Revenues .............. 26,000

Unearned Revenues ............... 56,000

C) Subscription Revenues .............. 176,000 Unearned Revenues ............... 176,000

D) Subscription Revenues .............. 150,000 Retained Earnings .................. 26,000

Unearned Revenues ............... 176,000

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

39

A change from an accelerated depreciation method to the straight-line depreciation method should be accounted for as a

A) change in accounting estimate.

B) change in accounting estimate effected by a change in accounting principle.

C) correction of an error.

D) a prior period adjustment.

A) change in accounting estimate.

B) change in accounting estimate effected by a change in accounting principle.

C) correction of an error.

D) a prior period adjustment.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

40

On December 31, 2011, Buckeye Corporation appropriately changed its inventory valuation method to FIFO cost from LIFO cost for both financial statement and income tax purposes. The change will result in a $140,000 increase in the beginning inventory at January 1, 2011. Assume a 30 percent income tax rate. The cumulative effect of this accounting change Buckeye for the year ended December 31, 2011, is

A) $0.

B) $42,000.

C) $98,000.

D) $140,000.

A) $0.

B) $42,000.

C) $98,000.

D) $140,000.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

41

Ending inventory for 2009 is overstated by $4,000 due to a faulty count and costing. The tax rate is 30%. Assume the same accounting methods for both financial reporting and taxes. The error is discovered late in 2011. The 2011 annual report shows the financial statements for 2009, 2010, 2011 on a comparative basis.

Which of the following is correct regarding the reporting of this error in the 2011 annual report?

A) A journal entry is made to report the prior period adjustment, and the 2009 and 2010 statements are shown corrected.

B) No journal entry is needed, and the 2009 and 2010 statements are shown as they were in the 2010 annual report.

C) No journal entry is needed, and the 2009 and 2010 statements are shown corrected.

D) A journal entry is made to report the prior period adjustment, and the 2009 and 2010 statements are shown as they were in the 2010 annual report.

Which of the following is correct regarding the reporting of this error in the 2011 annual report?

A) A journal entry is made to report the prior period adjustment, and the 2009 and 2010 statements are shown corrected.

B) No journal entry is needed, and the 2009 and 2010 statements are shown as they were in the 2010 annual report.

C) No journal entry is needed, and the 2009 and 2010 statements are shown corrected.

D) A journal entry is made to report the prior period adjustment, and the 2009 and 2010 statements are shown as they were in the 2010 annual report.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

42

For a company with a periodic inventory system, which of the following would cause income to be overstated in the period of occurrence?

A) Overestimating bad debt expense

B) Understating beginning inventory

C) Overstated purchases

D) Understated ending inventory

A) Overestimating bad debt expense

B) Understating beginning inventory

C) Overstated purchases

D) Understated ending inventory

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

43

If, at the end of a period, Matthew Company erroneously excluded some goods from its ending inventory and also erroneously did not record the purchase of these goods in its accounting records, these errors would cause

A) no effect on the company's net income, working capital, and retained earnings.

B) the company's cost of goods available for sale, cost of goods sold, and net income to be understated.

C) the company's ending inventory, cost of goods available for sale, and retained earnings to be understated.

D) the company's ending inventory, cost of goods sold, and retained earnings to be understated.

A) no effect on the company's net income, working capital, and retained earnings.

B) the company's cost of goods available for sale, cost of goods sold, and net income to be understated.

C) the company's ending inventory, cost of goods available for sale, and retained earnings to be understated.

D) the company's ending inventory, cost of goods sold, and retained earnings to be understated.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

44

Adams Company decides at the beginning of 2011 to adopt the FIFO method of inventory valuation. The company had been using the LIFO method for financial and tax reporting since it inception on January 1, 2009. The profit-sharing agreement was in place for all years prior to the year of change, 2011. Payments under this agreement are not an inventoriable cost.

Which of the following statements regarding the accounting for the profit-sharing agreement in connection with the change from LIFO to FIFO is correct?

A) The effects of the change in accounting principle on the profit-sharing agreement must be treated retrospectively.

B) The effects of the change in accounting principle on the profit-sharing agreement should be reported only in the period in which the change in accounting principle was made.

C) It would be impracticable to determine the effect on the profit-sharing agreement as a result of the change in accounting principle.

D) There would be no effect on the profit-sharing agreement as a result of the change in accounting principle.

Which of the following statements regarding the accounting for the profit-sharing agreement in connection with the change from LIFO to FIFO is correct?

A) The effects of the change in accounting principle on the profit-sharing agreement must be treated retrospectively.

B) The effects of the change in accounting principle on the profit-sharing agreement should be reported only in the period in which the change in accounting principle was made.

C) It would be impracticable to determine the effect on the profit-sharing agreement as a result of the change in accounting principle.

D) There would be no effect on the profit-sharing agreement as a result of the change in accounting principle.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following, if discovered by James Company in the accounting period subsequent to the period of occurrence, requires the company to report the correction of an error?

A) The estimate of the useful life of a depreciable asset should have been revised.

B) A change from declining-balance depreciation method to straight-line method

C) Capitalization of an expense

D) Change in percentage of sales used for determining bad debt expense

A) The estimate of the useful life of a depreciable asset should have been revised.

B) A change from declining-balance depreciation method to straight-line method

C) Capitalization of an expense

D) Change in percentage of sales used for determining bad debt expense

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is not an example of an accounting error, as distinguished from a change in accounting principle or change in accounting estimate?

A) Misstatement of assets, liabilities, or owners' equity

B) Incorrect classification of an expenditure as between expense and an asset

C) Failure to recognize accruals and deferrals

D) Recognition of a gain on disposal of fully depreciated property

A) Misstatement of assets, liabilities, or owners' equity

B) Incorrect classification of an expenditure as between expense and an asset

C) Failure to recognize accruals and deferrals

D) Recognition of a gain on disposal of fully depreciated property

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is characteristic of a change in accounting principle?

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported, and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported, and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

48

A change in the estimated useful life of a building

A) is not allowed by generally accepted accounting principles.

B) affects the depreciation on the building beginning with the year of the change.

C) must be handled as a retroactive adjustment to all accounts affected, back to the year of the acquisition of the building.

D) creates a new account to be recognized on the income statement reflecting the difference in net income up to the beginning of the year of the change.

A) is not allowed by generally accepted accounting principles.

B) affects the depreciation on the building beginning with the year of the change.

C) must be handled as a retroactive adjustment to all accounts affected, back to the year of the acquisition of the building.

D) creates a new account to be recognized on the income statement reflecting the difference in net income up to the beginning of the year of the change.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following should not be reported retroactively?

A) Use of an unacceptable accounting principle, then changing to an acceptable accounting principle

B) Correction of an overstatement of ending inventory made two years ago

C) Use of an unrealistic accounting estimate, then changing to a realistic estimate

D) Change from a good faith but erroneous estimate to a new estimate

A) Use of an unacceptable accounting principle, then changing to an acceptable accounting principle

B) Correction of an overstatement of ending inventory made two years ago

C) Use of an unrealistic accounting estimate, then changing to a realistic estimate

D) Change from a good faith but erroneous estimate to a new estimate

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following would not be accounted for as a change in accounting principle?

A) Change from the first-in, first-out method to the last-in, first-out method of inventory pricing

B) Change from the last-in, first-out method to the first-in, first-out method of inventory pricing

C) Change from completed-contract accounting to percentage-of-completion

D) Change from straight-line method to accelerated method of depreciation

A) Change from the first-in, first-out method to the last-in, first-out method of inventory pricing

B) Change from the last-in, first-out method to the first-in, first-out method of inventory pricing

C) Change from completed-contract accounting to percentage-of-completion

D) Change from straight-line method to accelerated method of depreciation

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is characteristic of a change in accounting estimate?

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported, and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

A) Requires the reporting of pro forma amounts for prior periods

B) Does not affect the financial statements of prior periods

C) Never needs to be disclosed

D) Should be reported by retrospectively adjusting the financial statements for all years reported, and reporting the cumulative effect of the change in income for all preceding years as an adjustment to the beginning balance of retained earnings for the earliest year reported

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

52

On December 27, 2011, Johnson Company ordered merchandise for resale from Quantum, Inc., that cost $7,000 (terms cash within 10 days). Quantum shipped the merchandise f.o.b. shipping point on December 28, 2011, and the goods arrived on January 2, 2012. The invoice was received on December 30, 2011. Johnson Company did not record the purchase in 2011 and did not include the goods in ending inventory. The effects on Johnson Company's 2011 financial statements were

A) income and owners' equity were correct; liabilities were incorrect, assets were correct.

B) income and owners' equity were correct; assets and liabilities were incorrect.

C) income, assets, liabilities, and owners' equity were correct.

D) income, assets, liabilities, and owners' equity were incorrect.

A) income and owners' equity were correct; liabilities were incorrect, assets were correct.

B) income and owners' equity were correct; assets and liabilities were incorrect.

C) income, assets, liabilities, and owners' equity were correct.

D) income, assets, liabilities, and owners' equity were incorrect.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

53

When a firm changed its method of accounting for inventory from LIFO to FIFO in 2011, it decided that the 2011 financial statements should be shown comparatively with the 2010 results.

Which of the following statements concerning reporting the change in the retained earnings statement is correct?

A) No direct change to retained earnings is needed since earnings for both years have been adjusted to reflect the change.

B) Only the January 1, 2010, retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

C) Only the January 1, 2011, retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

D) Both the January 1, 2010, and January 1, 2011, retained earnings balances are reported at different amounts to reflect the effects of the change in earnings before those respective dates.

Which of the following statements concerning reporting the change in the retained earnings statement is correct?

A) No direct change to retained earnings is needed since earnings for both years have been adjusted to reflect the change.

B) Only the January 1, 2010, retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

C) Only the January 1, 2011, retained earnings balance is reported at a different amount to reflect the effects of the change in earnings.

D) Both the January 1, 2010, and January 1, 2011, retained earnings balances are reported at different amounts to reflect the effects of the change in earnings before those respective dates.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

54

Young Corporation decided to change its depreciation policy by (1) changing from double-declining-balance depreciation, and (2) changing the estimated useful life on all automobiles used in the business from five years to four years.

Which of the following is correct concerning these two changes?

A) Both are changes in accounting principle.

B) Both are changes in accounting estimate.

C) One is an error correction, and one is change in accounting principle.

D) One is a change in estimate effected through a change in accounting principle, and one is a change in estimate.

Which of the following is correct concerning these two changes?

A) Both are changes in accounting principle.

B) Both are changes in accounting estimate.

C) One is an error correction, and one is change in accounting principle.

D) One is a change in estimate effected through a change in accounting principle, and one is a change in estimate.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

55

The September 30, 2011, physical inventory of Baxter Corporation appropriately included $3,800 of merchandise purchased on account that was not recorded in purchases until October 2011. What effect will this error have on September 30, 2011, assets, liabilities, retained earnings, and earnings for the year then ended, respectively?

A) Understate; no effect; overstate; overstate

B) No effect; overstate; understate; understate

C) No effect; understate; overstate; overstate

D) No effect; understate; understate; overstate

A) Understate; no effect; overstate; overstate

B) No effect; overstate; understate; understate

C) No effect; understate; overstate; overstate

D) No effect; understate; understate; overstate

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

56

BJ Company uses a periodic inventory system. If the company's beginning inventory in the current year is overstated, and that is the only error in the current year, then the company's income for the current year will be

A) understated and assets correct.

B) understated and assets overstated.

C) overstated and assets overstated.

D) understated and assets understated.

A) understated and assets correct.

B) understated and assets overstated.

C) overstated and assets overstated.

D) understated and assets understated.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following would cause income of the current period to be understated?

A) Capitalizing research and development costs

B) Failure to recognize unearned rent revenue

C) Changing from LIFO to FIFO for merchandise inventory

D) Understating estimates of asset residual values

A) Capitalizing research and development costs

B) Failure to recognize unearned rent revenue

C) Changing from LIFO to FIFO for merchandise inventory

D) Understating estimates of asset residual values

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is a counterbalancing error?

A) Understated depletion expense

B) Bond premium underamortized

C) Prepaid expense adjusted incorrectly

D) Overstated depreciation expenses

A) Understated depletion expense

B) Bond premium underamortized

C) Prepaid expense adjusted incorrectly

D) Overstated depreciation expenses

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following types of errors will not self-correct in the next year?

A) Accrued expenses not recognized at year-end

B) Accrued revenues that have not been collected not recognized at year-end

C) Depreciation expense overstated for the year

D) Prepaid expenses not recognized at year-end

A) Accrued expenses not recognized at year-end

B) Accrued revenues that have not been collected not recognized at year-end

C) Depreciation expense overstated for the year

D) Prepaid expenses not recognized at year-end

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

60

The ending inventory for Wattis Company was overstated by $6,000 in 2011. The overstatement will cause Wattis Company's

A) retained earnings to be understated on the 2011 balance sheet.

B) cost of goods sold to be understated on the 2012 income statement.

C) cost of goods sold to be overstated on the 2011 income statement.

D) 2012 balance sheet not to be misstated.

A) retained earnings to be understated on the 2011 balance sheet.

B) cost of goods sold to be understated on the 2012 income statement.

C) cost of goods sold to be overstated on the 2011 income statement.

D) 2012 balance sheet not to be misstated.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

61

Western Company purchased some equipment on January 2, 2008, for $24,000. The company used straight-line depreciation based on a ten-year estimated life with no residual value. During 2011, management decided that this equipment could be used only three more years and then would be replaced with a technologically superior model. What entry should the company make as of January 1, 2011, to reflect this change?

A) No entry

B) Debit a Prior Period Adjustment account for $4,800 and credit accumulated depreciation for $4,800.

C) Debit Retained Earnings for $4,800 and credit accumulated depreciation for $4,800.

D) Debit Depreciation Expense for $4,800 and credit Accumulated Depreciation for $4,800.

A) No entry

B) Debit a Prior Period Adjustment account for $4,800 and credit accumulated depreciation for $4,800.

C) Debit Retained Earnings for $4,800 and credit accumulated depreciation for $4,800.

D) Debit Depreciation Expense for $4,800 and credit Accumulated Depreciation for $4,800.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

62

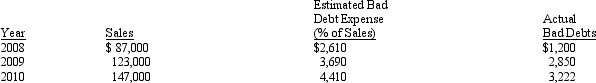

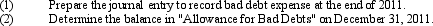

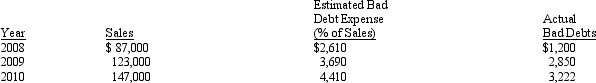

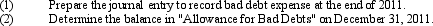

Perfect Technologies has estimated bad debts using the percentage-of-sales method since their business began operations in 2008. Information relating to bad debts and sales is as follows:

At the beginning of 2011, Perfect proposes changing their estimation of bad debt expense from 3 percent of sales to 2 percent. Sales for the year totaled $163,000 and actual bad debts amounted to $3,720.

At the beginning of 2011, Perfect proposes changing their estimation of bad debt expense from 3 percent of sales to 2 percent. Sales for the year totaled $163,000 and actual bad debts amounted to $3,720.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

63

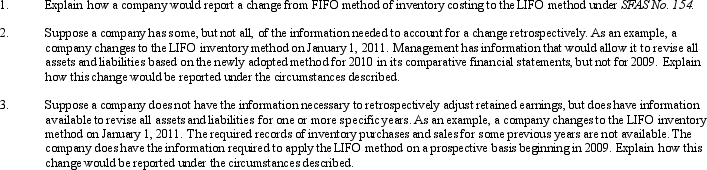

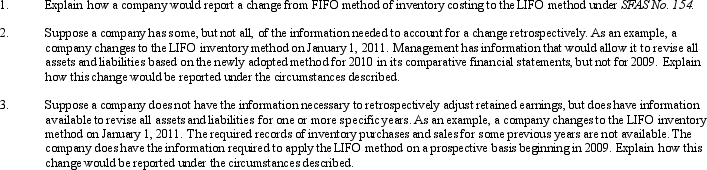

Statement of Financial Accounting Standards No. 154, "Accounting Changes and Error Corrections, requires that voluntary changes in accounting principles be reported retrospectively. The standard recognizes that such retrospective restatement is not always practical.

Required:

Required:

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

64

Johnson's Distributing purchased equipment on January 1, 2008. The equipment cost $124,000 with a salvage value of $12,000 and an estimated life of 8 years. Initially, Johnson depreciated the equipment using the sum-of-the-years'-digits method. On January 1, 2011, the company elected to change to the straight-line method of depreciation.

Required:

Determine the depreciation expense for 2011 and prepare the appropriate journal entry.

Required:

Determine the depreciation expense for 2011 and prepare the appropriate journal entry.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is not a justification for a change in depreciation methods?

A) A change in the estimated useful life of an asset as a result of unexpected obsolescence

B) A change in the pattern of receiving the estimated future benefits from an asset

C) To conform to the depreciation method prevalent in a particular industry

D) A change in the estimated future benefits from the asset

A) A change in the estimated useful life of an asset as a result of unexpected obsolescence

B) A change in the pattern of receiving the estimated future benefits from an asset

C) To conform to the depreciation method prevalent in a particular industry

D) A change in the estimated future benefits from the asset

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

66

Ideally, managers should make accounting changes only as a result of new experience or information, or due to changes in economic conditions that demand methods of accounting that more accurately reflect such changing conditions. Managers should be attempting to achieve the closest match between reporting and economic reality.

Identify motivations for managers to make accounting changes other than the goal of achieving congruence between reporting and economic reality.

Identify motivations for managers to make accounting changes other than the goal of achieving congruence between reporting and economic reality.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

67

Stone Enterprise purchased a machine on January 3, 2008. The machine cost $46,000 with an estimated salvage value of $2,000 and an estimated useful life of 10 years. As a result of technological improvements, a revision of the machine's useful life and estimated salvage value was made. On January 1, 2011, the equipment was estimated to last through 2012 with an estimated value at that time of $500. Stone uses the straight-line method for depreciation.

Prepare the journal entry to record depreciation on December 31, 2011.

Prepare the journal entry to record depreciation on December 31, 2011.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

68

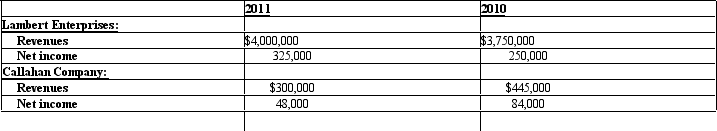

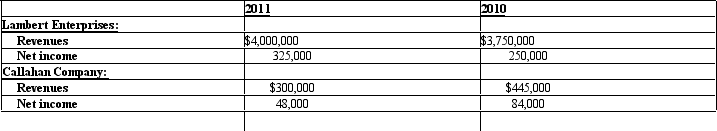

Lambert Enterprises acquired Callahan Company for $700,000 December 31, 2011. This amount exceeded the recorded value of Callahan Company's net assets by $150,000 on the acquisition date. The entire excess of cost over the book value of the net assets related to a piece of equipment owned by Callahan that had a remaining life of five years as of the acquisition date. The companies reported the following amounts for the 2010 and 2011:

Prepare the pro forma information for this acquisition required by SFAS No. 141.

Prepare the pro forma information for this acquisition required by SFAS No. 141.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

69

Cameron Co. began operations on January 1, 2008, at which time it acquired depreciable assets of $100,000. The assets have an estimated useful life of ten years and no salvage value.

In 2011, Cameron Co. changed from the sum-of-the-years'-digits depreciation method to the straight-line depreciation method.

Required:

Determine the depreciation expense for 2011 and prepare the appropriate journal entry.

In 2011, Cameron Co. changed from the sum-of-the-years'-digits depreciation method to the straight-line depreciation method.

Required:

Determine the depreciation expense for 2011 and prepare the appropriate journal entry.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

70

On January 1, 2011, Nicole Corporation changed its method of accounting for bad debts from the direct write-off method to the allowance method. The company's controller determined that an allowance of $22,000 should be established on that date.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

71

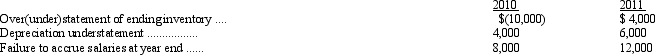

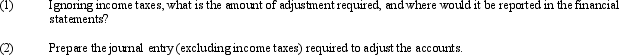

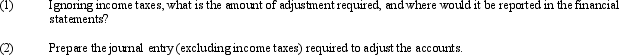

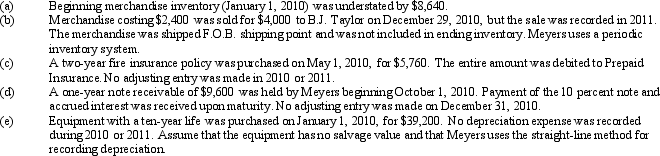

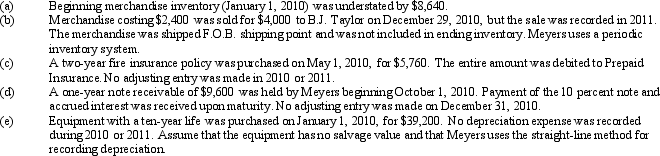

In reviewing the books of Meyers Retailers Inc., the auditor discovered certain errors that had occurred during 2010 and 2011. No errors were corrected during 2010. The errors are summarized below:

Prepare journal entries to correct each of these independent situations. Assume that the nominal accounts for 2011 have not yet been closed into the income summary account.

Prepare journal entries to correct each of these independent situations. Assume that the nominal accounts for 2011 have not yet been closed into the income summary account.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

72

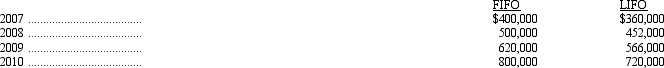

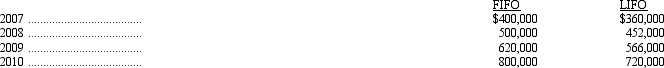

On January 1, 2011, Wiley Corporation changed its inventory cost flow assumption from FIFO to LIFO. The change was made for financial statement and tax reporting. Wiley's inventory values at the end of each year since inception under both methods are summarized below.

Ignoring income taxes, what is the amount of adjustment required in the 2011 accounts, and where would it be reported in the financial statement?

Ignoring income taxes, what is the amount of adjustment required in the 2011 accounts, and where would it be reported in the financial statement?

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

73

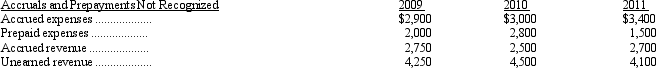

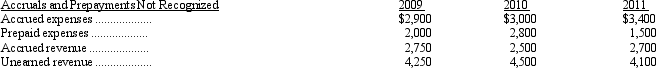

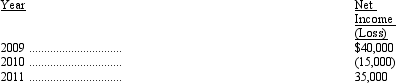

Since its organization on January 1, 2009, Langley Inc. failed to properly recognize accruals and prepayments. Selected accounts revealed the following information:

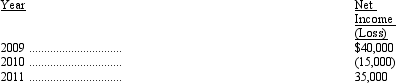

Net income reported by the company was:

Compute the corrected net income for the years 2009, 2010, and 2011. (Ignore income taxes.)

Net income reported by the company was:

Compute the corrected net income for the years 2009, 2010, and 2011. (Ignore income taxes.)

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck

74

Managers often are accused of making accounting changes in order to avoid regulation, to achieve compliance with debt covenants, to increase compensation through earnings-based bonus plans, or to smooth earnings. Managers may indeed believe that by increasing earnings, and thus increasing earnings per share, stock prices will increase.

Explain the relationship between attempts by managers to manipulate earnings through accounting changes and the efficient market hypothesis.

Explain the relationship between attempts by managers to manipulate earnings through accounting changes and the efficient market hypothesis.

Unlock Deck

Unlock for access to all 74 flashcards in this deck.

Unlock Deck

k this deck