Deck 19: Derivatives, Contingencies, Business Segments, and Interim Reports

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/79

Play

Full screen (f)

Deck 19: Derivatives, Contingencies, Business Segments, and Interim Reports

1

An agreement between two parties to exchange a specified amount of a commodity, security, or foreign currency at a specified date in the future with the price or exchange rate being set now is referred to as a(n)

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

B

2

For which type of derivative are changes in the fair value deferred and recognized as an equity adjustment?

A) Fair value hedge

B) Cash flow hedge

C) Operating hedge

D) Notional value hedge

A) Fair value hedge

B) Cash flow hedge

C) Operating hedge

D) Notional value hedge

B

3

Which choice best describes the information that should be disclosed related to derivative contracts?

A) Fair value

B) Notional amount

C) Both of these

D) Neither of these

A) Fair value

B) Notional amount

C) Both of these

D) Neither of these

C

4

A company enters into an interest rate swap in order to hedge a $5,000,000 variable-rate loan. The loan is expected to be fully repaid this year on June 10. The contract requires that if the interest rate on April 30 of next year is greater than 11%, the company receives the difference on a principal amount of $5,000,000. Alternatively, if the interest rate is less than 11%, the company must pay the difference. Which of the following statements is correct regarding this contract?

A) The swap agreement effectively hedges the variable interest payments.

B) The timing of the swap payment matches the timing of the interest payments and, therefore, the variable interest payments are hedged.

C) The timing of the swap payment does not match the timing of the interest payments and, therefore, the variable interest payments are not hedged.

D) This swap represents a fair value hedge.

A) The swap agreement effectively hedges the variable interest payments.

B) The timing of the swap payment matches the timing of the interest payments and, therefore, the variable interest payments are hedged.

C) The timing of the swap payment does not match the timing of the interest payments and, therefore, the variable interest payments are not hedged.

D) This swap represents a fair value hedge.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

5

In exchange for the rights inherent in an option contract, the owner of the option will typically pay a price

A) only when a call option is exercised.

B) only when a put option is exercised.

C) when either a call option or a put option is exercised.

D) at the time the option is received regardless of whether the option is exercised or not.

A) only when a call option is exercised.

B) only when a put option is exercised.

C) when either a call option or a put option is exercised.

D) at the time the option is received regardless of whether the option is exercised or not.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

6

A company enters into a futures contract with the intent of hedging an expected purchase of some equipment from a German company for DM400,000 on December 31. The contract requires that if the U.S. dollar value of DM800,000 is greater than $400,000 on December 31, the company will receive the difference. Alternatively, if the U.S. dollar value is less than $400,000, the company will pay the difference. Which of the following statements is correct regarding this contract?

A) The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark commitment.

B) The futures contract exceeds the amount of the commitment and thus hedges movements in the Deutsche mark exchange rate.

C) The futures contract is a contract to sell Deutsche marks at a fixed price.

D) The extra DM400,000 would be accounted for as a speculative investment.

A) The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark commitment.

B) The futures contract exceeds the amount of the commitment and thus hedges movements in the Deutsche mark exchange rate.

C) The futures contract is a contract to sell Deutsche marks at a fixed price.

D) The extra DM400,000 would be accounted for as a speculative investment.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

7

In considering interim financial reporting, how does APB Opinion No. 28 conclude that such reporting should be viewed?

A) As reporting for a basic accounting period

B) As useful only if activity is evenly spread throughout the year so that estimates are unnecessary

C) As a "special" type of reporting that need not follow generally accepted accounting principles

D) As reporting for an integral part of an annual period

A) As reporting for a basic accounting period

B) As useful only if activity is evenly spread throughout the year so that estimates are unnecessary

C) As a "special" type of reporting that need not follow generally accepted accounting principles

D) As reporting for an integral part of an annual period

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following tests may be used to determine if an industry segment of an enterprise is a reportable segment under FASB Statement No. 131?

A) Its revenue (both from external customers and internal segments) is equal to or greater than 10 percent of total revenue (external and internal).

B) The absolute value of its operating profit is equal to or greater than 10 percent of the total of the operating profit for all segments that reported profits (or the total of the losses for all segments that reported losses).

C) The segment contains 10 percent or more of the combined assets of all operating segments.

D) All of these.

A) Its revenue (both from external customers and internal segments) is equal to or greater than 10 percent of total revenue (external and internal).

B) The absolute value of its operating profit is equal to or greater than 10 percent of the total of the operating profit for all segments that reported profits (or the total of the losses for all segments that reported losses).

C) The segment contains 10 percent or more of the combined assets of all operating segments.

D) All of these.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

9

On February 1, Shoemaker Corporation entered into a firm commitment to purchase specialized equipment from the Okazaki Trading Company for ¥80,000,000 on April 1. Shoemaker would like to reduce the exchange rate risk that could increase the cost of the equipment in U.S. dollars by April 1, but Shoemaker is not sure which direction the exchange rate may move. What type of contract would protect Shoemaker from an unfavorable movement in the exchange rate while allowing them to benefit from a favorable movement in the exchange rate?

A) Interest rate swap

B) Forward contract

C) Call option

D) Put option

A) Interest rate swap

B) Forward contract

C) Call option

D) Put option

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

10

Uncertainty that the party on the other side of an agreement will abide by the terms of the agreement is referred to as

A) price risk.

B) credit risk.

C) interest rate risk.

D) exchange rate risk.

A) price risk.

B) credit risk.

C) interest rate risk.

D) exchange rate risk.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

11

A contingent loss should be disclosed in a note to the financial statements but should not be recorded as a liability if the

A) possibility of loss is remote.

B) contingency involves pending or threatened litigation.

C) outcome is uncertain.

D) actual incurrence of a loss is reasonably possible.

A) possibility of loss is remote.

B) contingency involves pending or threatened litigation.

C) outcome is uncertain.

D) actual incurrence of a loss is reasonably possible.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

12

If a cannery wanted to lock in the price they would pay for peaches in August four months before harvest (in April of the same year), they would be most likely to enter into which kind of agreement?

A) Interest rate swap

B) Fixed commodities contract

C) Futures contract

D) Option

A) Interest rate swap

B) Fixed commodities contract

C) Futures contract

D) Option

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

13

When gains or losses on derivatives designated as fair value hedges exceed the gains or losses on the item being hedged, the excess

A) affects reported net income.

B) is recognized as an equity adjustment.

C) is recognized as part of comprehensive income.

D) is not recognized.

A) affects reported net income.

B) is recognized as an equity adjustment.

C) is recognized as part of comprehensive income.

D) is not recognized.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

14

A contract, traded on an exchange, that allows a company to buy a specified quantity of a commodity or a financial security at a specified price on a specified future date is referred to as a(n)

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

15

A contract giving the owner the right, but not the obligation, to buy or sell an asset at a specified price any time during a specified period in the future is referred to as a(n)

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

A) interest rate swap.

B) forward contract.

C) futures contract.

D) option.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

16

According to Statement of Financial Accounting Standards No. 131, "Disclosures about Segments of an Enterprise and Related Information," how do firms identify reportable segments?

A) By geographic regions

B) By product lines

C) By industry classification

D) By designations used inside the firm

A) By geographic regions

B) By product lines

C) By industry classification

D) By designations used inside the firm

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

17

Uncertainty about the future market value of an asset is referred to as

A) price risk.

B) credit risk.

C) interest rate risk.

D) exchange rate risk.

A) price risk.

B) credit risk.

C) interest rate risk.

D) exchange rate risk.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

18

Which type of contract is unique in that it protects the owner against unfavorable movements in the prices or rates while allowing the owner to benefit from favorable movements?

A) Interest rate swap

B) Forward contract

C) Futures contract

D) Option

A) Interest rate swap

B) Forward contract

C) Futures contract

D) Option

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

19

A company enters into a futures contract with the intent of hedging an account payable of DM400,000 due on December 31. The contract requires that if the U.S. dollar value of DM400,000 is greater than $200,000 on December 31, the company will be required to pay the difference. Alternatively, if the U.S. dollar value is less than $200,000, the company will receive the difference. Which of the following statements is correct regarding this contract?

A) The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark payable.

B) The futures contract is a contract to buy Deutsche marks at a fixed price.

C) The futures contract is a contract to sell Deutsche marks at a fixed price.

D) The contract obligates the company to pay if the value of the U.S. dollar increases.

A) The Deutsche mark futures contract effectively hedges against the effect of exchange rate changes on the U.S. dollar value of the Deutsche mark payable.

B) The futures contract is a contract to buy Deutsche marks at a fixed price.

C) The futures contract is a contract to sell Deutsche marks at a fixed price.

D) The contract obligates the company to pay if the value of the U.S. dollar increases.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

20

An obligation that is contingent on the occurrence of a future event should be reported in the balance sheet as a liability if the

A) future event is likely to occur.

B) amount of the obligation can be reasonably estimated.

C) occurrence of the future event is at least reasonably possible and the amount is known.

D) occurrence of the future event is probable and the amount can be reasonably estimated.

A) future event is likely to occur.

B) amount of the obligation can be reasonably estimated.

C) occurrence of the future event is at least reasonably possible and the amount is known.

D) occurrence of the future event is probable and the amount can be reasonably estimated.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not true regarding standards for interim reporting?

A) Declines in inventory value should be deferred to future interim periods.

B) Use of the gross margin method for computing cost of goods sold must be disclosed.

C) Costs and expenses not directly associated with interim revenue must be allocated to interim periods on a reasonable basis.

D) Gains and losses that arise in an interim period should be recognized in the interim period in which they arise if they would not normally be deferred at year-end.

A) Declines in inventory value should be deferred to future interim periods.

B) Use of the gross margin method for computing cost of goods sold must be disclosed.

C) Costs and expenses not directly associated with interim revenue must be allocated to interim periods on a reasonable basis.

D) Gains and losses that arise in an interim period should be recognized in the interim period in which they arise if they would not normally be deferred at year-end.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

22

When a company with reportable segments issues interim condensed financial statements, current GAAP requires that the interim reports provide all of the following for each reportable segment except

A) revenues for external customers.

B) intersegment revenues.

C) a measure of segment profit or loss.

D) total assets.

A) revenues for external customers.

B) intersegment revenues.

C) a measure of segment profit or loss.

D) total assets.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

23

On July 1, 2011, Cahoon Company sold some limited edition art prints to Sitake Company for ¥47,850,000 to be paid on September 30 of that year. The current exchange rate on July 1, 2011, was ¥110=$1, so the total payment at the current exchange rate would be equal to $435,000. Cahoon entered into a forward contract with a large bank to guarantee the number of dollars to be received. According to the terms of the contract, if ¥47,850,000 is worth less than $435,000, the bank will pay Cahoon the difference in cash. Likewise, if ¥47,850,000 is worth more than $435,000, Cahoon must pay the bank the difference in cash.

Using the information above and assuming the exchange rate on September 30 is ¥105=$1, what amount will Cahoon pay to, or receive from, the bank (rounded to the nearest dollar)?

A) $18,913 payment

B) $18,913 receipt

C) $20,714 payment

D) $20,714 receipt

Using the information above and assuming the exchange rate on September 30 is ¥105=$1, what amount will Cahoon pay to, or receive from, the bank (rounded to the nearest dollar)?

A) $18,913 payment

B) $18,913 receipt

C) $20,714 payment

D) $20,714 receipt

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

24

Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2011. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2011. WSM shares are trading at $100 per share on January 2, 2011, at which time Hall pays $100 for the call option.

Using the information above, assume that the price of the WSM shares has risen to $120 per share on March 31, 2011, and the Hall is preparing financial statements for the quarter ending March 31. As regards this option, Hall, Inc., would report which of the following?

A) A $20,000 realized gain

B) A $20,000 unrealized gain

C) A deferred gain of $19,900

D) Nothing would be reported in the financial statements or the notes thereto.

Using the information above, assume that the price of the WSM shares has risen to $120 per share on March 31, 2011, and the Hall is preparing financial statements for the quarter ending March 31. As regards this option, Hall, Inc., would report which of the following?

A) A $20,000 realized gain

B) A $20,000 unrealized gain

C) A deferred gain of $19,900

D) Nothing would be reported in the financial statements or the notes thereto.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

25

On November 1, 2011, Cahoon Company sold some limited edition art prints to Sitake Company for ¥47,850,000 to be paid on January 1, 2012. The current exchange rate on November 1, 2011, was ¥110=$1, so the total payment at the current exchange rate would be equal to $435,000. Cahoon entered into a forward contract with a large bank to guarantee the number of dollars to be received. According to the terms of the contract, if ¥47,850,000 is worth less than $435,000, the bank will pay Cahoon the difference in cash. Likewise, if ¥47,850,000 is worth more than $435,000, Cahoon must pay the bank the difference in cash. Assuming the exchange rate on December 31, 2011 is ¥115=$1, what amount will Cahoon disclose as the fair value of the forward contract on December 31, 2011 (answers rounded to the nearest dollar)?

A) $0

B) $18,913

C) $20,714

D) $416,087

A) $0

B) $18,913

C) $20,714

D) $416,087

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

26

Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2011. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2011. WSM shares are trading at $100 per share on January 2, 2011, at which time Hall pays $100 for the call option. Assume that the price per share of WSM stock is $120 on April 30, 2011, and that the time value of the option has not changed. In order to settle the option contract, Hall, Inc., would most likely

A) pay Bennett Investment $20,000.

B) purchase the shares of WSM at $100 per share and sell the shares at $120 per share to Bennett.

C) receive $20,000 from Bennett Investment.

D) receive $400 from Bennett Investment.

A) pay Bennett Investment $20,000.

B) purchase the shares of WSM at $100 per share and sell the shares at $120 per share to Bennett.

C) receive $20,000 from Bennett Investment.

D) receive $400 from Bennett Investment.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

27

Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2011. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2011. WSM shares are trading at $100 per share on January 2, 2011, at which time Hall pays $400 for the call option. The $400 paid by Hall, Inc., to Bennett Investment is referred to as the

A) option premium.

B) notional amount.

C) strike price.

D) intrinsic value.

A) option premium.

B) notional amount.

C) strike price.

D) intrinsic value.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

28

Alpha Company purchases a call option to hedge an investment of 20,000 shares of Beta Company stock. The option agreement provides that if the prices of a share of Beta Company stock is greater than $30 on October 25, Alpha receives the difference (multiplied by 20,000 shares). Alternatively, if the price of the stock is less than $30, the option is worthless and will be allowed to expire. Which of the following statements regarding this call option is correct?

A) The call option effectively hedges the investment in the shares of Beta stock.

B) The call option is an option to sell Beta Company stock at a fixed price.

C) The call option represents a speculative option rather than a hedge.

D) Alpha could have purchased a put option or a call option to effectively hedge the investment in the shares of Beta stock.

A) The call option effectively hedges the investment in the shares of Beta stock.

B) The call option is an option to sell Beta Company stock at a fixed price.

C) The call option represents a speculative option rather than a hedge.

D) Alpha could have purchased a put option or a call option to effectively hedge the investment in the shares of Beta stock.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

29

On January 1, 2011, Cougar Company received a two-year $500,000 loan. The loan calls for payments to made at the end of each year based on the prevailing market rate at January 1 of each year. The interest rate at January 1, 2011, was 10 percent. Aggie company also has a two-year $500,000 loan, but Aggie's loan carries a fixed interest rate of 10 percent.

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on January 1, 2012 is 8 percent, what will be Cougar's settlement payment to/from Aggie?

A) $5,000 payment

B) $5,000 receipt

C) $10,000 payment

D) $10,000 receipt

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on January 1, 2012 is 8 percent, what will be Cougar's settlement payment to/from Aggie?

A) $5,000 payment

B) $5,000 receipt

C) $10,000 payment

D) $10,000 receipt

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

30

On March 1, Chow Corporation entered into a firm commitment to purchase specialized equipment from the Gifu Trading Company for ¥80,000,000 on June 1. The exchange rate on March 1 is ¥100 = $1. To reduce the exchange rate risk that could increase the cost of the equipment in U.S. dollars, Chow pays $20,000 for a call option contract. This contract gives Chow the option to purchase ¥80,000,000 at an exchange rate of ¥100 = $1 on June 1. On June 1, the exchange rate is ¥105 = $1. How much did Chow save by purchasing the call option (answers rounded to the nearest dollar)?

A) $20,000

B) $27,619

C) $47,619

D) Chow would have been better off not to have purchased the call option.

A) $20,000

B) $27,619

C) $47,619

D) Chow would have been better off not to have purchased the call option.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

31

On June 18, Edwards Corporation entered into a firm commitment to purchase specialized equipment from the Okazaki Trading Company for ¥80,000,000 on August 20. The exchange rate on June 18 is ¥100 = $1. To reduce the exchange rate risk that could increase the cost of the equipment in U.S. dollars, Edwards pays $12,000 for a call option contract. This contract gives Edwards the option to purchase ¥80,000,000 at an exchange rate of ¥100 = $1 on August 20. On August 20, the exchange rate is ¥93 = $1. How much did Edwards save by purchasing the call option (answers rounded to the nearest dollar)?

A) $12,000

B) $48,215

C) $60,215

D) Edwards would have been better off not to have purchased the call option.

A) $12,000

B) $48,215

C) $60,215

D) Edwards would have been better off not to have purchased the call option.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

32

Landon Construction Co. carries $10,000,000 comprehensive public liability insurance with a $200,000 deductible clause. A suit for personal injury damages was brought against Landon in 2011. Landon's counsel believes it probable that the insurance company will settle out of court for an estimated amount of $550,000. At December 31, 2011, Landon should report an accrued liability of

A) $550,000.

B) $350,000.

C) $200,000.

D) $0.

A) $550,000.

B) $350,000.

C) $200,000.

D) $0.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

33

Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2011. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2011. WSM shares are trading at $100 per share on January 2, 2011, at which time Hall pays $100 for the call option.

Using the information above, the call option would be recorded in the accounts of Hall as

A) an asset.

B) a liability.

C) a gain.

D) would not be recorded in the accounts (memorandum entry only).

Using the information above, the call option would be recorded in the accounts of Hall as

A) an asset.

B) a liability.

C) a gain.

D) would not be recorded in the accounts (memorandum entry only).

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

34

On January 1, 2011, Cougar Company received a two-year $500,000 loan. The loan calls for payments to made at the end of each year based on the prevailing market rate at January 1 of each year. The interest rate at January 1, 2011, was 10 percent. Aggie company also has a two-year $500,000 loan, but Aggie's loan carries a fixed interest rate of 10 percent.

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on December 31, 2011 is 12 percent, what amount will Cougar report as the fair value of the interest rate swap at December 31, 2011 (answers rounded to the nearest dollar)?

A) $0

B) $8,929

C) $10,000

D) $500,000

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on December 31, 2011 is 12 percent, what amount will Cougar report as the fair value of the interest rate swap at December 31, 2011 (answers rounded to the nearest dollar)?

A) $0

B) $8,929

C) $10,000

D) $500,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

35

Hall, Inc., enters into a call option contract with Bennett Investment Co. on January 2, 2011. This contract gives Hall the option to purchase 1,000 shares of WSM stock at $100 per share. The option expires on April 30, 2011. WSM shares are trading at $100 per share on January 2, 2011, at which time Hall pays $100 for the call option.

Using the information above, the 1,000 shares of WSM stock in this contract is referred to as the

A) collateral.

B) notional amount.

C) option premium.

D) derivative.

Using the information above, the 1,000 shares of WSM stock in this contract is referred to as the

A) collateral.

B) notional amount.

C) option premium.

D) derivative.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following is not required under current GAAP for disaggregated information relating to geographic area information?

A) Revenues from external customers from the home country of the firm and from all foreign countries in total.

B) The total of long-lived assets located in the firm's home country and located in foreign countries.

C) Operating profits from external customers from the home country of the firm and from all foreign countries in total.

D) Revenues for any foreign country for which the revenues from that country are material to the firm.

A) Revenues from external customers from the home country of the firm and from all foreign countries in total.

B) The total of long-lived assets located in the firm's home country and located in foreign countries.

C) Operating profits from external customers from the home country of the firm and from all foreign countries in total.

D) Revenues for any foreign country for which the revenues from that country are material to the firm.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

37

On July 1, 2011, Cahoon Company sold some limited edition art prints to Sitake Company for ¥47,850,000 to be paid on September 30 of that year. The current exchange rate on July 1, 2011, was ¥110=$1, so the total payment at the current exchange rate would be equal to $435,000. Cahoon entered into a forward contract with a large bank to guarantee the number of dollars to be received. According to the terms of the contract, if ¥47,850,000 is worth less than $435,000, the bank will pay Cahoon the difference in cash. Likewise, if ¥47,850,000 is worth more than $435,000, Cahoon must pay the bank the difference in cash.

Using the information above and assuming the exchange rate on September 30 is ¥115=$1, what amount will Cahoon pay to, or receive from, the bank (rounded to the nearest dollar)?

A) $18,913 payment

B) $18,913 receipt

C) $20,714 payment

D) $20,714 receipt

Using the information above and assuming the exchange rate on September 30 is ¥115=$1, what amount will Cahoon pay to, or receive from, the bank (rounded to the nearest dollar)?

A) $18,913 payment

B) $18,913 receipt

C) $20,714 payment

D) $20,714 receipt

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

38

Cosmos Corporation sells five different types of products. The company is divided for internal reporting purposes into five different divisions based on these five different product lines. The company should prepare the note disclosure for disaggregated information based upon the

A) five types of products.

B) five different divisions.

C) materiality of each product line based on the revenue or operating profits generated by each product line or the assets utilized by each product line.

D) geographic areas in which the 5 products are sold.

A) five types of products.

B) five different divisions.

C) materiality of each product line based on the revenue or operating profits generated by each product line or the assets utilized by each product line.

D) geographic areas in which the 5 products are sold.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

39

During 2011, Jackson Company became involved in a tax dispute with the IRS. At December 31, 2011, Jackson's tax adviser believed that an unfavorable outcome was probable and a reasonable estimate of additional taxes was $500,000 but could be as much as $650,000. After the 2011 financial statements were issued, Jackson received and accepted an IRS settlement offer of $550,000. What amount of accrued liability would Jackson have reported in its December 31, 2011, balance sheet?

A) $650,000

B) $550,000

C) $500,000

D) $0

A) $650,000

B) $550,000

C) $500,000

D) $0

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

40

On January 1, 2011, Cougar Company received a two-year $500,000 loan. The loan calls for payments to made at the end of each year based on the prevailing market rate at January 1 of each year. The interest rate at January 1, 2011, was 10 percent. Aggie company also has a two-year $500,000 loan, but Aggie's loan carries a fixed interest rate of 10 percent.

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on January 1, 2012, is 12 percent, what will be Cougar's settlement payment to/from Aggie?

A) $5,000 payment

B) $5,000 receipt

C) $10,000 payment

D) $10,000 receipt

Cougar Company does not want to bear the risk that interest rates may increase in year two of the loan. Aggie Company believes that rates may decrease and they would prefer to have variable debt. So the two companies enter into an interest rate swap agreement whereby Aggie agrees to make Cougar's interest payment in 2012 and Cougar likewise agrees to make Aggie's interest payment in 2012. The two companies agree to make settlement payments, for the difference only, on December 31, 2012. If the interest rate on January 1, 2012, is 12 percent, what will be Cougar's settlement payment to/from Aggie?

A) $5,000 payment

B) $5,000 receipt

C) $10,000 payment

D) $10,000 receipt

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

41

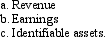

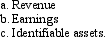

A significant industry segment (for segment reporting purposes) is one which meets any of the three criteria relating to

The percent that is used to measure each of these criteria is the same.

Which of the following is the percent used to measure each of these criteria?

A) 1 percent

B) 5 percent

C) 10 percent

D) 15 percent

The percent that is used to measure each of these criteria is the same.

Which of the following is the percent used to measure each of these criteria?

A) 1 percent

B) 5 percent

C) 10 percent

D) 15 percent

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

42

A truck owned and operated by Abbott Company was involved in an accident with an auto driven by L. Costello on January 12, 2011. Abbott received notice on April 24, 2011, of a lawsuit for $800,000 damages for a personal injury suffered by L. Costello. Abbott's counsel believes it is probable that L. Costello will be successful against the company for an estimated amount in the range between $100,000 and $400,000. No amount within this range is a better estimate of potential damages than any other amount. It is expected that the lawsuit will be adjudicated in the latter part of 2012. What amount of loss should Abbott accrue at December 31, 2011?

A) $400,000

B) $250,000

C) $100,000

D) $800,000

A) $400,000

B) $250,000

C) $100,000

D) $800,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

43

A loss contingency that is remote and cannot be reasonably estimated

A) may be disclosed in a note to the financial statements.

B) must be disclosed in a note to the financial statements.

C) must be reported in the body of the financial statements.

D) is permitted to be reported in the body of the financial statements.

A) may be disclosed in a note to the financial statements.

B) must be disclosed in a note to the financial statements.

C) must be reported in the body of the financial statements.

D) is permitted to be reported in the body of the financial statements.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following contingencies should be accrued in the accounts and reported in the financial statements?

A) The company is forcefully contesting a personal injury lawsuit and a loss is possible and reasonable estimable.

B) An accommodation endorsement involving a remote loss

C) It is probable that a company will receive $50,000 in settlement of a lawsuit.

D) The estimated expenses of a one-year product warranty.

A) The company is forcefully contesting a personal injury lawsuit and a loss is possible and reasonable estimable.

B) An accommodation endorsement involving a remote loss

C) It is probable that a company will receive $50,000 in settlement of a lawsuit.

D) The estimated expenses of a one-year product warranty.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

45

Information obtained prior to the issuance of the current period's financial statements of a company indicates that it is probable that, at the date of the financial statements, a liability will be incurred for obligations related to product warranties on products sold during the current period. During the past three years, product warranty costs have been approximately 1 1/2 percent of annual sales revenue.

An estimated loss contingency should be

A) neither accrued nor disclosed in the financial statements.

B) recognized as an appropriation of retained earnings.

C) accrued in the accounts and reported in the financial statements.

D) disclosed in the financial statements but not accrued.

An estimated loss contingency should be

A) neither accrued nor disclosed in the financial statements.

B) recognized as an appropriation of retained earnings.

C) accrued in the accounts and reported in the financial statements.

D) disclosed in the financial statements but not accrued.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements regarding requirements for segment disclosures is most accurate?

A) Segment disclosures must include most of the items found in financial statements for the entire enterprise.

B) Segment reporting is generally applied in a similar fashion in various companies, since the requirement are detailed and inflexible.

C) Segment reporting requirements are so flexible that firms can often resist disclosing information they would prefer to keep confidential.

D) Segment reporting is not required for any entities; the standards are concerned with determination of segment information if a company wishes to disclose it.

A) Segment disclosures must include most of the items found in financial statements for the entire enterprise.

B) Segment reporting is generally applied in a similar fashion in various companies, since the requirement are detailed and inflexible.

C) Segment reporting requirements are so flexible that firms can often resist disclosing information they would prefer to keep confidential.

D) Segment reporting is not required for any entities; the standards are concerned with determination of segment information if a company wishes to disclose it.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is most likely to require only a note disclosure as a contingency?

A) Cash discounts given for early payment by customers (which are almost always taken)

B) Remote chance of loss from a lawsuit in process

C) Probable claim for an income tax refund

D) Loss from an investment in equity securities that is certain

A) Cash discounts given for early payment by customers (which are almost always taken)

B) Remote chance of loss from a lawsuit in process

C) Probable claim for an income tax refund

D) Loss from an investment in equity securities that is certain

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

48

On January 17, 2011, an explosion occurred at an Orioles Fireworks plant causing extensive property damage to area buildings. Although no claims had yet been asserted against Orioles by March 10, 2011, Orioles' management and counsel concluded that it is reasonably possible Orioles will be responsible for damages and that $2,500,000 would be a reasonable estimate of its liability. Orioles' $10,000,000 comprehensive public liability policy has a $500,000 deductible clause. In Orioles' December 31, 2011, financial statements, which were issued on March 25, 2012, how should this item be reported?

A) As a footnote disclosure indicating the possible loss of $500,000

B) As an accrued liability of $500,000

C) As a footnote disclosure indicating the possible loss of $2,500,000

D) As an accrued liability of $2,500,000

A) As a footnote disclosure indicating the possible loss of $500,000

B) As an accrued liability of $500,000

C) As a footnote disclosure indicating the possible loss of $2,500,000

D) As an accrued liability of $2,500,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

49

Gain contingencies that are remote and can be reasonably estimated

A) must be disclosed in a note to the financial statements.

B) may be disclosed in a note to the financial statements.

C) must be reported in the body of the financial statements.

D) should not be reported or disclosed.

A) must be disclosed in a note to the financial statements.

B) may be disclosed in a note to the financial statements.

C) must be reported in the body of the financial statements.

D) should not be reported or disclosed.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

50

In May 2011, the Marlins Company became involved in litigation. As a result of this litigation, it is probable that Marlins will have to pay $700,000. In July 2011, a competitor commenced a suit against Marlins alleging violation of antitrust laws seeking damages of $1,100,000. Marlins denies the allegations, and the likelihood of Marlins paying any damages is remote. In September 2011, Braves County brought action against Marlins for $900,000 for polluting Lake Tomahawk. It is reasonably possible that Braves County will be successful, but the amount of damages Marlins will have to pay is not reasonably determinable. What amount, if any, should be accrued by a charge to income in 2011?

A) $2,700,000

B) $1,600,000

C) $700,000

D) $0

A) $2,700,000

B) $1,600,000

C) $700,000

D) $0

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is themost likely candidate for a contingent liability that must be accrued?

A) Potential liability for a lawsuit in which the firm is a defendant

B) Property tax payable

C) Potential liability on a product that is still in the planning stages (no items have been sold)

D) Warranty liability

A) Potential liability for a lawsuit in which the firm is a defendant

B) Property tax payable

C) Potential liability on a product that is still in the planning stages (no items have been sold)

D) Warranty liability

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

52

On November 5, 2011, a Timp Rental truck was in an accident with an auto driven by Fred Meyer. Timp Rental received notice on January 12, 2012, of a lawsuit for $700,000 damages for personal injuries suffered by Meyer. Timp Rental's counsel believes it is probable that Meyer will be awarded an estimated amount in the range between $200,000 and $450,000, and that $300,000 is a better estimate of potential liability than any other amount. Timp's accounting year ends on December 31, and the 2011 financial statements were issued on March 2, 2012. What amount of loss should Timp accrue at December 31, 2011?

A) $0

B) $200,000

C) $300,000

D) $450,000

A) $0

B) $200,000

C) $300,000

D) $450,000

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

53

Disclosure usually is not required for

A) contingent gains that are probable and can be reasonably estimated.

B) contingent losses that are reasonable possible and cannot be reasonably estimated.

C) contingent gains that are reasonably possible and cannot be reasonably estimated.

D) contingent losses that are remote and can be reasonably estimated

A) contingent gains that are probable and can be reasonably estimated.

B) contingent losses that are reasonable possible and cannot be reasonably estimated.

C) contingent gains that are reasonably possible and cannot be reasonably estimated.

D) contingent losses that are remote and can be reasonably estimated

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

54

Maxwell Corporation was involved in a lawsuit with the EPA alleging inadequate air pollution control facilities at its Granger plant site during 2008. At December 31, 2011, it appeared probable that the EPA would settle for approximately $150,000. This event should be recognized in 2011 as a(n)

A) extraordinary loss.

B) disclosure of a contingency loss only in a note.

C) should not be disclosed or recognized..

D) loss on the lawsuit (operating expense).

A) extraordinary loss.

B) disclosure of a contingency loss only in a note.

C) should not be disclosed or recognized..

D) loss on the lawsuit (operating expense).

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following liabilities is not contingent?

A) A liability to replace a specific defective television set already returned to the manufacturer

B) A liability to pay pension benefits if a specific employee lives to retirement

C) A liability to pay any adverse judgment for a product liability case currently on appeal

D) A liability to pay for books received by a college bookstore under terms that allow for the return for full refund of any books not sold

A) A liability to replace a specific defective television set already returned to the manufacturer

B) A liability to pay pension benefits if a specific employee lives to retirement

C) A liability to pay any adverse judgment for a product liability case currently on appeal

D) A liability to pay for books received by a college bookstore under terms that allow for the return for full refund of any books not sold

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

56

A contingency must be accrued in the accounts and reported in the financial statements when

A) the amount of the loss can be reliably estimated and it is probable that an asset is impaired or a liability incurred.

B) it is evident that an asset has been impaired or a liability has been incurred even though the amount of the loss cannot be reliably estimated.

C) it is not certain that funds will be available to settle damages that may arise from a pending lawsuit.

D) a loss is expected and its amount is uncertain.

A) the amount of the loss can be reliably estimated and it is probable that an asset is impaired or a liability incurred.

B) it is evident that an asset has been impaired or a liability has been incurred even though the amount of the loss cannot be reliably estimated.

C) it is not certain that funds will be available to settle damages that may arise from a pending lawsuit.

D) a loss is expected and its amount is uncertain.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

57

A company that receives 10 percent or more of its revenue from sales to a single customer must disclose the

A) identity of the customer.

B) identity of the customer and the amount of revenue from that customer.

C) type of revenues earned from that customer only.

D) amount of revenue from that customer only.

A) identity of the customer.

B) identity of the customer and the amount of revenue from that customer.

C) type of revenues earned from that customer only.

D) amount of revenue from that customer only.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

58

Contingent liabilities will or will not become actual liabilities depending on

A) whether they are probable and estimable.

B) the degree of uncertainty.

C) the present condition suggesting a liability.

D) the outcome of a future event.

A) whether they are probable and estimable.

B) the degree of uncertainty.

C) the present condition suggesting a liability.

D) the outcome of a future event.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

59

Reporting in the body of the financial statements is required for

A) loss contingencies that are probable and can be reasonably estimated.

B) gain contingencies that are probable and can be reasonably estimated.

C) loss contingencies that are possible and can be reasonably estimated.

D) all loss contingencies.

A) loss contingencies that are probable and can be reasonably estimated.

B) gain contingencies that are probable and can be reasonably estimated.

C) loss contingencies that are possible and can be reasonably estimated.

D) all loss contingencies.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

60

A truck owned and operated by Abbott Company was involved in an accident with an auto driven by L. Costello on January 12, 2011. Abbott received notice on April 24, 2011, of a lawsuit for $800,000 damages for a personal injury suffered by L. Costello. Abbott's counsel believes it is reasonably possible that L. Costello will be successful against the company for an estimated amount in the range between $100,000 and $400,000. No amount within this range is a better estimate of potential damages than any other amount. It is expected that the lawsuit will be adjudicated in the latter part of 2012. What amount of loss should Abbott accrue at December 31, 2011?

A) $400,000

B) $250,000

C) $100,000

D) $0

A) $400,000

B) $250,000

C) $100,000

D) $0

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following measures is not used to determine whether a subunit of a business is a reportable segment?

A) Revenue

B) Owners' equity

C) Earnings

D) Assets

A) Revenue

B) Owners' equity

C) Earnings

D) Assets

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

62

The reported identifiable assets of a reportable segment exclude which of the following?

A) Segment patents

B) Segment receivables

C) Portion the segment uses of corporate assets used by all segments

D) Allowance for doubtful accounts on segment receivables

A) Segment patents

B) Segment receivables

C) Portion the segment uses of corporate assets used by all segments

D) Allowance for doubtful accounts on segment receivables

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

63

The calculation of a reportable segment's operating income or loss excludes which of the following?

A) Corporate costs allocated to the segment on a reasonable basis

B) Segment sales

C) Segment wage expense

D) Segment income tax expense

A) Corporate costs allocated to the segment on a reasonable basis

B) Segment sales

C) Segment wage expense

D) Segment income tax expense

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

64

Interim income tax expense is based on

A) the interim period's pretax earnings and tax rate applicable in that period.

B) four times the interim period's pretax earnings if the interim period is a quarter.

C) an estimate of the annual tax rate.

D) the average income tax for all previous interim periods and the current interim period.

A) the interim period's pretax earnings and tax rate applicable in that period.

B) four times the interim period's pretax earnings if the interim period is a quarter.

C) an estimate of the annual tax rate.

D) the average income tax for all previous interim periods and the current interim period.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

65

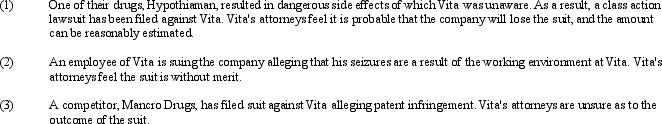

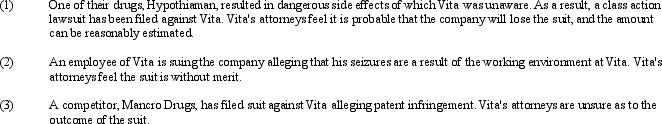

Vita Technologies is involved in cancer research. Vita is involved in a number of lawsuits related to their operations. For each case, indicate the disclosure that should be provided by Vita Technologies in the annual financial statement.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

66

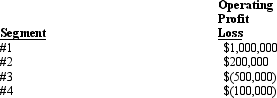

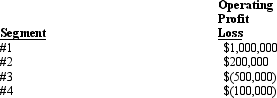

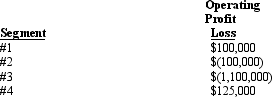

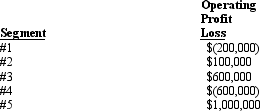

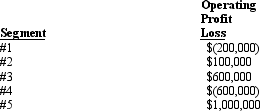

The following segments were identified for an enterprise:

Which of the four segments is a reportable segment?

A) 1 and 2 only

B) 1 and 3 only

C) 1, 2, and 3 only

D) all four

Which of the four segments is a reportable segment?

A) 1 and 2 only

B) 1 and 3 only

C) 1, 2, and 3 only

D) all four

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

67

Quest Company began operations five years ago. The company produces and sells software. The company's primary market is in the United States, where 60% of sales occur. Ten percent of the company's sales occur in Japan and 30% of sales occur in Europe. Foreign sales are denominated in local currencies. Major software purchases may be paid over a one-year period.

Quest Company has obtained its long-term financing from U.S., Japanese, and German banks. Approximately one-half of the loans from U.S. banks are variable-rate loans, with the remainder of the company's loans being fixed-rate obligations.

Quest Company has seen dramatic fluctuations in earnings during its five years of existence.

Identify the types of risk faced by Quest Company.

Quest Company has obtained its long-term financing from U.S., Japanese, and German banks. Approximately one-half of the loans from U.S. banks are variable-rate loans, with the remainder of the company's loans being fixed-rate obligations.

Quest Company has seen dramatic fluctuations in earnings during its five years of existence.

Identify the types of risk faced by Quest Company.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

68

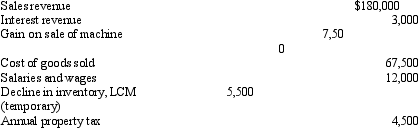

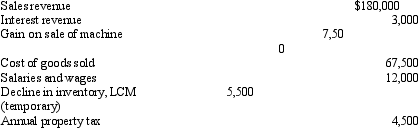

Marshall Company reported the following data with regard to its first quarter of operations:

The expected annual income tax rate is 40 percent. Marshall should report net income on the first quarter interim financial statements of

A) $0.

B) $61,425.

C) $63,225.

D) $65,925.

The expected annual income tax rate is 40 percent. Marshall should report net income on the first quarter interim financial statements of

A) $0.

B) $61,425.

C) $63,225.

D) $65,925.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

69

A company identified four industry segments as reportable out of a total of eight subunits of the company based on the identifiable asset criterion. Total company sales excluding intersegment sales are $2,000,000 for the year, and the sum of sales for the four identified segments is $1,300,000.

Given these facts, the company

A) need not report on a segment basis this period.

B) must disclose only the four subunits as segments.

C) must identify one or more additional segments for segmental disclosure purposes.

D) treat all subunits of the firm as reportable.

Given these facts, the company

A) need not report on a segment basis this period.

B) must disclose only the four subunits as segments.

C) must identify one or more additional segments for segmental disclosure purposes.

D) treat all subunits of the firm as reportable.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

70

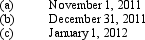

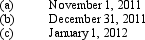

Stiggins Fitness Enterprises uses soybeans to make one of their nutritional supplement products. Stiggins anticipates a need of 500,000 pounds of soybeans in January of 2012. On November 1, 2011, Stiggins purchased a call option for 500,000 pounds of soybeans on January 1, 2012, at a price of $0.40 per pound, which is the market price on November 1. Stiggins paid $1,200 for the call option and designated this option as a hedge against price fluctuations for their January purchase of soybeans. On December 31, 2011, and January 1, 2012, the prevailing market price for soybeans is $0.45 per pound. On January 1, 2012, Stiggins purchased 500,000 pounds of soybeans.

Make the necessary entries on Stiggins's books at

Make the necessary entries on Stiggins's books at

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

71

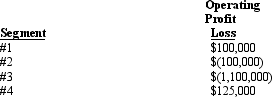

The following segments were identified for an enterprise:

Which of the four segments is a reportable segment?

A) 3 only

B) 3 and 4 only

C) 4 only

D) None are reportable segments

Which of the four segments is a reportable segment?

A) 3 only

B) 3 and 4 only

C) 4 only

D) None are reportable segments

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

72

The sum of reportable segment sales must be a least equal to what percent of total company sales?

A) 100%

B) 75%

C) 50%

D) 65%

A) 100%

B) 75%

C) 50%

D) 65%

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

73

On January 1, 2011, Eden Ventures, Inc., received a three-year, $1 million loan with interest payments due at the end of each year and the principal to be repaid on December 31, 2013. The interest rate for the first year is the prevailing market rate of 9 percent, and the rate each succeeding year will be equal to the prevailing market rate on January 1 of that year. Eden also entered into an interest rate swap agreement related to this loan. Under the terms of the swap agreement, in the years 2012 and 2013, Eden will receive a swap payment based on the principal amount of $1 million. If the January 1 interest rate is greater than 9 percent, Eden will receive a swap payment for the difference; and if the January 1 interest rate is less than 9 percent, Eden will make a swap payment for the difference. The swap payments are made on December 31 of each year. On January 1, 2012, the interest rate is 8 percent, and on January 1, 2013, the interest rate is 12 percent.

Make all the journal entries necessary on Eden's books at the dates shown below. For purposes of estimating future swap payments, assume that the current interest rate is the best forecast of the future interest rate (round all entries to the nearest dollar).

Make all the journal entries necessary on Eden's books at the dates shown below. For purposes of estimating future swap payments, assume that the current interest rate is the best forecast of the future interest rate (round all entries to the nearest dollar).

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

74

How is income tax expense for the third quarter interim period computed?

A) The annual rate multiplied by the third quarter pretax earnings.

B) The estimated tax for the first three quarters based on an annual rate, less a similar estimate for the first two quarters.

C) The rate applicable during the third quarter multiplied by four times the third quarter pretax earnings.

D) One-half of the difference between total estimated annual income tax expense and the income tax for the first two quarters.

A) The annual rate multiplied by the third quarter pretax earnings.

B) The estimated tax for the first three quarters based on an annual rate, less a similar estimate for the first two quarters.

C) The rate applicable during the third quarter multiplied by four times the third quarter pretax earnings.

D) One-half of the difference between total estimated annual income tax expense and the income tax for the first two quarters.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

75

Yokochan Bakeries specializes in making cakes, cookies, and other pastries out of rice flour which they grind themselves. Yokochan anticipates purchasing 40,000 pounds of rice in January 2012. On November 1, 2011, Yokochan entered into a futures contract with Sagara Growers to purchase 40,000 pounds of rice on January 1, 2012, at $0.50 per pound. On December 31, 2011, and January 1, 2012, the prevailing market price for rice is $0.55 per pound. Yokochan purchases the rice and settles the futures contract on January 1, 2012.

Make the necessary entries on Yokochan's books at

Make the necessary entries on Yokochan's books at

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following neednot be disclosed on a segmental basis for a subunit identified as a reportable segment?

A) Sales

B) Net assets

C) Identifiable assets

D) Total depreciation, depletion, and amortization

A) Sales

B) Net assets

C) Identifiable assets

D) Total depreciation, depletion, and amortization

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following statements is correct regarding APB Opinion No. 28, "Interim Financial Reporting," and IAS No. 34, "Interim Financial Reporting"?

A) Both pronouncements view each reporting interval as a separate accounting period.

B) Only IAS No. 34 views each reporting interval as a separate accounting period.

C) Only APB Opinion No. 28 views each reporting interval as a separate accounting period.

D) Only IAS No. 34 views each interim period as an integral part of each annual period.

A) Both pronouncements view each reporting interval as a separate accounting period.

B) Only IAS No. 34 views each reporting interval as a separate accounting period.

C) Only APB Opinion No. 28 views each reporting interval as a separate accounting period.

D) Only IAS No. 34 views each interim period as an integral part of each annual period.

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

78

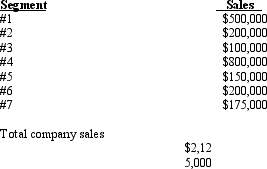

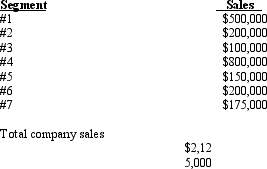

The following segments were identified for an enterprise:

Which of the five segments is a reportable segment?

A) All are reportable segments

B) All but 1 and 2

C) 3 and 5 only

D) All but 2

Which of the five segments is a reportable segment?

A) All are reportable segments

B) All but 1 and 2

C) 3 and 5 only

D) All but 2

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck

79

The following segments have been identified for an enterprise, along with each segments sales. No segment qualifies on any other criterion for determining reportable segments except possibly for sales. Sales for each segment, and the total for the enterprise follow:

What is the minimum number of reportable segments for this firm?

A) 2

B) 3

C) 4

D) 5

What is the minimum number of reportable segments for this firm?

A) 2

B) 3

C) 4

D) 5

Unlock Deck

Unlock for access to all 79 flashcards in this deck.

Unlock Deck

k this deck