Deck 18: Earnings Per Share

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/78

Play

Full screen (f)

Deck 18: Earnings Per Share

1

For purposes of computing the weighted-average number of shares outstanding during the year, a midyear event that must be treated as occurring at the beginning of the year is the

A) declaration and issuance of a stock dividend.

B) purchase of treasury stock.

C) sale of additional common stock.

D) issuance of stock warrants.

A) declaration and issuance of a stock dividend.

B) purchase of treasury stock.

C) sale of additional common stock.

D) issuance of stock warrants.

A

2

When computing diluted earnings per share, stock options are

A) recognized only if they are dilutive.

B) recognized only if they are antidilutive.

C) recognized only if they were exercised.

D) ignored.

A) recognized only if they are dilutive.

B) recognized only if they are antidilutive.

C) recognized only if they were exercised.

D) ignored.

A

3

The EPS computation that is forward-looking and based on assumptions about future transactions is

A) diluted EPS.

B) basic EPS.

C) continuing operations EPS.

D) extraordinary EPS.

A) diluted EPS.

B) basic EPS.

C) continuing operations EPS.

D) extraordinary EPS.

A

4

When using the if-converted method to compute diluted earnings per share, convertible securities should be

A) included only if antidilutive.

B) included only if dilutive.

C) included whether dilutive or not.

D) not included.

A) included only if antidilutive.

B) included only if dilutive.

C) included whether dilutive or not.

D) not included.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

5

When computing dilutive EPS, the treasury stock method can be used for all of the following except

A) convertible preferred stock.

B) stock warrants.

C) stock options.

D) stock rights.

A) convertible preferred stock.

B) stock warrants.

C) stock options.

D) stock rights.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

6

The if-converted method of computing EPS data assumes conversion of convertible securities at the

A) beginning of the earliest period reported (or at time of issuance, if later).

B) beginning of the earliest period reported (regardless of time of issuance).

C) middle of the earliest period reported (regardless of time of issuance).

D) ending of the earliest period reported (regardless of time of issuance).

A) beginning of the earliest period reported (or at time of issuance, if later).

B) beginning of the earliest period reported (regardless of time of issuance).

C) middle of the earliest period reported (regardless of time of issuance).

D) ending of the earliest period reported (regardless of time of issuance).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

7

In calculating diluted earnings per share, which of the following should not be considered?

A) The weighted average number of common shares outstanding

B) The amount of dividends declared on cumulative preferred shares

C) The amount of cash dividends declared on common shares

D) The number of common shares resulting from the assumed conversion of debentures outstanding

A) The weighted average number of common shares outstanding

B) The amount of dividends declared on cumulative preferred shares

C) The amount of cash dividends declared on common shares

D) The number of common shares resulting from the assumed conversion of debentures outstanding

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

8

The main purpose of reporting diluted earnings per share is to

A) provide a comparison figure for debt holders.

B) indicate earnings shareholders will receive in future periods.

C) distinguish between companies with a complex capital structure and companies with a simple capital structure.

D) show the maximum possible dilution of earnings.

A) provide a comparison figure for debt holders.

B) indicate earnings shareholders will receive in future periods.

C) distinguish between companies with a complex capital structure and companies with a simple capital structure.

D) show the maximum possible dilution of earnings.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

9

Under current GAAP, a company with a complex capital structure and potential earnings per share dilution must present

A) primary and fully diluted earnings per share.

B) basic and diluted earnings per share.

C) basic and primary earnings per share.

D) basic earnings per share and cash flow per share.

A) primary and fully diluted earnings per share.

B) basic and diluted earnings per share.

C) basic and primary earnings per share.

D) basic earnings per share and cash flow per share.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

10

Earnings per share disclosures are required only for

A) companies with complex capital structures.

B) companies that change their capital structures during the reporting period.

C) public companies.

D) private companies.

A) companies with complex capital structures.

B) companies that change their capital structures during the reporting period.

C) public companies.

D) private companies.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

11

In applying the treasury stock method of computing diluted earnings per share, when is it appropriate to use the average market price of common stock during the year as the assumed repurchase price?

A) Always

B) Never

C) When the average market price is higher than the exercise price

D) When the average market price is lower than the exercise price

A) Always

B) Never

C) When the average market price is higher than the exercise price

D) When the average market price is lower than the exercise price

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

12

In determining earnings per share, interest expense, net of applicable income taxes, on convertible debt which is dilutive should be

A) ignored for diluted earnings per share.

B) added back to net income for diluted earnings per share.

C) deducted from net income for diluted earnings per share.

D) none of these.

A) ignored for diluted earnings per share.

B) added back to net income for diluted earnings per share.

C) deducted from net income for diluted earnings per share.

D) none of these.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

13

Earnings per share information should be reported for all of the following except

A) continuing operations.

B) extraordinary gain.

C) net income.

D) cash flows from operating activities.

A) continuing operations.

B) extraordinary gain.

C) net income.

D) cash flows from operating activities.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

14

When computing diluted EPS for a company with a complex capital structure, what is the denominator in the computation?

A) Number of common shares outstanding at year-end

B) Weighted-average number of common shares outstanding

C) Weighted-average number of common shares outstanding plus all other potentially antidilutive securities

D) Weighted-average number of common shares outstanding plus all other potentially dilutive securities

A) Number of common shares outstanding at year-end

B) Weighted-average number of common shares outstanding

C) Weighted-average number of common shares outstanding plus all other potentially antidilutive securities

D) Weighted-average number of common shares outstanding plus all other potentially dilutive securities

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

15

For a company having several different issues of convertible securities and/or stock options and warrants, the FASB requires selection of the combination of securities producing

A) the lowest possible earnings per share.

B) the highest possible earnings per share.

C) the earnings per share figure midway between the lowest possible and the highest possible earnings per share.

D) any earnings per share figure between the lowest possible and the highest possible earnings per share.

A) the lowest possible earnings per share.

B) the highest possible earnings per share.

C) the earnings per share figure midway between the lowest possible and the highest possible earnings per share.

D) any earnings per share figure between the lowest possible and the highest possible earnings per share.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

16

When computing earnings per share on common stock, dividends on cumulative, nonconvertible preferred stock should be

A) deducted from net income only if the dividends were declared or paid in the current period.

B) deducted from net income regardless of whether the dividends were not paid or declared in the period.

C) deducted from net income only if net income is greater than the dividends.

D) ignored.

A) deducted from net income only if the dividends were declared or paid in the current period.

B) deducted from net income regardless of whether the dividends were not paid or declared in the period.

C) deducted from net income only if net income is greater than the dividends.

D) ignored.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

17

Where in the financial statements should basic and complex EPS figures for income from continuing operations be reported?

A) In the accompanying notes

B) In management's discussion and analysis

C) On the income statement

D) On the statement of cash flows

A) In the accompanying notes

B) In management's discussion and analysis

C) On the income statement

D) On the statement of cash flows

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

18

Of the following, select the incorrect statement concerning earnings per share.

A) During periods when all income is paid out as dividends, earnings per share and dividends per share under a simple capital structure would be identical.

B) Under a simple capital structure, no adjustment to shares outstanding is necessary for a stock split on the last day of the fiscal period.

C) During a period, changes in stock issued or reacquired by a company may affect earnings per share.

D) During a loss period, the amount of loss attributed to each share of common stock should be computed.

A) During periods when all income is paid out as dividends, earnings per share and dividends per share under a simple capital structure would be identical.

B) Under a simple capital structure, no adjustment to shares outstanding is necessary for a stock split on the last day of the fiscal period.

C) During a period, changes in stock issued or reacquired by a company may affect earnings per share.

D) During a loss period, the amount of loss attributed to each share of common stock should be computed.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

19

In computing the earnings per share of common stock, noncumulative preferred dividends not declared should be

A) deducted from the net income for the year.

B) added to the net income for the year.

C) ignored.

D) deducted from the net income for the year, net of tax.

A) deducted from the net income for the year.

B) added to the net income for the year.

C) ignored.

D) deducted from the net income for the year, net of tax.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

20

What is the correct treatment of a stock dividend issued in mid-year when computing the weighted-average number of common shares outstanding for earnings per share purposes?

A) The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period.

B) The stock dividend should be included in the weighted-average number of common shares outstanding only if the additional shares result in a decrease of 3 percent or more in earnings per share.

C) The stock dividend should be weighted as if the additional shares were issued at the beginning of the year.

D) The stock dividend should be ignored since no additional capital was received.

A) The stock dividend should be weighted by the length of time that the additional number of shares are outstanding during the period.

B) The stock dividend should be included in the weighted-average number of common shares outstanding only if the additional shares result in a decrease of 3 percent or more in earnings per share.

C) The stock dividend should be weighted as if the additional shares were issued at the beginning of the year.

D) The stock dividend should be ignored since no additional capital was received.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

21

For companies with a complex capital structure, a convertible security is potentially dilutive if its incremental EPS is

A) greater than basic EPS after considering any stock options, rights, and warrants.

B) less than basic EPS after considering any stock options, rights, and warrants.

C) equal to basic EPS after considering any stock options, rights, and warrants.

D) less than 1.00 after considering any stock options, rights, and warrants.

A) greater than basic EPS after considering any stock options, rights, and warrants.

B) less than basic EPS after considering any stock options, rights, and warrants.

C) equal to basic EPS after considering any stock options, rights, and warrants.

D) less than 1.00 after considering any stock options, rights, and warrants.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

22

During its fiscal year, Richards' Distributing had net income of $100,000 (no extraordinary items) and 50,000 shares of common stock and 10,000 shares of preferred stock outstanding. Richards declared and paid dividends of $.50 per share to common and $6.00 per share to preferred. The preferred stock is convertible into common stock on a share-for-share basis. For the year, Richards Distributing should report diluted earnings (loss) per share of

A) $(0.80).

B) $1.00.

C) $1.67.

D) $2.67.

A) $(0.80).

B) $1.00.

C) $1.67.

D) $2.67.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

23

Landrover, Inc. had 150,000 shares of common stock issued and outstanding at December 31, 2010. On July 1, 2011, an additional 25,000 shares of common stock were issued for cash. Landrover also had unexercised stock options to purchase 20,000 shares of common stock at $15 per share outstanding at the beginning and end of 2011. The market price of Landrover's common stock was $20 throughout 2011. What number of shares should be used in computing diluted earnings per share for the year ended December 31, 2011?

A) 182,500

B) 180,000

C) 177,500

D) 167,500

A) 182,500

B) 180,000

C) 177,500

D) 167,500

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

24

On December 31, 2010, Superior, Inc. had 600,000 shares of common stock issued and outstanding. Superior issued a 10 percent stock dividend on July 1, 2011. On October 1, 2011, Superior reacquired 48,000 shares of its common stock and recorded the purchase using the cost method of accounting for treasury stock. What number of shares should be used in computing basic earnings per share for the year ended December 31, 2011?

A) 612,000

B) 618,000

C) 648,000

D) 660,000

A) 612,000

B) 618,000

C) 648,000

D) 660,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

25

At December 31, 2010, Dayplanner Inc. had 250,000 shares of common stock outstanding. On October 1, 2011, an additional 60,000 shares of common stock were issued for cash. Dayplanner also had 2,000,000 of 8 percent convertible bonds outstanding at December 31, 2011, which are convertible into 50,000 shares of common stock. The bonds are dilutive in the 2011 earnings per share computation. No bonds were issued or converted into common stock during 2011. What is the number of shares that should be used in computing diluted earnings per share for the year ended December 31, 2011?

A) 265,000

B) 300,000

C) 310,000

D) 315,000

A) 265,000

B) 300,000

C) 310,000

D) 315,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

26

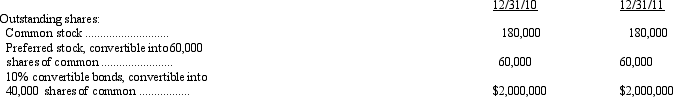

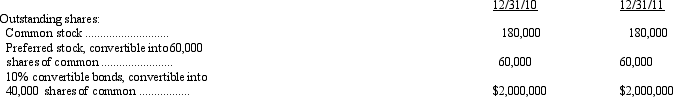

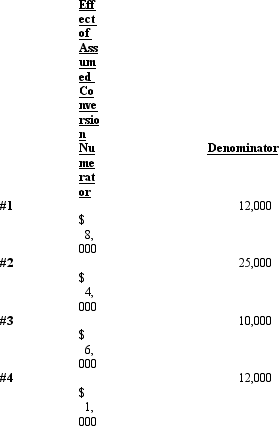

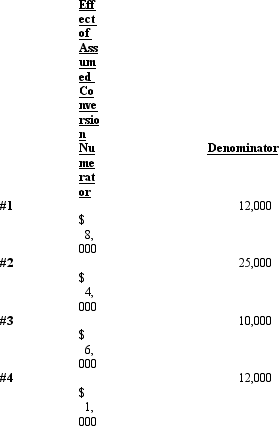

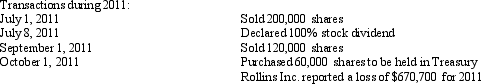

The following information relates to the capital structure of Metcalf Corp.:

During 2011 Metcalf paid $90,000 in dividends on the preferred stock. Metcalf's net income for 2011 was $1,960,000 and the income tax rate was 40 percent. For the year ended December 31, 2011, the diluted earnings per share is

A) $7.29.

B) $7.43.

C) $8.17.

D) $8.29.

During 2011 Metcalf paid $90,000 in dividends on the preferred stock. Metcalf's net income for 2011 was $1,960,000 and the income tax rate was 40 percent. For the year ended December 31, 2011, the diluted earnings per share is

A) $7.29.

B) $7.43.

C) $8.17.

D) $8.29.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

27

At December 31, 2011, the Murdock Company had 150,000 shares of common stock issued and outstanding. On April 1, 2012, an additional 30,000 shares of common stock were issued. Murdock's net income for the year ended December 31, 2012, was $517,500. During 2012, Murdock declared and paid $300,000 in cash dividends on its nonconvertible preferred stock. The basic earnings per common share, rounded to the nearest penny, for the year ended December 31, 2012, should be

A) $3.00.

B) $2.00.

C) $1.45.

D) $1.26.

A) $3.00.

B) $2.00.

C) $1.45.

D) $1.26.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

28

Zacor Incorporated has 2,500,000 shares of common stock outstanding on December 31, 2010. An additional 500,000 shares of common stock were issued April 1, 2011, and 250,000 more on July 1, 2011. On October 1, 2011, Zacor issued 5,000, $1,000 face value, 7 percent convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common stock in 2011. What is the number of shares to be used in computing basic earnings per share and diluted earnings per share, respectively?

A) 2,875,000 and 2,925,000

B) 2,875,000 and 3,075,000

C) 3,000,000 and 3,050,000

D) 3,000,000 and 3,200,000

A) 2,875,000 and 2,925,000

B) 2,875,000 and 3,075,000

C) 3,000,000 and 3,050,000

D) 3,000,000 and 3,200,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

29

The JVB Corporation had 200,000 shares of common stock and 10,000 shares of cumulative, $6 preferred stock outstanding during 2011. The preferred stock is convertible at the rate of three shares of common per share of preferred. For 2011, the company had a $60,000 net loss from operations and declared no dividends. JVB should report 2011 diluted loss per share of (rounded to the nearest cent)

A) $(0.30).

B) $(0.52).

C) $(0.58).

D) $(0.60).

A) $(0.30).

B) $(0.52).

C) $(0.58).

D) $(0.60).

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

30

The Thomas Company's net income for the year ended December 31 was $30,000. During the year, Thomas declared and paid $3,000 in cash dividends on preferred stock and $5,250 in cash dividends on common stock. At December 31, 36,000 shares of common stock were outstanding, 30,000 of which had been issued and outstanding throughout the year and 6,000 of which were issued on July 1. There were no other common stock transactions during the year, and there is no potential dilution of earnings per share. What should be the year's basic earnings per common share of Thomas, rounded to the nearest penny?

A) $0.66

B) $0.75

C) $0.82

D) $0.91

A) $0.66

B) $0.75

C) $0.82

D) $0.91

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

31

An entity that reports a discontinued operation or an extraordinary item shall present basic and diluted earnings per share amounts for those line items

A) only on the face of the income statement.

B) only in the notes to the financial statements.

C) either on the face of the income statement or in the notes to the financial statements.

D) only if management chooses to do so as these amounts are not required to be disclosed either in the financial statements or the notes thereto.

A) only on the face of the income statement.

B) only in the notes to the financial statements.

C) either on the face of the income statement or in the notes to the financial statements.

D) only if management chooses to do so as these amounts are not required to be disclosed either in the financial statements or the notes thereto.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

32

On January 2, 2011, Worley Co. issued at par $50,000 of 4 percent bonds convertible, in total, into 5,000 shares of Worley's common stock. No bonds were converted during 2011. Throughout 2011 Worley had 5,000 shares of common stock outstanding. Worley's 2011 net income was $5,000. Worley's income tax rate is 40 percent. No potentially dilutive securities other than the convertible bonds were outstanding during 2011. Worley's diluted earnings per share for 2011 would be

A) $0.58.

B) $0.62.

C) $0.70.

D) $1.16.

A) $0.58.

B) $0.62.

C) $0.70.

D) $1.16.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

33

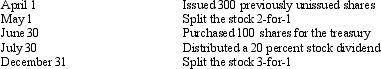

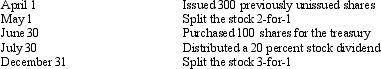

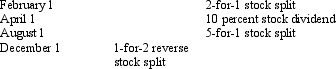

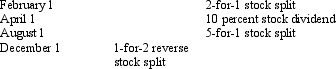

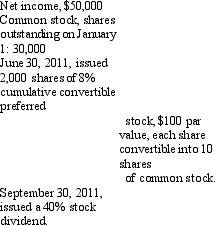

Shoemaker Company had 1,000 common shares issued and outstanding at January 1. During the year, Shoemaker also had the common stock transactions listed below.

Given this information, what is the weighted-average number of shares that Shoemaker should use for earnings per share purposes?

A) 2,880

B) 8,460

C) 8,820

D) 9,720

Given this information, what is the weighted-average number of shares that Shoemaker should use for earnings per share purposes?

A) 2,880

B) 8,460

C) 8,820

D) 9,720

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

34

At December 31, 2011 and 2010, Lapham Corp. had 200,000 shares of common stock and 20,000 shares of 5 percent, $100 par value cumulative preferred stock outstanding. No dividends were declared on either the preferred or common stock in 2010 or 2011. Net income for 2011 was $1,000,000. For 2011, basic earnings per common share amounted to

A) $5.00.

B) $4.75.

C) $4.50.

D) $4.00.

A) $5.00.

B) $4.75.

C) $4.50.

D) $4.00.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

35

Glendale Enterprises had 200,000 shares of common stock issued and outstanding at December 31, 2010. On July 1, 2011, Glendale issued a 10 percent stock dividend. Unexercised stock options to purchase 40,000 shares of common stock (adjusted for the 2011 stock dividend) at $20 per share were outstanding at the beginning and end of 2011. The market price of Glendale's common stock (which was not affected by the stock dividend) was $25 per share during 2011. Net income for the year ended December 31, 2011, was $1,100,000. What should be Glendale's 2011 diluted earnings per common share, rounded to the nearest penny?

A) $4.23

B) $4.82

C) $5.00

D) $5.05

A) $4.23

B) $4.82

C) $5.00

D) $5.05

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

36

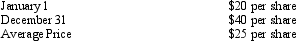

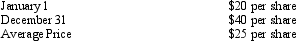

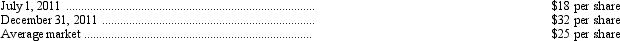

The 2011 net income of Atwater Inc. was $200,000 and 100,000 shares of its common stock were outstanding during the entire year. In addition, there were outstanding options to purchase 10,000 shares of common stock at $10 per share. These options were granted in 2008 and none had been exercised by December 31, 2011. Market prices of Atwater's common stock during 2011 were

The amount that should be shown as Atwater's diluted earnings per share for 2011 (rounded to the nearest cent) is

A) $2.00.

B) $1.95.

C) $1.89.

D) $1.86.

The amount that should be shown as Atwater's diluted earnings per share for 2011 (rounded to the nearest cent) is

A) $2.00.

B) $1.95.

C) $1.89.

D) $1.86.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

37

In calculating earning per share, stock options warrants, and rights are

A) always dilutive.

B) never dilutive.

C) dilutive if the exercise price is less than the average market price of the common stock.

D) dilutive if the exercise price is more than the average market price of the common stock.

A) always dilutive.

B) never dilutive.

C) dilutive if the exercise price is less than the average market price of the common stock.

D) dilutive if the exercise price is more than the average market price of the common stock.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

38

Warrants exercisable at $20 each to obtain 20,000 shares of common stock were outstanding during a period when the average and year-end market price of the common stock was $25. Application of the treasury stock method for the assumed exercise of these warrants in computing diluted earnings per share will increase the weighted-average number of outstanding common shares by

A) 20,000.

B) 16,667.

C) 16,000.

D) 4,000.

A) 20,000.

B) 16,667.

C) 16,000.

D) 4,000.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

39

At December 31, 2010, the Roberts Company had 700,000 shares of common stock outstanding. On September 1, 2011, an additional 300,000 shares of common stock were issued. In addition, Roberts had $20,000,000 of 8 percent convertible bonds outstanding at December 31, 2010, which are convertible into 400,000 shares of common stock. No bonds were converted into common stock in 2011. The net income for the year ended December 31, 2011, was $6,000,000. Assuming the income tax rate was 40 percent, what should be the diluted earnings per share for the year ended December 31, 2011?

A) $5.00

B) $5.53

C) $5.80

D) $8.30

A) $5.00

B) $5.53

C) $5.80

D) $8.30

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

40

Bay Area Supplies had 60,000 shares of common stock outstanding at January 1. On May 1, Bay Areas Supplies issued 31,500 shares of common stock. Outstanding all year were 30,000 shares of nonconvertible preferred stock on which a dividend of $4 per share was paid in December. Net income for the year was $290,100. Bay Area Supplies should report basic earnings per share for the year of

A) $1.86.

B) $2.10.

C) $2.84.

D) $3.17.

A) $1.86.

B) $2.10.

C) $2.84.

D) $3.17.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

41

Datatec, Inc., had 400,000 shares of $20 par common stock and 40,000 shares of $100 par, 6% cumulative, convertible preferred stock outstanding for the entire year ended December 31, 2011. Each share of the preferred stock is convertible into 5 shares of common stock. Datatec's net income for 2011 was $1,680,000. For the year ended December 31, 2011, the diluted earnings per share is

A) $2.40.

B) $2.80.

C) $3.60.

D) $4.20.

A) $2.40.

B) $2.80.

C) $3.60.

D) $4.20.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

42

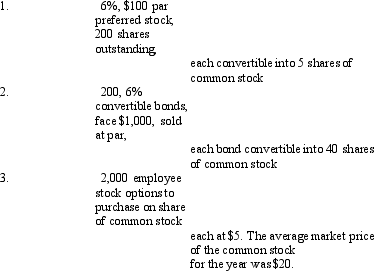

Assume a company had net income of $20,000 and 8,000 shares of common stock outstanding the entire year. Also assume there were two potentially dilutive issues outstanding for the entire year:

What is diluted earnings per share for this company for the year?

A) $2.50

B) $2.40

C) $2.11

D) $2.00

What is diluted earnings per share for this company for the year?

A) $2.50

B) $2.40

C) $2.11

D) $2.00

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

43

Franklin Corporation had 100 shares of common stock issued and outstanding at December 31, 2010. On July 1, 2011, Franklin issued a 10 percent stock dividend. Unexercised stock options to purchase 20 shares of common stock (adjusted for the 2011 stock dividend) at $20 per share were outstanding at the beginning and end of 2011. The average market price of Franklin's common stock (which was not affected by the stock dividend) was $25 per share during 2011. The ending market price was $40. Net income for the year ended December 31, 2011, was $2,200.

What was Franklin's 2011 basic earnings per share, rounded to the nearest cent?

A) $19.30

B) $20.00

C) $20.20

D) $20.96

What was Franklin's 2011 basic earnings per share, rounded to the nearest cent?

A) $19.30

B) $20.00

C) $20.20

D) $20.96

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

44

At December 31, 2010, Lefton, Inc. had 600,000 shares of common stock outstanding. On April 1, 2011, an additional 180,000 shares of common stock were issued for cash. Lefton also had $5,000,000 of 8% convertible bonds outstanding at December 31, 2010, which are convertible into 150,000 shares of common stock. The bonds are dilutive in the 2011 EPS computation. No bonds were issued or converted into common stock during 2011.

Using the information above, what is the number of shares that should be used in computing basic earnings per share for 2011?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Using the information above, what is the number of shares that should be used in computing basic earnings per share for 2011?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

45

On December 31, 2010, Feterik Company had 7,000 shares of common stock issued and outstanding. On April 1, 2011, an additional 1,000 shares of common stock were issued and on July 1, 500 more shares were issued. On October 1, 2011, Feterik issued 10, $1,000 maturity value, 8% convertible bonds. Each bond is convertible into 40 shares of common stock. No bonds were converted into common stock in 2011. Assuming there are no antidilutive securities, what is the number of shares Feterik should use to compute diluted earnings per share for the year ended December 31, 2011?

A) 7,950

B) 8,100

C) 8,150

D) 8,400

A) 7,950

B) 8,100

C) 8,150

D) 8,400

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

46

At December 31, 2010, Garrison Company had 400 shares of common stock outstanding. On October 1, 2011, an additional 100 shares of common stock were issued. In addition, Garrison had $40,000 of 8 percent convertible bonds outstanding at December 31, 2011, which are convertible in 225 shares of common stock. No bonds were converted into common stock in 2011. Net income for the year ended December 31, 2011, was $14,000. Assuming an income tax rate of 50%, the basic earnings per share for the year ended December 31, 2011, would be

A) $24.00

B) $26.48

C) $28.00

D) $32.95

A) $24.00

B) $26.48

C) $28.00

D) $32.95

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

47

A company already has calculated its basic earnings per share (EPS). In determining diluted earnings per share, the annual dividend on convertible cumulative preferred stock which is dilutive should be

A) added back to the number of basic EPS whether declared or not.

B) deducted from the numerator of basic EPS only if declared.

C) added back to the numerator of basic EPS only if declared.

D) deducted from the numerator of basic EPS whether declared or not.

A) added back to the number of basic EPS whether declared or not.

B) deducted from the numerator of basic EPS only if declared.

C) added back to the numerator of basic EPS only if declared.

D) deducted from the numerator of basic EPS whether declared or not.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

48

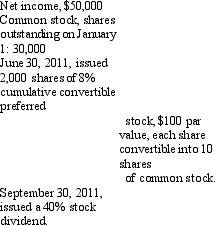

The following information applies to the next three questions:

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2010?

A) The stock options are antidilutive and should not be included either in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 95 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares.

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2010?

A) The stock options are antidilutive and should not be included either in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 95 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

49

Andrews Corporation began business on January 1, 2011. Due to difficulties in beginning operations, the company issued 30 shares of common stock (par $10) on January 1, 2011, to the organizers. Fifteen additional shares were also sold on that date. The following also occurred during the year 2011:

The weighted average number of shares outstanding for 2011 was

A) 64.08 shares.

B) 146.25 shares.

C) 180.00 shares.

D) 247.50 shares.

The weighted average number of shares outstanding for 2011 was

A) 64.08 shares.

B) 146.25 shares.

C) 180.00 shares.

D) 247.50 shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

50

The following information applies to the next three questions:

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2011?

A) The stock options are antidilutive and should not be included in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 105 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares.

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in the earnings per share calculation for the year ending December 31, 2011?

A) The stock options are antidilutive and should not be included in basic or diluted earnings per share.

B) The stock options are dilutive and should be included in diluted earnings per share in the amount of 105 shares.

C) The stock options are dilutive and should be included in diluted earnings per share in the amount of 2,000 shares.

D) The stock options are dilutive and should be included in diluted earnings per share in the amount of 400 shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

51

The following information applies to the next three questions:

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in earnings per share calculations for the year ending December 31, 2009?

A) The stock options are antidilutive and should not be included either in basic and diluted earnings per share.

B) The stock options are dilutive and should be included both in basic and diluted earnings per share.

C) The stock options are dilutive and should be included both in basic and diluted earnings per share in the amount of 400 shares.

D) The stock options are dilutive and should be included only in diluted earnings per share in the amount of 400 shares.

James Corporation currently has stock rights outstanding for 2,000 common shares. The exercise price of these shares is $20. The options were issued in January of 2009. The average market price of the related common stock during the year 2009 was $25. The average market price of the related common stock during 2010 was $21 and during 2011 was $19. The company's fiscal year ends on December 31 of each year.

How should these stock rights be treated in earnings per share calculations for the year ending December 31, 2009?

A) The stock options are antidilutive and should not be included either in basic and diluted earnings per share.

B) The stock options are dilutive and should be included both in basic and diluted earnings per share.

C) The stock options are dilutive and should be included both in basic and diluted earnings per share in the amount of 400 shares.

D) The stock options are dilutive and should be included only in diluted earnings per share in the amount of 400 shares.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

52

When a company with a complex capital structure has a loss from continuing operations and potentially dilutive securities, the calculation of earning per share (EPS) results in

A) simple EPS (no potentially dilutive securities are included in the calculation).

B) no EPS being reported.

C) EPS being reported, using the same calculation of dilutive EPS as would be used if net income were positive.

D) EPS being reported, using securities in the calculation of dilutive EPS that would be anti-dilutive if income were positive.

A) simple EPS (no potentially dilutive securities are included in the calculation).

B) no EPS being reported.

C) EPS being reported, using the same calculation of dilutive EPS as would be used if net income were positive.

D) EPS being reported, using securities in the calculation of dilutive EPS that would be anti-dilutive if income were positive.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

53

In computing earnings per share, convertible preferred stock may increase the number of shares outstanding if it is

A) dilutive and nonconvertible.

B) dilutive and convertible.

C) antidilutive and nonconvertible.

D) antidilutive and convertible.

A) dilutive and nonconvertible.

B) dilutive and convertible.

C) antidilutive and nonconvertible.

D) antidilutive and convertible.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

54

At December 31, 2010, Benjamin Company had 700 shares of common stock outstanding. On September 1, 2011, an additional 300 shares of common stock were issued. In addition, Benjamin had $20,000 of 8 percent convertible bonds outstanding at December 31, 2010, which are convertible into 400 shares of common stock. No bonds were converted into common stock in 2011. Net income for the year ended December 31,2011, was $6,000. Assuming an income tax rate of 50 percent what would be the company's diluted earnings per share for the year ended December 31, 2011?

A) $7.50

B) $5.67

C) $5.00

D) $4.33

A) $7.50

B) $5.67

C) $5.00

D) $4.33

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

55

Basic earnings per share represents the amount of earnings attributable to

A) all common stock and dilutive securities.

B) common stock, preferred stock, and all dilutive securities.

C) each share of common stock outstanding, and any non-conditional conversions and exercises.

D) each share of common stock, and options or warrants which convert to common stock.

A) all common stock and dilutive securities.

B) common stock, preferred stock, and all dilutive securities.

C) each share of common stock outstanding, and any non-conditional conversions and exercises.

D) each share of common stock, and options or warrants which convert to common stock.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

56

Franklin Company had 100 shares of common stock issued and outstanding at December 31, 2010. On July 1, 2011, Ferris issued a 10 percent stock dividend. Unexercised stock options to purchase 20 shares of common stock (adjusted for the 2011 stock dividend) at $20 per share were outstanding at the beginning and end of 2011. The average market price of Franklin's common stock (which was not affected by the stock dividend) was $25 per share during 2011. The ending market price was $40. Net income for the year ended December 31, 2011, was $2,200. What was Franklin's 2011 diluted earnings per share, rounded to the nearest cent?

A) $19.30

B) $20.00

C) $20.20

D) $18.33

A) $19.30

B) $20.00

C) $20.20

D) $18.33

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

57

At December 31, 2010, Lefton, Inc. had 600,000 shares of common stock outstanding. On April 1, 2011, an additional 180,000 shares of common stock were issued for cash. Lefton also had $5,000,000 of 8% convertible bonds outstanding at December 31, 2010, which are convertible into 150,000 shares of common stock. The bonds are dilutive in the 2011 EPS computation. No bonds were issued or converted into common stock during 2011.

Using the information above, what is the number of shares that should be used in computing diluted earnings per share for 2011?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Using the information above, what is the number of shares that should be used in computing diluted earnings per share for 2011?

A) 735,000

B) 780,000

C) 885,000

D) 910,000

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

58

What would be the effect on book value per share and earnings per share if a corporation purchased its own shares in the open market at a price greater than the book value per share?

A) Increase both book value per share and earnings per share

B) Decrease both book value per share and earnings per share

C) Decrease book value per share and increase earnings per share

D) No effect on book value but increase earnings per share

A) Increase both book value per share and earnings per share

B) Decrease both book value per share and earnings per share

C) Decrease book value per share and increase earnings per share

D) No effect on book value but increase earnings per share

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

59

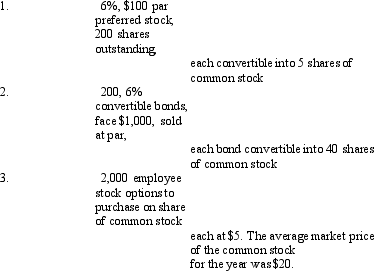

A company with a 40% tax rate had 50,000 shares of common stock and the following three potentially dilutive issues outstanding for the entire year:

What is the correct ordering (ranking) of the dilutive issues for determining their inclusion into diluted earnings per share?

A) 1, 2, 3

B) 3, 1, 2

C) 3, 2, 1

D) 2, 1, 3

What is the correct ordering (ranking) of the dilutive issues for determining their inclusion into diluted earnings per share?

A) 1, 2, 3

B) 3, 1, 2

C) 3, 2, 1

D) 2, 1, 3

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following is correct regarding earnings per share (EPS)?

A) If preferred stock is outstanding, dividends declared on the preferred stock are always deducted from net income in calculating EPS.

B) EPS can never be negative.

C) If income from continuing operations is less than zero, potentially dilutive securities are anti-dilutive.

D) All issues of convertible to common stock must be included in the calculation of diluted EPS.

A) If preferred stock is outstanding, dividends declared on the preferred stock are always deducted from net income in calculating EPS.

B) EPS can never be negative.

C) If income from continuing operations is less than zero, potentially dilutive securities are anti-dilutive.

D) All issues of convertible to common stock must be included in the calculation of diluted EPS.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

61

Statement of Financial Accounting Standards No. 128, "Earnings Per Share," requires that earnings per share figures be presented only by companies with publicly held common stock or potential common stock.

List arguments for and against the exclusion of nonpublic companies from the requirement of reporting earnings per share.

List arguments for and against the exclusion of nonpublic companies from the requirement of reporting earnings per share.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

62

During all of 2011 Dawson Manufacturing Company had 950,000 shares of common stock outstanding. On June 30, 2011, the company issued 10,000 7 percent convertible bonds at par. The maturity value of each bond is $1,000. Each bond is convertible into 20 shares of common stock. None were converted during 2011.

Dawson also had 60,000 stock warrants outstanding for all of 2011. The option price is $10 per share. The market price of the common stock was $40 on December 31, 2011, and the average market price for 2011 was $30.

Dawson reported a net income of $3,650,000 for 2011. Assume the company had a 40 percent income tax rate.

Dawson also had 60,000 stock warrants outstanding for all of 2011. The option price is $10 per share. The market price of the common stock was $40 on December 31, 2011, and the average market price for 2011 was $30.

Dawson reported a net income of $3,650,000 for 2011. Assume the company had a 40 percent income tax rate.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

63

The following information relates to the Simplex Company for 2011:

What is diluted earnings per share?

A) $1.00

B) $0.89

C) $0.81

D) $0.76

What is diluted earnings per share?

A) $1.00

B) $0.89

C) $0.81

D) $0.76

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

64

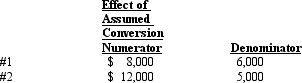

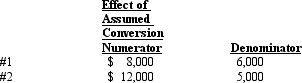

A company earned $20,000 in 2011 and had 20,000 shares of common stock outstanding the entire year. The following four potentially dilutive securities were also outstanding for the entire year. The numerator and denominator effects of the issues are as indicated:

What is diluted EPS?

A) $0.44

B) $0.32

C) $1.00

D) $0.81

What is diluted EPS?

A) $0.44

B) $0.32

C) $1.00

D) $0.81

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

65

At December 31, 2010, General Corporation had 400 shares of common stock outstanding. On October 1, 2011, an additional 100 shares of common stock were issued. In addition, General Corp. had $40,000 of 8 percent convertible bonds outstanding at December 31, 2010, which are convertible into 225 shares of common stock. No bonds were converted into common stock in 2011. Net income for the year ending December 31, 2011, was $14,000. Assuming the income tax rate was 50 percent, the diluted earnings per share for the year ended December 31, 2011, should be

A) $24.00.

B) $26.48.

C) $28.00.

D) $32.96.

A) $24.00.

B) $26.48.

C) $28.00.

D) $32.96.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

66

Which combination is the correct statement regarding disclosure requirements for earnings per share?

A) Only the EPS figure for net income must be presented and it must appear on the face of the income statement.

B) Income from continuing operations and net income may be presented on the face of the income statement or in the notes.

C) Income from continuing operations and net income are required to be presented on the face of the income statement; presentation of EPS amounts for extraordinary items and discontinued operations is optional.

D) Income from continuing operations and net income are both required to be presented on the face of the income statement; presentation of EPS amounts for extraordinary items and discontinued operations may be presented on the face of the income statement or in the notes.

A) Only the EPS figure for net income must be presented and it must appear on the face of the income statement.

B) Income from continuing operations and net income may be presented on the face of the income statement or in the notes.

C) Income from continuing operations and net income are required to be presented on the face of the income statement; presentation of EPS amounts for extraordinary items and discontinued operations is optional.

D) Income from continuing operations and net income are both required to be presented on the face of the income statement; presentation of EPS amounts for extraordinary items and discontinued operations may be presented on the face of the income statement or in the notes.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

67

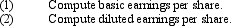

During 2011, Wright Corp. had outstanding 125,000 shares of common stock and 7,500 shares of noncumulative, 8 percent, $50 par preferred stock. Each preferred share is convertible into 8 shares of common stock. In 2011, net income was $231,500.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

68

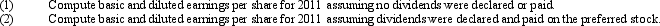

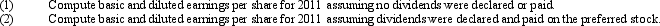

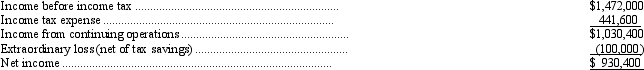

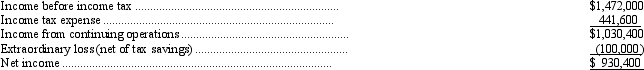

The income statement of Micro Computers, Inc. showed the following information on December 31, 2011.

Compute earnings per share figures for common stock under the assumption that Micro Computer Inc. has

Compute earnings per share figures for common stock under the assumption that Micro Computer Inc. has

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

69

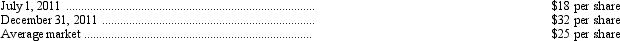

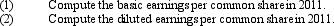

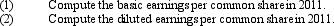

On December 31, 2011, Masters Inc. had outstanding 180,000 shares of common stock. Net income for 2011 was $285,000. Outstanding options (granted July 1, 2011) to purchase 15,000 shares of common stock at $20 per share had not been exercised by December 31, 2011. During 2011, market prices for the common stock were:

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

70

Which of the following is correct regarding the effect that dilutive convertible bonds have on the earnings per share computation?

A) The number of shares the bonds would convert to is added to the denominator; interest, net of tax, is subtracted from the numerator.

B) The number of shares the bonds would convert to is added to the denominator; interest net of tax is added to the numerator.

C) The number of shares the bonds would convert to is subtracted from the denominator; interest, net of tax, is subtracted from the numerator.

D) The number of shares the bonds would convert to is subtracted from the denominator; interest, net of tax, is added to the numerator.

A) The number of shares the bonds would convert to is added to the denominator; interest, net of tax, is subtracted from the numerator.

B) The number of shares the bonds would convert to is added to the denominator; interest net of tax is added to the numerator.

C) The number of shares the bonds would convert to is subtracted from the denominator; interest, net of tax, is subtracted from the numerator.

D) The number of shares the bonds would convert to is subtracted from the denominator; interest, net of tax, is added to the numerator.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

71

You are an independent CPA and have just acquired a new client,

A. Dunn Manufacturing Company. The president of the company recently read an article advising a firm's management team to seek to maximize the long-run value of the firm's stock. The article mentioned profit maximization, earnings per share, and the role of these two factors in stock price maximization. The president wants your advice on how the choice of inventory cost flow methods (e.g., FIFO vs. LIFO) relates to profit maximization, earnings per share, and stock price maximization.

A. Dunn Manufacturing Company. The president of the company recently read an article advising a firm's management team to seek to maximize the long-run value of the firm's stock. The article mentioned profit maximization, earnings per share, and the role of these two factors in stock price maximization. The president wants your advice on how the choice of inventory cost flow methods (e.g., FIFO vs. LIFO) relates to profit maximization, earnings per share, and stock price maximization.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

72

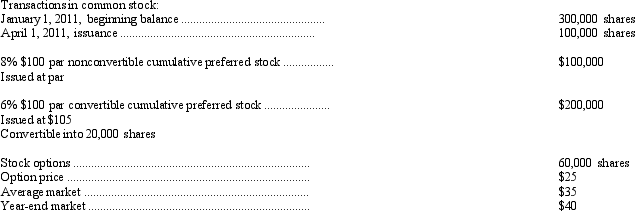

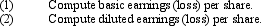

The Stanley Corp. provides the following data for 2011:

The net income for 2011 is $2,300,000. The company's tax rate is 30 percent. No conversions or options were exercised during 2011.

The net income for 2011 is $2,300,000. The company's tax rate is 30 percent. No conversions or options were exercised during 2011.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

73

If convertible bonds are dilutive, the interest expense added back to the numerator in calculating diluted earnings per share is

A) net of tax, and includes discount and premium amortization.

B) net of tax, but does not include discount and premium amortization.

C) not net of tax, but includes discount and premium amortization.

D) not net of tax, and does not include discount or premium amortization.

A) net of tax, and includes discount and premium amortization.

B) net of tax, but does not include discount and premium amortization.

C) not net of tax, but includes discount and premium amortization.

D) not net of tax, and does not include discount or premium amortization.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

74

Southern Corporation has 20,000 shares of common stock and 5,000 shares of preferred stock outstanding during 2011. Southern reported net income of $60,000 for 2011. Each share of preferred stock is convertible into two shares of common stock. The preferred stock is entitled to a noncumulative annual dividend of $5 per share. After the common stock has been paid a dividend of $1 per share, the preferred stock participates in any additional dividends on a 2:3 per share ratio with the common. For 2011, the common shareholders have been paid $25,000 (or $1.25 per share), and the preferred shareholders have been paid $25,000 (or $5.00 per share).

Required:

Calculate basic earnings per share under the two-class method for 2011.

Required:

Calculate basic earnings per share under the two-class method for 2011.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

75

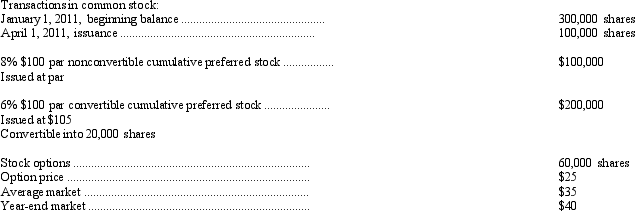

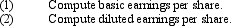

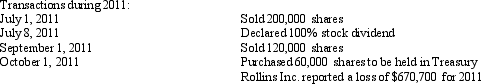

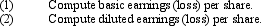

At December 31, 2010, Rollins Inc. had 400,000 shares of common stock outstanding. The company also had 40,000 shares of $7 convertible preferred stock. Each share is convertible into 4 shares of common stock. (Dividends were declared and paid.)

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

76

The price-earnings ratio frequently is used by analysts and investors for evaluating stock prices because it relates the earnings of the business to the current market price of the stock. The ratio is computed by dividing the market price per share by the earnings per share before extraordinary items.

Explain how the price-earnings ratio should be interpreted, including any problems associated with the interpretation of the ratio.

Explain how the price-earnings ratio should be interpreted, including any problems associated with the interpretation of the ratio.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

77

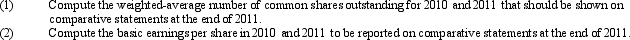

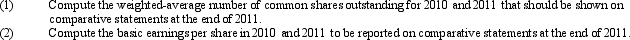

On December 31, 2009, Jamfest Travel Inc. had 450,000 shares of no-par common stock issued and outstanding. All shares were sold for $7.50. On June 30, 2010, the firm issued an additional 135,000 shares for $7 per share. The 2010 income was $319,200. On September 1, 2009, a 15 percent stock dividend was issued to all common shareholders. On October 1, 2011, 60,000 shares were reacquired as treasury shares. Net income in 2011 was $278,063.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck

78

During 2011, the Ellis Corporation had 370,000 shares of $20 par common stock outstanding. On January 1, 2011, 2,000, 8 percent bonds were issued with a maturity value of $1,000 each. To enhance the bond sale, the company offered a conversion of 50 shares of common stock for each bond at the option of the purchaser. Net income for 2011 was $464,000. The income tax rate was 30 percent. Compute the diluted earnings per share of common stock.

Unlock Deck

Unlock for access to all 78 flashcards in this deck.

Unlock Deck

k this deck