Deck 14: Monetary Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/93

Play

Full screen (f)

Deck 14: Monetary Policy

1

Who are the members of the Bank of Canada's Governing Council?

A)the Ministers of Finance from each province as well as the Federal Minister of Finance

B)the Bank's Governor, Senior Deputy Governor, and four Deputy Governors

C)the Minister of Finance, the Governor, and four Deputy Governors

D)the Bank's Governor, Senior Deputy Governor, and four Deputy governors who are appointed by the Prime Minister to represent the public interest

E)the Prime Minister, the Minister of Finance, and the Bank's Governor

A)the Ministers of Finance from each province as well as the Federal Minister of Finance

B)the Bank's Governor, Senior Deputy Governor, and four Deputy Governors

C)the Minister of Finance, the Governor, and four Deputy Governors

D)the Bank's Governor, Senior Deputy Governor, and four Deputy governors who are appointed by the Prime Minister to represent the public interest

E)the Prime Minister, the Minister of Finance, and the Bank's Governor

the Bank's Governor, Senior Deputy Governor, and four Deputy Governors

2

As the sole issuer of Canadian money, the Bank of Canada can set any one of three variables:

A)the rate of inflation, the interest rate, and the natural unemployment rate.

B)the monetary base, the exchange rate, and the short- term interest rate.

C)the monetary base, the interest rate, and the natural unemployment rate.

D)the inflation rate, the natural unemployment rate, and the real economic growth rate.

E)the exchange rate, the interest rate, and the inflation rate.

A)the rate of inflation, the interest rate, and the natural unemployment rate.

B)the monetary base, the exchange rate, and the short- term interest rate.

C)the monetary base, the interest rate, and the natural unemployment rate.

D)the inflation rate, the natural unemployment rate, and the real economic growth rate.

E)the exchange rate, the interest rate, and the inflation rate.

the monetary base, the exchange rate, and the short- term interest rate.

3

The objective of the Bank of Canada's monetary policy is

A)to keep the overnight loans rate below 2 percent a year and the unemployment rate at its natural rate.

B)to keep the labour force participation rate above 80 percent, the inflation rate below 2 percent a year, and the exchange rate fluctuating by less than 3 percent a year.

C)to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 percent a year, and long- term interest rates below 4 percent a year.

D)to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 percent a year, and long- term real GDP growth above 4 percent a year.

E)to control the quantity of money and interest rates to avoid inflation and when possible prevent excessive swings in real GDP growth and unemployment.

A)to keep the overnight loans rate below 2 percent a year and the unemployment rate at its natural rate.

B)to keep the labour force participation rate above 80 percent, the inflation rate below 2 percent a year, and the exchange rate fluctuating by less than 3 percent a year.

C)to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 percent a year, and long- term interest rates below 4 percent a year.

D)to keep the unemployment rate below 5 percent, the inflation rate between 1 and 3 percent a year, and long- term real GDP growth above 4 percent a year.

E)to control the quantity of money and interest rates to avoid inflation and when possible prevent excessive swings in real GDP growth and unemployment.

to control the quantity of money and interest rates to avoid inflation and when possible prevent excessive swings in real GDP growth and unemployment.

4

How is consultation between the Bank of Canada and the Government of Canada on monetary policy arranged?

A)The Bank of Canada Act requires regular consultations between the Governor and the Minister of Finance.

B)Consultations are arranged at the discretion of the Minister of Finance.

C)Consultations are arranged at the discretion of the Governor of the Bank of Canada.

D)No consultation is required or needed.

E)Consultations are arranged through the Parliamentary Committee on Finance.

A)The Bank of Canada Act requires regular consultations between the Governor and the Minister of Finance.

B)Consultations are arranged at the discretion of the Minister of Finance.

C)Consultations are arranged at the discretion of the Governor of the Bank of Canada.

D)No consultation is required or needed.

E)Consultations are arranged through the Parliamentary Committee on Finance.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

5

One criticism of the Bank of Canada's focus on an inflation control target is that

A)the Bank pays too much attention to unemployment and real GDP growth and not enough to inflation control.

B)if inflation falls below the target range, a recession will result.

C)it makes setting expectations of inflation difficult.

D)the Bank rarely achieves its target.

E)if inflation edges above the target range, the Bank decreases aggregate demand and could create a recession.

A)the Bank pays too much attention to unemployment and real GDP growth and not enough to inflation control.

B)if inflation falls below the target range, a recession will result.

C)it makes setting expectations of inflation difficult.

D)the Bank rarely achieves its target.

E)if inflation edges above the target range, the Bank decreases aggregate demand and could create a recession.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following benefits flow from the application of an inflation- control target?

A)The monetary authorities can change the target range whenever they feel it is appropriate.

B)If actual inflation exceeds the target range, the Bank of Canada can induce a recession to correct the matter.

C)People can make decisions with an understanding that inflation rates will remain relatively low.

D)Financial market traders have a clearer understanding of the Bank of Canada's intentions.

E)Both C and D

A)The monetary authorities can change the target range whenever they feel it is appropriate.

B)If actual inflation exceeds the target range, the Bank of Canada can induce a recession to correct the matter.

C)People can make decisions with an understanding that inflation rates will remain relatively low.

D)Financial market traders have a clearer understanding of the Bank of Canada's intentions.

E)Both C and D

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

7

Choose the statement that is incorrect.

A)The actual path of the CPI was on trend from 1997 through 2011.

B)The Bank of Canada and the Government of Canada agree that the inflation- control target range will be 1 percent to 3 percent.

C)From 2001 through 2007, the core CPI inflation rate was below 1 percent a year.

D)Since 2011, the CPI has moved below the 2 percent trend line.

E)Between 1997 and 2017, the core inflation rate has a bias to be below 2 percent a year.

A)The actual path of the CPI was on trend from 1997 through 2011.

B)The Bank of Canada and the Government of Canada agree that the inflation- control target range will be 1 percent to 3 percent.

C)From 2001 through 2007, the core CPI inflation rate was below 1 percent a year.

D)Since 2011, the CPI has moved below the 2 percent trend line.

E)Between 1997 and 2017, the core inflation rate has a bias to be below 2 percent a year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following issues is a concern that critics express about the use of an inflation- control target?

A)The policy control rests in the hands of civil servants rather than in the hands of elected officials.

B)Monetary policy tends to be sensitive to the state of employment while focusing on inflation control targets.

C)It encourages a focus on real GDP growth at the expense of employment and of inflation.

D)It encourages a focus on inflation at the expense of employment and real GDP growth.

E)The policy control rests in the hands of elected officials rather than in the hands of civil servants.

A)The policy control rests in the hands of civil servants rather than in the hands of elected officials.

B)Monetary policy tends to be sensitive to the state of employment while focusing on inflation control targets.

C)It encourages a focus on real GDP growth at the expense of employment and of inflation.

D)It encourages a focus on inflation at the expense of employment and real GDP growth.

E)The policy control rests in the hands of elected officials rather than in the hands of civil servants.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

9

What is the overnight loans rate?

A)the percentage change in the volume of loans that take place overnight

B)the interest rate on loans that the big banks make to each other

C)the interest rate that the Bank of Canada pays when it buys securities from chartered banks

D)the volume of loans that take place during the night

E)the interest rate that the Bank of Canada charges chartered banks

A)the percentage change in the volume of loans that take place overnight

B)the interest rate on loans that the big banks make to each other

C)the interest rate that the Bank of Canada pays when it buys securities from chartered banks

D)the volume of loans that take place during the night

E)the interest rate that the Bank of Canada charges chartered banks

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

10

How can the Bank of Canada use the bank rate to regulate the overnight loans rate?

A)The bank rate is set at the settlement balances rate plus 0.25 percentage points.

B)The bank rate is set at 0.25 percentage points below the settlement balances rate, which is used to determine the overnight loans rate.

C)The bank rate is set at the target overnight rate plus 0.25 percentage points.

D)The overnight loans rate is set at 25 basis points above the bank rate.

E)The overnight loans rate is set at a quarter percentage point above the bank rate, which in turn is set by the Bank of Canada.

A)The bank rate is set at the settlement balances rate plus 0.25 percentage points.

B)The bank rate is set at 0.25 percentage points below the settlement balances rate, which is used to determine the overnight loans rate.

C)The bank rate is set at the target overnight rate plus 0.25 percentage points.

D)The overnight loans rate is set at 25 basis points above the bank rate.

E)The overnight loans rate is set at a quarter percentage point above the bank rate, which in turn is set by the Bank of Canada.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

11

The settlement balances rate is the

A)proportion of outstanding loans from banks that are resolved.

B)interest rate paid to banks on their reserves held at the Bank of Canada.

C)interest rate that the Bank of Canada charges the big banks on loans.

D)ratio of the value securities sold by the Bank of Canada to securities outstanding.

E)proportion of overnight inter- bank loans that are resolved.

A)proportion of outstanding loans from banks that are resolved.

B)interest rate paid to banks on their reserves held at the Bank of Canada.

C)interest rate that the Bank of Canada charges the big banks on loans.

D)ratio of the value securities sold by the Bank of Canada to securities outstanding.

E)proportion of overnight inter- bank loans that are resolved.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

12

The operating band is

A)the target inflation rate plus or minus a quarter of a percentage point.

B)the interest rate that is established through an open market operation.

C)the target overnight interest rate plus or minus 25 basis points.

D)a half percentage point range in the target inflation rate.

E)the range between the lending rate and the borrowing rate.

A)the target inflation rate plus or minus a quarter of a percentage point.

B)the interest rate that is established through an open market operation.

C)the target overnight interest rate plus or minus 25 basis points.

D)a half percentage point range in the target inflation rate.

E)the range between the lending rate and the borrowing rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

13

The two parts of the inflation- control target are that the inflation- control target range will be _______ percent a year, and policy will aim at keeping the trend of inflation at _______ percent a year.

A)0 to 2; 1

B)2 to 4; 3

C)1 to 3; 2

D)- 1 to 1; 0

E)3 to 5; 4

A)0 to 2; 1

B)2 to 4; 3

C)1 to 3; 2

D)- 1 to 1; 0

E)3 to 5; 4

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

14

Why does the Bank of Canada pay close attention to the core inflation measures in addition to the overall CPI inflation rate?

A)The core inflation measures include taxes, while the overall CPI rate does not.

B)The core inflation measures are more volatile and therefore a better predictor of trend inflation.

C)The core inflation measures have a lower average value and therefore makes the Bank look better.

D)The core inflation measures provide a better view of the underlying inflation trend and better predict future CPI inflation.

E)The core inflation measures include eight volatile prices and are therefore more likely to stay within the target band.

A)The core inflation measures include taxes, while the overall CPI rate does not.

B)The core inflation measures are more volatile and therefore a better predictor of trend inflation.

C)The core inflation measures have a lower average value and therefore makes the Bank look better.

D)The core inflation measures provide a better view of the underlying inflation trend and better predict future CPI inflation.

E)The core inflation measures include eight volatile prices and are therefore more likely to stay within the target band.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

15

How is responsibility for monetary policy set forth in Canada?

A)The Canadian Government administers monetary policy through the office of the Minister of Finance.

B)The Prime Minister bears ultimate responsibility for monetary policy.

C)The Bank of Canada administers monetary policy as directed by the Minister of Finance.

D)The Bank of Canada Act places responsibility for the conduct of monetary policy on the Bank's Governing Council.

E)Both B and D

A)The Canadian Government administers monetary policy through the office of the Minister of Finance.

B)The Prime Minister bears ultimate responsibility for monetary policy.

C)The Bank of Canada administers monetary policy as directed by the Minister of Finance.

D)The Bank of Canada Act places responsibility for the conduct of monetary policy on the Bank's Governing Council.

E)Both B and D

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

16

The current Governor of the Bank of Canada is

A)Ben Bernanke.

B)Stephen Poloz

C)David Dodge.

D)Paul Martin.

E)Stephen Harper.

A)Ben Bernanke.

B)Stephen Poloz

C)David Dodge.

D)Paul Martin.

E)Stephen Harper.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

17

Choose the statement that is incorrect.

A)The last time the Bank of Canada created a recession was at the beginning of the 1990s when it was faced with the threat of ongoing double- digit inflation.

B)The Bank of Canada's monetary policy is sensitive to the state of employment while maintaining its focus on achieving its inflation target.

C)The Bank of Canada's strategy of inflation rate targeting that keeps the inflation rate low and stable makes the maximum possible contribution towards achieving full employment and sustained economic growth.

D)The inflation- control target uses the Consumer Price Index as the measure of inflation.

E)The Bank of Canada's strategy of inflation rate targeting has resulted in an unemployment rate that is 0.3 percent per year below the natural unemployment rate on average.

A)The last time the Bank of Canada created a recession was at the beginning of the 1990s when it was faced with the threat of ongoing double- digit inflation.

B)The Bank of Canada's monetary policy is sensitive to the state of employment while maintaining its focus on achieving its inflation target.

C)The Bank of Canada's strategy of inflation rate targeting that keeps the inflation rate low and stable makes the maximum possible contribution towards achieving full employment and sustained economic growth.

D)The inflation- control target uses the Consumer Price Index as the measure of inflation.

E)The Bank of Canada's strategy of inflation rate targeting has resulted in an unemployment rate that is 0.3 percent per year below the natural unemployment rate on average.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

18

25 basis points is

A)a quarter of the Bank of Canada's target inflation rate.

B)the spread between the savings rate and the lending rate.

C)the spread between the bank rate and the settlement balances rate.

D)the gap by which real GDP exceeds potential GDP.

E)a quarter of a percentage point.

A)a quarter of the Bank of Canada's target inflation rate.

B)the spread between the savings rate and the lending rate.

C)the spread between the bank rate and the settlement balances rate.

D)the gap by which real GDP exceeds potential GDP.

E)a quarter of a percentage point.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

19

Use the information below to answer the following questions.

Fact 14.1.1 Inflation Control Target Renewal

The 2016 inflation control target agreement between the Government of Canada and the Bank of Canada runs to the end of 20 Source: Bank of Canada, November 2016

Refer to Fact 14.1.1.Choose the statement that is incorrect.

A)It is important to renew the agreement because the target provides an anchor for low inflation expectations.

B)It is important to renew the agreement because knowing that the Bank of Canada is striving to reach the target makes the short- run output- inflation tradeoff as favourable as possible.

C)Obstacles to the renewal of the agreement may occur because some critics argue that by focusing on inflation, the Bank sometimes permits real GDP growth to suffer.

D)Obstacles to the renewal of the agreement may occur because some critics argue that by focusing on inflation, the Bank sometimes permits the unemployment rate to rise.

E)It is important to renew the agreement because with the agreement the inflation rate will always remain between 1 and 3 percent a year.

Fact 14.1.1 Inflation Control Target Renewal

The 2016 inflation control target agreement between the Government of Canada and the Bank of Canada runs to the end of 20 Source: Bank of Canada, November 2016

Refer to Fact 14.1.1.Choose the statement that is incorrect.

A)It is important to renew the agreement because the target provides an anchor for low inflation expectations.

B)It is important to renew the agreement because knowing that the Bank of Canada is striving to reach the target makes the short- run output- inflation tradeoff as favourable as possible.

C)Obstacles to the renewal of the agreement may occur because some critics argue that by focusing on inflation, the Bank sometimes permits real GDP growth to suffer.

D)Obstacles to the renewal of the agreement may occur because some critics argue that by focusing on inflation, the Bank sometimes permits the unemployment rate to rise.

E)It is important to renew the agreement because with the agreement the inflation rate will always remain between 1 and 3 percent a year.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

20

Use the information below to answer the following questions.

Fact 14.1.1 Inflation Control Target Renewal

The 2016 inflation control target agreement between the Government of Canada and the Bank of Canada runs to the end of 20 Source: Bank of Canada, November 2016

Refer to Fact 14.1.1.In the inflation control agreement, the Government of Canada and the Bank of Canada agree to all of the following except that

A)the inflation target will continue to be 2 percent.

B)if the CPI becomes too volatile, in the future the target will be defined in terms of the 12- month rate of change in the core CPI.

C)the target will continue to be defined in terms of the 12- month rate of change in the total CPI.

D)the inflation- control range is 1 percent to 3 percent a year.

E)the agreement will run until December 31, 2016.

Fact 14.1.1 Inflation Control Target Renewal

The 2016 inflation control target agreement between the Government of Canada and the Bank of Canada runs to the end of 20 Source: Bank of Canada, November 2016

Refer to Fact 14.1.1.In the inflation control agreement, the Government of Canada and the Bank of Canada agree to all of the following except that

A)the inflation target will continue to be 2 percent.

B)if the CPI becomes too volatile, in the future the target will be defined in terms of the 12- month rate of change in the core CPI.

C)the target will continue to be defined in terms of the 12- month rate of change in the total CPI.

D)the inflation- control range is 1 percent to 3 percent a year.

E)the agreement will run until December 31, 2016.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

21

The bank rate is the interest rate

A)banks pay on term deposits.

B)banks charge their very best loan customers.

C)received for holding Government of Canada Treasury Bills.

D)the Bank of Canada charges when it lends reserves to the big banks.

E)the Bank of Canada pays on reserves held by banks.

A)banks pay on term deposits.

B)banks charge their very best loan customers.

C)received for holding Government of Canada Treasury Bills.

D)the Bank of Canada charges when it lends reserves to the big banks.

E)the Bank of Canada pays on reserves held by banks.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

22

The sale of government securities by the Bank of Canada

A)increases bank reserves.

B)increases the banks' loans to the public.

C)increases the quantity of money.

D)decreases bank reserves.

E)lowers interest rates.

A)increases bank reserves.

B)increases the banks' loans to the public.

C)increases the quantity of money.

D)decreases bank reserves.

E)lowers interest rates.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

23

Which of the following quotations correctly describes the impact of monetary policy on the economy?

A)"The extra money pumped into the economy by the central bank is creating less exports."

B)"House sales are down lots, due to the higher money growth."

C)"Businesses are investing more, now that monetary policy has become less expansionary."

D)"The extra money pumped into the economy by the central bank is creating more jobs."

E)"The tightening of money growth is helping sell goods abroad."

A)"The extra money pumped into the economy by the central bank is creating less exports."

B)"House sales are down lots, due to the higher money growth."

C)"Businesses are investing more, now that monetary policy has become less expansionary."

D)"The extra money pumped into the economy by the central bank is creating more jobs."

E)"The tightening of money growth is helping sell goods abroad."

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

24

The purchase of government securities by the Bank of Canada

A)decreases the price of bonds.

B)tightens credit conditions.

C)fights inflation.

D)increases bank loans.

E)decreases bank reserves.

A)decreases the price of bonds.

B)tightens credit conditions.

C)fights inflation.

D)increases bank loans.

E)decreases bank reserves.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

25

The policy tools used by the Bank of Canada include

A)the exchange rate and open market operations.

B)the operating band and open market operations.

C)prime rate and the exchange rate.

D)prime rate and bank rate.

E)open market operations and prime rate.

A)the exchange rate and open market operations.

B)the operating band and open market operations.

C)prime rate and the exchange rate.

D)prime rate and bank rate.

E)open market operations and prime rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

26

The overnight rate is determined by equilibrium in the market for _______ The overnight rate _______ .

A)reserves; equals the real interest rate minus the inflation rate

B)loanable funds; equals the real interest rate

C)reserves; is the rate that sets the quantity of reserves demanded equal to the quantity of reserves supplied

D)loanable funds; equals the real interest rate minus the inflation rate

E)money; equals the real interest rate

A)reserves; equals the real interest rate minus the inflation rate

B)loanable funds; equals the real interest rate

C)reserves; is the rate that sets the quantity of reserves demanded equal to the quantity of reserves supplied

D)loanable funds; equals the real interest rate minus the inflation rate

E)money; equals the real interest rate

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

27

If the overnight rate is below target, the Bank _______securities to _______ reserves, which _______ the supply of overnight funds and _______ the overnight rate.

A)buys; increase; increases; lowers

B)buys; increase; decreases; raises

C)buys; decrease; decreases; raises

D)sells; decrease; decreases; raises

E)sells; increase; increases; lowers

A)buys; increase; increases; lowers

B)buys; increase; decreases; raises

C)buys; decrease; decreases; raises

D)sells; decrease; decreases; raises

E)sells; increase; increases; lowers

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

28

An open market operation

A)refers to loans made by the Bank of Canada to chartered banks.

B)refers to the Bank of Canada's sales and purchases of corporate stock.

C)refers to the purchase or sale of Canadian currency in exchange for foreign currency.

D)is the purchase or sale of government of Canada securities by the Bank of Canada from or to a chartered bank or the public.

E)can change bank deposits but cannot alter the quantity of money.

A)refers to loans made by the Bank of Canada to chartered banks.

B)refers to the Bank of Canada's sales and purchases of corporate stock.

C)refers to the purchase or sale of Canadian currency in exchange for foreign currency.

D)is the purchase or sale of government of Canada securities by the Bank of Canada from or to a chartered bank or the public.

E)can change bank deposits but cannot alter the quantity of money.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

29

If the overnight rate is above target, the Bank _______securities to _______ reserves, which _______ the supply of overnight funds and _______ the overnight rate.

A)buys; increase; decreases; raises

B)buys; decrease; decreases; raises

C)sells; decrease; decreases; raises

D)buys; increase; increases; lowers

E)sells; increase; increases; lowers

A)buys; increase; decreases; raises

B)buys; decrease; decreases; raises

C)sells; decrease; decreases; raises

D)buys; increase; increases; lowers

E)sells; increase; increases; lowers

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

30

If the Bank of Canada aims to lower the overnight rate, it will

A)lower the bank rate and settlement balances rate, as well as sell government securities.

B)lower the bank rate and settlement balances rate, as well as buy government securities.

C)lower the bank rate and increase the settlement balances rate, as well as buy government securities.

D)raise the bank rate and settlement balances rate, as well as sell government securities.

E)raise the bank rate and settlement balances rate, as well as buy government securities.

A)lower the bank rate and settlement balances rate, as well as sell government securities.

B)lower the bank rate and settlement balances rate, as well as buy government securities.

C)lower the bank rate and increase the settlement balances rate, as well as buy government securities.

D)raise the bank rate and settlement balances rate, as well as sell government securities.

E)raise the bank rate and settlement balances rate, as well as buy government securities.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following quotations correctly describes the impact of monetary policy on the economy?

A)"Businesses are investing more, now that monetary policy has become less expansionary."

B)"The extra money pumped into the economy by the central bank is creating fewer jobs."

C)"House sales are down lots, due to the higher money growth."

D)"The tightening of money growth is helping sell goods abroad."

E)"The extra money pumped into the economy by the central bank is creating more exports."

A)"Businesses are investing more, now that monetary policy has become less expansionary."

B)"The extra money pumped into the economy by the central bank is creating fewer jobs."

C)"House sales are down lots, due to the higher money growth."

D)"The tightening of money growth is helping sell goods abroad."

E)"The extra money pumped into the economy by the central bank is creating more exports."

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

32

Choose the statement that is incorrect.

A)Since late 2000, the Bank has established eight fixed dates on which it announces its overnight loans rate target for the coming period of approximately six weeks.

B)The Bank of Canada's choice of monetary policy instrument is the overnight loans rate.

C)In recent years, the overnight loans rate has been at historically low levels.

D)Although the Bank of Canada can change the overnight rate by any reasonable amount that it chooses, it normally changes the overnight rate by a single percentage point at a time.

E)The Bank sometimes acts in an emergency between normal announcement dates.

A)Since late 2000, the Bank has established eight fixed dates on which it announces its overnight loans rate target for the coming period of approximately six weeks.

B)The Bank of Canada's choice of monetary policy instrument is the overnight loans rate.

C)In recent years, the overnight loans rate has been at historically low levels.

D)Although the Bank of Canada can change the overnight rate by any reasonable amount that it chooses, it normally changes the overnight rate by a single percentage point at a time.

E)The Bank sometimes acts in an emergency between normal announcement dates.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

33

Choose the statement that is incorrect.

A)From 2009 to 2018, the overnight loans rate was at historically low levels because the Bank wanted to lean in the direction of avoiding recession.

B)The Bank of Canada's choice of policy instrument is the overnight loans rate.

C)When the Bank of Canada wants to slow inflation, it raises the overnight loans rate.

D)The Bank of Canada normally changes the overnight loans rate by 25 basis points.

E)The Bank has established 12 fixed dates each year on which it announces its overnight rate target for the coming period.

A)From 2009 to 2018, the overnight loans rate was at historically low levels because the Bank wanted to lean in the direction of avoiding recession.

B)The Bank of Canada's choice of policy instrument is the overnight loans rate.

C)When the Bank of Canada wants to slow inflation, it raises the overnight loans rate.

D)The Bank of Canada normally changes the overnight loans rate by 25 basis points.

E)The Bank has established 12 fixed dates each year on which it announces its overnight rate target for the coming period.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

34

How does the Bank of Canada set the bank rate?

A)The Bank of Canada does not determine the bank rate.

B)The bank rate is set at a quarter percentage point above the target overnight loans rate.

C)The bank rate is set at a quarter percentage point above the prime lending rate.

D)The bank rate is set at 25 basis points above the operating band.

E)The bank rate is set at a quarter percentage point below the overnight loans rate.

A)The Bank of Canada does not determine the bank rate.

B)The bank rate is set at a quarter percentage point above the target overnight loans rate.

C)The bank rate is set at a quarter percentage point above the prime lending rate.

D)The bank rate is set at 25 basis points above the operating band.

E)The bank rate is set at a quarter percentage point below the overnight loans rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

35

The Bank of Canada can lower the overnight loans rate by

A)raising the bank rate.

B)lowering the bank rate.

C)raising the settlement balances rate.

D)lowering the settlement balances rate.

E)both B and D

A)raising the bank rate.

B)lowering the bank rate.

C)raising the settlement balances rate.

D)lowering the settlement balances rate.

E)both B and D

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

36

In an open market operation aimed at increasing expenditure, the Bank of Canada

A)sells government securities, decreasing bank reserves, increasing lending, increasing the overnight rate.

B)sells government securities, decreasing bank reserves, decreasing lending, decreasing the overnight rate.

C)buys government securities, increasing bank reserves, increasing lending, increasing the overnight rate.

D)sells government securities, decreasing bank reserves, decreasing lending, increasing the overnight rate.

E)buys government securities, increasing bank reserves, increasing lending, decreasing the overnight rate.

A)sells government securities, decreasing bank reserves, increasing lending, increasing the overnight rate.

B)sells government securities, decreasing bank reserves, decreasing lending, decreasing the overnight rate.

C)buys government securities, increasing bank reserves, increasing lending, increasing the overnight rate.

D)sells government securities, decreasing bank reserves, decreasing lending, increasing the overnight rate.

E)buys government securities, increasing bank reserves, increasing lending, decreasing the overnight rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

37

The overnight loans rate is the interest rate

A)on overnight loans that the big banks make to each other.

B)banks pay on term deposits.

C)the Bank of Canada charges when it lends reserves to banks.

D)banks charge their best loan customers.

E)the Bank of Canada pays on reserves held by banks.

A)on overnight loans that the big banks make to each other.

B)banks pay on term deposits.

C)the Bank of Canada charges when it lends reserves to banks.

D)banks charge their best loan customers.

E)the Bank of Canada pays on reserves held by banks.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

38

The current overnight loans rate is 3 percent, with the Bank of Canada's operating band set at 2.75 to 3.25 percent.If the Bank of Canada lowers their operating band to 2.25 to 2.75 percent, which of the following is one of the reasons the overnight rate will fall to within this new range?

A)Since the banking system can now earn 2.75 percent from the Bank of Canada, no bank would lend on the overnight loan market at 3 percent.

B)Since the banking system can now borrow from the Bank of Canada at 2.75 percent, no bank would borrow on the overnight loan market at 3 percent.

C)Since the banking system can now borrow from the Bank of Canada at 2.25 percent, no bank would borrow on the overnight loan market at 3 percent.

D)There is a legal requirement that the overnight rate must be within the Bank of Canada's operating band.

E)Since the banking system can now earn 2.25 percent from the Bank of Canada, no bank would lend on the overnight loan market at 3 percent.

A)Since the banking system can now earn 2.75 percent from the Bank of Canada, no bank would lend on the overnight loan market at 3 percent.

B)Since the banking system can now borrow from the Bank of Canada at 2.75 percent, no bank would borrow on the overnight loan market at 3 percent.

C)Since the banking system can now borrow from the Bank of Canada at 2.25 percent, no bank would borrow on the overnight loan market at 3 percent.

D)There is a legal requirement that the overnight rate must be within the Bank of Canada's operating band.

E)Since the banking system can now earn 2.25 percent from the Bank of Canada, no bank would lend on the overnight loan market at 3 percent.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

39

Two monetary policy instruments that the Bank of Canada can use are

A)the foreign exchange rate and the government budget balance.

B)the current account balance and the capital and financial account balance.

C)the monetary base and the short- term interest rate.

D)the quantity of Canadian dollars held in Canadian banks and the quantity fo Canadian dollars held by foreign central banks.

E)the federal government budget balance and the real interest rate.

A)the foreign exchange rate and the government budget balance.

B)the current account balance and the capital and financial account balance.

C)the monetary base and the short- term interest rate.

D)the quantity of Canadian dollars held in Canadian banks and the quantity fo Canadian dollars held by foreign central banks.

E)the federal government budget balance and the real interest rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

40

If the Bank of Canada buys government securities, all of the following happens except

A)net exports increase.

B)bank reserves increase.

C)the quantity of money increases.

D)the supply of loanable funds increases.

E)the bank rate rises.

A)net exports increase.

B)bank reserves increase.

C)the quantity of money increases.

D)the supply of loanable funds increases.

E)the bank rate rises.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

41

An increase in the quantity of money leads to

A)a decrease in net exports.

B)a decrease in real GDP.

C)an increase in aggregate demand.

D)an increase in short- run aggregate supply.

E)a decrease in the price level.

A)a decrease in net exports.

B)a decrease in real GDP.

C)an increase in aggregate demand.

D)an increase in short- run aggregate supply.

E)a decrease in the price level.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

42

If the Bank of Canada buys government securities in the open market, the supply curve of real money

A)shifts leftward and the overnight loans rate rises.

B)shifts rightward and the overnight loans rate falls

C)shifts leftward and the overnight loans rate falls.

D)shifts rightward and the overnight loans rate remains constant because the demand for money increases at the same time.

E)shifts rightward and the overnight loans rate rises.

A)shifts leftward and the overnight loans rate rises.

B)shifts rightward and the overnight loans rate falls

C)shifts leftward and the overnight loans rate falls.

D)shifts rightward and the overnight loans rate remains constant because the demand for money increases at the same time.

E)shifts rightward and the overnight loans rate rises.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

43

The Bank of Canada raises the overnight loans rate.In the foreign exchange market people _______ dollars and the price of the dollar _______ because the Canadian interest rate differential _______.

A)sell; rises; falls

B)buy; falls; rises

C)buy; rises; rises

D)buy; rises; falls

E)sell; falls; falls

A)sell; rises; falls

B)buy; falls; rises

C)buy; rises; rises

D)buy; rises; falls

E)sell; falls; falls

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

44

The ripple effects that occur when the Bank of Canada raises the overnight loan rate include

A)a decrease in short- run interest rates.

B)an increase in short- run aggregate supply.

C)a decrease in short- run aggregate supply.

D)a decrease in consumption expenditure and investment.

E)an increase in net exports.

A)a decrease in short- run interest rates.

B)an increase in short- run aggregate supply.

C)a decrease in short- run aggregate supply.

D)a decrease in consumption expenditure and investment.

E)an increase in net exports.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

45

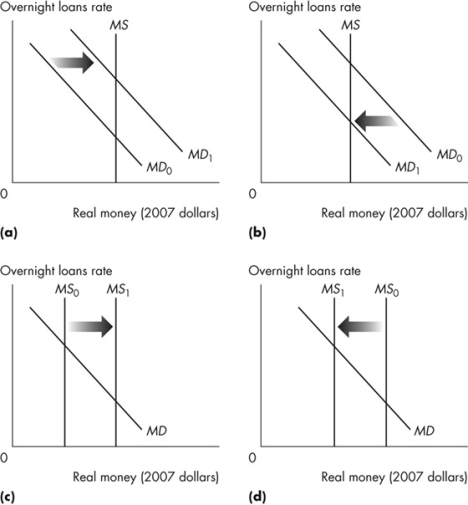

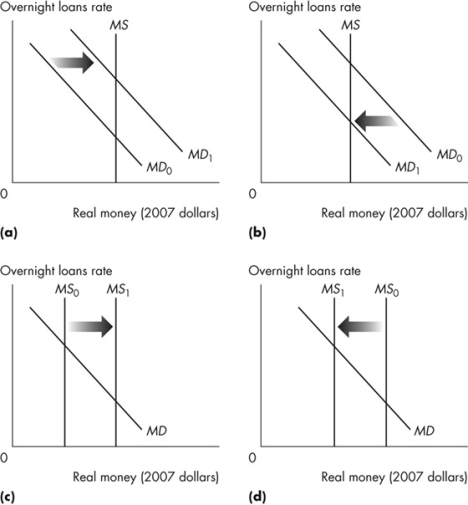

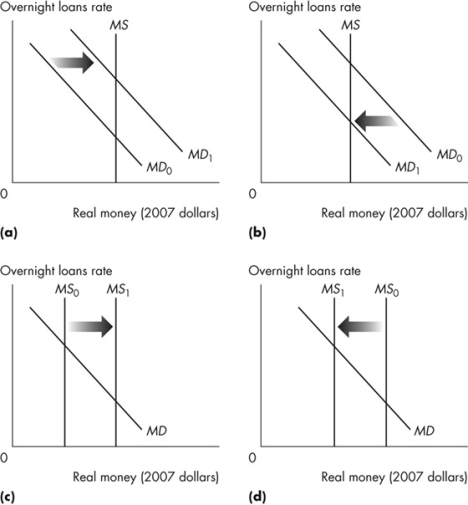

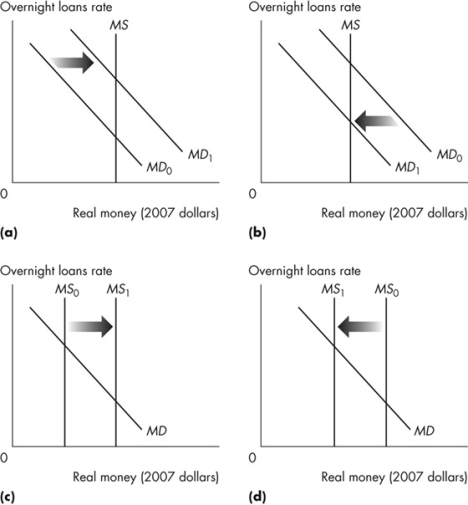

Use the figure below to answer the following questions.

Figure 14.3.1

Figure 14.3.1

Refer to Figure 14.3.1.Everything else remaining the same, which graph best illustrates the effect of the Bank of Canada lowering the overnight loans rate?

A)a only

B)b only

C)c only

D)d only

E)Both a and c

Figure 14.3.1

Figure 14.3.1Refer to Figure 14.3.1.Everything else remaining the same, which graph best illustrates the effect of the Bank of Canada lowering the overnight loans rate?

A)a only

B)b only

C)c only

D)d only

E)Both a and c

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

46

Use the figure below to answer the following questions.

Figure 14.3.1

Figure 14.3.1

Refer to Figure 14.3.1.Everything else remaining the same, which graph best illustrates the effect of the Bank of Canada raising the overnight loans rate?

A)a only

B)b only

C)c only

D)d only

E)Both b and d

Figure 14.3.1

Figure 14.3.1Refer to Figure 14.3.1.Everything else remaining the same, which graph best illustrates the effect of the Bank of Canada raising the overnight loans rate?

A)a only

B)b only

C)c only

D)d only

E)Both b and d

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements about the overnight loans rate is false?

A)The overnight loans rate and the treasury bill rate move closely together.

B)The overnight loans rate is most often less than the long- term bond rate.

C)The overnight loans rate and the long- term bond rate trend in the same direction.

D)The long- term bond rate fluctuates less than the short- term rates.

E)The higher the overnight loans rate, the greater the quantity of money.

A)The overnight loans rate and the treasury bill rate move closely together.

B)The overnight loans rate is most often less than the long- term bond rate.

C)The overnight loans rate and the long- term bond rate trend in the same direction.

D)The long- term bond rate fluctuates less than the short- term rates.

E)The higher the overnight loans rate, the greater the quantity of money.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

48

The purchase of government securities by the Bank of Canada

A)decreases the quantity of money.

B)raises the overnight loans rate.

C)decreases the supply of loanable funds.

D)increases aggregate demand.

E)decreases bank reserves.

A)decreases the quantity of money.

B)raises the overnight loans rate.

C)decreases the supply of loanable funds.

D)increases aggregate demand.

E)decreases bank reserves.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

49

If Canadian interest rate differential rises, the exchange rate value of the dollar _______ and net exports _______.

A)falls; decrease

B)rises; increase

C)falls; increase

D)rises; decrease

E)rises only if the U.S.interest rates rise concurrently; decrease

A)falls; decrease

B)rises; increase

C)falls; increase

D)rises; decrease

E)rises only if the U.S.interest rates rise concurrently; decrease

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

50

If the Bank of Canada lowers the overnight loans rate, the exchange rate _______, and net exports _______.

A)falls; increase

B)rises; decrease

C)falls; decrease

D)rises; increase

E)falls; do not change

A)falls; increase

B)rises; decrease

C)falls; decrease

D)rises; increase

E)falls; do not change

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

51

To decrease aggregate demand, the Bank of Canada can

A)raise the overnight loans rate, which decreases the government budget deficit.

B)lower the overnight loans rate, which increases the quantity of money.

C)raise the overnight loans rate, which increases the quantity of money.

D)raise the overnight loans rate, which decreases the quantity of money.

E)lower the overnight loans rate, which decreases the quantity of money.

A)raise the overnight loans rate, which decreases the government budget deficit.

B)lower the overnight loans rate, which increases the quantity of money.

C)raise the overnight loans rate, which increases the quantity of money.

D)raise the overnight loans rate, which decreases the quantity of money.

E)lower the overnight loans rate, which decreases the quantity of money.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

52

Which statement below best expresses the relationship between the 3- month Treasury bill rate and the overnight loans rate? The rates are

A)not similar because the treasury bill rate is set by the Government of Canada whereas the overnight loans rate is set by the Bank of Canada.

B)not similar because the treasury bill rate is established through the financial markets whereas the overnight loans rate is set by the Bank of Canada.

C)similar because banks can readily substitute between them.

D)not similar because banks can not readily substitute between them.

E)similar because they are both required to remain with the Bank of Canada's operating band.

A)not similar because the treasury bill rate is set by the Government of Canada whereas the overnight loans rate is set by the Bank of Canada.

B)not similar because the treasury bill rate is established through the financial markets whereas the overnight loans rate is set by the Bank of Canada.

C)similar because banks can readily substitute between them.

D)not similar because banks can not readily substitute between them.

E)similar because they are both required to remain with the Bank of Canada's operating band.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

53

In a situation of inflationary pressure, an increase in the overnight loans rate results in

A)an increase in real GDP and the price level.

B)a rise in the price level, but no change in real GDP.

C)an increase in real GDP, but a fall in the price level.

D)a fall in the price level and a decrease in real GDP.

E)an increase in real GDP, but no change in the price level.

A)an increase in real GDP and the price level.

B)a rise in the price level, but no change in real GDP.

C)an increase in real GDP, but a fall in the price level.

D)a fall in the price level and a decrease in real GDP.

E)an increase in real GDP, but no change in the price level.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

54

To lower interest rates, the Bank of Canada can

A)raise the bank rate.

B)raise the exchange rate.

C)increase the treasury bill rate.

D)buy government securities.

E)decrease bank reserves.

A)raise the bank rate.

B)raise the exchange rate.

C)increase the treasury bill rate.

D)buy government securities.

E)decrease bank reserves.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

55

If the Bank of Canada lowers the overnight loans rate,

A)other short- term interest rates fall.

B)other short- term interest rates rise.

C)the exchange rate falls.

D)the long- term interest rate falls.

E)A, C, and D are correct.

A)other short- term interest rates fall.

B)other short- term interest rates rise.

C)the exchange rate falls.

D)the long- term interest rate falls.

E)A, C, and D are correct.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

56

When the Bank of Canada lowers the overnight loans rate and the Canadian interest rate differential falls, the Canadian dollar _______ on the foreign exchange market and _______.

A)falls; the increase in imports is greater than the increase in exports

B)falls; aggregate demand decreases

C)rises; aggregate demand decreases

D)rises; U.S.aggregate demand decreases

E)falls; aggregate demand increases

A)falls; the increase in imports is greater than the increase in exports

B)falls; aggregate demand decreases

C)rises; aggregate demand decreases

D)rises; U.S.aggregate demand decreases

E)falls; aggregate demand increases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements correctly describes an anti- inflationary monetary policy?

A)"The Bank of Canada's recent moves to decrease the value of the Canadian dollar are leading to more spending in the economy."

B)"The Bank of Canada's recent purchases of government securities is stimulating the housing sector."

C)"The Bank of Canada's recent moves to lower interest rates are behind the recent decreases in the value of the Canadian dollar."

D)"The Bank of Canada's recent moves to increase the overnight loans rate are leading to less lending and less consumer spending."

E)"The Bank of Canada's recent sales of government securities are stimulating the housing sector."

A)"The Bank of Canada's recent moves to decrease the value of the Canadian dollar are leading to more spending in the economy."

B)"The Bank of Canada's recent purchases of government securities is stimulating the housing sector."

C)"The Bank of Canada's recent moves to lower interest rates are behind the recent decreases in the value of the Canadian dollar."

D)"The Bank of Canada's recent moves to increase the overnight loans rate are leading to less lending and less consumer spending."

E)"The Bank of Canada's recent sales of government securities are stimulating the housing sector."

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

58

If the Bank of Canada lowers the overnight loans rate, other short- term interest rates _______ and the exchange rate _______.

A)fall; rises

B)fall; falls

C)fall; does not change

D)do not change; falls

E)fall, and the long- term interest rate rises; falls

A)fall; rises

B)fall; falls

C)fall; does not change

D)do not change; falls

E)fall, and the long- term interest rate rises; falls

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

59

When the Bank of Canada lowers the overnight loans rate, the Canadian interest rate differential _______ and the Canadian dollar _______ on the foreign exchange market.

A)falls; depreciates

B)falls; changes to equal the value of the U.S.dollar

C)rises; appreciates

D)rises; depreciates

E)falls; appreciates

A)falls; depreciates

B)falls; changes to equal the value of the U.S.dollar

C)rises; appreciates

D)rises; depreciates

E)falls; appreciates

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

60

Monetary policy is difficult to conduct because

A)the monetary policy transmission process is long and drawn out.

B)the interest rate always rises.

C)it takes several years for the real GDP growth rate to respond to a change in the interest rate.

D)politicians frequently block the policy's intended outcomes.

E)the tools available don't work.

A)the monetary policy transmission process is long and drawn out.

B)the interest rate always rises.

C)it takes several years for the real GDP growth rate to respond to a change in the interest rate.

D)politicians frequently block the policy's intended outcomes.

E)the tools available don't work.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

61

A decrease in the overnight loans rate

A)increases other short- term interest rates, decreases investment, and decreases aggregate demand.

B)decreases the demand for loanable funds, lowers the real interest rate, and decreases aggregate demand.

C)lowers the exchange rate, increases the demand for loanable funds, and increases aggregate demand.

D)lowers the exchange rate, increases the supply of loanable funds, and increases aggregate demand.

E)lowers other short- term interest rates, raises the real interest rate, and increases aggregate demand.

A)increases other short- term interest rates, decreases investment, and decreases aggregate demand.

B)decreases the demand for loanable funds, lowers the real interest rate, and decreases aggregate demand.

C)lowers the exchange rate, increases the demand for loanable funds, and increases aggregate demand.

D)lowers the exchange rate, increases the supply of loanable funds, and increases aggregate demand.

E)lowers other short- term interest rates, raises the real interest rate, and increases aggregate demand.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

62

If a central bank wants to implement a contractionary policy that decreases real GDP, it conducts an open market operation by _______ securities.Bank reserves _______ and the supply of loanable funds _______.The quantity of money _______.

A)selling; decrease; decreases; decreases

B)purchasing; decrease; decreases; decreases

C)purchasing; decrease; increases; decreases

D)purchasing; increase; increases; increases

E)selling; increase; increases; increases

A)selling; decrease; decreases; decreases

B)purchasing; decrease; decreases; decreases

C)purchasing; decrease; increases; decreases

D)purchasing; increase; increases; increases

E)selling; increase; increases; increases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

63

If the Bank of Canada wants to stimulate the economy to limit the effects of a recessionary gap, then it _______ the overnight loans rate to _______ the real interest rate and _______ investment.

A)lowers; raise; increase

B)lowers; lower; increase

C)raises; raise; decrease

D)lowers; raise; decrease

E)lowers; lower; decrease

A)lowers; raise; increase

B)lowers; lower; increase

C)raises; raise; decrease

D)lowers; raise; decrease

E)lowers; lower; decrease

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

64

If the Bank of Canada wants to eliminate an inflationary gap, which of the following would be an appropriate policy?

A)Lower the exchange rate.

B)Buy government securities.

C)Decease the government budget deficit.

D)Raise the overnight loans rate.

E)Lower the overnight loans rate.

A)Lower the exchange rate.

B)Buy government securities.

C)Decease the government budget deficit.

D)Raise the overnight loans rate.

E)Lower the overnight loans rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

65

When the Bank of Canada raises the overnight loans rate, other short- term interest rates

A)rise, consumption expenditure, investment and net exports increase, and the aggregate demand curve shifts rightward.

B)fall, consumption expenditure, investment and net exports decrease, and the aggregate demand curve shifts leftward.

C)rise, consumption expenditure, investment and net exports decrease, and the aggregate demand curve shifts leftward.

D)fall, consumption expenditure, investment and net exports increase, and the aggregate demand curve shifts rightward.

E)none of the above

A)rise, consumption expenditure, investment and net exports increase, and the aggregate demand curve shifts rightward.

B)fall, consumption expenditure, investment and net exports decrease, and the aggregate demand curve shifts leftward.

C)rise, consumption expenditure, investment and net exports decrease, and the aggregate demand curve shifts leftward.

D)fall, consumption expenditure, investment and net exports increase, and the aggregate demand curve shifts rightward.

E)none of the above

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

66

When the Bank of Canada fights inflation by implementing an open market operation, the supply of reserves curve shifts _______ and the supply of money curve shifts _______.

A)rightward; rightward

B)rightward; leftward

C)leftward; rightward

D)leftward; leftward

E)none of the above

A)rightward; rightward

B)rightward; leftward

C)leftward; rightward

D)leftward; leftward

E)none of the above

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

67

When the Bank of Canada fights inflation by implementing open market operations, the supply of loanable funds curve shifts _______ and the aggregate demand curve shifts _______.

A)rightward; rightward

B)leftward; rightward

C)leftward; leftward

D)rightward; leftward

E)leftward; leftward, and potential GDP decreases

A)rightward; rightward

B)leftward; rightward

C)leftward; leftward

D)rightward; leftward

E)leftward; leftward, and potential GDP decreases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

68

When the Bank of Canada fights recession by lowering the overnight loans rate, the supply of reserves curve shifts _______ and the supply of money curve shifts _______.

A)rightward; leftward

B)leftward; leftward

C)rightward; rightward

D)leftward; rightward

E)rightward; rightward, and the demand for loanable funds increases

A)rightward; leftward

B)leftward; leftward

C)rightward; rightward

D)leftward; rightward

E)rightward; rightward, and the demand for loanable funds increases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

69

When the Bank of Canada lowers the overnight loans rate, there is a _______ shift of the _______ curve.

A)rightward; LAS

B)rightward; AD

C)rightward; SAS

D)leftward; SAS

E)leftward; AD

A)rightward; LAS

B)rightward; AD

C)rightward; SAS

D)leftward; SAS

E)leftward; AD

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

70

To combat a recession, the Bank of Canada _______ the overnight loans rate, which _______ the quantity of money.

A)lowers; increases

B)raises; decreases

C)lowers; decreases

D)raises; increases

E)lowers; decreases the demand for bank reserves and increases

A)lowers; increases

B)raises; decreases

C)lowers; decreases

D)raises; increases

E)lowers; decreases the demand for bank reserves and increases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

71

The short- run effect of lowering the overnight loans rate is that the

A)price level rises and real GDP increases.

B)price level rises and real GDP decreases.

C)price level lowers and real GDP decreases.

D)price level lowers and real GDP increases.

E)price level rises and real GDP equals potential GDP.

A)price level rises and real GDP increases.

B)price level rises and real GDP decreases.

C)price level lowers and real GDP decreases.

D)price level lowers and real GDP increases.

E)price level rises and real GDP equals potential GDP.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

72

When the Bank of Canada fights recession by lowering the overnight loan rate, the supply of loanable funds curve shifts _______, and the aggregate demand curve shifts _______.

A)leftward; leftward

B)rightward; leftward

C)leftward; rightward

D)rightward; rightward

E)rightward and the demand for loanable funds curve shifts rightward; rightward

A)leftward; leftward

B)rightward; leftward

C)leftward; rightward

D)rightward; rightward

E)rightward and the demand for loanable funds curve shifts rightward; rightward

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

73

A decrease in the overnight loans rate leads to all of the following except

A)an increase in imports.

B)an increase in consumption expenditure.

C)a fall in the exchange rate.

D)an increase in the quantity of money.

E)an increase in exports.

A)an increase in imports.

B)an increase in consumption expenditure.

C)a fall in the exchange rate.

D)an increase in the quantity of money.

E)an increase in exports.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

74

The headline "The Bank of Canada Has Cut the Bank Rate" suggests that the Bank of Canada is trying to

A)help banks make profits.

B)increase the overnight loans rate.

C)lower inflationary pressures.

D)raise the value of the Canadian dollar.

E)stimulate aggregate demand.

A)help banks make profits.

B)increase the overnight loans rate.

C)lower inflationary pressures.

D)raise the value of the Canadian dollar.

E)stimulate aggregate demand.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

75

A monetary policy aimed at increasing domestic expenditure will

A)have no impact on interest rates nor on the exchange rate.

B)have no impact on interest rates, but increase the exchange rate.

C)increase interest rates and decrease the exchange rate.

D)decrease interest rates and the exchange rate.

E)decrease interest rates and increase the exchange rate.

A)have no impact on interest rates nor on the exchange rate.

B)have no impact on interest rates, but increase the exchange rate.

C)increase interest rates and decrease the exchange rate.

D)decrease interest rates and the exchange rate.

E)decrease interest rates and increase the exchange rate.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

76

If the Bank of Canada is concerned with inflation it will _______ the overnight loans rate to _______.

A)raise; increase aggregate demand

B)raise; increase potential GDP

C)lower; increase aggregate demand

D)raise; decrease aggregate demand

E)lower; decrease aggregate demand

A)raise; increase aggregate demand

B)raise; increase potential GDP

C)lower; increase aggregate demand

D)raise; decrease aggregate demand

E)lower; decrease aggregate demand

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

77

In the short run, lowering the overnight loans rate shifts the _______ curve _______ and _______ real GDP.

A)short- run aggregate supply; rightward; increases

B)long- run aggregate supply; rightward; increases

C)aggregate demand; leftward; increases

D)aggregate demand; leftward; decreases

E)aggregate demand; rightward; increases

A)short- run aggregate supply; rightward; increases

B)long- run aggregate supply; rightward; increases

C)aggregate demand; leftward; increases

D)aggregate demand; leftward; decreases

E)aggregate demand; rightward; increases

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

78

If the Bank of Canada is concerned with recession it will _______ the overnight loans rate to _______.

A)raise; decrease aggregate demand

B)lower; decrease aggregate demand

C)lower; increase potential GDP

D)raise; increase aggregate demand

E)lower; increase aggregate demand

A)raise; decrease aggregate demand

B)lower; decrease aggregate demand

C)lower; increase potential GDP

D)raise; increase aggregate demand

E)lower; increase aggregate demand

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

79

If the Bank of Canada fears inflation it will undertake an open market _______ of securities, the overnight loans rate will _______ and the long- term real interest rate will _______.

A)sale; rise; rise

B)purchase; rise; fall

C)sale; rise; fall

D)purchase; fall; rise

E)sale; fall; fall

A)sale; rise; rise

B)purchase; rise; fall

C)sale; rise; fall

D)purchase; fall; rise

E)sale; fall; fall

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck

80

In response to an inflationary gap, the Bank of Canada

A)waits until the price level falls before acting.

B)lowers the overnight loans rate by buying securities.

C)lowers the overnight loans rate by selling securities.

D)raises the overnight loans rate by selling securities.

E)raises the overnight loans rate by buying securities.

A)waits until the price level falls before acting.

B)lowers the overnight loans rate by buying securities.

C)lowers the overnight loans rate by selling securities.

D)raises the overnight loans rate by selling securities.

E)raises the overnight loans rate by buying securities.

Unlock Deck

Unlock for access to all 93 flashcards in this deck.

Unlock Deck

k this deck