Deck 6: Losses and Loss Limitations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/121

Play

Full screen (f)

Deck 6: Losses and Loss Limitations

1

A bond held by an investor that is uncollectible will be treated as a worthless security and hence,produce a capital loss.

True

2

James is in the business of debt collection.He purchased a $20,000 account receivable from Green Corporation for $15,000.During the year,James collected $17,000 in final settlement of the account.James can take a $2,000 bad debt deduction in the current year.

False

3

A nonbusiness bad debt can offset an unlimited amount of long-term capital gain.

True

4

A cash basis taxpayer must include as income the proceeds from the sale of an account receivable to a collection agency.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

5

A loss is not allowed for a security that declines in value.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

6

A bona fide debt cannot arise on a loan between father and son.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

7

Al,who is single,has a gain of $40,000 on the sale of § 1244 stock (small business stock)and a loss of $80,000 on the sale of § 1244 stock.As a result,Al has a $40,000 ordinary loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

8

A corporation which makes a loan to a shareholder can have a nonbusiness bad debt deduction.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

9

A nonbusiness bad debt is a debt unrelated to the taxpayer's trade or business either when it was created or when it became worthless.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

10

The amount of partial worthlessness on a nonbusiness bad debt is deducted in the year partial worthlessness is determined.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

11

A nonbusiness bad debt deduction can be taken any year after the debt becomes totally worthless.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

12

If a taxpayer sells their § 1244 stock at a loss,all of the loss will be ordinary loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

13

A loss from a worthless security is always treated as a short-term capital loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

14

If an account receivable written off during a prior year is subsequently collected during the current year,the amount collected must be included in the gross income of the current year to the extent it created a tax benefit in the prior year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

15

Several years ago,John purchased 2,000 shares of Red Corporation § 1244 stock from Mark for $40,000.Last year,John sold one-half of his Red Corporation stock to Mike for $12,000.During the current year,John sold the remaining Red Corporation stock for $3,000.John has a $17,000 ($3,000 - $20,000)ordinary loss for the current year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

16

"Other casualty" means casualties similar to those associated with fires,storms,or shipwrecks.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

17

Last year,taxpayer had a $10,000 nonbusiness bad debt.Taxpayer also had an $8,000 short-term capital gain and taxable income of $35,000.If taxpayer collects the entire $10,000 during the current year,$8,000 needs to be included in gross income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

18

If a business debt previously deducted as partially worthless becomes totally worthless this year,only the amount not previously deducted can be deducted this year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

19

In determining whether a debt is a business or nonbusiness bad debt,the debtor's use of the borrowed funds is important.

FALSE

FALSE

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

20

An individual may deduct a loss on rental property even if it does not meet the definition of a casualty loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

21

Judy owns a 20% interest in a partnership (not real estate)in which her at-risk amount was $35,000 at the beginning of the year.The partnership borrowed $50,000 on a recourse note and made a $40,000 profit during the year.Her at-risk amount at the end of the year is $43,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

22

In the current year,Don has a $55,000 loss from a business he owns.His at-risk amount at the end of the year,prior to considering the current year loss,is $36,000.He will be allowed to deduct the $55,000 loss this year if he is a material participant in the business.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

23

Taxpayer's home was destroyed by a storm in the current year and the area was declared a disaster area.If the taxpayer elects to treat the loss as having occurred in the prior year,it will be subject to the 10%-of-AGI reduction based on the AGI of the current year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

24

Jackson Company incurs a $50,000 loss on a passive activity during the year.The company has active income of $34,000 and portfolio income of $24,000.If Jackson is a personal service corporation,it may deduct $34,000 of the passive loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

25

A taxpayer can carry any NOL incurred forward 20 years.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

26

If investment property is stolen,the amount of the loss is the adjusted basis of the property at the time of the theft reduced by $100 and 10% of AGI.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

27

If the amount of the insurance recovery for a theft of business property is greater than the asset's fair market value but less than it's adjusted basis,a gain is recognized.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

28

A personal casualty loss deduction may be allowed for losses resulting from termites.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

29

Tonya owns an interest in an activity (not real estate)that converted recourse financing to nonrecourse financing.Recapture of previously allowed losses is required if Tonya's at-risk amount is reduced below zero as a result of the debt restructuring.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

30

Sherri owns an interest in a business that is not a passive activity and in which she has $20,000 at risk.If the business incurs a loss from operations during the year and her share of the loss is $32,000,this loss will be fully deductible.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

31

Kelly,who earns a yearly salary of $120,000,sold an activity with a suspended passive loss of $44,000.The activity was sold at a loss and Kelly has no other passive activities.The suspended loss is not deductible.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

32

The amount of loss for partial destruction of business property is the decline in fair market value of the business property.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

33

Gray Company,a closely held C corporation,incurs a $50,000 loss on a passive activity during the year.The company has active income of $34,000 and portfolio income of $24,000.If Gray is not a personal service corporation,it may deduct $34,000 of the passive loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

34

All of a taxpayer's tax credits relating to a passive activity can be utilized when the activity is sold at a loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

35

A theft loss is taken in the year of the theft.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

36

Jack owns a 10% interest in a partnership (not real estate)in which his at-risk amount is $42,000 at the beginning of the year.During the year,the partnership borrows $80,000 on a nonrecourse note and incurs a loss of $60,000 from operations.Jack's at-risk amount at the end of the year is $44,000.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

37

Oriole Corporation has active income of $45,000 and a passive loss of $23,000 in the current year.Under an exception,Oriole can deduct the $23,000 loss if it is a personal service corporation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

38

The cost of repairs to damaged property is not an acceptable measure of the loss in value of the property.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

39

The amount of a loss on insured personal use property is reduced by the insurance coverage if no claim is made against the insurer.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

40

Last year,Amos had AGI of $50,000.Amos also had a diamond ring stolen which cost $20,000 and was worth $17,000 at the time of the theft.He itemized deductions on last year's tax return.In the current year,Amos recovered $17,000 from the insurance company.Therefore,he must include $11,900 in gross income on the tax return for the current year.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

41

Individuals can deduct from active or portfolio income losses of up to $25,000 from real estate rental activities in which they actively participate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

42

When determining whether an individual is a material participant,participation by an owner's spouse generally counts.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

43

If an owner participates for more than 500 hours in a DVD rental activity,any loss from that activity is treated as an active loss that can offset active income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

44

Nathan owns Activity A,which produces income,and Activity B,which produces passive losses.From a tax planning perspective,Nathan will be better off if Activity A is passive.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

45

Dick participates in an activity for 90 hours during the year.He has no employees and there are no other participants.Dick is a material participant.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

46

Wolf Corporation has active income of $55,000 and a passive loss of $33,000 in the current year.Wolf cannot deduct the $33,000 loss if it is a closely held C corporation that is not a personal service corporation.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

47

Roger owns and actively participates in the operations of an apartment building which produces a $40,000 loss during the year.He has AGI of $150,000 from an active business.He may deduct $25,000 of the loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

48

Services performed by an employee are treated as being related to a real estate trade or business if the employee performing the services has more than a 5% ownership interest in the employer.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

49

Mary Jane participates for 100 hours during the year in an activity she owns.She has no employees and is the only participant in the activity.The activity is a significant participation activity.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

50

A taxpayer is considered to be a material participant if he or she spends more than 500 hours in the activity.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

51

Individuals with modified AGI of $100,000 can deduct against active or portfolio income losses of up to $25,000 from real estate rental activities in which they actively participate.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

52

A taxpayer is considered to be a material participant in a significant participation activity if he or she spends at least 400 hours in the activity.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

53

Tom participates for 100 hours in Activity A and 450 hours in Activity B,both of which are nonrental businesses.Both activities are active.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

54

Wayne owns a small apartment building that produces a $45,000 loss during the year.His AGI before considering the rental loss is $85,000.Because Wayne is an active participant with respect to the rental activity,he may deduct the $45,000 loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

55

Bruce owns a small apartment building that produces a $25,000 loss during the year.His AGI before considering the rental loss is $85,000.Bruce must be a material participant with respect to the rental activity in order to deduct the $25,000 loss under the real estate rental exception.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

56

Linda owns investments that produce portfolio income and Activity A that produces losses.From a tax perspective,Linda will be better off if Activity A is not passive.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

57

Joyce owns an activity (not real estate)in which she participates for 100 hours a year; her husband participates for 450 hours.Joyce qualifies as a material participant.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

58

In the current year,Kelly had a $35,000 loss from a real estate rental activity in which she is a 10% owner.If she is an active participant and if her modified AGI is $100,000,she can deduct $25,000 of the loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

59

Tom participates for 300 hours in Activity A and 250 hours in Activity B,both of which are nonrental businesses.Both activities are active.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

60

From January through November,Vern participated for 420 hours as a salesman in a partnership in which he owns a 50% interest.The partnership has four full-time employees.During December,Vern spends 110 hours cleaning the store and painting the walls in order to meet the material participation standards.Vern qualifies as a material participant.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

61

Jim had a car accident in 2013 in which his car was completely destroyed.At the time of the accident,the car had a fair market value of $30,000 and an adjusted basis of $40,000.Jim used the car 100% of the time for business use.Jim received an insurance recovery of 70% of the value of the car at the time of the accident.If Jim's AGI for the year is $60,000,determine his deductible loss on the car.

A)$900.

B)$2,900.

C)$3,000.

D)$9,000.

E)None of the above.

A)$900.

B)$2,900.

C)$3,000.

D)$9,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following events would produce a deductible loss?

A)Erosion of personal use land due to rain or wind.

B)Termite infestation of a personal residence over a several year period.

C)Damages to personal automobile resulting from a taxpayer's willful negligence.

D)A misplaced diamond ring.

E)None of the above.

A)Erosion of personal use land due to rain or wind.

B)Termite infestation of a personal residence over a several year period.

C)Damages to personal automobile resulting from a taxpayer's willful negligence.

D)A misplaced diamond ring.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

63

Three years ago,Sharon loaned her sister $30,000 to buy a car.A note was issued for the loan with the provision for monthly payments of principal and interest.Last year,Sharon purchased a car from the same dealer,Hank's Auto.As partial payment for the car,the dealer accepted the note from Sharon's sister.At the time Sharon purchased the car,the note had a balance of $18,000.During the current year,Sharon's sister died.Hank's Auto was notified that no further payments on the note would be received.At the time of the notification,the note had a balance due of $15,500.What is the amount of loss,with respect to the note,that Hank's Auto may claim on the current year tax return?

A)$0.

B)$3,000.

C)$15,500.

D)$18,000.

E)None of the above.

A)$0.

B)$3,000.

C)$15,500.

D)$18,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

64

Mary incurred a $20,000 nonbusiness bad debt last year.She also had an $8,000 long-term capital gain last year.Her taxable income for last year was an NOL of $15,000.During the current year,she unexpectedly collected $12,000 on the debt.How should Mary account for the collection?

A)$0 income.

B)$8,000 income.

C)$11,000 income.

D)$12,000 income.

E)None of the above.

A)$0 income.

B)$8,000 income.

C)$11,000 income.

D)$12,000 income.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

65

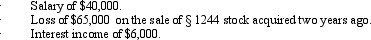

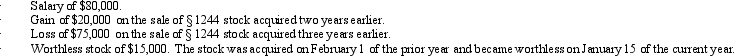

John files a return as a single taxpayer.In 2013,he had the following items:  Determine John's AGI for 2013.

Determine John's AGI for 2013.

A)($5,000).

B)$0.

C)$45,000.

D)$51,000.

E)None of the above.

Determine John's AGI for 2013.

Determine John's AGI for 2013.A)($5,000).

B)$0.

C)$45,000.

D)$51,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

66

Chris receives a gift of a passive activity from his father whose basis was $60,000.Suspended losses related to the activity are $18,000.Chris will be allowed to offset the $18,000 suspended losses against future passive income.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

67

Norm's car,which he uses 100% for personal purposes,was completely destroyed in an accident in 2013.The car's adjusted basis at the time of the accident was $13,000.Its fair market value was $10,000.The car was covered by a $2,000 deductible insurance policy.Norm did not file a claim against the insurance policy because of a fear that reporting the accident would result in a substantial increase in his insurance rates.His adjusted gross income was $14,000 (before considering the loss).What is Norm's deductible loss?

A)$0.

B)$100.

C)$500.

D)$9,500.

E)None of the above.

A)$0.

B)$100.

C)$500.

D)$9,500.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

68

Five years ago,Tom loaned his son John $20,000 to start a business.A note was executed with an interest rate of 8%,which is the Federal rate.The note required monthly payments of the interest with the $20,000 due at the end of ten years.John always made the interest payments until last year.During the current year,John notified his father that he was bankrupt and would not be able to repay the $20,000 or the accrued interest of $1,800.Tom is an accrual basis taxpayer whose only income is salary and interest income.The proper treatment for the nonpayment of the note is:

A)No deduction.

B)$3,000 deduction.

C)$20,000 deduction.

D)$21,800 deduction.

E)None of the above.

A)No deduction.

B)$3,000 deduction.

C)$20,000 deduction.

D)$21,800 deduction.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

69

On June 2,2012,Fred's TV Sales sold Mark a large HD TV,on account,for $12,000.Fred's TV Sales uses the accrual method.In 2013,when the balance on the account was $8,000,Mark filed for bankruptcy.Fred was notified that he could not expect to receive any of the amount owed to him.In 2014,final settlement was made and Fred received $1,000.How much bad debt loss can Fred deduct in 2014?

A)$0.

B)$7,000.

C)$8,000.

D)$12,000.

E)None of the above.

A)$0.

B)$7,000.

C)$8,000.

D)$12,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

70

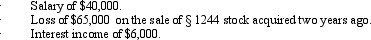

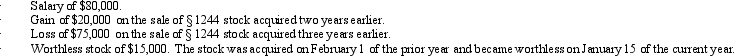

Bruce,who is single,had the following items for the current year:  Determine Bruce's AGI for the current year.

Determine Bruce's AGI for the current year.

A)$27,000.

B)$38,000.

C)$42,000.

D)$47,000.

E)None of the above.

Determine Bruce's AGI for the current year.

Determine Bruce's AGI for the current year.A)$27,000.

B)$38,000.

C)$42,000.

D)$47,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

71

Peggy is in the business of factoring accounts receivable.Last year,she purchased a $30,000 account receivable for $25,000.This year,the account was settled for $25,000.How much loss can Peggy deduct and in which year?

A)$5,000 for the current year.

B)$5,000 for the prior year and $5,000 for the current year.

C)$5,000 for the prior year.

D)$10,000 for the current year.

E)None of the above.

A)$5,000 for the current year.

B)$5,000 for the prior year and $5,000 for the current year.

C)$5,000 for the prior year.

D)$10,000 for the current year.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

72

Two years ago,Gina loaned Tom $50,000.Tom signed a note the terms of which called for monthly payments of $2,000 plus 6% interest on the outstanding balance.Last year,when the balance owing on the loan was $18,000,Tom defaulted on the note.As of the end of last year,there appeared to be no reasonable prospect of Gina recovering the $18,000.As a consequence,Gina claimed the $18,000 as a nonbusiness bad debt.Last year,Gina had AGI of a negative $6,000 which included $5,000 net long-term capital gains and $4,000 of qualified dividends.Gina did not itemize her deductions.During the current year,Tom paid Gina $13,000 in final settlement of the loan.How should Gina account for the payment in the current year?

A)File an amended tax return for last year.

B)Report no income for the current year.

C)Report $8,000 of income for the current year.

D)Report $12,000 of income for the current year.

E)None of the above.

A)File an amended tax return for last year.

B)Report no income for the current year.

C)Report $8,000 of income for the current year.

D)Report $12,000 of income for the current year.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

73

On February 20,2012,Bill purchased stock in Pink Corporation (the stock is not small business stock)for $1,000.On May 1,2013,the stock became worthless.During 2013,Bill also had an $8,000 loss on § 1244 small business stock purchased two years ago,a $9,000 loss on a nonbusiness bad debt,and a $5,000 long-term capital gain.How should Bill treat these items on his 2013 tax return?

A)$4,000 long-term capital loss and $9,000 short-term capital loss.

B)$4,000 long-term capital loss and $3,000 short-term capital loss.

C)$8,000 ordinary loss and $3,000 short-term capital loss.

D)$8,000 ordinary loss and $5,000 short-term capital loss.

E)$8,000 long-term capital loss and $6,000 short-term capital loss.

A)$4,000 long-term capital loss and $9,000 short-term capital loss.

B)$4,000 long-term capital loss and $3,000 short-term capital loss.

C)$8,000 ordinary loss and $3,000 short-term capital loss.

D)$8,000 ordinary loss and $5,000 short-term capital loss.

E)$8,000 long-term capital loss and $6,000 short-term capital loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

74

Jed is an electrician.Jed and his wife are accrual basis taxpayers and file a joint return.Jed wired a new house for Alison and billed her $15,000.Alison paid Jed $10,000 and refused to pay the remainder of the bill,claiming the fee to be exorbitant.Jed took Alison to Small Claims Court for the unpaid amount and was awarded a $2,000 judgement.Jed was able to collect the judgement but not the remainder of the bill from Alison.What amount of loss may Jed deduct in the current year?

A)$0.

B)$2,000.

C)$3,000.

D)$5,000.

E)None of the above.

A)$0.

B)$2,000.

C)$3,000.

D)$5,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

75

Kim dies owning a passive activity with a basis of $75,000,a fair market value of $140,000,and suspended losses of $80,000.All of the $80,000 passive loss can be deducted on Kim's final income tax return.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

76

On September 3,2012,Able,a single individual,purchased § 1244 stock in Red Corporation from his friend Al for $60,000.On December 31,2012,the stock was worth $85,000.On August 15,2013,Able was notified that the stock was worthless.How should Able report this item on his 2013 tax return?

A)$85,000 capital loss.

B)$85,000 ordinary loss.

C)$50,000 ordinary loss and $35,000 capital loss.

D)$60,000 ordinary loss.

E)None of the above.

A)$85,000 capital loss.

B)$85,000 ordinary loss.

C)$50,000 ordinary loss and $35,000 capital loss.

D)$60,000 ordinary loss.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

77

Last year,Lucy purchased a $100,000 account receivable for $90,000.During the current year,Lucy collected $97,000 on the account.What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected.

A)$0.

B)$2,000 gain.

C)$3,000 loss.

D)$13,000 loss.

E)None of the above.

A)$0.

B)$2,000 gain.

C)$3,000 loss.

D)$13,000 loss.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

78

On July 20,2011,Matt (who files a joint return)purchased 3,000 shares of Orange Corporation stock (the stock is § 1244 small business stock)for $24,000.On November 10,2012,Matt purchased an additional 1,000 shares of Orange Corporation stock from a friend for $150,000.On September 15,2013,Matt sold the 4,000 shares of stock for $120,000.How should Matt treat the sale of the stock on his 2013 return?

A)$54,000 ordinary loss.

B)$100,000 ordinary loss; $46,000 net capital gain.

C)$100,000 ordinary loss; $20,000 STCL.

D)$130,000 ordinary loss; $66,000 LTCG.

E)None of the above.

A)$54,000 ordinary loss.

B)$100,000 ordinary loss; $46,000 net capital gain.

C)$100,000 ordinary loss; $20,000 STCL.

D)$130,000 ordinary loss; $66,000 LTCG.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

79

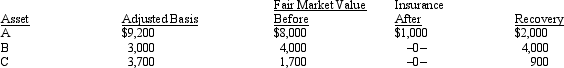

In 2013,Wally had the following insured personal casualty losses (arising from one casualty).Wally also had $42,000 AGI for the year before considering the casualty.  Wally's casualty loss deduction is:

Wally's casualty loss deduction is:

A)$1,500.

B)$1,600.

C)$4,800.

D)$58,000.

E)None of the above.

Wally's casualty loss deduction is:

Wally's casualty loss deduction is:A)$1,500.

B)$1,600.

C)$4,800.

D)$58,000.

E)None of the above.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck

80

Lucy owns and actively participates in the operations of an apartment complex that produces a $50,000 loss during the year.Her modified AGI is $125,000 from an active business.Disregarding any at-risk amount limitation,she may deduct $25,000 of the loss,and the remaining $25,000 is a suspended passive loss.

Unlock Deck

Unlock for access to all 121 flashcards in this deck.

Unlock Deck

k this deck