Deck 16: Real-World Competition and Technology

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/22

Play

Full screen (f)

Deck 16: Real-World Competition and Technology

1

Demonstrate graphically and explain verbally what is meant by the term X-inefficiency.

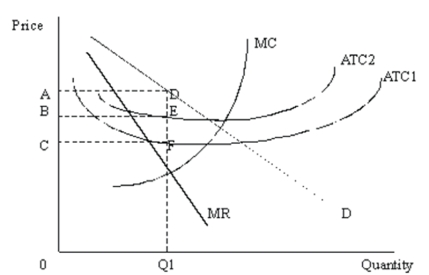

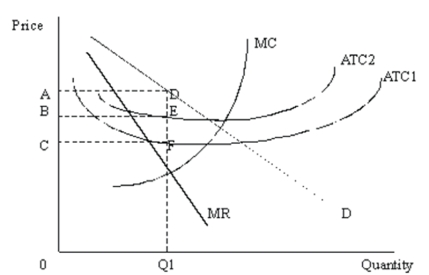

X-inefficiency refers to situations where firms are operating far less efficiently than they could technically. It is often associated with the lazy monopolist who is not forced by competition to take the time and trouble to be as efficient as he could be. To illustrate X-inefficiency we need to draw a picture in which a firm faces two ATC curves; one that it could operate on if it were not being lazy (labeled as ATC1 on the diagram) and the one it actually is operating on, which is higher than it otherwise would be (labeled as ATC2). If the firm seeks to maximize profits, it produces Q1. At this level, economic profit is represented by the area ADFC. A lazy monopolist does not operate efficiently and allows ATC to rise to, say, ATC2. In this case, economic profit is squeezed down to area ADEB.

2

Define X-inefficiency and explain how the threat of takeovers helps to limit X-inefficiency.

Lazy monopolists are managers that don't make the effort required to maximize profits. The resulting inefficiency is called "X-inefficiency," which occurs when firms operate far less efficiently than they could technically. Although these producers have monopoly power, they don't make full monopoly profits. If there are no threats of competition from outside the industry, lazy monopolists will not be concerned about losing their jobs and X-inefficiency will continue.

Because of lazy monopolists, many takeovers are based on the expectation that new management can manage a company's assets much more profitably. Those looking to buy a company believe that they can raise the value of the assets by improving the efficiency. Hence, a major market check on lazy monopolist behavior is the threat of a corporate takeover. Though the firm's survival is not threatened, the firm's management is. When managers fear that their company may be taken over (and they might be out of a job), they may work to make their company more efficient so as not to give any corporate raider a reason to think that the company can be improved by a takeover and subsequent turnover of management.

Because of lazy monopolists, many takeovers are based on the expectation that new management can manage a company's assets much more profitably. Those looking to buy a company believe that they can raise the value of the assets by improving the efficiency. Hence, a major market check on lazy monopolist behavior is the threat of a corporate takeover. Though the firm's survival is not threatened, the firm's management is. When managers fear that their company may be taken over (and they might be out of a job), they may work to make their company more efficient so as not to give any corporate raider a reason to think that the company can be improved by a takeover and subsequent turnover of management.

3

Once a firm has a monopoly it often has to worry about other firms trying to get a piece of its action. Describe three things monopolists do to try to keep other firms from getting a share of their markets. Discuss how much a monopolist would spend on any of these tactics.

Monopolists can try to prevent other firms from entering their markets by spending money on advertising to make their products seem unique, by lobbying for government regulations that would prevent the entry of other firms by producing products that are difficult to copy and by charging less than the profit-maximizing price to discourage entry.

Since the benefit of being a monopolist is earning positive economic profit, a rational monopolist will spend up to the entire dollar amount of the expected positive economic profit amount to get and keep its monopoly.

Problems and Applications

Since the benefit of being a monopolist is earning positive economic profit, a rational monopolist will spend up to the entire dollar amount of the expected positive economic profit amount to get and keep its monopoly.

Problems and Applications

4

What are the implications of the monitoring problem for economic analysis?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

5

What is the monitoring problem as it applies to corporate management? What are some potential solutions for this problem?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

6

What is the monitoring problem, and how does it relate to the standard economic model of the firm?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

7

Having just graduated from college, you accept a position with a large corporation as an entry-level sales manager. After a few weeks on the job, you observe that many of your senior colleagues are not working very hard, but make a lot more money than you do. You remember learning about the "motivating discipline" of corporate takeovers within your Economics courses. Draft a memo to your colleagues explaining how corporate takeovers might impact their lives if they don't alter their behavior. Why might you hesitate to write such a letter?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

8

Explain how owners can try to deal with the monitoring problem by using incentive-compatible contracts. Is tying managerial compensation to annual profit a sure-fire solution to the monitoring problem? Why or why not?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

9

Distinguish two uses of the word competition, and relate that discussion to Peter Thiel's statement that competition is for losers.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

10

Economists often describe competition as a market structure. Why do they also think of competition as a process?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

11

Explain why X-inefficiencies are often associated with lazy monopolists. In your answer, make sure you define a lazy monopolist and X-inefficiency.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

12

Define X-inefficiency and explain how the threat of takeovers helps to limit X-inefficiency.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

13

If one were to observe the short-run behavior of a typical American business enterprise, you might fail to see the profit-maximizing behavior assumed by economists. Suggest two reasons for this.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

14

Demonstrate graphically and explain verbally why there is an incentive for suppliers to get together to restrict supply. As part of your explanation discuss why consumers-even though they are hurt by this-typically don't fight it.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

15

Describe two market mechanisms that may serve to enhance efficiency and limit the lazy monopolist problem. Can efficiency be achieved by incentives other than profit?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

16

A sizeable proportion of corporate takeovers are financed with so-called junk bonds. Such bonds offer bondholders higher rates of return than most other bonds traded because there are no hard assets as collateral to reduce the risk for bondholders in case of a default. The sellers of the bonds hope to be able to meet their obligations to pay these high rates of return to bondholders through the expected increase in profits of the company(ies) just taken over. How do the monitoring problem and the existence of lazy monopolists contribute to the market for junk bonds?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

17

The threat of a corporate takeover will help prevent lazy monopolist behavior and lead managers to run more efficient, more profitable firms in order to prevent being taken over. Wouldn't a more efficient, more profitable firm be even more inviting for a corporate takeover? Explain why not.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

18

Describe two things firms do to try to break up a monopoly. Give an example of each. What can monopolists do to try to keep other firms from taking away some of their markets?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

19

Economists describe competition as a market structure, a specific type of institutional arrangement. In what other way can the term "competition" be used? Explain your answer.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

20

Briefly describe the monitoring problem as it applies to the managers of corporations. Why is this problem so severe in large corporations?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

21

Often, if a monopoly exists, other firms try to figure out how to break it up - to get a share of the monopolist's profit. Describe two things firms do to try to enter a monopolized industry. Give an example of each.

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck

22

Consider the following advertisement: "We will pay you $13 to buy a light bulb that pays for itself." The coupon necessary to take advantage of this offer was available only at offices at the local electric company. Why do you think the electric company would make such an offer?

Unlock Deck

Unlock for access to all 22 flashcards in this deck.

Unlock Deck

k this deck