Deck 7: Corporate Valuation and Stock Valuation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 7: Corporate Valuation and Stock Valuation

1

Justus Motor Co.has a WACC of 11.50%, and its value of operations is $25.00 million.Justus's free cash flow is expected to grow at a constant rate of 7.00%.What was the last free cash flow, FCF0 in millions?

A) $0.95

B) $1.05

C) $1.16

D) $1.27

E) $1.40

A) $0.95

B) $1.05

C) $1.16

D) $1.27

E) $1.40

$1.05

2

The cash flows associated with common stock are more difficult to estimate than those related to bonds because stock has a residual claim against the company versus a contractual obligation for a bond.

True

3

If a company's free cash flows are expected to grow at a constant rate of 5% a year, which of the following statements is CORRECT? The stock is in equilibrium.

A) The company's stock's dividend yield is 5%.

B) The value of operations is expected to decline in the future.

C) The company's WACC must be equal to or less than 5%.

D) The company's value of operations one year from now is expected to be 5% above the current price.

E) The expected return on the company's stock is 5% a year.

A) The company's stock's dividend yield is 5%.

B) The value of operations is expected to decline in the future.

C) The company's WACC must be equal to or less than 5%.

D) The company's value of operations one year from now is expected to be 5% above the current price.

E) The expected return on the company's stock is 5% a year.

The company's value of operations one year from now is expected to be 5% above the current price.

4

Which of the following statements is CORRECT?

A) The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

B) The preemptive right is a provision in the corporate charter that gives common stockholders the right to purchase (on a pro rata basis) new issues of the firm's common stock.

C) The free cash flow valuation model, Vops =FCF1/(WACC − g), cannot be used for firms that have negative growth rates.

D) The free cash flow valuation model, Vops = FCF1/(WACC − g), can be used only for firms whose growth rates exceed their WACC.

E) If a company has two classes of common stock, Class A and Class B, the stocks may pay different dividends, but under all state charters the two classes must have the same voting rights.

A) The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

B) The preemptive right is a provision in the corporate charter that gives common stockholders the right to purchase (on a pro rata basis) new issues of the firm's common stock.

C) The free cash flow valuation model, Vops =FCF1/(WACC − g), cannot be used for firms that have negative growth rates.

D) The free cash flow valuation model, Vops = FCF1/(WACC − g), can be used only for firms whose growth rates exceed their WACC.

E) If a company has two classes of common stock, Class A and Class B, the stocks may pay different dividends, but under all state charters the two classes must have the same voting rights.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

According to the basic FCF stock valuation model, the value an investor should assign to a share of stock is dependent on the length of time he or she plans to hold the stock.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

If a firm's stockholders are given the preemptive right, this means that stockholders have the right to call for a meeting to vote to replace the management.Without the preemptive right, dissident stockholders would have to seek a change in management through a proxy fight.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

Projected free cash flows should be discounted at the firm's weighted average cost of capital to find the value of its operations.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

The projected cash flow for the next year for Minesuah Inc.is $100,000, and FCF is expected to grow at a constant rate of 6%.If the company's weighted average cost of capital is 11%, what is the value of its operations?

A) $1,714,750

B) $1,805,000

C) $1,900,000

D) $2,000,000

E) $2,100,000

A) $1,714,750

B) $1,805,000

C) $1,900,000

D) $2,000,000

E) $2,100,000

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is CORRECT?

A) Two firms with the same expected free cash flows and growth rates must also have the same value of operations.

B) It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

C) If a company has a weighted average cost of capital WACC = 12%, and if its free cash flows are expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

D) The value of operations is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

E) The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

A) Two firms with the same expected free cash flows and growth rates must also have the same value of operations.

B) It is appropriate to use the constant growth model to estimate a stock's value even if its growth rate is never expected to become constant.

C) If a company has a weighted average cost of capital WACC = 12%, and if its free cash flows are expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

D) The value of operations is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

E) The constant growth model takes into consideration the capital gains investors expect to earn on a stock.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

A company's free cash flow was just FCF0 = $1.50 million.The weighted average cost of capital is WACC = 10.1%, and the constant growth rate is g = 4.0%.What is the current value of operations?

A) $23.11 million

B) $23.70 million

C) $24.31 million

D) $24.93 million

E) $25.57 million

A) $23.11 million

B) $23.70 million

C) $24.31 million

D) $24.93 million

E) $25.57 million

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

A proxy is a document giving one party the authority to act for another party, including the power to vote shares of common stock.Proxies can be important tools relating to control of firms.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is NOT CORRECT?

A) The free cash flow valuation model discounts free cash flows by the required return on equity.

B) The free cash flow valuation model can be used to find the value of a division.

C) An important step in applying the free cash flow valuation model is forecasting the firm's pro forma financial statements.

D) Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value.

E) The free cash flow valuation model can be used both for companies that pay dividends and those that do not pay dividends.

A) The free cash flow valuation model discounts free cash flows by the required return on equity.

B) The free cash flow valuation model can be used to find the value of a division.

C) An important step in applying the free cash flow valuation model is forecasting the firm's pro forma financial statements.

D) Free cash flows are assumed to grow at a constant rate beyond a specified date in order to find the horizon, or terminal, value.

E) The free cash flow valuation model can be used both for companies that pay dividends and those that do not pay dividends.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

Young & Liu Inc.'s free cash flow during the just-ended year (t = 0) was $100 million, and FCF is expected to grow at a constant rate of 5% in the future.If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions?

A) $948

B) $998

C) $1,050

D) $1,103

E) $1,158

A) $948

B) $998

C) $1,050

D) $1,103

E) $1,158

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

The preemptive right gives current stockholders the right to purchase, on a pro rata basis, any new shares issued by the firm.This right helps protect current stockholders against both dilution of control and dilution of value.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

Founders' shares are a type of classified stock where the shares are owned by the firm's founders, and they generally have more votes per share than the other classes of common stock.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

Classified stock differentiates various classes of common stock, and using it is one way companies can meet special needs such as when owners of a start-up firm need additional equity capital but don't want to relinquish voting control.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

Lance Inc.'s free cash flow was just $1.00 million.If the expected long-run growth rate for this company is 5.4%, if the weighted average cost of capital is 11.4%, Lance has $4 million in short-term investments and $3 million in debt, and 1 million shares outstanding, what is the intrinsic stock price?

A) $17.28

B) $17.70

C) $18.13

D) $18.57

E) $19.01

A) $17.28

B) $17.70

C) $18.13

D) $18.57

E) $19.01

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

The free cash flow valuation model cannot be used unless a company doesn't pay dividends.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

The preemptive right is important to shareholders because it

A) will result in higher dividends per share.

B) is included in every corporate charter.

C) protects the current shareholders against a dilution of their ownership interests.

D) protects bondholders, and thus enables the firm to issue debt with a relatively low interest rate.

E) allows managers to buy additional shares below the current market price.

A) will result in higher dividends per share.

B) is included in every corporate charter.

C) protects the current shareholders against a dilution of their ownership interests.

D) protects bondholders, and thus enables the firm to issue debt with a relatively low interest rate.

E) allows managers to buy additional shares below the current market price.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

Judd Corporation has a weighted average cost of capital of 10.25%, and its value of operations is $57.50 million.Free cash flow is expected to grow at a constant rate of 6.00% per year.What is the expected year-end free cash flow, FCF1 in millions?

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

The Jameson Company just paid a dividend of $0.75 per share, and that dividend is expected to grow at a constant rate of 5.50% per year in the future.The company's beta is 1.15, the market risk premium is 5.00%, and the risk-free rate is 4.00%.What is Jameson's current stock price, P0?

A) $18.62

B) $19.08

C) $19.56

D) $20.05

E) $20.55

A) $18.62

B) $19.08

C) $19.56

D) $20.05

E) $20.55

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

According to the nonconstant growth model discussed in the textbook, the discount rate used to find the present value of the expected cash flows during the initial growth period is the same as the discount rate used to find the PVs of cash flows during the subsequent constant growth period.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

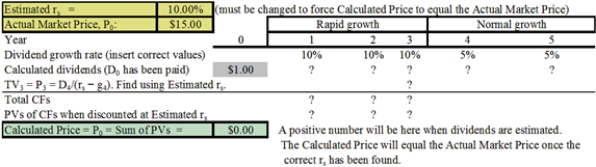

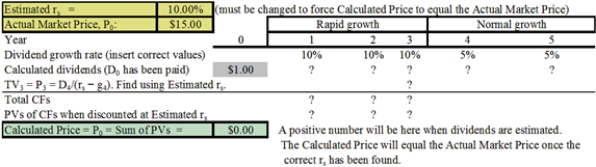

Julia Saunders is your boss and the treasurer of Foster Carter Enterprises (FCE).She asked you to help her estimate the intrinsic value of the company's stock.FCE just paid a dividend of $1.00, and the stock now sells for $15.00 per share.Julia asked a number of security analysts what they believe FCE's future dividends will be, based on their analysis of the company.The consensus is that the dividend will be increased by 10% during Years 1 to 3, and it will be increased at a rate of 5% per year in Year 4 and thereafter.Julia asked you to use that information to estimate the required rate of return on the stock, rs, and she provided you with the following template for use in the analysis:  Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?

Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?

A) 11.84%

B) 12.21%

C) 12.58%

D) 12.97%

E) 13.36%

Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?

Julia told you that the growth rates in the template were just put in as a trial, and that you must replace them with the analysts' forecasted rates to get the correct forecasted dividends and then the estimated TV.She also notes that the estimated value for rs, at the top of the template, is also just a guess, and you must replace it with a value that will cause the Calculated Price shown at the bottom to equal the Actual Market Price.She suggests that, after you have put in the correct dividends, you can manually calculate the price, using a series of guesses as to the Estimated rs.The value of rs that causes the calculated price to equal the actual price is the correct one.She notes, though, that this trial-and-error process would be quite tedious, and that the correct rs could be found much faster with a simple Excel model, especially if you use Goal Seek.What is the value of rs?A) 11.84%

B) 12.21%

C) 12.58%

D) 12.97%

E) 13.36%

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

The last dividend paid by Coppard Inc.was $1.25.The dividend growth rate is expected to be constant at 15% for 3 years, after which dividends are expected to grow at a rate of 6% forever.If the firm's required return (rs) is 11%, what is its current stock price?

A) $30.57

B) $31.52

C) $32.49

D) $33.50

E) $34.50

A) $30.57

B) $31.52

C) $32.49

D) $33.50

E) $34.50

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

Hirshfeld Corporation's stock has a required rate of return of 10.25%, and it sells for $57.50 per share.The dividend is expected to grow at a constant rate of 6.00% per year.What is the expected year-end dividend, D1?

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

A) $2.20

B) $2.44

C) $2.69

D) $2.96

E) $3.25

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

The last dividend paid by Wilden Corporation was $1.55.The dividend growth rate is expected to be constant at 1.5% for 2 years, after which dividends are expected to grow at a rate of 8.0% forever.The firm's required return (rs) is 12.0%.What is the best estimate of the current stock price?

A) $37.05

B) $38.16

C) $39.30

D) $40.48

E) $41.70

A) $37.05

B) $38.16

C) $39.30

D) $40.48

E) $41.70

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

Preferred stock is a hybrid⎯a sort of cross between a common stock and a bond⎯in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

Kinkead Inc.forecasts that its free cash flow in the coming year, i.e., at t = 1, will be −$10 million, but its FCF at t = 2 will be $20 million.After Year 2, FCF is expected to grow at a constant rate of 4% forever.If the weighted average cost of capital is 14%, what is the firm's value of operations, in millions?

A) $158

B) $167

C) $175

D) $184

E) $193

A) $158

B) $167

C) $175

D) $184

E) $193

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

A company is expected to have free cash flows of $0.75 million next year.The weighted average cost of capital is WACC = 10.5%, and the expected constant growth rate is g = 6.4%.The company has $2 million in short-term investments, $2 million in debt, and 1 million shares.What is the stock's current intrinsic stock price?

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

A) $17.39

B) $17.84

C) $18.29

D) $18.75

E) $19.22

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

National Advertising just paid a dividend of D0 = $0.75 per share, and that dividend is expected to grow at a constant rate of 6.50% per year in the future.The company's beta is 1.25, the required return on the market is 10.50%, and the risk-free rate is 4.50%.What is the company's current stock price?

A) $14.52

B) $14.89

C) $15.26

D) $15.64

E) $16.03

A) $14.52

B) $14.89

C) $15.26

D) $15.64

E) $16.03

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

McGaha Enterprises expects earnings and dividends to grow at a rate of 25% for the next 4 years, after the growth rate in earnings and dividends will fall to zero, i.e., g = 0.The company's last dividend, D0, was $1.25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00%.What is the current price of the common stock?

A) $26.77

B) $27.89

C) $29.05

D) $30.21

E) $31.42

A) $26.77

B) $27.89

C) $29.05

D) $30.21

E) $31.42

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is CORRECT?

A) If a company has a WACC = 12% and its free cash flow is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

B) The free cash flow valuation model for constant growth, Vop = FCF1/(WACC − g), can be used to value firms whose free cash flows are expected to decline at a constant rate, i.e., to grow at a negative rate.

C) The value of operations of a stock is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

D) The constant growth model cannot be used for a zero growth stock, where free cash flows are expected to remain constant over time.

E) The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years.

A) If a company has a WACC = 12% and its free cash flow is expected to grow at a constant rate of 5%, this implies that the stock's dividend yield is also 5%.

B) The free cash flow valuation model for constant growth, Vop = FCF1/(WACC − g), can be used to value firms whose free cash flows are expected to decline at a constant rate, i.e., to grow at a negative rate.

C) The value of operations of a stock is the present value of all expected future free cash flows, discounted at the free cash flow growth rate.

D) The constant growth model cannot be used for a zero growth stock, where free cash flows are expected to remain constant over time.

E) The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

Kellner Motor Co.'s stock has a required rate of return of 11.50%, and it sells for $25.00 per share.Kellner's dividend is expected to grow at a constant rate of 7.00%.What was the last dividend, D0?

A) $0.95

B) $1.05

C) $1.16

D) $1.27

E) $1.40

A) $0.95

B) $1.05

C) $1.16

D) $1.27

E) $1.40

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

Gere Furniture forecasts a free cash flow of $40 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5% thereafter.If the weighted average cost of capital is 10% and the cost of equity is 15%, what is the horizon value, in millions at t = 3?

A) $840

B) $882

C) $926

D) $972

E) $1,021

A) $840

B) $882

C) $926

D) $972

E) $1,021

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

Barnette Inc.'s free cash flows are expected to be unstable during the next few years while the company undergoes restructuring.However, FCF is expected to be $50 million in Year 5, i.e., FCF at t = 5 equals $50 million, and the FCF growth rate is expected to be constant at 6% beyond that point.If the weighted average cost of capital is 12%, what is the horizon value (in millions) at t = 5?

A) $719

B) $757

C) $797

D) $839

E) $883

A) $719

B) $757

C) $797

D) $839

E) $883

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

Connolly Co.'s expected year-end dividend is D1 = $1.60, its required return is rs = 11.00%, its dividend yield is 6.00%, and its growth rate is expected to be constant in the future.What is Connolly's expected stock price in 7 years, i.e., what is ?

A) $37.52

B) $39.40

C) $41.37

D) $43.44

E) $45.61

A) $37.52

B) $39.40

C) $41.37

D) $43.44

E) $45.61

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

Orwell Building Supplies' last dividend was $1.75.Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever.Its required return (rs) is 12%.What is the best estimate of the current stock price?

A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

A) $41.58

B) $42.64

C) $43.71

D) $44.80

E) $45.92

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

Burke Tires just paid a dividend of D0 = $1.32.Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter.The required return on this low-risk stock is 9.00%.What is the best estimate of the stock's current market value?

A) $41.59

B) $42.65

C) $43.75

D) $44.87

E) $45.99

A) $41.59

B) $42.65

C) $43.75

D) $44.87

E) $45.99

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

Decker Tires' free cash flow was just FCF0 = $1.32.Analysts expect the company's free cash flow to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter.The WACC for this company 9.00%.Decker has $4 million in short-term investments and $14 million in debt and 1 million shares outstanding.What is the best estimate of the stock's current intrinsic price?

A) $31.59

B) $32.65

C) $33.75

D) $34.87

E) $35.99

A) $31.59

B) $32.65

C) $33.75

D) $34.87

E) $35.99

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

The required return for Williamson Heating's stock is 12%, and the stock sells for $40 per share.The firm just paid a dividend of $1.00, and the dividend is expected to grow by 30% per year for the next 4 years, so D4 = $1.00(1.30)4 = $2.8561.After t = 4, the dividend is expected to grow at a constant rate of X% per year forever.What is the stock's expected constant growth rate after t = 4, i.e., what is X?

A) 5.17%

B) 5.44%

C) 5.72%

D) 6.02%

E) 6.34%

A) 5.17%

B) 5.44%

C) 5.72%

D) 6.02%

E) 6.34%

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

Alcott's preferred stock pays a dividend of $1.00 per quarter.If the price of the stock is $45.00, what is its nominal (not effective) annual rate of return?

A) 8.03%

B) 8.24%

C) 8.45%

D) 8.67%

E) 8.89%

A) 8.03%

B) 8.24%

C) 8.45%

D) 8.67%

E) 8.89%

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

Connor Publishing's preferred stock pays a dividend of $1.00 per quarter, and it sells for $55.00 per share.What is its effective annual (not nominal) rate of return?

A) 6.62%

B) 6.82%

C) 7.03%

D) 7.25%

E) 7.47%

A) 6.62%

B) 6.82%

C) 7.03%

D) 7.25%

E) 7.47%

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

Carby Hardware has an outstanding issue of perpetual preferred stock with an annual dividend of $7.50 per share.If the required return on this preferred stock is 6.5%, at what price should the preferred stock sell?

A) $104.27

B) $106.95

C) $109.69

D) $112.50

E) $115.38

A) $104.27

B) $106.95

C) $109.69

D) $112.50

E) $115.38

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

From an investor's perspective, a firm's preferred stock is generally considered to be less risky than its common stock but more risky than its bonds.However, from a corporate issuer's standpoint, these risk relationships are reversed: Bonds are the most risky for the firm, preferred is next, and common is least risky.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck