Deck 4: Further Development and Analysis of the Classical Linear Regression Model

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/25

Play

Full screen (f)

Deck 4: Further Development and Analysis of the Classical Linear Regression Model

1

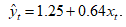

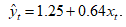

Assuming there are 1000 observations in your sample, what are the test statistic and critical value of a two-sided hypothesis test of whether the true value of  statistically different from zero be given a 5% significance level?

statistically different from zero be given a 5% significance level?

A) 1.10 and 1.96, respectively

B) 0.91 and 1.65, respectively

C) -0.62 and 1.96, respectively

D) Cannot say without more information

statistically different from zero be given a 5% significance level?

statistically different from zero be given a 5% significance level?A) 1.10 and 1.96, respectively

B) 0.91 and 1.65, respectively

C) -0.62 and 1.96, respectively

D) Cannot say without more information

1.10 and 1.96, respectively

2

Consider a bivariate regression model with coefficient standard errors calculated using the usual formulae. Which of the following statements is/are correct regarding the standard error estimator for the slope coefficient?

(I) It varies positively with the square root of the residual variance (s)

(ii) It varies positively with the spread of X about its mean value

(iii) It varies positively with the spread of X about zero

(iv) It varies positively with the sample size T

A) (i) only

B) (i) and (iv) only

C) (i), (ii) and (iv) only

D) (i), (ii), (iii) and (iv).

(I) It varies positively with the square root of the residual variance (s)

(ii) It varies positively with the spread of X about its mean value

(iii) It varies positively with the spread of X about zero

(iv) It varies positively with the sample size T

A) (i) only

B) (i) and (iv) only

C) (i), (ii) and (iv) only

D) (i), (ii), (iii) and (iv).

(i) only

3

What result is proved by the Gauss-Markov theorem?

A) That OLS gives unbiased coefficient estimates

B) That OLS gives minimum variance coefficient estimates

C) That OLS gives minimum variance coefficient estimates only among the class of linear unbiased estimators

D) That OLS ensures that the errors are distributed normally

A) That OLS gives unbiased coefficient estimates

B) That OLS gives minimum variance coefficient estimates

C) That OLS gives minimum variance coefficient estimates only among the class of linear unbiased estimators

D) That OLS ensures that the errors are distributed normally

That OLS gives minimum variance coefficient estimates only among the class of linear unbiased estimators

4

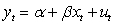

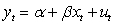

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha ( ) of Fund ABC from question 6?

) of Fund ABC from question 6?

A) 3.5

B) 4.5

C) 5.5

D) 6.5

is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

Suppose that the unbiased estimator of the standard deviation of the disturbance (s) is 5.1. What is the nearest value to the standard errors of the estimated CAPM alpha (

) of Fund ABC from question 6?

) of Fund ABC from question 6?A) 3.5

B) 4.5

C) 5.5

D) 6.5

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

5

Regression is concerned with describing and evaluating the relationship between

A) A dependent variable and regressands

B) An independent variable and regressors

C) A dependent variable and regressors

D) An effect variable and explained variables

A) A dependent variable and regressands

B) An independent variable and regressors

C) A dependent variable and regressors

D) An effect variable and explained variables

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

6

Suppose you have calculated the following regression results:

The standard errors of

The standard errors of  1.22 and 0.58, respectively

1.22 and 0.58, respectively

Using the test of significance approach, what is the test statistic value of a hypothesis to test whether the true value ofstatistically different from zero?

a hypothesis to test whether the true value ofstatistically different from zero?

A) 1.10

B) 0.91

C) -0.62

D) Cannot say without more information

The standard errors of

The standard errors of  1.22 and 0.58, respectively

1.22 and 0.58, respectivelyUsing the test of significance approach, what is the test statistic value of

a hypothesis to test whether the true value ofstatistically different from zero?

a hypothesis to test whether the true value ofstatistically different from zero?A) 1.10

B) 0.91

C) -0.62

D) Cannot say without more information

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is correct concerning the conditions required for OLS to be a usable estimation technique?

A) The model must be linear in the parameters

B) The model must be linear in the variables

C) The model must be linear in the variables and the parameters

D) The model must be linear in the residuals.

A) The model must be linear in the parameters

B) The model must be linear in the variables

C) The model must be linear in the variables and the parameters

D) The model must be linear in the residuals.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

8

What does a positive linear relationship between x and y in a simple regression imply?

A) Increases in the independent variable are usually accompanied by increases in the regressor

B) The relationship between x and y cannot be explained by a straight line

C) Decreases in the independent variable is usually accompanied by increases in the regressors

D) Increases in the regressor are usually accompanied by increases in the dependent variable

A) Increases in the independent variable are usually accompanied by increases in the regressor

B) The relationship between x and y cannot be explained by a straight line

C) Decreases in the independent variable is usually accompanied by increases in the regressors

D) Increases in the regressor are usually accompanied by increases in the dependent variable

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following is NOT correct with regard to the p-value attached to a test statistic?

A) p-values can only be used for two-sided tests

B) It is the marginal significance level where we would be indifferent between rejecting and not rejecting the null hypothesis

C) It is the exact significance level for the test

D) Given the p-value, we can make inferences without referring to statistical tables

A) p-values can only be used for two-sided tests

B) It is the marginal significance level where we would be indifferent between rejecting and not rejecting the null hypothesis

C) It is the exact significance level for the test

D) Given the p-value, we can make inferences without referring to statistical tables

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following is NOT a good reason for including a disturbance term in a regression equation?

A) It captures omitted determinants of the dependent variable

B) To allow for the non-zero mean of the dependent variable

C) To allow for errors in the measurement of the dependent variable

D) To allow for random influences on the dependent variable

A) It captures omitted determinants of the dependent variable

B) To allow for the non-zero mean of the dependent variable

C) To allow for errors in the measurement of the dependent variable

D) To allow for random influences on the dependent variable

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

11

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

The estimators and

and  determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?

determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?

(I) The errors have zero mean

(II) The variance of the errors is constant and finite over all values of the independent variable(s)

(III) The errors are linearly independent of one another

(IV)There is no relationship between the error and corresponding independent variables

A) I and II only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

The estimators

and

and  determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?

determined by OLS will be the Best Linear Unbiased Estimators (BLUE) if which of the following assumptions hold?(I) The errors have zero mean

(II) The variance of the errors is constant and finite over all values of the independent variable(s)

(III) The errors are linearly independent of one another

(IV)There is no relationship between the error and corresponding independent variables

A) I and II only

B) I, II and III only

C) II, III and IV only

D) I, II, III and IV

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

12

The type I error associated with testing a hypothesis is equal to

A) One minus the type II error

B) The confidence level

C) The size of the test

D) The size of the sample

A) One minus the type II error

B) The confidence level

C) The size of the test

D) The size of the sample

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

13

Which of these is not a reason for adding a disturbance term to a regression model ?

A) Some determinants of the effect variable may be omitted from the model

B) Some determinants of the effect variable may be unobservable

C) Some determinants of the independent variable may be omitted from the model

D) There may be errors in the way that the dependent variable is measured which cannot be modelled

A) Some determinants of the effect variable may be omitted from the model

B) Some determinants of the effect variable may be unobservable

C) Some determinants of the independent variable may be omitted from the model

D) There may be errors in the way that the dependent variable is measured which cannot be modelled

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

14

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

Given the data in question 6, what is the estimated beta ( ) of Fund ABC?

) of Fund ABC?

A) 3.1

B) 2.1

C) 1.1

D) None of the above

is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

Given the data in question 6, what is the estimated beta (

) of Fund ABC?

) of Fund ABC?A) 3.1

B) 2.1

C) 1.1

D) None of the above

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

15

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

The estimated alpha ( ) and beta (

) and beta (  ) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?

) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?

A) 39.5%

B) 30.7%

C) 5.4%

D) 64.8%

is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

The estimated alpha (

) and beta (

) and beta (  ) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?

) of a rival fund, Fund DEF, are 2.3 and 3.1, respectively. If the expected market risk premium is 12%, what would we expect the excess return of Fund DEF to be?A) 39.5%

B) 30.7%

C) 5.4%

D) 64.8%

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

16

In a time series regression of the excess return of a mutual fund on a constant and the excess return on a market index, which of the following statements should be true for the fund manager to be considered to have "beaten the market" in a statistical sense?

A) The estimate for should be positive and statistically significant

B) The estimate for should be positive and statistically significantly greater than the risk-free rate of return

C) The estimate for should be positive and statistically significant

D) The estimate for should be negative and statistically significant.

A) The estimate for should be positive and statistically significant

B) The estimate for should be positive and statistically significantly greater than the risk-free rate of return

C) The estimate for should be positive and statistically significant

D) The estimate for should be negative and statistically significant.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is a correct interpretation of a "95% confidence interval" for a regression parameter?

A) We are 95% sure that the interval contains the true value of the parameter

B) We are 95% sure that our estimate of the coefficient is correct

C) We are 95% sure that the interval contains our estimate of the coefficient

D) In repeated samples, we would derive the same estimate for the coefficient 95% of the time

A) We are 95% sure that the interval contains the true value of the parameter

B) We are 95% sure that our estimate of the coefficient is correct

C) We are 95% sure that the interval contains our estimate of the coefficient

D) In repeated samples, we would derive the same estimate for the coefficient 95% of the time

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

18

The method of estimating econometric models which involves fitting a line to the data by minimising the sum of squared residuals is the

A) Method of ordinary least squares

B) Method of moments

C) Method of generalised squared moments

D) Method of maximum likelihood

A) Method of ordinary least squares

B) Method of moments

C) Method of generalised squared moments

D) Method of maximum likelihood

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

19

Suppose you have 5-year annual data on the excess returns on a fund manager’s portfolio (“fund ABC”) and the excess returns on a market index (where  is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

What is the most appropriate interpretation of the assumption concerning the regression disturbance terms?

A) The errors are nonlinearly independent of one another

B) The errors are linearly dependent of one another

C) The covariance of the errors is constant and finite over all its values

D) The errors are linearly independent of one another

is the return on fund ABC,

is the return on fund ABC,  is the risk-free rate and

is the risk-free rate and  is the return on the market index):

is the return on the market index):

What is the most appropriate interpretation of the assumption concerning the regression disturbance terms?

A) The errors are nonlinearly independent of one another

B) The errors are linearly dependent of one another

C) The covariance of the errors is constant and finite over all its values

D) The errors are linearly independent of one another

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

20

Which of these is not a standard method for estimating econometric models?

A) Ordinary least squares

B) The method of moments

C) Method of generalised squared moments

D) Maximum likelihood

A) Ordinary least squares

B) The method of moments

C) Method of generalised squared moments

D) Maximum likelihood

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

21

What is the relationship, if any, between the normal and t-distributions?

A) A t-distribution with zero degrees of freedom is a normal

B) A t-distribution with one degree of freedom is a normal

C) A t-distribution with infinite degrees of freedom is a normal

D) There is no relationship between the two distributions.

A) A t-distribution with zero degrees of freedom is a normal

B) A t-distribution with one degree of freedom is a normal

C) A t-distribution with infinite degrees of freedom is a normal

D) There is no relationship between the two distributions.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

22

Which one of the following is NOT an assumption of the classical linear regression model?

A) The explanatory variables are uncorrelated with the error terms.

B) The disturbance terms have zero mean

C) The dependent variable is not correlated with the disturbance terms

D) The disturbance terms are independent of one another.

A) The explanatory variables are uncorrelated with the error terms.

B) The disturbance terms have zero mean

C) The dependent variable is not correlated with the disturbance terms

D) The disturbance terms are independent of one another.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

23

Consider an increase in the size of the test used to examine a hypothesis from 5% to 10%. Which one of the following would be an implication?

A) The probability of a Type I error is increased

B) The probability of a Type II error is increased

C) The rejection criterion has become more strict

D) The null hypothesis will be rejected less often.

A) The probability of a Type I error is increased

B) The probability of a Type II error is increased

C) The rejection criterion has become more strict

D) The null hypothesis will be rejected less often.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

24

Two researchers have identical models, data, coefficients and standard error estimates. They test the same hypothesis using a two-sided alternative, but researcher 1 uses a 5% size of test while researcher 2 uses a 10% test. Which one of the following statements is correct?

A) Researcher 2 will use a larger critical value from the t-tables

B) Researcher 2 will have a higher probability of type I error

C) Researcher 1 will be more likely to reject the null hypothesis

D) Both researchers will always reach the same conclusion.

A) Researcher 2 will use a larger critical value from the t-tables

B) Researcher 2 will have a higher probability of type I error

C) Researcher 1 will be more likely to reject the null hypothesis

D) Both researchers will always reach the same conclusion.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is the most accurate definition of the term "the OLS estimator"?

A) It comprises the numerical values obtained from OLS estimation

B) It is a formula that, when applied to the data, will yield the parameter estimates

C) It is equivalent to the term "the OLS estimate"

D) It is a collection of all of the data used to estimate a linear regression model.

A) It comprises the numerical values obtained from OLS estimation

B) It is a formula that, when applied to the data, will yield the parameter estimates

C) It is equivalent to the term "the OLS estimate"

D) It is a collection of all of the data used to estimate a linear regression model.

Unlock Deck

Unlock for access to all 25 flashcards in this deck.

Unlock Deck

k this deck