Deck 22: S Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/129

Play

Full screen (f)

Deck 22: S Corporations

1

A corporation can revoke its S election prospectively.

True

2

Where the S corporation rules are silent, C corporation provisions apply.

True

3

Distributions of appreciated property by an S corporation are not taxable to the entity.

False

4

A one person LLC can be a shareholder of an S corporation.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

5

S corporation status allows shareholders to realize tax benefits from corporate losses immediately (assuming sufficient stock basis).

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

6

An estate may be a shareholder of an S corporation.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

7

If a resident alien shareholder moves outside the U.S., the S election is terminated.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

8

The AAA begins with a zero balance on the first day of an S corporation's first tax year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

9

NOL carryovers from C years can be used in an S corporation year against ordinary income.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

10

An S election is made on the shareholder's Form 2553.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

11

Tax-exempt income at the S corporation level flows through as taxable to the shareholder.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

12

A corporation may alternate between S corporation and C corporation status each year, depending on which results in more tax savings.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

13

An S election made before becoming a corporation is valid only beginning with the first 12-month tax year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

14

Most limited liability partnerships can own stock in an S corporation.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

15

AAA can have a negative balance.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

16

A newly formed S corporation does not receive any tax benefit from a C corporation's NOL incurred in its first election tax year.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

17

Liabilities affect the owner's basis differently in an S corporation than they do in a partnership.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

18

A former spouse is treated as being in the same family as the individual to whom he or she was married, for purposes of determining the number of S corporation shareholders.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

19

A distribution from the other adjustment account (OAA) is not taxable to an S shareholder.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

20

An S corporation cannot incur a tax liability at the corporation level.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

21

A capital loss allocated to a shareholder always reduces the Other Adjustments Account.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

22

Tax-exempt income at the corporate level flows through as exempt to S shareholders.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

23

An S corporation does not recognize a loss when distributing assets that are worth less than their basis.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

24

Depreciation recapture income is a Schedule K item on the Form 1120S.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

25

The passive investment income of an S corporation includes gains from the sale of securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

26

The termination of an S election occurs on the day after a corporation ceases to be a qualifying S corporation.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

27

Any distribution of cash or property by a corporation that does not exceed the balance of AAA with respect to S stock during a post-termination transition period of approximately one year is applied against and reduces the basis of the S stock.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

28

All tax preference items flow through the S corporation, to be included in the shareholders' AMT calculations.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

29

A per-day, per-share allocation of flow-through S corporation items must be used.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

30

Post-termination distributions that are charged against OAA are received tax-free.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

31

An S shareholder's basis is increased by stock purchases and capital contributions.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

32

Form 1120S provides an S shareholder's computation of his or her stock basis.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

33

When loss assets are distributed by an S corporation, a shareholder's basis is equal to the asset's fair market value.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

34

The Section 179 expense deduction is a Schedule K item on the Form 1120S.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

35

An S shareholder's basis is decreased by distributions treated as being paid from AAA.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

36

An item that appears in the "Other Adjustments Account" affects stock basis, but not AAA, such as tax-exempt interest.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

37

An S corporation shareholder's stock basis includes his or her direct investments plus a ratable share of any corporate liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

38

An S shareholder who dies during the S corporation tax year must report his or her share of the pro rata income (loss) items up to the date of death, on the final individual tax return.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

39

Only 51% of the shareholders must consent to an S election.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

40

Persons who were S shareholders during any part of the year before the election date, but were not shareholders when the election was made, also must consent to an S election.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

41

An S corporation can claim a deduction for its NOL amounts.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

42

A service-type S corporation shareholder cannot claim the 20% QBI deduction.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

43

The corporate-level tax on recognized built-in gains applies when an S corporation disposes of an asset in a taxable disposition within five years after the date on which the S election took effect.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

44

An S shareholder's stock basis does not include a ratable share of S corporation liabilities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

45

Identify a disadvantage of being an S corporation.

A) Estates can be shareholders.

B) Losses flow through immediately to the shareholders.

C) Section 1202 treatment (Qualified Small Business Stock) is not available.

D) Tax-exempt income flows through as excludible to shareholders.

E) None of the above is a disadvantage of the S election.

A) Estates can be shareholders.

B) Losses flow through immediately to the shareholders.

C) Section 1202 treatment (Qualified Small Business Stock) is not available.

D) Tax-exempt income flows through as excludible to shareholders.

E) None of the above is a disadvantage of the S election.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

46

The passive investment income of an S corporation includes net capital gains from the sale of stocks and securities.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

47

The exclusion of gain on disposition of small business stock is not available on disposition of S corporation stock.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

48

Which corporation is eligible to make the S election?

A) Non-U.S. corporation.

B) One-person limited liability company.

C) Insurance company.

D) U.S. bank.

E) None of the above can select S status.

A) Non-U.S. corporation.

B) One-person limited liability company.

C) Insurance company.

D) U.S. bank.

E) None of the above can select S status.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

49

The LIFO recapture tax is a variation of the passive investment income penalty tax.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

50

An S shareholder's stock basis can be reduced below zero.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

51

Which statement is incorrect with respect to filing an S election?

A) Form 2553 must be filed.

B) All shareholders must consent.

C) The election may be filed in the previous year.

D) An extension of time is available for filing Form 2553.

E) None of the above is incorrect.

A) Form 2553 must be filed.

B) All shareholders must consent.

C) The election may be filed in the previous year.

D) An extension of time is available for filing Form 2553.

E) None of the above is incorrect.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

52

There are no advantages for an S corporation to issue § 1244 stock.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

53

An S corporation must possess which of the following characteristics?

A) Not more than one hundred shareholders.

B) Corporation organized in the U.S.

C) Only one class of stock.

D) All of the above are required of an S corporation.

E) None of the above are required of an S corporation.

A) Not more than one hundred shareholders.

B) Corporation organized in the U.S.

C) Only one class of stock.

D) All of the above are required of an S corporation.

E) None of the above are required of an S corporation.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

54

An S shareholder's stock basis is reduced by flow-through losses before accounting for distributions.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

55

Which statement is incorrect?

A) S corporations are treated as corporations under state law.

B) S corporations are treated as partnerships for Federal income tax purposes.

C) Distributions of appreciated property are taxable to the S corporation.

D) None of the above statements is incorrect.

A) S corporations are treated as corporations under state law.

B) S corporations are treated as partnerships for Federal income tax purposes.

C) Distributions of appreciated property are taxable to the S corporation.

D) None of the above statements is incorrect.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

56

What statement is correct with respect to an S corporation?

A) There is no advantage to elect § 1244 stock.

B) An S corporation can own up to 85% of an insurance company.

C) A resident alien may be a shareholder.

D) A voting trust arrangement is not available.

E) None of the above statements is true.

A) There is no advantage to elect § 1244 stock.

B) An S corporation can own up to 85% of an insurance company.

C) A resident alien may be a shareholder.

D) A voting trust arrangement is not available.

E) None of the above statements is true.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

57

An S corporation is subject to the following tax(es).

A) Corporate income tax (§ 11).

B) Built-in gains tax.

C) Alternative minimum tax.

D) None of the above apply to S corporations.

A) Corporate income tax (§ 11).

B) Built-in gains tax.

C) Alternative minimum tax.

D) None of the above apply to S corporations.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

58

Which, if any, of the following can be eligible shareholders of an S corporation?

A) A Roth IRA.

B) Partnership.

C) A non-U.S. corporation.

D) A nonqualifying trust.

E) None of the above can own stock.

A) A Roth IRA.

B) Partnership.

C) A non-U.S. corporation.

D) A nonqualifying trust.

E) None of the above can own stock.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

59

Compensation for services rendered to an S corporation is subject to FICA taxes.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

60

Pass-through S corporation losses can reduce the basis in the shareholder's loan to the entity, but distributions do not reduce loan basis.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

61

During the year, Miles Nutt, the sole shareholder of a calendar year S corporation, received a distribution of $16,000. At the end of last year, his stock basis was $4,000. The corporation earned $11,000 ordinary income during the year. It has no accumulated E & P. Which statement is correct?

A) Nutt recognizes a $1,000 LTCG.

B) Nutt's stock basis is $2,000.

C) Nutt's ordinary income is $15,000.

D) Nutt's tax-free return of capital is $11,000.

A) Nutt recognizes a $1,000 LTCG.

B) Nutt's stock basis is $2,000.

C) Nutt's ordinary income is $15,000.

D) Nutt's tax-free return of capital is $11,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

62

Which item does not appear on Schedule K of Form 1120S?

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

A) Intangible drilling costs.

B) Foreign loss.

C) Utilities expense.

D) Recovery of a tax benefit.

E) All of the above items appear on Schedule K.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

63

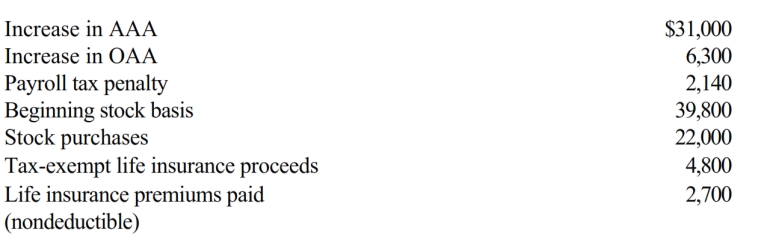

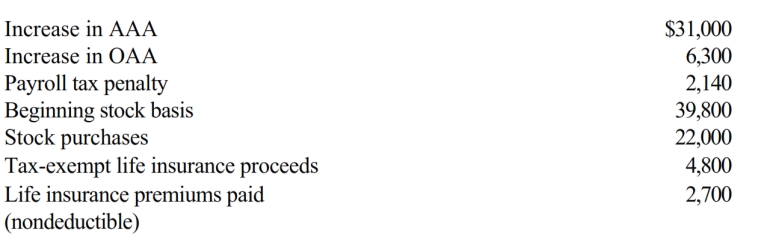

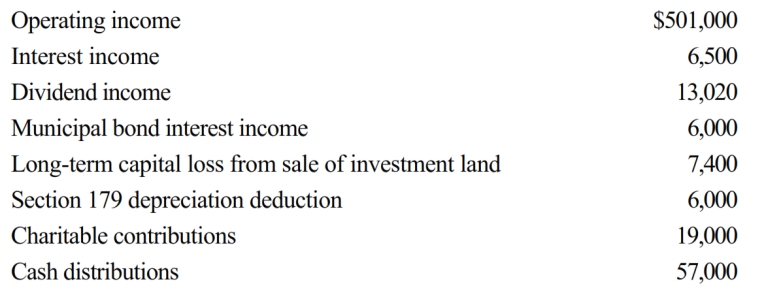

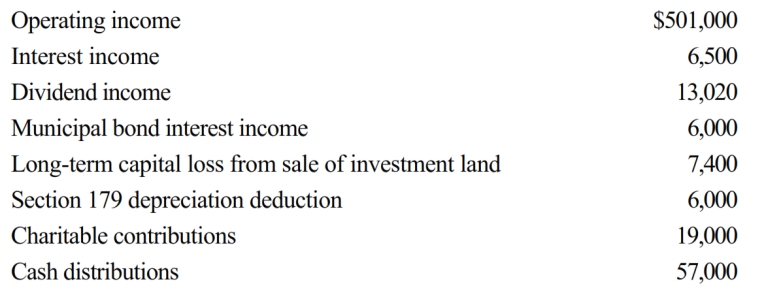

You are given the following facts about a solely owned S corporation. What is the shareholder's ending stock basis?

A) $61,800

B) $68,100

C) $99,100

D) $100,100

A) $61,800

B) $68,100

C) $99,100

D) $100,100

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

64

Several individuals acquire assets on behalf of Skip Corporation on May 28, purchased assets on June 3 and began business on June 11. They subscribe to shares of stock, file articles of incorporation for Skip, and become shareholders on June 21. The S election must be filed no later than 2 1/2 months after:

A) May 28.

B) June 3.

C) June 11.

D) June 21.

E) December 31.

A) May 28.

B) June 3.

C) June 11.

D) June 21.

E) December 31.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

65

Which item has no effect on an S corporation's AAA?

A) Stock purchase by a shareholder.

B) Interest expense.

C) Cost of goods sold.

D) Capital loss.

E) All have an effect on AAA.

A) Stock purchase by a shareholder.

B) Interest expense.

C) Cost of goods sold.

D) Capital loss.

E) All have an effect on AAA.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

66

The maximum number of actual shareholders in an S corporation is:

A) 75.

B) 100.

C) 200.

D) Some other number.

E) Indeterminable.

A) 75.

B) 100.

C) 200.

D) Some other number.

E) Indeterminable.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

67

Fred is the sole shareholder of an S corporation in Fort Deposit, Alabama. At a time when his stock basis is $20,000, the corporation distributes appreciated property worth $100,000 (basis of $20,000). Fred's taxable gain is:

A) $0.

B) $10,000.

C) $80,000.

D) $100,000.

A) $0.

B) $10,000.

C) $80,000.

D) $100,000.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

68

Which, if any, of the following items has no effect on the stock basis of an S corporation shareholder?

A) Operating income.

B) Long-term capital gain.

C) Cost of goods sold.

D) Short-term capital loss.

E) The 20% QBI deduction.

A) Operating income.

B) Long-term capital gain.

C) Cost of goods sold.

D) Short-term capital loss.

E) The 20% QBI deduction.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

69

Which, if any, of the following items decreases an S corporation's AAA?

A) Section 1231 loss.

B) Expenses related to tax-exempt income.

C) Depletion in excess of basis.

D) Distribution from earnings and profits.

E) None of the above affects the AAA.

A) Section 1231 loss.

B) Expenses related to tax-exempt income.

C) Depletion in excess of basis.

D) Distribution from earnings and profits.

E) None of the above affects the AAA.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

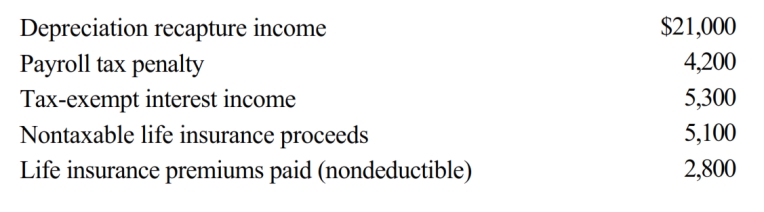

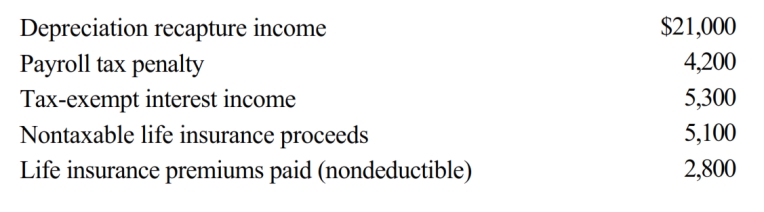

70

If an S corporation's beginning balance in OAA is zero, and the following transactions occur, what is the ending OAA balance?

A) $1,300

B) $7,600

C) $23,300

D) $27,500

E) None of the above

A) $1,300

B) $7,600

C) $23,300

D) $27,500

E) None of the above

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

71

A new S corporation shareholder can revoke the S election unilaterally, if he/she owns how much of the existing S corporation's stock?

A) More than 50%.

B) 50% or more.

C) The election can be revoked only if all of the shareholders consent.

D) The election cannot be revoked during the first year of the new shareholder's ownership.

A) More than 50%.

B) 50% or more.

C) The election can be revoked only if all of the shareholders consent.

D) The election cannot be revoked during the first year of the new shareholder's ownership.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

72

Amit, Inc., an S corporation, holds an AAA balance of $614,000 at the beginning of the tax year. During the year, the following items occur.

Amit's ending AAA balance is:

A) $1,055,620.

B) $1,185,150.

C) $1,191,150.

D) $1,242,150.

E) Some other amount.

Amit's ending AAA balance is:

A) $1,055,620.

B) $1,185,150.

C) $1,191,150.

D) $1,242,150.

E) Some other amount.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

73

Which transaction affects the Other Adjustments Account on an S corporation's Schedule M-2?

A) Payroll penalty.

B) Unreasonable compensation.

C) Life insurance proceeds (nontaxable to the recipient S corporation).

D) Taxable interest.

A) Payroll penalty.

B) Unreasonable compensation.

C) Life insurance proceeds (nontaxable to the recipient S corporation).

D) Taxable interest.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

74

Kinney, Inc., an electing S corporation, holds $5,000 of AEP and $9,000 in AAA at the beginning of the calendar tax year. Kinney has two shareholders, Eric and Maria, each of whom owns 500 shares of Kinney's stock. Kinney's taxable income is $6,000 for the year. Kinney distributes $6,000 to each shareholder on February 1, and it distributes another $3,000 to each shareholder on September 1. How is Eric taxed on the distribution?

A) $500 dividend income.

B) $1,000 dividend income.

C) $1,500 dividend income.

D) $3,000 dividend income.

A) $500 dividend income.

B) $1,000 dividend income.

C) $1,500 dividend income.

D) $3,000 dividend income.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

75

Which statement is incorrect with respect to the number-of-shareholders test in filing an S election?

A) Husband Jaime and wife Maria count as one shareholder.

B) Grandmother Adela and granddaughter Maria count as one shareholder.

C) Husband Jaime and the estate of wife Maria count as one shareholder.

D) Husband Jaime and ex-wife Isabel count as one shareholder.

E) None of the above statements is incorrect.

A) Husband Jaime and wife Maria count as one shareholder.

B) Grandmother Adela and granddaughter Maria count as one shareholder.

C) Husband Jaime and the estate of wife Maria count as one shareholder.

D) Husband Jaime and ex-wife Isabel count as one shareholder.

E) None of the above statements is incorrect.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

76

Which statement is incorrect with respect to an S shareholder's consent?

A) Both husband and wife must consent if one owns the stock as community property.

B) An S election requires a consent from all of the S corporation's shareholders.

C) A consent must be in writing.

D) None of the above statements is incorrect.

A) Both husband and wife must consent if one owns the stock as community property.

B) An S election requires a consent from all of the S corporation's shareholders.

C) A consent must be in writing.

D) None of the above statements is incorrect.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

77

Which, if any, of the following can be eligible shareholders of an S corporation?

A) A partnership.

B) A nonresident alien.

C) A three-person LLC.

D) The estate of a deceased shareholder.

E) None of the above are eligible shareholders.

A) A partnership.

B) A nonresident alien.

C) A three-person LLC.

D) The estate of a deceased shareholder.

E) None of the above are eligible shareholders.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

78

Which item is not included in an S corporation's nonseparately computed income?

A) Net sales.

B) Cost of goods sold.

C) Dividends received.

D) Depreciation recapture.

E) All of the above are included in non-separately computed income.

A) Net sales.

B) Cost of goods sold.

C) Dividends received.

D) Depreciation recapture.

E) All of the above are included in non-separately computed income.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

79

What method is used to allocate S corporation income or losses (unless an election to the contrary is made)?

A) Any method agreed to by all of the shareholders.

B) Per-day allocation.

C) FIFO method.

D) LIFO method.

A) Any method agreed to by all of the shareholders.

B) Per-day allocation.

C) FIFO method.

D) LIFO method.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck

80

Which item does not appear on Schedule K of Form 1120S?

A) Tax-exempt interest income.

B) Section 1231 gain.

C) Section 179 depreciation deduction.

D) Depreciation recapture income.

E) All of the above appear on Schedule K.

A) Tax-exempt interest income.

B) Section 1231 gain.

C) Section 179 depreciation deduction.

D) Depreciation recapture income.

E) All of the above appear on Schedule K.

Unlock Deck

Unlock for access to all 129 flashcards in this deck.

Unlock Deck

k this deck