Deck 28: Income Taxation of Trusts and Estates

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/161

Play

Full screen (f)

Deck 28: Income Taxation of Trusts and Estates

1

With respect to a trust, the terms creator, donor, and grantor are synonyms.

True

2

The first step in computing an estate's taxable income is the determination of its fiduciary accounting income for the year.

True

3

A complex trust is automatically exempt from the Federal AMT.

False

4

The Stratford Estate incurs a $25,000 legal fee in disposing of the real property of the decedent. The executor can decide to claim a $5,000 deduction against the Federal estate tax, and a $20,000 deduction on the estate's income tax return.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

5

The Stratford Estate incurs a $25,000 casualty loss in disposing of the real property of the decedent. The deduction is claimed against the Federal estate tax, unless by election it is claimed on the estate's income tax return.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

6

Usually, a beneficiary takes a carryover basis when a trust distributes a non-cash asset.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

7

Tax planning motivations usually predominate over other objectives in deciding whether to create a trust.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

8

Estates and trusts can claim Federal income tax deductions for costs incurred in maintaining investments in U.S. state and local bonds.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

9

An example of income in respect of a decedent is the taxpayer's last paycheck, uncollected at death.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

10

A complex trust pays tax on the income that it accumulates (i.e., that it does not distribute).

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

11

A trust might be used when a married couple is divorcing.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

12

A decedent's income in respect of a decedent is subject to the Federal income tax, but it is excluded from the estate tax.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

13

If provided for in the controlling agreement, a trust might terminate when the income beneficiary reaches age 35.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

14

Trusts can select any Federal income tax year-end.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

15

Like a corporation, the fiduciary reports and pays its own Federal income tax liability.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

16

An estate's remainder beneficiary generally must wait until the entity is terminated by the executor to receive any distributions.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

17

When a trust operates a trade or business, it can claim a deduction for wages paid to employees.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

18

Under IRS regulations, the decedent's estate must terminate within four years of the date of death, so as to minimize income-shifting techniques.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

19

Generally, capital gains are allocated to fiduciary income, because they arise from current-year transactions as directed by the trustee.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

20

Corpus, principal, and assets of the trust are synonyms.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

21

Harry, the sole income beneficiary, received a $40,000 distribution from the Lucy Trust, in a year when the trust's distributable net income was $30,000. Harry's AGI can increase by as much as $40,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

22

"First-tier distributions" allowed by the will or trust document are made at the discretion of the executor or trustee.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

23

The Whitmer Trust operates a manufacturing business and distributes the profits to its income beneficiaries. Whitmer also passes through to the income beneficiaries the data needed to compute their credit or deduction for foreign income taxes paid.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

24

The Crown Trust distributed one-half of its accounting income to Lee this year. Lee also is allocated one-half of Crown's credit for building low-income housing.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

25

One-fourth of the Cruger Estate's distributable net income consists of net long-term capital gains. Thus, when income beneficiary Susie receives a $40,000 income distribution from the estate, $10,000 of it qualifies for the favorable Federal income tax rate.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

26

The Julius Trust made a gift to the United Charity on August 1, Year Two, from its Year One business profits. The trust's charitable contribution deduction can be claimed in Year Two.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

27

The Griffin Trust makes a gift of long-term capital gain property to a qualifying charity. Griffin's entity-level deduction cannot exceed 30% of distributable net income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

28

A fiduciary's distribution deduction shifts the tax burden for the distributed amount of current-year income from the entity to the beneficiary.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

29

Harry, the sole income beneficiary, received a $40,000 distribution from the Lucy Trust, in a year when the trust's distributable net income was $50,000. Harry's AGI can increase by as much as $40,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

30

The Gable Trust reports $20,000 business income and $10,000 exempt interest income, and it paid a $3,000 fiduciary fee. Gable's distributable net income includes $10,000 for the interest income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

31

In computing distributable net income (DNI) for a trust, one removes any net capital gain or loss that is allocable to income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

32

Harry, the sole income beneficiary, received a $40,000 distribution from the Lucy Trust, in a year when the trust's distributable net income was $50,000. Harry's AGI can increase by as much as $50,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

33

When DNI includes exempt interest income, the beneficiary includes less than the full amount of DNI in current- year gross income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

34

The Malik Estate operates a manufacturing business. Malik made no income distributions this year. It can claim the full deduction for the MACRS depreciation of the assets of the business.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

35

The Whitmer Trust operates a manufacturing business. When Whitmer incurs a net operating loss, the current-year deduction passes through to the income beneficiaries.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

36

The unextended due date for a calendar-year trust to file its Form 1041 is March 15.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

37

Sixty percent of the income received by the Atom Trust this year constituted municipal bond interest. Atom's trustee also made a $100,000 gift to the United Fund, a qualifying charity. The charitable deduction associated with this gift is limited to $60,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

38

The Gable Trust reports $20,000 business income and $10,000 exempt interest income, and it paid a $3,000 fiduciary fee. Gable's distributable net income includes $10,000 of net tax-exempt income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

39

The Gable Trust reports $20,000 business income and $10,000 exempt interest income, and it paid a $3,000 fiduciary fee. Gable's distributable net income (DNI) includes $9,000 for the interest income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

40

Judy can claim one-third of the Sweet Estate's cost recovery deductions, because she received one-third of the fiduciary's distributable net income (DNI).

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

41

The Prakash Trust is required to pay its entire annual accounting income to beneficiaries Sam and Janet. The trust's personal exemption is:

A) $0.

B) $100.

C) $300.

D) $600.

A) $0.

B) $100.

C) $300.

D) $600.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

42

The Code defines a "simple trust" as which of the following?

A) One which is allowed to file Form 1041-EZ.

B) One which has only one income beneficiary.

C) One whose grantor was an individual who still is alive.

D) One which must distribute its accounting income every year.

A) One which is allowed to file Form 1041-EZ.

B) One which has only one income beneficiary.

C) One whose grantor was an individual who still is alive.

D) One which must distribute its accounting income every year.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

43

The Prakash Trust is required to pay its entire annual accounting income to the Daytona Museum, a qualifying charity. The trust's personal exemption is:

A) $0.

B) $100.

C) $300.

D) $600.

A) $0.

B) $100.

C) $300.

D) $600.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following is a typical duty of an executor of an estate?

A) Pay funeral expenses.

B) Pay off the decedent's financial liabilities.

C) Distribute the net assets of the probate estate.

D) Manage the decedent's assets until they are liquidated or distributed.

E) All of the above.

A) Pay funeral expenses.

B) Pay off the decedent's financial liabilities.

C) Distribute the net assets of the probate estate.

D) Manage the decedent's assets until they are liquidated or distributed.

E) All of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is a typical duty of a trustee?

A) File the entity's state and Federal income tax returns.

B) Invest the assets that comprise the corpus of the entity.

C) Distribute entity accounting income to the beneficiaries in accordance with the provisions of the trust instrument.

D) All of the above.

A) File the entity's state and Federal income tax returns.

B) Invest the assets that comprise the corpus of the entity.

C) Distribute entity accounting income to the beneficiaries in accordance with the provisions of the trust instrument.

D) All of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

46

When a trust distributes an in-kind asset with a realized loss, most likely this loss cannot be immediately deducted by the first-tier beneficiary.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

47

The trustee of the Epsilon Trust distributed an asset to Telly, a qualifying income beneficiary. The asset's basis to the trust was $10,000, and its fair market value on the distribution date was $25,000. Which of the following statements is true?

A) Assuming that the trustee made an election under § 643(e), the trust is allowed a $10,000 distribution deduction for this transaction.

B) Assuming that the trustee made an election under § 643(e), Telly recognizes $10,000 gross income on the distribution.

C) Lacking any election by the trustee, the trust recognizes $15,000 gross income on the distribution.

D) Lacking any election by the trustee, Telly's basis in the asset is $10,000.

E) Lacking any election by the trustee, Telly's basis in the asset is stepped up to $25,000.

A) Assuming that the trustee made an election under § 643(e), the trust is allowed a $10,000 distribution deduction for this transaction.

B) Assuming that the trustee made an election under § 643(e), Telly recognizes $10,000 gross income on the distribution.

C) Lacking any election by the trustee, the trust recognizes $15,000 gross income on the distribution.

D) Lacking any election by the trustee, Telly's basis in the asset is $10,000.

E) Lacking any election by the trustee, Telly's basis in the asset is stepped up to $25,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

48

Three weeks after Abed died, his brother Tony properly received Abed's last paycheck from his employer. The gross amount of the check was $4,000, and a $300 deduction for state income taxes was subtracted in computing the net amount of the payment. Which of the following statements is true?

A) The $300 is deductible on neither Tony's income tax return nor on Abed's estate tax return.

B) The $300 is deductible both on Tony's income tax return and on Abed's estate tax return.

C) The $300 is deductible only in computing Abed's taxable estate.

D) The $300 is deductible only on the income tax return of Abed's estate.

A) The $300 is deductible on neither Tony's income tax return nor on Abed's estate tax return.

B) The $300 is deductible both on Tony's income tax return and on Abed's estate tax return.

C) The $300 is deductible only in computing Abed's taxable estate.

D) The $300 is deductible only on the income tax return of Abed's estate.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

49

Income beneficiary Turk received $30,000 from the Urgent Trust. Trust accounting income for the year was $100,000. The trust generated $20,000 in cost recovery deductions. How much can Turk deduct with respect to the cost recovery deductions that Urgent generated?

A) $0

B) $6,000

C) $14,000

D) $20,000

A) $0

B) $6,000

C) $14,000

D) $20,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

50

Tax planning usually dictates that high-income and high-wealth individuals be specified as second-tier beneficiaries of a trust arrangement.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is a typical duty of a trustee?

A) Modify the language of the trust instrument so as to lower the entity's Federal income tax.

B) Make decisions as to how to invest the trust corpus portfolio.

C) Allocate items between income and corpus using Subchapter J rules.

D) All of the above.

A) Modify the language of the trust instrument so as to lower the entity's Federal income tax.

B) Make decisions as to how to invest the trust corpus portfolio.

C) Allocate items between income and corpus using Subchapter J rules.

D) All of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

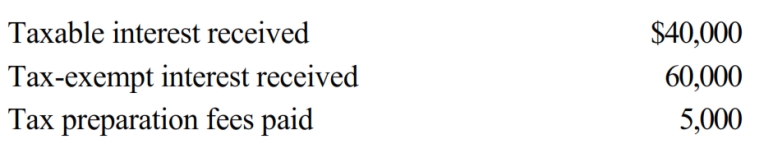

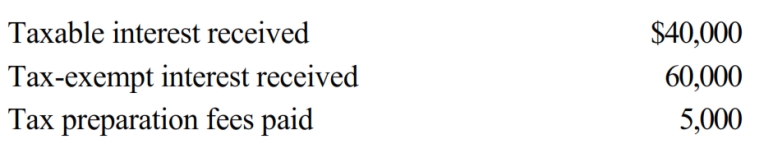

52

The Chen Trust incurred the following items during the year. What is Chen's deduction for the tax preparation fees?

A) $0

B) $2,000

C) $3,000

D) $5,000

A) $0

B) $2,000

C) $3,000

D) $5,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

53

Generally, an administrative expense attributable to municipal bond interest should be claimed on the estate's Form 706.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

54

The Prakash Estate has equal income beneficiaries Sam and Janet. As allowed by the terms of the will, the estate makes no income distributions during the current tax year. The estate's personal exemption is:

A) $0.

B) $100.

C) $300.

D) $600.

A) $0.

B) $100.

C) $300.

D) $600.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

55

Three months after Brianna Timkin died, her executor received the final $40,000 installment from a sale of land that Brianna completed several years ago. Which of the following statements is true?

A) The $40,000 is both included in Brianna's gross estate, and subject to tax on her estate's income tax return.

B) The $40,000 is subject to neither income nor estate tax, because it was received after Brianna's death.

C) The $40,000 is subject to tax only on her estate's income tax return.

D) The $40,000 is included only in Brianna's gross estate.

A) The $40,000 is both included in Brianna's gross estate, and subject to tax on her estate's income tax return.

B) The $40,000 is subject to neither income nor estate tax, because it was received after Brianna's death.

C) The $40,000 is subject to tax only on her estate's income tax return.

D) The $40,000 is included only in Brianna's gross estate.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

56

The tax rules regarding the income taxation of trusts and estates are included in which Subchapter of the Internal Revenue Code?

A) C

B) J

C) K

D) S

A) C

B) J

C) K

D) S

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

57

The Chen Trust is required to distribute its accounting income every year, one-half to Missy Chen, and one-half to the local church's homeless shelter. What is the Chen Trust's personal exemption?

A) $0

B) $100

C) $300

D) $600

A) $0

B) $100

C) $300

D) $600

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following taxpayers use a Schedule K and K-1 to pass through income, loss, and credit amounts to the owners or beneficiaries?

A) Complex trust.

B) Partnership.

C) S corporation.

D) All of the above taxpayers use Schedules K and K-1.

A) Complex trust.

B) Partnership.

C) S corporation.

D) All of the above taxpayers use Schedules K and K-1.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

59

The Philmore Estate is subject to a 40% Federal estate tax rate and a 25% Federal and state income tax rate.

Generally, an administrative expense should be claimed on the estate tax return.

Generally, an administrative expense should be claimed on the estate tax return.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following taxpayers can be subject to an entity-level Federal income tax?

A) Complex trust.

B) Partnership.

C) Limited liability company.

D) All of the above taxpayers are passthrough entities, and they never are subject to an entity-level Federal income tax.

A) Complex trust.

B) Partnership.

C) Limited liability company.

D) All of the above taxpayers are passthrough entities, and they never are subject to an entity-level Federal income tax.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

61

This year, the Huang Trust is a complex trust. This year, it distributed all of its accounting income and $5,000 from corpus, to its sole income beneficiary Kun. Huang's taxable income for the year is:

A) $0.

B) ($100).

C) ($300).

D) ($5,000).

A) $0.

B) ($100).

C) ($300).

D) ($5,000).

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

62

The Zhao Estate generated distributable net income (DNI) this year of $100,000, one-fourth of which was tax- exempt interest, and the balance of which was long-term capital gain. Kyle Zhao, the sole income beneficiary of the estate, received a distribution of the entire $125,000 accounting income of the entity. How does Kyle report the distribution?

A) $75,000 long-term capital gain, $25,000 exempt interest.

B) $50,000 long-term capital gain, $50,000 exempt interest.

C) $75,000 long-term capital gain, $25,000 ordinary income.

D) $93,750 long-term capital gain, $31,250 exempt interest.

A) $75,000 long-term capital gain, $25,000 exempt interest.

B) $50,000 long-term capital gain, $50,000 exempt interest.

C) $75,000 long-term capital gain, $25,000 ordinary income.

D) $93,750 long-term capital gain, $31,250 exempt interest.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

63

The Brighton Trust has distributable net income for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee is required to distribute $25,000 to Roger and $50,000 to Sally. After payment of these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the Brighton trustee distributes an additional $20,000 to Roger, and $30,000 to Sally. How much income from the trust must Sally recognize?

A) $80,000

B) $65,000

C) $50,000

D) $30,000

A) $80,000

B) $65,000

C) $50,000

D) $30,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

64

The Suarez Trust generated distributable net income (DNI) this year of $150,000, two-thirds of which was portfolio income, and the balance of which was exempt interest. Under the terms of the trust, Clara Suarez is to receive an annual income distribution of $30,000. At the discretion of the trustee, additional distributions can be made to Clara or to Clark Suarez III. This year, the trustee's distributions to Clara totaled $60,000. Clark received $90,000. How much of the trust's DNI is assigned to Clara?

A) $75,000

B) $60,000

C) $45,000

D) $30,000

A) $75,000

B) $60,000

C) $45,000

D) $30,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

65

The Uldis Trust has distributable net income (DNI) for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee must distribute $75,000 to Roger and $75,000 to Sally. After paying these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the Uldis trustee distributes an additional $10,000 to Roger and $30,000 to Sally. How much gross income from the trust must Roger recognize?

A) $10,000

B) $50,000

C) $75,000

D) $85,000

A) $10,000

B) $50,000

C) $75,000

D) $85,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following is the annual maximum amount to be included as gross income by all of the income beneficiaries of the trust or estate?

A) Entity taxable income.

B) Entity adjusted gross income.

C) Distributable net income.

D) Fiduciary accounting income.

A) Entity taxable income.

B) Entity adjusted gross income.

C) Distributable net income.

D) Fiduciary accounting income.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

67

The Doyle Trust reports distributable net income for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee must distribute $20,000 to Roger and $20,000 to Sally. After paying these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the trustee distributes an additional $25,000 to Roger and $50,000 to Sally. How much gross income from the trust must Sally recognize?

A) $70,000

B) $60,000

C) $40,000

D) $20,000

A) $70,000

B) $60,000

C) $40,000

D) $20,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

68

Ellie Inc., a calendar-year C corporation, wants to make a gift to a charity that is deductible on its year 1 Form 1120. The gift must be made by Ellie:

A) During year 1.

B) During year 1 or 2.

C) On or before April 15, year 2.

D) On or before September 30, year 2.

A) During year 1.

B) During year 1 or 2.

C) On or before April 15, year 2.

D) On or before September 30, year 2.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following restrictions applies concerning distributions to trust beneficiaries?

A) Special allocations are not allowed under Subchapter J.

B) Special allocations are allowed, but only in the trust's termination year.

C) Special allocations are allowed, but only for portfolio income items.

D) Special allocations of income types are allowed, assuming that they carry a substantial economic effect.

A) Special allocations are not allowed under Subchapter J.

B) Special allocations are allowed, but only in the trust's termination year.

C) Special allocations are allowed, but only for portfolio income items.

D) Special allocations of income types are allowed, assuming that they carry a substantial economic effect.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

70

Which, if any, of the following statements relates to the tax treatment of both estates and trusts?

A) The termination date of the entity is specified in the controlling document.

B) The entity must use the same tax year as its creator (i.e., grantor, decedent).

C) The entity is required to distribute all of its income currently to its beneficiaries.

D) In the year of its termination, the entity's net operating loss carryovers are passed through to its beneficiaries.

A) The termination date of the entity is specified in the controlling document.

B) The entity must use the same tax year as its creator (i.e., grantor, decedent).

C) The entity is required to distribute all of its income currently to its beneficiaries.

D) In the year of its termination, the entity's net operating loss carryovers are passed through to its beneficiaries.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

71

During the current year, the Santo Trust received $30,000 of taxable interest income, paid trustee's commissions of $3,000, and had no other income or expenses. The Santo trust instrument requires that $20,000 be paid annually to Marilyn, and $40,000 be paid annually to Domingo. How much gross income must Marilyn and Domingo recognize?

A) $20,000 by Marilyn and $40,000 by Domingo.

B) $15,000 by Marilyn and $15,000 by Domingo.

C) $13,500 by Marilyn and $13,500 by Domingo.

D) $9,000 by Marilyn and $18,000 by Domingo.

A) $20,000 by Marilyn and $40,000 by Domingo.

B) $15,000 by Marilyn and $15,000 by Domingo.

C) $13,500 by Marilyn and $13,500 by Domingo.

D) $9,000 by Marilyn and $18,000 by Domingo.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

72

The Ellie Trust, a calendar-year entity, wants to make a gift to a charity that is deductible on its year 1 Form 1041. The gift must be made by Ellie:

A) During year 1.

B) During year 1 or 2.

C) On or before April 15, year 2.

D) On or before September 30, year 2.

A) During year 1.

B) During year 1 or 2.

C) On or before April 15, year 2.

D) On or before September 30, year 2.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

73

The Uldis Trust reports distributable net income for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee must distribute $75,000 to Roger and $75,000 to Sally. After paying these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the Uldis trustee distributes an additional $10,000 to Roger and $30,000 to Sally. How much gross income from the trust must Sally recognize?

A) $30,000

B) $50,000

C) $100,000

D) $105,000

A) $30,000

B) $50,000

C) $100,000

D) $105,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

74

The distributable net income (DNI) of a fiduciary taxpayer:

A) Constitutes the maximum amount for the fiduciary's distribution deduction.

B) Specifies the character of the distributions in the hands of the year's income beneficiaries.

C) Marks the maximum amount of gross income that income beneficiaries must report when receiving distributions.

D) All of the above.

A) Constitutes the maximum amount for the fiduciary's distribution deduction.

B) Specifies the character of the distributions in the hands of the year's income beneficiaries.

C) Marks the maximum amount of gross income that income beneficiaries must report when receiving distributions.

D) All of the above.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

75

The Doyle Trust reports distributable net income for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee must distribute $20,000 to Roger and $20,000 to Sally. After paying these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the trustee distributes an additional $25,000 to Roger and $50,000 to Sally. How much gross income from the trust must Roger recognize?

A) $50,000

B) $45,000

C) $40,000

D) $20,000

A) $50,000

B) $45,000

C) $40,000

D) $20,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

76

The Doyle Trust reports distributable net income for the year of $100,000 and no income from tax-exempt sources. Under the terms of the trust instrument, the trustee must distribute $30,000 to Roger and $30,000 to Sally. After payment of these amounts, the trustee is empowered to make additional distributions at its discretion. Exercising this authority, the trustee distributes an additional $25,000 to Roger and $25,000 to Sally. How much income from the trust must Sally recognize?

A) $25,000.

B) $30,000.

C) $50,000.

D) $55,000.

A) $25,000.

B) $30,000.

C) $50,000.

D) $55,000.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

77

This year, the Nano Trust reported $50,000 entity accounting income and $40,000 distributable net income (DNI). Nano distributed $60,000 cash to Horatio, its sole income beneficiary. Nano is a simple trust. Nano's distribution deduction is:

A) $60,000.

B) $50,000.

C) $40,000.

D) $0.

A) $60,000.

B) $50,000.

C) $40,000.

D) $0.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

78

The Suarez Trust generated distributable net income (DNI) this year of $150,000, two-thirds of which was portfolio income, and the balance of which was exempt interest. Under the terms of the trust, Clara Suarez is to receive an annual income distribution of $30,000. At the discretion of the trustee, additional distributions can be made to Clara, or to Clark Suarez III. This year, the trustee's distributions to Clara totaled $60,000. Clark received $90,000. How much of the trust's DNI is assigned to Clark?

A) $0, only first-tier distributions are subject to Federal income tax.

B) $60,000

C) $75,000

D) $90,000

A) $0, only first-tier distributions are subject to Federal income tax.

B) $60,000

C) $75,000

D) $90,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

79

This year, the Nano Trust reported $50,000 entity accounting income and $40,000 distributable net income (DNI). Nano distributed $30,000 cash to Horatio, its sole income beneficiary. Nano is a complex trust. Nano's distribution deduction is:

A) $50,000.

B) $40,000.

C) $30,000.

D) $0. Because the distributions of a complex trust are discretionary, no deduction is allowed.

A) $50,000.

B) $40,000.

C) $30,000.

D) $0. Because the distributions of a complex trust are discretionary, no deduction is allowed.

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck

80

The Willis Trust instrument provides that Tamara, the sole income beneficiary, is to receive $40,000 annually. If trust accounting income is not sufficient to pay this amount, the Willis trustee is empowered to invade corpus to the extent necessary. During the current year, the trust reports distributable net income (DNI) of $100,000, including $30,000 of net tax-exempt interest. In accordance with the trust instrument, $40,000 is paid to Tamara. What is Tamara's gross income from the Willis Trust for the current year?

A) $100,000

B) $70,000

C) $40,000

D) $28,000

A) $100,000

B) $70,000

C) $40,000

D) $28,000

Unlock Deck

Unlock for access to all 161 flashcards in this deck.

Unlock Deck

k this deck