Deck 6: Efficient Capital Markets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

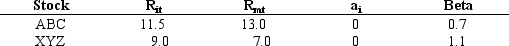

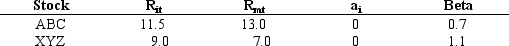

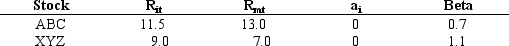

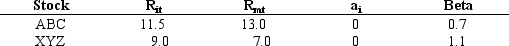

Question

Question

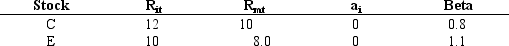

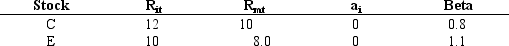

Question

Question

Question

Question

Question

Question

Question

Question

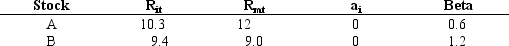

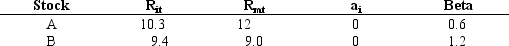

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/90

Play

Full screen (f)

Deck 6: Efficient Capital Markets

1

There is little evidence from studies examining initial public offerings (IPOs) that suggest markets are semistrong form efficient.

False

2

Results of initial public offering (IPOs) studies tend to support the semi-strong EMH, because it appears that prices adjusted rapidly after initial underpricing.

True

3

Technical analysis and the efficient market hypothesis have a consistent set of assumptions concerning stock market behavior.

False

4

In tests of the semistrong-form EMH, it is not necessary to use risk-adjusted rates of return.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

5

An efficient market requires a large number of profit-maximizing investors.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

6

In his original article, Fama divided the efficient market hypothesis into two subhypotheses.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

7

Even when fees and costs are considered most mutual fund managers outperform the aggregate market.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

8

The strong form of the efficient market hypothesis contends that only insiders can earn abnormal returns.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

9

Studies concerning quarterly earnings reports indicate that information in quarterly statements is of value and can provide an above-average risk-adjusted return.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

10

The random walk hypothesis contends that stock prices occur randomly.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

11

Tests have shown that if small filters are used in simulating trading rules, these trading rules have produced above average returns after transactions costs are factored in.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

12

Results from studies on the effects of unexpected world events have consistently indicated that the price change is so rapid, that it takes place between the close of one day and the opening of the next day.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

13

Results of studies concerning corporate insider trading indicate that corporate insiders generally enjoy above-average returns.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

14

Studies examining stock splits support the semistrong form efficient market hypothesis.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

15

The weak form of the efficient market hypothesis contends that technical trading rules are of little value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

16

If the efficient market hypothesis is true price changes are independent and biased.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

17

The weak form of the efficient market hypothesis contends that stock prices fully reflect all public and private information.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

18

When considering markets in Europe, it is inappropriate to assume a level of efficiency similar to that for U.S. markets.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

19

Prices in efficient capital markets fully reflect all available information and rapidly adjust to new information.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

20

The weak-form efficient market hypothesis assumes all publicly available information is reflected in current stock prices.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following has not been involved in a direct test of the semi-strong form of the efficient market hypothesis?

A)Stock splits

B)New Issues

C)Exchange listing

D)Accounting changes

E)NYSE Specialists' returns

A)Stock splits

B)New Issues

C)Exchange listing

D)Accounting changes

E)NYSE Specialists' returns

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

22

The opportunity to take advantage of the downward pressure on stock prices that result from end-of-the-year tax selling is known as

A)The End-of-the-Year Effect.

B)The December Anomaly.

C)The End-of-the-Year Anomaly.

D)The January Anomaly.

E)The New Years Anomaly.

A)The End-of-the-Year Effect.

B)The December Anomaly.

C)The End-of-the-Year Anomaly.

D)The January Anomaly.

E)The New Years Anomaly.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

23

A trading rule which signals purchase of a stock if it rises X percent and sale of a stock if it falls X percent is known as a

A)Breakout.

B)Short sale.

C)Sieve.

D)Filter.

E)Relative strength.

A)Breakout.

B)Short sale.

C)Sieve.

D)Filter.

E)Relative strength.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

24

Banz and Reinganum found that small firms consistently outperformed large firms. This anomaly is referred to as the

A)Large firm effect.

B)Size effect.

C)Small firm effect.

D)PIE effect.

E)None of the above.

A)Large firm effect.

B)Size effect.

C)Small firm effect.

D)PIE effect.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

25

If statistical tests of stock returns over time support the efficient market hypothesis the resulting correlations should be

A)Positive.

B)Negative.

C)Zero.

D)Lagged.

E)Skewed.

A)Positive.

B)Negative.

C)Zero.

D)Lagged.

E)Skewed.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

26

Some studies have attempted to determine whether it is possible to predict future returns for a stock based on publicly available quarterly earnings reports. The results of these studies indicate

A)Stock prices adjust to reflect quarterly earnings reports.

B)Stock prices do not adjust to reflect quarterly earnings reports.

C)Support for the semistrong EMH.

D)Stock prices adjust if earnings reports are released in January.

E)Stock prices do not adjust if earnings reports are released in January.

A)Stock prices adjust to reflect quarterly earnings reports.

B)Stock prices do not adjust to reflect quarterly earnings reports.

C)Support for the semistrong EMH.

D)Stock prices adjust if earnings reports are released in January.

E)Stock prices do not adjust if earnings reports are released in January.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

27

A "runs test" on successive stock price changes which supports the efficient market hypothesis would show the actual number of runs

A)Falls into the range expected of a random series.

B)Falls into the range expected of a dependent series.

C)Is small.

D)Is large.

E)Would approximate N/2.

A)Falls into the range expected of a random series.

B)Falls into the range expected of a dependent series.

C)Is small.

D)Is large.

E)Would approximate N/2.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

28

Examples of anomalies providing contrary evidence to the semi-strong efficient market hypothesis include studies of all of the following except

A)Quarterly earnings reports.

B)Price earnings ratios.

C)Total market value.

D)Stocks ranked by Standard & Poor's.

E)The January effect.

A)Quarterly earnings reports.

B)Price earnings ratios.

C)Total market value.

D)Stocks ranked by Standard & Poor's.

E)The January effect.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

29

There is empirical evidence that low P/E stocks have outperformed high P/E stocks for some historical time periods.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

30

Which statement is true concerning alternative efficient market hypothesis?

A)The weak hypothesis encompasses the semi-strong hypothesis.

B)The weak hypothesis encompasses the strong hypothesis.

C)The semi-strong hypothesis encompasses the weak hypothesis.

D)The strong hypothesis relates only to public information.

E)None of the above (all statements are false)

A)The weak hypothesis encompasses the semi-strong hypothesis.

B)The weak hypothesis encompasses the strong hypothesis.

C)The semi-strong hypothesis encompasses the weak hypothesis.

D)The strong hypothesis relates only to public information.

E)None of the above (all statements are false)

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

31

Fusion investing is the integration of the following elements of investment valuation:

A)Fundamental value and investor sentiment.

B)Fads and fashions.

C)Technical analysis and investor sentiment.

D)Historical prices and returns.

E)Transaction costs and fundamental value.

A)Fundamental value and investor sentiment.

B)Fads and fashions.

C)Technical analysis and investor sentiment.

D)Historical prices and returns.

E)Transaction costs and fundamental value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

32

Abnormal returns associated with rankings by a major advisory service are associated with

A)The PIE effect.

B)The Value-Line Enigma.

C)The Value-Line Effect.

D)The Standard and Poor's Anomaly.

E)The rankings anomaly.

A)The PIE effect.

B)The Value-Line Enigma.

C)The Value-Line Effect.

D)The Standard and Poor's Anomaly.

E)The rankings anomaly.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

33

A portfolio manager without superior analytical skills should

A)Determine and quantify the risk preferences of a client.

B)Minimize transaction costs.

C)Maintain the specified risk level.

D)Ensure that the portfolio is completely diversified.

E)All of the above.

A)Determine and quantify the risk preferences of a client.

B)Minimize transaction costs.

C)Maintain the specified risk level.

D)Ensure that the portfolio is completely diversified.

E)All of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

34

The implication of efficient capital markets and a lack of superior analysts have led to the introduction of

A)Balanced funds.

B)Naive funds.

C)January funds.

D)Index funds.

E)Futures options.

A)Balanced funds.

B)Naive funds.

C)January funds.

D)Index funds.

E)Futures options.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

35

The performance of four major groups of investors has been studied in connection with tests of the strong-form of the efficient market hypothesis. These include all of the following except

A)Professional money managers.

B)Stock exchange specialists.

C)Securities Exchange officers.

D)Security analysts.

E)Corporate insiders.

A)Professional money managers.

B)Stock exchange specialists.

C)Securities Exchange officers.

D)Security analysts.

E)Corporate insiders.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

36

The weak form of the efficient market hypothesis states that

A)Successive price changes are dependent.

B)Successive price changes are independent.

C)Successive price changes are biased.

D)Successive price changes depend on trading volume.

E)Properly specified trading rules are of value.

A)Successive price changes are dependent.

B)Successive price changes are independent.

C)Successive price changes are biased.

D)Successive price changes depend on trading volume.

E)Properly specified trading rules are of value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following would be inconsistent with an efficient market?

A)Information arrives randomly and independently.

B)Stock prices adjust rapidly to new information.

C)Price changes are independent.

D)Price changes are random.

E)Price adjustments are biased.

A)Information arrives randomly and independently.

B)Stock prices adjust rapidly to new information.

C)Price changes are independent.

D)Price changes are random.

E)Price adjustments are biased.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

38

Superior analysts are encouraged to concentrate their efforts in "middle tier" stocks. This is recommended because

A)it works to minimize taxes for the client.

B)only individuals deal in the middle tier stocks.

C)prices may not adjust quite as rapidly for middle tier stocks as they do in the top tier; therefore, the chances of temporarily undervalued securities are greater.

D)it includes companies too small to be considered by institutions.

E)technical analysts never look at "middle tier" stocks.

A)it works to minimize taxes for the client.

B)only individuals deal in the middle tier stocks.

C)prices may not adjust quite as rapidly for middle tier stocks as they do in the top tier; therefore, the chances of temporarily undervalued securities are greater.

D)it includes companies too small to be considered by institutions.

E)technical analysts never look at "middle tier" stocks.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

39

Recent studies indicate that due to lower transaction costs intraday patterns of returns and volume persisted and result in profitable momentum trading strategies.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

40

Which is not an implication of the EMH?

A)To do superior industry or company analysis you must understand the variables that affect returns and do a superior job of estimating these variables.

B)Aggregate market analysis that involves very detailed analysis of reliable historical economic data should outperform a simple buy-and-hold policy.

C)A superior analyst is one who can consistently select stocks that provide positive abnormal returns on a risk-adjusted basis.

D)If a portfolio manager does not have any superior analysts, he/she should consider investing funds in an index fund.

E)If a portfolio manager has some superior analytical skills, they should be encouraged to concentrate in second tier stocks which have liquidity, but may be neglected.

A)To do superior industry or company analysis you must understand the variables that affect returns and do a superior job of estimating these variables.

B)Aggregate market analysis that involves very detailed analysis of reliable historical economic data should outperform a simple buy-and-hold policy.

C)A superior analyst is one who can consistently select stocks that provide positive abnormal returns on a risk-adjusted basis.

D)If a portfolio manager does not have any superior analysts, he/she should consider investing funds in an index fund.

E)If a portfolio manager has some superior analytical skills, they should be encouraged to concentrate in second tier stocks which have liquidity, but may be neglected.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

41

In order to confirm the weak-form efficient market hypothesis you could develop trading rules that consider

A)Advance-decline ratios.

B)Short sales.

C)Specialist activities.

D)Any of the above.

E)None of the above.

A)Advance-decline ratios.

B)Short sales.

C)Specialist activities.

D)Any of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

42

According to the strong-form efficient market hypothesis, stock prices fully reflect

A)All security market information only.

B)All public information only.

C)All public and private information only.

D)All of the above.

E)None of the above.

A)All security market information only.

B)All public information only.

C)All public and private information only.

D)All of the above.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

43

In order to confirm the weak-form efficient market hypothesis, an examination of stock price runs over time would reveal that stock price changes over time were

A)Highly positively correlated.

B)Moderately positively correlated.

C)Highly negatively correlated.

D)Moderately negatively correlated.

E)None of the above.

A)Highly positively correlated.

B)Moderately positively correlated.

C)Highly negatively correlated.

D)Moderately negatively correlated.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

44

Confirmation bias refers to the situation where

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

45

In tests of the semistrong-form efficient market hypothesis, an adjustment for market effects is carried out by

A)Calculating the historical return.

B)Calculating the market rate of return.

C)Calculating the abnormal rate of return.

D)Calculating the cross-sectional return.

E)None of the above.

A)Calculating the historical return.

B)Calculating the market rate of return.

C)Calculating the abnormal rate of return.

D)Calculating the cross-sectional return.

E)None of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

46

The January anomaly refers to the phenomenon where stock prices

A)Decline in December.

B)Decline in January.

C)Rise in January.

D)Decline in December and rise in January.

E)Rise in December and decline in January.

A)Decline in December.

B)Decline in January.

C)Rise in January.

D)Decline in December and rise in January.

E)Rise in December and decline in January.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following behaviors is consistent with escalation bias?

A)Buying more of a stock as it increases in value.

B)Buying more of a stock as it decreases in value.

C)Selling a stock as it decreases in value.

D)Selling a stock as it increases in value.

E)Buying or selling a stock as it increases in value.

A)Buying more of a stock as it increases in value.

B)Buying more of a stock as it decreases in value.

C)Selling a stock as it decreases in value.

D)Selling a stock as it increases in value.

E)Buying or selling a stock as it increases in value.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

48

According to prospect theory

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

49

Researchers have found a positive relationship between default spread and stock returns in the long run because a large default spread implies

A)a high risk premium and higher expected returns.

B)a high risk premium and lower expected returns.

C)a low risk premium and higher expected returns.

D)a low risk premium and lower expected returns.

E)none of the above.

A)a high risk premium and higher expected returns.

B)a high risk premium and lower expected returns.

C)a low risk premium and higher expected returns.

D)a low risk premium and lower expected returns.

E)none of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

50

Investigators have tested the strong form EMH by examining the performance of the following type of investor:

A)Corporate insiders.

B)Stock exchange specialists.

C)Security analysts.

D)Professional money managers.

E)All of the above.

A)Corporate insiders.

B)Stock exchange specialists.

C)Security analysts.

D)Professional money managers.

E)All of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

51

According to the weak-form efficient market hypothesis, which of the following types of information are fully reflected in stock prices?

A)Rates of return, trading volume, and news about the economy.

B)Dividend and earnings announcements.

C)Rates of return, trading volume, and block trades.

D)Earnings announcements and rates of return.

E)All of the above.

A)Rates of return, trading volume, and news about the economy.

B)Dividend and earnings announcements.

C)Rates of return, trading volume, and block trades.

D)Earnings announcements and rates of return.

E)All of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following assumptions imply capital markets will be efficient?

A)A large number of independent profit-maximizing participants analyze securities.

B)New information regarding securities comes to the market in a random fashion.

C)Investors adjust security prices rapidly to reflect the effect of new information.

D)Both b and c only.

E)All of the above are assumptions that imply a market will be efficient.

A)A large number of independent profit-maximizing participants analyze securities.

B)New information regarding securities comes to the market in a random fashion.

C)Investors adjust security prices rapidly to reflect the effect of new information.

D)Both b and c only.

E)All of the above are assumptions that imply a market will be efficient.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

53

Evidence supporting the strong-form efficient market hypothesis (EMH) resulted from examining

A)Value Line rankings.

B)Corporate insiders.

C)Stock exchange specialists.

D)Both b and c only.

E)All of the above.

A)Value Line rankings.

B)Corporate insiders.

C)Stock exchange specialists.

D)Both b and c only.

E)All of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

54

The results of studies that have looked at the relationship between PEG ratios and subsequent stock returns

A)Find an inverse relationship, with annual rebalancing.

B)Find no relationship, with monthly or quarterly rebalancing.

C)Find an inverse relationship, with monthly or quarterly rebalancing.

D)Find a direct relationship, with monthly or quarterly rebalancing.

E)Find a direct relationship with annual rebalancing

A)Find an inverse relationship, with annual rebalancing.

B)Find no relationship, with monthly or quarterly rebalancing.

C)Find an inverse relationship, with monthly or quarterly rebalancing.

D)Find a direct relationship, with monthly or quarterly rebalancing.

E)Find a direct relationship with annual rebalancing

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

55

According to the semistrong-form efficient market hypothesis, which of the following types of information are fully reflected in stock prices?

A)Rates of return, trading volume, and news about the economy.

B)Dividend and earnings announcements.

C)Rates of return, trading volume, and block trades.

D)Earnings announcements and rates of return.

E)All of the above.

A)Rates of return, trading volume, and news about the economy.

B)Dividend and earnings announcements.

C)Rates of return, trading volume, and block trades.

D)Earnings announcements and rates of return.

E)All of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

56

In an event study the objective is to

A)Determine whether it is possible to predict stock prices.

B)Determine how fast stock prices adjust to news.

C)Examine the cross-sectional distributions of returns.

D)Conduct a time series analysis of returns.

E)Determine normal P/E ratios.

A)Determine whether it is possible to predict stock prices.

B)Determine how fast stock prices adjust to news.

C)Examine the cross-sectional distributions of returns.

D)Conduct a time series analysis of returns.

E)Determine normal P/E ratios.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

57

Escalation bias refers to the situation where

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

A)Investors have a propensity to sell winners too soon and hang on to losers too long.

B)Investors ignore bad news and overemphasize good news.

C)Investors tend to follow the herd.

D)Investors put more money into a failure rather than into a success.

E)Investors are all noise traders.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

58

Behavioral finance differs from the standard model of finance because behavioral finance

A)Precludes the impact of investor psychology.

B)Includes the impact of investor psychology.

C)Accepts the Efficient Markets Hypothesis.

D)Rejects the idea of market anomalies.

E)none of the above.

A)Precludes the impact of investor psychology.

B)Includes the impact of investor psychology.

C)Accepts the Efficient Markets Hypothesis.

D)Rejects the idea of market anomalies.

E)none of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

59

Studies of the relationship between P/E ratios and stock returns have found that

A)Low P/E stocks of large cap stocks outperformed low P/E stocks of small cap stocks.

B)Low P/E stocks of small cap stocks outperformed high P/E stocks of large cap stocks.

C)High P/E stocks of large cap stocks outperformed low P/E stocks of small cap stocks.

D)High P/E stocks of large cap stocks outperformed high P/E stocks of small cap stocks.

E)none of the above.

A)Low P/E stocks of large cap stocks outperformed low P/E stocks of small cap stocks.

B)Low P/E stocks of small cap stocks outperformed high P/E stocks of large cap stocks.

C)High P/E stocks of large cap stocks outperformed low P/E stocks of small cap stocks.

D)High P/E stocks of large cap stocks outperformed high P/E stocks of small cap stocks.

E)none of the above.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

60

Fama and French examined the relationship between the Book Value to Market Value ratio and average stock returns and found

A)No evidence of a relationship for U.S.stocks.

B)Evidence of a negative relationship in U.S.stocks only.

C)Evidence of a positive relationship for Japanese stocks only.

D)Evidence of a negative relationship for U.S.and Japanese stocks.

E)Evidence of a positive relationship for U.S.and Japanese stocks.

A)No evidence of a relationship for U.S.stocks.

B)Evidence of a negative relationship in U.S.stocks only.

C)Evidence of a positive relationship for Japanese stocks only.

D)Evidence of a negative relationship for U.S.and Japanese stocks.

E)Evidence of a positive relationship for U.S.and Japanese stocks.

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

61

All of the following are underlying assumptions of the capital asset pricing model (CAPM) except:

A)A large number of profit-maximizing participants analyze and value securities.

B)New information enters the market in a random fashion

C)Security prices adjust rapidly to reflect the effect of new information

D)Expected returns implicit in the current price of the security reflect its risk

E)All of the above are assumptions of the CAPM

A)A large number of profit-maximizing participants analyze and value securities.

B)New information enters the market in a random fashion

C)Security prices adjust rapidly to reflect the effect of new information

D)Expected returns implicit in the current price of the security reflect its risk

E)All of the above are assumptions of the CAPM

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

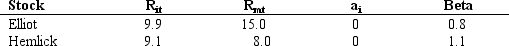

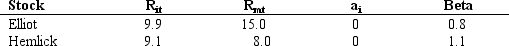

62

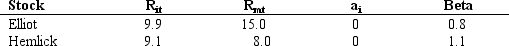

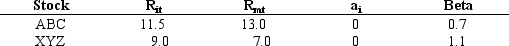

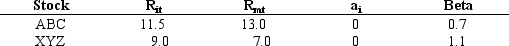

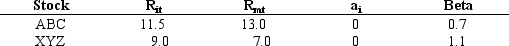

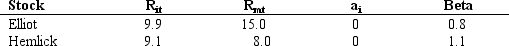

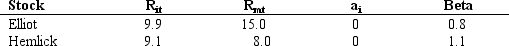

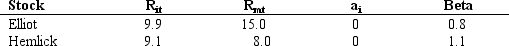

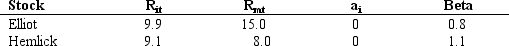

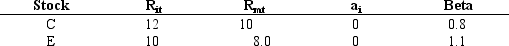

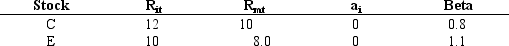

Exhibit 6.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Elliot during period t using only the aggregate market return (ignore differential systematic risk)?

A)1.50

B)1.10

C)-1.50

D)-5.10

E)-8.00

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Elliot during period t using only the aggregate market return (ignore differential systematic risk)?

A)1.50

B)1.10

C)-1.50

D)-5.10

E)-8.00

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

63

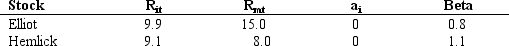

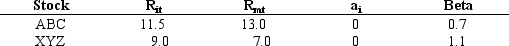

Exhibit 6.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock XYZ during period t using only the aggregate market return (ignore differential systematic risk)?

A)-3.2%

B)2.4%

C)2.0%

D)1.3%

E)-1.5%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock XYZ during period t using only the aggregate market return (ignore differential systematic risk)?

A)-3.2%

B)2.4%

C)2.0%

D)1.3%

E)-1.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

64

Exhibit 6.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock ABC when you consider its systematic risk measure (beta)?

A)2.4%

B)1.5%

C)-1.5%

D)2.0%

E)-3.2%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock ABC when you consider its systematic risk measure (beta)?

A)2.4%

B)1.5%

C)-1.5%

D)2.0%

E)-3.2%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

65

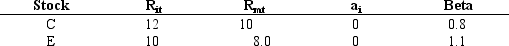

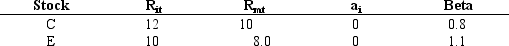

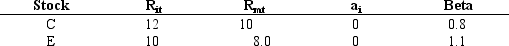

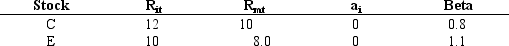

Exhibit 6.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock C when you consider its systematic risk measure (beta)?

A)4.0%

B)1.2%

C)2.0%

D)-1.05%

E)-8.5%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock C when you consider its systematic risk measure (beta)?

A)4.0%

B)1.2%

C)2.0%

D)-1.05%

E)-8.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

66

Exhibit 6.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

-Refer to Exhibit 6.1. What is the abnormal rate of return for Stock C during period t using only the aggregate market return (ignore differential systematic risk)?

A)4.0%

B)1.2%

C).-1.05%

D)2.0%

E).-8.50

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

-Refer to Exhibit 6.1. What is the abnormal rate of return for Stock C during period t using only the aggregate market return (ignore differential systematic risk)?

A)4.0%

B)1.2%

C).-1.05%

D)2.0%

E).-8.50

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

67

Exhibit 6.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Elliot when you consider its systematic risk measure (beta)?

A)-2.10%

B)-2.00%

C)5.20%

D)14.10%

E)None of the above

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Elliot when you consider its systematic risk measure (beta)?

A)-2.10%

B)-2.00%

C)5.20%

D)14.10%

E)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

68

Tests of the efficient market hypothesis (EMH) are sometimes based on examining its abnormal rate of return. The abnormal rate of return is calculated by:

A)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's beta and the CAPM.

B)Subtracting the actual rate of return from the expected return, where the expected return is based on the stock's beta and the CAPM.

C)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's projected dividend yields

D)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's projected dividend yields.

E)None of the above

A)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's beta and the CAPM.

B)Subtracting the actual rate of return from the expected return, where the expected return is based on the stock's beta and the CAPM.

C)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's projected dividend yields

D)Subtracting the expected rate of return from the actual return, where the expected return is based on the stock's projected dividend yields.

E)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

69

Exhibit 6.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock E when you consider its systematic risk measure (beta)?

A)2.0%

B)1.2%

C)4.0%

D)-1.05%

E)-8.5%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock E when you consider its systematic risk measure (beta)?

A)2.0%

B)1.2%

C)4.0%

D)-1.05%

E)-8.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

70

Exhibit 6.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock XYZ when you consider its systematic risk measure (beta)?

A)2.0%

B)-1.5%

C)2.4%

D)1.3%

E)-3.2%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock XYZ when you consider its systematic risk measure (beta)?

A)2.0%

B)-1.5%

C)2.4%

D)1.3%

E)-3.2%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

71

Exhibit 6.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Hemlick when you consider its systematic risk measure (beta)?

A)0.1%

B)0.3%

C)0.5%

D)1.5%

E)3.0%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Hemlick when you consider its systematic risk measure (beta)?

A)0.1%

B)0.3%

C)0.5%

D)1.5%

E)3.0%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

72

Exhibit 6.3

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Hemlick during period t using only the aggregate market return (ignore differential systematic risk)?

A)0.11

B)1.10

C)-1.80

D)-1.80.

E)-4.60

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.3. What is the abnormal rate of return for Hemlick during period t using only the aggregate market return (ignore differential systematic risk)?

A)0.11

B)1.10

C)-1.80

D)-1.80.

E)-4.60

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

73

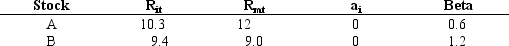

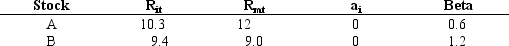

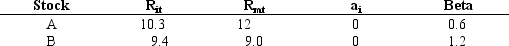

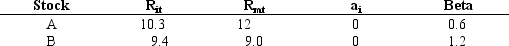

Exhibit 6.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock A during period t using only the aggregate market return (ignore differential systematic risk)?

A)3.34

B)1.75

C)-1.75

D)-3.70

E)-1.70

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock A during period t using only the aggregate market return (ignore differential systematic risk)?

A)3.34

B)1.75

C)-1.75

D)-3.70

E)-1.70

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following ratios is the most commonly used ratio for predicting the performance of a growth company?

A)PE ratio

B)PG ratio

C)PEG ratio

D)MV/BV ratio

E)BV/MV ratio

A)PE ratio

B)PG ratio

C)PEG ratio

D)MV/BV ratio

E)BV/MV ratio

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

75

Exhibit 6.2

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock ABC during period t using only the aggregate market return (ignore differential systematic risk)?

A)3.2%

B)2.4%

C)1.3%

D)-1.5%

E)2.0%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.2. What is the abnormal rate of return for Stock ABC during period t using only the aggregate market return (ignore differential systematic risk)?

A)3.2%

B)2.4%

C)1.3%

D)-1.5%

E)2.0%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 6.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock B during period t using only the aggregate market return (ignore differential systematic risk)?

A)0.40

B)1.40

C)-1.10

D)-4.40

E)-6.40

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock B during period t using only the aggregate market return (ignore differential systematic risk)?

A)0.40

B)1.40

C)-1.10

D)-4.40

E)-6.40

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

77

Fusion investing refers to the combination of

A)Technical analysis and fundamental analysis.

B)Behavioral analysis and technical analysis.

C)Fundamental analysis and investor sentiment.

D)Technical analysis and investor sentiment.

E)All of the above

A)Technical analysis and fundamental analysis.

B)Behavioral analysis and technical analysis.

C)Fundamental analysis and investor sentiment.

D)Technical analysis and investor sentiment.

E)All of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

78

In an efficient market all securities should have:

A)Equal returns for the same time period

B)Equal risk-adjusted returns

C)Equal inflation-adjusted returns

D)All of the above

E)None of the above

A)Equal returns for the same time period

B)Equal risk-adjusted returns

C)Equal inflation-adjusted returns

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

79

Exhibit 6.4

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock A when you consider its systematic risk measure (beta)?

A)2.30%

B)2.10%

C)3.10%

D)12.40%

E)None of the above

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.4. What is the abnormal rate of return for Stock A when you consider its systematic risk measure (beta)?

A)2.30%

B)2.10%

C)3.10%

D)12.40%

E)None of the above

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck

80

Exhibit 6.1

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period t

Rmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock E during period t using only the aggregate market return (ignore differential systematic risk)?

A)4.0%

B)2.0%

C)1.2%

D)-1.05%

E)-8.5%

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

Rit = return for stock i during period t

Rit = return for stock i during period tRmt = return for the aggregate market during period t

Refer to Exhibit 6.1. What is the abnormal rate of return for Stock E during period t using only the aggregate market return (ignore differential systematic risk)?

A)4.0%

B)2.0%

C)1.2%

D)-1.05%

E)-8.5%

Unlock Deck

Unlock for access to all 90 flashcards in this deck.

Unlock Deck

k this deck