Deck 18: Accounting and Reporting for Private Not-For-Profit Organizations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 18: Accounting and Reporting for Private Not-For-Profit Organizations

1

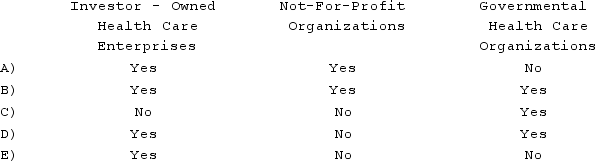

Which of the following types of health care entities follow FASB Accounting Standards Codification for preparing financial statements?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A

2

With respect to the donations received in 2019, what amount should be reported in the Statement of Activities as net increase to Net Assets with Donor Restrictions for the year 2019?

A) $ 3,000

B) $ 9,000

C) $15,000

D) $18,000

E) $21,000

A) $ 3,000

B) $ 9,000

C) $15,000

D) $18,000

E) $21,000

B

3

Which of the following is a voluntary health and welfare entity?

A) A charity raising money for underprivileged children.

B) A nursing home.

C) A private medical school.

D) A hospital.

E) A preschool.

A) A charity raising money for underprivileged children.

B) A nursing home.

C) A private medical school.

D) A hospital.

E) A preschool.

A

4

On a statement of functional expenses for a voluntary health and welfare entity, how are expenses classified?

A) Health services expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

A) Health services expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

What amount should be reclassified on the Statement of Activities for 2020 from the With Donor Restrictions column to the Without Donor Restrictions column?

A) $3,000.

B) $6,000.

C) $9,000.

D) $12,000.

E) $15,000.

A) $3,000.

B) $6,000.

C) $9,000.

D) $12,000.

E) $15,000.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

Unconditional promises to transfer cash or other resources to an entity in a voluntary nonreciprocal transaction is the GAAP definition of:

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

On a Statement of Activities for a not-for-profit entity, what is the minimum required classification for categories of expenses?

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

A) Fund-raising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Program services expenses and supporting services expenses.

D) Operating expenses and supporting services expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

When individuals are considering whether to make a donation to a not-for-profit entity, the answer to which of the following questions is not typically sought?

A) Will donated funds be used effectively by the entity to accomplish its purpose?

B) Will the donated funds be wasted?

C) How much should this entity receive?

D) Is this entity profitable?

E) Is contributing to this charity a wise allocation of resources?

A) Will donated funds be used effectively by the entity to accomplish its purpose?

B) Will the donated funds be wasted?

C) How much should this entity receive?

D) Is this entity profitable?

E) Is contributing to this charity a wise allocation of resources?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

Not-for-profit entities are required to present information about the nature and function of expenses and this information can be reported in which of the following?

A) Statement of Cash Flows, Statement of Functional Expenses, or Statement of Activities.

B) Statement of Activities, Statement of Functional Expenses, or notes to financial statements.

C) Statement of Financial Position, Statement of Functional Expenses, or Statement of Cash Flows.

D) Statement of Financial Position, Statement of Cash Flows, or notes to financial statements.

E) Statement of Activities, Statement of Budget to Actual, or Income Statement.

A) Statement of Cash Flows, Statement of Functional Expenses, or Statement of Activities.

B) Statement of Activities, Statement of Functional Expenses, or notes to financial statements.

C) Statement of Financial Position, Statement of Functional Expenses, or Statement of Cash Flows.

D) Statement of Financial Position, Statement of Cash Flows, or notes to financial statements.

E) Statement of Activities, Statement of Budget to Actual, or Income Statement.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

What is the basis of accounting used in reporting the Statement of Activities?

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) Either cash basis or accrual basis, depending on the type of revenue.

E) Either modified accrual basis or accrual basis, depending on the type of revenue.

A) Cash basis.

B) Modified accrual basis.

C) Accrual basis.

D) Either cash basis or accrual basis, depending on the type of revenue.

E) Either modified accrual basis or accrual basis, depending on the type of revenue.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

Unconditional transfers of cash or other resources to an entity in a voluntary nonreciprocal transaction is the GAAP definition of:

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

A) Miscellaneous revenues.

B) Contributions.

C) Unconditional promises to give.

D) Exchange transactions.

E) Pledges.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

With respect to the donations received in 2019, what total amount should be recorded as an increase to Net Assets with Donor Restrictions?

A) $ 3,000

B) $ 9,000

C) $15,000

D) $18,000

E) $21,000

A) $ 3,000

B) $ 9,000

C) $15,000

D) $18,000

E) $21,000

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

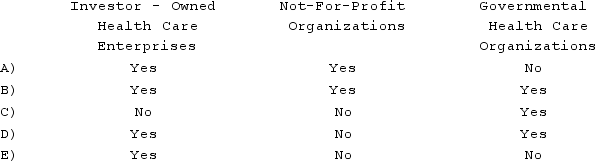

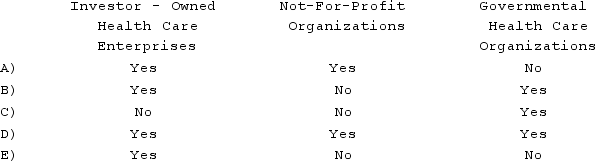

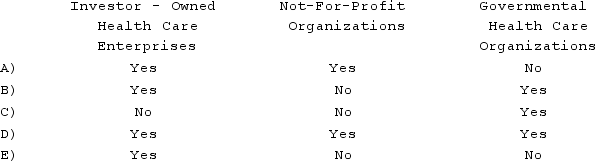

Which of the following types of health care entities recognize depreciation expense?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

When are unconditional promises to give recognized as revenues?

A) In the period the promise is received.

B) In the period the promise is collected.

C) In the period in which the conditions upon which they are contingent are substantially met.

D) In the period in which the conditions upon which they are contingent have begun to be met.

E) Unconditional promises from potential donors are not revenues.

A) In the period the promise is received.

B) In the period the promise is collected.

C) In the period in which the conditions upon which they are contingent are substantially met.

D) In the period in which the conditions upon which they are contingent have begun to be met.

E) Unconditional promises from potential donors are not revenues.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

Which account should be credited to record a gift of cash which is from an outside party to an animal rescue agency and is used for expenses to care for the animals?

A) Non-Operating Gain - Special Revenues.

B) Contractual Adjustments.

C) Patient Service Revenues.

D) Drugs and Medicines.

E) Contributions Revenues - Without Donor Restrictions.

A) Non-Operating Gain - Special Revenues.

B) Contractual Adjustments.

C) Patient Service Revenues.

D) Drugs and Medicines.

E) Contributions Revenues - Without Donor Restrictions.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Prior to ASU 2016-14, what are the three categories of net assets required by GAAP in reporting of a not-for-profit entity?

A) Unrestricted, Temporarily Restricted, and Permanently Restricted.

B) Unrestricted, Restricted, and Fund Balance.

C) Restricted, Permanently Restricted, and Fund Balance.

D) Unrestricted, Temporarily Restricted, and Fund Balance.

E) None of these answer choices are correct.

A) Unrestricted, Temporarily Restricted, and Permanently Restricted.

B) Unrestricted, Restricted, and Fund Balance.

C) Restricted, Permanently Restricted, and Fund Balance.

D) Unrestricted, Temporarily Restricted, and Fund Balance.

E) None of these answer choices are correct.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

On a Statement of Activities for a not-for-profit entity, what are the broad categories of supporting service costs required to be reported?

A) Fundraising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Fundraising expenses and supporting services expenses.

D) Fundraising expenses and administrative expenses.

E) Operating expenses and administrative expenses.

A) Fundraising expenses and operating expenses.

B) Program services expenses and administrative services expenses.

C) Fundraising expenses and supporting services expenses.

D) Fundraising expenses and administrative expenses.

E) Operating expenses and administrative expenses.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

Which one of the following financial statements is not required by GAAP regarding a voluntary health and welfare entity?

A) Statement of Financial Position.

B) Statement of Functional Expenses.

C) Statement of Activities.

D) Statement of Cash Flows.

E) Statement of Operations.

A) Statement of Financial Position.

B) Statement of Functional Expenses.

C) Statement of Activities.

D) Statement of Cash Flows.

E) Statement of Operations.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

Historically, what pattern of reporting was used by private not-for-profit entities?The same as used with respect to for-profit entities.Reporting that utilizes a fund accounting approach.A pattern of reporting that does not consider the entire entity.

A) 1 only.

B) 2 only.

C) 1 and 2 only.

D) 1, 2 and 3.

E) 2 and 3 only.

A) 1 only.

B) 2 only.

C) 1 and 2 only.

D) 1, 2 and 3.

E) 2 and 3 only.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

In accruing patient charges for the current month, which one of the following accounts should a hospital credit?

A) Accounts Payable.

B) Deferred Revenue.

C) Public Support Revenue.

D) Patient Service Revenues.

E) Accounts Receivable.

A) Accounts Payable.

B) Deferred Revenue.

C) Public Support Revenue.

D) Patient Service Revenues.

E) Accounts Receivable.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

Not-for-profit entities that are eligible to obtain tax-exempt status under Internal Revenue Code section 501(c)(4) are

A) Those promoting literacy.

B) Those promoting scientific research.

C) Chambers of Commerce.

D) Professional sports leagues.

E) Those functioning exclusively to promote social welfare.

A) Those promoting literacy.

B) Those promoting scientific research.

C) Chambers of Commerce.

D) Professional sports leagues.

E) Those functioning exclusively to promote social welfare.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

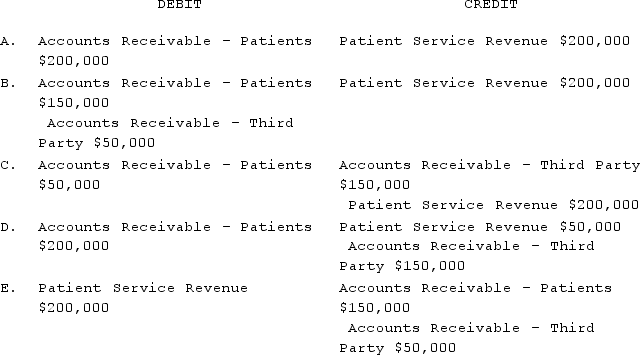

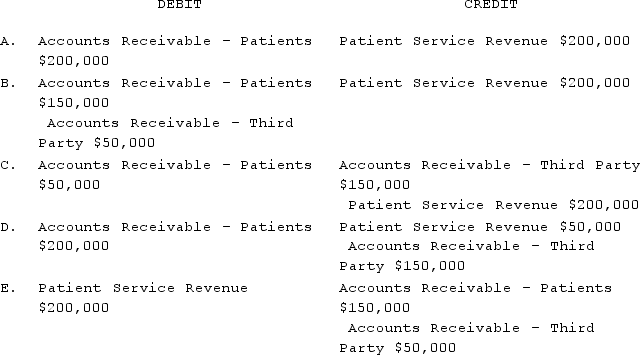

Which entry would be the correct entry to record that a hospital has provided patient services for $200,000, of which 25% will be billed to a third party?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

If the total acquisition value of an acquired not-for-profit entity is greater than the fair value of all identifiable net assets of the entity, and that entity's revenues are not generated by rendering goods or services or from membership dues, then the excess of acquisition value over identifiable net assets is immediately reported:

A) As goodwill on the consolidated Statement of Position.

B) As a pro-rata increase to the identifiable assets and liabilities acquired.

C) As a direct reduction in unrestricted net assets on the Statement of Financial Position.

D) As a reduction in unrestricted net assets on the Statement of Activities.

E) As an increase in other assets on the Statement of Financial Position.

A) As goodwill on the consolidated Statement of Position.

B) As a pro-rata increase to the identifiable assets and liabilities acquired.

C) As a direct reduction in unrestricted net assets on the Statement of Financial Position.

D) As a reduction in unrestricted net assets on the Statement of Activities.

E) As an increase in other assets on the Statement of Financial Position.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

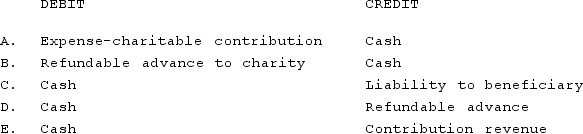

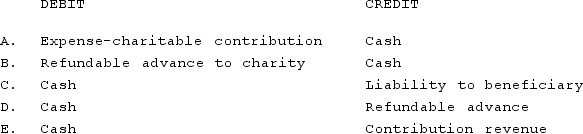

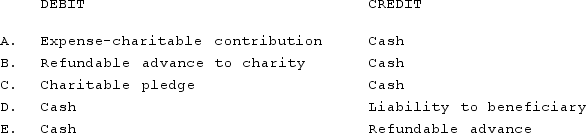

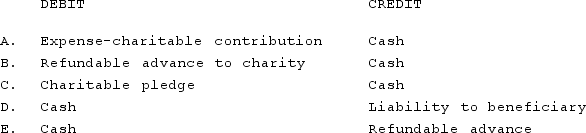

Which entry would be the correct entry on the not-for-profit entity's books to record a donor's gift when the money is simply passing through the not-for-profit entity, it creates no direct benefit, and control of the assets has been relinquished by the donor?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is not a benefit of Internal Revenue Code Section 501(c)(3) status?

A) Exemption from paying federal taxes on most income.

B) Likely exemption from paying state taxes on most income.

C) Charitable donations to 501(c)(3) entities can reduce the donor's taxable income.

D) Can engage in political election campaign activity.

E) Can participate in lobbying.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

42) Give several examples, by name, of specific not-for-profit entities that are voluntary health and welfare entities.

A) Exemption from paying federal taxes on most income.

B) Likely exemption from paying state taxes on most income.

C) Charitable donations to 501(c)(3) entities can reduce the donor's taxable income.

D) Can engage in political election campaign activity.

E) Can participate in lobbying.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

42) Give several examples, by name, of specific not-for-profit entities that are voluntary health and welfare entities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

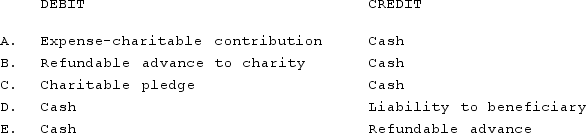

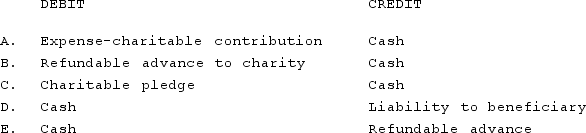

Which entry would be the correct entry on the donor's books when the donor retains control of an asset, such as cash, which it contributes to a not-for-profit entity?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

What is the appropriate account to credit when estimating a portion of health care entity's receivables that will prove to be uncollectible?

A) Provision for Bad Debts.

B) Allowance for Uncollectible and Reduced Accounts.

C) Patient Service Revenues.

D) Accounts Receivable.

E) Contractual Adjustments.

A) Provision for Bad Debts.

B) Allowance for Uncollectible and Reduced Accounts.

C) Patient Service Revenues.

D) Accounts Receivable.

E) Contractual Adjustments.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

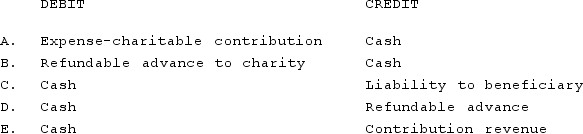

Which entry would be the correct entry on the not-for-profit entity's books to record a donor's gift when the donor retains power over the assets?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

In not-for-profit accounting, an acquisition occurs when one not-for-profit entity obtains:

A) Significant influence over another not-for-profit entity.

B) More than 50% of another not-for-profit entity's fixed assets.

C) The right to collect more than 20% of pledged contributions.

D) Control over another not-for-profit entity.

E) None of these answer choices are correct. An acquisition can only occur for profit-oriented entities.

A) Significant influence over another not-for-profit entity.

B) More than 50% of another not-for-profit entity's fixed assets.

C) The right to collect more than 20% of pledged contributions.

D) Control over another not-for-profit entity.

E) None of these answer choices are correct. An acquisition can only occur for profit-oriented entities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

When an acquisition occurs in not-for-profit accounting, recognition of goodwill depends on:

A) Whether control has been achieved by the acquiring not-for-profit entity.

B) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenue from providing goods or services or from membership fees, or whether it is expected to generate primarily contribution and investment revenue in the future.

C) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenues from goods or services or membership fees, as well as significant amounts of contribution revenues in the future.

D) Whether the acquired not-for-profit entity has a history of generating significant revenues of any type.

E) None of these answer choices are correct. Goodwill can only be recognized in an acquisition of a for-profit entity.

A) Whether control has been achieved by the acquiring not-for-profit entity.

B) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenue from providing goods or services or from membership fees, or whether it is expected to generate primarily contribution and investment revenue in the future.

C) Whether the acquired not-for-profit entity has the ability to generate significant amounts of revenues from goods or services or membership fees, as well as significant amounts of contribution revenues in the future.

D) Whether the acquired not-for-profit entity has a history of generating significant revenues of any type.

E) None of these answer choices are correct. Goodwill can only be recognized in an acquisition of a for-profit entity.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

Which statement below is not correct for financial statements of not-for-profit entities?

A) Pledged contributions are recognized in the accounting period in which pledged by donors.

B) A not-for-profit entity's Statement of Financial Position includes a section specifically for net assets.

C) Contributed assets are recognized by a not-for-profit entity as public support contribution revenue.

D) Depreciation expense is not recognized by not-for-profit entities.

E) Not-for-profit entities issue a Statement of Activities.

A) Pledged contributions are recognized in the accounting period in which pledged by donors.

B) A not-for-profit entity's Statement of Financial Position includes a section specifically for net assets.

C) Contributed assets are recognized by a not-for-profit entity as public support contribution revenue.

D) Depreciation expense is not recognized by not-for-profit entities.

E) Not-for-profit entities issue a Statement of Activities.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

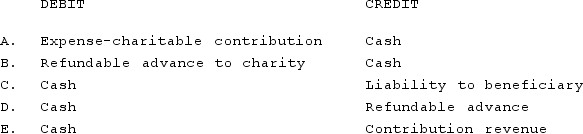

Which entry would be the correct entry on the donor's books when the donor relinquishes control of an asset, such as cash, which it contributes to a not-for-profit entity?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following topics are not included in the Form 990 which tax-exempt entities file to maintain their tax-exempt status?

A) Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees and Independent Contractors.

B) Donor Disclosure: Identification of Every Donor by Name, Contribution Value & Contribution Type.

C) Statement of Revenue.

D) Balance Sheet.

E) Statement of Functional Expenses.

A) Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees and Independent Contractors.

B) Donor Disclosure: Identification of Every Donor by Name, Contribution Value & Contribution Type.

C) Statement of Revenue.

D) Balance Sheet.

E) Statement of Functional Expenses.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

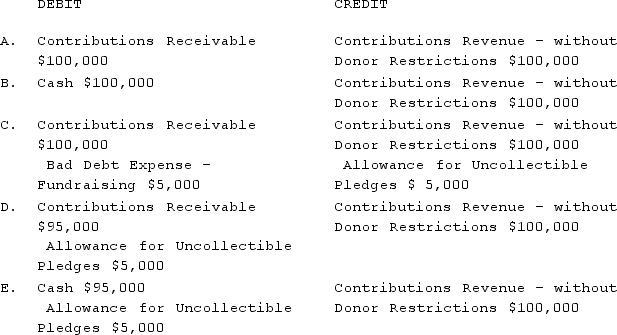

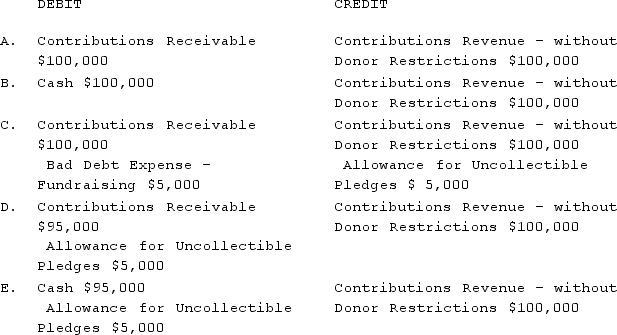

34

Which entry would be the correct entry to record pledges of $100,000 for a telethon event to raise money for a not-for-profit public television station? The public television entity estimates that 5% of the funds will be uncollectible.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

Why did the FASB issue Accounting Standards Update No. 2014-09, "Revenue from Contracts with Customers?"

A) To bring consistency to the recognition of revenue.

B) To prohibit the use of bad debt expense.

C) To allow a wide array of revenue recognition methods based on industry preferences.

D) To encourage entities to be more forgiving of bad debt.

E) To give entities more flexibility in how and when they recognize revenue.

A) To bring consistency to the recognition of revenue.

B) To prohibit the use of bad debt expense.

C) To allow a wide array of revenue recognition methods based on industry preferences.

D) To encourage entities to be more forgiving of bad debt.

E) To give entities more flexibility in how and when they recognize revenue.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

What is the appropriate account to debit when reducing net patient service revenue as a result of arrangements with third party payors?

A) Contractual Adjustments.

B) Allowance for Uncollectible and Reduced Accounts.

C) Patient Service Revenues.

D) Account Receivable - Patients.

E) Accounts Receivable - Third Party.

A) Contractual Adjustments.

B) Allowance for Uncollectible and Reduced Accounts.

C) Patient Service Revenues.

D) Account Receivable - Patients.

E) Accounts Receivable - Third Party.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

Which entry would be the correct entry to record that a not-for-profit entity collected $80,000 of amounts pledged and also wrote off $3,000 of amounts pledged that were previously estimated as amounts uncollectible?

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

A) Option A.

B) Option B.

C) Option C.

D) Option D.

E) Option E.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

A gift to a not-for-profit school that is not restricted by the donor is recorded with a credit to:

A) Fund Balance.

B) Deferred Revenues.

C) Contribution Revenues.

D) Non-Operating Revenues.

E) Encumbrances.

A) Fund Balance.

B) Deferred Revenues.

C) Contribution Revenues.

D) Non-Operating Revenues.

E) Encumbrances.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is not true about a merger of two not-for-profit entities?

A) The two entities will continue to legally exist but there will be a new governing board.

B) Neither entity is considered to be acquired.

C) Identifiable assets and liabilities are not adjusted to their fair values at the date of the merger.

D) The two entities will together form an entirely new entity with a new governing board.

E) There will be no acquisition value or goodwill determination.

A) The two entities will continue to legally exist but there will be a new governing board.

B) Neither entity is considered to be acquired.

C) Identifiable assets and liabilities are not adjusted to their fair values at the date of the merger.

D) The two entities will together form an entirely new entity with a new governing board.

E) There will be no acquisition value or goodwill determination.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

How are investments in equity securities with readily determinable market values, and their related unrealized gains and losses, reported by a not-for-profit entity?

A) At lower of cost or market in the Statement of Financial Position, with unrealized losses in the Statement of Activities.

B) At fair value in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

C) At lower of cost or market in the Statement of Financial Position, with unrealized losses in Temporarily Restricted Net Assets.

D) At original cost in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

E) At original cost in the Statement of Financial Position, with unrealized gains and losses disclosed in the notes to the financial statements.

A) At lower of cost or market in the Statement of Financial Position, with unrealized losses in the Statement of Activities.

B) At fair value in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

C) At lower of cost or market in the Statement of Financial Position, with unrealized losses in Temporarily Restricted Net Assets.

D) At original cost in the Statement of Financial Position, with unrealized gains and losses in the Statement of Activities.

E) At original cost in the Statement of Financial Position, with unrealized gains and losses disclosed in the notes to the financial statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

What are third-party payors? Why are their interests important in accounting for health care entities?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

$540,000 of the $2,940,000 was expected to be uncollectible.Required:Prepare the necessary journal entry to record the anticipated uncollectible amount.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

What is the main source of financial support for most voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

What are the objectives of accounting for a not-for-profit entity?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

What term is often used by voluntary health and welfare entities as a category for resources received from contributions, as opposed to those from providing goods or services?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

During 2020, the Clifford Humane Society, a voluntary health and welfare entity, received cash donations of $912,000 and membership dues of $68,000. A member of the Humane Society donated services valued at $8,500 that would otherwise have been performed by a paid staff member. A pet food manufacturer donated dog food valued at $17,200. The Humane Society received a gift of $150,000, to be used in building a new animal shelter. Also during 2020, investments held by the Humane Society earned interest of $2,500.Required:Prepare a schedule showing the amount that the Clifford Humane Society should have recorded for contributions from public support for 2020.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

For a not-for-profit entity, when is recognition of contributions of artworks and historical treasures not required?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

Prepare the necessary journal entry to record the revenue and receivables.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

What two classifications are used for the expenses incurred by voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

What criteria must be met before a not-for-profit entity can recognize contributed services as a means of support?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

What financial statements would normally be prepared by a voluntary health and welfare entity?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

For November 2021, Harleytown Hospital's charges for patient services were $716,000, of which 85% was billed to third-party payors.Required:Prepare the journal entry to accrue patient charges for the month.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

How does a recipient not-for-profit entity record the receipt of a gift that will be transferred without restriction to another charitable entity? What if the donor retains the right to revoke or redirect the gift?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

How does a not-for-profit entity account for: 1) cash contributions, and 2) donated goods that are received for operating purposes? What types of revenues are recognized by voluntary health and welfare entities?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

In this month, there were several patients that had no health insurance and due to their low income level, the hospital decided that $96,000 of receivables would not be collectible.Required:Prepare the necessary journal entry to reflect the decision to consider the $96,000 as charity care.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

For not-for-profit entities, what is the difference in identification of "control" between a merger and an acquisition?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

The hospital estimated that contractual adjustments would reduce the amount collected from third-party payors to $1,790,000.Required:Prepare the necessary journal entry to record the contractual adjustments.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

What should Sterling Foundation report as program service expenses?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

What should Sterling Foundation report as supporting service expenses?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

For a not-for-profit entity, what are supporting services expenses?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

A not-for-profit entity receives a computer as a donation (valued at $3,000). Prepare the journal entry for the transaction.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

The Butler Center is a voluntary health and welfare entity. During 2020, unrestricted pledges of $880,000 were received by the Butler Center, sixty-five percent of which were fulfilled in 2020. Officials estimated that fifteen percent of the original amount of pledges will be uncollectible. The remainder of the amount expected to be collected from pledges will be received in 2021 (for use in 2021).Required:1) Show with appropriate amounts how the Butler Center would present the pledges on its Statement of Financial Position on the day the pledges are recorded in 2020.2) Show with appropriate amounts the effect on net assets the Butler Center would report for contributions for 2020.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

A local social worker, earning $14 per hour working for the state government, contributed 550 hours of time at no charge to the Sunrise Homeless Shelter, a voluntary health and welfare entity. If not for these donated services, an additional staff person would have been hired by the entity.Required:How should the Sunrise Homeless Shelter record the contributed services?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

Rainbow Childcare Agency is a private not-for-profit entity providing child care for a fee. The agency has a permanent endowment and the income may be used to sponsor families that are unable to pay for services but the principal must be preserved. In addition, various fundraising activities take place during the year.When the agency held its annual holiday fundraiser in 2020, pledges of $75,000 were received. The administration expected 6% of the pledges to be uncollectible.In addition, income of $12,500 was received from the permanent endowment to sponsor children to be placed with foster families.Prepare the journal entries for these transactions.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

What criteria did the FASB establish for not-for-profit entities to use in determining if a contribution is conditional?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

Record the journal entries that reflect all of this information.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

67

A local business donated medical supplies to Madison Home with a value of $45,000. Prepare the journal entry for the receipt of these supplies.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

68

Assume that the donor retains the right to revoke or redirect the gift.Prepare the journal entries for Charity A and Charity B. The entries should be for the gift when received by Charity A, and when the gift is distributed for Charity B.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

69

During 2021, the Tigger Humane Society, a voluntary health and welfare entity, received cash donations of $765,000 and membership dues of $54,000. A member of the Humane Society donated services valued at $5,000 that would otherwise have been performed by a paid staff member. A pet food manufacturer donated dog food valued at $13,200.The Humane Society received a gift of $125,000, to be used for building a new animal shelter. Also during 2021, investments held by the Humane Society earned interest of $1,200.Required:Prepare a schedule showing the amount that the Tigger Humane Society should have recorded for contributions from public support for 2021, according to ASU 2016-14.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

70

Manna House, a local not-for-profit, provides food assistance to those in need. Manna House recently received two donations:a) Cash donation of $25,000 that must be used to purchase a vehicle to be used to deliver food. If the money is not used to purchase a vehicle for that purpose, the money must be returned to the donor.b) Donated furniture that may be used for the Manna House office, sold, or put to any other use Manna House sees fit. The fair value of the furniture is $10,000.Required:Prepare the journal entries for the receipt of these donations.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

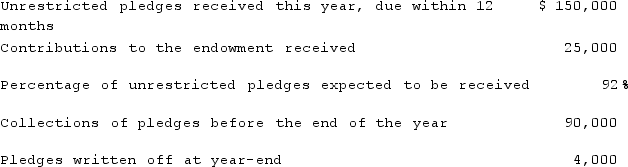

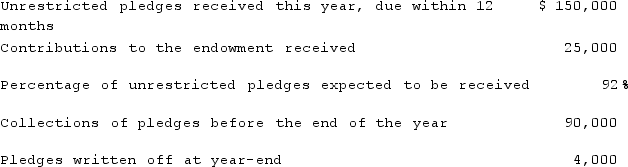

71

A not-for-profit entity provides the following information for the year 2020:  Required:Prepare the journal entries for these transactions for the year 2020.

Required:Prepare the journal entries for these transactions for the year 2020.

Required:Prepare the journal entries for these transactions for the year 2020.

Required:Prepare the journal entries for these transactions for the year 2020.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

72

What is the five-step progression that a health care entity must follow in recording revenues?

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

74

Match between columns

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck