Deck 11: Worldwide Accounting Diversity and International Accounting Standards

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/65

Play

Full screen (f)

Deck 11: Worldwide Accounting Diversity and International Accounting Standards

1

All of the following are true regarding IASB members except:

A) IASB shall comprise 16 members, and up to 3 of those members may be part-time.

B) Full-time members must sever employment relationships with former employers.

C) Full-time members are not allowed to hold any position giving rise to perceived economic incentives that might call their independence into question.

D) Part-time members must sever employment relationships with former employers.

E) Primary qualifications for IASB membership are professional competence and practical experience.

A) IASB shall comprise 16 members, and up to 3 of those members may be part-time.

B) Full-time members must sever employment relationships with former employers.

C) Full-time members are not allowed to hold any position giving rise to perceived economic incentives that might call their independence into question.

D) Part-time members must sever employment relationships with former employers.

E) Primary qualifications for IASB membership are professional competence and practical experience.

D

2

Which of the following is not a likely step to furthering convergence of FASB and IFRS?

A) FASB adopting an existing IASB Standard.

B) IASB adopting an existing FASB standard.

C) FASB and IASB issuing an identical standard.

D) FASB working with IASB to develop a new standard.

E) Realizing that identical standards, rather than similar standards, is not realistic.

A) FASB adopting an existing IASB Standard.

B) IASB adopting an existing FASB standard.

C) FASB and IASB issuing an identical standard.

D) FASB working with IASB to develop a new standard.

E) Realizing that identical standards, rather than similar standards, is not realistic.

C

3

The most relevant factor in determining the purpose of financial reporting is:

A) The nature of the country's financing system.

B) The country's current economic conditions.

C) The ability to control inflation.

D) A strong equity financing system which is more conservative, minimal disclosures, and tight tax laws.

E) A weak equity financing system which is less conservative, extensive disclosures and loose tax laws.

A) The nature of the country's financing system.

B) The country's current economic conditions.

C) The ability to control inflation.

D) A strong equity financing system which is more conservative, minimal disclosures, and tight tax laws.

E) A weak equity financing system which is less conservative, extensive disclosures and loose tax laws.

A

4

Which of the following is not a problem caused by diverse accounting practices across countries?

A) Preparation of consolidated financial statements.

B) Gaining access to foreign capital markets.

C) Lack of comparability of financial statements between companies in the same country.

D) Cost and expertise required of accounting staff who prepare consolidated financial statements.

E) Need for a company to maintain multiple sets of accounting records.

A) Preparation of consolidated financial statements.

B) Gaining access to foreign capital markets.

C) Lack of comparability of financial statements between companies in the same country.

D) Cost and expertise required of accounting staff who prepare consolidated financial statements.

E) Need for a company to maintain multiple sets of accounting records.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

5

All of the following are influences on the development of a country's financial reporting practices except:

A) The country's legal system.

B) The country's political system.

C) The taxation system.

D) The country's cultural system.

E) The country's level of inflation.

A) The country's legal system.

B) The country's political system.

C) The taxation system.

D) The country's cultural system.

E) The country's level of inflation.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

6

What international organization currently issues IFRS?

A) IASB.

B) IASC.

C) IOSCO.

D) FASB.

E) EU.

A) IASB.

B) IASC.

C) IOSCO.

D) FASB.

E) EU.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

7

Convergence of accounting standards would not occur by:

A) FASB adopting an existing IASB standard.

B) IASB adopting an existing FASB standard.

C) IASB issuing a new standard.

D) IASB and FASB jointly developing a new standard.

E) IASB and FASB each issuing a similar but not identical standard.

A) FASB adopting an existing IASB standard.

B) IASB adopting an existing FASB standard.

C) IASB issuing a new standard.

D) IASB and FASB jointly developing a new standard.

E) IASB and FASB each issuing a similar but not identical standard.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

8

Which one of the following is not a background or qualification requirement for full-time IASB members?

A) Professional competence.

B) Attain 10 years of auditing experience.

C) Practical experience.

D) Cease holding positions which might call into question their independence.

E) Sever relationship with former employers.

A) Professional competence.

B) Attain 10 years of auditing experience.

C) Practical experience.

D) Cease holding positions which might call into question their independence.

E) Sever relationship with former employers.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following states that "the objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders and other creditors in making decisions about providing resources to the entity?"

A) IASC Standards.

B) SIC Interpretations.

C) IFRIC Interpretations.

D) IASB Conceptual Framework.

E) International Accounting Standard 2.

A) IASC Standards.

B) SIC Interpretations.

C) IFRIC Interpretations.

D) IASB Conceptual Framework.

E) International Accounting Standard 2.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is false regarding a country's legal system?

A) The two major types of legal systems are common law and codified Roman law.

B) Common law originated in the Roman jus civile.

C) Code law countries tend to have more statutes governing a wider range of human activity.

D) Accounting law is rather general in code law countries.

E) A nongovernmental organization is more likely to develop in a common law country than in a code law country.

A) The two major types of legal systems are common law and codified Roman law.

B) Common law originated in the Roman jus civile.

C) Code law countries tend to have more statutes governing a wider range of human activity.

D) Accounting law is rather general in code law countries.

E) A nongovernmental organization is more likely to develop in a common law country than in a code law country.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

11

A U.S. company has many foreign subsidiaries and wants to convert its consolidated financial statements from U.S. GAAP to IFRS. Which of the following items is not one of the likely accounting issues to resolve for the opening IFRS balance sheet?

A) Inventory valuation.

B) Capitalizing development costs.

C) Bank overdrafts that are integral to cash management.

D) Goodwill calculation from acquisition of a subsidiary.

E) Liability for restructuring charges.

A) Inventory valuation.

B) Capitalizing development costs.

C) Bank overdrafts that are integral to cash management.

D) Goodwill calculation from acquisition of a subsidiary.

E) Liability for restructuring charges.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

12

Foreign companies whose stock is listed on a U.S. stock exchange and using foreign GAAP other than IFRS must file their annual report with the SEC on:

A) Form 8-A.

B) Form 10-A.

C) Form 16-K.

D) Form 20-F.

E) Form 20-K.

A) Form 8-A.

B) Form 10-A.

C) Form 16-K.

D) Form 20-F.

E) Form 20-K.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

13

The types of differences that exist between IFRS and U.S. GAAP would not generally include:

A) Presentation differences.

B) Measurement differences.

C) Disclosure differences.

D) Comparability differences.

E) Classification differences.

A) Presentation differences.

B) Measurement differences.

C) Disclosure differences.

D) Comparability differences.

E) Classification differences.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

14

A U.S. company has many foreign subsidiaries and is converting its consolidated financial statements from U.S. GAAP to IFRS. Which of the following items is not one of the likely accounting issues to resolve for the conversion?

A) Measuring impairment.

B) Classifying preferred shares of stock.

C) Sale and leaseback gain recognition.

D) Measuring salaries expense.

E) Prior service cost recognition for defined benefit plans.

A) Measuring impairment.

B) Classifying preferred shares of stock.

C) Sale and leaseback gain recognition.

D) Measuring salaries expense.

E) Prior service cost recognition for defined benefit plans.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not a factor influencing a country's financial reporting practices?

A) Providers of financing.

B) Inflation.

C) Legal system.

D) Gross National Product.

E) Political and economic ties.

A) Providers of financing.

B) Inflation.

C) Legal system.

D) Gross National Product.

E) Political and economic ties.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not true about IFRS?

A) The IASB does not have the ability to enforce proper usage of IFRS.

B) IFRS is available to any organization or nation that wishes to use those standards.

C) IFRS is a comprehensive set of financial reporting standards.

D) IFRS includes only pronouncements issued by the IASB.

E) IFRS are considered as generally accepted accounting principles.

A) The IASB does not have the ability to enforce proper usage of IFRS.

B) IFRS is available to any organization or nation that wishes to use those standards.

C) IFRS is a comprehensive set of financial reporting standards.

D) IFRS includes only pronouncements issued by the IASB.

E) IFRS are considered as generally accepted accounting principles.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

17

In countries of Latin America:

A) Accounting practice currently emphasizes political colonialism.

B) Accounting standards previously emphasized accounting in highly inflationary economies.

C) Banks are the primary source of financing for companies.

D) Accounting standards focus are based on recent market economy reforms.

E) Accounting information is prepared to meet the needs of governmental planners.

A) Accounting practice currently emphasizes political colonialism.

B) Accounting standards previously emphasized accounting in highly inflationary economies.

C) Banks are the primary source of financing for companies.

D) Accounting standards focus are based on recent market economy reforms.

E) Accounting information is prepared to meet the needs of governmental planners.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not a way for a country to use IFRS?

A) Require foreign companies listed on that country's stock exchange to use IFRS for consolidated financial statements.

B) Allow foreign companies listed on that country's stock exchange to use IFRS.

C) Permit its domestic companies listed on that country's stock exchange to use IFRS.

D) Adopt IFRS as that country's national GAAP.

E) Prohibit the use of a country's national GAAP.

A) Require foreign companies listed on that country's stock exchange to use IFRS for consolidated financial statements.

B) Allow foreign companies listed on that country's stock exchange to use IFRS.

C) Permit its domestic companies listed on that country's stock exchange to use IFRS.

D) Adopt IFRS as that country's national GAAP.

E) Prohibit the use of a country's national GAAP.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

19

All of the following are ways a country may use IFRS except:

A) A country may require foreign companies listed on its domestic stock exchange to use IFRS.

B) A country may permit companies listed on its domestic stock exchange to use IFRS.

C) A country may permit foreign companies listed on a foreign stock exchange to use foreign GAAP.

D) A country may require companies listed on its domestic stock exchange to use IFRS in preparing consolidated financial statements.

E) A country may adopt IFRS as its national GAAP.

A) A country may require foreign companies listed on its domestic stock exchange to use IFRS.

B) A country may permit companies listed on its domestic stock exchange to use IFRS.

C) A country may permit foreign companies listed on a foreign stock exchange to use foreign GAAP.

D) A country may require companies listed on its domestic stock exchange to use IFRS in preparing consolidated financial statements.

E) A country may adopt IFRS as its national GAAP.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following is not an authoritative pronouncement of International Financial Reporting Standards (IFRSs)?

A) International Financial Reporting Standards issued by the IASB

B) International Accounting Standards issued by the IASC and adopted by the IASB

C) Interpretations issued by the International Financial Reporting Interpretations Committee (IFRICs)

D) International Accounting Principles

E) Interpretations issued by the Standing Interpretations Committee (SICs) and adopted by the IASB

A) International Financial Reporting Standards issued by the IASB

B) International Accounting Standards issued by the IASC and adopted by the IASB

C) Interpretations issued by the International Financial Reporting Interpretations Committee (IFRICs)

D) International Accounting Principles

E) Interpretations issued by the Standing Interpretations Committee (SICs) and adopted by the IASB

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not a step in preparing IFRS financial statements for the first time?

A) Determine applicable IFRS accounting policies based on standards in effect on the reporting date.

B) Determine applicable IFRS accounting policies based on the standards in effect on the opening balance sheet date.

C) Recognize assets and liabilities required to be recognized under IFRS that were not recognized under previous GAAP.

D) Derecognize assets and liabilities previously recognized that are not allowed to be recognized under IFRS.

E) Measure assets and liabilities recognized on the opening balance sheet in accordance with IFRS.

A) Determine applicable IFRS accounting policies based on standards in effect on the reporting date.

B) Determine applicable IFRS accounting policies based on the standards in effect on the opening balance sheet date.

C) Recognize assets and liabilities required to be recognized under IFRS that were not recognized under previous GAAP.

D) Derecognize assets and liabilities previously recognized that are not allowed to be recognized under IFRS.

E) Measure assets and liabilities recognized on the opening balance sheet in accordance with IFRS.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

22

The most recent FASB-IASB convergence projects include:

A) Leases, Research and Development, Revenue Recognition, and Fair Value Measurement.

B) Leases, Revenue Recognition, Fair Value Measurement, and Joint Ventures.

C) Insurance Contracts, Post-Employment Benefits, Income Taxes and Impairment.

D) Insurance Contracts, Income Taxes, Leases, and Revenue Recognition.

E) Revenue Recognition, Leases, Insurance Contracts, and Income Taxes.

A) Leases, Research and Development, Revenue Recognition, and Fair Value Measurement.

B) Leases, Revenue Recognition, Fair Value Measurement, and Joint Ventures.

C) Insurance Contracts, Post-Employment Benefits, Income Taxes and Impairment.

D) Insurance Contracts, Income Taxes, Leases, and Revenue Recognition.

E) Revenue Recognition, Leases, Insurance Contracts, and Income Taxes.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

23

ASU, Inc., a U.S. company, was acquired by an international company and ASU has a transition date of January 1, 2021 for first-time adoption of IFRS. ASU has a new cookie brand that is ready to be marketed but the company has not yet received copyright approval for the brand's logo. All costs for development of the copyright were expensed prior to IFRS January 1, 2021. ASU and its new international parent both have December 31 year-end accounting years. What should ASU do to prepare financial statements for the first time in accordance with IFRS?

A) Debit development expense and credit copyright for the year ended December 31, 2021.

B) Debit copyright and credit copyright expense at January 1, 2021.

C) Debit copyright and credit research and development expense for the year ended December 31, 2020.

D) Debit copyright and credit stockholders' equity at January 1, 2021.

E) Debit stockholders' equity and credit research and development expense at January 1, 2021.

A) Debit development expense and credit copyright for the year ended December 31, 2021.

B) Debit copyright and credit copyright expense at January 1, 2021.

C) Debit copyright and credit research and development expense for the year ended December 31, 2020.

D) Debit copyright and credit stockholders' equity at January 1, 2021.

E) Debit stockholders' equity and credit research and development expense at January 1, 2021.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

24

Carpenter, Inc., a wholly owned subsidiary of the U.S.-based company, Buildings Ltd., was notified of a loss contingency with an estimated cost ranging between $100,000 and $220,000. Carpenter, Inc. hired an expert appraiser who assessed that all possible dollar amounts of liability in this range are equally likely. Management of Carpenter, Inc. has estimated that there is a 65 percent chance that this contingency will result in an actual loss.According to U.S. GAAP, what is the amount recognized by Carpenter, Inc. as a provision for loss contingency?

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $100,000

C) $220,000

D) $120,000

E) $160,000

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $100,000

C) $220,000

D) $120,000

E) $160,000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is the organization that governs the IASB?

A) IASC.

B) IOSCO.

C) UNESCO.

D) IFRS Foundation.

E) IAS Service.

A) IASC.

B) IOSCO.

C) UNESCO.

D) IFRS Foundation.

E) IAS Service.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

26

IFRS for SMEs differ from full IFRS in all of the following ways except:

A) IFRS for SMEs require significantly fewer disclosures.

B) Interim period reports need not be prepared when following IFRS for SMEs.

C) Recognizing and measuring assets are simplified when following IFRS for SMEs.

D) Segment reporting must be provided when following IFRS for SMEs.

E) IFRS for SMEs do not require earnings per share to be reported.

A) IFRS for SMEs require significantly fewer disclosures.

B) Interim period reports need not be prepared when following IFRS for SMEs.

C) Recognizing and measuring assets are simplified when following IFRS for SMEs.

D) Segment reporting must be provided when following IFRS for SMEs.

E) IFRS for SMEs do not require earnings per share to be reported.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

27

A foreign subsidiary of a U.S.-based company has been notified of a loss contingency with an estimated cost ranging between $250,000 and $275,000 which is probable of resulting in an actual loss. Each dollar amount within this range of cost is equally likely of being the actual outcome.According to IFRS, what is the amount recognized as a provision for loss contingency?

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $25,000

C) $275,000

D) $262,500

E) $250,000

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $25,000

C) $275,000

D) $262,500

E) $250,000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

28

All of the following are simplified principles for recognizing and measuring assets, liabilities, income, and expenses for SMEs under IFRS except:

A) Borrowing costs are expensed as incurred.

B) All development costs are expensed as incurred.

C) Actuarial gains and losses for defined benefit plans may be either recognized immediately or deferred and amortized.

D) Goodwill is amortized over its useful life.

E) The cost model for property, plant, and equipment must be used.

A) Borrowing costs are expensed as incurred.

B) All development costs are expensed as incurred.

C) Actuarial gains and losses for defined benefit plans may be either recognized immediately or deferred and amortized.

D) Goodwill is amortized over its useful life.

E) The cost model for property, plant, and equipment must be used.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

29

A company is preparing financial statements using IFRS for the first time for the year ended December 31, 2021. The "transition date" for reporting is

A) December 31, 2021.

B) December 31, 2020.

C) January 1, 2020.

D) January 1, 2021.

E) January 1, 2022.

A) December 31, 2021.

B) December 31, 2020.

C) January 1, 2020.

D) January 1, 2021.

E) January 1, 2022.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

30

IFRS for SMEs are primarily designed to meet the needs of:

A) Small Manufacturing Enterprises.

B) Governmental entities.

C) Companies whose shares of stock are not publicly traded.

D) Not-for-profit organizations.

E) Special Model Entities.

A) Small Manufacturing Enterprises.

B) Governmental entities.

C) Companies whose shares of stock are not publicly traded.

D) Not-for-profit organizations.

E) Special Model Entities.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is not an example of IFRS simplified for SMEs?

A) All borrowing costs are expensed as incurred.

B) All development costs are expensed as incurred.

C) Goodwill is amortized over its useful life.

D) There is a choice between using the cost model and the revaluation model for property, plant, and equipment.

E) Actuarial gains and losses for defined benefit plans are recognized immediately.

A) All borrowing costs are expensed as incurred.

B) All development costs are expensed as incurred.

C) Goodwill is amortized over its useful life.

D) There is a choice between using the cost model and the revaluation model for property, plant, and equipment.

E) Actuarial gains and losses for defined benefit plans are recognized immediately.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

32

Which statement is correct as it relates to diverse accounting practices across countries?

A) Gaining access to foreign capital markets is relatively easy and inexpensive once the financial statements are converted to the local currency of the country where the financing is desired.

B) U.S. GAAP is acceptable worldwide wherever IFRS has not been adopted.

C) To have stock listed on a U.S. stock exchange, all financial statements submitted to the SEC must be prepared either using U.S. GAAP or using IFRS.

D) Stock analysts specializing in industry coverage can compare financial statements regardless of various national or international accounting standards used by companies being compared.

E) Translating financial statements of various currencies into one common currency for consolidation purposes does not resolve the problem of diversity of accounting practices across countries.

A) Gaining access to foreign capital markets is relatively easy and inexpensive once the financial statements are converted to the local currency of the country where the financing is desired.

B) U.S. GAAP is acceptable worldwide wherever IFRS has not been adopted.

C) To have stock listed on a U.S. stock exchange, all financial statements submitted to the SEC must be prepared either using U.S. GAAP or using IFRS.

D) Stock analysts specializing in industry coverage can compare financial statements regardless of various national or international accounting standards used by companies being compared.

E) Translating financial statements of various currencies into one common currency for consolidation purposes does not resolve the problem of diversity of accounting practices across countries.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

33

A foreign subsidiary of a U.S.-based company has been notified of a loss contingency with an estimated cost ranging between $250,000 and $275,000 which is probable of resulting in an actual loss. Each dollar amount within this range of cost is equally likely of being the actual outcome.According to U.S. GAAP, what is the amount recognized as a provision for loss contingency?

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $25,000

C) $250,000

D) $262,500

E) $275,000

A) No amount will be recorded but an amount will be disclosed in the notes to the financial statements.

B) $25,000

C) $250,000

D) $262,500

E) $275,000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following is a correct statement with regard to differences between IFRS and U.S. GAAP?

A) Reporting a bank overdraft that is an integral part of a cash management policy is a recognition difference.

B) Reporting LIFO inventory is a presentation difference.

C) Reporting past service cost for defined benefit pension plans is a measurement difference.

D) Reporting convertible debt is a recognition difference.

E) Reporting development costs is a classification difference.

A) Reporting a bank overdraft that is an integral part of a cash management policy is a recognition difference.

B) Reporting LIFO inventory is a presentation difference.

C) Reporting past service cost for defined benefit pension plans is a measurement difference.

D) Reporting convertible debt is a recognition difference.

E) Reporting development costs is a classification difference.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

35

Of the following IFRS, which was the most recently issued?

A) First-Time Adoption of IFRS

B) Leases

C) Revenue from Contracts with Customers

D) Insurance Contracts

E) Financial Instruments: Disclosures

A) First-Time Adoption of IFRS

B) Leases

C) Revenue from Contracts with Customers

D) Insurance Contracts

E) Financial Instruments: Disclosures

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

36

When measuring assets and liabilities recognized on the opening balance sheet in accordance with first-time adoption of IFRS, the reporting company must:

A) Use its current valuation method and disclose the method in the notes to the financial statements.

B) Retrospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet.

C) Prospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet.

D) Recognize the difference in measurement, and disclose it in the notes to the financial statements as a change in accounting estimate.

E) Retrospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet and recognize the amount of change in the income statement.

A) Use its current valuation method and disclose the method in the notes to the financial statements.

B) Retrospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet.

C) Prospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet.

D) Recognize the difference in measurement, and disclose it in the notes to the financial statements as a change in accounting estimate.

E) Retrospectively apply applicable IASB standards to each asset and liability reported on the opening balance sheet and recognize the amount of change in the income statement.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a problem caused by diversity in accounting practices across countries?

A) Comparing companies in the same industry that are headquartered in different countries.

B) Translating foreign currency balances into U.S. dollars.

C) Converting local GAAP financial statements into U.S. GAAP for consolidation purposes.

D) Maintaining separate accounting records in both the local and U.S. GAAP.

E) Identifying and retaining personnel who are competent to prepare financial statements in both international and domestic accounting standards.

A) Comparing companies in the same industry that are headquartered in different countries.

B) Translating foreign currency balances into U.S. dollars.

C) Converting local GAAP financial statements into U.S. GAAP for consolidation purposes.

D) Maintaining separate accounting records in both the local and U.S. GAAP.

E) Identifying and retaining personnel who are competent to prepare financial statements in both international and domestic accounting standards.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is not one of the steps to prepare IFRS statements for the first time?

A) Determine applicable IFRS accounting policies based on standards in force on the reporting date.

B) Recognize assets and liabilities required to be recognized under IFRS that were not recognized under previous GAAP.

C) Derecognize assets and liabilities previously recognized that are not allowed to be recognized under IFRS.

D) Reclassify items previously classified in a different manner from what is acceptable under IFRS.

E) Comply with most disclosure and presentation requirements.

A) Determine applicable IFRS accounting policies based on standards in force on the reporting date.

B) Recognize assets and liabilities required to be recognized under IFRS that were not recognized under previous GAAP.

C) Derecognize assets and liabilities previously recognized that are not allowed to be recognized under IFRS.

D) Reclassify items previously classified in a different manner from what is acceptable under IFRS.

E) Comply with most disclosure and presentation requirements.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

39

The FASB-IASB convergence project on leases resulted in the following:

A) Lease accounting will be the same under IFRS and under U.S. GAAP in that lessors and lessees will capitalize all leases as finance leases and treat them as such in the measurement of income.

B) Lessor and lessee accounting will be the same under IFRS and under U.S. GAAP in that lessors will capitalize all leases and lessees will capitalize some leases as finance leases but treat others as operating leases.

C) Lease accounting will differ in that under IFRS lessees will capitalize some leases as finance leases and others as operating leases, while under U.S. GAAP lessees will capitalize all leases as finance leases but treat them as traditional operating leases in the measurement of net income.

D) Lease accounting will be similar under IFRS and U.S. GAAP for lessees but will differ for lessors in their treatment of the measurement of net income.

E) Lease accounting will differ for lessees in that, under IFRS, all leases will be treated as finance leases both on the balance sheet and in the measurement of net income, and under U.S. GAAP lessees will capitalize operating leases on the balance sheet similar to finance leases but will treat them as traditional operating leases in the measurement of income.

A) Lease accounting will be the same under IFRS and under U.S. GAAP in that lessors and lessees will capitalize all leases as finance leases and treat them as such in the measurement of income.

B) Lessor and lessee accounting will be the same under IFRS and under U.S. GAAP in that lessors will capitalize all leases and lessees will capitalize some leases as finance leases but treat others as operating leases.

C) Lease accounting will differ in that under IFRS lessees will capitalize some leases as finance leases and others as operating leases, while under U.S. GAAP lessees will capitalize all leases as finance leases but treat them as traditional operating leases in the measurement of net income.

D) Lease accounting will be similar under IFRS and U.S. GAAP for lessees but will differ for lessors in their treatment of the measurement of net income.

E) Lease accounting will differ for lessees in that, under IFRS, all leases will be treated as finance leases both on the balance sheet and in the measurement of net income, and under U.S. GAAP lessees will capitalize operating leases on the balance sheet similar to finance leases but will treat them as traditional operating leases in the measurement of income.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

40

Carpenter, Inc., a wholly owned subsidiary of the U.S.-based company, Buildings Ltd., was notified of a loss contingency with an estimated cost ranging between $100,000 and $220,000. Carpenter, Inc. hired an expert appraiser who assessed that all possible dollar amounts of liability in this range are equally likely. Management of Carpenter, Inc. has estimated that there is a 65 percent chance that this contingency will result in an actual loss.In the conversion from U.S. GAAP financial statements to IFRS financial statements, what is the amount of adjustment needed to adjust for the difference in accounting for a provision for loss contingency?

A) $0

B) $100,000

C) $160,000

D) $120,000

E) $220,000

A) $0

B) $100,000

C) $160,000

D) $120,000

E) $220,000

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

41

What are the steps to be taken in preparing IFRS financial statements for the first time?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

42

What are some examples of accounting treatments under IFRS for SMEs for recognizing and measuring assets, liabilities, income, and expenses?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not one of the optional exemptions provided by IFRS 1 to first-time adopters of IFRS in preparing the opening balance sheet?

A) Option not to adjust the carrying amount of goodwill recognized under previous GAAP.

B) Option not to restate a business combination originally accounted for under the pooling method.

C) Option not to retrospectively apply IFRS 2 to stock options.

D) Option not to recognize any cumulative translation adjustment for foreign subsidiaries.

E) Option not to comply with all presentation and disclosure requirements.

A) Option not to adjust the carrying amount of goodwill recognized under previous GAAP.

B) Option not to restate a business combination originally accounted for under the pooling method.

C) Option not to retrospectively apply IFRS 2 to stock options.

D) Option not to recognize any cumulative translation adjustment for foreign subsidiaries.

E) Option not to comply with all presentation and disclosure requirements.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

44

What are recognition differences in financial reporting and what would be an example of a recognition difference between IFRS and U.S. GAAP?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

45

What is the significance of the "Norwalk Agreement?"

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

46

In the 2012 Financial Staff Report issued by the SEC, what were some of the unresolved issues identified that prevented the SEC from requiring IFRS usage?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

47

What does the IASB's Conceptual Framework for Financial Reporting state as the objective of general purpose financial reporting?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

48

What are the two primary methods used by countries to incorporate IFRS into their financial reporting requirements for listed companies?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

49

State the two major types of legal systems used around the world and briefly describe their differences.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

50

Why do countries have their own unique set of financial reporting practices?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

51

What are the four types of authoritative pronouncements that make up the International Financial Reporting Standards (IFRS)?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

52

With regard to IFRS, what does SME refer to, and what is the significance with regard to financial reporting requirements?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

53

IAS 1 requires a complete set of financial statements to include all of the following except

A) a statement of financial position.

B) a statement of comprehensive income.

C) a statement of changes in equity.

D) a statement of bank reconciliation.

E) a statement of cash flows.

A) a statement of financial position.

B) a statement of comprehensive income.

C) a statement of changes in equity.

D) a statement of bank reconciliation.

E) a statement of cash flows.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

54

What problems are caused by diverse accounting practices?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

55

What are the four different ways IFRS can be used by a country?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

56

What is the IOSCO?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

57

The major providers of financing in some countries are stockholders, while other countries predominantly use banks as the main financing source. What difference does it make to accounting disclosures in comparing a company from one of each of those countries?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

58

IFRS 1 requires companies transitioning to IFRS to prepare an opening balance sheet at the "date of transition." Which of the following describes the date of transition?

A) The beginning of the earliest period for which an entity presents full comparative information under IFRS.

B) The beginning of the year for which the entity prepares its first IFRS financial statements.

C) The last day of year in which an entity presents full comparative information under IFRS.

D) At least ninety days before the entity presents its first IFRS financial statements.

E) No more than 180 days before the entity presents its first IFRS financial statements.

A) The beginning of the earliest period for which an entity presents full comparative information under IFRS.

B) The beginning of the year for which the entity prepares its first IFRS financial statements.

C) The last day of year in which an entity presents full comparative information under IFRS.

D) At least ninety days before the entity presents its first IFRS financial statements.

E) No more than 180 days before the entity presents its first IFRS financial statements.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

59

All of the following are successful FASB-IASB convergence projects except

A) revenue recognition.

B) business combinations.

C) leases.

D) fair value measurement.

E) income taxes.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

46) With regards to IFRS 1, what is the "date of transition" and why is it important?

A) revenue recognition.

B) business combinations.

C) leases.

D) fair value measurement.

E) income taxes.

ESSAY. Write your answer in the space provided or on a separate sheet of paper.

46) With regards to IFRS 1, what is the "date of transition" and why is it important?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

60

What two reconciliations are required by IFRS 1 for first-time IFRS Adopters?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

61

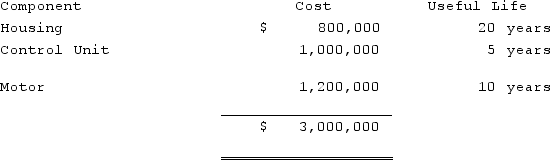

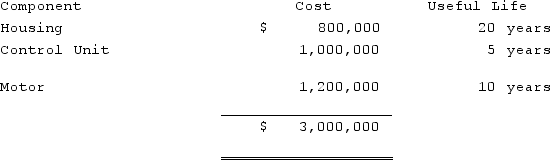

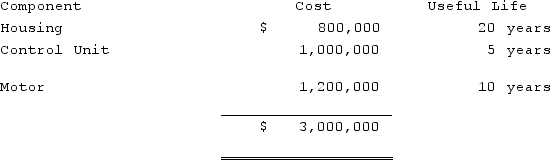

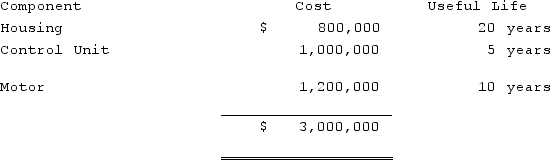

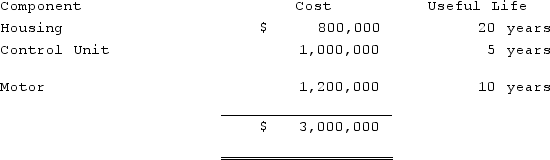

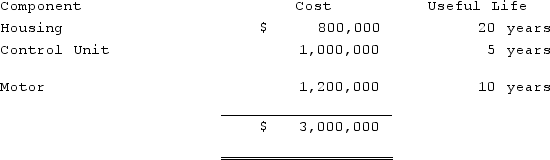

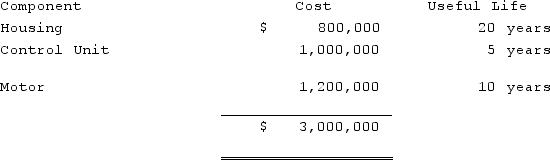

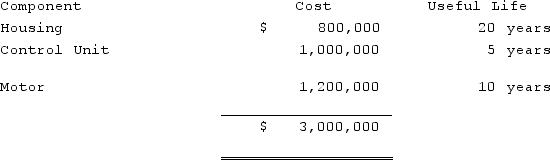

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry to convert the 2020 Teapot, Ltd. financial statements from IFRS to U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry to convert the 2020 Teapot, Ltd. financial statements from IFRS to U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry to convert the 2020 Teapot, Ltd. financial statements from IFRS to U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry to convert the 2020 Teapot, Ltd. financial statements from IFRS to U.S. GAAP.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

62

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Teapot, Ltd. based on IFRS accounting principles.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

63

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.Prepare the journal entry for the 2020 depreciation expense for Davis Housewares Corp. based on U.S. GAAP.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

64

What are measurement differences in financial reporting and what would be an example of a difference between IFRS and U.S. GAAP?

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck

65

Teapot, Ltd. is a foreign company that uses IFRS for its financial reporting. Teapot is a wholly-owned subsidiary of Davis Housewares Corp. which is a U.S. company that prepares its consolidated financial statements in accordance with U.S. GAAP. Teapot purchased a piece of equipment for $3,000,000 on January 1, 2020. The equipment has an overall useful life of 20 years and no salvage value. The equipment is comprised of the following three significant components, shown with their associated cost and useful life.  As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

As a corporate policy, Davis Housewares Corp. utilizes the straight-line method of depreciation for machinery and equipment and plans to extend this policy to Teapot, Ltd.On December 31, 2020, Wave Corp. a foreign subsidiary of Pepper Corp., had a bank overdraft of $30,000 on one of its bank accounts. Bank overdrafts are an integral part of Wave's cash management policy.1) Prepare the journal entry to convert the foreign subsidiary from its IFRS financial statements to U.S.GAAP financial statements.2) Briefly explain why this journal entry is required.

Unlock Deck

Unlock for access to all 65 flashcards in this deck.

Unlock Deck

k this deck