Deck 10: Price-Searcher Markets With Low Entry Barriers

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/232

Play

Full screen (f)

Deck 10: Price-Searcher Markets With Low Entry Barriers

1

Will the United States eventually run out of oil and have to reduce living standards?

A) No, because increases in the price of oil provide incentives to conserve oil, discover more oil, and discover more alternatives to oil.

B) No, because the government has subsidized alternative forms of energy such as wind and solar.

C) No, because government programs to mandate energy-efficient cars and public transportation will save oil.

D) Yes; even though technology has recently helped find more oil, this trend cannot continue.

A) No, because increases in the price of oil provide incentives to conserve oil, discover more oil, and discover more alternatives to oil.

B) No, because the government has subsidized alternative forms of energy such as wind and solar.

C) No, because government programs to mandate energy-efficient cars and public transportation will save oil.

D) Yes; even though technology has recently helped find more oil, this trend cannot continue.

No, because increases in the price of oil provide incentives to conserve oil, discover more oil, and discover more alternatives to oil.

2

Higher prices for natural resources are

A) a natural and inevitable result of resource depletion.

B) not possible for more than a short time, as technological advances clearly guarantee falling resource prices.

C) not the story of the last two centuries, because resource prices have declined through most of this period.

D) the major cause of resource shortages in the world.

A) a natural and inevitable result of resource depletion.

B) not possible for more than a short time, as technological advances clearly guarantee falling resource prices.

C) not the story of the last two centuries, because resource prices have declined through most of this period.

D) the major cause of resource shortages in the world.

not the story of the last two centuries, because resource prices have declined through most of this period.

3

Why do most economists believe we will not run out of oil?

A) The government has wisely subsidized alternative forms of energy.

B) If oil was in short supply, its price would rise, causing consumers to conserve on its use and producers to discover more oil and alternative energy sources.

C) Government imposed regulations that force automobile manufacturers to produce cars that use less gasoline per mile.

D) This is a trick question. Most economists believe that the world will run out of oil in about 20 years.

A) The government has wisely subsidized alternative forms of energy.

B) If oil was in short supply, its price would rise, causing consumers to conserve on its use and producers to discover more oil and alternative energy sources.

C) Government imposed regulations that force automobile manufacturers to produce cars that use less gasoline per mile.

D) This is a trick question. Most economists believe that the world will run out of oil in about 20 years.

If oil was in short supply, its price would rise, causing consumers to conserve on its use and producers to discover more oil and alternative energy sources.

4

Forests in the United States have, in recent decades,

A) expanded substantially in the amount of wood grown.

B) been steadily declining in acreage and in wood produced.

C) been cut and cleared at a faster and faster rate.

D) shown no trend in growth or shrinkage.

A) expanded substantially in the amount of wood grown.

B) been steadily declining in acreage and in wood produced.

C) been cut and cleared at a faster and faster rate.

D) shown no trend in growth or shrinkage.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

5

Supply and demand analysis suggests that a sharp increase in the price of gasoline will cause the

A) price of fuel-efficient compact cars to decrease.

B) supply of gasoline to decrease.

C) demand for large luxury cars to increase.

D) demand for fuel-efficient cars to increase.

A) price of fuel-efficient compact cars to decrease.

B) supply of gasoline to decrease.

C) demand for large luxury cars to increase.

D) demand for fuel-efficient cars to increase.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

6

Generally, the demand for energy in the long run will be

A) approximately equal in elasticity to the demand for energy in the short run.

B) considerably less elastic than in the short run.

C) considerably more elastic than in the short run.

D) perfectly inelastic because we must have energy to survive.

A) approximately equal in elasticity to the demand for energy in the short run.

B) considerably less elastic than in the short run.

C) considerably more elastic than in the short run.

D) perfectly inelastic because we must have energy to survive.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

7

Doomsday projections have generally

A) been correct.

B) been incorrect, but with better technology and the ability to predict the future, these forecasts have become much more accurate in the last few decades.

C) been inconsistent. Some projections came true, others failed.

D) been wrong.

A) been correct.

B) been incorrect, but with better technology and the ability to predict the future, these forecasts have become much more accurate in the last few decades.

C) been inconsistent. Some projections came true, others failed.

D) been wrong.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

8

How does the invisible hand ensure that an economy will not run out of a renewable resource?

A) As resources run low, consumers will naturally decrease their demand for those resources.

B) Government will begin to regulate scarce resources as an effective means of rationing those resources.

C) If there is demand for those resources, producers will continue increasing supply regardless of price.

D) Price increases due to the diminishing supply of a resource will both curb consumption and provide incentive for producers to expand supply.

A) As resources run low, consumers will naturally decrease their demand for those resources.

B) Government will begin to regulate scarce resources as an effective means of rationing those resources.

C) If there is demand for those resources, producers will continue increasing supply regardless of price.

D) Price increases due to the diminishing supply of a resource will both curb consumption and provide incentive for producers to expand supply.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

9

Entrepreneurs will increase their efforts to develop economical alternative energy sources

A) if current energy supply decreases and prices rise.

B) if current energy supply is ample and prices are low.

C) only if current supply runs out and a full-scale crisis ensues.

D) if the government imposes price controls that keep energy prices from rising.

A) if current energy supply decreases and prices rise.

B) if current energy supply is ample and prices are low.

C) only if current supply runs out and a full-scale crisis ensues.

D) if the government imposes price controls that keep energy prices from rising.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

10

Generally, the elasticity of demand for an energy source in the long run will be

A) approximately equal to its elasticity of demand in the short run.

B) considerably more elastic than in the short run.

C) slightly less elastic than in the short run.

D) considerably less elastic than in the short run.

A) approximately equal to its elasticity of demand in the short run.

B) considerably more elastic than in the short run.

C) slightly less elastic than in the short run.

D) considerably less elastic than in the short run.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

11

Economic theory indicates that the amount consumed of a natural resource depends on

A) the price of the resource.

B) consumer income.

C) the price of substitute resources.

D) all of the above.

A) the price of the resource.

B) consumer income.

C) the price of substitute resources.

D) all of the above.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

12

The supply of oil for users in the United States

A) was never an issue of serious public concern until the 1970s.

B) has never been an issue of serious concern by political leaders.

C) has often been a topic for dire warnings and forecasts of oil depletion.

D) has been more and more in doubt since the early 1980s.

A) was never an issue of serious public concern until the 1970s.

B) has never been an issue of serious concern by political leaders.

C) has often been a topic for dire warnings and forecasts of oil depletion.

D) has been more and more in doubt since the early 1980s.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is true about the demand and supply of natural resources?

A) The quantity demanded of a natural resource will generally be more responsive to a change in price in the long run than in the short run.

B) The future supply of a natural resource will fall when current prices for that resource rise.

C) The supply of a natural resource is fixed by nature; it cannot be responsive to a price change in the long run.

D) None of the above is correct.

A) The quantity demanded of a natural resource will generally be more responsive to a change in price in the long run than in the short run.

B) The future supply of a natural resource will fall when current prices for that resource rise.

C) The supply of a natural resource is fixed by nature; it cannot be responsive to a price change in the long run.

D) None of the above is correct.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following statements is true about the demand for and/or the supply of natural resources?

A) The supply curve for natural resources is more elastic in the long run than in the short run.

B) The elasticity of demand for electricity, natural gas, and gasoline equals approximately 0.1 in both the short run and the long run.

C) Natural resources are demanded by consumers and producers in steadily growing amounts, so future shortages are inevitable.

D) The supply of many natural resources is finite; thus the long-run elasticity of supply must be zero.

A) The supply curve for natural resources is more elastic in the long run than in the short run.

B) The elasticity of demand for electricity, natural gas, and gasoline equals approximately 0.1 in both the short run and the long run.

C) Natural resources are demanded by consumers and producers in steadily growing amounts, so future shortages are inevitable.

D) The supply of many natural resources is finite; thus the long-run elasticity of supply must be zero.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

15

Resource markets are like any other market in that

A) the increase in quantity supplied in response to a higher price will generally be greater in the long run than in the short run.

B) the amount demanded of a resource is inversely related to its price.

C) higher prices encourage people to search for substitutes.

D) all of the above are correct.

A) the increase in quantity supplied in response to a higher price will generally be greater in the long run than in the short run.

B) the amount demanded of a resource is inversely related to its price.

C) higher prices encourage people to search for substitutes.

D) all of the above are correct.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

16

Doomsday forecasts projecting that a consumable resource will soon be depleted, fail to account for

A) government regulation of the resource.

B) public pressure to conserve usage of the resource.

C) the role of prices in conservation; as the supply of the resource decreases, the price increases and people will turn to alternative resources.

D) supply and demand; as supply of a resource decreases, the demand will also decrease.

A) government regulation of the resource.

B) public pressure to conserve usage of the resource.

C) the role of prices in conservation; as the supply of the resource decreases, the price increases and people will turn to alternative resources.

D) supply and demand; as supply of a resource decreases, the demand will also decrease.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

17

Predictions of severe shortages due to impending natural resource depletion

A) are widely accepted by resource economists even though such predictions are a relatively new occurrence.

B) have been wrong in the past, but most resource economists believe that the threat of resource depletion is now far more severe than ever before.

C) are typically made without adequate recognition and consideration of resource price elasticities.

D) typically assume that price elasticities are greater than they really are.

A) are widely accepted by resource economists even though such predictions are a relatively new occurrence.

B) have been wrong in the past, but most resource economists believe that the threat of resource depletion is now far more severe than ever before.

C) are typically made without adequate recognition and consideration of resource price elasticities.

D) typically assume that price elasticities are greater than they really are.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

18

In a market economy, if the supply of oil declines relative to demand,

A) it will only be a matter of time until we run out of oil.

B) the price of gas will rise, and therefore price controls should be imposed in order to assure efficient allocation of petroleum resources.

C) oil prices will fall, reducing the incentive to find new oil reserves and alternative technologies.

D) oil prices will rise, increasing the incentive to conserve, discover new oil reserves, and develop alternative technologies.

A) it will only be a matter of time until we run out of oil.

B) the price of gas will rise, and therefore price controls should be imposed in order to assure efficient allocation of petroleum resources.

C) oil prices will fall, reducing the incentive to find new oil reserves and alternative technologies.

D) oil prices will rise, increasing the incentive to conserve, discover new oil reserves, and develop alternative technologies.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

19

If the prices of energy products rise sharply, consumers will most likely

A) sharply reduce their consumption of these products in both the short run and the long run.

B) reduce their consumption of these products slightly in the short run and more sharply in the long run.

C) reduce their consumption of these products sharply in the short run, but in the long run consumption will fall by only a small amount.

D) increase their consumption of these products slightly in the short run and more sharply in the long run.

A) sharply reduce their consumption of these products in both the short run and the long run.

B) reduce their consumption of these products slightly in the short run and more sharply in the long run.

C) reduce their consumption of these products sharply in the short run, but in the long run consumption will fall by only a small amount.

D) increase their consumption of these products slightly in the short run and more sharply in the long run.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

20

Doomsday forecasts about running out of natural resources, with dire consequences,

A) have occurred at least as far back in time as the 16th century.

B) have generally been correct, and resources today are nearly all rising in price.

C) seldom are taken seriously enough by the public.

D) began to be heard for the first time after Earth Day of 1970.

A) have occurred at least as far back in time as the 16th century.

B) have generally been correct, and resources today are nearly all rising in price.

C) seldom are taken seriously enough by the public.

D) began to be heard for the first time after Earth Day of 1970.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

21

If proved reserves of a mineral amount to twelve years of use at the current rate of consumption,

A) it is likely, though not certain, that we will run out of that mineral in about twelve years.

B) we are likely to run out of the mineral in less than twelve years if our rate of use has been increasing.

C) if the good becomes more scarce relative to supply in the future, its price will rise and thereby encourage both conservation and exploration.

D) if proved reserves diminish, lower prices will extend the day of exhaustion well into the future.

A) it is likely, though not certain, that we will run out of that mineral in about twelve years.

B) we are likely to run out of the mineral in less than twelve years if our rate of use has been increasing.

C) if the good becomes more scarce relative to supply in the future, its price will rise and thereby encourage both conservation and exploration.

D) if proved reserves diminish, lower prices will extend the day of exhaustion well into the future.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

22

What happens to a resource as it becomes scarcer?

A) The price rises and this increases the future supply relative to demand.

B) The price rises and this increases the future demand relative to supply.

C) The price falls and this increases the future supply relative to demand.

D) The price falls and this increases the future demand relative to supply.

A) The price rises and this increases the future supply relative to demand.

B) The price rises and this increases the future demand relative to supply.

C) The price falls and this increases the future supply relative to demand.

D) The price falls and this increases the future demand relative to supply.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

23

In the petroleum industry, proved reserves are

A) evidence that uncertainty is not a problem in the industry.

B) inevitably growing smaller over time.

C) the same thing as the current supply of petroleum.

D) resources recoverable at current prices and technology.

A) evidence that uncertainty is not a problem in the industry.

B) inevitably growing smaller over time.

C) the same thing as the current supply of petroleum.

D) resources recoverable at current prices and technology.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

24

In the natural gas industry, recent technological improvements and the use of fracking have

A) increased the demand for natural gas, causing its price to rise.

B) increased the supply of natural gas, causing its price to decline.

C) reduced the demand for natural gas even though the proved reserves of the resource have fallen.

D) resulted in sharply higher natural gas prices because of the dangers that accompany fracking.

A) increased the demand for natural gas, causing its price to rise.

B) increased the supply of natural gas, causing its price to decline.

C) reduced the demand for natural gas even though the proved reserves of the resource have fallen.

D) resulted in sharply higher natural gas prices because of the dangers that accompany fracking.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

25

While the price of a resource may increase sharply during some periods, the structure of ____ accompanying the price increase makes depletion highly unlikely and provides the seeds for future reversal. (Fill in the blank)

A) government programs

B) foreign competition

C) incentives

D) taxation

A) government programs

B) foreign competition

C) incentives

D) taxation

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

26

Proved reserves are likely to underestimate the total quantity of the resource in the ground because

A) of flaws in information flows between countries.

B) government agencies have an incentive to keep reserves secret.

C) of future improvements in technology and higher future prices.

D) scientists have not been able to use the latest techniques to estimate reserves in less developed countries.

A) of flaws in information flows between countries.

B) government agencies have an incentive to keep reserves secret.

C) of future improvements in technology and higher future prices.

D) scientists have not been able to use the latest techniques to estimate reserves in less developed countries.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

27

The concept of "proved reserves" refers to the amount of a resource that can be produced

A) in one year's time.

B) in the next ten years.

C) before it runs out.

D) at current prices and technology.

A) in one year's time.

B) in the next ten years.

C) before it runs out.

D) at current prices and technology.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

28

Data on world reserves of minerals, gathered by Blackman and Baumol, show that between 1950 and 2000, production of most minerals

A) greatly exceeded the reserves available in 1950.

B) declined as depletion occurred.

C) greatly reduced the reserves available in 2000.

D) was limited to a fraction of the reserves available in 1950.

A) greatly exceeded the reserves available in 1950.

B) declined as depletion occurred.

C) greatly reduced the reserves available in 2000.

D) was limited to a fraction of the reserves available in 1950.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

29

When the price of gasoline increases substantially, many consumers will

A) turn to fuel saving alternatives like hybrid vehicles.

B) drive less.

C) take public transportation.

D) all of the above are true.

A) turn to fuel saving alternatives like hybrid vehicles.

B) drive less.

C) take public transportation.

D) all of the above are true.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

30

"If China and India continue their economic expansion, the world cannot provide enough raw materials without terrible shortages worldwide." Evaluate this statement.

A) True, increased demand from developing countries will swamp the existing supply of resources.

B) True, increased demand from China and India will lead to large shortages in the North America and Europe.

C) False, the shortage will be limited to China and India.

D) False, increasing scarcity will result in higher prices and the deployment of new technologies that increase the efficiency of production, and together these markets forces will help to balance demand and supply worldwide.

A) True, increased demand from developing countries will swamp the existing supply of resources.

B) True, increased demand from China and India will lead to large shortages in the North America and Europe.

C) False, the shortage will be limited to China and India.

D) False, increasing scarcity will result in higher prices and the deployment of new technologies that increase the efficiency of production, and together these markets forces will help to balance demand and supply worldwide.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

31

The classic resource study of Barnett and Morse found that

A) resource costs have been rising at such a rate that, within fifty years, the prices of most natural resources will be exorbitant.

B) the current proved reserves of most minerals are becoming perilously low.

C) resource prices declined between 1870 and 1920, but since 1920 the relative price of natural resources has been increasing at an annual rate of approximately 3.5 percent.

D) technology and developing substitutes outran our use of scarce natural resources during the last century, so that relative resource prices have declined.

A) resource costs have been rising at such a rate that, within fifty years, the prices of most natural resources will be exorbitant.

B) the current proved reserves of most minerals are becoming perilously low.

C) resource prices declined between 1870 and 1920, but since 1920 the relative price of natural resources has been increasing at an annual rate of approximately 3.5 percent.

D) technology and developing substitutes outran our use of scarce natural resources during the last century, so that relative resource prices have declined.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

32

Proved reserves of tin have declined since 2000, but the price of tin has fluctuated for the past six decades, with no obvious upward or downward trend. This indicates that

A) the world will run out of tin in a few years because the proved reserves have fallen.

B) short-term rises in demand and/or declines in the supply of tin have occurred over time, but there is no reason to worry about running out of this resource in the foreseeable future.

C) the demand for tin has been rising and the world will run out of tin in the future unless there is a reversal of this trend.

D) the market price of tin will rise as miners discover more tin.

A) the world will run out of tin in a few years because the proved reserves have fallen.

B) short-term rises in demand and/or declines in the supply of tin have occurred over time, but there is no reason to worry about running out of this resource in the foreseeable future.

C) the demand for tin has been rising and the world will run out of tin in the future unless there is a reversal of this trend.

D) the market price of tin will rise as miners discover more tin.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

33

Proved reserves of natural gas and oil

A) will last only another five years at the current worldwide consumption rate.

B) reveal little about whether the world is about to run out of these resources since they are calculated at present levels of price and technology.

C) are just another way of measuring how many years civilization will continue.

D) indicate that the supply of petroleum will be depleted by the year 2020 unless governments adopt price controls and energy rationing.

A) will last only another five years at the current worldwide consumption rate.

B) reveal little about whether the world is about to run out of these resources since they are calculated at present levels of price and technology.

C) are just another way of measuring how many years civilization will continue.

D) indicate that the supply of petroleum will be depleted by the year 2020 unless governments adopt price controls and energy rationing.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

34

Predictions that natural resources such as oil will be essentially used up in the next few decades

A) have been frequently made for the past century but have always proven to be false.

B) have usually been based on the quantity of proved reserves.

C) have ignored the role of price in governing the quantities demanded and supplied.

D) All of the above are correct.

A) have been frequently made for the past century but have always proven to be false.

B) have usually been based on the quantity of proved reserves.

C) have ignored the role of price in governing the quantities demanded and supplied.

D) All of the above are correct.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

35

Proved reserves of petroleum are

A) the verified quantity of petroleum that can be recovered at current prices and levels of technology.

B) the only reserves likely to be available in the future.

C) refined products awaiting shipment to the market.

D) the total amount of the resource in existence, regardless of the productive effort undertaken to expand the future availability of the resource.

A) the verified quantity of petroleum that can be recovered at current prices and levels of technology.

B) the only reserves likely to be available in the future.

C) refined products awaiting shipment to the market.

D) the total amount of the resource in existence, regardless of the productive effort undertaken to expand the future availability of the resource.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

36

Economic theory indicates that the economy is better off not to produce proved reserves of a mineral "too quickly." By this, the theory means that

A) people prefer some bad luck in exploration efforts, rather than too much good luck in finding the resources.

B) society does not want the resource to be too abundantly available since this would reduce its price and GDP.

C) other nations' resources should be used first, even if doing so is more costly.

D) using additional resources for exploration is a harmful decision if the present discounted value of the benefits is smaller than the cost.

A) people prefer some bad luck in exploration efforts, rather than too much good luck in finding the resources.

B) society does not want the resource to be too abundantly available since this would reduce its price and GDP.

C) other nations' resources should be used first, even if doing so is more costly.

D) using additional resources for exploration is a harmful decision if the present discounted value of the benefits is smaller than the cost.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

37

Empirical evidence suggests that the relative scarcity of most resources is

A) declining.

B) increasing slowly.

C) increasing rapidly.

D) largely unchanged over the past four decades.

A) declining.

B) increasing slowly.

C) increasing rapidly.

D) largely unchanged over the past four decades.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

38

Suppose that new demands greatly reduce the proved reserves of titanium to unexpectedly low levels, and it appears that the new demands will continue. If the market price is unregulated, we should expect that the price will

A) rise sharply, calling forth added exploration and more effective (and more costly) recovery methods, resulting in additional new supplies of titanium.

B) rise sharply, calling forth new ways for manufacturers to conserve titanium and to find substitutes for it.

C) over time, bring the quantity supplied of titanium into balance with the quantity demanded.

D) do all of the above.

A) rise sharply, calling forth added exploration and more effective (and more costly) recovery methods, resulting in additional new supplies of titanium.

B) rise sharply, calling forth new ways for manufacturers to conserve titanium and to find substitutes for it.

C) over time, bring the quantity supplied of titanium into balance with the quantity demanded.

D) do all of the above.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

39

Since 1979, the price of crude oil in real terms

A) has fluctuated but the overall trend has been downward.

B) rose during 1980-2000, but the price trend has been downward since 2000.

C) declined throughout most of the 1980s and 1990s, but in 2011 the price was once again higher than the level of 1980.

D) all of the above are true.

A) has fluctuated but the overall trend has been downward.

B) rose during 1980-2000, but the price trend has been downward since 2000.

C) declined throughout most of the 1980s and 1990s, but in 2011 the price was once again higher than the level of 1980.

D) all of the above are true.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

40

Fracking, a technique for breaking up (or fracturing) rock deep under the earth to release natural gas, has

A) increased the price of natural gas.

B) decreased the supply of natural gas.

C) contaminated natural gas so it is no longer a "clean" fuel.

D) decreased the price of natural gas.

A) increased the price of natural gas.

B) decreased the supply of natural gas.

C) contaminated natural gas so it is no longer a "clean" fuel.

D) decreased the price of natural gas.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

41

Researcher Indur Goklany has estimated that if traditional technologies, like those used in 1961, were still in use, other things equal, wildlife habitat

A) would be more abundant and far healthier today.

B) would have increased, benefiting wildlife substantially.

C) would have declined substantially, as the need for farmland would not have declined as it did.

D) would have been unaffected.

A) would be more abundant and far healthier today.

B) would have increased, benefiting wildlife substantially.

C) would have declined substantially, as the need for farmland would not have declined as it did.

D) would have been unaffected.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

42

When a highly valued resource cannot be easily traded, as is often true with water flowing in a river, then

A) it will not be hoarded by the rich, but will be available to all on an equal basis.

B) we can expect shortages from time to time, and conflicts over access to its use.

C) its price will be low as a result.

D) markets in the resource will clear more easily, without greed and profit to get in the way.

A) it will not be hoarded by the rich, but will be available to all on an equal basis.

B) we can expect shortages from time to time, and conflicts over access to its use.

C) its price will be low as a result.

D) markets in the resource will clear more easily, without greed and profit to get in the way.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

43

A private owner of a resource has a strong incentive to

A) conserve the resource for the future, particularly if it is expected to increase in value.

B) use the resource today even if its value is expected to increase substantially in the future.

C) use the resource in ways that impose harm on others.

D) ignore the wishes of others when deciding how to use the resource.

A) conserve the resource for the future, particularly if it is expected to increase in value.

B) use the resource today even if its value is expected to increase substantially in the future.

C) use the resource in ways that impose harm on others.

D) ignore the wishes of others when deciding how to use the resource.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

44

According to water resource economists

A) water is seldom in short supply anywhere in the world.

B) we are not running out of water, but specific places do run short of water, given the status of their water supply arrangements and ease (or lack of) transferability of water among users.

C) the world is running out of water, just as it is running out of accessible oil.

D) there is no workable way to make water markets function properly, because in the end, we can't make more water the way we can make more bread or automobiles.

A) water is seldom in short supply anywhere in the world.

B) we are not running out of water, but specific places do run short of water, given the status of their water supply arrangements and ease (or lack of) transferability of water among users.

C) the world is running out of water, just as it is running out of accessible oil.

D) there is no workable way to make water markets function properly, because in the end, we can't make more water the way we can make more bread or automobiles.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

45

Researcher Terry Anderson claims that with respect to the supply of water, trading it would be

A) wrong and counter-productive.

B) essentially impossible due to lack of technologies to move the water.

C) highly productive and bring cooperation among the traders.

D) a problem, since monopolists would come to own too much.

A) wrong and counter-productive.

B) essentially impossible due to lack of technologies to move the water.

C) highly productive and bring cooperation among the traders.

D) a problem, since monopolists would come to own too much.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

46

Natural gas prices in real terms have

A) increased sharply since 2008.

B) closely followed the pattern of oil prices since 2008.

C) risen dramatically during the past ten years.

D) fallen sharply since 2008.

A) increased sharply since 2008.

B) closely followed the pattern of oil prices since 2008.

C) risen dramatically during the past ten years.

D) fallen sharply since 2008.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

47

Water, when it is not tradeable among current and potential users, is often kept that way

A) by governments demanding tight control over who gets the water.

B) by nature, as water cannot be easily moved from place to place in large quantities.

C) to protect fish and other wildlife, rather than for any other reason.

D) by monopoly owners in the private sector.

A) by governments demanding tight control over who gets the water.

B) by nature, as water cannot be easily moved from place to place in large quantities.

C) to protect fish and other wildlife, rather than for any other reason.

D) by monopoly owners in the private sector.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

48

The overall trend in resource prices has been

A) upward.

B) downward.

C) constant.

D) increasing exponentially.

A) upward.

B) downward.

C) constant.

D) increasing exponentially.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

49

In the United States, water purchases from the government

A) always cover the costs of water delivery.

B) are often subsidized for the user of water.

C) are not subsidized, because that would be inefficient.

D) almost never occur.

A) always cover the costs of water delivery.

B) are often subsidized for the user of water.

C) are not subsidized, because that would be inefficient.

D) almost never occur.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

50

In the Central Utah Project, the water delivered from dams to users

A) is very well utilized, because planners allocated water to its highest valued uses and users.

B) cannot generally be traded, so is often wastefully used in low-valued uses.

C) is often sold to water-short cities by farmers who can then enjoy a profit from the sale.

D) is very expensive to the users who get it.

A) is very well utilized, because planners allocated water to its highest valued uses and users.

B) cannot generally be traded, so is often wastefully used in low-valued uses.

C) is often sold to water-short cities by farmers who can then enjoy a profit from the sale.

D) is very expensive to the users who get it.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

51

Non-renewable resources are those that

A) are not renewed by nature, but their supply can be easily expanded by humans.

B) are naturally renewed by nature; timber provides an example.

C) are not renewed by nature at a significant rate.

D) cannot be recycled, by their very nature.

A) are not renewed by nature, but their supply can be easily expanded by humans.

B) are naturally renewed by nature; timber provides an example.

C) are not renewed by nature at a significant rate.

D) cannot be recycled, by their very nature.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

52

When market trades in water occur, we can assume that

A) the party releasing water is the loser.

B) the party buying water is paying too much.

C) the trade in something as important as water is immoral.

D) the signals and incentives flowing from the trades help many in that water market, not just the buyer and seller directly.

A) the party releasing water is the loser.

B) the party buying water is paying too much.

C) the trade in something as important as water is immoral.

D) the signals and incentives flowing from the trades help many in that water market, not just the buyer and seller directly.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

53

Renewable resources are those that

A) can be renewed, but only with the use of energy resources.

B) are constantly being renewed by nature.

C) will inevitably run out over time, like all other resources.

D) are not really scarce, because they are constantly renewed naturally.

A) can be renewed, but only with the use of energy resources.

B) are constantly being renewed by nature.

C) will inevitably run out over time, like all other resources.

D) are not really scarce, because they are constantly renewed naturally.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

54

Water supply problems are widespread, indicating that

A) water markets can seldom work, because water Is a necessity.

B) property rights are frequently incomplete and not fully tradable.

C) water is too important to ration by price.

D) water markets are seldom controlled by government.

A) water markets can seldom work, because water Is a necessity.

B) property rights are frequently incomplete and not fully tradable.

C) water is too important to ration by price.

D) water markets are seldom controlled by government.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

55

When private ownership rights are clearly defined and well enforced, owners of resources

A) have no incentive to consider the desires of others or the potential future value of the resource.

B) have an incentive to develop and expand resources that are expected to be valuable in the future.

C) have an incentive to consume the resource as quickly as possible before others seize it.

D) have little incentive to take care of the resource or conserve it for the future.

A) have no incentive to consider the desires of others or the potential future value of the resource.

B) have an incentive to develop and expand resources that are expected to be valuable in the future.

C) have an incentive to consume the resource as quickly as possible before others seize it.

D) have little incentive to take care of the resource or conserve it for the future.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

56

How are the economic forces that apply to renewable resources different than those that apply to non-renewable resources?

A) Non-renewable resources must be protected by government policies to prevent depletion.

B) Non-renewable resources do not have any substitutes so the economic forces are different than those for renewable resources..

C) Both renewable and non-renewable resources may become scarcer over time so the economic forces at work are similar.

D) Renewable resources are not subject to the laws of economics since the scarcity condition no longer holds.

A) Non-renewable resources must be protected by government policies to prevent depletion.

B) Non-renewable resources do not have any substitutes so the economic forces are different than those for renewable resources..

C) Both renewable and non-renewable resources may become scarcer over time so the economic forces at work are similar.

D) Renewable resources are not subject to the laws of economics since the scarcity condition no longer holds.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

57

When water cannot be traded among current and potential users, then

A) each user will take more care to conserve, because added water cannot be obtained.

B) users have a strong incentive to conserve because they are now protected from price increases imposed by greedy entrepreneurs.

C) efficiency improves, as dry years can be better anticipated and planned for, and every user knows the quantity that will be available.

D) water will not flow to its highest valued uses, and some users will use water for relatively low-valued uses, because they cannot gain by selling it to others.

A) each user will take more care to conserve, because added water cannot be obtained.

B) users have a strong incentive to conserve because they are now protected from price increases imposed by greedy entrepreneurs.

C) efficiency improves, as dry years can be better anticipated and planned for, and every user knows the quantity that will be available.

D) water will not flow to its highest valued uses, and some users will use water for relatively low-valued uses, because they cannot gain by selling it to others.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

58

Forests in the United States, starting from the time the colonists arrived,

A) have always expanded.

B) have only shrunk in size.

C) have changed little.

D) shrank as they were logged and cleared for farms, then rebounded, especially in the twentieth century.

A) have always expanded.

B) have only shrunk in size.

C) have changed little.

D) shrank as they were logged and cleared for farms, then rebounded, especially in the twentieth century.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

59

The influence of agricultural technologies on farm land in the United States has been

A) very little up until now.

B) substantial, as greater productivity per acre reduced the need for farmland.

C) substantial; the productivity of much farm land has been destroyed by new technologies and may never be useful again.

D) to make farmland less productive over time as the minerals In the soil are used up.

A) very little up until now.

B) substantial, as greater productivity per acre reduced the need for farmland.

C) substantial; the productivity of much farm land has been destroyed by new technologies and may never be useful again.

D) to make farmland less productive over time as the minerals In the soil are used up.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

60

Water shortages are usually the result of

A) profit-seeking owners of the resource holding water off the market and refusing to trade.

B) bad forecasts by water planners.

C) monopoly fixing of water prices.

D) a lack of tradeable property rights in water.

A) profit-seeking owners of the resource holding water off the market and refusing to trade.

B) bad forecasts by water planners.

C) monopoly fixing of water prices.

D) a lack of tradeable property rights in water.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

61

The strategy underlying price discrimination is

A) to charge higher prices to customers who have good substitutes available to them and lower prices to customers without many substitutes available to them..

B) to charge everyone the same price but limit the quantity they are allowed to buy.

C) to increase total revenue by charging higher prices to those with the most inelastic demand for the product and lower prices to those with the most elastic demand.

D) to reduce per-unit cost by charging higher prices to those with the most inelastic demand and lower prices to those with the most elastic demand.

A) to charge higher prices to customers who have good substitutes available to them and lower prices to customers without many substitutes available to them..

B) to charge everyone the same price but limit the quantity they are allowed to buy.

C) to increase total revenue by charging higher prices to those with the most inelastic demand for the product and lower prices to those with the most elastic demand.

D) to reduce per-unit cost by charging higher prices to those with the most inelastic demand and lower prices to those with the most elastic demand.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

62

A profit-maximizing price searcher will expand output to the point where

A) total revenue equals total cost.

B) marginal revenue equals marginal cost.

C) price equals average total cost.

D) price equals marginal cost.

A) total revenue equals total cost.

B) marginal revenue equals marginal cost.

C) price equals average total cost.

D) price equals marginal cost.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

63

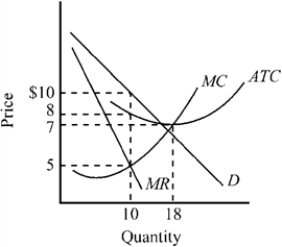

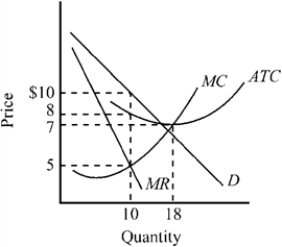

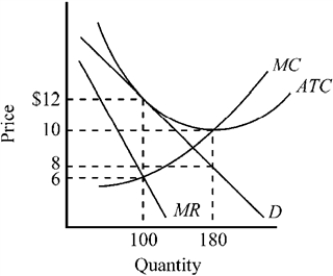

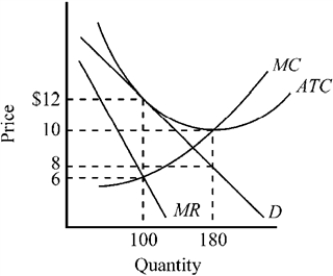

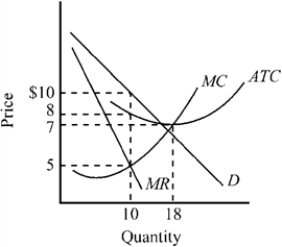

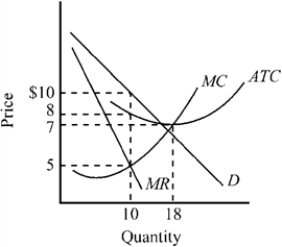

Use the figure to answer the following question(s).

Figure 10-2

What price should a competitive price-searcher firm with the cost and demand conditions depicted in Figure 10-2 charge if it wants to maximize its profit?

A) $5

B) $7

C) $8

D) $10

Figure 10-2

What price should a competitive price-searcher firm with the cost and demand conditions depicted in Figure 10-2 charge if it wants to maximize its profit?

A) $5

B) $7

C) $8

D) $10

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

64

Compared to the outcome when the firms are price takers, competitive price-searcher markets will result in

A) a wider variety of products and higher prices.

B) less product variety and higher prices.

C) a wider variety of products and lower prices.

D) less product variety and lower prices.

A) a wider variety of products and higher prices.

B) less product variety and higher prices.

C) a wider variety of products and lower prices.

D) less product variety and lower prices.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

65

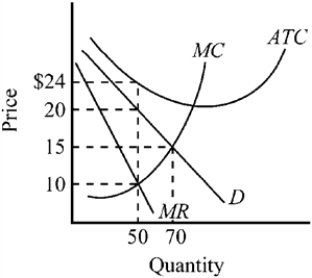

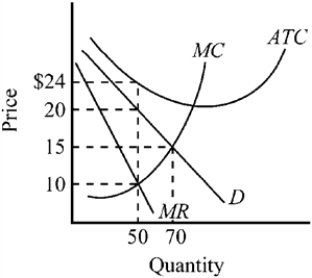

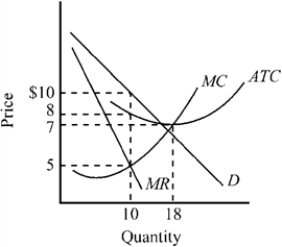

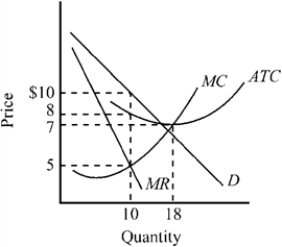

Use the figure to answer the following question(s).

Figure 10-4

What price should a competitive price-searcher firm with the cost and demand conditions depicted in Figure 10-4 charge if it wants to maximize its profit?

A) $10

B) $15

C) $20

D) $24

Figure 10-4

What price should a competitive price-searcher firm with the cost and demand conditions depicted in Figure 10-4 charge if it wants to maximize its profit?

A) $10

B) $15

C) $20

D) $24

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

66

In a competitive price-searcher market, the firms will

A) be able to choose their price, and the entry barriers into the market will be low.

B) be able to choose their price, and the entry barriers into the market will be high.

C) have to accept the market price for their product, and the entry barriers into the market will be low.

D) have to accept the market price for their product, and the entry barriers into the market will be high.

A) be able to choose their price, and the entry barriers into the market will be low.

B) be able to choose their price, and the entry barriers into the market will be high.

C) have to accept the market price for their product, and the entry barriers into the market will be low.

D) have to accept the market price for their product, and the entry barriers into the market will be high.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

67

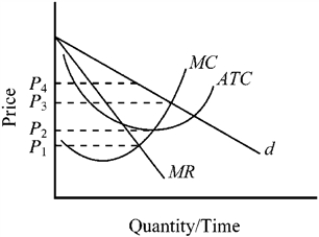

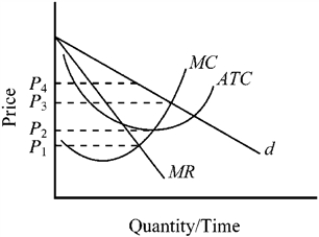

Figure 10-1

Given the cost and demand conditions in Figure 10-1, what price should this competitive price-searcher firm charge in order to maximize profits?

A) P1

B) P2

C) P3

D) P4

Given the cost and demand conditions in Figure 10-1, what price should this competitive price-searcher firm charge in order to maximize profits?

A) P1

B) P2

C) P3

D) P4

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

68

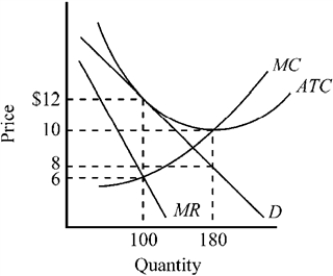

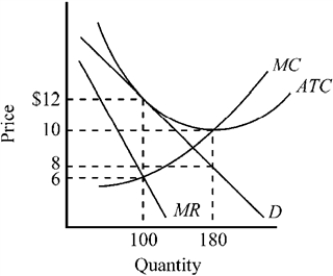

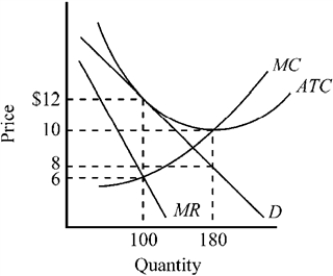

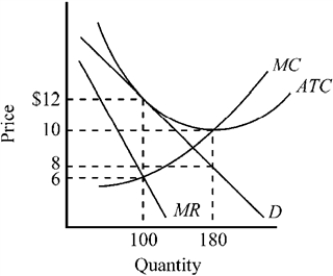

Use the figure to answer the following question(s).

Figure 10-3

If the cost and demand conditions of this competitive price-searcher firm depicted in Figure 10-3 are representative of the market, what will happen in the future?

A) Firms will go out of business, and the market price will rise.

B) The current market price will tend to persist into the future.

C) New firms will enter the market, and the market price will decline.

D) The firms in this industry probably will collude in order to increase their profitability.

Figure 10-3

If the cost and demand conditions of this competitive price-searcher firm depicted in Figure 10-3 are representative of the market, what will happen in the future?

A) Firms will go out of business, and the market price will rise.

B) The current market price will tend to persist into the future.

C) New firms will enter the market, and the market price will decline.

D) The firms in this industry probably will collude in order to increase their profitability.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

69

Use the figure to answer the following question(s).

Figure 10-3

What price should a competitive price searcher firm with the cost and demand conditions depicted in Figure 10-3 charge if it wants to maximize its profit?

A) $6

B) $8

C) $10

D) $12

Figure 10-3

What price should a competitive price searcher firm with the cost and demand conditions depicted in Figure 10-3 charge if it wants to maximize its profit?

A) $6

B) $8

C) $10

D) $12

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

70

Use the figure to answer the following question(s).

Figure 10-2

If the cost and demand conditions of this competitive price-searcher firm depicted in Figure 10-2 are representative of the market, what will happen in the future?

A) Firms will go out of business, and the market price will rise.

B) The current market price will tend to persist into the future.

C) New firms will enter the market, and demand facing this firm will decline.

D) The firms in this industry probably will collude in order to increase their profitability.

Figure 10-2

If the cost and demand conditions of this competitive price-searcher firm depicted in Figure 10-2 are representative of the market, what will happen in the future?

A) Firms will go out of business, and the market price will rise.

B) The current market price will tend to persist into the future.

C) New firms will enter the market, and demand facing this firm will decline.

D) The firms in this industry probably will collude in order to increase their profitability.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

71

If a market is in long-run equilibrium, which of the following conditions will be present in a competitive price-taker market but absent from a competitive price-searcher market?

A) P = ATC

B) MR = MC

C) P = MC

D) MR < P

A) P = ATC

B) MR = MC

C) P = MC

D) MR < P

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

72

Use the figure to answer the following question(s).

Figure 10-2

What is the maximum economic profit this firm depicted in Figure 10-2 will be able to earn?

A) zero

B) $20

C) $30

D) $100

Figure 10-2

What is the maximum economic profit this firm depicted in Figure 10-2 will be able to earn?

A) zero

B) $20

C) $30

D) $100

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

73

As long as a market is contestable, then even if it has only a few sellers, the

A) threat of new entrants will prevent the prices from rising above the competitive level.

B) producers will be able to charge prices that are high enough to produce long-run economic profits.

C) producers will not face new competition because the barriers to entry are high.

D) market will never be expected to come close to the competitive result.

A) threat of new entrants will prevent the prices from rising above the competitive level.

B) producers will be able to charge prices that are high enough to produce long-run economic profits.

C) producers will not face new competition because the barriers to entry are high.

D) market will never be expected to come close to the competitive result.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

74

When natural resources are not traded, or where markets are not allowed to function as well as they can under a system of well-defined property rights, the problems of ____ and ____ are common. (Fill in the blanks)

A) higher taxes; increased regulation

B) waste; scarcity

C) inflation; unemployment

D) slow growth; fluctuating currency values

A) higher taxes; increased regulation

B) waste; scarcity

C) inflation; unemployment

D) slow growth; fluctuating currency values

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

75

If firms in a competitive price-searcher market are currently earning economic losses, then in the long run,

A) new firms will enter the market, and the current firms will experience a decrease in demand for their products until zero economic profit is again restored.

B) new firms will enter the market, and the current firms will experience an increase in demand for their products until zero economic profit is again restored.

C) some existing firms will exit the market, and the remaining firms will experience an increase in demand for their products until zero economic profit is again restored.

D) some existing firms will exit the market, and the remaining firms will experience a decrease in demand for their products until zero economic profit is again restored.

A) new firms will enter the market, and the current firms will experience a decrease in demand for their products until zero economic profit is again restored.

B) new firms will enter the market, and the current firms will experience an increase in demand for their products until zero economic profit is again restored.

C) some existing firms will exit the market, and the remaining firms will experience an increase in demand for their products until zero economic profit is again restored.

D) some existing firms will exit the market, and the remaining firms will experience a decrease in demand for their products until zero economic profit is again restored.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

76

If a government wanted to increase the prosperity of a nation, it could best serve this goal by

A) protecting domestic industries from international trade, thus encouraging domestic growth.

B) regulating the way in which firms can operate.

C) reducing barriers that restrict the ability of potential competitors to enter markets.

D) subsidizing firms that are in danger of going out of business.

A) protecting domestic industries from international trade, thus encouraging domestic growth.

B) regulating the way in which firms can operate.

C) reducing barriers that restrict the ability of potential competitors to enter markets.

D) subsidizing firms that are in danger of going out of business.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

77

Use the figure to answer the following question(s).

Figure 10-3

What is the maximum economic profit this firm depicted in Figure 10-3 will be able to earn?

A) zero

B) $200

C) $400

D) $600

Figure 10-3

What is the maximum economic profit this firm depicted in Figure 10-3 will be able to earn?

A) zero

B) $200

C) $400

D) $600

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

78

Entrepreneurial judgment

A) is necessary to make business decisions when no fixed decision rule can be used.

B) is fully incorporated into modern economic models of business behavior.

C) requires decision makers to follow carefully defined rules regarding uncertainty, discovery, and business judgment.

D) requires government advice and regulation.

A) is necessary to make business decisions when no fixed decision rule can be used.

B) is fully incorporated into modern economic models of business behavior.

C) requires decision makers to follow carefully defined rules regarding uncertainty, discovery, and business judgment.

D) requires government advice and regulation.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

79

In the long run, neither competitive price takers nor competitive price searchers will be able to earn economic profits because

A) entry barriers into these markets are high, raising the costs of each firm.

B) the government will dictate moderate prices for these firms.

C) competition will force prices down to the level of per-unit production costs.

D) marginal revenue is always less than marginal cost when barriers to entry are low.

A) entry barriers into these markets are high, raising the costs of each firm.

B) the government will dictate moderate prices for these firms.

C) competition will force prices down to the level of per-unit production costs.

D) marginal revenue is always less than marginal cost when barriers to entry are low.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck

80

Why do water supply problems exist in many parts of the world?

A) Efforts to build large-scale reservoirs in arid countries have stalled due to the enormous expense involved in completing these projects.

B) Water markets are missing or incomplete.

C) Global warming has increased the evaporation rate of water by over 10%.

D) The water supply is unfit for public consumption in many areas due to pollution.

A) Efforts to build large-scale reservoirs in arid countries have stalled due to the enormous expense involved in completing these projects.

B) Water markets are missing or incomplete.

C) Global warming has increased the evaporation rate of water by over 10%.

D) The water supply is unfit for public consumption in many areas due to pollution.

Unlock Deck

Unlock for access to all 232 flashcards in this deck.

Unlock Deck

k this deck