Deck 3: Accrual Accounting Income

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

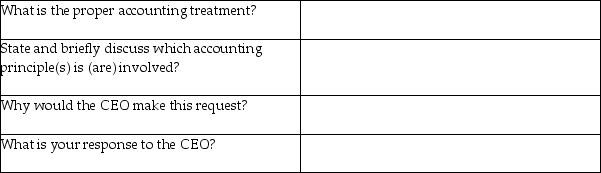

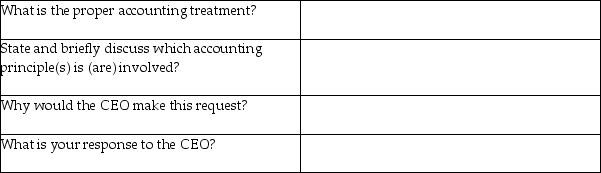

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/223

Play

Full screen (f)

Deck 3: Accrual Accounting Income

1

The basic defect of cash-basis accounting is that the cash basis ignores important information.

True

2

The only way for a business to know for certain how well it performed is to shut down, sell the assets, pay the liabilities, and return any leftover cash to the owners.

True

3

Under cash-basis accounting, income statements and balance sheets may be misstated.

True

4

When cash-basis accounting is used, and services are provided on account:

A)only the income statement will be incorrect.

B)only the balance sheet will be incorrect.

C)both the income statement and the balance sheet will be incorrect.

D)either the income statement or the balance sheet will be incorrect.

A)only the income statement will be incorrect.

B)only the balance sheet will be incorrect.

C)both the income statement and the balance sheet will be incorrect.

D)either the income statement or the balance sheet will be incorrect.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following transactions would be recorded under accrual accounting but NOT under cash-basis accounting?

A)collecting cash from customers

B)borrowing money from the bank

C)purchasing of inventory on account

D)issuing stock for cash

A)collecting cash from customers

B)borrowing money from the bank

C)purchasing of inventory on account

D)issuing stock for cash

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

6

Under cash-basis accounting, no journal entry is recorded when a sale is made on account.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

7

Under accrual-basis accounting, if a company fails to record a sale on account:

A)revenue will be understated.

B)assets will be understated.

C)net income will still be correct.

D)A and B.

A)revenue will be understated.

B)assets will be understated.

C)net income will still be correct.

D)A and B.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

8

Generally Accepted Accounting Principles (GAAP)require the use of accrual accounting.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

9

Under cash-basis accounting, stockholders' equity is increased when company makes a sale, not when the company collects the cash at a later date.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

10

The journal entry to record a cash sale will be the same under the accrual and cash-basis of accounting.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

11

The time-period concept ensures that the accounting information follows the framework of concepts and principles.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

12

A doctor performed surgery in April and did not receive cash payment from the patient until August. Under cash-basis accounting, the doctor recognizes revenue:

A)in April.

B)in August.

C)in April or August.

D)at a time that cannot be determined from the facts.

A)in April.

B)in August.

C)in April or August.

D)at a time that cannot be determined from the facts.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

13

Cash-basis accounting is a more faithful representation of economic reality than accrual accounting.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is a CORRECT statement about the two bases of accounting?

A)Cash-basis accounting records revenues when they are earned.

B)Cash-basis accounting records expenses only at the end of the month.

C)GAAP requires accrual accounting.

D)Only the largest companies in the United States use accrual accounting.

A)Cash-basis accounting records revenues when they are earned.

B)Cash-basis accounting records expenses only at the end of the month.

C)GAAP requires accrual accounting.

D)Only the largest companies in the United States use accrual accounting.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

15

The ________ basis of accounting records revenues ONLY when cash is received.

A)deferral

B)cash

C)accrual

D)hybrid

A)deferral

B)cash

C)accrual

D)hybrid

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

16

Under accrual accounting, revenue is recorded:

A)when the cash is received, regardless of when the services are performed.

B)when the services are performed, regardless of when the cash is received.

C)at the end of every month.

D)only if the cash is received at the same time the services are performed.

A)when the cash is received, regardless of when the services are performed.

B)when the services are performed, regardless of when the cash is received.

C)at the end of every month.

D)only if the cash is received at the same time the services are performed.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

17

Accrual accounting records the impact of both cash and noncash business transactions as they occur.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

18

An expense occurred in 2016, and it is not paid until 2017. Using cash-basis accounting, the expense should appear on:

A)the 2016 income statement.

B)the 2017 income statement.

C)whichever income statement the business prefers.

D)both the 2016 and 2017 income statements.

A)the 2016 income statement.

B)the 2017 income statement.

C)whichever income statement the business prefers.

D)both the 2016 and 2017 income statements.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

19

An expense occurred in 2016, but it is not paid until 2017. Using accrual accounting, the expense should appear on:

A)the 2016 income statement.

B)the 2017 income statement.

C)whichever income statement the business prefers.

D)both the 2016 and 2017 income statements.

A)the 2016 income statement.

B)the 2017 income statement.

C)whichever income statement the business prefers.

D)both the 2016 and 2017 income statements.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

20

A doctor performed surgery in March and did not receive cash from the patient until July. Under accrual accounting, the doctor recognizes revenue:

A)in March.

B)in July.

C)in either March or July.

D)at a time that cannot be determined from the facts.

A)in March.

B)in July.

C)in either March or July.

D)at a time that cannot be determined from the facts.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

21

The expense recognition principle states that expenses have future benefit to the company.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

22

An interim period used for reporting purposes is generally:

A)more than one year, but less than the life of the company.

B)more than one year.

C)less than one year.

D)the same as the fiscal year.

A)more than one year, but less than the life of the company.

B)more than one year.

C)less than one year.

D)the same as the fiscal year.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

23

Cash-basis accounting does NOT record:

A)receipt of cash from interest earned on note receivable.

B)payment of salaries to employees.

C)expiration of prepaid rent.

D)borrowing money from the local bank.

A)receipt of cash from interest earned on note receivable.

B)payment of salaries to employees.

C)expiration of prepaid rent.

D)borrowing money from the local bank.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

24

Expenses have a future benefit to the company.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

25

Wilde Company earned revenues of $150,000 in cash and $210,000 on account during 2016. Of the $210,000 on account, $61,000 was collected in cash in 2016 and the rest in 2017. The company incurred expenses of $135,000 in 2016 and made payments of $70,000 towards the expenses in 2016. What is net income in 2016 under cash-basis accounting?

A)$140,000

B)$80,000

C)$141,000

D)$225,000

A)$140,000

B)$80,000

C)$141,000

D)$225,000

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

26

The expense recognition principle recognizes expenses in the period they are paid.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

27

Since accrual accounting follows the revenue principle and the expense recognition principle, all ethical challenges are avoided.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

28

The revenue principle determines when to record revenue and the amount of revenue to record.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

29

The revenue principle states that revenue should be recorded in the same period as the cash is received.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

30

The amount of revenue to record is the amount of cash or its equivalent that is transferred from the customer to the seller.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

31

Winter Company earned revenues of $170,000 in cash and $230,000 on account during 2016. Of the $230,000 on account, $66,000 was collected in cash in 2016 and the rest in 2017. The company incurred expenses of $105,000 in 2016 and made payments of $80,000 towards the expenses in 2016. What is net income in 2016 under accrual accounting?

A)$125,000

B)$295,000

C)$320,000

D)$400,000

A)$125,000

B)$295,000

C)$320,000

D)$400,000

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

32

Cash-basis accounting does NOT record:

A)purchase of supplies with cash.

B)sale of common stock.

C)payment of note payable.

D)depreciation expense.

A)purchase of supplies with cash.

B)sale of common stock.

C)payment of note payable.

D)depreciation expense.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

33

Under cash-basis accounting, cash receipts are treated as ________ and cash payments are treated as ________.

A)retained earnings; dividends

B)retained earnings; income

C)revenues; expenses

D)gains; losses

A)retained earnings; dividends

B)retained earnings; income

C)revenues; expenses

D)gains; losses

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

34

Under international financial reporting standards (IFRS), the retail industry recognizes revenue when the cash is received.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

35

Accrual accounting records all of the following transactions EXCEPT:

A)earning of unearned revenue received in advance.

B)expiration of prepaid insurance.

C)accrual of expenses incurred but not paid.

D)receipt of Award for Service to the Community of Naperville, Illinois.

A)earning of unearned revenue received in advance.

B)expiration of prepaid insurance.

C)accrual of expenses incurred but not paid.

D)receipt of Award for Service to the Community of Naperville, Illinois.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

36

Expenses are the costs of assets used up and liabilities created in earning revenue.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements regarding the time-period concept is NOT correct?

A)Interim financial reports are rarely prepared.

B)Accountants prepare financial statements for specific periods of time.

C)The basic accounting period is one year.

D)Most large companies use a calendar year for financial reporting.

A)Interim financial reports are rarely prepared.

B)Accountants prepare financial statements for specific periods of time.

C)The basic accounting period is one year.

D)Most large companies use a calendar year for financial reporting.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

38

The requirement to report accounting information at regular intervals is known as the:

A)interim reporting concept.

B)revenue principle.

C)time-period concept.

D)expense recognition principle.

A)interim reporting concept.

B)revenue principle.

C)time-period concept.

D)expense recognition principle.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

39

On December 15, 2017, a company receives an order from a customer for services to be performed on December 28, 2017. Due to a backlog of orders, the company does not perform the services until January 3, 2018. The customer pays for the services on January 6, 2018. The revenue principle requires the revenue to be recorded by the company on:

A)December 15, 2017.

B)January 3, 2018.

C)December 28, 2017.

D)January 6, 2018.

A)December 15, 2017.

B)January 3, 2018.

C)December 28, 2017.

D)January 6, 2018.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

40

On July 25, Henry Company's accountant prepared a check for the August rent payment. Henry Company mailed the check on July 27 to the landlord. The landlord received the check on July 31 and cashed it on August 2. When should Henry Company record the rent expense associated with this transaction? Henry Company uses accrual accounting.

A)July 25

B)July 27

C)August 31

D)August 2

A)July 25

B)July 27

C)August 31

D)August 2

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

41

Prepaid Rent and Unearned Service Revenue are examples of accounts that do not need to be adjusted at the end of the accounting period.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

42

The Financial Accounting Standards Board(FASB)and the International Accounting Standards Board (IASB)are working together to develop similar standards. Which of the following statements is FALSE?

A)The FASB and IASB have recently issued a joint new standard that provides a globally consistent, converged, and simplified way to recognize revenue.

B)In the retail merchandising industry, the joint new revenue recognition standard has not substantially changed the rules by which revenue is recognized.

C)In the retail merchandising industry, FASB and IASB have historically used different rules for revenue recognition.

D)The joint new revenue recognition standard is based on the idea that all business transactions involve contracts that exchange goods or services for cash or claims to receive cash.

A)The FASB and IASB have recently issued a joint new standard that provides a globally consistent, converged, and simplified way to recognize revenue.

B)In the retail merchandising industry, the joint new revenue recognition standard has not substantially changed the rules by which revenue is recognized.

C)In the retail merchandising industry, FASB and IASB have historically used different rules for revenue recognition.

D)The joint new revenue recognition standard is based on the idea that all business transactions involve contracts that exchange goods or services for cash or claims to receive cash.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

43

In an unadjusted trial balance, the accounts are not yet ready for the preparation of the company's financial statements.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1, 2017, a customer places an order for a new customized vehicle. The contract price is $45,000. The vehicle is delivered to the dealer and customer on April 1, 2017. What amount of revenue does the dealer record on January 1, 2017 and April 1, 2017?

A)$45,000; $0

B)$22,500; $22,500

C)$15,000; $15,000

D)$0; $45,000

A)$45,000; $0

B)$22,500; $22,500

C)$15,000; $15,000

D)$0; $45,000

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

45

On November 1, 2016, a company using accrual accounting, pays $720,000 for a television advertising campaign. Commercials will run evenly over six months beginning on November 1, 2016. How much Advertising Expense will be reported on an income statement prepared for the year ended December 31, 2017?

A)$240,000

B)$360,000

C)$480,000

D)$720,000

A)$240,000

B)$360,000

C)$480,000

D)$720,000

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

46

An accrual is an adjustment for the receipt of cash in advance of providing services.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

47

To obtain a new customer, a business sells merchandise to the customer for $100. Normally, the merchandise sells for $200. For this sale, the business should record revenue of:

A)$100.

B)$200.

C)either amount.

D)an average of the two amounts.

A)$100.

B)$200.

C)either amount.

D)an average of the two amounts.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

48

Depreciation allocates the cost of land to expense over the useful life of the land.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

49

Under accrual accounting, the event that triggers revenue recognition for the sale of goods is the:

A)date a contract is signed.

B)date the customer pays for the goods.

C)date the customer orders the goods.

D)delivery of goods to customer.

A)date a contract is signed.

B)date the customer pays for the goods.

C)date the customer orders the goods.

D)delivery of goods to customer.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

50

Define the following terms:

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

51

The expense recognition principle requires the recognition of expenses:

A)in the same period in which the related revenues are earned.

B)in the period they are paid.

C)in the period assets are created.

D)in the period in which future benefit for the company occurs.

A)in the same period in which the related revenues are earned.

B)in the period they are paid.

C)in the period assets are created.

D)in the period in which future benefit for the company occurs.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

52

Following the expense recognition principle, to recognize expenses along with the related revenues, means to:

A)add expenses and revenues together to compute net income or net loss.

B)recognize the expense of a period against the cash revenues during the period.

C)abandon the matching principle.

D)subtract expenses from the related revenues to compute net income or net loss.

A)add expenses and revenues together to compute net income or net loss.

B)recognize the expense of a period against the cash revenues during the period.

C)abandon the matching principle.

D)subtract expenses from the related revenues to compute net income or net loss.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

53

A CPA prepares tax returns for clients and bills them after the work is completed. It usually takes two weeks of work to prepare the tax returns. It takes 30 days on average to receive payment from the clients. The CPA uses cash-basis accounting. The revenue should be recorded when the CPA:

A)starts working on the tax returns.

B)completes working on the tax returns.

C)bills the clients.

D)receives payments from the clients.

A)starts working on the tax returns.

B)completes working on the tax returns.

C)bills the clients.

D)receives payments from the clients.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following is a TRUE statement regarding expenses?

A)Expenses represent future benefit to the company.

B)The expense recognition principle recognizes revenue in the same period in which the related revenues are earned.

C)Expenses will never result in the creation of a liability account.

D)The critical event for recording salary expense is the payment of cash.

A)Expenses represent future benefit to the company.

B)The expense recognition principle recognizes revenue in the same period in which the related revenues are earned.

C)Expenses will never result in the creation of a liability account.

D)The critical event for recording salary expense is the payment of cash.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

55

On June 1, 2017, Starbucks paid the rent of $114,000 for 40 of its stores in Washington and California. The rent covers the period, June 1, 2017 through November 30, 2017. On June 1, Starbucks will record ________. On June 30, Starbucks will record ________.

A)Rent Expense of $114,000; nothing

B)nothing; Rent Expense of $114,000

C)nothing; Rent Expense of $19,000

D)Prepaid Rent of $114,000; Rent Expense of $19,000

A)Rent Expense of $114,000; nothing

B)nothing; Rent Expense of $114,000

C)nothing; Rent Expense of $19,000

D)Prepaid Rent of $114,000; Rent Expense of $19,000

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

56

The revenue principle deals with the following:

A)when to record revenue and where to record this revenue.

B)where to record revenue and the amount of revenue to record.

C)when to record revenue and the amount of revenue to record.

D)when to record revenue and when to record related expenses.

A)when to record revenue and where to record this revenue.

B)where to record revenue and the amount of revenue to record.

C)when to record revenue and the amount of revenue to record.

D)when to record revenue and when to record related expenses.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

57

The revenue principle requires that a business record revenue when the business:

A)receives an order from a customer.

B)prepares the invoice for the customer.

C)delivers goods to or performs services for a customer.

D)receives payment from a customer.

A)receives an order from a customer.

B)prepares the invoice for the customer.

C)delivers goods to or performs services for a customer.

D)receives payment from a customer.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

58

Some accounts do not need to be adjusted at the end of the period, since the day-to-day transactions provide all the data for these accounts.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

59

Fiscal year 2016 (April 1, 2016 - March 31, 2017)has been great for Murphy Incorporated. Net income is higher than expected. Management believes that fiscal year 2017 will not be as profitable. On December 31, 2106, Murphy signed a one year contract for monthly advertising for $2,400,000. The advertising began on January 1, 2017. The CEO has asked the accountant to expense the $2,400,000 during fiscal year 2016.

You are the accountant. Comment on each of the following:

You are the accountant. Comment on each of the following:

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

60

According to the joint new standard for revenue recognition, issued by FASB and IASB, which item below is NOT necessary?

A)Identify the contract with the customer.

B)Identify the separate performance obligations in the contract.

C)Allocate the transaction price to the separate performance obligations in the contract.

D)Recognize expenses as the entity satisfies the performance obligations.

A)Identify the contract with the customer.

B)Identify the separate performance obligations in the contract.

C)Allocate the transaction price to the separate performance obligations in the contract.

D)Recognize expenses as the entity satisfies the performance obligations.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

61

One company's prepaid expense is another company's unearned revenue.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

62

Unearned Service Revenue is a revenue account.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

63

Prepaid expenses will become ________ when their future benefits expire.

A)expenses

B)revenues

C)liabilities

D)assets

A)expenses

B)revenues

C)liabilities

D)assets

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

64

The accumulated depreciation account decreases over the life of the asset.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

65

________ will be increased when a company receives cash before performing the services.

A)Service Revenue

B)Accumulated Depreciation

C)Unearned Service Revenue

D)Accrued Salaries Payable

A)Service Revenue

B)Accumulated Depreciation

C)Unearned Service Revenue

D)Accrued Salaries Payable

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

66

Income tax expense and the related income tax payable are typically accrued as the final adjusting entry of the period.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

67

The adjusted trial balance lists only the balance sheet accounts and their final balances in a single place.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

68

With an accrual of revenue:

A)the cash is received after the revenue is recorded.

B)the cash is paid before the expense is recorded.

C)plant assets can create an accrual adjustment.

D)prepaid expenses can create an accrual adjustment.

A)the cash is received after the revenue is recorded.

B)the cash is paid before the expense is recorded.

C)plant assets can create an accrual adjustment.

D)prepaid expenses can create an accrual adjustment.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

69

________ is the allocation of the cost of an asset over the asset's useful life.

A)Accrual

B)Deferral

C)Depreciation

D)Expiration

A)Accrual

B)Deferral

C)Depreciation

D)Expiration

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

70

The amount of prepaid insurance that is used up during a period of time is recorded as Insurance Expense.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

71

The following accounts are up-to-date and need no adjustment at the end of the period:

A)Cash, Common Stock and Prepaid Rent.

B)Prepaid Rent, Supplies and Unearned Rent Revenue.

C)Cash, Land and Common Stock.

D)Cash, Dividends and Unearned Rent Revenue.

A)Cash, Common Stock and Prepaid Rent.

B)Prepaid Rent, Supplies and Unearned Rent Revenue.

C)Cash, Land and Common Stock.

D)Cash, Dividends and Unearned Rent Revenue.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

72

Every adjusting entry must affect both the income statement and the balance sheet.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

73

An accrual adjustment is made for payment of an item in advance of use.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

74

If deferred revenue has been earned by the end of the current period but no adjustment is recorded, net income for the current period will be understated.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

75

Which account is credited in the adjusting entry to allocate the cost of equipment?

A)Equipment Expense

B)Depreciation Expense, Equipment

C)Accumulated Equipment

D)Accumulated Depreciation, Equipment

A)Equipment Expense

B)Depreciation Expense, Equipment

C)Accumulated Equipment

D)Accumulated Depreciation, Equipment

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

76

Adjusting entries:

A)close the revenue accounts.

B)close the expense accounts.

C)adjust Cash.

D)adjust Unearned Revenue.

A)close the revenue accounts.

B)close the expense accounts.

C)adjust Cash.

D)adjust Unearned Revenue.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

77

The adjusting entry, to recognize salaries that are owed to employees, increases net income and increases liabilities.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

78

Adjusting entries:

A)are needed for all balance sheet accounts.

B)must be made on a daily basis to record supplies used during that day.

C)are needed because errors have been made in previous journal entries.

D)are made before the financial statements can be prepared.

A)are needed for all balance sheet accounts.

B)must be made on a daily basis to record supplies used during that day.

C)are needed because errors have been made in previous journal entries.

D)are made before the financial statements can be prepared.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

79

When an adjustment is made for prepaid rent:

A)an asset increases and an expense decreases.

B)one asset increases and another decreases.

C)an asset decreases and an expense increases.

D)a liability decreases and an expense decreases.

A)an asset increases and an expense decreases.

B)one asset increases and another decreases.

C)an asset decreases and an expense increases.

D)a liability decreases and an expense decreases.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck

80

The book value of a plant asset is the:

A)accumulated depreciation less the cost of the asset.

B)cost of the asset.

C)balance in the accumulated depreciation account.

D)cost of the asset less the accumulated depreciation.

A)accumulated depreciation less the cost of the asset.

B)cost of the asset.

C)balance in the accumulated depreciation account.

D)cost of the asset less the accumulated depreciation.

Unlock Deck

Unlock for access to all 223 flashcards in this deck.

Unlock Deck

k this deck