Deck 7: Income From Property

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/9

Play

Full screen (f)

Deck 7: Income From Property

1

Stella Flier has received an inheritance of $100,000. She is trying to decide what

to do with this money and has come to you for some advice. She has an excellent credit rating and no outstanding debts. She would like to buy a $225,000 house and invest $100,000 in bonds as a safety net.

Required:

How could Stella minimize her tax liability, assuming only the facts given?

to do with this money and has come to you for some advice. She has an excellent credit rating and no outstanding debts. She would like to buy a $225,000 house and invest $100,000 in bonds as a safety net.

Required:

How could Stella minimize her tax liability, assuming only the facts given?

Stella could use the $100,000 for a down payment on her house and

borrow $125,000 for the remainder. She could then borrow $100,000 to purchase the bonds. The interest on the investment loan would be

deductible against any income earned on the bonds. If Stella were to borrow the full amount required for her house while buying the bonds

with her inheritance, she would not have any allowable deductions for tax purposes.

borrow $125,000 for the remainder. She could then borrow $100,000 to purchase the bonds. The interest on the investment loan would be

deductible against any income earned on the bonds. If Stella were to borrow the full amount required for her house while buying the bonds

with her inheritance, she would not have any allowable deductions for tax purposes.

2

Pear Corporation earned $150,000 of pre-tax income. The tax rate for the company is 14,5%. The sole shareholder received all of the net earnings in the form of a non-eligible dividend. The shareholder's personal tax rate is 50%. The shareholder is

Entitled to a total (federal + provincial) dividend tax credit equal to $21,630. What is the net personal tax owing on the dividend by the shareholder? (Round all numbers to zero decimal places.)

A) $21,630

B) $53,396

C) $21,750

D) $42,495

Entitled to a total (federal + provincial) dividend tax credit equal to $21,630. What is the net personal tax owing on the dividend by the shareholder? (Round all numbers to zero decimal places.)

A) $21,630

B) $53,396

C) $21,750

D) $42,495

B

3

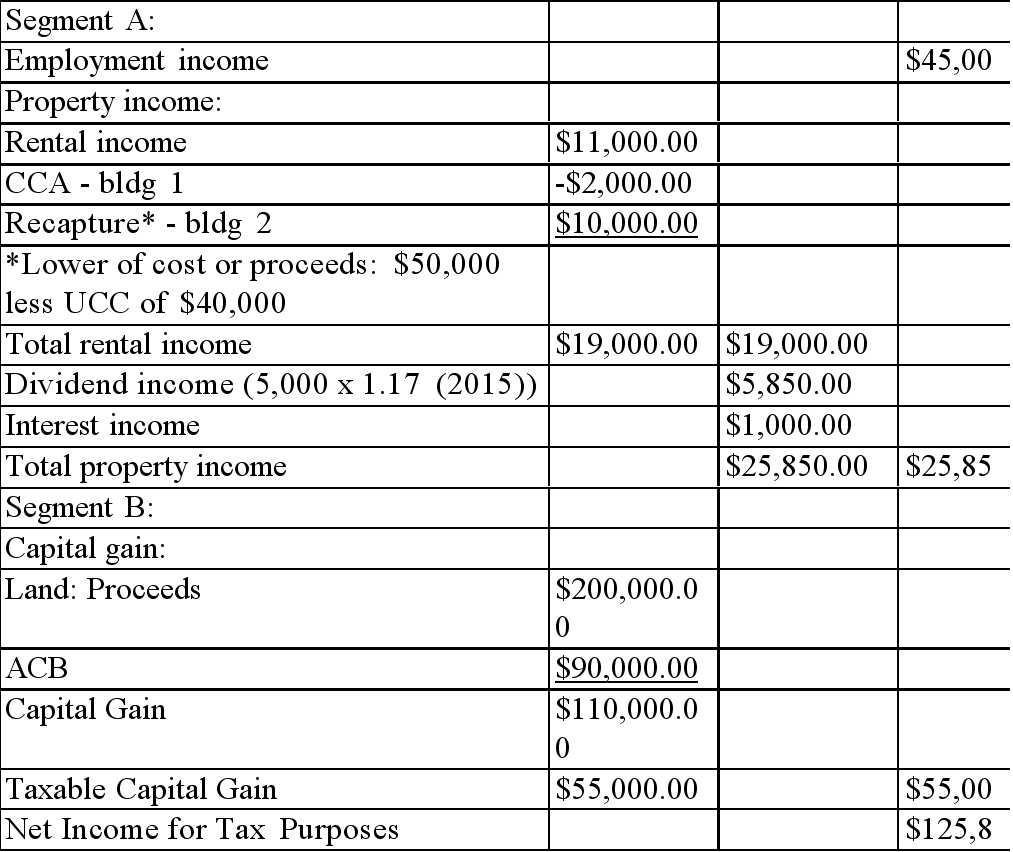

Martha Shine owned the following in 20X4:

-Rental properties originally valued at $275,000 (Property 1: land $70,000, building $55,000) (Property 2: land $90,000, building $60,000)

-Net rental income before CCA was $11,000.

-The UCC on building 1, as of January 1, 20X4 was $50,000.

-The UCC on building 2, as of January 1, 20X4 was $40,000.

-Property 2 was sold in 20X4 for $250,000 (land $200,000, building $50,000)

-Shares in ABC Inc. (a CCPC) valued at $50,000

-Non-eligible dividends paid to Martha in 20X4 totaled $5,000.

-Savings of $30,000

-Interest earned in 20X4 was $1,000.

Martha also worked full-time as a baker in 20X4, earning a gross salary of

$45,000.

Martha is in a 45% tax bracket. Required:

Using the Aggregate Formula, calculate Martha's net income for tax purposes in 20X4. Assume that Martha will take the maximum CCA allowed this year on her rental properties.

-Rental properties originally valued at $275,000 (Property 1: land $70,000, building $55,000) (Property 2: land $90,000, building $60,000)

-Net rental income before CCA was $11,000.

-The UCC on building 1, as of January 1, 20X4 was $50,000.

-The UCC on building 2, as of January 1, 20X4 was $40,000.

-Property 2 was sold in 20X4 for $250,000 (land $200,000, building $50,000)

-Shares in ABC Inc. (a CCPC) valued at $50,000

-Non-eligible dividends paid to Martha in 20X4 totaled $5,000.

-Savings of $30,000

-Interest earned in 20X4 was $1,000.

Martha also worked full-time as a baker in 20X4, earning a gross salary of

$45,000.

Martha is in a 45% tax bracket. Required:

Using the Aggregate Formula, calculate Martha's net income for tax purposes in 20X4. Assume that Martha will take the maximum CCA allowed this year on her rental properties.

4

A public corporation earns $500,000 in pre-tax profits and pays out all of its after-tax earnings in dividends. The corporate tax rate is 27.5% and the

shareholders are all in a 50% tax bracket. The dividend gross-up rate is 1.38 and the total dividend tax credit (federal and provincial) is 27.5%.

Required:

A) Calculate the total amount of federal tax paid by the corporation.

B) Calculate the total net federal tax paid by the shareholders on the dividends.

C) Briefly explain how this tax structure illustrates the theory of integration.

shareholders are all in a 50% tax bracket. The dividend gross-up rate is 1.38 and the total dividend tax credit (federal and provincial) is 27.5%.

Required:

A) Calculate the total amount of federal tax paid by the corporation.

B) Calculate the total net federal tax paid by the shareholders on the dividends.

C) Briefly explain how this tax structure illustrates the theory of integration.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

5

On March 1, 20X1, Notes Inc. purchased a two-year guaranteed investment

certificate (GIC) for $15,000. The interest compounds annually at 8% and will be received at the end of the full term. Notes Inc. has a marginal tax rate of 30%,

which will increase to 34% in 20X2. Notes Inc. uses the calendar year as its fisca year.

Angela Major also invested $15,000 in a GIC with an 8% annual return, on

March 1, 20X1. Angela's marginal tax rate in 20X1 is 40%, which is expected to rise to 45% in 20X3.

(Assume there are no leap years in this time period.) Required:

Calculate the after-tax interest income for each year for Notes Inc. and for Angela. (Round all numbers.)

certificate (GIC) for $15,000. The interest compounds annually at 8% and will be received at the end of the full term. Notes Inc. has a marginal tax rate of 30%,

which will increase to 34% in 20X2. Notes Inc. uses the calendar year as its fisca year.

Angela Major also invested $15,000 in a GIC with an 8% annual return, on

March 1, 20X1. Angela's marginal tax rate in 20X1 is 40%, which is expected to rise to 45% in 20X3.

(Assume there are no leap years in this time period.) Required:

Calculate the after-tax interest income for each year for Notes Inc. and for Angela. (Round all numbers.)

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

6

Amanda received a $300,000 inheritance on May 1st, 20X2. With the proceeds, she purchased the following investments:

1) Two rental properties: Property A has a value of $85,000, of which $40,000 is allocated to the building. Property B has a value of $110,000, of which $60,000 is allocated to the building. The properties earned a total of $9,750 in rental

income before CCA. Both buildings are Class 1 - 4% assets, and the maximum allowable CCA will be claimed each year. The capital growth of the two

buildings combined is expected to be 5%.

2) A bond: Valued at $50,000 with 10% annual interest paid at maturity

3) Portfolio shares: Worth $10,000 - Eligible dividends in the amount of $700

were paid to Amanda before the end of the year. The capital growth of the shares is expected to be 3%.

4) The remainder of the money was applied to her $150,000 mortgage.

Amanda is in a personal marginal tax bracket of 45%. Her marginal tax rate for dividends is 21% and her marginal tax rate for capital gains is 23%.

Required:

A) Calculate Amanda's minimum property income for 20X2.

B) Calculate the annual pre-tax yield (as a percentage) for each of the three investments.

C) Calculate the after-tax yield (as a percentage) for each of the three investments.

D) Briefly explain the tax benefit that Amanda could have realized had she used her inheritance to pay off her mortgage and then borrowed funds to make the

above investments.

1) Two rental properties: Property A has a value of $85,000, of which $40,000 is allocated to the building. Property B has a value of $110,000, of which $60,000 is allocated to the building. The properties earned a total of $9,750 in rental

income before CCA. Both buildings are Class 1 - 4% assets, and the maximum allowable CCA will be claimed each year. The capital growth of the two

buildings combined is expected to be 5%.

2) A bond: Valued at $50,000 with 10% annual interest paid at maturity

3) Portfolio shares: Worth $10,000 - Eligible dividends in the amount of $700

were paid to Amanda before the end of the year. The capital growth of the shares is expected to be 3%.

4) The remainder of the money was applied to her $150,000 mortgage.

Amanda is in a personal marginal tax bracket of 45%. Her marginal tax rate for dividends is 21% and her marginal tax rate for capital gains is 23%.

Required:

A) Calculate Amanda's minimum property income for 20X2.

B) Calculate the annual pre-tax yield (as a percentage) for each of the three investments.

C) Calculate the after-tax yield (as a percentage) for each of the three investments.

D) Briefly explain the tax benefit that Amanda could have realized had she used her inheritance to pay off her mortgage and then borrowed funds to make the

above investments.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is true concerning dividends?

A) Dividends received from a CCPC's business income that is subject to the small business deduction are typically grossed-up to include 138% of the dividend.

B) Eligible dividends require a 117% gross-up.

C) Dividends received from a CCPC's business income that is not subject to the small business deduction are typically grossed-up to include 117% of the dividend.

D) The scheme to eliminate double taxation assumes that the corporate tax rate is 27.5% when dividends are grossed-up to include 138% of the dividend.

A) Dividends received from a CCPC's business income that is subject to the small business deduction are typically grossed-up to include 138% of the dividend.

B) Eligible dividends require a 117% gross-up.

C) Dividends received from a CCPC's business income that is not subject to the small business deduction are typically grossed-up to include 117% of the dividend.

D) The scheme to eliminate double taxation assumes that the corporate tax rate is 27.5% when dividends are grossed-up to include 138% of the dividend.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

8

Joanne owns a rental property, which she purchased for $150,000 in 20X0 (land $50,000 and building $100,000). In the same year, her rental income before CCA was

$8,000. In 20X1 the rental income before CCA was $3000. Joanne has chosen to expense the CCA on her rental property. Which of the following statements is true? (The rental property is a Class 1, 4% asset.)

A) Joanne has a rental loss in 20X1 of $920.

B) Joanne has a rental loss in 20X1 of $840.

C) Joanne's rental income in 20X0 was $4,000.

D) Joanne's rental income in 20X1 is $0.

$8,000. In 20X1 the rental income before CCA was $3000. Joanne has chosen to expense the CCA on her rental property. Which of the following statements is true? (The rental property is a Class 1, 4% asset.)

A) Joanne has a rental loss in 20X1 of $920.

B) Joanne has a rental loss in 20X1 of $840.

C) Joanne's rental income in 20X0 was $4,000.

D) Joanne's rental income in 20X1 is $0.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements concerning the tax treatment of interest income is true?

A) Individuals must accrue interest on a daily basis.

B) Foreign interest income and Canadian interest income are recognized under different sets of tax rules.

C) The anniversary day accrual method of recognizing interest income requires that interest income received by an individual be recognized for tax purposes for every twelve month period from the date the investment is made.

D) The anniversary day accrual method of recognizing interest income requires that interest income received by a corporation be recognized for tax purposes for every twelve month period from the date the investment is made.

A) Individuals must accrue interest on a daily basis.

B) Foreign interest income and Canadian interest income are recognized under different sets of tax rules.

C) The anniversary day accrual method of recognizing interest income requires that interest income received by an individual be recognized for tax purposes for every twelve month period from the date the investment is made.

D) The anniversary day accrual method of recognizing interest income requires that interest income received by a corporation be recognized for tax purposes for every twelve month period from the date the investment is made.

Unlock Deck

Unlock for access to all 9 flashcards in this deck.

Unlock Deck

k this deck