Deck 3: Property Dispositions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 3: Property Dispositions

1

All tax gains and losses are ultimately characterized as either ordinary or capital.

True

2

The adjusted basis is the initial basis less cost recovery deductions.

True

3

The gain or loss realized on the sale of an asset is the amount realized less the adjusted basis.

True

4

A parcel of land is always a capital asset.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

Accounts receivable and inventory are examples of ordinary assets.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

Unrecaptured §1250 gain is taxed at a maximum rate of 25 percent.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

Unrecaptured §1250 gains apply only to individuals.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

The gain or loss realized on the sale of an asset is always recognized for tax purposes.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

Ordinary gains and losses are obtained on the sale of investments.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

Assets held for investment and personal use assets are examples of capital assets.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

Depreciation recapture changes both the amount and character of a gain.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

§1250 recaptures the excess of accelerated depreciation over straight-line depreciation on real property placed in service before 1987 as ordinary income.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

An asset's tax-adjusted basis is usually greater than its book-adjusted basis.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

Generally, the amount realized is everything of value received in a sale less selling expenses.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

Taxpayers can recognize a taxable gain on the sale of an asset even though an asset's real economic value has declined.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

For corporations, §291 recaptures 20 percent of the lesser of depreciation taken or the realized gain as ordinary income.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

The amount realized is the sale proceeds less the adjusted basis.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

§1231 assets include all assets used in a trade or business.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

Only accelerated depreciation is recaptured for §1245 assets.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

After application of the look-back rule, net §1231 gains become capital while net §1231 losses become ordinary.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

For a like-kind exchange, realized gain is deferred if the exchange is solely for like-kind property.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

A net §1231 gain becomes ordinary while a net §1231 loss becomes long-term capital gain.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

The §1231 look-back rule applies whether there is a net gain or loss.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not true regarding an asset's adjusted basis?

A) Tax-adjusted basis is usually greater than book-adjusted basis.

B) Tax-adjusted basis is usually less than book-adjusted basis.

C) Adjusted basis is cost basis less cost recovery deductions.

D) Tax-adjusted basis may change over time.

A) Tax-adjusted basis is usually greater than book-adjusted basis.

B) Tax-adjusted basis is usually less than book-adjusted basis.

C) Adjusted basis is cost basis less cost recovery deductions.

D) Tax-adjusted basis may change over time.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is how gain or loss realized is calculated?

A) Cash less selling costs.

B) Cost basis less cost recovery.

C) Cash less cost recovery.

D) Amount realized less adjusted basis.

E) None of the choices are correct.

A) Cash less selling costs.

B) Cost basis less cost recovery.

C) Cash less cost recovery.

D) Amount realized less adjusted basis.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is not usually included in an asset's tax basis?

A) Purchase price.

B) Sales tax.

C) Shipping costs.

D) Installation costs.

E) None of the choices are correct.

A) Purchase price.

B) Sales tax.

C) Shipping costs.

D) Installation costs.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following is not used in the calculation of the amount realized:

A) Cash.

B) Adjusted basis.

C) Fair market value of other property received.

D) Buyer's assumption of liabilities.

E) All of the choices are used.

A) Cash.

B) Adjusted basis.

C) Fair market value of other property received.

D) Buyer's assumption of liabilities.

E) All of the choices are used.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

For an installment sale, the gross profit percentage is the gain recognized divided by the gain realized.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

A loss realized for property destroyed in a hurricane is deferred under the involuntary conversion rules.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Boot is not like-kind property involved in a like-kind exchange.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following realized gains results in a recognized gain?

A) Farmland traded for an office building.

B) Sale to a related party.

C) Involuntary conversion.

D) Iowa cropland exchanged for a Minnesota warehouse.

A) Farmland traded for an office building.

B) Sale to a related party.

C) Involuntary conversion.

D) Iowa cropland exchanged for a Minnesota warehouse.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Losses on sales between related parties are realized but not recognized.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

A simultaneous exchange must take place for a transaction to qualify as a like-kind exchange.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Realized gains are recognized unless there is specific exception.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

A taxpayer that receives boot in a like-kind exchange resulting in a gain recognizes as gain the lesser of the fair market value of the boot received or the gain realized.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

In a deferred like-kind exchange, the like-kind property to be received must be identified within 45 days and acquired within 180 days from the initial exchange.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

The §1231 look-back rule recharacterizes §1231 gains if §1231 losses have created ordinary losses in the last five years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

Residential real property is not like-kind with nonresidential real property.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

An installment sale is any sale where at least a portion of the sale proceeds is received in a subsequent taxable year.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

§1239 recharacterizes 50 percent of the gain on sales to a related party as ordinary income.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following sections does not recapture or recharacterize a taxpayer's gain?

A) §1239.

B) §1250.

C) §1245.

D) §291.

E) None of the choices are correct.

A) §1239.

B) §1250.

C) §1245.

D) §291.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

Leesburg sold a machine for $2,200 on November 10th of the current year. The machine was purchased for $2,600. Leesburg had taken $1,200 of depreciation deductions on the machine through the date of the sale. What is Leesburg's gain or loss realized on the machine?

A) $800 gain.

B) $1,000 gain.

C) $1,200 loss.

D) $1,400 loss.

E) None of the choices are correct.

A) $800 gain.

B) $1,000 gain.

C) $1,200 loss.

D) $1,400 loss.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is true regarding depreciation recapture?

A) Changes the character of a loss.

B) Changes the character of a gain.

C) Changes the amount of a gain.

D) Only applies to ordinary assets.

E) None of the choices are correct.

A) Changes the character of a loss.

B) Changes the character of a gain.

C) Changes the amount of a gain.

D) Only applies to ordinary assets.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

Which of the following gains does not result solely in an ordinary gain or loss?

A) Sale of equipment held for less than a year.

B) Sale of inventory.

C) Sale of equipment where the gain realized exceeds the accumulated depreciation.

D) Sale of equipment where the accumulated depreciation exceeds the gain realized.

E) None of the choices are correct.

A) Sale of equipment held for less than a year.

B) Sale of inventory.

C) Sale of equipment where the gain realized exceeds the accumulated depreciation.

D) Sale of equipment where the accumulated depreciation exceeds the gain realized.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following results in an ordinary gain or loss?

A) Sale of a machine at a gain.

B) Sale of stock held for investment.

C) Sale of a §1231 asset.

D) Sale of inventory.

E) None of the choices are correct.

A) Sale of a machine at a gain.

B) Sale of stock held for investment.

C) Sale of a §1231 asset.

D) Sale of inventory.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following sections recaptures or recharacterizes only corporate taxpayers' gains?

A) §291.

B) §1239.

C) §1245.

D) Unrecaptured §1250 gains.

E) None of the choices are correct.

A) §291.

B) §1239.

C) §1245.

D) Unrecaptured §1250 gains.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following does not ultimately result in a capital gain or loss?

A) Sale of a personal use asset.

B) Sale of inventory.

C) Gain on equipment used in a trade or business and held for more than one year, if it is the only asset sale during the year.

D) Sale of capital stock in another company.

E) None of the choices are correct.

A) Sale of a personal use asset.

B) Sale of inventory.

C) Gain on equipment used in a trade or business and held for more than one year, if it is the only asset sale during the year.

D) Sale of capital stock in another company.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

Butte sold a machine to a machine dealer for $50,000. Butte bought the machine for $55,000 several years ago and has claimed $12,500 of depreciation expense on the machine. What is the amount and character of Butte's gain or loss?

A) $7,500 §1231 loss.

B) $5,000 §1231 loss.

C) $7,500 ordinary gain.

D) $7,500 capital gain.

E) None of the choices are correct.

A) $7,500 §1231 loss.

B) $5,000 §1231 loss.

C) $7,500 ordinary gain.

D) $7,500 capital gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Bozeman sold equipment that it uses in its business for $80,000. Bozeman bought the equipment two years ago for $75,000 and has claimed $20,000 of depreciation expense. What is the amount and character of Bozeman's gain or loss?

A) $25,000 §1231 gain.

B) $20,000 ordinary gain, and $5,000 §1231 gain.

C) $5,000 ordinary gain, and $20,000 §1231 gain.

D) $25,000 capital gain.

E) None of the choices are correct.

A) $25,000 §1231 gain.

B) $20,000 ordinary gain, and $5,000 §1231 gain.

C) $5,000 ordinary gain, and $20,000 §1231 gain.

D) $25,000 capital gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

The sale of land held for investment results in which of the following types of gain or loss?

A) Capital.

B) Ordinary.

C) §1231.

D) §1245.

E) None of the choices are correct.

A) Capital.

B) Ordinary.

C) §1231.

D) §1245.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

Bateman Corporation sold an office building that it used in its business for $800,000. Bateman bought the building 10 years ago for $600,000 and has claimed $200,000 of depreciation expense. What is the amount and character of Bateman's gain or loss?

A) $40,000 ordinary and $360,000 §1231 gain.

B) $200,000 ordinary and $200,000 §1231 gain.

C) $400,000 ordinary gain.

D) $400,000 capital gain.

E) None of the choices are correct.

A) $40,000 ordinary and $360,000 §1231 gain.

B) $200,000 ordinary and $200,000 §1231 gain.

C) $400,000 ordinary gain.

D) $400,000 capital gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Foreaker LLC sold a piece of land that it uses in its business for $52,000. Foreaker bought the land two years ago for $42,500. What is the amount and character of Foreaker's gain?

A) $9,500 §1221.

B) $9,500 §1231.

C) $9,500 §1245.

D) $9,500 §1250.

E) None of the choices are correct.

A) $9,500 §1221.

B) $9,500 §1231.

C) $9,500 §1245.

D) $9,500 §1250.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

The sale of computer equipment used in a trade or business for nine months results in which of the following types of gain or loss?

A) Capital.

B) Ordinary.

C) §1231.

D) §1245.

E) None of the choices are correct.

A) Capital.

B) Ordinary.

C) §1231.

D) §1245.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

The sale for more than the original cost basis (before depreciation) of machinery used in a trade or business and held for more than one year results in which of the following types of gain or loss?

A) Capital and ordinary.

B) Ordinary only.

C) Capital and §1231.

D) §1245 and §1231.

E) None of the choices are correct.

A) Capital and ordinary.

B) Ordinary only.

C) Capital and §1231.

D) §1245 and §1231.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following is not a §1245 asset if held for more than one year?

A) Machinery.

B) Automobile.

C) Business cell phone.

D) Land.

E) None of the choices are correct.

A) Machinery.

B) Automobile.

C) Business cell phone.

D) Land.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

Brad sold a rental house that he owned for $250,000. Brad bought the rental house five years ago for $225,000 and has claimed $50,000 of depreciation expense. What is the amount and character of Brad's gain or loss?

A) $25,000 ordinary and $50,000 unrecaptured §1250 gain.

B) $25,000 §1231 gain and $50,000 unrecaptured §1250 gain.

C) $75,000 ordinary gain.

D) $75,000 capital gain.

E) None of the choices are correct.

A) $25,000 ordinary and $50,000 unrecaptured §1250 gain.

B) $25,000 §1231 gain and $50,000 unrecaptured §1250 gain.

C) $75,000 ordinary gain.

D) $75,000 capital gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

What is the character of land used in an active trade or business for two years?

A) Capital.

B) Ordinary.

C) §1231.

D) Investment.

E) None of the choices are correct.

A) Capital.

B) Ordinary.

C) §1231.

D) Investment.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

The sale at a loss of machinery that was used in a trade or business and held for more than one year results in which of the following types of loss?

A) Capital.

B) §291.

C) §1231.

D) §1245.

E) None of the choices are correct.

A) Capital.

B) §291.

C) §1231.

D) §1245.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

Sumner sold equipment that it uses in its business for $30,000. Sumner bought the equipment a few years ago for $80,000 and has claimed $40,000 of depreciation expense. Assuming that this is Sumner's only disposition during the year, what is the amount and character of Sumner's gain or loss?

A) $10,000 §1231 loss.

B) $10,000 §1245 loss.

C) $50,000 ordinary loss.

D) $10,000 capital loss.

E) None of the choices are correct.

A) $10,000 §1231 loss.

B) $10,000 §1245 loss.

C) $50,000 ordinary loss.

D) $10,000 capital loss.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following transactions results solely in §1245 gain?

A) Sale of machinery held for less than one year.

B) Sale of machinery held for more than one year, where the gain realized exceeds the accumulated depreciation.

C) Sale of machinery held for more than one year, where the accumulated depreciation exceeds the gain realized.

D) Sale of land held for more than one year, where the amount realized exceeds the adjusted basis.

E) None of the choices are correct.

A) Sale of machinery held for less than one year.

B) Sale of machinery held for more than one year, where the gain realized exceeds the accumulated depreciation.

C) Sale of machinery held for more than one year, where the accumulated depreciation exceeds the gain realized.

D) Sale of land held for more than one year, where the amount realized exceeds the adjusted basis.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

Why does §1250 recapture generally no longer apply?

A) Congress repealed the code section.

B) Real property is depreciated using the straight-line method after 1986.

C) §1245 recapture trumps §1250 recapture.

D) Because unrecaptured §1250 gains now apply to all taxpayers instead.

E) None of the choices are correct.

A) Congress repealed the code section.

B) Real property is depreciated using the straight-line method after 1986.

C) §1245 recapture trumps §1250 recapture.

D) Because unrecaptured §1250 gains now apply to all taxpayers instead.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Which one of the following is not a requirement of a deferred like-kind exchange?

A) The like-kind property to be received must be identified within 45 days.

B) The exchange must be completed within the taxable year.

C) The like-kind property must be received within 180 days.

D) The exchanged property must be like-kind.

E) All of the choices are correct.

A) The like-kind property to be received must be identified within 45 days.

B) The exchange must be completed within the taxable year.

C) The like-kind property must be received within 180 days.

D) The exchanged property must be like-kind.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

Which of the following is not true regarding §1239?

A) It only applies to related taxpayers.

B) It only applies to gains on sales of depreciable property.

C) It only applies to gains on sales of nonresidential real property.

D) It does not apply to losses.

E) None of the choices are correct.

A) It only applies to related taxpayers.

B) It only applies to gains on sales of depreciable property.

C) It only applies to gains on sales of nonresidential real property.

D) It does not apply to losses.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following is true regarding the §1231 look-back rule?

A) It only applies when a §1231 loss occurs.

B) It only applies when a §1231 gain occurs.

C) It only applies when a §1231 gain occurs and there is a nonrecaptured §1231 loss in the prior five years.

D) It only applies when a §1231 gain occurs and there is a nonrecaptured §1231 gain in the prior five years.

E) None of the choices are correct.

A) It only applies when a §1231 loss occurs.

B) It only applies when a §1231 gain occurs.

C) It only applies when a §1231 gain occurs and there is a nonrecaptured §1231 loss in the prior five years.

D) It only applies when a §1231 gain occurs and there is a nonrecaptured §1231 gain in the prior five years.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

When do unrecaptured §1250 gains apply?

A) When the taxpayer makes the election.

B) It applies only when noncorporate taxpayers sell depreciable real property at a gain.

C) It applies when §1245 recapture trumps §1250 recapture.

D) It applies only when real property purchased before 1986 is sold at a gain.

E) None of the choices are correct.

A) When the taxpayer makes the election.

B) It applies only when noncorporate taxpayers sell depreciable real property at a gain.

C) It applies when §1245 recapture trumps §1250 recapture.

D) It applies only when real property purchased before 1986 is sold at a gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

Which one of the following is not considered boot in a like-kind exchange?

A) Cash.

B) Other property.

C) Mortgage given.

D) Mortgage received.

E) All of the choices can be considered as boot.

A) Cash.

B) Other property.

C) Mortgage given.

D) Mortgage received.

E) All of the choices can be considered as boot.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

Koch traded Machine 1 for Machine 2 when the fair market value of both machines was $50,000. Koch originally purchased Machine 1 for $75,000, and Machine 1's adjusted basis was $40,000 at the time of the exchange. Machine 2's seller purchased it for $65,000 and Machine 2's adjusted basis was $55,000 at the time of the exchange. What is Koch's adjusted basis in Machine 2 after the exchange?

A) $40,000.

B) $50,000.

C) $55,000.

D) $75,000.

E) None of the choices are correct.

A) $40,000.

B) $50,000.

C) $55,000.

D) $75,000.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

How long after the initial exchange does a taxpayer have to identify replacement property in a like-kind exchange?

A) The like-kind property to be received must be identified within 45 days.

B) The like-kind property to be received must be identified by the earlier of 45 days or the last day of the taxpayer's taxable year.

C) The like-kind property to be received must be identified within 180 days.

D) There is no deadline for the identification of replacement property.

E) All of the choices are correct.

A) The like-kind property to be received must be identified within 45 days.

B) The like-kind property to be received must be identified by the earlier of 45 days or the last day of the taxpayer's taxable year.

C) The like-kind property to be received must be identified within 180 days.

D) There is no deadline for the identification of replacement property.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

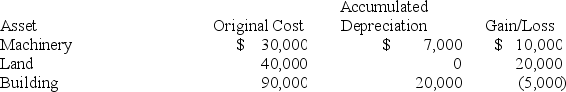

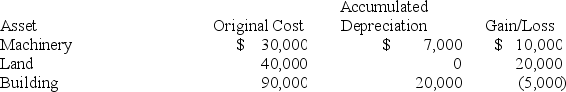

Brandon, an individual, began business four years ago and has sold §1231 assets with $5,000 of losses within the last five years. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Use dividends and capital gains tax rates for reference.

A) $25,000 ordinary income and $8,000 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain, $12,000 ordinary income, and $5,790 tax liability.

D) $12,000 §1231 gain, $13,000 ordinary income, and $5,960 tax liability.

E) None of the choices are correct.

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?Use dividends and capital gains tax rates for reference.

A) $25,000 ordinary income and $8,000 tax liability.

B) $25,000 §1231 gain and $3,750 tax liability.

C) $13,000 §1231 gain, $12,000 ordinary income, and $5,790 tax liability.

D) $12,000 §1231 gain, $13,000 ordinary income, and $5,960 tax liability.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

Which one of the following is not true regarding a like-kind exchange?

A) Loss on like-kind property is not recognized.

B) Gains on boot given are deferred.

C) Losses on boot given are not recognized.

D) Land can be like-kind with a building.

E) All of the choices are true.

A) Loss on like-kind property is not recognized.

B) Gains on boot given are deferred.

C) Losses on boot given are not recognized.

D) Land can be like-kind with a building.

E) All of the choices are true.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following is not an involuntary conversion?

A) Destruction caused by a hurricane.

B) Eminent domain.

C) A foreclosure.

D) Fire damage.

E) All of these choices are involuntary conversions.

A) Destruction caused by a hurricane.

B) Eminent domain.

C) A foreclosure.

D) Fire damage.

E) All of these choices are involuntary conversions.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

A deferred like-kind exchange does not help accomplish which of the following objectives?

A) To facilitate finding replacement property.

B) To help acquire the replacement property.

C) To reduce the possibility that the seller must receive cash (boot) that will taint the transaction.

D) To certify the taxpayer's Form 8824-Like-kind exchanges.

E) All of the choices are correct.

A) To facilitate finding replacement property.

B) To help acquire the replacement property.

C) To reduce the possibility that the seller must receive cash (boot) that will taint the transaction.

D) To certify the taxpayer's Form 8824-Like-kind exchanges.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

Alpha sold machinery that it used in its business to Beta, a related entity, for $40,000. Beta used the machinery in its business. Alpha bought the machinery a few years ago for $50,000 and has claimed $30,000 of depreciation expense. What is the amount and character of Alpha's gain?

A) $20,000 ordinary income under §1239.

B) $10,000 ordinary gain and $10,000 §1231 gain.

C) $20,000 §1231 gain.

D) $20,000 capital gain.

E) None of the choices are correct.

A) $20,000 ordinary income under §1239.

B) $10,000 ordinary gain and $10,000 §1231 gain.

C) $20,000 §1231 gain.

D) $20,000 capital gain.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

The general rule regarding the exchanged basis in the new property received in a like-kind exchange is:

A) The basis is equal to the fair market value of the new property.

B) The basis is equal to the fair market value of the old property.

C) The basis is equal to the adjusted basis of the old property.

D) The basis is equal to the cost basis of the old property.

E) All of the choices are correct.

A) The basis is equal to the fair market value of the new property.

B) The basis is equal to the fair market value of the old property.

C) The basis is equal to the adjusted basis of the old property.

D) The basis is equal to the cost basis of the old property.

E) All of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Mary exchanged an office building used in her business for some land. Mary originally purchased the building for $45,000, and it had an adjusted basis of $20,000 at the time of the exchange. The land had a fair market value of $40,000. Mary also gave $4,000 to the seller in the transaction. What is Mary's adjusted basis in the land after the exchange?

A) $20,000.

B) $24,000.

C) $36,000.

D) $40,000.

E) None of the choices are correct.

A) $20,000.

B) $24,000.

C) $36,000.

D) $40,000.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Winchester LLC sold the following business assets during the current year: (1) automobile, $30,000 cost basis, $12,000 depreciation, $20,000 proceeds; (2) machinery, $25,000 cost basis, $20,000 depreciation, $10,000 proceeds; (3) furniture, $15,000 cost basis, $10,000 depreciation, $4,000 proceeds; (4) computer equipment, $25,000 cost basis, $6,000 depreciation, $10,000 proceeds; (5) Winchester had unrecaptured §1231 losses of $3,000 in the prior five years. What are the amount and character of Winchester's gains and losses before the §1231 netting process? Assume all assets were held for more than one year.

A) $3,000 ordinary loss, $0 §1231 loss.

B) $7,000 ordinary gain, $10,000 §1231 loss.

C) $7,000 ordinary loss, $4,000 §1231 gain.

D) $1,000 ordinary gain, $4,000 §1231 loss.

E) None of the choices are correct.

A) $3,000 ordinary loss, $0 §1231 loss.

B) $7,000 ordinary gain, $10,000 §1231 loss.

C) $7,000 ordinary loss, $4,000 §1231 gain.

D) $1,000 ordinary gain, $4,000 §1231 loss.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Each of the following is true except for:

A) a direct involuntary conversion occurs when property taken under eminent domain is replaced with other property.

B) qualified replacement property rules are more restrictive than the like-kind property rules.

C) an indirect involuntary conversion occurs when property is destroyed and insurance proceeds are used to purchase qualified replacement property.

D) losses realized in involuntary conversions are deferred.

E) all of the choices are true.

A) a direct involuntary conversion occurs when property taken under eminent domain is replaced with other property.

B) qualified replacement property rules are more restrictive than the like-kind property rules.

C) an indirect involuntary conversion occurs when property is destroyed and insurance proceeds are used to purchase qualified replacement property.

D) losses realized in involuntary conversions are deferred.

E) all of the choices are true.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

Arlington LLC exchanged land used in its business for some new land. Arlington originally purchased the land it exchanged for $28,000. The new land had a fair market value of $35,000. Arlington also received $2,000 of office equipment in the transaction. What is Arlington's recognized gain or loss on the exchange?

A) $0.

B) $2,000.

C) $7,000.

D) $9,000.

E) None of the choices are correct.

A) $0.

B) $2,000.

C) $7,000.

D) $9,000.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

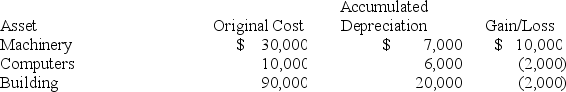

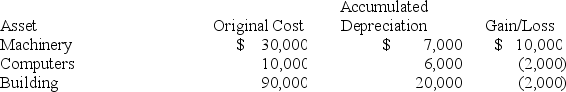

Brandon, an individual, began business four years ago and has never sold a §1231 asset. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

A) $7,000 ordinary income, $1,000 §1231 loss, and $1,920 tax liability.

B) $6,000 ordinary income and $1,920 tax liability.

C) $7,000 §1231 gain and $2,240 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability?A) $7,000 ordinary income, $1,000 §1231 loss, and $1,920 tax liability.

B) $6,000 ordinary income and $1,920 tax liability.

C) $7,000 §1231 gain and $2,240 tax liability.

D) $7,000 §1231 gain and $1,050 tax liability.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

Ashburn reported a $105,000 net §1231 gain in Year 6. Assuming Ashburn reported $60,000 of nonrecaptured §1231 losses during Years 1-5, what amount of Ashburn's net §1231 gain for Year 6, if any, is treated as ordinary income?

A) $0.

B) $45,000.

C) $60,000.

D) $105,000.

E) None of the choices are correct.

A) $0.

B) $45,000.

C) $60,000.

D) $105,000.

E) None of the choices are correct.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck