Deck 16: Inflation, Disinflation, and Deflation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/194

Play

Full screen (f)

Deck 16: Inflation, Disinflation, and Deflation

1

In the classical model, it is thought that the long-run:

A) and short-run aggregate supply curves are both upward sloping.

B) aggregate supply curve is vertical and the short-run aggregate supply curve is upward sloping.

C) and short-run aggregate supply curves are both vertical.

D) aggregate supply curve is upward sloping and the short-run aggregate supply curve is vertical.

A) and short-run aggregate supply curves are both upward sloping.

B) aggregate supply curve is vertical and the short-run aggregate supply curve is upward sloping.

C) and short-run aggregate supply curves are both vertical.

D) aggregate supply curve is upward sloping and the short-run aggregate supply curve is vertical.

and short-run aggregate supply curves are both vertical.

2

Workers in country A have wage contracts for cost-of-living adjustments (COLAs), which adjust wages to offset the effect of inflation, and workers in country B do not. When the central banks of countries A and B increase the money supply:

A) prices in country A increase faster than prices in country B.

B) prices in country B increase faster than prices in country A.

C) prices in countries A and B will change at the same rate.

D) COLAs have no effect on the speed of price changes.

A) prices in country A increase faster than prices in country B.

B) prices in country B increase faster than prices in country A.

C) prices in countries A and B will change at the same rate.

D) COLAs have no effect on the speed of price changes.

prices in country A increase faster than prices in country B.

3

If the monetary authorities decide to increase the nominal money supply by 10% when the economy is at its full-employment level of output, in the long run the aggregate price level increases by _____% and real GDP _____.

A) 10; increases by 10%

B) 5; increases by 5%, according to Okun's law

C) 10; returns to the potential level of output

D) 5; increases by 20%, given a marginal propensity to consume of 0.5

A) 10; increases by 10%

B) 5; increases by 5%, according to Okun's law

C) 10; returns to the potential level of output

D) 5; increases by 20%, given a marginal propensity to consume of 0.5

10; returns to the potential level of output

4

In the long run, an increase in aggregate demand from a position of full employment leads to:

A) higher prices and higher output.

B) higher prices and the same output.

C) higher output and lower prices.

D) higher output and higher unemployment.

A) higher prices and higher output.

B) higher prices and the same output.

C) higher output and lower prices.

D) higher output and higher unemployment.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

5

During periods of low inflation, the short-run aggregate supply curve is:

A) vertical.

B) horizontal.

C) upward sloping.

D) downward sloping.

A) vertical.

B) horizontal.

C) upward sloping.

D) downward sloping.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

6

In the long run, any given percentage increase in the money supply:

A) decreases real GDP.

B) leads to an equal percentage increase in the overall price level.

C) increases real GDP.

D) leads to an equal percentage decrease in the unemployment rate.

A) decreases real GDP.

B) leads to an equal percentage increase in the overall price level.

C) increases real GDP.

D) leads to an equal percentage decrease in the unemployment rate.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

7

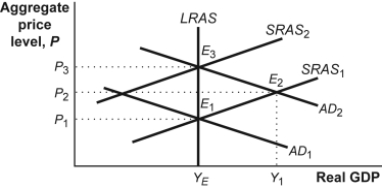

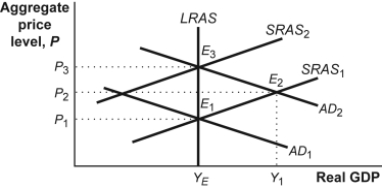

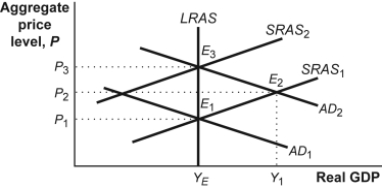

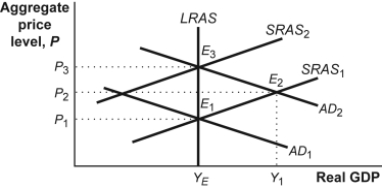

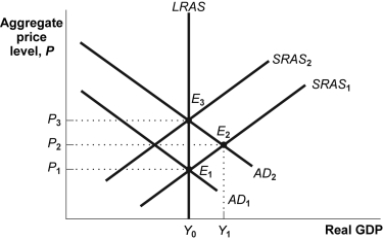

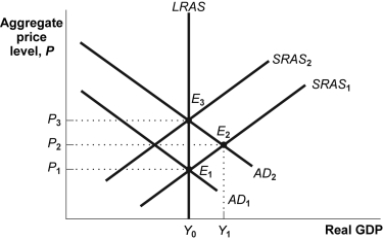

Use the following to answer questions:

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, real GDP will:

A) not change.

B) increase from YE to Y1.

C) increase from Y1 to YE.

D) establish a new potential output.

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, real GDP will:

A) not change.

B) increase from YE to Y1.

C) increase from Y1 to YE.

D) establish a new potential output.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

8

In the short run in periods of low inflation, an increase in aggregate demand from a position of full employment leads to:

A) higher prices and higher unemployment.

B) higher prices and higher output.

C) lower prices and higher output.

D) lower prices and higher unemployment.

A) higher prices and higher unemployment.

B) higher prices and higher output.

C) lower prices and higher output.

D) lower prices and higher unemployment.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

9

Assume that workers and businesses are sensitized to inflation and are quick to raise wages and prices in response to changes in the money supply. This implies that inflation is _____ and there are _____ adjustments of wages and prices of intermediate goods.

A) high; quick

B) low; quick

C) high; slow

D) low; slow

A) high; quick

B) low; quick

C) high; slow

D) low; slow

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

10

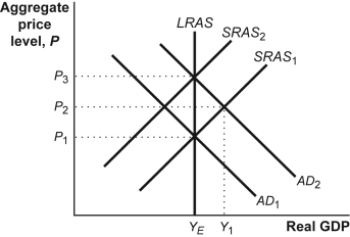

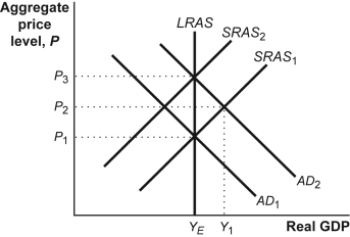

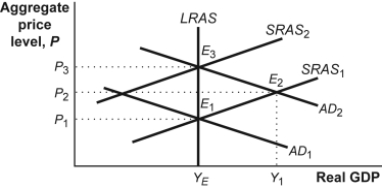

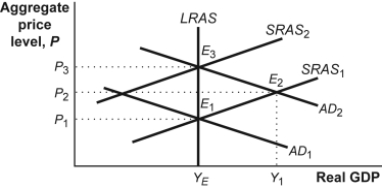

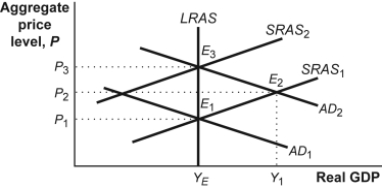

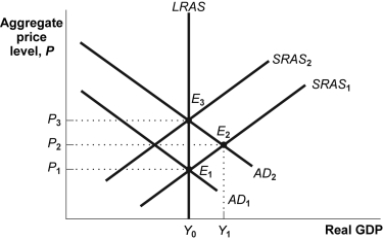

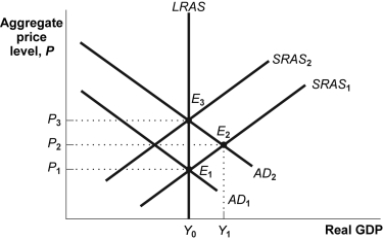

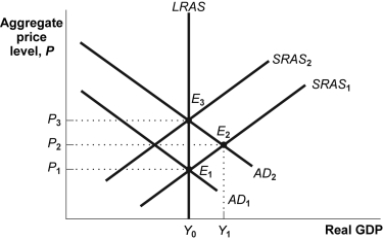

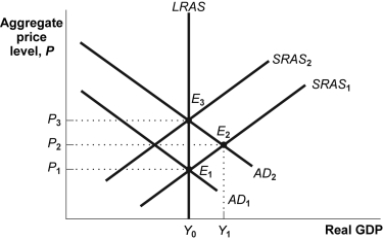

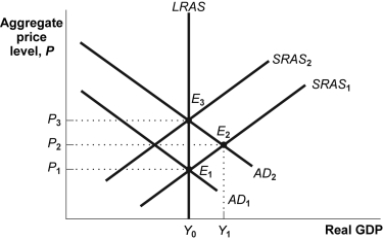

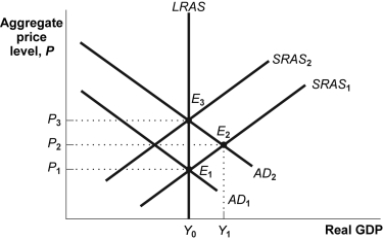

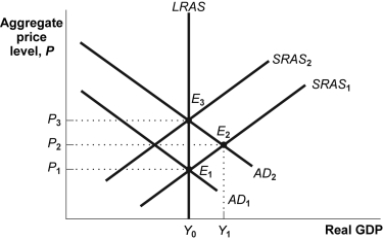

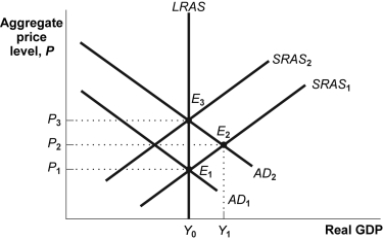

Use the following to answer question 7:

(Figure: AD-AS Model) Refer to Figure: AD-AS Model. Suppose that the economy is at YE with a price level of P1. Which of the following would represent the new long-run equilibrium position if the aggregate demand curve shifted to the right from AD1 to AD2 as a result of an increase in the money supply?

A) YE and P2

B) YE and P1

C) Y1 and P2

D) YE and P3

(Figure: AD-AS Model) Refer to Figure: AD-AS Model. Suppose that the economy is at YE with a price level of P1. Which of the following would represent the new long-run equilibrium position if the aggregate demand curve shifted to the right from AD1 to AD2 as a result of an increase in the money supply?

A) YE and P2

B) YE and P1

C) Y1 and P2

D) YE and P3

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

11

Use the following to answer questions:

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the equilibrium point will:

A) not change.

B) immediately move from E1 to E2.

C) immediately move from E2 to E1.

D) immediately move from E1 to E3.

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the equilibrium point will:

A) not change.

B) immediately move from E1 to E2.

C) immediately move from E2 to E1.

D) immediately move from E1 to E3.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

12

The notion that the real quantity of money is always at its long-run equilibrium level is associated with the _____ of the price level.

A) classical model

B) Keynesian model

C) monetarist model

D) modern view

A) classical model

B) Keynesian model

C) monetarist model

D) modern view

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is the BEST explanation for an upward-sloping short-run aggregate supply curve?

A) Prices are perfectly flexible.

B) Wages are perfectly flexible.

C) Wages and prices of some goods are sticky in the short run.

D) Wages and prices of some goods are flexible in the short run but sticky in the long run.

A) Prices are perfectly flexible.

B) Wages are perfectly flexible.

C) Wages and prices of some goods are sticky in the short run.

D) Wages and prices of some goods are flexible in the short run but sticky in the long run.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

14

Use the following to answer questions:

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the SRAS will:

A) not change, since in the classical model the SRAS and LRAS are both vertical at potential output.

B) decrease from SRAS1 to SRAS2.

C) increase from SRAS2 to SRAS1.

D) increase from SRAS1 to SRAS2.

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the SRAS will:

A) not change, since in the classical model the SRAS and LRAS are both vertical at potential output.

B) decrease from SRAS1 to SRAS2.

C) increase from SRAS2 to SRAS1.

D) increase from SRAS1 to SRAS2.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

15

Use the following to answer questions:

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the price level will:

A) not change.

B) increase from P1 to P2.

C) increase from P1 to P3.

D) decrease from P1 to P2.

(Figure: Classical Model of the Price Level) Refer to Figure: Classical Model of the Price Level. If the central bank increases the money supply such that aggregate demand shifts from AD1 to AD2, according to this classical model, the price level will:

A) not change.

B) increase from P1 to P2.

C) increase from P1 to P3.

D) decrease from P1 to P2.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

16

During hyperinflation in Germany in 1922-1923, prices rose at _____% per day.

A) 0.1

B) 16

C) 50

D) 100

A) 0.1

B) 16

C) 50

D) 100

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

17

During periods of high inflation, the short-run aggregate supply curve is:

A) vertical.

B) horizontal.

C) upward sloping.

D) downward sloping.

A) vertical.

B) horizontal.

C) upward sloping.

D) downward sloping.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

18

Inflation does NOT reduce purchasing power if:

A) prices of essential products, such as food and gasoline, don't increase too much.

B) nominal wages rise at the same rate as prices.

C) it remains under 10% per year.

D) the Federal Reserve increases the money supply enough to offset it.

A) prices of essential products, such as food and gasoline, don't increase too much.

B) nominal wages rise at the same rate as prices.

C) it remains under 10% per year.

D) the Federal Reserve increases the money supply enough to offset it.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

19

What distinction did Zimbabwe achieve in June 2008?

A) It was the first African nation to become a democracy.

B) It ended apartheid.

C) It had the world's highest inflation rate.

D) It had the world's highest unemployment rate.

A) It was the first African nation to become a democracy.

B) It ended apartheid.

C) It had the world's highest inflation rate.

D) It had the world's highest unemployment rate.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

20

The classical model of the price level is most likely to be a good approximation of reality during periods of:

A) recession.

B) high unemployment.

C) low inflation.

D) high inflation.

A) recession.

B) high unemployment.

C) low inflation.

D) high inflation.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

21

As people get used to inflation:

A) the short-run aggregate demand curve adjusts more rapidly.

B) wages adjust faster, and the short-run aggregate supply shifts quickly to the right.

C) wages adjust faster, and the short-run aggregate supply shifts quickly to the left.

D) the long-run aggregate demand adjusts more slowly.

A) the short-run aggregate demand curve adjusts more rapidly.

B) wages adjust faster, and the short-run aggregate supply shifts quickly to the right.

C) wages adjust faster, and the short-run aggregate supply shifts quickly to the left.

D) the long-run aggregate demand adjusts more slowly.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

22

The Fed monetizes the debt when it:

A) prints money and buys government debt from the public.

B) sells bonds.

C) decreases the money supply.

D) targets interest rates.

A) prints money and buys government debt from the public.

B) sells bonds.

C) decreases the money supply.

D) targets interest rates.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

23

If the money held by the public is $3 billion and inflation is 6%, the inflation tax is:

A) $3.18 billion.

B) $50 billion.

C) $180 million.

D) $1.8 billion.

A) $3.18 billion.

B) $50 billion.

C) $180 million.

D) $1.8 billion.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

24

The inflation tax is the effect on the public of the:

A) higher tax paid by individuals whose incomes are indexed to inflation.

B) sales taxes paid during periods of inflation.

C) reduction in the value of money caused by inflation.

D) higher prices consumers pay due to inflation.

A) higher tax paid by individuals whose incomes are indexed to inflation.

B) sales taxes paid during periods of inflation.

C) reduction in the value of money caused by inflation.

D) higher prices consumers pay due to inflation.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

25

In economies with persistently high inflation, an increase in the money supply will have:

A) a positive effect on the real quantity of money in the long run.

B) a negative effect on the real quantity of money, as the aggregate price level increases by more than the money supply.

C) a positive effect on the aggregate real output in the long run.

D) no effect on the real quantity of money, making money neutral in the long run.

A) a positive effect on the real quantity of money in the long run.

B) a negative effect on the real quantity of money, as the aggregate price level increases by more than the money supply.

C) a positive effect on the aggregate real output in the long run.

D) no effect on the real quantity of money, making money neutral in the long run.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

26

According to the classical model of the price level, an increase in the money supply will cause _____ and _____ increase in real GDP.

A) inflation; no long-run

B) inflation; a long-run

C) no inflation; a long-run

D) deflation; no long-run

A) inflation; no long-run

B) inflation; a long-run

C) no inflation; a long-run

D) deflation; no long-run

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

27

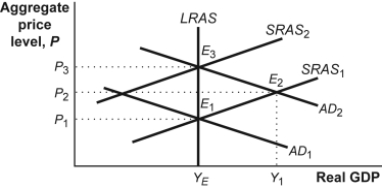

Use the following to answer questions:

(Figure: AD-AS) Refer to Figure: AD-AS. If our economy is at equilibrium and the Fed uses expansionary monetary policy, _____ will shift to _____ and the economy will move from _____. Then nominal wages will _____ and _____ will shift to _____. The economy will move from _____.

A) AD2; AD1; E2 to E1; rise; SRAS1; SRAS2; E2 to E3

B) SRAS1 ; SRAS2 ; E2 to E3; stay the same; AD2; AD1; E2 to E1

C) SRAS2; SRAS1; E3 to E2; stay the same; AD2; AD1; E2 to E1

D) AD1; AD2; E1 to E2; rise; SRAS1; SRAS2; from E2 to E3

(Figure: AD-AS) Refer to Figure: AD-AS. If our economy is at equilibrium and the Fed uses expansionary monetary policy, _____ will shift to _____ and the economy will move from _____. Then nominal wages will _____ and _____ will shift to _____. The economy will move from _____.

A) AD2; AD1; E2 to E1; rise; SRAS1; SRAS2; E2 to E3

B) SRAS1 ; SRAS2 ; E2 to E3; stay the same; AD2; AD1; E2 to E1

C) SRAS2; SRAS1; E3 to E2; stay the same; AD2; AD1; E2 to E1

D) AD1; AD2; E1 to E2; rise; SRAS1; SRAS2; from E2 to E3

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

28

Fiat money is:

A) money backed by gold.

B) money that only the government will accept to pay taxes.

C) paper money with no intrinsic value.

D) used only in the United States as a medium of exchange.

A) money backed by gold.

B) money that only the government will accept to pay taxes.

C) paper money with no intrinsic value.

D) used only in the United States as a medium of exchange.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following to answer questions:

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. Finally, the economy moves to E3. The classical model of price level assumes that the economy moves from _____; thus, inflation _____ and real GDP _____.

A) E1 to E3, ignoring E2; increases; remains the same

B) E2 to E3, ignoring E1; remains the same; increases

C) E2 to E3; decreases; remains the same

D) E1 to E2, ignoring E3; remains the same; remains the same

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. Finally, the economy moves to E3. The classical model of price level assumes that the economy moves from _____; thus, inflation _____ and real GDP _____.

A) E1 to E3, ignoring E2; increases; remains the same

B) E2 to E3, ignoring E1; remains the same; increases

C) E2 to E3; decreases; remains the same

D) E1 to E2, ignoring E3; remains the same; remains the same

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

30

The inflation tax is the effect on the public of:

A) the increase in the real value of money caused by inflation.

B) the decrease in the real value of money caused by inflation.

C) the result of indexing wages to inflation.

D) cost of living adjustments.

A) the increase in the real value of money caused by inflation.

B) the decrease in the real value of money caused by inflation.

C) the result of indexing wages to inflation.

D) cost of living adjustments.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

31

Use the following to answer questions:

(Figure: AD-AS) Refer to Figure: AD-AS. If our economy is at equilibrium with low-level inflation and the Fed uses expansionary monetary policy, the initial effect is that _____ will shift to _____ and the economy will move from _____.

A) AD1; AD2; E1 to E2

B) SRAS1; SRAS2; E2 to E3

C) SRAS2; SRAS1; E3 to E2

D) AD2; AD1; E2 to E1

(Figure: AD-AS) Refer to Figure: AD-AS. If our economy is at equilibrium with low-level inflation and the Fed uses expansionary monetary policy, the initial effect is that _____ will shift to _____ and the economy will move from _____.

A) AD1; AD2; E1 to E2

B) SRAS1; SRAS2; E2 to E3

C) SRAS2; SRAS1; E3 to E2

D) AD2; AD1; E2 to E1

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

32

In economies with persistently high inflation, an increase in the money supply will:

A) translate into a proportional increase in the aggregate price level much faster than usual.

B) translate into a proportional increase in the aggregate price level only in the long run.

C) not affect either the aggregate price level or the aggregate output.

D) translate into a proportional increase in the aggregate output much faster than usual.

A) translate into a proportional increase in the aggregate price level much faster than usual.

B) translate into a proportional increase in the aggregate price level only in the long run.

C) not affect either the aggregate price level or the aggregate output.

D) translate into a proportional increase in the aggregate output much faster than usual.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

33

Government debt is monetized when:

A) commercial banks buy newly issued Treasury bills.

B) the Fed conducts open-market purchases.

C) the Fed transfers part of its financial reserves to the Treasury, which in turn buys Treasury bills back.

D) the Fed sells Treasury bills in the bond market.

A) commercial banks buy newly issued Treasury bills.

B) the Fed conducts open-market purchases.

C) the Fed transfers part of its financial reserves to the Treasury, which in turn buys Treasury bills back.

D) the Fed sells Treasury bills in the bond market.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

34

Historical evidence has led economists to conclude that during periods of high inflation, the _____ model of the price level is a good approximation of reality because nominal wages and prices adjust more _____ than during periods of low inflation.

A) classical; quickly

B) modern; slowly

C) classical; slowly

D) modern; quickly

A) classical; quickly

B) modern; slowly

C) classical; slowly

D) modern; quickly

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following to answer questions:

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. SRAS1 will shift to SRAS2 because:

A) real wages rise in the long run.

B) nominal wages rise in the long run.

C) the real money supply rises in the long run.

D) aggregate real output rises in the long run.

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy starts at E1 and moves to E2, where AD2 intersects SRAS1. SRAS1 will shift to SRAS2 because:

A) real wages rise in the long run.

B) nominal wages rise in the long run.

C) the real money supply rises in the long run.

D) aggregate real output rises in the long run.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

36

The inflation tax is likely to be high when:

A) there is a budget surplus.

B) the government relies on seignorage to finance large portions of a budget deficit.

C) the Fed decreases the money supply.

D) corporate and personal income tax rates are increased.

A) there is a budget surplus.

B) the government relies on seignorage to finance large portions of a budget deficit.

C) the Fed decreases the money supply.

D) corporate and personal income tax rates are increased.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

37

When the Treasury Department borrows from the public to finance the government's purchases of goods and services and the Fed buys the debt back from the public in the form of Treasury bills, it is known as:

A) moral suasion.

B) money illusion.

C) structuring the deficit.

D) monetizing the debt.

A) moral suasion.

B) money illusion.

C) structuring the deficit.

D) monetizing the debt.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following to answer questions:

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy is initially at E1, where AD1 intersects SRAS1 and LRAS. Now, suppose that the AD1 shifts to AD2. That shift could be due to a(n):

A) increase in the aggregate price level.

B) decrease in government expenditure.

C) increase in tax rates.

D) increase in money supply.

(Figure: AD-AS) Refer to Figure: AD-AS. Suppose that the economy is initially at E1, where AD1 intersects SRAS1 and LRAS. Now, suppose that the AD1 shifts to AD2. That shift could be due to a(n):

A) increase in the aggregate price level.

B) decrease in government expenditure.

C) increase in tax rates.

D) increase in money supply.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

39

The main difference between the classical model of the price level and the modern understanding of the relationship between the money supply, the price level, and real GDP is that according to classical economists, _____, while today's economists _____.

A) money is neutral in the long run; do not consider money to be neutral in the long run.

B) the adjustment of prices takes some time; expect changes in the money supply to be instantaneous.

C) did not consider money to be neutral in the long run; consider money neutral in the long run.

D) the adjustment of prices to changes in the money supply is instantaneous; argue that this adjustment process takes some time.

A) money is neutral in the long run; do not consider money to be neutral in the long run.

B) the adjustment of prices takes some time; expect changes in the money supply to be instantaneous.

C) did not consider money to be neutral in the long run; consider money neutral in the long run.

D) the adjustment of prices to changes in the money supply is instantaneous; argue that this adjustment process takes some time.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

40

If the Fed increases the monetary base by $40 billion through open-market operations:

A) GDP will increase by $40 billion.

B) the price level will increase by $40 billion.

C) the U.S. government debt held by the public has been reduced by $40 billion.

D) government spending has increased by $40 billion.

A) GDP will increase by $40 billion.

B) the price level will increase by $40 billion.

C) the U.S. government debt held by the public has been reduced by $40 billion.

D) government spending has increased by $40 billion.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

41

Real seignorage is calculated by the:

A) real interest rate times the money supply.

B) rate of growth of the money supply times the real money supply.

C) real interest rate minus the inflation rate.

D) rate of growth of the money supply divided by the price index.

A) real interest rate times the money supply.

B) rate of growth of the money supply times the real money supply.

C) real interest rate minus the inflation rate.

D) rate of growth of the money supply divided by the price index.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

42

As people try to avoid the inflation tax, the government must _____ the inflation rate to _____.

A) lower; avoid a budget deficit

B) lower; raise the same revenue from inflation

C) increase; raise the same revenue from inflation

D) increase; avoid a budget surplus, which will harm employment

A) lower; avoid a budget deficit

B) lower; raise the same revenue from inflation

C) increase; raise the same revenue from inflation

D) increase; avoid a budget surplus, which will harm employment

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

43

From 2000 to 2008 Zimbabwe's prices:

A) decreased by 50%.

B) increased by 50%.

C) increased by 100%.

D) increased by 80 trillion percent.

A) decreased by 50%.

B) increased by 50%.

C) increased by 100%.

D) increased by 80 trillion percent.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

44

If an administration pursues expansionary policy before an election to bring down unemployment, it can:

A) produce inflation only if the real interest rate is zero to begin with.

B) lower people's expectations about inflation through a sense of false complacency.

C) produce inflation if the targeted rate of unemployment is too low.

D) produce disinflation if the expansionary monetary policy is unanticipated.

A) produce inflation only if the real interest rate is zero to begin with.

B) lower people's expectations about inflation through a sense of false complacency.

C) produce inflation if the targeted rate of unemployment is too low.

D) produce disinflation if the expansionary monetary policy is unanticipated.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

45

An inflation tax is:

A) the reduction in purchasing power due to inflation.

B) a tax on businesses for raising prices.

C) a tax on people with inflated incomes.

D) an excise tax on new automobile tires.

A) the reduction in purchasing power due to inflation.

B) a tax on businesses for raising prices.

C) a tax on people with inflated incomes.

D) an excise tax on new automobile tires.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

46

If the money supply grows by 4% and the real money supply is $100 billion, real seignorage is:

A) $4 billion.

B) $25 billion.

C) $400 billion.

D) $2.5 trillion.

A) $4 billion.

B) $25 billion.

C) $400 billion.

D) $2.5 trillion.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

47

Seignorage refers to the:

A) problems faced by Social Security as the population ages.

B) government's right to print money.

C) problems senior citizens face in retirement.

D) problems created when the government prints too much money.

A) problems faced by Social Security as the population ages.

B) government's right to print money.

C) problems senior citizens face in retirement.

D) problems created when the government prints too much money.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

48

Seignorage is the:

A) government's cost of printing and coining money.

B) revenue generated by the government's right to print money.

C) money financial institutions make selling government bonds to the Fed when the Fed creates money.

D) revenue the government generates in tax receipts.

A) government's cost of printing and coining money.

B) revenue generated by the government's right to print money.

C) money financial institutions make selling government bonds to the Fed when the Fed creates money.

D) revenue the government generates in tax receipts.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

49

Politicians may accept moderate inflation in an election year, since the _____ in aggregate _____ serves to _____.

A) increase; supply; increase output

B) decrease; supply; decrease employment

C) decrease; demand; decrease output

D) increase; demand; increase output

A) increase; supply; increase output

B) decrease; supply; decrease employment

C) decrease; demand; decrease output

D) increase; demand; increase output

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

50

Politicians may accept moderate inflation in an election year, since the _____ in aggregate _____ serves to _____.

A) increase; supply; decrease employment

B) decrease; supply; increase employment

C) decrease; demand; increase output

D) increase; demand; increase employment

A) increase; supply; decrease employment

B) decrease; supply; increase employment

C) decrease; demand; increase output

D) increase; demand; increase employment

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

51

Economists call the revenue generated by the government's right to print money:

A) seignorage.

B) monetary policy.

C) fiscal policy.

D) reserve policy.

A) seignorage.

B) monetary policy.

C) fiscal policy.

D) reserve policy.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

52

Zimbabwe's economic instability was caused primarily by:

A) its joining the Coalition of the Willing in the Iraq war.

B) its attempts to join the European Union.

C) the government's seizure of the country's farms, which disrupted production.

D) its high tariffs on imported goods.

A) its joining the Coalition of the Willing in the Iraq war.

B) its attempts to join the European Union.

C) the government's seizure of the country's farms, which disrupted production.

D) its high tariffs on imported goods.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

53

If the public holds $300 billion in monetary purchasing power and the inflation rate is 5%, then the inflation tax that year is:

A) $5 billion.

B) $15 billion.

C) $60 billion.

D) $1,500 billion.

A) $5 billion.

B) $15 billion.

C) $60 billion.

D) $1,500 billion.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

54

Politicians have an incentive to push the unemployment rate below the natural rate of unemployment right before their reelection because the:

A) expansionary monetary policy is used to finance the political campaigns.

B) political benefits are immediate and the economic costs are delayed.

C) Phillips curve is horizontal in the long run.

D) opportunistic seignorage gains are very large.

A) expansionary monetary policy is used to finance the political campaigns.

B) political benefits are immediate and the economic costs are delayed.

C) Phillips curve is horizontal in the long run.

D) opportunistic seignorage gains are very large.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

55

When a central bank prints money to pay government debts, causing rising prices that erode the purchasing power of money held by the public, it is called a(n) _____ tax.

A) payroll

B) inflation

C) currency

D) budget

A) payroll

B) inflation

C) currency

D) budget

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

56

If the real money supply is $500 billion and the money supply grows by 2%, then real seignorage is:

A) $25 trillion.

B) $1 trillion.

C) $10 billion.

D) $1 billion.

A) $25 trillion.

B) $1 trillion.

C) $10 billion.

D) $1 billion.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

57

If a high inflation rate leads people to _____ their money holdings, this may lead to a further increase in the money supply and _____ inflation.

A) reduce; lower

B) increase; lower

C) reduce; higher

D) increase; higher

A) reduce; lower

B) increase; lower

C) reduce; higher

D) increase; higher

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

58

The inflation tax refers to:

A) moving into higher tax brackets.

B) the reduction in the real value of money when inflation falls.

C) the reduction in the real value of money when inflation rises.

D) the tax imposed on inflation by the government.

A) moving into higher tax brackets.

B) the reduction in the real value of money when inflation falls.

C) the reduction in the real value of money when inflation rises.

D) the tax imposed on inflation by the government.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

59

A large inflation tax does NOT cause people to:

A) substitute real goods for money.

B) substitute interest-bearing assets for money.

C) reduce their real money holdings.

D) sell gold.

A) substitute real goods for money.

B) substitute interest-bearing assets for money.

C) reduce their real money holdings.

D) sell gold.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

60

Historically, governments have turned to seignorage to pay their bills when the:

A) economy is growing.

B) government lacks the will to reduce the budget deficit by raising taxes or reducing spending.

C) inflation rate is low.

D) unemployment rate is low.

A) economy is growing.

B) government lacks the will to reduce the budget deficit by raising taxes or reducing spending.

C) inflation rate is low.

D) unemployment rate is low.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

61

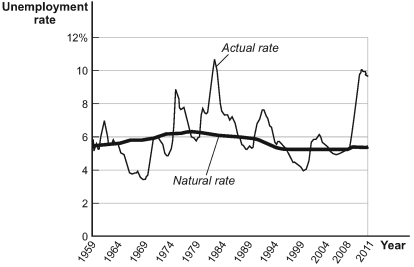

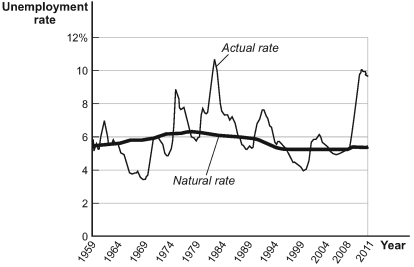

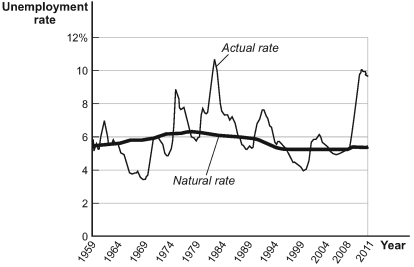

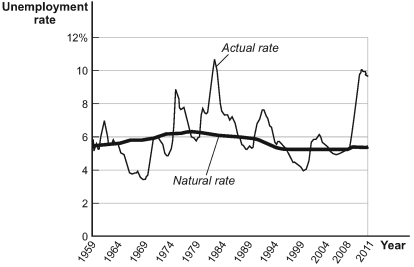

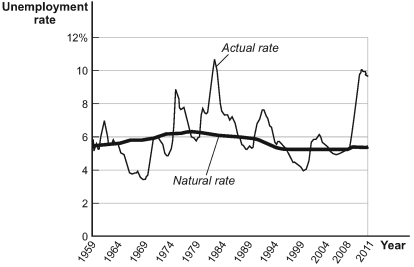

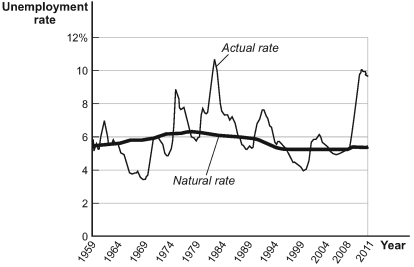

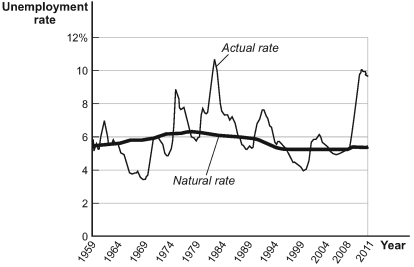

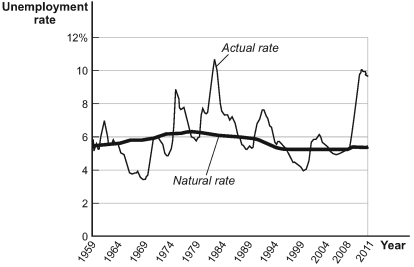

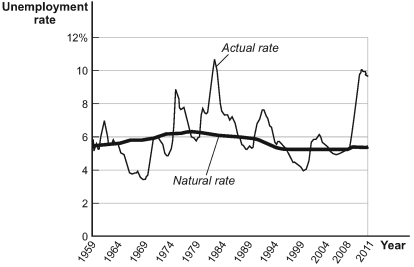

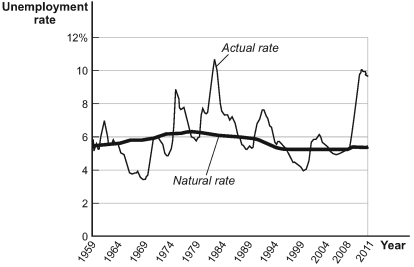

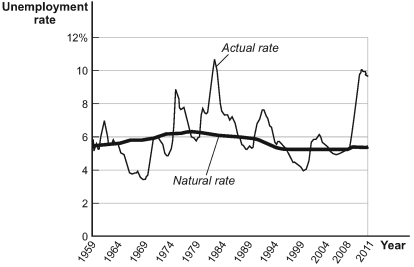

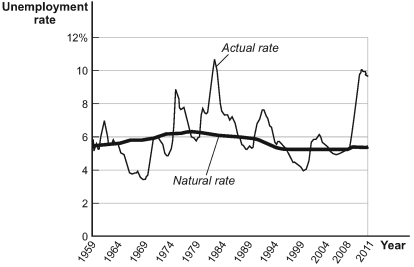

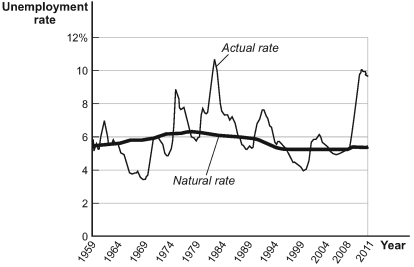

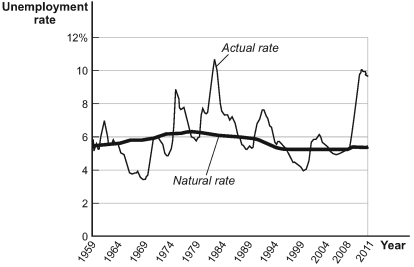

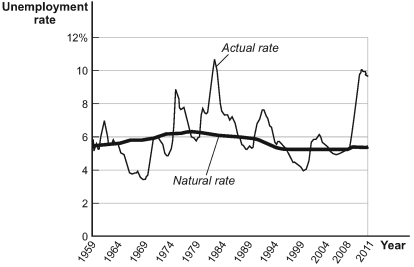

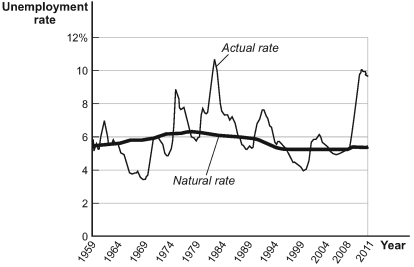

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the actual unemployment rate was approximately:

A) zero.

B) 3%.

C) 5%.

D) 10%.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the actual unemployment rate was approximately:

A) zero.

B) 3%.

C) 5%.

D) 10%.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

62

Suppose that actual aggregate output is equal to the potential output; the actual unemployment rate is:

A) equal to the natural rate of unemployment.

B) higher than the natural rate of unemployment.

C) zero.

D) equal to the cyclical rate of unemployment.

A) equal to the natural rate of unemployment.

B) higher than the natural rate of unemployment.

C) zero.

D) equal to the cyclical rate of unemployment.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

63

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the amount of cyclical unemployment was approximately:

A) 2%

B) 40.5%

C) 9%

D) 14%

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the amount of cyclical unemployment was approximately:

A) 2%

B) 40.5%

C) 9%

D) 14%

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

64

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the actual unemployment rate was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the actual unemployment rate was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

65

When the output gap is negative, the actual unemployment rate is:

A) above the natural rate.

B) below the natural rate.

C) equal to the natural rate.

D) The actual and natural unemployment rates are not related to the output gap.

A) above the natural rate.

B) below the natural rate.

C) equal to the natural rate.

D) The actual and natural unemployment rates are not related to the output gap.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

66

Which statement is likely to be TRUE if actual output is equal to potential output?

A) The actual unemployment rate is equal to the natural rate of unemployment.

B) The actual unemployment rate is above the natural rate of unemployment.

C) There will be zero unemployment.

D) The natural rate of unemployment will be above the actual unemployment rate.

A) The actual unemployment rate is equal to the natural rate of unemployment.

B) The actual unemployment rate is above the natural rate of unemployment.

C) There will be zero unemployment.

D) The natural rate of unemployment will be above the actual unemployment rate.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

67

If potential output is higher than actual output, then the unemployment rate is:

A) below the natural rate.

B) above the natural rate.

C) equal to the natural rate.

D) zero.

A) below the natural rate.

B) above the natural rate.

C) equal to the natural rate.

D) zero.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

68

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011 the output gap was:

A) positive.

B) negative.

C) zero.

D) impossible to determine without more information.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011 the output gap was:

A) positive.

B) negative.

C) zero.

D) impossible to determine without more information.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

69

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the natural unemployment rate (structural plus frictional) was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the natural unemployment rate (structural plus frictional) was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

70

When the output gap is _____, the unemployment rate is _____ the natural rate.

A) negative; below

B) zero; zero

C) inflationary; above

D) positive; below

A) negative; below

B) zero; zero

C) inflationary; above

D) positive; below

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

71

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the cyclical unemployment rate was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure 16-4: Actual and Natural Rates of Unemployment. In 1982, the cyclical unemployment rate was approximately:

A) zero.

B) 4%.

C) 6%.

D) 10%.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

72

If actual output growth is 5% when potential output growth is 5%, then the unemployment rate will:

A) not change.

B) rise.

C) fall.

D) be zero.

A) not change.

B) rise.

C) fall.

D) be zero.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

73

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2000, the output gap was:

A) positive.

B) negative.

C) zero.

D) impossible to determine without more information.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2000, the output gap was:

A) positive.

B) negative.

C) zero.

D) impossible to determine without more information.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

74

When the output gap is positive, the unemployment rate is:

A) positive.

B) above the natural rate.

C) below the natural rate.

D) negative.

A) positive.

B) above the natural rate.

C) below the natural rate.

D) negative.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

75

The unemployment rate will fall if potential output growth is:

A) higher than actual output growth.

B) lower than actual output growth.

C) equal to actual output growth.

D) higher than the inflation rate.

A) higher than actual output growth.

B) lower than actual output growth.

C) equal to actual output growth.

D) higher than the inflation rate.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

76

When the actual unemployment rate is equal to the natural rate of unemployment:

A) the unemployment rate is zero.

B) potential output exceeds actual output.

C) the output gap is zero.

D) actual output exceeds potential output.

A) the unemployment rate is zero.

B) potential output exceeds actual output.

C) the output gap is zero.

D) actual output exceeds potential output.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

77

When the output gap is _____, reflecting an inflationary gap, the unemployment rate is _____ the natural rate of unemployment.

A) positive; above

B) negative; below

C) positive; below

D) negative; above

A) positive; above

B) negative; below

C) positive; below

D) negative; above

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

78

The difference between real GDP and potential GDP is known as the:

A) price gap.

B) unemployment gap.

C) output gap.

D) budget deficit.

A) price gap.

B) unemployment gap.

C) output gap.

D) budget deficit.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

79

Use the following to answer questions:

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the natural unemployment rate was approximately:

A) zero.

B) 3%.

C) 5.5%.

D) 9%.

(Figure: Actual and Natural Rates of Unemployment) Refer to Figure: Actual and Natural Rates of Unemployment. In 2011, the natural unemployment rate was approximately:

A) zero.

B) 3%.

C) 5.5%.

D) 9%.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck

80

If an economy has just had a serious recession but real GDP is expanding once again, we can expect the unemployment rate to:

A) fall immediately.

B) rise immediately.

C) rise if people who were previously discouraged enter the work force but do not find jobs right away.

D) fall if people who were previously discouraged enter the work force but do not find jobs right away.

A) fall immediately.

B) rise immediately.

C) rise if people who were previously discouraged enter the work force but do not find jobs right away.

D) fall if people who were previously discouraged enter the work force but do not find jobs right away.

Unlock Deck

Unlock for access to all 194 flashcards in this deck.

Unlock Deck

k this deck