Deck 4: The General Fund and Special Revenue Funds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/69

Play

Full screen (f)

Deck 4: The General Fund and Special Revenue Funds

1

If a General Fund purchases capital assets with cash, what effect will this transaction have on the assets and fund balance, respectively, of the fund?

A) Neither assets nor fund balance will change (the increase in capital assets will offset the decrease in cash).

B) Both assets and fund balance will increase.

C) Both assets and fund balance will decrease.

D) No effect since the purchase is recorded only in the General Capital Assets account.

A) Neither assets nor fund balance will change (the increase in capital assets will offset the decrease in cash).

B) Both assets and fund balance will increase.

C) Both assets and fund balance will decrease.

D) No effect since the purchase is recorded only in the General Capital Assets account.

C

2

A school district receives a federal grant of $200,000 that is restricted to support a program designed to teach elementary school students a foreign language. The grant pays for only about five percent of the program costs. The remaining funds for the program come from a special tax levy made for this purpose. The program is accounted for in one fund. Which of the following funds could be used for this activity?

A) Special Revenue Fund.

B) Enterprise Fund.

C) General Fund.

D) Agency Fund.

A) Special Revenue Fund.

B) Enterprise Fund.

C) General Fund.

D) Agency Fund.

A

3

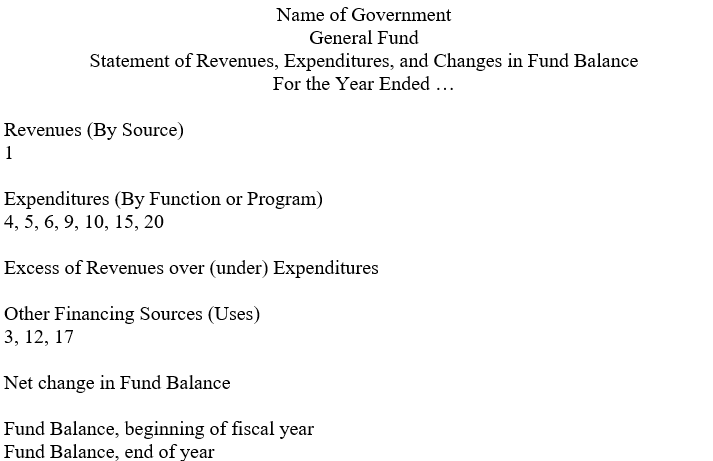

Prepare, using good form, a skeleton General Fund Statement of Revenues, Expenditures, and Changes in Fund Balances.

(B) Next, insert the number representing each of the following items in the appropriate location in the statement. If any item is not reported in the statement, explain why not.

1. Property taxes levied for and collected in the current year

2. Estimated cost of goods ordered but not received by year end

3. Transfer to another fund

4. Salary costs incurred during the year

5. Payment to retire long-term note principal

6. Payment of interest on long-term note

7. Accrued interest on long-term note

8. Receipt of proceeds of short-term note

9. Payment of interest on short-term note

10. Accrued interest on short-term note

11. Payment to retire principal of short-term note

12. Payment to establish an Enterprise Fund activity; no repayment expected

13. Long-term loan from the General Fund to an Internal Service Fund

14. Short-term loan from the General Fund to a Capital Projects Fund

15. Purchase of equipment

16. Purchase of temporary investment in securities

17. Receipt of proceeds from sale of fixed asset

18. Property taxes collected in advance on next year's tax levy

19. Depreciation of equipment

20. Purchase of electricity from the Electric Enterprise Fund

(B) Next, insert the number representing each of the following items in the appropriate location in the statement. If any item is not reported in the statement, explain why not.

1. Property taxes levied for and collected in the current year

2. Estimated cost of goods ordered but not received by year end

3. Transfer to another fund

4. Salary costs incurred during the year

5. Payment to retire long-term note principal

6. Payment of interest on long-term note

7. Accrued interest on long-term note

8. Receipt of proceeds of short-term note

9. Payment of interest on short-term note

10. Accrued interest on short-term note

11. Payment to retire principal of short-term note

12. Payment to establish an Enterprise Fund activity; no repayment expected

13. Long-term loan from the General Fund to an Internal Service Fund

14. Short-term loan from the General Fund to a Capital Projects Fund

15. Purchase of equipment

16. Purchase of temporary investment in securities

17. Receipt of proceeds from sale of fixed asset

18. Property taxes collected in advance on next year's tax levy

19. Depreciation of equipment

20. Purchase of electricity from the Electric Enterprise Fund

Not reported:

2-This is an encumbrance, not an expenditure. Encumbrances do not change total fund balance.

7-Interest on general long-term debt is recognized as expenditures in the period that it matures. It is not accrued except in very restrictive circumstances.

8 and 11-Short-term borrowings and repayments thereof do not affect the fund balance of a governmental fund. Fund assets and fund liabilities increase or decrease by equal amounts.

13 and 14-Interfund borrowings create interfund payables and receivables. They do not affect fund balance. Indeed, to allow them to do so, even if long-term, would make manipulation of fund balances quite easy.

16-This transaction does not change the net assets of a fund or its fund balance.

18-These taxes do not meet the availability criterion. A deferred inflow of resources, called taxes collected in advance, will be reported in the balance sheet.

19-Capital assets are not assets of governmental funds. The funds are essentially working capital entities. Depreciation is not a use of working capital and does not affect the fund. Depreciation of general capital assets is reported only in the government-wide financial statements.

4

Listed below (in alphabetical order) are the general ledger and budgetary accounts for the City of Walland. All balances are year end, unless otherwise noted. All accounts have a normal balance. At the end of the year, the City Council passed an ordinance that all outstanding orders would be honored in the following fiscal year. Also, the Finance Officer set aside $40 for equipment replacement.

Requirements:

1. Prepare the Statement of Revenues, Expenditures, and Changes in Fund Balance for the year ended June 30, 20X4.

2. Prepare the Balance Sheet for the year ended June 30, 20X4.

3. Prepare all necessary closing entries.

Requirements:

1. Prepare the Statement of Revenues, Expenditures, and Changes in Fund Balance for the year ended June 30, 20X4.

2. Prepare the Balance Sheet for the year ended June 30, 20X4.

3. Prepare all necessary closing entries.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

5

Problem 8 - Fund Balance Calculations

The City of Armona had the following assets and liabilities at June 30, 20X3, the end of its fiscal year (all amounts are in thousands):

Additional information:

1. The city received a state grant of $300 stipulating that it could be spent at any time on equipment. To date, none of the money has been spent.

"2. The city council, in a formal vote, adopted a binding resolution to set aside another $500 for equipment purchases.

Requirement: Calculate the five components of Fund Balance."

The City of Armona had the following assets and liabilities at June 30, 20X3, the end of its fiscal year (all amounts are in thousands):

Additional information:

1. The city received a state grant of $300 stipulating that it could be spent at any time on equipment. To date, none of the money has been spent.

"2. The city council, in a formal vote, adopted a binding resolution to set aside another $500 for equipment purchases.

Requirement: Calculate the five components of Fund Balance."

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

6

An interfund transfer is

A) a reciprocal transaction.

B) a nonreciprocal transaction.

C) a short-term interfund loan.

D) a long-term interfund loan.

A) a reciprocal transaction.

B) a nonreciprocal transaction.

C) a short-term interfund loan.

D) a long-term interfund loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following is not a characteristic of the General Fund?

A) Is used to account for all financial resources that are not restricted, committed, or assigned to a specific purpose and consequently accounted for in another fund.

B) Is used by all governments that report governmental fund activities.

C) Requires a combining statement at year end for governments that have more than one General Fund.

D) Is established at inception of a government and exists throughout its life.

A) Is used to account for all financial resources that are not restricted, committed, or assigned to a specific purpose and consequently accounted for in another fund.

B) Is used by all governments that report governmental fund activities.

C) Requires a combining statement at year end for governments that have more than one General Fund.

D) Is established at inception of a government and exists throughout its life.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

8

A new computer, which had been estimated to cost $28,000, was received for an activity of a special revenue fund. The actual cost of the computer was $29,400. To record this in the special revenue fund,

A) Capital assets should be debited for $29,400.

B) Expenditures should be debited for $28,000.

C) Expenditures should be debited for $29,400.

D) There is no entry in the special revenue fund. The General Capital Assets account should be debited for $28,000.

A) Capital assets should be debited for $29,400.

B) Expenditures should be debited for $28,000.

C) Expenditures should be debited for $29,400.

D) There is no entry in the special revenue fund. The General Capital Assets account should be debited for $28,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

9

Selected transactions of the City of Miser Station General Fund for the 20X1 fiscal year are presented on the following page. All amounts are in thousands of dollars.

General instructions:

a. Dates and formal explanations may be omitted, but number your entries appropriately.

b. All interest rates are annual percentage rates (APRs).

c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries.

d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues-Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay.

e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry).

Requirements:

1. Prepare the General Fund general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE."

Transactions:

1. The City Council approved the following budget for the fiscal year:

Estimated Revenues $20,000

Appropriations 18,900

Of these amounts, $15,000 is for operating expenditures and $12,000 is for property tax revenues.

2. The property tax levy was recorded, $12,000, of which $600 will probably prove uncollectible.

3. Purchase orders were approved and issued for the following:

Non-inventory supplies $150

Police vehicle 20

4. All of the non-inventory supplies on order from entry 3 were received. The actual cost was $155 and payment will be made at a later date.

?

5. Cash receipts were (see entry 2):

6. Current taxes receivable (entries 2 and 5) and the related allowance (entry 2) were reclassified as delinquent after the due date.

7. A loan of $50 was made from the General Fund to the City Gasoline Tax Fund (CGTF), which is accounted for as a Special Revenue Fund. The loan will be repaid in five years.

8. The $10 of remaining assets (cash) from a terminated Capital Projects Fund (CPF) were received.

9. A pickup truck purchased seven years ago for $30 with General Fund money was sold for $5. The City's proprietary funds usually depreciate this type of asset over a 10-year period using straight-line depreciation with zero (0) salvage value and disposes of assets at the end of its useful life.

10. Paid $25 to City employees.

11. Sold land for $300, which had been used many years ago as a public park. The land had been purchased for $140.

12. General Fund resources of $250 were paid to a newly established Capital Projects Fund. The resources will not be repaid to the General Fund.

13. The City paid $140 from its General Fund to the fund that services the City's long-term debt.

14. The police vehicle (entry 3) was received and $19 in cash was paid to the vendor.

15. Paid $500 to the Debt Service Fund to provide for upcoming principal and interest payments.

16. Paid $5,000 to the City Airport Enterprise Fund to provide financing for a major expansion project; $2,000 is not required to be repaid, but $3,000 is to be repaid at the end of five years.

17. Loaned $320 to the Capital Projects Fund-to be repaid in 90 days.

18. Paid $12 to the Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures of that fund.

19. Received a bill from the Utility Enterprise Fund for electricity usage charged to General Fund departments and agencies, $300. This bill will be paid at a later date.

20. Instructed the Library Special Revenue Fund to pay its portion of the utility bill (entry 19), $25; the cash was not immediately received.

21. The Library Special Revenue Fund paid the amount owed (entry 20).

22. Taxes receivable of $100 were determined to be uncollectible and were written off.

General instructions:

a. Dates and formal explanations may be omitted, but number your entries appropriately.

b. All interest rates are annual percentage rates (APRs).

c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries.

d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues-Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay.

e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry).

Requirements:

1. Prepare the General Fund general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE."

Transactions:

1. The City Council approved the following budget for the fiscal year:

Estimated Revenues $20,000

Appropriations 18,900

Of these amounts, $15,000 is for operating expenditures and $12,000 is for property tax revenues.

2. The property tax levy was recorded, $12,000, of which $600 will probably prove uncollectible.

3. Purchase orders were approved and issued for the following:

Non-inventory supplies $150

Police vehicle 20

4. All of the non-inventory supplies on order from entry 3 were received. The actual cost was $155 and payment will be made at a later date.

?

5. Cash receipts were (see entry 2):

6. Current taxes receivable (entries 2 and 5) and the related allowance (entry 2) were reclassified as delinquent after the due date.

7. A loan of $50 was made from the General Fund to the City Gasoline Tax Fund (CGTF), which is accounted for as a Special Revenue Fund. The loan will be repaid in five years.

8. The $10 of remaining assets (cash) from a terminated Capital Projects Fund (CPF) were received.

9. A pickup truck purchased seven years ago for $30 with General Fund money was sold for $5. The City's proprietary funds usually depreciate this type of asset over a 10-year period using straight-line depreciation with zero (0) salvage value and disposes of assets at the end of its useful life.

10. Paid $25 to City employees.

11. Sold land for $300, which had been used many years ago as a public park. The land had been purchased for $140.

12. General Fund resources of $250 were paid to a newly established Capital Projects Fund. The resources will not be repaid to the General Fund.

13. The City paid $140 from its General Fund to the fund that services the City's long-term debt.

14. The police vehicle (entry 3) was received and $19 in cash was paid to the vendor.

15. Paid $500 to the Debt Service Fund to provide for upcoming principal and interest payments.

16. Paid $5,000 to the City Airport Enterprise Fund to provide financing for a major expansion project; $2,000 is not required to be repaid, but $3,000 is to be repaid at the end of five years.

17. Loaned $320 to the Capital Projects Fund-to be repaid in 90 days.

18. Paid $12 to the Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures of that fund.

19. Received a bill from the Utility Enterprise Fund for electricity usage charged to General Fund departments and agencies, $300. This bill will be paid at a later date.

20. Instructed the Library Special Revenue Fund to pay its portion of the utility bill (entry 19), $25; the cash was not immediately received.

21. The Library Special Revenue Fund paid the amount owed (entry 20).

22. Taxes receivable of $100 were determined to be uncollectible and were written off.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

10

A Special Revenue Fund

A) Is used to account for resources restricted or committed to expenditures for capital outlay or debt service purposes.

B) Must be used to account for all expendable restricted or committed resources.

C) Must include resources from a revenue source that is restricted or committed to expenditures for specific purposes other than debt service or capital outlay.

D) Must be used to account for all nonexpendable, restricted or committed resources.

A) Is used to account for resources restricted or committed to expenditures for capital outlay or debt service purposes.

B) Must be used to account for all expendable restricted or committed resources.

C) Must include resources from a revenue source that is restricted or committed to expenditures for specific purposes other than debt service or capital outlay.

D) Must be used to account for all nonexpendable, restricted or committed resources.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

11

The accounting equation for a special revenue fund is

A) Assets - Liabilities = Net Position.

B) Financial Assets + Deferred Outflows - Related Liabilities - Deferred Inflows = Fund Balance.

C) General Capital Assets - Unmatured General Long-Term Liabilities = Net Position.

D) Current Assets = Current Liabilities.

A) Assets - Liabilities = Net Position.

B) Financial Assets + Deferred Outflows - Related Liabilities - Deferred Inflows = Fund Balance.

C) General Capital Assets - Unmatured General Long-Term Liabilities = Net Position.

D) Current Assets = Current Liabilities.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

12

Selected transactions for the Jackson Independent School District are presented below. All amounts are in thousands of dollars.

1. On January 1, the school district levied property taxes of $8,000. The due date for the taxes is March 31. The school district expects to collect all except $200 either by the end of the fiscal year or within 60 days thereafter. The other $200 is expected to be uncollectible.

2. During the first quarter (ending March 31) the school district collected $6,800 of its current year's property taxes. The rest of the taxes are past due.

3. On June 12, the school district wrote off $88 of property taxes as uncollectible.

4. From March 31 to December 31 the school district collected $700 of the property taxes that were levied on January 1. The school district expects to collect an additional $300 of these taxes during the first two months of the next fiscal year.

Instructions: Prepare the necessary journal entries. Dates and explanations may be omitted. If a transaction requires no entry, do not leave it blank: state "No Entry Required" and explain why

1. On January 1, the school district levied property taxes of $8,000. The due date for the taxes is March 31. The school district expects to collect all except $200 either by the end of the fiscal year or within 60 days thereafter. The other $200 is expected to be uncollectible.

2. During the first quarter (ending March 31) the school district collected $6,800 of its current year's property taxes. The rest of the taxes are past due.

3. On June 12, the school district wrote off $88 of property taxes as uncollectible.

4. From March 31 to December 31 the school district collected $700 of the property taxes that were levied on January 1. The school district expects to collect an additional $300 of these taxes during the first two months of the next fiscal year.

Instructions: Prepare the necessary journal entries. Dates and explanations may be omitted. If a transaction requires no entry, do not leave it blank: state "No Entry Required" and explain why

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

13

The city of Brittainville's Special Revenue Fund levied $350,000 in taxes, during the current year. (1% is expected to be uncollectible.) Also during the year, the fund collected $7,500 of interest revenue and $50,000 was transferred from the General Fund. As a result of these transactions fund balance will increase by

A) $407,500.

B) $404,000.

C) $357,500.

D) $354,000.

A) $407,500.

B) $404,000.

C) $357,500.

D) $354,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

14

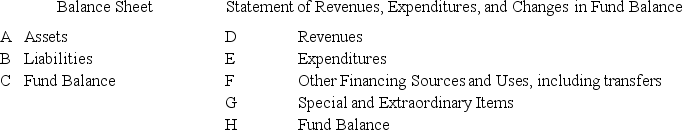

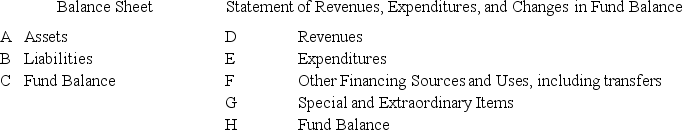

Listed below are the sections of the Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance that would be prepared for the General Fund:

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.

1.Services rendered to the City by employees

2. Allowance for Uncollectible Taxes

3. Advance to Enterprise Fund

4. Sale of park land (considered unusual in nature but under the control of management)

5. Property taxes levied and collected

6. Fund Balance – Nonspendable – Inventory

7. Vouchers Payable

8. Transfer to the Special Revenue Fund

9. Correction of Prior Year Error

10. Due to Internal Service Fund

11. Purchase of a capital asset

12. Building inspection services provided to contractors

13. Receipt of materials ordered

14. Payment from Fund A to Fund B for transaction erroneously recorded in Fund B

15. Insurance recovery from a tornado (tornado was considered unusual and infrequent)

16. Investments

17. Interest earned on investments

18. Short-term borrowing from a bank

19. Interest paid on short-term loan

20. Due from Special Revenue Fund

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.1.Services rendered to the City by employees

2. Allowance for Uncollectible Taxes

3. Advance to Enterprise Fund

4. Sale of park land (considered unusual in nature but under the control of management)

5. Property taxes levied and collected

6. Fund Balance – Nonspendable – Inventory

7. Vouchers Payable

8. Transfer to the Special Revenue Fund

9. Correction of Prior Year Error

10. Due to Internal Service Fund

11. Purchase of a capital asset

12. Building inspection services provided to contractors

13. Receipt of materials ordered

14. Payment from Fund A to Fund B for transaction erroneously recorded in Fund B

15. Insurance recovery from a tornado (tornado was considered unusual and infrequent)

16. Investments

17. Interest earned on investments

18. Short-term borrowing from a bank

19. Interest paid on short-term loan

20. Due from Special Revenue Fund

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

15

Ledford County levied property taxes of $10,000,000, 2% of which is expected to be uncollectible. Prior to this new levy, the county still had $ 350,000 of uncollected taxes from previous years. How much should be reported as Taxes Receivable after the new levy has been recorded?

A) $10,000,000.

B) $9,800,000.

C) $10,350,000.

D) $10,150,000.

A) $10,000,000.

B) $9,800,000.

C) $10,350,000.

D) $10,150,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

16

General Fund expenditures for uncollectible accounts receivable should be reported in the period that the receivable is

A) Established.

B) Written off as uncollectible.

C) Legally due and payable.

D) There are no expenditures for uncollectible accounts receivable.

A) Established.

B) Written off as uncollectible.

C) Legally due and payable.

D) There are no expenditures for uncollectible accounts receivable.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

17

Selected transactions of the City of Miser Station General Fund for the 20X1 fiscal year are presented on the following page. All amounts are in thousands of dollars.

General instructions:

a. Dates and formal explanations may be omitted, but number your entries appropriately.

b. All interest rates are annual percentage rates (APRs).

c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries.

d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues-Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay. Additional detail for budgetary entries is not required.

e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry).

Requirements:

1. Prepare the general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE."

Transactions:

1. The City Council approved the following budget for the fiscal year:

Of these amounts, $8,000 is for operating expenditures and $10,000 is for property tax revenues.

2. The property tax levy was recorded, $10,000, of which 3% will probably prove uncollectible.

3. The city ordered $200 in supplies.

4. The City borrowed $500 from the Blount National Bank on a two-month, 6% note.

5. Cash receipts were (see entry #2):

6. The City Council revised the budget (see entry #1). Appropriations were reduced $3,000 and Estimated Revenues were reduced $2,000 (Appropriations for Expenditures - Operating were reduced $1,000; property tax revenues were not affected).

7. Of the previous supplies order (Entry #3), 75% of the order was received. The actual cost of the goods received was $135. The amount due the vendor will be paid at a later date.

8. City employees were paid, $25.

9. The city ordered a new police car. The estimated cost is $21.

10. The City repaid the short-term note (see entry #4) when due.

11. Wrote off $100 of taxes receivable as uncollectible (see entry #2).

12. Paid $12 to the Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures of that fund.

13. The city received the police car (see entry #9). The actual cost was $22. The vendor will be paid at a later date.

14. The city collected $50 for licenses.

15. The city paid $157 on account.

General instructions:

a. Dates and formal explanations may be omitted, but number your entries appropriately.

b. All interest rates are annual percentage rates (APRs).

c. Record your entries on the lined paper provided with your answer pages. Sufficient space has been provided to allow you to skip lines between entries.

d. When recording Revenues, classify them as Revenues-Property Taxes or Revenues-Other. When recording expenditures, classify them as Expenditures-Operating, Expenditures-Debt Service, or Expenditures-Capital Outlay. Additional detail for budgetary entries is not required.

e. Show all work for any amount required in an entry that is not given in the exam (except when recording the amount necessary to balance the journal entry).

Requirements:

1. Prepare the general ledger journal entries for the transactions. If no entry is required, do not leave it blank. State "No Entry Required" and briefly explain why.

2. For any transaction affecting the General Capital Assets or General Long-Term Liabilities accounts, indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element, use "NE."

Transactions:

1. The City Council approved the following budget for the fiscal year:

Of these amounts, $8,000 is for operating expenditures and $10,000 is for property tax revenues.

2. The property tax levy was recorded, $10,000, of which 3% will probably prove uncollectible.

3. The city ordered $200 in supplies.

4. The City borrowed $500 from the Blount National Bank on a two-month, 6% note.

5. Cash receipts were (see entry #2):

6. The City Council revised the budget (see entry #1). Appropriations were reduced $3,000 and Estimated Revenues were reduced $2,000 (Appropriations for Expenditures - Operating were reduced $1,000; property tax revenues were not affected).

7. Of the previous supplies order (Entry #3), 75% of the order was received. The actual cost of the goods received was $135. The amount due the vendor will be paid at a later date.

8. City employees were paid, $25.

9. The city ordered a new police car. The estimated cost is $21.

10. The City repaid the short-term note (see entry #4) when due.

11. Wrote off $100 of taxes receivable as uncollectible (see entry #2).

12. Paid $12 to the Special Revenue Fund to repay it for General Fund employee salaries that were inadvertently recorded as expenditures of that fund.

13. The city received the police car (see entry #9). The actual cost was $22. The vendor will be paid at a later date.

14. The city collected $50 for licenses.

15. The city paid $157 on account.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

18

Employees of the City of Calderwood are paid from the General Fund. These employees are paid for amounts earned over a two-week period. The amount due the employees is disbursed one week later. The last payroll period in December ended December 27, 20X2. The fiscal year ended December 31, 20X2. The employees were paid January 3, 20X3. The salaries earned for the last payroll period of 20X2 should be reported as expenditures of

A) 20X2.

B) 20X2 if paid within the first 60 days of the next year.

C) 20X3.

D) Either 20X2 or 20X3 depending upon the government's policy, which must be applied consistently.

A) 20X2.

B) 20X2 if paid within the first 60 days of the next year.

C) 20X3.

D) Either 20X2 or 20X3 depending upon the government's policy, which must be applied consistently.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

19

Transactions in governmental accounting may be classified as being either:

• External - transactions between the governmental unit and its citizens, employees, suppliers, creditors, or other governments.

• Internal - transactions between funds

A listing of all possible transactions would then look like this:

A. External transactions

B. Long-term loans

C. Transfers

D. Interfund services provided and used

E. Reimbursements

F. Short-term loans

G. Other transactions between funds that do not meet the criteria B to F

Identify the type of transaction that best fits each of the following events:

1. A government-owned and operated electric utility billed its industrial and commercial users $2,000,000 for electric usage.

2. The same government-owned and operated electric utility billed the local government $150,000 for electric usage. The entire bill was sent to the General Fund.

3. Some General Fund money was advanced to a Capital Projects Fund to allow construction on a project to begin before related bonds were to be issued. The amount is to be repaid in 6 months.

4. A vehicle used by the Parks and Recreation Activity, which is accounted for in the General Fund, was reassigned to the Golf course, which is accounted for in an Enterprise Fund.

5. Property taxes were levied by the General Fund on the property owners of the City.

6. The annual payment from the General Fund to a Debt Service Fund for the annual long-term debt principal and interest payment on some serial bonds issued five years earlier by the General Fund.

7. An invoice that should have been paid by Special Revenue Fund #1 was erroneously paid by Special Revenue Fund #2. Money was paid by SRF #1 to SRF #2 to correct the error.

8. Computer support for government functions is provided centrally by an Automated Data Processing Internal Service Fund which bills each department monthly based on CPU time. The bill for November was sent to the General Fund for payment.

9. Special Revenue Fund cash was contributed to establish an Enterprise Fund.

10. A payment from an Enterprise Fund to the General Fund for utilities paid for with General Fund cash and recorded as expenditures in the General Fund in the current year (See entry 2).

11. The remaining assets of a Debt Service Fund were transferred to the General Fund for use in operations.

12. The General Fund provided money to an Enterprise Fund to purchase capital assets. This payment is to be repaid in 5 years without interest.

• External - transactions between the governmental unit and its citizens, employees, suppliers, creditors, or other governments.

• Internal - transactions between funds

A listing of all possible transactions would then look like this:

A. External transactions

B. Long-term loans

C. Transfers

D. Interfund services provided and used

E. Reimbursements

F. Short-term loans

G. Other transactions between funds that do not meet the criteria B to F

Identify the type of transaction that best fits each of the following events:

1. A government-owned and operated electric utility billed its industrial and commercial users $2,000,000 for electric usage.

2. The same government-owned and operated electric utility billed the local government $150,000 for electric usage. The entire bill was sent to the General Fund.

3. Some General Fund money was advanced to a Capital Projects Fund to allow construction on a project to begin before related bonds were to be issued. The amount is to be repaid in 6 months.

4. A vehicle used by the Parks and Recreation Activity, which is accounted for in the General Fund, was reassigned to the Golf course, which is accounted for in an Enterprise Fund.

5. Property taxes were levied by the General Fund on the property owners of the City.

6. The annual payment from the General Fund to a Debt Service Fund for the annual long-term debt principal and interest payment on some serial bonds issued five years earlier by the General Fund.

7. An invoice that should have been paid by Special Revenue Fund #1 was erroneously paid by Special Revenue Fund #2. Money was paid by SRF #1 to SRF #2 to correct the error.

8. Computer support for government functions is provided centrally by an Automated Data Processing Internal Service Fund which bills each department monthly based on CPU time. The bill for November was sent to the General Fund for payment.

9. Special Revenue Fund cash was contributed to establish an Enterprise Fund.

10. A payment from an Enterprise Fund to the General Fund for utilities paid for with General Fund cash and recorded as expenditures in the General Fund in the current year (See entry 2).

11. The remaining assets of a Debt Service Fund were transferred to the General Fund for use in operations.

12. The General Fund provided money to an Enterprise Fund to purchase capital assets. This payment is to be repaid in 5 years without interest.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

20

Each of the following transactions would decrease fund balance in the General Fund except

A) The purchase of capital assets.

B) The principal repayment of long-term debt.

C) Depreciation.

D) Salaries and wages.

A) The purchase of capital assets.

B) The principal repayment of long-term debt.

C) Depreciation.

D) Salaries and wages.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

21

The city's central garage, which is accounted for as an Internal Service Fund, repairs and maintains all of the city's vehicles. The fire department is accounted for in the General Fund. The Central Garage Internal Service Fund sends a bill to the fire department for $18,000, which represents the cost of maintaining fire trucks for the month. The Central Garage Internal Service Fund should record

A) Debit Due from General Fund and credit Revenues.

B) Debit Due from General Fund and credit Expenses.

C) Debit Expenses and credit Due to General Fund.

D) Debit Revenues and credit Due to General Fund.

A) Debit Due from General Fund and credit Revenues.

B) Debit Due from General Fund and credit Expenses.

C) Debit Expenses and credit Due to General Fund.

D) Debit Revenues and credit Due to General Fund.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

22

In governmental funds, governments must accrue interest on

A) General long-term debt.

B) General long-term debt, but only if the interest is paid in the first 60 days after year end.

C) Short-term debt of the fund.

D) Short-term debt of the fund, but only if the interest is paid in the first 60 days after year end.

A) General long-term debt.

B) General long-term debt, but only if the interest is paid in the first 60 days after year end.

C) Short-term debt of the fund.

D) Short-term debt of the fund, but only if the interest is paid in the first 60 days after year end.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

23

A bill that should have been paid by a Special Revenue Fund was erroneously paid by the General Fund. The General Fund refunds the amount to the Special Revenue Fund. This transaction is an example of an interfund

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

24

A city's General Fund provides a two-year loan to the Internal Service Fund. To record this transaction the city should record a debit to what account in the General Fund?

A) Due from the Internal Service Fund.

B) Advance to the Internal Service Fund.

C) Advance from the Internal Service Fund.

D) Transfer to the Internal Service Fund.

A) Due from the Internal Service Fund.

B) Advance to the Internal Service Fund.

C) Advance from the Internal Service Fund.

D) Transfer to the Internal Service Fund.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

25

Assume the General Fund borrows $50,000 from the Enterprise Fund. The interfund loan is scheduled to be paid back in five years. Which of the following statements properly characterizes the reporting effects of this transaction?

A) General Fund Assets increase; General Capital Assets account increase.

B) General Fund Assets and Fund Balance increase.

C) General Fund Assets and Liabilities increase.

D) General Fund Assets and General Long-Term Liabilities account increase.

A) General Fund Assets increase; General Capital Assets account increase.

B) General Fund Assets and Fund Balance increase.

C) General Fund Assets and Liabilities increase.

D) General Fund Assets and General Long-Term Liabilities account increase.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

26

Accounts receivables are determined to be uncollectible and are written off. The following account should be debited:

A) Bad Debt Expense.

B) Revenue.

C) Allowance for Uncollectible Accounts Receivable.

D) Accounts Receivable.

A) Bad Debt Expense.

B) Revenue.

C) Allowance for Uncollectible Accounts Receivable.

D) Accounts Receivable.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following interfund activities is classified as a reciprocal transaction?

A) Reimbursing one fund from another for expenditures or expenses that were previously recorded in error.

B) Moving assets (e.g., cash and inventory) from one fund to another without receiving resources or services in return.

C) Transferring Enterprise Fund resources to the General Fund or other funds to subsidize their operations.

D) Selling and purchasing goods or services between funds at approximately market value.

A) Reimbursing one fund from another for expenditures or expenses that were previously recorded in error.

B) Moving assets (e.g., cash and inventory) from one fund to another without receiving resources or services in return.

C) Transferring Enterprise Fund resources to the General Fund or other funds to subsidize their operations.

D) Selling and purchasing goods or services between funds at approximately market value.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

28

If an Enterprise Fund transfers $10,000 to the General Fund and the General Fund loans $15,000 to an Internal Service Fund, the effect on the fund balance of the General Fund would be

A) An increase of $10,000.

B) A net decrease of $5,000.

C) A decrease of $15,000.

D) A net increase of $5,000.

A) An increase of $10,000.

B) A net decrease of $5,000.

C) A decrease of $15,000.

D) A net increase of $5,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

29

A local school district issued a short-term note payable to purchase $500,000 of recreation equipment. The note will be repaid with General Fund resources. The General Fund would record

A) Debit Expenditures - Capital Outlay and credit Due to Bank, for $500,000.

B) Debit Capital Assets and credit Notes Payable, for $500,000.

C) Debit Capital Assets and credit Revenues, for $500,000.

D) Debit Expenditures - Capital Outlay and credit Note Payable, for $500,000.

A) Debit Expenditures - Capital Outlay and credit Due to Bank, for $500,000.

B) Debit Capital Assets and credit Notes Payable, for $500,000.

C) Debit Capital Assets and credit Revenues, for $500,000.

D) Debit Expenditures - Capital Outlay and credit Note Payable, for $500,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

30

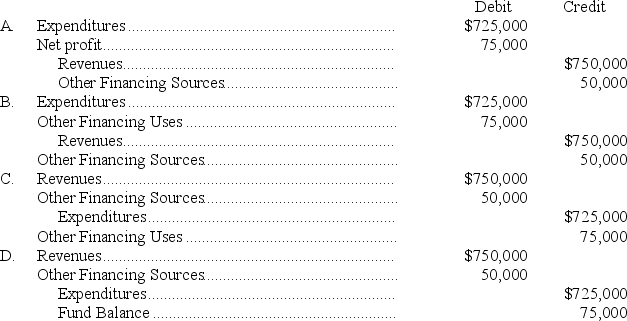

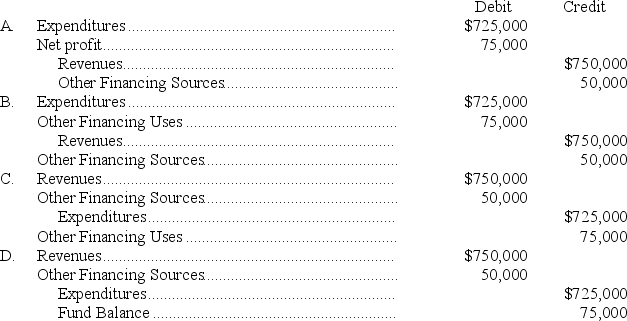

The Special Revenue Fund of the city of Wakefield ended its fiscal year with revenues of $750,000, other financing sources of $50,000, and expenditures of $725,000. The closing entry in the Special Revenue Fund would be

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

31

$1,000,000 of General Fund cash was contributed to provide permanent capital for a newly established municipal landfill Enterprise Fund. This transaction is an example of an interfund

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

32

General Fund resources of $500,000 were contributed to a Capital Projects Fund to finance a portion of the cost of a major capital project. This transaction is an example of an interfund

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

33

A city's police department receives goods from an Internal Service Fund for which it has not yet paid the ISF. To record this transaction the city should record a credit to what account in the General Fund?

A) Due to the Internal Service Fund.

B) Advance from the Internal Service Fund.

C) Vouchers payable.

D) Assigned fund balance.

A) Due to the Internal Service Fund.

B) Advance from the Internal Service Fund.

C) Vouchers payable.

D) Assigned fund balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

34

$40,000 of General Fund expenditures had been paid for from and recorded in a Special Revenue Fund. Upon discovery of this situation, $40,000 was paid from the General Fund to the Special Revenue Fund. This transaction is recorded in the Special Revenue Fund by debiting Cash and crediting

A) Expenditures.

B) Other financing sources in.

C) Transfer in.

D) Revenues.

A) Expenditures.

B) Other financing sources in.

C) Transfer in.

D) Revenues.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

35

For a transaction to be classified as an extraordinary item it must be

A) Unusual in nature and infrequent in occurrence.

B) Unusual in nature or infrequent in occurrence but not under the control of management.

C) Unusual in nature or infrequent in occurrence and under the control of management.

D) Unusual in nature or infrequent in occurrence.

A) Unusual in nature and infrequent in occurrence.

B) Unusual in nature or infrequent in occurrence but not under the control of management.

C) Unusual in nature or infrequent in occurrence and under the control of management.

D) Unusual in nature or infrequent in occurrence.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

36

Assume the General Fund has two outstanding investments as of its 6/30/X5 year end, as follows:

-$100,000 Certificate of Deposit, 6 month original maturity, 3% annual interest rate, purchased 4/30/X5

-$500,000 Commercial Paper, 8 month original maturity, 3% annual interest rate, purchased 1/31/X5

The interest revenue that would be recorded in the GAAP-based external financial statements for the General Fund under the fair value method as of 6/30/X5 assuming a 3% interest rate still applies to such investments would be

A) $500.

B) $6,250.

C) $6,750.

D) $11,500.

-$100,000 Certificate of Deposit, 6 month original maturity, 3% annual interest rate, purchased 4/30/X5

-$500,000 Commercial Paper, 8 month original maturity, 3% annual interest rate, purchased 1/31/X5

The interest revenue that would be recorded in the GAAP-based external financial statements for the General Fund under the fair value method as of 6/30/X5 assuming a 3% interest rate still applies to such investments would be

A) $500.

B) $6,250.

C) $6,750.

D) $11,500.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

37

A government's General Fund departments purchased electric services from the government's own Electric Utility Enterprise Fund. This transaction is an example of an interfund

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following should not be accrued as expenditures in a governmental fund at year end?

A) Salaries earned by employees but not paid.

B) Repair work performed by contractors, but not completed.

C) Interest incurred on short-term debt, but not yet due.

D) Interest incurred on long-term debt, but not yet due.

A) Salaries earned by employees but not paid.

B) Repair work performed by contractors, but not completed.

C) Interest incurred on short-term debt, but not yet due.

D) Interest incurred on long-term debt, but not yet due.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

39

Taxes receivable of $80,000, which have a related allowance for uncollectible taxes of $8,000, become delinquent. The entry to record this includes a debit to

A) Taxes Receivable - Current.

B) Allowance for Uncollectible Current Taxes.

C) Allowance for Uncollectible Delinquent Taxes.

D) Revenues - Property Taxes.

A) Taxes Receivable - Current.

B) Allowance for Uncollectible Current Taxes.

C) Allowance for Uncollectible Delinquent Taxes.

D) Revenues - Property Taxes.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

40

General Fund resources are provided to a Capital Projects Fund to finance a portion of a major capital project. The Capital Projects Fund is required to repay the resources that it received from the General Fund. This transaction is an example of an interfund

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

A) Transfer.

B) Services provided and used transaction.

C) Reimbursement transaction.

D) Loan.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

41

Assume a city's General Fund has $75,000 of inventory, $600,000 of long-term loans receivable (not constrained to any particular use), $250,000 long-term loans due from other funds (not constrained to a particular use), and $1,900,000 of investments. Based solely on this information, the city's nonspendable fund balance would be

A) $925,000.

B) $850,000.

C) $675,000.

D) $600,000.

A) $925,000.

B) $850,000.

C) $675,000.

D) $600,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following events could potentially qualify for reporting as an extraordinary item?

A) A city government sells city hall.

B) City Hall is hit by lightning and is significantly damaged by fire.

C) The city offers employees an early retirement incentive package and 15 employees accept the offer.

D) City has unexpected loss on sale of an investment in AT&T stock.

A) A city government sells city hall.

B) City Hall is hit by lightning and is significantly damaged by fire.

C) The city offers employees an early retirement incentive package and 15 employees accept the offer.

D) City has unexpected loss on sale of an investment in AT&T stock.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

43

The following information pertains to the Richardson County General Fund:

The change in fund balance for Richardson County's General Fund for the year is a

A) $2,600 decrease.

B) $2,675 decrease.

C) $2,925 decrease.

D) $3,600 decrease.

The change in fund balance for Richardson County's General Fund for the year is a

A) $2,600 decrease.

B) $2,675 decrease.

C) $2,925 decrease.

D) $3,600 decrease.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

44

The following information pertains to the Scott County General Fund: Expenditures $14,800,000

Revenues $14,200,000

The change in fund balance Scott County's General Fund for the year is a

A) $1,600,000 decrease.

B) $1,000,000 decrease.

C) $600,000 decrease.

D) $400,000 increase.

Revenues $14,200,000

The change in fund balance Scott County's General Fund for the year is a

A) $1,600,000 decrease.

B) $1,000,000 decrease.

C) $600,000 decrease.

D) $400,000 increase.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following could never be considered part of assigned fund balance?

A) The finance director sets aside a substantial amount of resources for a special project.

B) Unassigned amounts loaned to another fund for more than one year.

C) Program manager - with blessing of city council - sets aside funds for multi-year project.

D) Fund balances remaining in a Special Revenue Fund after determining the appropriate balances for nonspendable fund balance, restricted fund balance, and committed fund balance.

A) The finance director sets aside a substantial amount of resources for a special project.

B) Unassigned amounts loaned to another fund for more than one year.

C) Program manager - with blessing of city council - sets aside funds for multi-year project.

D) Fund balances remaining in a Special Revenue Fund after determining the appropriate balances for nonspendable fund balance, restricted fund balance, and committed fund balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

46

The City of Trixie reports in their General Fund a $505,000 special item (an inflow) and a $1,750,000 extraordinary item (an outflow) in the same year. Which of the following statements would be false?

A) Fund balance would decrease $1,245,000.

B) The extraordinary item and the special item should be reported separately on the face of the Statement of Revenues, Expenditures, and Changes in Fund Balance.

C) Fund balance would increase by only $505,000.

D) Of extraordinary items and special items, only special items are under the control of management.

A) Fund balance would decrease $1,245,000.

B) The extraordinary item and the special item should be reported separately on the face of the Statement of Revenues, Expenditures, and Changes in Fund Balance.

C) Fund balance would increase by only $505,000.

D) Of extraordinary items and special items, only special items are under the control of management.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following fund balance classifications is not for GAAP financial statement reporting?

A) Nonspendable Fund Balance.

B) Budgetary Fund Balance.

C) Committed Fund Balance.

D) Unassigned Fund Balance.

A) Nonspendable Fund Balance.

B) Budgetary Fund Balance.

C) Committed Fund Balance.

D) Unassigned Fund Balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is an appropriate use of a fund balance restriction?

A) To report the amount of capital assets acquired during the year.

B) To indicate that the finance director is setting aside a substantial amount of resources for a special project.

C) To report the amount of long-term debt that will mature in the next 12 months.

D) To report amounts that can only be used for specific purposes due to debt covenant constraints.

A) To report the amount of capital assets acquired during the year.

B) To indicate that the finance director is setting aside a substantial amount of resources for a special project.

C) To report the amount of long-term debt that will mature in the next 12 months.

D) To report amounts that can only be used for specific purposes due to debt covenant constraints.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

49

For a transaction to be classified as a special item it must be

A) Unusual in nature or infrequent in occurrence but not under the control of management.

B) Unusual in nature and infrequent in occurrence.

C) Unusual in nature or infrequent in occurrence and under the control of management.

D) Unusual in nature or infrequent in occurrence.

A) Unusual in nature or infrequent in occurrence but not under the control of management.

B) Unusual in nature and infrequent in occurrence.

C) Unusual in nature or infrequent in occurrence and under the control of management.

D) Unusual in nature or infrequent in occurrence.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

50

Unassigned fund balance be described as

A) The residual fund balance that remains after accounting for nonspendable fund balance, restricted fund balance, committed fund balance, and assigned fund balance.

B) A fund balance category that is used to report positive and negative balances in any governmental fund.

C) The amount of governmental fund net assets with no constraints on their use.

D) A fund balance category that is used to report positive and negative balances in the General Fund, but only negative balances in other governmental funds.

A) The residual fund balance that remains after accounting for nonspendable fund balance, restricted fund balance, committed fund balance, and assigned fund balance.

B) A fund balance category that is used to report positive and negative balances in any governmental fund.

C) The amount of governmental fund net assets with no constraints on their use.

D) A fund balance category that is used to report positive and negative balances in the General Fund, but only negative balances in other governmental funds.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

51

Hannah County has a total fund balance in the General Fund as of the end of the year of $1,565,000. Assume the following:

-The budget officer decided to commit $405,000 for new road maintenance. (The county's governing board had previously given her this authority.)

-Unspent restricted drug enforcement grant proceeds of $75,000

-The county's governing board passed a resolution to commit $500,000 to for construction of a fleet maintenance facility

In the year-end financial statements, Hannah County would report committed fund balance in the General Fund as

A) $75,000.

B) $500,000.

C) $575,000.

D) $905,000.

-The budget officer decided to commit $405,000 for new road maintenance. (The county's governing board had previously given her this authority.)

-Unspent restricted drug enforcement grant proceeds of $75,000

-The county's governing board passed a resolution to commit $500,000 to for construction of a fleet maintenance facility

In the year-end financial statements, Hannah County would report committed fund balance in the General Fund as

A) $75,000.

B) $500,000.

C) $575,000.

D) $905,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following would result in a portion of fund balance being classified as nonspendable?

A) Advances to other funds.

B) Inventory of materials and supplies.

C) A city council passing enabling legislation that requires proceeds from a newly authorized sales tax be spent on a downtown revitalization project.

D) Prepaid insurance.

A) Advances to other funds.

B) Inventory of materials and supplies.

C) A city council passing enabling legislation that requires proceeds from a newly authorized sales tax be spent on a downtown revitalization project.

D) Prepaid insurance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

53

A government levies property taxes of $2,500,000, 1% of which are expected to prove uncollectible. The property taxes should be reported in the General Fund statement of revenues, expenditures, and changes in fund balances as

A) Revenues of $2,500,000 and expenditures of $25,000.

B) Revenues of $2,500,000 and other financing uses of $25,000.

C) Revenues of $2,475,000 and no expenditures or other financing uses.

D) Other financing sources of $2,500,000 and expenditures of $25,000.

A) Revenues of $2,500,000 and expenditures of $25,000.

B) Revenues of $2,500,000 and other financing uses of $25,000.

C) Revenues of $2,475,000 and no expenditures or other financing uses.

D) Other financing sources of $2,500,000 and expenditures of $25,000.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

54

Restricted fund balance in the General Fund can be the result of

A) A city budget director setting aside funds to be spent for city street improvement.

B) Donors giving monies to a city if only the earnings on investment of the gift can be spent for park beautification and the original gift principal must be maintained intact.

C) A city council passing enabling legislation that requires proceeds from a newly authorized sales tax be spent on a downtown revitalization project.

D) A city council taking a formal action to set aside money for a future contract.

A) A city budget director setting aside funds to be spent for city street improvement.

B) Donors giving monies to a city if only the earnings on investment of the gift can be spent for park beautification and the original gift principal must be maintained intact.

C) A city council passing enabling legislation that requires proceeds from a newly authorized sales tax be spent on a downtown revitalization project.

D) A city council taking a formal action to set aside money for a future contract.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following does not affect the "Excess of Revenues over Expenditures"?

A) Purchase of capital assets.

B) Incurring and paying salaries.

C) Property taxes levied and collected in the year.

D) Transfers from Enterprise Funds.

A) Purchase of capital assets.

B) Incurring and paying salaries.

C) Property taxes levied and collected in the year.

D) Transfers from Enterprise Funds.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

56

Hannah County has a total fund balance in the General Fund as of the end of the year of $1,565,000. Assume the following:

-The budget officer decided to set aside $405,000 for new road maintenance. The county's governing board had previously given her this authority.

-Unspent restricted drug enforcement grant proceeds of $75,000.

-The county's governing board passed a resolution to commit $500,000 to use for construction of a fleet maintenance facility.

In the year-end financial statements, Hannah County would report unassigned fund balance and assigned fund balance, respectively, in the General Fund as

A) $1,085,000 unassigned fund balance; $405,000 assigned fund balance.

B) $660,000 unassigned fund balance; $905,000 assigned fund balance.

C) $585,000 unassigned fund balance; $405,000 assigned fund balance.

D) $495,000 unassigned fund balance; $480,000 assigned fund balance.

-The budget officer decided to set aside $405,000 for new road maintenance. The county's governing board had previously given her this authority.

-Unspent restricted drug enforcement grant proceeds of $75,000.

-The county's governing board passed a resolution to commit $500,000 to use for construction of a fleet maintenance facility.

In the year-end financial statements, Hannah County would report unassigned fund balance and assigned fund balance, respectively, in the General Fund as

A) $1,085,000 unassigned fund balance; $405,000 assigned fund balance.

B) $660,000 unassigned fund balance; $905,000 assigned fund balance.

C) $585,000 unassigned fund balance; $405,000 assigned fund balance.

D) $495,000 unassigned fund balance; $480,000 assigned fund balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

57

When total fund balance of a Special Revenue Fund is a negative amount, which fund balance category must be zero?

A) Assigned.

B) Restricted.

C) Unassigned.

D) Committed.

A) Assigned.

B) Restricted.

C) Unassigned.

D) Committed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

58

Which fund balance account may contain a negative balance?

A) Assigned.

B) Restricted

C) Unassigned

D) Committed.

A) Assigned.

B) Restricted

C) Unassigned

D) Committed.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

59

Fund balance may be assigned when

A) Management determines that a portion of unassigned fund balance should be set aside for the construction of a new fire station.

B) The city council passes an ordinance to set aside a portion of unassigned fund balance for construction of a new fire station.

C) Management believes that a portion of restricted fund balance should be set aside for the construction of a new fire station.

D) Management determines it needs a predetermined amount of materials and supplies inventory at the end of each year.

A) Management determines that a portion of unassigned fund balance should be set aside for the construction of a new fire station.

B) The city council passes an ordinance to set aside a portion of unassigned fund balance for construction of a new fire station.

C) Management believes that a portion of restricted fund balance should be set aside for the construction of a new fire station.

D) Management determines it needs a predetermined amount of materials and supplies inventory at the end of each year.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

60

A city acquired a dump truck for general government usage. The government paid nothing down and signed a 10%, short-term note payable for the price of the truck, $80,000. The note will mature in the next fiscal year. What items should appear in the statement of revenues, expenditures, and changes in fund balance for the General Fund in the year the truck was purchased?

A) Capital outlay expenditures of $80,000, but no interest.

B) Interest expenditures on the note, but no capital outlay expenditures since nothing was paid.

C) Capital outlay expenditures of $80,000 and interest expenditures on the note.

D) Depreciation expense (depending on the estimated useful life of the truck) and interest expenditures on the note.

A) Capital outlay expenditures of $80,000, but no interest.

B) Interest expenditures on the note, but no capital outlay expenditures since nothing was paid.

C) Capital outlay expenditures of $80,000 and interest expenditures on the note.

D) Depreciation expense (depending on the estimated useful life of the truck) and interest expenditures on the note.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

61

Which General Fund financial statement may be reported using a basis of accounting other than GAAP?

A) Balance Sheet.

B) Statement of Revenues, Expenditures, and Changes in Fund Balance.

C) Statement of Revenues, Expenditures, and Changes in Fund Balance-Budget and Actual.

D) Statement of Revenues, Expenses, and Changes in Fund Net Position.

A) Balance Sheet.

B) Statement of Revenues, Expenditures, and Changes in Fund Balance.

C) Statement of Revenues, Expenditures, and Changes in Fund Balance-Budget and Actual.

D) Statement of Revenues, Expenses, and Changes in Fund Net Position.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is an appropriate use of a fund balance restriction?

A) To report the amount of capital assets acquired during the year.

B) To indicate that the finance director is setting aside a substantial amount of resources for a special project.

C) To report the expected costs of orders outstanding at year end that are to be filled in the next fiscal year.

D) To report amounts that can only be used for specific purposes due to debt covenant constraints.

A) To report the amount of capital assets acquired during the year.

B) To indicate that the finance director is setting aside a substantial amount of resources for a special project.

C) To report the expected costs of orders outstanding at year end that are to be filled in the next fiscal year.

D) To report amounts that can only be used for specific purposes due to debt covenant constraints.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

63

Hannah County has a total fund balance in the General Fund as of the end of the year of $1,565,000. Assume the following:

-The budget officer decided to set aside $405,000 for new road maintenance. The county's governing board had previously given her this authority.

-Purchase orders of $41,000, which were not related to restricted or committed resources, were outstanding at year end.

-Unspent restricted drug enforcement grant proceeds of $75,000.

-The county's governing board passed an ordinance to use $500,000 for construction of a fleet maintenance facility.

In the year-end financial statements, Hannah County would report unassigned fund balance and assigned fund balance, respectively, in the General Fund as

A) $949,000 unassigned fund balance; $41,000 assigned fund balance.

B) $544,000 unassigned fund balance; $405,000 assigned fund balance.

C) $544,000 unassigned fund balance; $446,000 assigned fund balance.

D) $1,044,000 unassigned fund balance; $446,000 assigned fund balance.

-The budget officer decided to set aside $405,000 for new road maintenance. The county's governing board had previously given her this authority.

-Purchase orders of $41,000, which were not related to restricted or committed resources, were outstanding at year end.

-Unspent restricted drug enforcement grant proceeds of $75,000.

-The county's governing board passed an ordinance to use $500,000 for construction of a fleet maintenance facility.

In the year-end financial statements, Hannah County would report unassigned fund balance and assigned fund balance, respectively, in the General Fund as

A) $949,000 unassigned fund balance; $41,000 assigned fund balance.

B) $544,000 unassigned fund balance; $405,000 assigned fund balance.

C) $544,000 unassigned fund balance; $446,000 assigned fund balance.

D) $1,044,000 unassigned fund balance; $446,000 assigned fund balance.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following should be reported in the statement of revenues, expenditures, and changes in fund balance of a General Fund?

A) A short-term loan to another governmental fund.

B) A long-term loan to another governmental fund.

C) Repayment of a short-term loan from a bank.

D) Repayment of a long-term loan from a bank.

A) A short-term loan to another governmental fund.

B) A long-term loan to another governmental fund.

C) Repayment of a short-term loan from a bank.

D) Repayment of a long-term loan from a bank.

Unlock Deck

Unlock for access to all 69 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following could never be considered part of assigned fund balance?

A) The finance director sets aside a substantial amount of resources for a special project.

B) Unassigned amounts loaned to another fund for more than one year.

C) Expected costs of orders outstanding at year end that are to be filled in the next fiscal year.