Deck 6: Decision Making Under Uncertainty

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

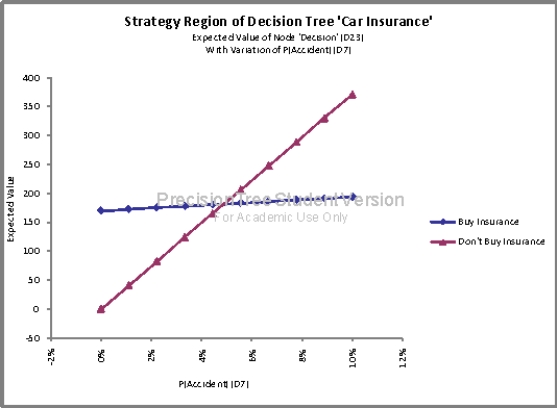

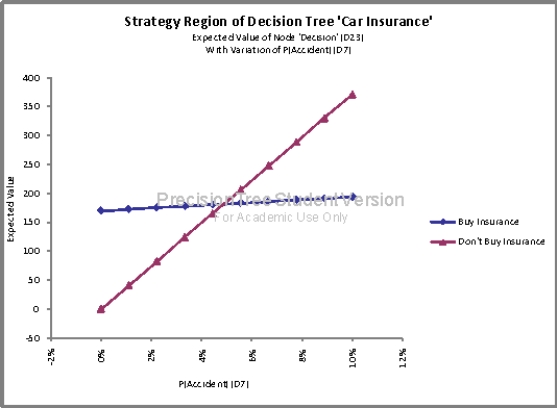

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

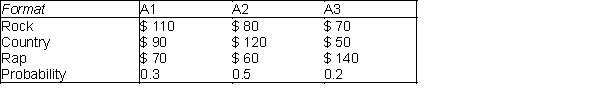

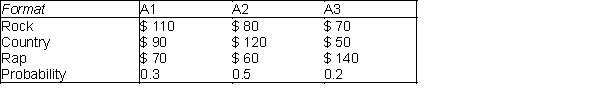

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/107

Play

Full screen (f)

Deck 6: Decision Making Under Uncertainty

1

In making decisions, we choose the decision with the largest expected monetary value at each node.

True

2

Decision trees are composed of nodes (circles, squares, and triangles) and branches (lines).

True

3

In decision trees, probabilities are listed on probability branches. These probabilities are ____ events that have already been observed.

A) marginal due to

B) conditional on

C) averaged with

D) increased by

E) the same as

A) marginal due to

B) conditional on

C) averaged with

D) increased by

E) the same as

conditional on

4

In decision trees, a decision node (a square) is a time when the result of an uncertain event becomes known.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

5

FMV provides a rational way of making decisions:

A) under all circumstances

B) when there is one outcome

C) at least when the monetary payoffs and costs are of "moderate" size relative to the decision maker's wealth

D) at least when the monetary payoffs and costs are large relative to the decision maker's wealth

E) under none of these situations

A) under all circumstances

B) when there is one outcome

C) at least when the monetary payoffs and costs are of "moderate" size relative to the decision maker's wealth

D) at least when the monetary payoffs and costs are large relative to the decision maker's wealth

E) under none of these situations

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

6

There are three types of nodes that are used with the decision trees. They are the:

A) mean nodes, variance nodes, and the standard deviation nodes

B) probability nodes, risk nodes, and the expected value nodes

C) supply nodes, demand nodes, and the expected value nodes

D) decision nodes, probability nodes, and end nodes.

E) horizontal nodes, vertical nodes, and the diagonal nodes

A) mean nodes, variance nodes, and the standard deviation nodes

B) probability nodes, risk nodes, and the expected value nodes

C) supply nodes, demand nodes, and the expected value nodes

D) decision nodes, probability nodes, and end nodes.

E) horizontal nodes, vertical nodes, and the diagonal nodes

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

7

The mean of the probability distribution is also called the:

A) median

B) standard deviation

C) variance

D) expected value

E) normalized point

A) median

B) standard deviation

C) variance

D) expected value

E) normalized point

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

8

In decision trees, an end node (a triangle) indicates that the problem is completed; that is, all decisions have been made, all uncertainty has been resolved, and all payoffs/costs have been incurred.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

9

In decision trees, a probability node (a circle) is a time when the decision maker makes a decision.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

10

Expected monetary value (EMV) is:

A) the average or expected value of the decision if you knew what would happen ahead of time

B) the weighted average of possible monetary values, weighted by their probabilities

C) the average or expected value of the information if it was completely accurate

D) the amount that you would lose by not picking the best alternative

E) a decision criterion that places an equal amount on all states of nature

A) the average or expected value of the decision if you knew what would happen ahead of time

B) the weighted average of possible monetary values, weighted by their probabilities

C) the average or expected value of the information if it was completely accurate

D) the amount that you would lose by not picking the best alternative

E) a decision criterion that places an equal amount on all states of nature

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

11

In decision trees, EMVs are calculated through a ____ process.

A) "pay it forward"

B) "going forward"

C) "folding back"

D) time value

A) "pay it forward"

B) "going forward"

C) "folding back"

D) time value

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

12

In decision trees, monetary values:

A) are shown in the nodes

B) are shown to the right of the nodes

C) appear under the nodes

D) are shown to the left of the nodes

A) are shown in the nodes

B) are shown to the right of the nodes

C) appear under the nodes

D) are shown to the left of the nodes

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

13

In decision trees, any branches leading into a node (from the left) have already occurred.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

14

In general, the expected monetary values (EMV) represent possible payoffs.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

15

Expected monetary value is the weighted sum of the possible monetary outcomes.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

16

The expected monetary value (EMV) criterion is sometimes referred to as "playing the averages".

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

17

The solution procedure that was introduced in the book for decision trees is called the:

A) folding diagram

B) single-stage method

C) risk profile method

D) precision tree method

E) folding back procedure

A) folding diagram

B) single-stage method

C) risk profile method

D) precision tree method

E) folding back procedure

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

18

In a single-stage decision tree problem, you make ____ first and then all you wait to see a(n) ____.

A) decisions; uncertainty outcome

B) calculations; known outcome

C) EMV calculations; certain events

D) likelihoods; uncertain outcome

A) decisions; uncertainty outcome

B) calculations; known outcome

C) EMV calculations; certain events

D) likelihoods; uncertain outcome

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

19

In decision trees, time:

A) is constant

B) proceeds from bottom to top

C) proceeds from top to bottom

D) proceeds from right to left

E) proceeds from left to right

A) is constant

B) proceeds from bottom to top

C) proceeds from top to bottom

D) proceeds from right to left

E) proceeds from left to right

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

20

The preferred criterion in decision making is.

A) maximin

B) maximax

C) EMV

D) none of these choices

A) maximin

B) maximax

C) EMV

D) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

21

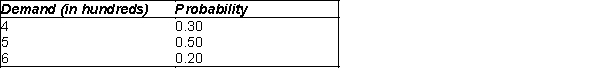

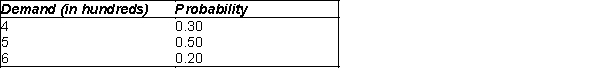

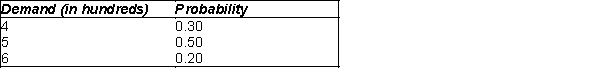

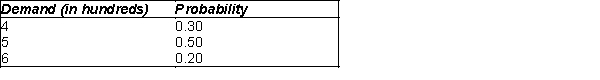

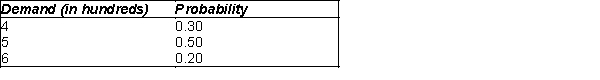

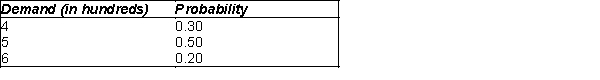

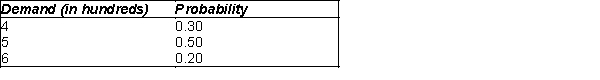

A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decide in November how many footballs to order for sale during the upcoming late summer and fall months. Assume that each football costs the chain $45. Furthermore, assume that each pair can be sold for a retail price of $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for $35 each. The probability distribution of consumer demand for these footballs (in hundreds) during the upcoming season has been assessed by the market research specialists and is presented below. Finally, assume that the sporting goods store chain must purchase the footballs in lots of 100 units.

(A) What is the payoff if the store orders 400 footballs and quantity demanded is 400 footballs?

(B) What is the payoff if the store orders 400 footballs and quantity demanded is 500 footballs?

(C) What is the payoff if the store orders 400 footballs and quantity demanded is 600 footballs?

(D) What is the payoff if the store orders 500 footballs and quantity demanded is 400 footballs?

(E) What is the payoff if the store orders 500 footballs and quantity demanded is 500 footballs?

(F) What is the payoff if the store orders 500 footballs and quantity demanded is 600 footballs?

(G) What is the payoff if the store orders 600 footballs and quantity demanded is 400 footballs?

(H) What is the payoff if the store orders 600 footballs and quantity demanded is 500 footballs?

(I) What is the payoff if the store orders 600 footballs and quantity demanded is 600 footballs?

(A) What is the payoff if the store orders 400 footballs and quantity demanded is 400 footballs?

(B) What is the payoff if the store orders 400 footballs and quantity demanded is 500 footballs?

(C) What is the payoff if the store orders 400 footballs and quantity demanded is 600 footballs?

(D) What is the payoff if the store orders 500 footballs and quantity demanded is 400 footballs?

(E) What is the payoff if the store orders 500 footballs and quantity demanded is 500 footballs?

(F) What is the payoff if the store orders 500 footballs and quantity demanded is 600 footballs?

(G) What is the payoff if the store orders 600 footballs and quantity demanded is 400 footballs?

(H) What is the payoff if the store orders 600 footballs and quantity demanded is 500 footballs?

(I) What is the payoff if the store orders 600 footballs and quantity demanded is 600 footballs?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

22

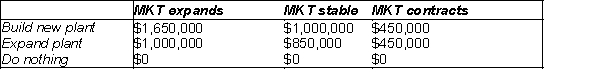

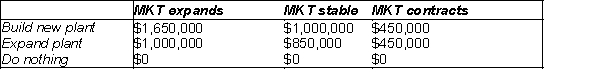

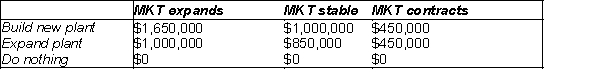

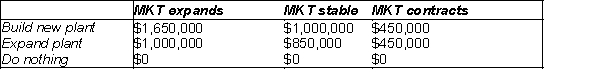

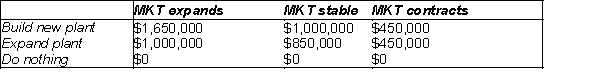

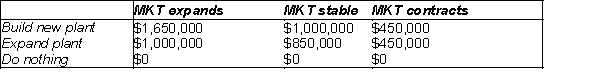

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.

Construct a decision tree to identify the course of action that maximizes WTC's expected profit. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

Construct a decision tree to identify the course of action that maximizes WTC's expected profit. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

23

A risk profile from PrecisionTree lists:

A) the full probability distribution

B) all possible outcomes and their corresponding utility

C) all options and their possible outcomes

D) the nodes and branches for each possible outcome

E) none of these choices

A) the full probability distribution

B) all possible outcomes and their corresponding utility

C) all options and their possible outcomes

D) the nodes and branches for each possible outcome

E) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

24

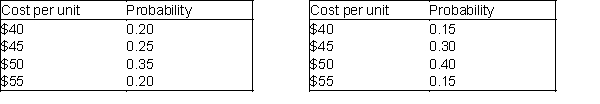

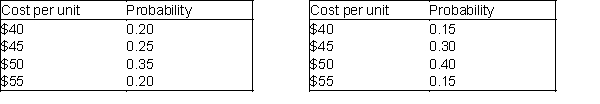

Tyson Manufacturing (a maker of industrial products) is interested in marketing a new product. The company must decide whether to manufacture this product essentially on its own or employ a subcontractor to manufacture it. Below are two tables that represent the information related to the estimated probability distribution of the cost of one unit of this product under each alternative.

Cost under "Make" alternative. Cost under "Buy" alternative. Assuming that Tyson seeks to minimize the expected unit cost of manufacturing of buying the new product, should the company make the new product or buy it from a subcontractor? Show your work.

Assuming that Tyson seeks to minimize the expected unit cost of manufacturing of buying the new product, should the company make the new product or buy it from a subcontractor? Show your work.

Cost under "Make" alternative. Cost under "Buy" alternative.

Assuming that Tyson seeks to minimize the expected unit cost of manufacturing of buying the new product, should the company make the new product or buy it from a subcontractor? Show your work.

Assuming that Tyson seeks to minimize the expected unit cost of manufacturing of buying the new product, should the company make the new product or buy it from a subcontractor? Show your work.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

25

(A) Construct a decision tree to help the company make its decision. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

(B) What is the best lease option? Why?

(C) Suppose the company could hire an experienced mechanic to inspect the old grader to determine the repair cost before the company makes its final decision. If the mechanic is always correct in his assessments, what is the most the company would pay for the inspection?

(B) What is the best lease option? Why?

(C) Suppose the company could hire an experienced mechanic to inspect the old grader to determine the repair cost before the company makes its final decision. If the mechanic is always correct in his assessments, what is the most the company would pay for the inspection?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

26

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.

(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

(A) What is WTC's payoff if they build a new plant and the market expands?

(B) What is WTC's payoff if they build a new plant and the market is stable?

(C) What is WTC's payoff if they build a new plant and the market contracts?

(D) What is WTC's payoff if they expand the plant and the market expands?

(E) What is WTC's payoff if they expand the plant and the market is stable?

(F) What is WTC's payoff if they expand the plant and the market contracts?

(G) What is WTC's payoff if they do nothing and the market expands?

(H) What is WTC's payoff if they do nothing and the market is stable?

(I) What is WTC's payoff if they do nothing and the market contracts?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

27

What should the credit union do? What is their expected profit?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

28

What course of action is optimal for WTC? What is the expected profit in that case?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

29

The Waco Tire Company (WTC) is considering expanding production to meet possible increases in demand. WTC's alternatives are to construct a new plant, expand the existing plant, or do nothing in the short run. It will cost them $1 million to build a new facility and $600,000 to expand their existing facility. The market for this particular product may expand, remain stable, or contract. ETC's marketing department estimates the probabilities of these market outcomes as 0.30, 0.45, and 0.25, respectively. The expected revenue for each alternative is presented in the table below.

Generate a risk profile for each of WTC's possible decisions in this problem. Characterize the differences in risk for the different options.

Generate a risk profile for each of WTC's possible decisions in this problem. Characterize the differences in risk for the different options.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

30

Construct a decision tree to help the credit union decide whether or not to make the loan. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

31

A risk profile lists the full probability distribution.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

32

What is the probability that a randomly selected individual from this population earns less than $50,000 per year?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

33

EMV criteria guarantee good outcomes.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

34

In a multistage decision problem, decisions and outcomes alternate. That is, a decision maker makes a decision, then some uncertainty is resolved, then the decision maker makes a second decision, then some further uncertainty is resolved, and so on.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

35

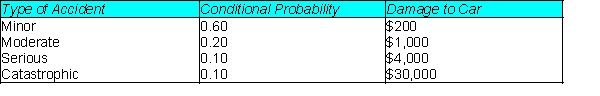

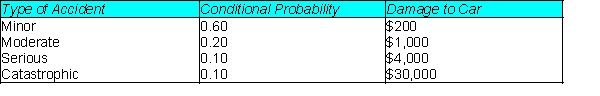

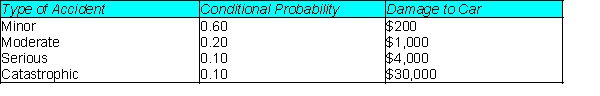

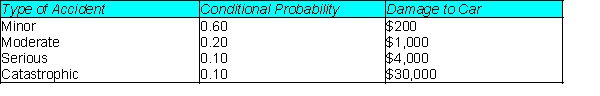

Ms. Rich has just bought a new $30,000 car. As a reasonably safe driver, she believes that there is only a 5% chance of being in an accident in the forthcoming year. If she is involved in an accident, the damage to her new car depends on the severity of the accident. The probability distribution for the range of possible accidents and the corresponding damage amounts (in dollars) are shown in the table below. Ms. Rich is trying to decide whether she is willing to pay $170 each year for collision insurance with a $300 deductible. Note that with this type of insurance, she pays the first $300 in damages if she causes an accident, and the insurance company pays the remainder.

Distribution of Accident Types and Corresponding Damage Amounts

Determine the payoffs associated with each possible decision and type of accident (cost in dollars).

Distribution of Accident Types and Corresponding Damage Amounts

Determine the payoffs associated with each possible decision and type of accident (cost in dollars).

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

36

(A) Construct a decision tree to help the landowner make her decision. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

(B) What should the landowner do? Why?

(C) Suppose the landowner is uncertain about the reliability of her geologist friend's estimate of the probability that oil will be found on her land. If she thinks the probability could be anywhere between 40% and 80%, would that change her decision?

(D) Suppose that, in addition to the uncertainty about the probability of finding oil, the landowner is also uncertain about the cost of the exploratory well (could vary +/- 25%) and the future profits (could vary +/- 50%). To which of these variables is the expected value most sensitive?

(E) What does the risk profile show about the relative risk levels for the landowner's two options?

(F) Suppose the landowner suspects that she may be a somewhat risk-averse decision maker, because the she doesn't feel there is as much of a difference between the two options as their expected values would indicate. She consults with a decision analysis expert who asks her to decide between two hypothetical alternatives: 1) a gamble with equal probabilities of winning an amount $X and losing an amount -$X/2, and 2) doing nothing, with a payoff of $0. The point at which she cannot decide between 1) and 2) is when X=$1,500,000. What is her risk tolerance if she uses an exponential utility function to model her preferences?

(G) Apply the risk tolerance given in your answer to the previous question to the landowner's decision tree in (A). What is the optimal decision in this case? What is the resulting certainty equivalent?

(H) If the landowner could hire an expert geologist prepare a report to help her make her decision, what is the most that information could be worth? Assume the geologist's information is perfectly reliable.

(B) What should the landowner do? Why?

(C) Suppose the landowner is uncertain about the reliability of her geologist friend's estimate of the probability that oil will be found on her land. If she thinks the probability could be anywhere between 40% and 80%, would that change her decision?

(D) Suppose that, in addition to the uncertainty about the probability of finding oil, the landowner is also uncertain about the cost of the exploratory well (could vary +/- 25%) and the future profits (could vary +/- 50%). To which of these variables is the expected value most sensitive?

(E) What does the risk profile show about the relative risk levels for the landowner's two options?

(F) Suppose the landowner suspects that she may be a somewhat risk-averse decision maker, because the she doesn't feel there is as much of a difference between the two options as their expected values would indicate. She consults with a decision analysis expert who asks her to decide between two hypothetical alternatives: 1) a gamble with equal probabilities of winning an amount $X and losing an amount -$X/2, and 2) doing nothing, with a payoff of $0. The point at which she cannot decide between 1) and 2) is when X=$1,500,000. What is her risk tolerance if she uses an exponential utility function to model her preferences?

(G) Apply the risk tolerance given in your answer to the previous question to the landowner's decision tree in (A). What is the optimal decision in this case? What is the resulting certainty equivalent?

(H) If the landowner could hire an expert geologist prepare a report to help her make her decision, what is the most that information could be worth? Assume the geologist's information is perfectly reliable.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

37

Which sensitivity analysis chart is most useful for seeing how the optimal decision changes as selected inputs vary?

A) strategy region chart

B) tornado chart

C) spider chart

D) all of these choices

E) none of these choices

A) strategy region chart

B) tornado chart

C) spider chart

D) all of these choices

E) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

38

A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decide in November how many footballs to order for sale during the upcoming late summer and fall months. Assume that each football costs the chain $45. Furthermore, assume that each pair can be sold for a retail price of $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for $35 each. The probability distribution of consumer demand for these footballs (in hundreds) during the upcoming season has been assessed by the market research specialists and is presented below. Finally, assume that the sporting goods store chain must purchase the footballs in lots of 100 units.

Generate a risk profile for each possible decision in this problem. Would this have any impact on your decision?

Generate a risk profile for each possible decision in this problem. Would this have any impact on your decision?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

39

The expected monetary value represents a long-run average.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

40

In a single-stage decision problem, a single decision is made first, and then all uncertainty is resolved.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

41

PrecisionTree tornado and spider charts are:

A) useful for seeing which inputs affect a selected EMV the most

B) not useful for decision making processes

C) useful for calculating EMVs

D) none of these choices

E) all of these choices

A) useful for seeing which inputs affect a selected EMV the most

B) not useful for decision making processes

C) useful for calculating EMVs

D) none of these choices

E) all of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

42

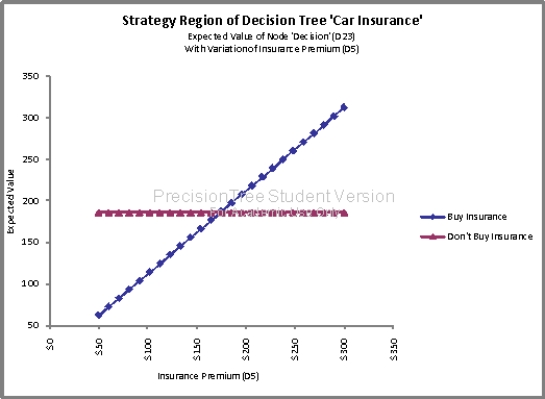

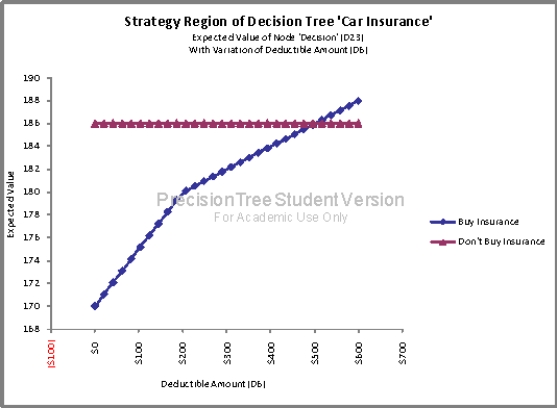

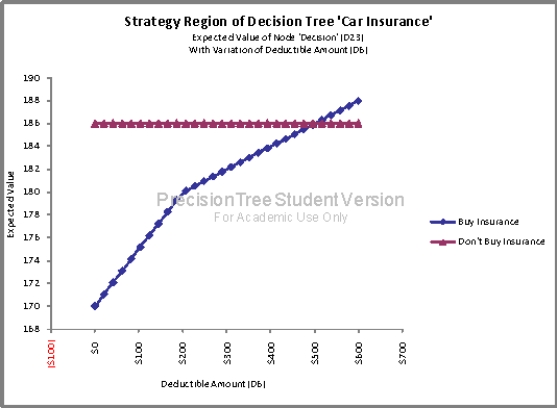

Using a strategy region graph, determine what impact, if any, the insurance premium cost has on her decision. Briefly explain your answer

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

43

Bayes' is useful in determining the value of perfect information (EVPI).

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

44

____ can be used to determine which input variables have the most impact on the expected value in a decision problem.

A) Payoff tables

B) Risk profiles

C) Spider charts

D) Decision nodes

E) None of these choices

A) Payoff tables

B) Risk profiles

C) Spider charts

D) Decision nodes

E) None of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

45

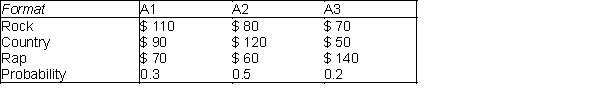

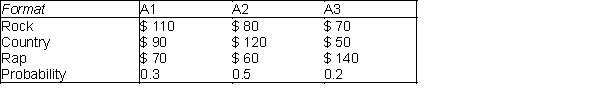

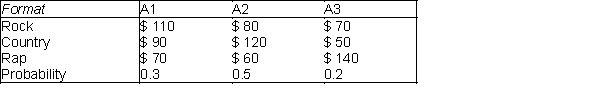

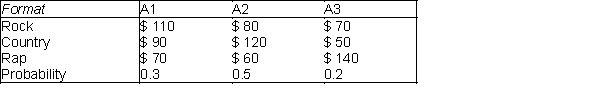

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience

The station is most uncertain about the average monthly revenue associated with the rock format and an A1 audience. Construct a strategy region chart for this input variable with a possible range from $85,000 to $200,000. Does the optimal decision to select the country format change at any point in this range?

Audience

The station is most uncertain about the average monthly revenue associated with the rock format and an A1 audience. Construct a strategy region chart for this input variable with a possible range from $85,000 to $200,000. Does the optimal decision to select the country format change at any point in this range?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

46

Perform a sensitivity analysis on the optimal decision and summarize your findings. Vary the probability of being in an accident from 0% to 10%, the insurance premium from $50 to $300, and the deductible amount from $0 to $600. In response to which model inputs is the expected total cost value most sensitive?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

47

Bayes' rule can be used for updating the probability of an uncertain outcome after observing the results of a test or study.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

48

Tornado charts and spider charts can be used to determine which input variables have the most impact on the expected value in a decision problem.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

49

What is Bayes' Rule?

A) a rule that provides a mathematical way of updating probabilities as new information becomes available

B) a rule that provides a mathematical way of calculating EMV

C) a rule that provides a mathematical way of calculating EVI

D) all of these choices

E) none of these choices

A) a rule that provides a mathematical way of updating probabilities as new information becomes available

B) a rule that provides a mathematical way of calculating EMV

C) a rule that provides a mathematical way of calculating EVI

D) all of these choices

E) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

50

The expected value of sample information (EVSI) is equal to:

A) EMV with posterior information - EMV with prior information

B) EMV with free perfect information - EMV free information

C) EMV with perfect information - EMV without information

D) EMV with free information - EMV without information

E) none of these choices

A) EMV with posterior information - EMV with prior information

B) EMV with free perfect information - EMV free information

C) EMV with perfect information - EMV without information

D) EMV with free information - EMV without information

E) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

51

Using a strategy region graph, determine what impact, if any, the insurance deductible amount has on her decision. Briefly explain your answer

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

52

A risk profile is a chart that represents the probability distribution of monetary outcomes for any decisions.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

53

Using a strategy region graph, determine what impact, if any, the probability of being in an accident has on her decision. Briefly explain your answer

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

54

The expected value of perfect information (EVPI) is equal to:

A) EMV with posterior information - EMV with prior information

B) EMV with free perfect information - EMV with information

C) EMV with free perfect information - EMV with no information

D) EMV with perfect information - EMV with less than perfect information

A) EMV with posterior information - EMV with prior information

B) EMV with free perfect information - EMV with information

C) EMV with free perfect information - EMV with no information

D) EMV with perfect information - EMV with less than perfect information

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

55

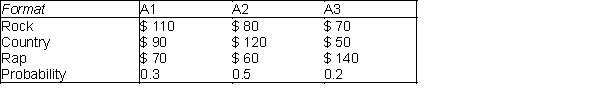

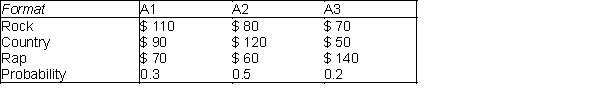

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience

As the average monthly revenue associated with the rock format and an A1 audience varies between about $142,500 and $200,000, what happens to the maximum expected revenue? Briefly explain why.

Audience

As the average monthly revenue associated with the rock format and an A1 audience varies between about $142,500 and $200,000, what happens to the maximum expected revenue? Briefly explain why.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

56

A strategy region chart is useful for seeing whether the decision changes over the range of the input variable.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

57

Ms. Rich has just bought a new $30,000 car. As a reasonably safe driver, she believes that there is only a 5% chance of being in an accident in the forthcoming year. If she is involved in an accident, the damage to her new car depends on the severity of the accident. The probability distribution for the range of possible accidents and the corresponding damage amounts (in dollars) are shown in the table below. Ms. Rich is trying to decide whether she is willing to pay $170 each year for collision insurance with a $300 deductible. Note that with this type of insurance, she pays the first $300 in damages if she causes an accident, and the insurance company pays the remainder.

Distribution of Accident Types and Corresponding Damage Amounts

Generate a statistical summary and risk profile for each of Mrs. Rich's possible decisions. Does this information impact her decision?

Distribution of Accident Types and Corresponding Damage Amounts

Generate a statistical summary and risk profile for each of Mrs. Rich's possible decisions. Does this information impact her decision?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

58

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience

As the average monthly revenue associated with the rock format and an A1 audience varies between $85,000 to about $140,000, what happens to the maximum expected revenue? Briefly explain why.

Audience

As the average monthly revenue associated with the rock format and an A1 audience varies between $85,000 to about $140,000, what happens to the maximum expected revenue? Briefly explain why.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

59

(A) Construct a decision tree to help her model her option decision making. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

(B) What is the optimal decision making policy regarding the options in all possible scenarios over the next two years?

(C) What is the expected value of the stock options? Ignore the time value of money (assume no discounting of future payoffs)

(D) If her estimates of the increases/decreases or probabilities are inaccurate, could the options have a negative EMV?

(B) What is the optimal decision making policy regarding the options in all possible scenarios over the next two years?

(C) What is the expected value of the stock options? Ignore the time value of money (assume no discounting of future payoffs)

(D) If her estimates of the increases/decreases or probabilities are inaccurate, could the options have a negative EMV?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

60

Why is there a kink in the line for the "Buy Insurance" line in the above strategy region chart?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

61

Suppose that an actual (not perfectly reliable) market research report has the following characteristics based on historical data: if the program is actually going to be a hit, there is a 90% chance that the market researchers will predict the program to be a hit, and if the program is actually going to be a flop, there is a 20% chance that the market researchers will predict the program to be a hit. Given this information, what are the posterior probabilities that a show will be a hit or a flop, given the market research report?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

62

Should the credit union purchase the report if it costs $150?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

63

If a randomly selected individual is observed to earn less than $50,000 per year, what is the probability that this person is a woman?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

64

In the nomenclature of Bayes' Rule, which of the following are probabilities that are conditioned on information that is obtained?

A) Prior probabilities

B) Posterior probabilities

C) Marginal probabilities

D) Objective probabilities

E) Subjective probabilities

A) Prior probabilities

B) Posterior probabilities

C) Marginal probabilities

D) Objective probabilities

E) Subjective probabilities

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

65

When the lines for two alternatives cross on a strategy region chart, this shows:

A) a change in which decision alternative is optimal

B) the point at which a decision was made

C) the point where the rate of change in expected value is zero

D) resolution of the uncertainty about the input variable

E) none of these choices

A) a change in which decision alternative is optimal

B) the point at which a decision was made

C) the point where the rate of change in expected value is zero

D) resolution of the uncertainty about the input variable

E) none of these choices

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

66

Suppose that an actual (not perfectly reliable) credit report has the following characteristics based on historical data; in cases where the customer did not default on the approved loan, the probability of receiving a favorable recommendation on the basis of the credit investigation was 80%, while in cases where the customer defaulted on the approved loan, the probability of receiving a favorable recommendation on the basis of the credit investigation was 25%. Given this information, what are the posterior probabilities that an earthquake will and will not occur, given the geologists predictions?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

67

(A) Construct a decision tree to help the power company decide what to do. Make sure to label all decision and chance nodes and include appropriate costs, payoffs and probabilities.

(B) Where should the power company build the plant? What is the expected cost?

(C) Suppose that a geologist (and his team) can be hired to analyze the fault structure at Chico Canyon. He will either predict whether an earthquake will occur or not. If the geologist is perfectly reliable, what is the most the company should be willing to pay for his services?

(D) Suppose that an actual (not perfectly reliable) geologist can be hired to analyze the earthquake risk. The geologist's past record indicates that he will predict an earthquake on 90% of the occasions for which an earthquake will occur and no earthquake on 85% of the occasions for which an earthquake will not occur. Given this information, what are the posterior probabilities that an earthquake will and will not occur, given the geologists predictions?

(E) Should the company hire the geologist if his fee is $1.5M?

(B) Where should the power company build the plant? What is the expected cost?

(C) Suppose that a geologist (and his team) can be hired to analyze the fault structure at Chico Canyon. He will either predict whether an earthquake will occur or not. If the geologist is perfectly reliable, what is the most the company should be willing to pay for his services?

(D) Suppose that an actual (not perfectly reliable) geologist can be hired to analyze the earthquake risk. The geologist's past record indicates that he will predict an earthquake on 90% of the occasions for which an earthquake will occur and no earthquake on 85% of the occasions for which an earthquake will not occur. Given this information, what are the posterior probabilities that an earthquake will and will not occur, given the geologists predictions?

(E) Should the company hire the geologist if his fee is $1.5M?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

68

A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decide in November how many footballs to order for sale during the upcoming late summer and fall months. Assume that each football costs the chain $45. Furthermore, assume that each pair can be sold for a retail price of $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for $35 each. The probability distribution of consumer demand for these footballs (in hundreds) during the upcoming season has been assessed by the market research specialists and is presented below. Finally, assume that the sporting goods store chain must purchase the footballs in lots of 100 units.

What is the optimal strategy for order quantity, and what is the expected profit in that case?

What is the optimal strategy for order quantity, and what is the expected profit in that case?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

69

The owner of a radio station in a rapidly growing community in central Texas is about to begin operations and must decide what type of program format to offer. She is considering three formats; rock, country, and rap. The number of listeners for a particular format will depend on the type of potential audience that is available. Income from advertising depends on the number of listeners the station has. Three broad categories of audience type can be described as A1, A2, and A3. The rock music format draws mainly for the A1 listener, the country music format draws mainly from the A2 listener and the rap music format draws mainly from the A3 listener. The station owner does not know which type of audience will dominate the community once its growth has stabilized. Probabilities have been assigned to the potential dominant audience, based on the community growth that has already occurred in this area. Since she wants to begin building an image now, the decision as to which format to adopt must be made in an environment of uncertainty. The station owner has been able to construct the following payoff table, in which the entries are average monthly revenue in thousands of dollars.

Audience

What format is optimal? What is the expected profit in that case?

Audience

What format is optimal? What is the expected profit in that case?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

70

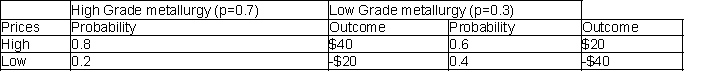

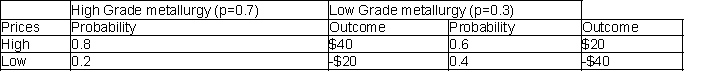

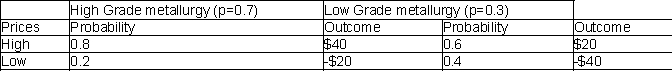

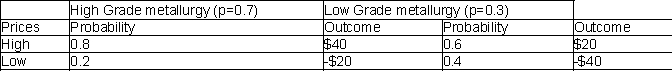

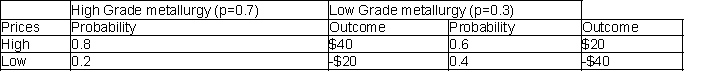

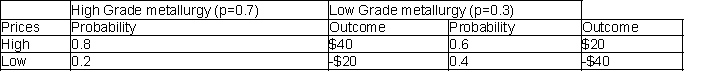

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

Should Southport conduct the imperfect core test if it costs $250,000?

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

Should Southport conduct the imperfect core test if it costs $250,000?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

71

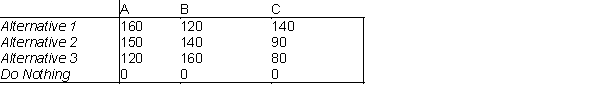

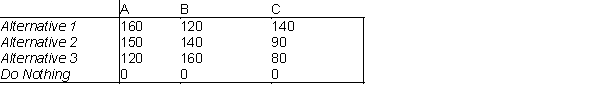

The following is a payoff table giving profits for various situations:

States of Nature The probabilities for states of nature A, B, and C are 0.3, 0.5, and 0.2 respectively.

The probabilities for states of nature A, B, and C are 0.3, 0.5, and 0.2 respectively.

What are the expected payoffs for the three alternatives?

States of Nature

The probabilities for states of nature A, B, and C are 0.3, 0.5, and 0.2 respectively.

The probabilities for states of nature A, B, and C are 0.3, 0.5, and 0.2 respectively.What are the expected payoffs for the three alternatives?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

72

The expected value of perfect information (EVPI) is the difference between the EMV with perfect information and the EMV with no additional information.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

73

The expected value of perfect information (EVPI) is irrelevant concept since perfect information is almost never available at any price.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following statements are true?

A) Sensitivity analysis is a process of seeing how optimal decision and EMV vary when one or more inputs vary.

B) Multistage decision problem is one where decisions and observations of uncertain outcomes alternate.

C) Contingency plan is a strategy in a multistage decision problem that specifies which decision to make for each possible outcome.

D) All of these choices are true.

E) None of these choices is true.

A) Sensitivity analysis is a process of seeing how optimal decision and EMV vary when one or more inputs vary.

B) Multistage decision problem is one where decisions and observations of uncertain outcomes alternate.

C) Contingency plan is a strategy in a multistage decision problem that specifies which decision to make for each possible outcome.

D) All of these choices are true.

E) None of these choices is true.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

75

If a randomly selected individual is observed to earn at least $50,000 per year, what is the probability that this person is a man?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

76

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

Since the core test can only sample a small part of the mine, Southport's geologists believe it is somewhat unrealistic to view it as a perfectly reliable test. Based on similar tests they have conducted in the past, they believe that if the metallurgical properties of the ore are actually High Grade, then the probability that this test will return "favorable" results is 0.95. If the metallurgical properties are Low Grade, the probability that this test will return "favorable" results is only 0.25. Otherwise, the test results will be considered "unfavorable". Given this information, what are the posterior probabilities that the ore will be a High Grade and Low Grade, given the core test report?

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

Since the core test can only sample a small part of the mine, Southport's geologists believe it is somewhat unrealistic to view it as a perfectly reliable test. Based on similar tests they have conducted in the past, they believe that if the metallurgical properties of the ore are actually High Grade, then the probability that this test will return "favorable" results is 0.95. If the metallurgical properties are Low Grade, the probability that this test will return "favorable" results is only 0.25. Otherwise, the test results will be considered "unfavorable". Given this information, what are the posterior probabilities that the ore will be a High Grade and Low Grade, given the core test report?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

77

Prior probabilities are sometimes called likelihoods, the probabilities that are influenced by information about the outcome of an earlier uncertainty.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

78

A buyer for a large sporting goods store chain must place orders for professional footballs with the football manufacturer six months prior to the time the footballs will be sold in the stores. The buyer must decide in November how many footballs to order for sale during the upcoming late summer and fall months. Assume that each football costs the chain $45. Furthermore, assume that each pair can be sold for a retail price of $90. If the footballs are still on the shelves after next Christmas, they can be discounted and sold for $35 each. The probability distribution of consumer demand for these footballs (in hundreds) during the upcoming season has been assessed by the market research specialists and is presented below. Finally, assume that the sporting goods store chain must purchase the footballs in lots of 100 units.

Construct a decision tree to identify the buyer's course of action that maximizes the expected profit earned by the chain from the purchase and subsequent sale of footballs in the coming year.

Construct a decision tree to identify the buyer's course of action that maximizes the expected profit earned by the chain from the purchase and subsequent sale of footballs in the coming year.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

79

The expected value of sample information (EVSI) is the difference between the EMV we can obtain with sample information and the EMV we can obtain without information.

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck

80

Southport Mining Corporation is considering a new mining venture in Indonesia. There are two uncertainties associated with this prospect; the metallurgical properties of the ore and the net price (market price minus mining and transportation costs) of the ore in the future.

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

What should the Southport do? What is their expected profit?

The metallurgical properties of the ore would be classified as either "high grade" or "low grade". Southport's geologists have estimated that there is a 70% chance that the ore will be "high grade", and otherwise, it will be "low grade". Depending on the net price, both ore classifications could be commercially successful.

The anticipated net prices depended on market conditions, and also on the metallurgical properties of the ore. Southport's economists have simplified the continuous distribution of possible prices into a two-outcome discrete distribution ("high" or "low" net price) for the investment analysis. The probabilities of these net prices, and the associated outcomes (in millions of dollars), are summarized below.

What should the Southport do? What is their expected profit?

Unlock Deck

Unlock for access to all 107 flashcards in this deck.

Unlock Deck

k this deck