Deck 9: Intercompany Bond Holdings and Miscellaneous

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/44

Play

Full screen (f)

Deck 9: Intercompany Bond Holdings and Miscellaneous

1

Pinta Company has total stockholders' equity of $2,000,000 consisting of $400,000 of $1 par value common stock, $400,000 of other contributed capital, and $1,200,000 of retained earnings.Pinta owns 80% of Santa Maria Company purchased at book value.Santa Maria has $800,000 of 5% cumulative preferred stock outstanding.Pinta acquired 40% of the preferred stock of Santa Maria for $200,000.After this transaction the balances in Pinta's retained earnings and other contributed capital accounts are:

A)$1,200,000 and $400,000.

B)$1,200,000 and $520,000.

C)$1,320,000 and $400,000.

D)$1,080,000 and $400,000.

A)$1,200,000 and $400,000.

B)$1,200,000 and $520,000.

C)$1,320,000 and $400,000.

D)$1,080,000 and $400,000.

B

2

The constructive gain or loss to the purchasing company is the difference between the

A)book value of the bonds and their par value.

B)book value of the bonds and their purchase price.

C)cost of the bonds and their par value.

D)cost of the bonds and their purchase price.

A)book value of the bonds and their par value.

B)book value of the bonds and their purchase price.

C)cost of the bonds and their par value.

D)cost of the bonds and their purchase price.

C

3

Use the following information to answer Questions

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

Compute the noncontrolling interest in the 2013 consolidated income assuming that Pallet Corporation reported a net income of $300,000 (includes dividend income from Stealth Company).Stealth Company reported net income of $180,000 and declared and paid cash dividends of $100,000.

A)$18,000

B)$17,440

C)$17,360

D)$18,560

E)none of these.

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

Compute the noncontrolling interest in the 2013 consolidated income assuming that Pallet Corporation reported a net income of $300,000 (includes dividend income from Stealth Company).Stealth Company reported net income of $180,000 and declared and paid cash dividends of $100,000.

A)$18,000

B)$17,440

C)$17,360

D)$18,560

E)none of these.

B

4

The constructive gain or loss on an intercompany bond retirement is recognized in the consolidated income statement _________ the recognition of the gain or loss on the individual companies' books.

A)after

B)before

C)at the same time as

D)before or after

A)after

B)before

C)at the same time as

D)before or after

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

5

Use the following information to answer Questions

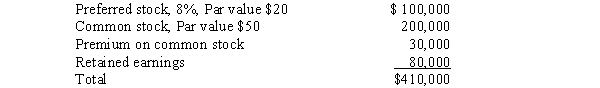

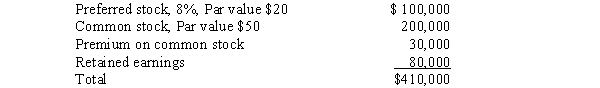

Polish Company acquired 90% of Sandwich Company's common stock for $780,000 and 40% of its preferred stock for $180,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 104% of par value.Dividends were not paid during 2012.During 2013, Sandwich Company reported net income of $120,000 and declared and paid cash dividends in the amount of $70,000.

-Noncontrolling interest in the 2013 reported net income of Sandwich Company is

A)$29,500.

B)$12,000.

C)$34,000.

D)$21,000.

E)$30,000.

Polish Company acquired 90% of Sandwich Company's common stock for $780,000 and 40% of its preferred stock for $180,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 104% of par value.Dividends were not paid during 2012.During 2013, Sandwich Company reported net income of $120,000 and declared and paid cash dividends in the amount of $70,000.

-Noncontrolling interest in the 2013 reported net income of Sandwich Company is

A)$29,500.

B)$12,000.

C)$34,000.

D)$21,000.

E)$30,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

6

Use the following information to answer Questions

Polish Company acquired 90% of Sandwich Company's common stock for $780,000 and 40% of its preferred stock for $180,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 104% of par value.Dividends were not paid during 2012.During 2013, Sandwich Company reported net income of $120,000 and declared and paid cash dividends in the amount of $70,000.

-The difference between the implied value of the preferred stock and its book value is

A)$40,000.

B)$39,600.

C)$34,400.

D)$26,000.

E)15,840.

Polish Company acquired 90% of Sandwich Company's common stock for $780,000 and 40% of its preferred stock for $180,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 104% of par value.Dividends were not paid during 2012.During 2013, Sandwich Company reported net income of $120,000 and declared and paid cash dividends in the amount of $70,000.

-The difference between the implied value of the preferred stock and its book value is

A)$40,000.

B)$39,600.

C)$34,400.

D)$26,000.

E)15,840.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

7

On a consolidated balance sheet, subsidiary preferred stock will be shown:

A)as part of consolidated stockholder's equity.

B)combined with any preferred stock of the parent.

C)as part of the noncontrolling interest amount to the extent such balance represents preferred stock held by the parent.

D)as part of the noncontrolling interest amount to the extent such balance represents preferred stock held by outside interests.

A)as part of consolidated stockholder's equity.

B)combined with any preferred stock of the parent.

C)as part of the noncontrolling interest amount to the extent such balance represents preferred stock held by the parent.

D)as part of the noncontrolling interest amount to the extent such balance represents preferred stock held by outside interests.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

8

If a subsidiary has both common and preferred stock outstanding, a parent must own a controlling interest in

A)both the subsidiary's common and preferred stock to justify consolidation.

B)the subsidiary's common stock to justify consolidation.

C)the subsidiary's common stock and at least 20% of the subsidiary's preferred stock to justify consolidation.

D)the subsidiary's common stock and more than 50% of the subsidiary's preferred stock to justify consolidation.

A)both the subsidiary's common and preferred stock to justify consolidation.

B)the subsidiary's common stock to justify consolidation.

C)the subsidiary's common stock and at least 20% of the subsidiary's preferred stock to justify consolidation.

D)the subsidiary's common stock and more than 50% of the subsidiary's preferred stock to justify consolidation.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

9

If the book value of preferred stock is greater than its implied value, the difference is accounted for as an increase in

A)consolidated retained earnings.

B)consolidated net income.

C)other contributed capital.

D)investment in subsidiary preferred stock.

A)consolidated retained earnings.

B)consolidated net income.

C)other contributed capital.

D)investment in subsidiary preferred stock.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

10

Constructive gains and losses from intercompany bond transactions are:

A)treated as extraordinary items on the consolidated income statement

B)included as other revenues and expenses on the consolidated income statement.

C)excluded from the consolidated income statement until realized.

D)eliminated from the consolidated income statement.

A)treated as extraordinary items on the consolidated income statement

B)included as other revenues and expenses on the consolidated income statement.

C)excluded from the consolidated income statement until realized.

D)eliminated from the consolidated income statement.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following methods of allocating the gain or loss on an intercompany bond retirement is the soundest conceptually?

A)The gain (loss) is allocated to the company that issued the bonds.

B)The gain (loss) is allocated to the company that purchased the bonds.

C)The gain (loss) is allocated to the parent company.

D)The gain (loss) is allocated between the purchasing and issuing companies.

A)The gain (loss) is allocated to the company that issued the bonds.

B)The gain (loss) is allocated to the company that purchased the bonds.

C)The gain (loss) is allocated to the parent company.

D)The gain (loss) is allocated between the purchasing and issuing companies.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

12

Soren Corporation is an 80% owned subsidiary of Passia Company.Soren purchased bonds of Passia Company for $103,000.Passia Company reported the bond liability on the date of purchase at $100,000 less unamortized discount of $5,000.Assuming that the constructive gain or loss is material, the consolidated income statement should report an

A)ordinary loss of $8,000.

B)ordinary gain of $8,000.

C)extraordinary loss of $8,000 adjusted for income tax effects.

D)extraordinary gain of $8,000 adjusted for income tax effects.

A)ordinary loss of $8,000.

B)ordinary gain of $8,000.

C)extraordinary loss of $8,000 adjusted for income tax effects.

D)extraordinary gain of $8,000 adjusted for income tax effects.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

13

Search Company is a 90% owned subsidiary of Passage Company.On January 1, 2013, Search Company purchased for $680,000 bonds of Passage Company that had a carrying value of $725,000 (par value $700,000).The bonds mature on December 31, 2014.Both companies use the straight-line method of amortization and have a December 31 year-end.The increase in 2013 consolidated income (i.e., income before subtracting noncontrolling interest) is

A)$45,000.

B)$44,000.

C)$54,000.

D)$36,000.

E)$46,000.

A)$45,000.

B)$44,000.

C)$54,000.

D)$36,000.

E)$46,000.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

14

From a consolidated entity point of view, the constructive gain or loss on the open market purchase of a parent company's bonds by a subsidiary company is

A)considered realized at the date of the open market purchase.

B)realized in future periods through discount and premium amortization on the books of the individual companies.

C)realized only to the extent of the parent company's interest in the subsidiary.

D)deferred and recognized in the consolidated income statement when the bonds are retired.

A)considered realized at the date of the open market purchase.

B)realized in future periods through discount and premium amortization on the books of the individual companies.

C)realized only to the extent of the parent company's interest in the subsidiary.

D)deferred and recognized in the consolidated income statement when the bonds are retired.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

15

The workpaper eliminating entry for a stock dividend declared by the subsidiary includes a

A)debit to Stock Dividends Declared - S Co.

B)debit to Noncontrolling interest.

C)credit to Stock Dividends Declared - S Co.

D)debit to Dividend Income.

A)debit to Stock Dividends Declared - S Co.

B)debit to Noncontrolling interest.

C)credit to Stock Dividends Declared - S Co.

D)debit to Dividend Income.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following information to answer Questions

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

The total gain or loss on the constructive retirement of the debt to be reported in the 2013 consolidated income statement is

A)$12,000 loss.

B)$12,000 gain.

C)$18,400 loss.

D)$18,400 gain.

E)$6,400 loss.

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

The total gain or loss on the constructive retirement of the debt to be reported in the 2013 consolidated income statement is

A)$12,000 loss.

B)$12,000 gain.

C)$18,400 loss.

D)$18,400 gain.

E)$6,400 loss.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

17

Use the following information to answer Questions

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

Pallet Corporation would report a balance in the Investment in Stealth Company Bonds account on December 31, 2013, of

A)$412,000.

B)$393,600.

C)$410,500.

D)$400,000.

E)none of these.

Pallet Corporation owns 90% of the outstanding common stock of Stealth Company.On January 1, 2011, Stealth Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Pallet Corporation paid $412,000 for Stealth Company bonds with a par value of $400,000 and a carrying value of $393,600.Both companies use the straight-line method to amortize bond premiums and discounts.Pallet Corporation accounts for the investment using the cost method of accounting.

Pallet Corporation would report a balance in the Investment in Stealth Company Bonds account on December 31, 2013, of

A)$412,000.

B)$393,600.

C)$410,500.

D)$400,000.

E)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

18

On January 1, 2013, Pale Company has $700,000 of 6%, 10-year bonds with an unamortized discount of $28,000.Slugg Company, an 80% subsidiary, purchased $350,000 of these bonds at 102.The gain or (loss) on the retirement of Pale's bonds is:

A)$14,000 loss.

B)$14,000 gain.

C)$21,000 loss.

D)$21,000 gain.

A)$14,000 loss.

B)$14,000 gain.

C)$21,000 loss.

D)$21,000 gain.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

19

The parent company records the receipt of shares from a subsidiary's stock dividend as

A)dividend income.

B)a reduction of the investment account.

C)an increase in the investment account.

D)none of these.

A)dividend income.

B)a reduction of the investment account.

C)an increase in the investment account.

D)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

20

Pointe Company purchased bonds from Sentient Company on the open market at a premium.Sentient Company is a 100% owned subsidiary of Pointe Company.Pointe intends to hold the bonds until maturity.In a consolidated balance sheet, the difference between the bond carrying values in the two companies would be:

A)included as a decrease to retained earnings.

B)included as an increase to retained earnings.

C)reported as a deferred debit to be amortized over the remaining life of the bonds.

D)reported as a deferred credit to be amortized over the remaining life of the bonds.

A)included as a decrease to retained earnings.

B)included as an increase to retained earnings.

C)reported as a deferred debit to be amortized over the remaining life of the bonds.

D)reported as a deferred credit to be amortized over the remaining life of the bonds.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

21

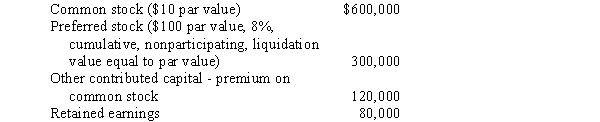

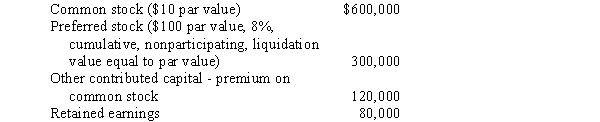

On January 1, 2013, Pippert Company acquired 80% of Skyler Company's common stock for $210,000 and 70% of Skyler's preferred stock for $80,000.Skyler Company reported the following stockholders' equity on this date:

The preferred stock is cumulative, nonparticipating, and callable at 104% of par value plus dividends in arrears.On January 1, 2013, dividends were in arrears for one year.Any difference between the implied value of the preferred stock and its book value interest is to be allocated to other contributed capital.

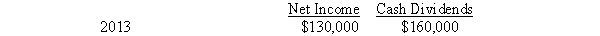

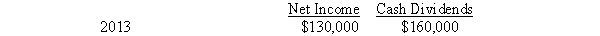

Changes in Skyler Company's retained earnings during 2013 and 2014 were as follows:

Required:

A.Compute the difference between the implied value and book value interest acquired for the investment in preferred stock.

B.Compute the balance in the Investment in Preferred Stock account on December 31, 2014.

C.Compute the amount of Skyler Company's net income that will be included in the controlling interest in consolidated net income for 2014.

The preferred stock is cumulative, nonparticipating, and callable at 104% of par value plus dividends in arrears.On January 1, 2013, dividends were in arrears for one year.Any difference between the implied value of the preferred stock and its book value interest is to be allocated to other contributed capital.

Changes in Skyler Company's retained earnings during 2013 and 2014 were as follows:

Required:

A.Compute the difference between the implied value and book value interest acquired for the investment in preferred stock.

B.Compute the balance in the Investment in Preferred Stock account on December 31, 2014.

C.Compute the amount of Skyler Company's net income that will be included in the controlling interest in consolidated net income for 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

22

Use the following information to answer Questions

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

Compute the noncontrolling interest in the 2013 consolidated income assuming that Parker Company reported a net income of $240,000 (includes dividend income from Stagger Company).Stagger Company reported net income of $150,000 and declared and paid cash dividends of $90,000.

A)$15,000.

B)$14,790.

C)$14,760.

D)$15,210.

E)None of these.

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

Compute the noncontrolling interest in the 2013 consolidated income assuming that Parker Company reported a net income of $240,000 (includes dividend income from Stagger Company).Stagger Company reported net income of $150,000 and declared and paid cash dividends of $90,000.

A)$15,000.

B)$14,790.

C)$14,760.

D)$15,210.

E)None of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

23

An outside party issued a note to Affiliate X, who then sold the note to Affiliate Y.Y discounted the note at an unaffiliated bank, endorsing it with recourse.Which party is primarily liable and which party is contingently liable for the note?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

24

Allocating the gain or loss on constructive bond retirement between the purchasing and issuing companies is preferred conceptually.Describe how this allocation would be made.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

25

Define "constructive retirement of debt." How is the total constructive gain or loss computed?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

26

On January 1, 2013, Prosser Company acquired 90% of the common stock of Simone Company for $720,000 and 20% of the preferred stock for $70,000.On this date, Simone Company reported the following account balances:

Simone Company did not declare a cash dividend during 2012.Prosser Company uses the cost method.

Required:

A.During 2013 Simone Company reported net income of $360,000 and declared cash dividends of $160,000.Calculate the 2013 noncontrolling interest in net income and the amount of the cash dividends Prosser Company should have received during the year from each of the stock investments.

B.Prepare, in general journal form, the workpaper entries that would be made in the preparation of the December 31, 2013, consolidated statements workpaper.The difference between the implied value of the common stock and the book value interest acquired is attributable to an undervaluation in the land of Simone Company.Any difference between the implied value of the preferred stock and its book value is allocated to other contributed capital.

Simone Company did not declare a cash dividend during 2012.Prosser Company uses the cost method.

Required:

A.During 2013 Simone Company reported net income of $360,000 and declared cash dividends of $160,000.Calculate the 2013 noncontrolling interest in net income and the amount of the cash dividends Prosser Company should have received during the year from each of the stock investments.

B.Prepare, in general journal form, the workpaper entries that would be made in the preparation of the December 31, 2013, consolidated statements workpaper.The difference between the implied value of the common stock and the book value interest acquired is attributable to an undervaluation in the land of Simone Company.Any difference between the implied value of the preferred stock and its book value is allocated to other contributed capital.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

27

Stemberger Company issued 10-year, 8% bonds with a par value of $1,000,000 on January 2, 2012, for $1,040,000.Interest is payable semiannually on June 30 and December 31.On December 31, 2013, Putter Company purchased $700,000 of Stemberger par value bonds for $670,000.Stemberger is an 80% owned subsidiary of Putter.Both companies use the straight-line method to amortize bond discounts and premiums.Stemberger declared cash dividends of $100,000 in 2013 and reported net income of $220,000 for the year.

Putter reported net income of $350,000 for 2013 and paid dividends of $160,000 during 2013.

Required:

A.Compute the total gain or loss on the constructive retirement of the debt.

B.Allocate the total gain or loss between Stemberger Company and Putter Company.

C.Compute the controlling interest in consolidated net income for 2013.

D.Prepare in general journal form the intercompany bond elimination entries for the consolidated statements workpaper prepared on December 31, 2013.

Putter reported net income of $350,000 for 2013 and paid dividends of $160,000 during 2013.

Required:

A.Compute the total gain or loss on the constructive retirement of the debt.

B.Allocate the total gain or loss between Stemberger Company and Putter Company.

C.Compute the controlling interest in consolidated net income for 2013.

D.Prepare in general journal form the intercompany bond elimination entries for the consolidated statements workpaper prepared on December 31, 2013.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

28

The gain or loss on the constructive retirement of debt is recognized subsequently by the individual companies.Explain.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

29

Use the following information to answer Questions

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

Parker Company would report a balance in the Investment in Stagger Company Bonds account on December 31, 2013, of

A)$315,000.

B)$297,600.

C)$313,125.

D)$300,000

E)None of these.

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

Parker Company would report a balance in the Investment in Stagger Company Bonds account on December 31, 2013, of

A)$315,000.

B)$297,600.

C)$313,125.

D)$300,000

E)None of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

30

Explain how the reciprocity calculation is modified in periods after the declaration of a stock dividend for firms using the cost method.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

31

Under the allocation method followed in this text, how is the noncontrolling interest in consolidated income affected by intercompany bondholdings?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

32

On January 1, 2013, Pultey Company acquired an 80% interest in Saucey Company for $1,070,000.Saucey reported common stock of $1,000,000 and retained earnings of $400,000 on this date.Any difference between implied value and the book value interest acquired is attributable to land.

Other information available for Saucey Company is shown below:

Pultey Company uses the cost method to account for its investment in Saucey Company.

Required:

A.Prepare the general journal entries for 2013 to record the receipt of the cash dividends.

B.Prepare in general journal form the workpaper entries necessary in the consolidated statements workpaper for the year end December 31, 2013.

Other information available for Saucey Company is shown below:

Pultey Company uses the cost method to account for its investment in Saucey Company.

Required:

A.Prepare the general journal entries for 2013 to record the receipt of the cash dividends.

B.Prepare in general journal form the workpaper entries necessary in the consolidated statements workpaper for the year end December 31, 2013.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

33

What journal entry, if any, would the parent company make to record the receipt of a stock dividend?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

34

Give the primary argument(s) in favor of assigning the total gain or loss on constructive bond retirement to the company that issued the bonds.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

35

Use the following information to answer Questions

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

The total gain or loss on the constructive retirement of the debt to be reported in the 2013 consolidated income statement is

A)$15,000 loss.

B)$15,000 gain.

C)$17,400 loss.

D)$17,400 gain.

E)$ 2,400 loss.

Parker Company owns 90% of the outstanding common stock of Stagger Company.On January 1, 2014, Stagger Company issued $500,000, 12%, ten-year bonds.

On January 1, 2013, Parker Company paid $315,000 for Stagger Company bonds with a par value of $300,000 and a carrying value of $297,600.Both companies use the straight-line method to amortize bond premiums and discounts.Parker Company accounts for the investment using the cost method of accounting.

The total gain or loss on the constructive retirement of the debt to be reported in the 2013 consolidated income statement is

A)$15,000 loss.

B)$15,000 gain.

C)$17,400 loss.

D)$17,400 gain.

E)$ 2,400 loss.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

36

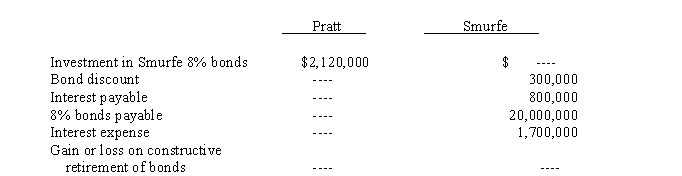

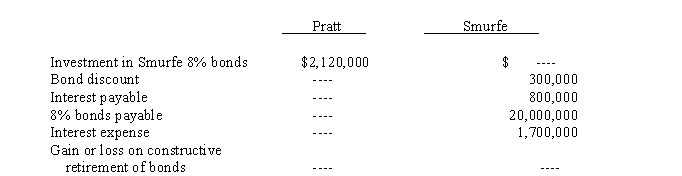

Pratt Company, who owns an 80% interest in Smurfe Company, purchased $2,000,000 of Smurfe's 8% bonds at 106 on December 31, 2013.The bonds pay interest on January 1 and July 1 and mature on December 31, 2013.Pratt Company uses the cost method to account for its investment in Smurfe.Selected balances from December 31, 2013 accounts of the two companies are as follows:

Required:

Prepare in general journal form the workpaper eliminations related to the bonds to consolidated the financial statements of Pratt and its subsidiary for the year ended December 31, 2013 and 2014.

Required:

Prepare in general journal form the workpaper eliminations related to the bonds to consolidated the financial statements of Pratt and its subsidiary for the year ended December 31, 2013 and 2014.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

37

Cash dividends are viewed as a distribution of the most recent earnings.How are stock dividends viewed?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

38

Use the following information to answer Questions

Pentagon Company acquired 90% of Smoker Company's common stock for $1,300,000 and 40% of its preferred stock for $300,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value.Dividends were not paid during 2012.During 2013, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000.

-Noncontrolling interest in the 2013 reported net income of Smoker Company is

A)$50,000.

B)$20,000.

C)$80,000.

D)$56,000.

E)none of these.

Pentagon Company acquired 90% of Smoker Company's common stock for $1,300,000 and 40% of its preferred stock for $300,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value.Dividends were not paid during 2012.During 2013, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000.

-Noncontrolling interest in the 2013 reported net income of Smoker Company is

A)$50,000.

B)$20,000.

C)$80,000.

D)$56,000.

E)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

39

On January 1, 2013, Power Company purchased 80% of the common stock of Stuckey Company for $400,000.Stuckey Company reported common stock of $200,000 ($10 par value), other contributed capital of $60,000, and retained earnings of $120,000 on this date.The difference between implied value and the book value interest acquired is attributable to the under-valuation of land held by Stuckey Company.Stuckey Company reported net income for 2013 of $100,000.During 2013 Stuckey Company declared and paid a 20% stock dividend and a $24,000 cash dividend.Stuckey Company stock had a market value of $30 per share on the date the stock dividend was declared.Power Company uses the cost method to account for its investment in Stuckey Company.

Required:

A.Prepare the journal entries required in the books of Power Company to account for the investment in Stuckey Company.

B.Prepare in general journal form the workpaper entries necessary in the consolidated statements workpaper for the year ended December 31, 2013.

C.Prepare the workpaper entry to establish reciprocity in the 2014 consolidated statements workpaper.

Required:

A.Prepare the journal entries required in the books of Power Company to account for the investment in Stuckey Company.

B.Prepare in general journal form the workpaper entries necessary in the consolidated statements workpaper for the year ended December 31, 2013.

C.Prepare the workpaper entry to establish reciprocity in the 2014 consolidated statements workpaper.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

40

Use the following information to answer Questions

Pentagon Company acquired 90% of Smoker Company's common stock for $1,300,000 and 40% of its preferred stock for $300,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value.Dividends were not paid during 2012.During 2013, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000.

-The difference between the implied value of the preferred stock and its book value is

A)$60,000.

B)$78,000

C)$55,200.

D)$36,000.

E)none of these.

Pentagon Company acquired 90% of Smoker Company's common stock for $1,300,000 and 40% of its preferred stock for $300,000.On January 1, 2013, the date of acquisition, the companies reported the following account balances: The preferred stock is 10%, cumulative, nonparticipating, and has a liquidation value equal to 102% of par value.Dividends were not paid during 2012.During 2013, Smoker Company reported net income of $200,000 and declared and paid cash dividends in the amount of $120,000.

-The difference between the implied value of the preferred stock and its book value is

A)$60,000.

B)$78,000

C)$55,200.

D)$36,000.

E)none of these.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

41

How does the existence of preferred stock affect the calculation of noncontrolling interest?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

42

What effect does a stock dividend have on the consolidated statements work paper in the year of declaration? In subsequent periods?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

43

What effect would cumulative preferred stock have on the allocation of a net loss to the common stockholders?

Business Ethics Question from the Textbook

The company that you work for is a subsidiary of a larger company.At the beginning of each year, the subsidiary prepares a budget for the year that includes a forecast of revenues for the coming year.The subsidiary sells a significant amount of inventory to the parent to be used in the manufacture of another product.The subsidiary's revenues for the current year are short of the budgeted amount.An error in the books has misclassified an intercompany sale as an ordinary sale.The manager of the subsidiary asks you not to fix the error until after the books are closed.What is your responsibility? What action, if any, should you take? Why?

Business Ethics Question from the Textbook

The company that you work for is a subsidiary of a larger company.At the beginning of each year, the subsidiary prepares a budget for the year that includes a forecast of revenues for the coming year.The subsidiary sells a significant amount of inventory to the parent to be used in the manufacture of another product.The subsidiary's revenues for the current year are short of the budgeted amount.An error in the books has misclassified an intercompany sale as an ordinary sale.The manager of the subsidiary asks you not to fix the error until after the books are closed.What is your responsibility? What action, if any, should you take? Why?

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck

44

Explain how to account for the difference between implied and book value interest of an in-vestment in preferred stock of a subsidiary.

Unlock Deck

Unlock for access to all 44 flashcards in this deck.

Unlock Deck

k this deck