Deck 19: Accounting for Nongovernment Nonbusiness Organizations:

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/33

Play

Full screen (f)

Deck 19: Accounting for Nongovernment Nonbusiness Organizations:

1

Resources of an unrestricted fund that are designated by the governing board for endowment purposes are accounted for in the unrestricted fund by all NNOs except

A)voluntary health and welfare organizations.

B)hospitals.

C)colleges and universities.

D)other NNOs.

A)voluntary health and welfare organizations.

B)hospitals.

C)colleges and universities.

D)other NNOs.

C

2

For a university, the receipt of assets for operating activities that have external restrictions as to the purposes for which they can be used is recorded by crediting

A)Fund Balance-Restricted.

B)Contribution Revenue.

C)Deferred Revenue.

D)Net Assets Released.

A)Fund Balance-Restricted.

B)Contribution Revenue.

C)Deferred Revenue.

D)Net Assets Released.

B

3

A municipality's capital projects fund is similar to a university's

A)renewals and replacements fund.

B)retirement of indebtedness fund.

C)investment in plant fund.

D)none of these.

A)renewals and replacements fund.

B)retirement of indebtedness fund.

C)investment in plant fund.

D)none of these.

A

4

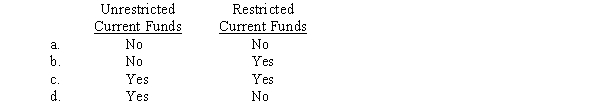

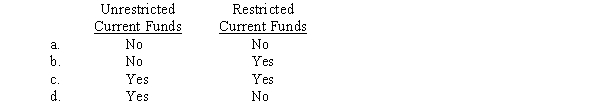

Which of the following is used for current expenditures by a college?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

5

Investments are reported by NNOs at

A)cost.

B)fair value.

C)the lower of cost or fair value.

D)the higher of cost or fair value.

A)cost.

B)fair value.

C)the lower of cost or fair value.

D)the higher of cost or fair value.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following statements related to pledges is incorrect?

A)Pledges are signed commitments to contribute specific amounts of money on a future date or in installments.

B)Pledges are recorded as revenues when a promise to give is nonrevocable and unconditional.

C)Pledges are generally enforceable contracts.

D)All of these are correct.

A)Pledges are signed commitments to contribute specific amounts of money on a future date or in installments.

B)Pledges are recorded as revenues when a promise to give is nonrevocable and unconditional.

C)Pledges are generally enforceable contracts.

D)All of these are correct.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

7

Under Southdale Hospital's established rate structure, the hospital would have earned patient service revenue of $7,000,000 for the year ended December 31, 2014.However, Southdale did not expect to collect this amount because of charity allowances of $1,000,000 and discounts of $500,000 to third party payers.In May 2014, Southdale purchased bandages from Ace Supply Co.at a cost of $5,000.However, Ace notified Southdale that the invoice was being cancelled and that the bandages were being donated to Southdale.

For the year ended December 31, 2014, Southdale should record the donation of bandages as:

A)a $5,000 reduction in operating expenses.

B)nonoperating revenue of $5,000.

C)other operating revenue of $5,000.

D)a memorandum entry only.

For the year ended December 31, 2014, Southdale should record the donation of bandages as:

A)a $5,000 reduction in operating expenses.

B)nonoperating revenue of $5,000.

C)other operating revenue of $5,000.

D)a memorandum entry only.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

8

All of the following are a plant fund in colleges and universities except

A)unexpended plant fund.

B)funds for renewals and replacements.

C)investment in plant.

D)plant replacement and expansion fund.

A)unexpended plant fund.

B)funds for renewals and replacements.

C)investment in plant.

D)plant replacement and expansion fund.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

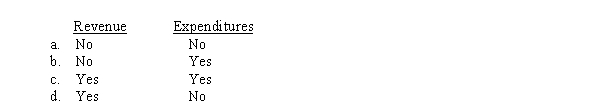

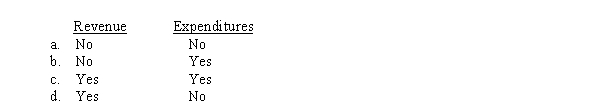

9

Tuition waivers for which there is no intention of collection from the student should be classified by a college as:

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

10

Board designated funds should be accounted for as

A)restricted funds.

B)specific purpose funds.

C)unrestricted funds.

D)none of these.

A)restricted funds.

B)specific purpose funds.

C)unrestricted funds.

D)none of these.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

11

Which basis of accounting should a voluntary health and welfare organization use?

A)Cash basis for all funds

B)Modified accrual basis for all funds

C)Accrual basis for all funds

D)Accrual basis for some funds and modified accrual basis for other funds

A)Cash basis for all funds

B)Modified accrual basis for all funds

C)Accrual basis for all funds

D)Accrual basis for some funds and modified accrual basis for other funds

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

12

Which one of the following statements is not required for NNOs?

A)statement of financial position

B)statement of cash flows

C)statement of changes in net assets

D)statement of activities

A)statement of financial position

B)statement of cash flows

C)statement of changes in net assets

D)statement of activities

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

13

Special entities are not-for-profit organizations that are

A)government owned.

B)privately owned.

C)publicly owned.

D)either government owned or privately owned.

A)government owned.

B)privately owned.

C)publicly owned.

D)either government owned or privately owned.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

14

Most property, plant and equipment transactions of hospitals are accounted for in the

A)fund for renewals and replacements.

B)general fund.

C)plant replacement and expansion fund.

D)unexpended plant fund.

A)fund for renewals and replacements.

B)general fund.

C)plant replacement and expansion fund.

D)unexpended plant fund.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

15

In accounting for loan funds, revenue is recorded when the

A)contribution is received.

B)loan is made to students.

C)loan is repaid by students.

D)students graduate.

A)contribution is received.

B)loan is made to students.

C)loan is repaid by students.

D)students graduate.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

16

Revenues and expenses of hospitals are recorded in the accounts of the

A)Endowment Fund.

B)General Fund.

C)Plant Replacement Fund.

D)Specific Purpose Fund.

A)Endowment Fund.

B)General Fund.

C)Plant Replacement Fund.

D)Specific Purpose Fund.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

17

Under Southdale Hospital's established rate structure, the hospital would have earned patient service revenue of $7,000,000 for the year ended December 31, 2014.However, Southdale did not expect to collect this amount because of charity allowances of $1,000,000 and discounts of $500,000 to third party payers.In May 2014, Southdale purchased bandages from Ace Supply Co.at a cost of $5,000.However, Ace notified Southdale that the invoice was being cancelled and that the bandages were being donated to Southdale.

For the year ended December 31, 2014, how much should Southdale record as patient service revenue?

A)$7,000,000

B)$6,500,000

C)$6,000,000

D)$5,500,000

For the year ended December 31, 2014, how much should Southdale record as patient service revenue?

A)$7,000,000

B)$6,500,000

C)$6,000,000

D)$5,500,000

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

18

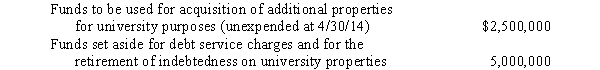

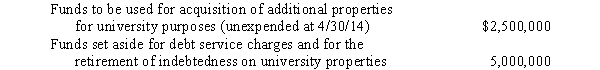

The following funds were among those on Cole University's books at April 30, 2014:  How much of the above-mentioned funds should be included in plant funds?

How much of the above-mentioned funds should be included in plant funds?

A)$0

B)$2,500,000

C)$5,000,000

D)$7,500,000

How much of the above-mentioned funds should be included in plant funds?

How much of the above-mentioned funds should be included in plant funds?A)$0

B)$2,500,000

C)$5,000,000

D)$7,500,000

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

19

All NNOs have current restricted funds and unrestricted funds except

A)colleges and universities

B)hospitals

C)VHWOs

D)ONNOs

A)colleges and universities

B)hospitals

C)VHWOs

D)ONNOs

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

20

When the donor has specified a particular date or event after which the principal of the Endowment Fund may be expended, the Endowment Fund is referred to as a(n)

A)pure endowment fund.

B)term endowment fund.

C)quasi endowment fund.

D)expendable endowment fund.

A)pure endowment fund.

B)term endowment fund.

C)quasi endowment fund.

D)expendable endowment fund.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

21

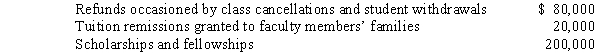

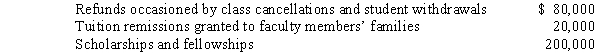

For the fall semester of 2014, Irving College assessed its students $5,000,000 for tuition and fees.The net amount realized was only $4,700,000 because of the following revenue reductions:  How much should Irving College report for the period for unrestricted current funds revenues from tuition and fees?

How much should Irving College report for the period for unrestricted current funds revenues from tuition and fees?

A)$5,000,000

B)$4,900,000

C)$4,780,000

D)$4,700,000

How much should Irving College report for the period for unrestricted current funds revenues from tuition and fees?

How much should Irving College report for the period for unrestricted current funds revenues from tuition and fees?A)$5,000,000

B)$4,900,000

C)$4,780,000

D)$4,700,000

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

22

Cindy Duncan is a social worker on the staff of Military Family Center, a voluntary welfare organization.She earns $42,000 annually for a normal workload of 2,000 hours.During 2014 she contributed an additional 800 hours of her time to Military Family Center at no extra charge.How much should Military Family Center record in 2014 as contributed service expense?

A)$0

B)$1,680

C)$8,400

D)$16,800

A)$0

B)$1,680

C)$8,400

D)$16,800

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

23

Admissions, counseling and registration are considered to be:

A)educational and general services.

B)auxiliary enterprises.

C)student services.

D)institutional support.

A)educational and general services.

B)auxiliary enterprises.

C)student services.

D)institutional support.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

24

A good reason for NNOs to adopt fund accounting even though FASB standards do not require it is because:

A)the capital assets are significant.

B)the donated services are significant.

C)the program services are involved with more than one type of revenue.

D)restrictions are placed by donors in many cases.

A)the capital assets are significant.

B)the donated services are significant.

C)the program services are involved with more than one type of revenue.

D)restrictions are placed by donors in many cases.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

25

The following events affected the New Athens University Loan Fund:

1.$300,000 is received from a donor to establish a student loan fund.Loans will carry a 6% annual interest rate.

2.The Loan Fund loaned the $300,000 to students.Five percent of the loans are estimated to be uncollectible.

3.Loans of $50,000 were repaid with $3,000 of interest.

4.A $1,000 student loan was written off as uncollectible.

Required:

Prepare the journal entries necessary to record these transactions.

1.$300,000 is received from a donor to establish a student loan fund.Loans will carry a 6% annual interest rate.

2.The Loan Fund loaned the $300,000 to students.Five percent of the loans are estimated to be uncollectible.

3.Loans of $50,000 were repaid with $3,000 of interest.

4.A $1,000 student loan was written off as uncollectible.

Required:

Prepare the journal entries necessary to record these transactions.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

26

On October 10, 2013, a national voluntary health help foundation was the recipient of a telethon sponsored by a renowned celebrity.Phone donations totaling $8,500,000 were promised.Based on historical information, 15% of these pledges are expected to be uncollectible.Of these pledges, $7,100,000 were collected in 2014; the remainder were considered uncollectible.

Required:

Identify the proper fund and prepare the journal entries necessary in 2013 and 2014.

Required:

Identify the proper fund and prepare the journal entries necessary in 2013 and 2014.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

27

GASB No.35 allows public colleges and universities to:

A)apply guidance designed for special-purpose governments.

B)use FASB standards to permit consistent reporting.

C)optionally follow FASB standards.

D)none of the above is correct.

A)apply guidance designed for special-purpose governments.

B)use FASB standards to permit consistent reporting.

C)optionally follow FASB standards.

D)none of the above is correct.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

28

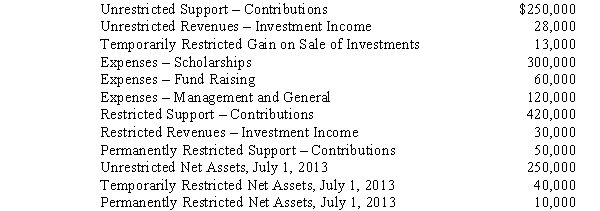

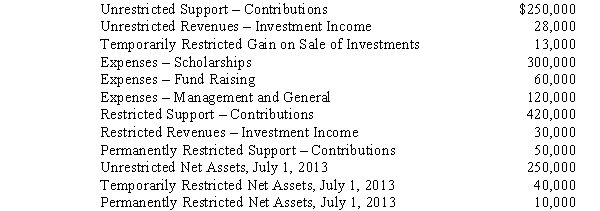

following information was taken from the accounts and records of the ABC Foundation, a private, not-for-profit organization.All balances are as of June 30, 2014, unless otherwise noted.

The unrestricted support from contributions was received in cash during the year.The expenses included $500,000 payable from donor-restricted resources.

Required:

Prepare ABC's statement of activities for the fiscal year ended June 30, 2014.

The unrestricted support from contributions was received in cash during the year.The expenses included $500,000 payable from donor-restricted resources.

Required:

Prepare ABC's statement of activities for the fiscal year ended June 30, 2014.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

29

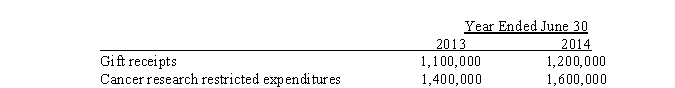

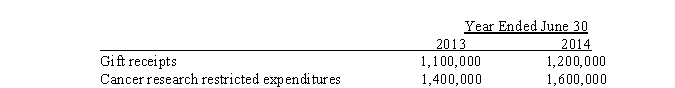

During the years ending June 30, 2013, and June 30, 2014, Jefferson University conducted a cancer research project financed by a $3,000,000 gift from an alumnus.This entire amount was pledged by the donor on July 10, 2009, although he paid only $800,000 at that date.The gift was restricted to the financing of this particular research project.During the two-year research period, Jefferson related gift receipts and research expenditures were as follows:  How much gift revenue should Jefferson University report in the temporarily restricted column of its statement of activities for the year ended June 30, 2014?

How much gift revenue should Jefferson University report in the temporarily restricted column of its statement of activities for the year ended June 30, 2014?

A)$3,000,000

B)$1,600,000

C)$1,200,000

D)$0

How much gift revenue should Jefferson University report in the temporarily restricted column of its statement of activities for the year ended June 30, 2014?

How much gift revenue should Jefferson University report in the temporarily restricted column of its statement of activities for the year ended June 30, 2014?A)$3,000,000

B)$1,600,000

C)$1,200,000

D)$0

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

30

Military Family Center is a voluntary welfare organization funded by contributions from the general public.During 2013 unrestricted pledges of $800,000 were received, half of which were payable in 2013 with the other half payable in 2014 for use in 2014.It was estimated that 10% of these pledges would be uncollectible.How much should National report as net contribution revenue for 2013 with respect to the pledges?

A)$800,000

B)$720,000

C)$360,000

D)$0

A)$800,000

B)$720,000

C)$360,000

D)$0

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following groups of not-for-profit entities must use fund accounting to be in conformity with GAAP?

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

32

An NNO obtained cash for the acquisition of property and equipment as follows:

These funds are used to acquire land.In addition, $20,000 in principal and $2,000 in interest is paid on indebtedness relating to property and equipment.Depreciation on property and equipment for the year is $80,000.

Required:

Prepare all necessary entries in the affected funds of the NNO, assuming that the NNO is a:

a.Voluntary health and welfare organization.

b.University.

c.Hospital.

These funds are used to acquire land.In addition, $20,000 in principal and $2,000 in interest is paid on indebtedness relating to property and equipment.Depreciation on property and equipment for the year is $80,000.

Required:

Prepare all necessary entries in the affected funds of the NNO, assuming that the NNO is a:

a.Voluntary health and welfare organization.

b.University.

c.Hospital.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck

33

Bell Foundation, a voluntary health and welfare organization, supported by contributions from the general public, included the following costs in its statement of functional expenses for the year ended December 31, 2014.  Bell's functional expenses for 2014 program services included

Bell's functional expenses for 2014 program services included

A)$200,000.

B)$600,000.

C)$1,000,000.

D)$1,800,000.

Bell's functional expenses for 2014 program services included

Bell's functional expenses for 2014 program services includedA)$200,000.

B)$600,000.

C)$1,000,000.

D)$1,800,000.

Unlock Deck

Unlock for access to all 33 flashcards in this deck.

Unlock Deck

k this deck