Deck 16: Accounting for Property,plant,equipment,and Intangible Assets

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/147

Play

Full screen (f)

Deck 16: Accounting for Property,plant,equipment,and Intangible Assets

1

Assets that are expected to provide benefits for a number of accounting periods are called:

A)current assets.

B)fixed assets.

C)long-term assets.

D)property,plant,and equipment.

A)current assets.

B)fixed assets.

C)long-term assets.

D)property,plant,and equipment.

C

2

Strawberry Supreme purchased new baking equipment for $17,000 subject to terms 3/15,n/45.The discount was taken.Additional costs included sales tax $700 and installation $500.The total cost to be added to the equipment account is:

A)$17,000.

B)$18,200.

C)$17,690.

D)$17,190.

A)$17,000.

B)$18,200.

C)$17,690.

D)$17,190.

C

3

Which of the following is an example of a land improvement?

A)Shrubbery

B)Fences

C)Paving a parking lot

D)All of these answers are correct.

A)Shrubbery

B)Fences

C)Paving a parking lot

D)All of these answers are correct.

D

4

A company purchased new computer equipment from a local vendor.An employee offered to pick up the equipment and received a speeding ticket on his way back to the office.The cost of the speeding ticket should not be charged to the cost of the equipment.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

5

A company purchased new machinery and incurred freight,assembly,and installation costs in addition to the invoice cost of the machinery.These additional costs should be debited to:

A)Miscellaneous Expense.

B)Machinery.

C)Installation Expense.

D)Machinery Expense.

A)Miscellaneous Expense.

B)Machinery.

C)Installation Expense.

D)Machinery Expense.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following assets would be classified as property,plant,and equipment?

A)Patent

B)Copyright

C)Goodwill

D)Furniture

A)Patent

B)Copyright

C)Goodwill

D)Furniture

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

7

A purchase of land and buildings would require the use of only one asset account,Land and Buildings.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

8

Tangible assets include:

A)building.

B)equipment.

C)land.

D)All of the above are correct.

A)building.

B)equipment.

C)land.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

9

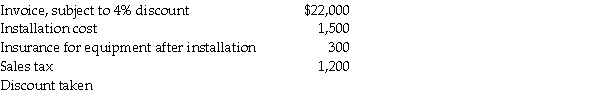

R.J.Berkshire incurred the following expenditures to buy new equipment:

The amount the Equipment account will be debited for is ________.

The amount the Equipment account will be debited for is ________.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

10

Incidental costs or assessments that should be charged to the Land account include:

A)installing a fence.

B)installing sewers.

C)clearing the property.

D)Both B and C are correct.

A)installing a fence.

B)installing sewers.

C)clearing the property.

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

11

Mount Company purchased a machine at an invoice cost of $25,000 subject to terms of 2/10,n/30.The discount was taken.Additional costs were installation,$1000;insurance on the machine after it was in operation,$500.The total cost to be added to the machinery account is:

A)$24,500.

B)$25,500.

C)$26,500.

D)$26,000.

A)$24,500.

B)$25,500.

C)$26,500.

D)$26,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

12

The amount to include in the entry to record the cost of a property,plant,and equipment asset would NOT include:

A)acquisition cost.

B)routine maintenance costs.

C)installation.

D)All of these answers are correct.

A)acquisition cost.

B)routine maintenance costs.

C)installation.

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

13

The cost of a plant asset did NOT include installation costs that were expensed.This error would cause:

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be understated.

D)Both B and C are correct.

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be understated.

D)Both B and C are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

14

Assembly costs,and any other costs necessary to get a machine ready for operation,including freight costs,would be added to the cost of the machine.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a non-depreciable asset?

A)Desk chairs

B)Land

C)Computer

D)Building

A)Desk chairs

B)Land

C)Computer

D)Building

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

16

The cost of a plant asset was increased for the payment of this year's insurance premium.This error would cause:

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period's end assets to be understated.

D)None of these is correct.

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period's end assets to be understated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

17

If there are repairs needed in the process of installation of machine,this should not be charged to the cost of the machine.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

18

Land is not depreciated.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

19

The entry to record the purchase of a machine on account that costs $15,000,installation costs,$1,500,and freight,$700,would be:

A)debit Machinery $15,000;credit Accounts Payable $15,000.

B)debit Machinery $15,000;debit Expenses 2,200;credit Accounts Payable $17,200.

C)debit Machinery $17,200;credit Accounts Payable $17,200.

D)debit Machinery $16,500;debit Freight Expense 700;credit Accounts Payable $17,200.

A)debit Machinery $15,000;credit Accounts Payable $15,000.

B)debit Machinery $15,000;debit Expenses 2,200;credit Accounts Payable $17,200.

C)debit Machinery $17,200;credit Accounts Payable $17,200.

D)debit Machinery $16,500;debit Freight Expense 700;credit Accounts Payable $17,200.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

20

Land Improvements is an asset account that records improvements to land that have a limited life.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

21

The depreciation method which charges more expense in earlier years than in later years is the:

A)straight-line method.

B)double declining-balance method.

C)units-of-production method.

D)All of the above are correct.

A)straight-line method.

B)double declining-balance method.

C)units-of-production method.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

22

J.Long purchased computer equipment for $7,000 on January 1,2015.It has a residual value of $700 with a useful life of 5 years.After the appropriate adjusting entry is made,the book value of the asset on December 31,2015,under the double declining-balance method,is:

A)$4,000.

B)$4,200.

C)$3,000.

D)$4,100.

A)$4,000.

B)$4,200.

C)$3,000.

D)$4,100.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

23

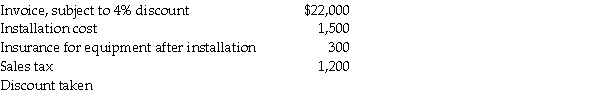

Rockwell Industries purchased a plant asset to be used in its business.The expenditures included:

The Machine account will be debited for ________.

The Machine account will be debited for ________.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

24

Double declining balance depreciation is used in the first year when straight line depreciation should be used.This error would cause:

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

25

What would be the depreciation expense using double declining-balance to compute the expense for year 2 of a machine costing $20,000,when residual value is $3,000,and useful life is 4 years?

A)$3,600

B)$6,000

C)$5,000

D)$3,000

A)$3,600

B)$6,000

C)$5,000

D)$3,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

26

In the last year of useful life,the salvage value was ignored using double declining-balance depreciation.This error would cause:

A)the period's end assets to be overstated.

B)the period's depreciation expense to be understated.

C)the period end assets to be understated.

D)None of these is correct.

A)the period's end assets to be overstated.

B)the period's depreciation expense to be understated.

C)the period end assets to be understated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

27

Salvage value was ignored when originally calculating the units-of-production depreciation.This error would cause:

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

28

Jason Moore purchased computer equipment for $5,000 on January 1,2015.It has a residual value of $200 with a useful life of 6 years.After the appropriate adjusting entries have been made,the balance in Accumulated Depreciation account for this asset on January 1,2017,under the straight-line method,should be:

A)$800.

B)$1,600.

C)$2,400.

D)$3,200.

A)$800.

B)$1,600.

C)$2,400.

D)$3,200.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

29

The depreciation method that does not base the expense on the passage of time but on the level of use is:

A)units-of-production.

B)straight-line.

C)modified accelerated cost recovery.

D)double declining-balance.

A)units-of-production.

B)straight-line.

C)modified accelerated cost recovery.

D)double declining-balance.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

30

Assuming a useful life of five years,which of the following GAAP methods would most likely result in the most depreciation in the first year?

A)Straight-line

B)MACRS

C)Double declining-balance

D)None of these answers is correct.

A)Straight-line

B)MACRS

C)Double declining-balance

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

31

Which depreciation method deducts residual value when computing depreciation expense?

A)Units-of-production

B)Straight-line

C)Double declining-balance

D)Both A and B are correct.

A)Units-of-production

B)Straight-line

C)Double declining-balance

D)Both A and B are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

32

The depreciation method in which an even amount of depreciation expense is taken each year is called:

A)straight-line method.

B)double declining-balance method.

C)units-of-production method.

D)All of the above are correct.

A)straight-line method.

B)double declining-balance method.

C)units-of-production method.

D)All of the above are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

33

Lacy purchased equipment for $76,000 on January 1.Its residual value is $4,000 with a useful life of 8 years.The amount of depreciation expense in the first year under the straight-line method is:

A)$9,000.

B)$9,500.

C)$19,000.

D)$10,000.

A)$9,000.

B)$9,500.

C)$19,000.

D)$10,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

34

Which depreciation method uses twice the straight-line rate?

A)Units-of-production

B)Modified accelerated cost recovery

C)Straight-line

D)Double declining-balance

A)Units-of-production

B)Modified accelerated cost recovery

C)Straight-line

D)Double declining-balance

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

35

Which depreciation method does NOT use the current book value in calculating depreciation expense?

A)Straight-line

B)Double declining-balance

C)Units-of-production

D)Both A and C

A)Straight-line

B)Double declining-balance

C)Units-of-production

D)Both A and C

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

36

What would the depreciation expense be in year 5 for a computer system using the straight-line method when cost is $16,000,residual value is $2,000,and the expected life is 7 years?

A)$2,000

B)$1,500

C)$1,250

D)$1,000

A)$2,000

B)$1,500

C)$1,250

D)$1,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

37

The book value of an asset is calculated by taking the:

A)market value of the asset less its accumulated depreciation.

B)cost of the asset less its accumulated depreciation.

C)residual value of the asset less its accumulated depreciation.

D)salvage value of the asset less its accumulated depreciation.

A)market value of the asset less its accumulated depreciation.

B)cost of the asset less its accumulated depreciation.

C)residual value of the asset less its accumulated depreciation.

D)salvage value of the asset less its accumulated depreciation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

38

The cost of equipment is expensed:

A)at the time it is paid.

B)over the periods that benefit the company.

C)in the period it is purchased.

D)in the period it is sold.

A)at the time it is paid.

B)over the periods that benefit the company.

C)in the period it is purchased.

D)in the period it is sold.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

39

When calculating declining balance depreciation,the straight-line rate was used instead of double the straight-line rate.In the first year of ownership,this error would cause:

A)the period end assets to be overstated.

B)the period's depreciation expense to be overstated.

C)the period end assets to be understated.

D)None of these is correct.

A)the period end assets to be overstated.

B)the period's depreciation expense to be overstated.

C)the period end assets to be understated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

40

Josh Kindel purchased equipment for $50,000 on January 1.Its residual value is $5,000 with a useful life of 10 years.The amount of depreciation expense in the first year under the double declining-balance method is:

A)$9,000.

B)$10,000.

C)$5,000.

D)$4,500.

A)$9,000.

B)$10,000.

C)$5,000.

D)$4,500.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

41

What would be the accumulated depreciation at the end of year 6 for a piece of equipment using the straight-line method when the cost is $11,000,residual value is $1,000,and the expected life is 10 years?

A)$6,600

B)$6,000

C)$1,000

D)$3,000

A)$6,600

B)$6,000

C)$1,000

D)$3,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

42

For tax purposes,________ establishes the guidelines and the percentages for depreciation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

43

Talarico's Subs purchased a new van for $28,000,its estimated useful life at 100,000 miles,residual value of $4,000.The van was driven 12,000 miles in year 1.What is the depreciation expense in year 1?

A)$2,880

B)$3,000

C)$3,360

D)$4,000

A)$2,880

B)$3,000

C)$3,360

D)$4,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

44

What would be the depreciation expense in year 1,using units-of-production,for a molding machine that cost $22,000,had a useful life of 7 years,and an estimated total machine hours of 40,000? The salvage value is $2,000 and production in year 1 was 8,000 hours.

A)$5,000

B)$4,400

C)$6,000

D)$4,000

A)$5,000

B)$4,400

C)$6,000

D)$4,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

45

The double declining-balance method is an accelerated depreciation method.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

46

Under MACRS,furniture is depreciated over seven years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

47

Double declining-balance method is used in the first year when straight-line should be used.This error would cause:

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

A)the period's net income to be overstated.

B)the period's net income to be understated.

C)the period end assets to be overstated.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

48

A depreciation method that allocates depreciation of a plant asset based on the Tax Act of 1989 is the:

A)straight-line method.

B)units-of-production method.

C)modified accelerated cost recovery method.

D)double declining-balance method.

A)straight-line method.

B)units-of-production method.

C)modified accelerated cost recovery method.

D)double declining-balance method.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

49

Using MACRS rates for a 15 and 20-year property,what is the percentage for the depreciable rate?

A)200 percent

B)150 percent

C)125 percent

D)100 percent

A)200 percent

B)150 percent

C)125 percent

D)100 percent

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

50

The units-of-production method does not take into account the passage of time.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

51

Net income is not affected by the depreciation method used.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

52

Under MACRS,which of the following classes uses the straight-line method?

A)10-year property

B)15-year property

C)24.5-year property

D)All of the above are correct.

A)10-year property

B)15-year property

C)24.5-year property

D)All of the above are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

53

What would the book value be at the end of year 6 for a piece of equipment using the straight-line method when cost is $11,000,residual value is $1,000,and the expected life is 10 years?

A)$4,400

B)$3,000

C)$5,000

D)$4,000

A)$4,400

B)$3,000

C)$5,000

D)$4,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

54

To calculate the double declining-balance rate,you would use half the straight line rate.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

55

For tax purposes,equipment is depreciated using the straight-line method under MACRS.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

56

A plant asset is fully depreciated when the book value is:

A)greater than the salvage value.

B)greater than the market value.

C)equal to the salvage value.

D)equal to the market value.

A)greater than the salvage value.

B)greater than the market value.

C)equal to the salvage value.

D)equal to the market value.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

57

A tractor costing $180,000 is depreciated using MACRS.The tractor qualifies as a 3-year property,and has a scrap value of $20,000.The depreciation rates are:

What is the depreciation expense for year 3?

A)$27,000

B)$35,560

C)$26,670

D)$23,696

What is the depreciation expense for year 3?

A)$27,000

B)$35,560

C)$26,670

D)$23,696

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

58

The depreciation method that ignores the salvage value is ________.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

59

What would be the depreciation expense in year 1,using units-of-production,for a molding machine that cost $15,000,had a useful life of 5 years,no residual value,and an estimated total machine hours of 50,000? Production in year 1 was 10,000 hours.

A)$3,000

B)$4,000

C)$6,000

D)$5,000

A)$3,000

B)$4,000

C)$6,000

D)$5,000

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

60

According to the MACRS tax rate table,the following classes do NOT use straight-line depreciation:

A)residential rental property.

B)automobiles.

C)nonresidential real property.

D)All of the above use straight line depreciation.

A)residential rental property.

B)automobiles.

C)nonresidential real property.

D)All of the above use straight line depreciation.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

61

A gain on disposal of an asset is listed as:

A)a liability on the balance sheet.

B)an asset on the balance sheet.

C)other expense on the income statement.

D)other income on the income statement.

A)a liability on the balance sheet.

B)an asset on the balance sheet.

C)other expense on the income statement.

D)other income on the income statement.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

62

When equipment that is fully depreciated is discarded:

A)debit the original cost of the asset.

B)credit the balance of Accumulated Depreciation.

C)debit Accumulated Depreciation and credit Equipment.

D)None of these answers is correct.

A)debit the original cost of the asset.

B)credit the balance of Accumulated Depreciation.

C)debit Accumulated Depreciation and credit Equipment.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

63

The entry to record the payment of an extraordinary repair of $5,000 that will extend the life of the machine 5 years,when the machine cost $30,000,and has accumulated depreciation of $26,000,is to:

A)debit Machinery $5,000;credit Accumulated Depreciation $5,000.

B)debit Accumulated Depreciation $5,000;credit Cash $5,000.

C)debit Accumulated Depreciation $1,000;credit Cash $1,000.

D)debit Machinery $1,000;credit Cash $1,000.

A)debit Machinery $5,000;credit Accumulated Depreciation $5,000.

B)debit Accumulated Depreciation $5,000;credit Cash $5,000.

C)debit Accumulated Depreciation $1,000;credit Cash $1,000.

D)debit Machinery $1,000;credit Cash $1,000.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

64

A company incorrectly records revenue expenditures as capital expenditures on its books.As a result,which of the following will be true?

A)Net income will be overstated for the year.

B)Owner's equity will be understated at year-end.

C)Total assets will be understated at year-end.

D)None of the above will occur.

A)Net income will be overstated for the year.

B)Owner's equity will be understated at year-end.

C)Total assets will be understated at year-end.

D)None of the above will occur.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

65

Accumulated depreciation is a contra ________ and is reported on the ________ ________.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

66

A piece of equipment is purchased for $78,000 on January 1.It has a 5-year life and a salvage value of $8,000.Compute the annual depreciation expense using the double declining-balance method for all 5 years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

67

Revenue expenditures do NOT include:

A)additions to existing plant assets.

B)changing tires on a car.

C)changing oil in a car.

D)All of the above are revenue expenditures.

A)additions to existing plant assets.

B)changing tires on a car.

C)changing oil in a car.

D)All of the above are revenue expenditures.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

68

Assume an asset costing $90,000 is expected to produce 400,000 units and have a salvage value of $2,000.During year 1,75,000 units were produced;during year 2,68,000 units were produced;and during year 3,70,000 units were produced.Using units-of-production,compute the depreciation expense for each of the three years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

69

A loss on the sale of a plant asset is listed as:

A)a liability on the balance sheet.

B)an asset on the balance sheet.

C)other expense on the income statement.

D)other income on the income statement.

A)a liability on the balance sheet.

B)an asset on the balance sheet.

C)other expense on the income statement.

D)other income on the income statement.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

70

Budgeting for items such as equipment and furniture would be considered:

A)capital expenses.

B)capital expenditures.

C)general expenses.

D)general expenditures.

A)capital expenses.

B)capital expenditures.

C)general expenses.

D)general expenditures.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

71

A car is purchased for $30,000 on January 1.It has a 5-year life and a salvage value of $2,000.Compute the annual depreciation expense using the double declining-balance method for all 4 years.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

72

Capital expenditures would include:

A)additions.

B)betterments.

C)extraordinary repairs.

D)All of these answers are correct.

A)additions.

B)betterments.

C)extraordinary repairs.

D)All of these answers are correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

73

The journal entry to record a loss when selling a plant asset would include:

A)a credit to accumulated depreciation.

B)a debit to loss on sale of plant asset.

C)a debit to the plant asset account.

D)None of these is correct.

A)a credit to accumulated depreciation.

B)a debit to loss on sale of plant asset.

C)a debit to the plant asset account.

D)None of these is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

74

Tender Years purchased a new van on January 1,201X,for $60,000.The life of the van is 5 years or 100,000 miles,with an estimated residual value of $5,000.During the first year,the van was driven 22,000 miles.Compute the depreciation expense for the first year applying each of the methods below.

a)________ Straight-line

b)________ Units-of-production

c)________ Double declining-balance

a)________ Straight-line

b)________ Units-of-production

c)________ Double declining-balance

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

75

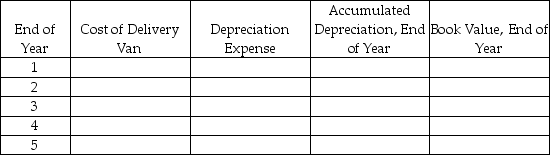

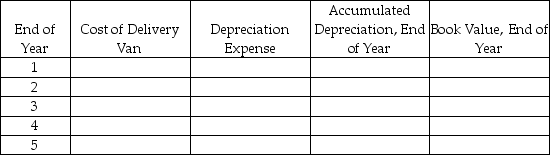

A company purchased a new delivery van on January 1,2012 for $25,000.The company expects to use the van for 5 years and then sell it for $5,000.Complete the following depreciation table assuming straight-line depreciation:

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

76

A gain on the sale of an asset occurs when:

A)the cash received is less than the book value of the asset.

B)the book value is equal to the cost of the asset,and the cash received is less than the cost of the asset.

C)the cash received is greater than the book value of the asset.

D)None of these answers is correct.

A)the cash received is less than the book value of the asset.

B)the book value is equal to the cost of the asset,and the cash received is less than the cost of the asset.

C)the cash received is greater than the book value of the asset.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

77

What is the difference between an extraordinary repair and a betterment?

A)A betterment extends the life of the asset;an extraordinary repair does not.

B)An extraordinary repair is a capital expenditure;a betterment is not.

C)An extraordinary repair may extend the life of the asset;a betterment does not.

D)None of these answers is correct.

A)A betterment extends the life of the asset;an extraordinary repair does not.

B)An extraordinary repair is a capital expenditure;a betterment is not.

C)An extraordinary repair may extend the life of the asset;a betterment does not.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

78

Yamara Company purchased a $80,000 machine on January 1.The machine is expected to have a useful life of 10 years or 60,000 operating hours and a residual value of $5,000.The machine was used for 6,000 hours in the first year and 4,400 hours in the second year.Compute the amount of depreciation expense for the first and second years under each of the methods below.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

79

A company installed a new engine in their delivery vehicle.This is an example of a(n):

A)addition.

B)betterment.

C)extraordinary repair

D)revenue expenditure.

A)addition.

B)betterment.

C)extraordinary repair

D)revenue expenditure.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck

80

A loss on the sale of an asset would occur when:

A)the cash received is less than the book value of the asset.

B)the cash received is equal to the book value of the asset.

C)the cash received is greater than the book value of the asset.

D)None of these answers is correct.

A)the cash received is less than the book value of the asset.

B)the cash received is equal to the book value of the asset.

C)the cash received is greater than the book value of the asset.

D)None of these answers is correct.

Unlock Deck

Unlock for access to all 147 flashcards in this deck.

Unlock Deck

k this deck