Deck 15: Exempt Entities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/123

Play

Full screen (f)

Deck 15: Exempt Entities

1

All organizations that are exempt from Federal income tax are exempt under § 501(c)(3).

False

2

An intermediate sanction imposed by the IRS on an exempt organization is a greater sanction than revocation of exempt status.

False

3

While the major objective of the Federal income tax law is to raise revenue, social considerations and economic objectives also affect the tax law.

True

4

To be classified as a private foundation, the exempt status of an organization can be provided under either § 501(c)(1) or § 501(c)(3).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

5

To satisfy the broadly supported provision to avoid classification as a private foundation, the exempt organization must satisfy both an external support test and an internal support test. Under the internal support test, more than one-third of the exempt organization's support for the taxable year must come from gross investment income and unrelated business taxable income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

6

A feeder organization is an exempt organization that provides funding for nutritional programs for children.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

7

A feeder organization is exempt from Federal income taxation because it carries on a trade or business for the benefit of an exempt organization and remits its profits to the exempt entity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

8

Theater, Inc., an exempt organization, owns a printing company, Printers, Inc., which remits 85% of its profits to Theater, Inc. Since Printers remits at least 85% of its profits to Theater, neither Theater, Inc., nor Printers, Inc., must pay income tax on this $85,000 ($100,000 × 85%).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

9

The League of Women Voters is a § 501(c)(3) organization.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

10

An educational organization such as the College of William and Mary that is exempt under § 501(c)(3) cannot be classified as a private foundation if its only sources of revenue are from tuition and alumni contributions.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

11

The tax consequences to a donor of making a charitable contribution to an exempt organization classified as a private foundation may be less favorable than the tax consequences to a donor of making a charitable contribution to an exempt organization that is not classified as a private foundation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

12

George is running for mayor of Culpepper. The members of Third Church adamantly oppose his candidacy. They would like to run a political advertisement in the local newspaper opposing his candidacy. The newspaper ad would have no effect on Third Church's exempt status because the ad opposes George; it does not support his opponent.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

13

Engaging in a prohibited transaction can result in an exempt organization being subject to Federal income tax, but cannot cause it to lose its exempt status unless the exempt organization repeats the prohibited transaction.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

14

General requirements for exempt status include the organization serving the common good and the organization being a not-for-profit entity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

15

Certain § 501(c)(3) exempt organizations are permitted to engage in lobbying activities on a limited basis. An example of such an exempt organization is a church.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

16

The excise taxes such as the tax on self-dealing and the tax on excess business holdings are imposed on exempt organizations classified as private foundations. The taxes are not imposed on exempt organizations classified as public charities.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

17

Certain § 501(c)(3) exempt organizations are permitted to engage in lobbying activities in the same manner as a C corporation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

18

An exempt entity in no circumstance is subject to Federal income tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

19

A church is one of the types of exempt organizations.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

20

To satisfy the "not for profit" requirement for exempt status, the entity may not be engaged in a trade or business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

21

The unrelated business income tax (UBIT) is calculated by multiplying unrelated business taxable income by the highest corporate tax rate.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

22

Federal agencies exempt from Federal income tax under § 501(c)(1) are not subject to the unrelated business income tax (UBIT).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

23

The excise tax imposed on a private foundation's investment income can be imposed as an initial (first-level) tax but cannot be imposed as an additional (second-level) tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

24

Only certain exempt organizations must obtain IRS approval to obtain exempt status.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

25

Debt-financed property consists of all real property of a tax-exempt organization on which there is a mortgage.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

26

If the unrelated business income of an exempt organization is $25,000 or less, the unrelated business income tax (UBIT) is $0.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

27

Revenue generated by an exempt organization from the distribution of low-cost items is not income from an unrelated trade or business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

28

If an exempt organization conducts a trade or business that is regularly carried on by the organization, where the business relates to the organization's exempt purpose, the organization is subject to the unrelated business income tax (UBIT).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

29

Personal property rental income is subject to and real property rental income is not subject to the unrelated business income tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

30

If personal property is leased with real property and more than 45% of the rent income under the lease is from personal property, all of the rent income is subject to the unrelated business income tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

31

Some of the excise taxes which may be imposed on private foundations may be imposed on both the private foundation and the foundation manager.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

32

Even though a church is not required to obtain IRS approval of its exempt status, it still annually must file a Form 990.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

33

For an exempt organization to be subject to the unrelated business income tax, the trade or business must not be substantially related to the exempt purpose of the organization.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

34

A corporate sponsorship payment that is contingent on attendance at a sporting event increases the amount of unrelated business income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

35

The income from a bingo game or a casino game conducted by an exempt organization may be unrelated business income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

36

If an exempt organization conducts a trade or business that consists of either exchanging or renting to other exempt organizations the organization's donor or membership list, such trade or business is an unrelated trade or business.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

37

The purpose of the excise tax imposed on a private foundation for failure to distribute sufficient levels of income is to motivate the foundation to distribute more of its income for application to exempt purposes.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

38

The trade or business of selling merchandise where substantially all of the merchandise has been received as contributions or gifts is not subject to the unrelated business income tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

39

For purposes of the unrelated business income tax (UBIT), a trade or business consists of any activity conducted for the production of income through the sale of merchandise, or from the performance of services for which profits have been earned during at least two of the five previous years.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

40

Unrelated debt-financed income, net of the unrelated debt-financed deductions, is subject to the unrelated business income tax only if the exempt organization is a private foundation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

41

Third Church operates a gift shop in its parish house. The total income of the church is $800,000. Of this amount, $300,000 comes from offerings and $500,000 comes from the net income of the gift shop. The gift shop operations are conducted by six full-time, paid employees. Which of the following statements is correct?

A)The $800,000 is unrelated business income.

B)The $500,000 of gift shop net income is unrelated business income.

C)The $300,000 is unrelated business income because the gift shop is a feeder organization.

D)None of the $800,000 is unrelated business income.

E)The unrelated business income tax does not apply to churches.

A)The $800,000 is unrelated business income.

B)The $500,000 of gift shop net income is unrelated business income.

C)The $300,000 is unrelated business income because the gift shop is a feeder organization.

D)None of the $800,000 is unrelated business income.

E)The unrelated business income tax does not apply to churches.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following statements is correct regarding the unrelated business income tax (UBIT)?

A)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business is not substantially related to the exempt purpose of the organization, and the trade or business is regularly carried on by the organization.

B)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business must be substantially related to the exempt purpose of the organization, and the trade or business must be regularly carried on by the organization.

C)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business is not substantially related to the exempt purpose of the organization, and the trade or business is carried on during more than half the year.

D)An exempt entity that conducts a business that competes with for-profit businesses automatically is subject to the UBIT.

E)None of the above statements is correct.

A)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business is not substantially related to the exempt purpose of the organization, and the trade or business is regularly carried on by the organization.

B)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business must be substantially related to the exempt purpose of the organization, and the trade or business must be regularly carried on by the organization.

C)To be subject to the UBIT, the exempt organization must conduct a trade or business, the trade or business is not substantially related to the exempt purpose of the organization, and the trade or business is carried on during more than half the year.

D)An exempt entity that conducts a business that competes with for-profit businesses automatically is subject to the UBIT.

E)None of the above statements is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following statements regarding the unrelated business income tax is not correct?

A)Unrelated business income is income from activities not related to the exempt purpose of the organization.

B)The unrelated business income tax is levied because the exempt organization is engaging in substantial commercial activities.

C)If the unrelated business income tax were not levied, nonexempt organizations would be placed at a substantial disadvantage when trying to compete with the exempt organization.

D)The tax rate that is applied to unrelated business taxable income is the highest corporate tax rate.

E)All of the above statements are correct.

A)Unrelated business income is income from activities not related to the exempt purpose of the organization.

B)The unrelated business income tax is levied because the exempt organization is engaging in substantial commercial activities.

C)If the unrelated business income tax were not levied, nonexempt organizations would be placed at a substantial disadvantage when trying to compete with the exempt organization.

D)The tax rate that is applied to unrelated business taxable income is the highest corporate tax rate.

E)All of the above statements are correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

44

The due date for the Exempt Organization Business Income Tax Return (Form 990-T) is the fifteenth day of the third month after the end of the taxable year.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

45

Unless the "widely available" provision is satisfied, a § 501(c)(3) exempt organization (excluding churches and private foundations) must make copies of the following available to the general public: Form 990 (Return of Organization Exempt from Income Tax) and Form 1023 [Application for Recognition of Exemption under § 501(c)(3)] or Form 1024 [Application for Recognition of Exemption under § 501(a)].

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following statements regarding the unrelated business income tax is correct?

A)Private foundations are subject to the unrelated business income tax.

B)Bingo games are not subject to the unrelated business income tax if they are conducted by an exempt organization.

C)The exchange or rental of membership lists with other exempt and nonexempt organizations is not an unrelated trade or business.

D)All of the above statements are correct.

E)None of the above statements is correct.

A)Private foundations are subject to the unrelated business income tax.

B)Bingo games are not subject to the unrelated business income tax if they are conducted by an exempt organization.

C)The exchange or rental of membership lists with other exempt and nonexempt organizations is not an unrelated trade or business.

D)All of the above statements are correct.

E)None of the above statements is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

47

Miracle, Inc., is a § 501(c)(3) organization involved in medical research. Based on its expectation that proposed legislation will adversely affect the funding supporting its mission, Miracle hires a lobbyist to work in Washington to represent its views.

Miracle is eligible for and thus makes the § 501(h) election. It calculates the lobbying nontaxable amount to be $100,000 ($500,000 exempt purpose expenditures × 20%). The total lobbying expenditures for the year were $115,000. Calculate Miracle's tax on excess lobbying expenditures.

Miracle is eligible for and thus makes the § 501(h) election. It calculates the lobbying nontaxable amount to be $100,000 ($500,000 exempt purpose expenditures × 20%). The total lobbying expenditures for the year were $115,000. Calculate Miracle's tax on excess lobbying expenditures.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

48

Which of the following is not an example of an exempt organization?

A)Religious, charitable, or educational organization.

B)Voluntary employees' beneficiary association.

C)Labor, agricultural, or horticultural organization.

D)Stock exchange.

E)All of the above can be exempt from tax.

A)Religious, charitable, or educational organization.

B)Voluntary employees' beneficiary association.

C)Labor, agricultural, or horticultural organization.

D)Stock exchange.

E)All of the above can be exempt from tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

49

All exempt organizations which are subject to the unrelated business income tax must file Form 990-T (Exempt Organization Business Income Tax Return).

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

50

Maroon, Inc., a tax-exempt organization, leases a building and equipment to Brown Partnership. The rental income from the building is $100,000 and from the equipment is $9,000. Rental expenses are $40,000 for the building and $4,000 for the equipment. What adjustment must be made to net unrelated business income?

A)$0

B)($60,000)

C)($65,000)

D)($109,000)

E)Some other amount.

A)$0

B)($60,000)

C)($65,000)

D)($109,000)

E)Some other amount.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

51

For purposes of the unrelated business income tax (UBIT), land that is acquired by the exempt organization for later exempt-use is excluded from the definition of debt-financed property if certain requirements are satisfied. Which of the following is not included in the requirements?

A)The principal purpose of acquiring the land is for use (substantially all) in achieving the organization's exempt purpose.

B)The fair market value of the land is not over 50% of the fair market value of land presently owned by the exempt organization.

C)The use of the land by the exempt organization will begin within ten years of the acquisition date.

D)At the date the land is acquired, it is located in the neighborhood of other property of the organization for which substantially all the use is for achieving the organization's exempt purpose.

E)All of the above are requirements.

A)The principal purpose of acquiring the land is for use (substantially all) in achieving the organization's exempt purpose.

B)The fair market value of the land is not over 50% of the fair market value of land presently owned by the exempt organization.

C)The use of the land by the exempt organization will begin within ten years of the acquisition date.

D)At the date the land is acquired, it is located in the neighborhood of other property of the organization for which substantially all the use is for achieving the organization's exempt purpose.

E)All of the above are requirements.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

52

Tan, Inc., a tax-exempt organization, has $65,000 of net unrelated business income. Total charitable contributions (all associated with the unrelated trade or business) are $7,500. Assuming that the $7,500 was deducted in calculating net unrelated business income, what is Tan's unrelated business taxable income?

A)$57,500

B)$65,250

C)$66,000

D)$72,500

E)Some other amount.

A)$57,500

B)$65,250

C)$66,000

D)$72,500

E)Some other amount.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

53

A § 501(c)(3) organization that otherwise would be classified as a private foundation can avoid such classification if it satisfies:

A)Only an external support test.

B)Only an internal support test.

C)Both an external support test and an internal support test.

D)An external support test, an internal support test, and a good faith test.

E)None of the above.

A)Only an external support test.

B)Only an internal support test.

C)Both an external support test and an internal support test.

D)An external support test, an internal support test, and a good faith test.

E)None of the above.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

54

Teal, Inc., is a private foundation which failed to distribute an adequate amount of income for the exempt purpose of Teal. Which of the following statements is correct?

A)An excise tax in the form of an initial tax at the rate of 10% may be imposed on Teal.

B)An excise tax in the form of an initial tax at the rate of 5% may be imposed on the foundation manager.

C)An excise tax in the form of an additional tax at the rate of 100% may be imposed on Teal.

D)An excise tax in the form of an additional tax at the rate of 50% may be imposed on the foundation manager.

E)None of the statements is correct.

A)An excise tax in the form of an initial tax at the rate of 10% may be imposed on Teal.

B)An excise tax in the form of an initial tax at the rate of 5% may be imposed on the foundation manager.

C)An excise tax in the form of an additional tax at the rate of 100% may be imposed on Teal.

D)An excise tax in the form of an additional tax at the rate of 50% may be imposed on the foundation manager.

E)None of the statements is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

55

Garden, Inc., a qualifying § 501(c)(3) organization, incurs lobbying expenditures of $210,000 during the taxable year. Exempt purpose expenditures are $900,000. If Garden makes the election under § 501(h) to make lobbying expenditures on a limited basis, its tax liability resulting from the lobbying expenditures is:

A)$0.

B)$12,500.

C)$50,000.

D)$60,000.

E)None of the above.

A)$0.

B)$12,500.

C)$50,000.

D)$60,000.

E)None of the above.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

56

Blue, Inc., receives its support from the following sources. Which of the following statements is correct?

A)Blue, Inc., is a private foundation because it satisfies the external support test and fails the internal support test.

B)Blue, Inc., is not a private foundation because it fails both the internal and external support tests.

C)Blue, Inc., is a private foundation because it satisfies both the external support test and the internal support test.

D)Blue, Inc., is not a private foundation because it satisfies both the external support test and the internal support test.

E)None of the statements is true.

A)Blue, Inc., is a private foundation because it satisfies the external support test and fails the internal support test.

B)Blue, Inc., is not a private foundation because it fails both the internal and external support tests.

C)Blue, Inc., is a private foundation because it satisfies both the external support test and the internal support test.

D)Blue, Inc., is not a private foundation because it satisfies both the external support test and the internal support test.

E)None of the statements is true.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements regarding intermediate sanctions is correct?

A)Intermediate sanctions are self-assessing (i.e., calculated and paid by the taxpayer rather than being imposed by the IRS).

B)The excise tax is imposed on the exempt organization and on disqualified persons.

C)Both a first-level tax and a second-level tax may apply.

D)The corporate tax rates apply in calculating the amount of the tax liability.

E)None of the above is correct.

A)Intermediate sanctions are self-assessing (i.e., calculated and paid by the taxpayer rather than being imposed by the IRS).

B)The excise tax is imposed on the exempt organization and on disqualified persons.

C)Both a first-level tax and a second-level tax may apply.

D)The corporate tax rates apply in calculating the amount of the tax liability.

E)None of the above is correct.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

58

Medical, Inc., a § 501(c)(3) exempt organization, engages in an excess benefit transaction, such that the intermediate sanctions rules may apply. The amount of the excess benefit is $50,000. For the organization management, the participation in the excess benefit transaction was not willful and was due to reasonable cause. Calculate the amount of the excise tax (first-level tax) imposed under the intermediate sanctions provision.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following attributes are associated with exempt organizations?

A)Organization serves some type of common good.

B)Organization is not a for profit entity.

C)Net earnings do not benefit the members of the organization.

D)Organization does not exert political influence.

E)All of the above statements are true.

A)Organization serves some type of common good.

B)Organization is not a for profit entity.

C)Net earnings do not benefit the members of the organization.

D)Organization does not exert political influence.

E)All of the above statements are true.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

60

Which of the following exempt organizations are required to file Form 990 (Return of Organization Exempt from Income Tax)?

A)Federal agencies.

B)Churches.

C)Exempt organizations whose annual gross receipts do not exceed $50,000.

D)Private foundations.

E)None of these entities must file Form 990.

A)Federal agencies.

B)Churches.

C)Exempt organizations whose annual gross receipts do not exceed $50,000.

D)Private foundations.

E)None of these entities must file Form 990.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

61

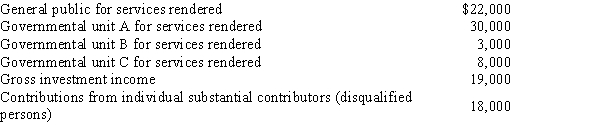

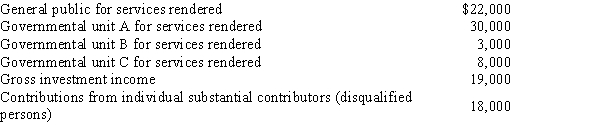

Assist, Inc., a § 501(c)(3) organization, receives the following sources of support during the tax year.  Is Assist, Inc., classified as a private foundation?

Is Assist, Inc., classified as a private foundation?

Is Assist, Inc., classified as a private foundation?

Is Assist, Inc., classified as a private foundation?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

62

Arbor, Inc., an exempt organization, leases land, building, and machinery to a tenant for a 5-year period. The rent income for the land and building is $400,000 per year and that from the related machinery is $80,000 per year. Expenses incurred by Arbor for the land and building during the year are $60,000, and those for the machinery are $36,000. Net unrelated business income, which includes the above rental income and expenses, is $800,000. Calculate Arbor's unrelated business taxable income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

63

What are intermediate sanctions and to what types of exempt organizations do they apply?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

64

Watch, Inc., a § 501(c)(3) exempt organization, solicits contributions through a mail campaign. An executive, who recently completed an executive MBA degree program, recommends that personal address labels be included as an additional way to motivate the potential donor to contribute. The value of these labels is $9.95 per potential donor. What is the effect of the inclusion of the address labels on Watch's unrelated business income?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

65

Well, Inc., a private foundation, makes a speculative investment of $400,000 that puts the foundation assets at risk. Calculate the tax on jeopardizing investments. Assume that corrective action is taken so that the additional tax does not apply.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

66

Agnes is aware that a feeder organization is subject to Federal income taxation. She wonders whether an organization otherwise taxable as a feeder organization can avoid such status if it remits less than 80% of its profits to the § 501(c)(3) entity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

67

What are the common characteristics of organizations that receive exempt status?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

68

An eligible § 501(c)(3) organization has made the § 501(h) election to participate in lobbying on a limited basis. If the lobbying nontaxable amount is exceeded, what are the potential tax consequences to the exempt organization?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

69

Rattler, Inc., an exempt organization, trains disabled individuals to design web pages. Rather than hold a traditional graduation exercise, the graduates compete in a web design contest. Such activities are held four times each year. An admission fee of $10 is charged to the general public to attend the contest. Eight hundred people attended the contest this year, and prizes of $2,000 were given to the top 3 graduates. Calculate the amount of Rattler's unrelated business income from this activity.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

70

Are organizations that qualify for exempt organization status completely exempt from Federal income taxation?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

71

Describe how an exempt organization can be eligible to make lobbying expenditures without losing its tax exemption.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

72

Ice, Inc., a § 501(c)(3) organization, has been leasing a building to Soft, Inc., a taxable entity, for 15 years. The lease terminates in the current tax year. Ice's adjusted basis for the building is $225,000. It sells the building to the Development Partnership, a taxable entity, for $440,000. Selling expenses are $26,400. Calculate the effect of the sale on Ice's UBTI.

?

?

?

?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

73

Define a private foundation.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

74

The Dispensary is a pharmacy that is part of a § 501(c)(3) hospital. Its primary mission is to dispense medicines for hospital patients. In addition, the pharmacy dispenses medicines to former hospital patients for a period of up to 30 days after discharge from the hospital. It does this for the dual purpose of convenience to the former patients (i.e., the closest pharmacy is 6 miles away), and to ensure that the former patients receive the medicines that have been prescribed for them.

The Dispensary carefully carries out the policy of the hospital board that no more than 25% of its gross revenues come from former-patient medicine sales. If necessary, in December of each year, sales to former patients are curtailed to assure compliance with this policy. Sales revenue from each of the two sources is as follows for the tax year.

Calculate the amount of The Dispensary's unrelated business income.

The Dispensary carefully carries out the policy of the hospital board that no more than 25% of its gross revenues come from former-patient medicine sales. If necessary, in December of each year, sales to former patients are curtailed to assure compliance with this policy. Sales revenue from each of the two sources is as follows for the tax year.

Calculate the amount of The Dispensary's unrelated business income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

75

Spirit, Inc., a § 501(c)(3) organization, is classified as a private foundation. It reports investment income of $175,000. Calculate Spirit's tax on its investment income.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

76

How can an exempt organization, otherwise classified as a private foundation, become a public charity?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

77

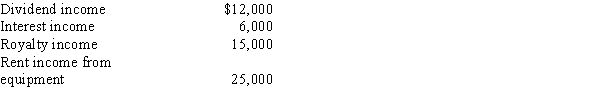

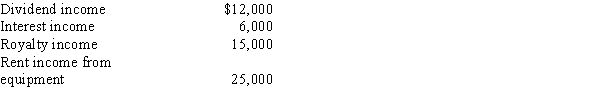

City, Inc., an exempt organization, has included among other amounts the following in calculating net unrelated business income of $500,000.  The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

The only expenses incurred associated with these items are rental expenses (which includes depreciation of $10,000) of $15,000. Calculate City, Inc.'s UBTI.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

78

Discuss benefits for which an exempt organization may be eligible, other than exemption from Federal income tax.

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

79

Pearl Inc., a tax-exempt organization, leases land, building, and machinery to Purple Partnership for a 5-year period. The rental income from the land and building is $100,000, with related expenses of $40,000. The rental income from the machinery is $9,000, with related expenses of $3,000. What adjustment must be made to net unrelated business income?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck

80

Why are some organizations exempt from Federal income tax?

Unlock Deck

Unlock for access to all 123 flashcards in this deck.

Unlock Deck

k this deck