Deck 10: Accounting for Sales and Cash Receipts

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

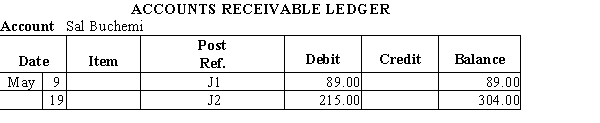

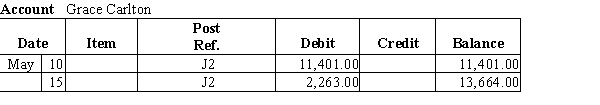

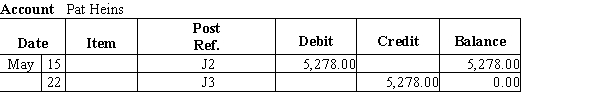

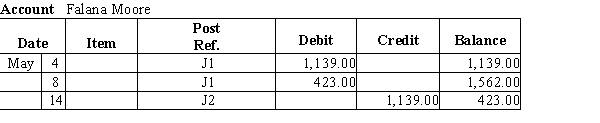

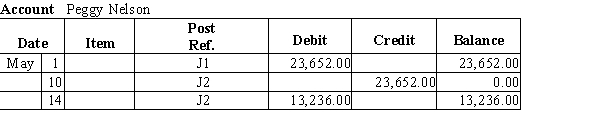

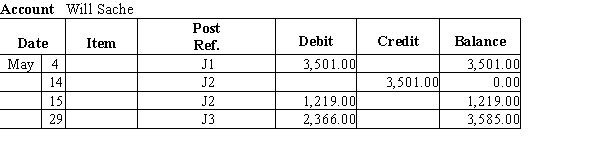

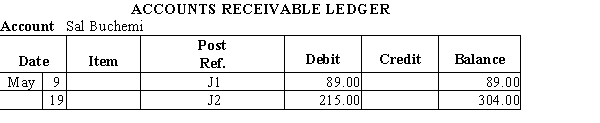

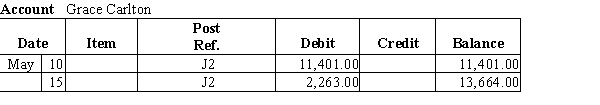

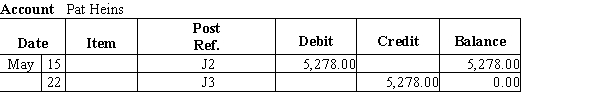

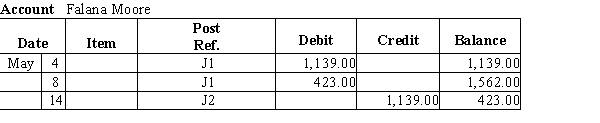

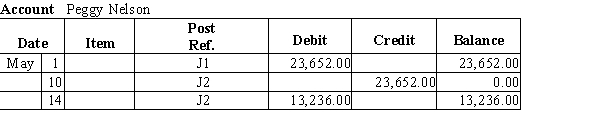

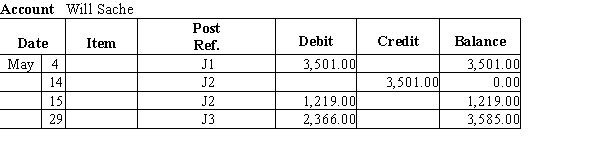

Question

Question

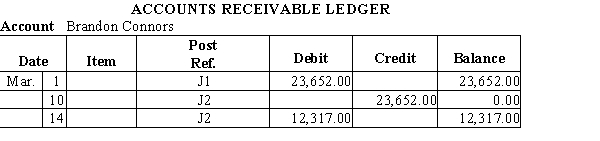

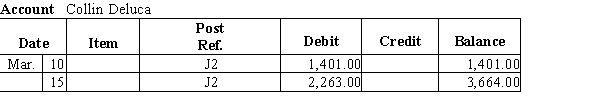

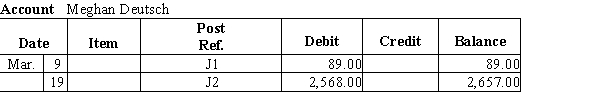

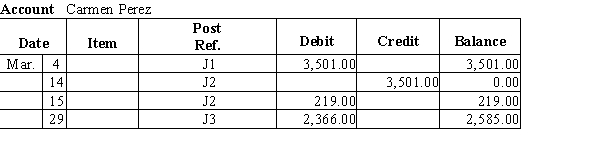

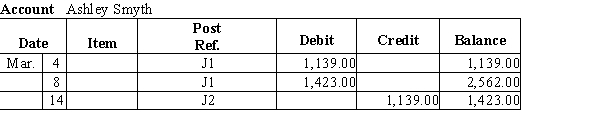

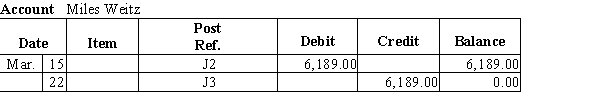

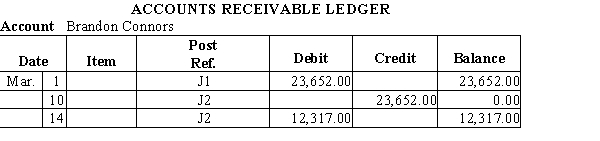

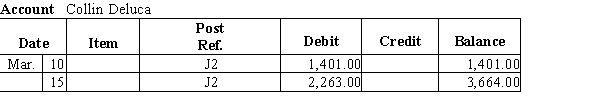

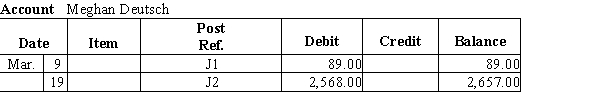

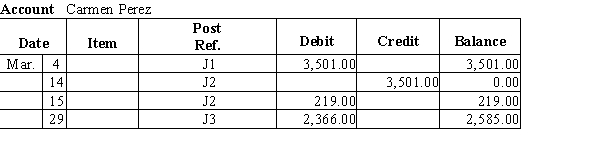

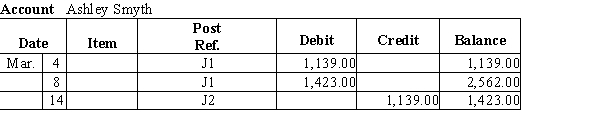

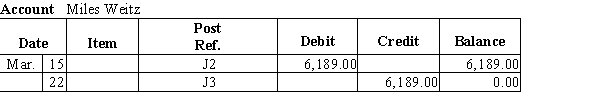

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/66

Play

Full screen (f)

Deck 10: Accounting for Sales and Cash Receipts

1

To verify that the sum of the accounts receivable ledger balances equals the Accounts Receivable balance, a schedule of accounts receivable is prepared.

True

2

A retail business allows customers to enter the store, select the merchandise they want, and bring it to a sales clerk.

True

3

If any merchandise has been returned, the sales discount is calculated on the net sales amount.

True

4

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Net sales less sales returns and allowances and sales discounts equal gross sales.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Net sales less sales returns and allowances and sales discounts equal gross sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

5

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A credit memo states the amount of a sales allowance or return.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A credit memo states the amount of a sales allowance or return.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

6

After all posting to the general ledger is completed, the accounts receivable, sales tax payable, and sales accounts in the general ledger are up to date.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

7

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Sales Returns and Allowances is debited for the selling price, including sales tax, of any merchandise returned by customers.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Sales Returns and Allowances is debited for the selling price, including sales tax, of any merchandise returned by customers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

8

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

To encourage customers who purchase merchandise on account to pay promptly, a cash discount is usually offered.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

To encourage customers who purchase merchandise on account to pay promptly, a cash discount is usually offered.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

9

Reductions in the price of merchandise granted by the seller because of defects or other problems with the merchandise are called merchandise sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

10

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The accounts receivable ledger is simply a detailed listing of the same information that is summarized in Accounts Receivable in the general ledger.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The accounts receivable ledger is simply a detailed listing of the same information that is summarized in Accounts Receivable in the general ledger.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

11

After the posting of the accounts receivable ledger and the general ledger is completed, the total of the accounts receivable ledger balances should equal the Accounts Receivable balance in the general ledger.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

12

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Selling goods on account is not common practice at the retail level of the distribution process.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Selling goods on account is not common practice at the retail level of the distribution process.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

13

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Merchandise returned by the customer for a refund is called a sales return.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

Merchandise returned by the customer for a refund is called a sales return.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

14

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

If the amount of sales returns and allowances is large in proportion to gross sales, a weakness in the merchandising operations is indicated and the trouble should be determined and corrected.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

If the amount of sales returns and allowances is large in proportion to gross sales, a weakness in the merchandising operations is indicated and the trouble should be determined and corrected.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

15

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A sales ticket is a document created as evidence of a sale in a retail business.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A sales ticket is a document created as evidence of a sale in a retail business.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

16

Merchandise returned by a customer for a refund is called a sales discount.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

17

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The sales account is credited for the selling price of merchandise sold during the period.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The sales account is credited for the selling price of merchandise sold during the period.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

18

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The amounts for sales returns and allowances, sales discounts, and net sales added together equal gross sales.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

The amounts for sales returns and allowances, sales discounts, and net sales added together equal gross sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

19

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

When a business uses a subsidiary accounts receivable ledger, there is no need to keep an accounts receivable account in the general ledger.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

When a business uses a subsidiary accounts receivable ledger, there is no need to keep an accounts receivable account in the general ledger.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

20

Match the terms with the definitions.a.Electronic Federal Tax Payment System (EFTPS)

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A common approach to keeping a record of each customer's account receivable is to use a subsidiary accounts receivable ledger.

b.employer FICA taxes

c.Employer Identification Number (EIN)

d.Form W-2

e.Form W-3

f.Form 940

g.Form 941

h.FUTA (Federal Unemployment Tax Act) tax

i.merit-rating system

j.self-employment income

k.self-employment tax

l.SUTA (state unemployment tax) tax

m.workers' compensation insurance

A common approach to keeping a record of each customer's account receivable is to use a subsidiary accounts receivable ledger.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

21

Sales made on account normally lead to cash receipts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

22

If the seller permits merchandise to be returned or an allowance to be made, it is customary for the seller to issue a(n)

A) debit memorandum.

B) return memorandum.

C) credit memorandum.

D) allowance memorandum.

A) debit memorandum.

B) return memorandum.

C) credit memorandum.

D) allowance memorandum.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

23

To verify that the sum of the accounts receivable ledger balances equals the Accounts Receivable balance, a schedule of accounts payable is prepared.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

24

For the merchant, bank credit card sales are nothing like cash sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

25

A credit memorandum for $156 (sale price of merchandise $150; sales tax of $6) was issued to a customer for goods returned that had been purchased on account. To enter this transaction properly,

A) Sales would be debited for $6.

B) Sales would be debited for $150.

C) Sales would be debited for $156.

D) Sales would not be debited.

A) Sales would be debited for $6.

B) Sales would be debited for $150.

C) Sales would be debited for $156.

D) Sales would not be debited.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

26

A schedule of accounts receivable is prepared to

A) verify that the sum of the accounts receivable ledger balances equals the Accounts Receivable balance.

B) send to all customers at the end of the month.

C) prove that the general ledger and accounts receivable ledger were posted at the same time.

D) keep track of all the company's customers.

A) verify that the sum of the accounts receivable ledger balances equals the Accounts Receivable balance.

B) send to all customers at the end of the month.

C) prove that the general ledger and accounts receivable ledger were posted at the same time.

D) keep track of all the company's customers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

27

Copies of a sales invoice are used to do all of the following EXCEPT

A) ship the merchandise.

B) bill the customer.

C) record the sale.

D) record the receipt of merchandise.

A) ship the merchandise.

B) bill the customer.

C) record the sale.

D) record the receipt of merchandise.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

28

Sales Tax Payable is a liability account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

29

A customer returns merchandise that was delivered in poor condition and that does not meet specification. The account that the seller would debit for the amount of the return is

A) Sales Returns and Allowances.

B) Purchase Returns and Allowances.

C) Sales.

D) Purchases.

A) Sales Returns and Allowances.

B) Purchase Returns and Allowances.

C) Sales.

D) Purchases.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following accounts is NOT used to account for merchandise sales transactions?

A) Sales

B) Sales Tax Payable

C) Sales Returns and Allowances

D) Accounts Payable

A) Sales

B) Sales Tax Payable

C) Sales Returns and Allowances

D) Accounts Payable

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

31

Merchandise is sold on account for $90, and the sale is subject to a retail sales tax of $5.40. The sales account should be credited for

A) $84.60.

B) $90.00.

C) $95.40.

D) $93.60.

A) $84.60.

B) $90.00.

C) $95.40.

D) $93.60.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

32

If the schedule of accounts receivable total and the Accounts Receivable balance total do not agree, a correcting entry is made to balance the two totals.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

33

The sales tax payable account is a revenue account that is credited for the amount of tax imposed on sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

34

A business that purchases clothing, furniture, computers, or other products to sell to other businesses is a

A) retail business.

B) not-for-profit business.

C) wholesale business.

D) service business

A) retail business.

B) not-for-profit business.

C) wholesale business.

D) service business

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

35

After posting is completed in the accounts receivable ledger and the general ledger, the total of the accounts receivable ledger balances should equal the

A) accounts payable account balance.

B) accounts receivable account balance.

C) cash account balance.

D) net income amount.

A) accounts payable account balance.

B) accounts receivable account balance.

C) cash account balance.

D) net income amount.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

36

The account in which the revenue earned from the sale of merchandise is entered is

A) Capital.

B) Sales.

C) Cash.

D) Inventory.

A) Capital.

B) Sales.

C) Cash.

D) Inventory.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

37

The sales account is a revenue account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

38

While sales returns and allowances can be debited directly to the sales account, it is better to debit a separate sales returns and allowances account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

39

To a seller, cash discounts are considered the same as sales discounts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

40

A summary accounts receivable account is called a(n)

A) controlling account.

B) balance account.

C) master account.

D) lead account.

A) controlling account.

B) balance account.

C) master account.

D) lead account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

41

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Merchandise returned by a customer for a refund.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Merchandise returned by a customer for a refund.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

42

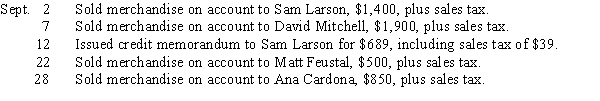

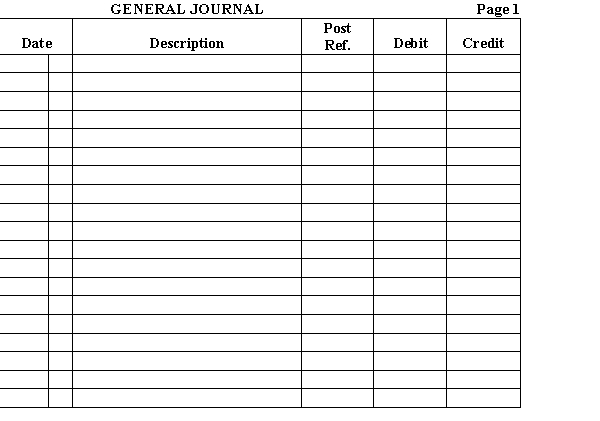

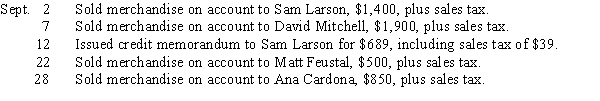

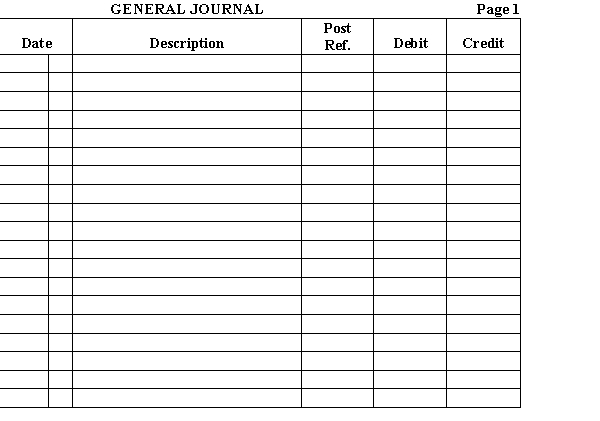

During the month of September, the following transactions occurred. The applicable sales tax rate is 6%. Enter the transactions in the general journal.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

43

To enter a cash sale, the journal entry includes

A) debiting Sales, debiting Sales Tax Payable, and crediting Cash.

B) debiting Sales Tax Payable, debiting Cash, and crediting Sales.

C) debiting Sales, debiting Cash, and crediting Sales Tax Payable.

D) debiting Cash, crediting Sales, and crediting Sales Tax Payable.

A) debiting Sales, debiting Sales Tax Payable, and crediting Cash.

B) debiting Sales Tax Payable, debiting Cash, and crediting Sales.

C) debiting Sales, debiting Cash, and crediting Sales Tax Payable.

D) debiting Cash, crediting Sales, and crediting Sales Tax Payable.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

44

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A transfer of merchandise from one business or individual to another in exchange for cash or a promise to pay cash.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A transfer of merchandise from one business or individual to another in exchange for cash or a promise to pay cash.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

45

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document issued when credit is given for merchandise returned or for an allowance.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document issued when credit is given for merchandise returned or for an allowance.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

46

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A summary account maintained in the general ledger for a subsidiary ledger (for example, the accounts receivable ledger).

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A summary account maintained in the general ledger for a subsidiary ledger (for example, the accounts receivable ledger).

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

47

A common approach to keeping a record of each customer's accounts receivable is to use a

A) sales journal.

B) subsidiary accounts receivable ledger.

C) controlling account.

D) general journal.

A) sales journal.

B) subsidiary accounts receivable ledger.

C) controlling account.

D) general journal.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

48

Merchandise is sold on account for $90, and the sale is subject to a retail sales tax of $6.40. The amount that should be added to Accounts Receivable would be

A) $6.40.

B) $94.60.

C) $83.60.

D) $96.40.

A) $6.40.

B) $94.60.

C) $83.60.

D) $96.40.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

49

From the following data, compute net sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

50

Merchandise returned by the customer for a refund is called a

A) sales return.

B) sales allowance.

C) credit memo.

D) debit memo.

A) sales return.

B) sales allowance.

C) credit memo.

D) debit memo.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

51

Total sales less the sales price of any goods returned by customers, less any reduction in price given to customers, less cash discounts allowed by the seller, is called

A) cost of goods sold.

B) gross margin.

C) net sales.

D) gross profit.

A) cost of goods sold.

B) gross margin.

C) net sales.

D) gross profit.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

52

For the merchant, bank credit card sales are treated in a manner similar to

A) sales on account.

B) cash sales.

C) installment sales.

D) layaway sales.

A) sales on account.

B) cash sales.

C) installment sales.

D) layaway sales.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

53

From the accounts receivable ledger, prepare a schedule of accounts receivable for Robinson's Auto Supply Center as of May 31, 20--.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

54

The source document of a sales transaction is called a

A) sales ticket.

B) sales return.

C) purchase order.

D) purchase receipt.

A) sales ticket.

B) sales return.

C) purchase order.

D) purchase receipt.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

55

From the accounts receivable ledger, prepare a schedule of accounts receivable for Jenn's Country Store as of March 31, 20--.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

56

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

The seller's term for cash discounts.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

The seller's term for cash discounts.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

57

A credit memorandum for $156 (sales price of merchandise, $150; sales tax $6) was issued to a customer for goods returned that had been purchased on account. To enter this transaction properly,

A) Accounts Receivable would be credited for $6.

B) Accounts Receivable would be credited for $150.

C) Accounts Receivable would be credited for $156.

D) Accounts Receivable would not be credited.

A) Accounts Receivable would be credited for $6.

B) Accounts Receivable would be credited for $150.

C) Accounts Receivable would be credited for $156.

D) Accounts Receivable would not be credited.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

58

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Discounts to encourage prompt payment by customers who buy merchandise on account.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Discounts to encourage prompt payment by customers who buy merchandise on account.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

59

The account that would be credited for the amount of tax collected and paid on sales would be

A) Sales.

B) Sales Tax Payable.

C) Cash.

D) Accounts Payable.

A) Sales.

B) Sales Tax Payable.

C) Cash.

D) Accounts Payable.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

60

A list showing the amount due from each customer as of a specified date is known as a

A) trial balance.

B) schedule of accounts payable.

C) schedule of accounts receivable.

D) work sheet.

A) trial balance.

B) schedule of accounts payable.

C) schedule of accounts receivable.

D) work sheet.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

61

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document that is generated to bill the customer who made the purchase.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document that is generated to bill the customer who made the purchase.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

62

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Reductions in the price of merchandise granted by the seller because of defects or other problems with the merchandise.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Reductions in the price of merchandise granted by the seller because of defects or other problems with the merchandise.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

63

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Purchases merchandise such as clothing, furniture, or computers, and sells that merchandise to its customers.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

Purchases merchandise such as clothing, furniture, or computers, and sells that merchandise to its customers.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

64

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document created as evidence of a sale in a retail business.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A document created as evidence of a sale in a retail business.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

65

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

An alphabetical or numerical listing of customer accounts and balances, usually prepared at the end of the month.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

An alphabetical or numerical listing of customer accounts and balances, usually prepared at the end of the month.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck

66

Match the terms with the definitions.a.accounts receivable ledger

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A separate ledger containing an individual account receivable for each customer, kept in either alphabetical or numerical order.

b.cash discounts

c.controlling account

d.credit memo

e.merchandising business

f.sale

g.sales allowances

h.sales discounts

i.sales invoice

j.sales return

k.sales ticket

l.schedule of accounts receivable

A separate ledger containing an individual account receivable for each customer, kept in either alphabetical or numerical order.

Unlock Deck

Unlock for access to all 66 flashcards in this deck.

Unlock Deck

k this deck