Deck 22: Corporations: Bonds

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

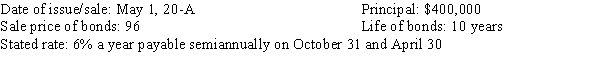

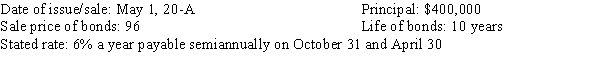

Question

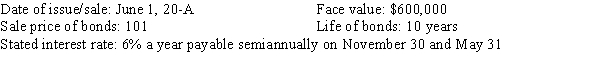

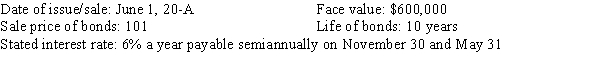

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/98

Play

Full screen (f)

Deck 22: Corporations: Bonds

1

A debenture bond is a common type of secured bond.

False

2

Bonds secured by a mortgage on corporate property are called guaranteed bonds.

False

3

Bonds issued in a series so that a specified amount of principal matures each year are called term bonds.

False

4

Usually, there is either a gain or a loss involved in the redemption of bonds before their maturity date.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

5

A bond is an obligation of the shareholders.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

6

Bonds issued that mature at regular intervals are called serial bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

7

While bonds and notes are both formal written promises to pay an amount of money at a specified date, notes generally tend to be for much smaller amounts and for a shorter period of time.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

8

Premium on Bonds Payable should be classified as a contra-liability account.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

9

Bonds Sinking Fund is reported as a liability on the corporation's balance sheet.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

10

Bondholders are the owners of the corporation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

11

A discount amortization effects a gradual reduction of the bonds payable account to zero over time.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

12

If the stated interest rate on bonds is less than the current market rate, the bonds will sell at a discount.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

13

Loss on Redemption generally is reported as other expense near the bottom of the income statement.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

14

The straight-line method of amortizing a bond premium or discount provides for amortizing an equal amount each time period.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

15

Bonds payable less the discount on bonds payable is called the carrying value of the bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

16

Gain on Redemption is reported as a component of other income on the corporation's income statement.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

17

The process of adjusting the bond interest expense account for any premium or discount is called amortization of the premium or discount.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

18

When bonds are issued at a discount, both bonds payable on the balance sheet and interest expense on the income statement are affected.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

19

A discount amortization does not affect the amount of cash paid for bond interest.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

20

The Discount on Bonds Payable balance is subtracted from Bonds Payable on the income statement.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

21

When bonds are redeemed at a loss, the journal entry would require a credit to Extraordinary Loss on Early Extinguishment of Debt.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

22

If the interest rate on bonds is lower than the current market rate, the bonds will sell at a premium.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

23

Convertible bonds give the issuing corporation the option of calling for redemption at a stated price before maturity date.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

24

The interest rate specified in a bond contract is known as the market rate.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

25

If bonds that originally were sold at a premium are redeemed, the calculation of the gain or loss must take into account the unamortized premium through the date of redemption.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

26

If the interest rate on bonds is the same as the current market rate, the bonds will sell for their face value.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

27

Bonds issued with a provision that they may be called for redemption before the date of maturity are called convertible bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

28

If a corporation issues term bonds, each bond will have the same maturity date.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

29

Convertible bonds are

A) bonds that all have the same maturity date.

B) bonds issued in a series so that a specified amount of the bonds matures each year.

C) bonds that give the issuing corporation the option of calling the bonds for redemption before the maturity date.

D) bonds that give the holder the option of exchanging the bonds for capital stock of the corporation.

A) bonds that all have the same maturity date.

B) bonds issued in a series so that a specified amount of the bonds matures each year.

C) bonds that give the issuing corporation the option of calling the bonds for redemption before the maturity date.

D) bonds that give the holder the option of exchanging the bonds for capital stock of the corporation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

30

An entry to record the sale and issuance of bonds at a discount will include a credit to Discount on Bonds Payable.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

31

Names and addresses of owners of coupon bonds are recorded and kept current in the corporate records.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

32

If bonds that originally were sold at face value are redeemed for less than face value, a gain results.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

33

The sum of bonds payable and premium on bonds payable is called the carrying value of the bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

34

The accumulation and investment of money over a period of years that provides the amount necessary for the redemption of a bond issued at its maturity is called a sinking fund.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

35

A $100,000 bond issue sold at 103 has a market price of $100,300.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

36

Debenture bonds are backed by specific assets of the corporation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

37

If cash is paid to a trustee who administers a sinking fund, the corporation would credit the Bond Sinking Fund for the amount of cash paid.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

38

To determine whether a bond will sell at a price equal to, greater than, or less than face value, compare the stated and market interest rates.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

39

Premium on Bonds Payable should be classified as an adjunct-liability account.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

40

Bonds Payable is reported as a long-term liability on the corporation's balance sheet.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

41

Bonds that are backed solely by specific secured assets are called

A) mortgage bonds.

B) guaranteed bonds.

C) collateral bonds.

D) debenture bonds.

A) mortgage bonds.

B) guaranteed bonds.

C) collateral bonds.

D) debenture bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

42

Bonds issued at the same time so that they all have the same maturity date are called

A) term bonds.

B) serial bonds.

C) convertible bonds.

D) callable bonds.

A) term bonds.

B) serial bonds.

C) convertible bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

43

Usually, there is a gain or loss involved when bonds are redeemed before maturity. The gain or loss is the difference between

A) the amount paid to redeem the bonds and the carrying value of the bonds.

B) the maturity value of the bonds and the market value of the bonds.

C) the carrying value of the bonds and the face value of the bonds.

D) the maturity value of the bonds and the carrying value of the bonds.

A) the amount paid to redeem the bonds and the carrying value of the bonds.

B) the maturity value of the bonds and the market value of the bonds.

C) the carrying value of the bonds and the face value of the bonds.

D) the maturity value of the bonds and the carrying value of the bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

44

If the rate of interest on bonds is lower that the current market rate, the bonds will sell at

A) a discount.

B) a premium.

C) face value.

D) maturity value.

A) a discount.

B) a premium.

C) face value.

D) maturity value.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

45

Bonds issued giving the holder the option of exchanging the bonds for capital stock of the corporation are called

A) term bonds.

B) convertible bonds.

C) capital stock bonds.

D) callable bonds.

A) term bonds.

B) convertible bonds.

C) capital stock bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

46

If the interest rate on bonds is higher than the current market rate, they will sell at

A) a discount.

B) a premium.

C) face value.

D) maturity value.

A) a discount.

B) a premium.

C) face value.

D) maturity value.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

47

Bond Interest Payable is reported as a(n)

A) current liability on the income statement.

B) current liability on the balance sheet.

C) adjunct-liability on the balance sheet.

D) contra-liability on the income statement.

A) current liability on the income statement.

B) current liability on the balance sheet.

C) adjunct-liability on the balance sheet.

D) contra-liability on the income statement.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

48

When selling bonds at a premium, the premium received effectively

A) reduces the cost of borrowing.

B) increases the cost of borrowing.

C) does not affect the cost of borrowing.

D) reduces the amount of cash received when bonds are sold.

A) reduces the cost of borrowing.

B) increases the cost of borrowing.

C) does not affect the cost of borrowing.

D) reduces the amount of cash received when bonds are sold.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

49

If bonds were originally sold at face value and the corporation pays more than the face amount when the bonds are redeemed, there is a

A) loss.

B) gain.

C) premium.

D) discount.

A) loss.

B) gain.

C) premium.

D) discount.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

50

The sale and issuance of $400,000, 8% bonds with a market rate of 8% would involve debiting Cash for

A) $32,000.

B) $368,000.

C) $400,000.

D) $432,000.

A) $32,000.

B) $368,000.

C) $400,000.

D) $432,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

51

If bonds were being issued with a stated rate of 8% and the market rate is 9%, the bonds would most likely sell at which of the following?

A) 108

B) 100

C) 95

D) 80

A) 108

B) 100

C) 95

D) 80

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

52

The premium on bonds payable account would be classified as a(n)

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) noncurrent liability.

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) noncurrent liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

53

Bondholders have which of the following relationships with a corporation?

A) They are creditors.

B) They are owners.

C) They become members of the board.

D) They are silent managers.

A) They are creditors.

B) They are owners.

C) They become members of the board.

D) They are silent managers.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

54

The discount on bonds payable account would be classified as a(n)

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) noncurrent liability.

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) noncurrent liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

55

Bonds secured by a mortgage on corporate property are called

A) mortgage bonds.

B) property bonds.

C) investment bonds.

D) adjustment bonds.

A) mortgage bonds.

B) property bonds.

C) investment bonds.

D) adjustment bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

56

When the selling price of a bond is stated at 100, it means that the bonds are selling

A) at a premium.

B) at a discount.

C) below par value.

D) at face value.

A) at a premium.

B) at a discount.

C) below par value.

D) at face value.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

57

Two of the main factors in determining the price at which bonds will sell are

A) the contract rate and the coupon rate.

B) the contract rate and the stated rate.

C) the market rate and the discount rate.

D) the stated rate and the market rate.

A) the contract rate and the coupon rate.

B) the contract rate and the stated rate.

C) the market rate and the discount rate.

D) the stated rate and the market rate.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

58

Bonds issued in a series so that a specified amount of the bond matures each year are called

A) term bonds.

B) serial bonds.

C) convertible bonds.

D) callable bonds.

A) term bonds.

B) serial bonds.

C) convertible bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

59

The bonds payable account would be classified as a(n)

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) long-term liability.

A) current liability.

B) adjunct-liability.

C) contra-liability.

D) long-term liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

60

Bonds issued with a provision that they may be called for redemption before the date of maturity are known as

A) convertible bonds.

B) term bonds.

C) debenture bonds.

D) callable bonds.

A) convertible bonds.

B) term bonds.

C) debenture bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

61

A ten-year bond issue of $400,000, interest rate of 9% paid semiannually, is sold for $440,000 when the market rate is 8%. The bonds were not sold between interest dates and the straight-line amortization method is used. The entry to record the first interest payment would include

A) a debit to Cash of $18,000.

B) a debit to Bond Interest Payable of $18,000.

C) a debit to Premium on Bonds Payable of $2,000.

D) a credit to Bond Interest Expense of $16,000.

A) a debit to Cash of $18,000.

B) a debit to Bond Interest Payable of $18,000.

C) a debit to Premium on Bonds Payable of $2,000.

D) a credit to Bond Interest Expense of $16,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

62

Gia Company had the following bond issue:

Date of issue/sale: April 1, 20-A

Face value: $200,000

Sale price of bonds: 99

Life of bonds: 10 years

Stated interest rate: 6% a year payable semiannually on September 30 and March 31

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on April 1, 20-A.

b.

The interest payment and premium amortization for first six months.

c.

The redemption of $50,000 worth of bonds on April 1, 20-E, at 102.

Date of issue/sale: April 1, 20-A

Face value: $200,000

Sale price of bonds: 99

Life of bonds: 10 years

Stated interest rate: 6% a year payable semiannually on September 30 and March 31

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on April 1, 20-A.

b.

The interest payment and premium amortization for first six months.

c.

The redemption of $50,000 worth of bonds on April 1, 20-E, at 102.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

63

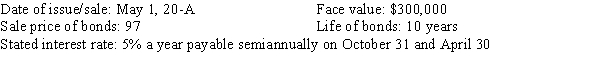

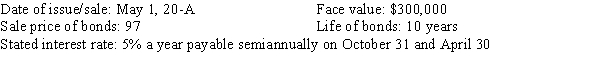

Fireside, Inc. had the following bond issue:

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

64

Baradzi Corporation had the following bond issue:

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on June 1, 20-A.

b.

The interest payment and premium amortization on the bonds for November 30, 20-A.

c.

The year-end adjusting entry for interest expense and premium amortization, 20-A.

d.

The reversing entry for January 1, 20-B.

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on June 1, 20-A.

b.

The interest payment and premium amortization on the bonds for November 30, 20-A.

c.

The year-end adjusting entry for interest expense and premium amortization, 20-A.

d.

The reversing entry for January 1, 20-B.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

65

A $200,000, 8% bond issue was sold at face value and later redeemed at 104% of face value. The corporation would have a

A) loss of $8,000.

B) gain of $8,000.

C) loss of $20,000.

D) gain of $20,000.

A) loss of $8,000.

B) gain of $8,000.

C) loss of $20,000.

D) gain of $20,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

66

Omni Video Corporation had the following bond issue:

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The interest payment and discount amortization on the bonds for October 31, 20-A.

c.

The redemption of $100,000 worth of bonds on November 1, 20-F, at 98.

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The interest payment and discount amortization on the bonds for October 31, 20-A.

c.

The redemption of $100,000 worth of bonds on November 1, 20-F, at 98.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

67

Roof Top Corporation had the following bond issue:

Date of issue/sale: May 1, 20-A

Principal: $400,000

Sale price of bonds: 98

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment.

c.

The redemption of $100,000 worth of bonds on May 1, 20-D, at 99.

Date of issue/sale: May 1, 20-A

Principal: $400,000

Sale price of bonds: 98

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment.

c.

The redemption of $100,000 worth of bonds on May 1, 20-D, at 99.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

68

A ten-year bond issue of $400,000, interest rate of 9% paid semiannually, is sold for $440,000 when the market rate is 8%. The bonds were not sold between interest dates and the straight-line amortization method is used. The bond interest expense for the first interest payment would be

A) $2,000.

B) $16,000.

C) $18,000.

D) $32,000.

A) $2,000.

B) $16,000.

C) $18,000.

D) $32,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

69

Match the terms with the definitions.a.amortization

b.bond

c.bond indenture

d.bond sinking fund

e.callable bonds

f.carrying value

g.convertible bonds

h.coupon bonds

i.debenture bonds

j.discount

k.face value

l.market rate

m.mortgage bonds

n.premium

o.principal

p.registered bonds

q.secured bonds

r.serial bonds

s.stated rate

t.term bonds

The difference between the face value and the price of a bond when the current market interest rate is less than the stated rate of that bond.

b.bond

c.bond indenture

d.bond sinking fund

e.callable bonds

f.carrying value

g.convertible bonds

h.coupon bonds

i.debenture bonds

j.discount

k.face value

l.market rate

m.mortgage bonds

n.premium

o.principal

p.registered bonds

q.secured bonds

r.serial bonds

s.stated rate

t.term bonds

The difference between the face value and the price of a bond when the current market interest rate is less than the stated rate of that bond.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

70

Clearview Corporation had the following bond issue:

Date of issue/sale: March 1, 20-A

Face value: $700,000

Sale price of bonds: 103

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on August 31 and February 28

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on March 1, 20-A.

b.

The interest payment and premium amortization on the bonds for the first six months.

c.

The year-end adjusting entry for interest and premium amortization.

d.

The reversing entry for January 1, 20-B.

Date of issue/sale: March 1, 20-A

Face value: $700,000

Sale price of bonds: 103

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on August 31 and February 28

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on March 1, 20-A.

b.

The interest payment and premium amortization on the bonds for the first six months.

c.

The year-end adjusting entry for interest and premium amortization.

d.

The reversing entry for January 1, 20-B.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

71

Perez Corporation pays $47,000 into a bond sinking fund each year for the future redemption of bonds. During the first year, the fund earns $3,825. When the bonds mature, there is a balance in the sinking fund of $417,000, of which $400,000 is used to redeem the bonds.

Required:

Prepare the following general journal entries.

a.

The initial sinking fund deposit.

b.

The first year's interest for the sinking fund.

c.

The redemption of the bonds.

d.

The return of excess cash to the corporation.

Required:

Prepare the following general journal entries.

a.

The initial sinking fund deposit.

b.

The first year's interest for the sinking fund.

c.

The redemption of the bonds.

d.

The return of excess cash to the corporation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

72

City Slicker Corporation pays $55,000 into a bond sinking fund each year for the future redemption of bonds. During the first year, the fund earns $1,475. When the bonds mature, there is a sinking fund balance of $612,000, and $600,000 is needed to redeem the bonds.

Required:

Prepare the following general journal entries.

a.

The initial sinking fund deposit.

b.

The first year's earnings.

c.

The redemption of the bonds.

d.

The return of excess cash to the corporation.

Required:

Prepare the following general journal entries.

a.

The initial sinking fund deposit.

b.

The first year's earnings.

c.

The redemption of the bonds.

d.

The return of excess cash to the corporation.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

73

Match the terms with the definitions.a.amortization

b.bond

c.bond indenture

d.bond sinking fund

e.callable bonds

f.carrying value

g.convertible bonds

h.coupon bonds

i.debenture bonds

j.discount

k.face value

l.market rate

m.mortgage bonds

n.premium

o.principal

p.registered bonds

q.secured bonds

r.serial bonds

s.stated rate

t.term bonds

A written promise to pay a specific sum of money at a specific future date.

b.bond

c.bond indenture

d.bond sinking fund

e.callable bonds

f.carrying value

g.convertible bonds

h.coupon bonds

i.debenture bonds

j.discount

k.face value

l.market rate

m.mortgage bonds

n.premium

o.principal

p.registered bonds

q.secured bonds

r.serial bonds

s.stated rate

t.term bonds

A written promise to pay a specific sum of money at a specific future date.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

74

The year-end adjusting entry required for bonds issued at a discount would require

A) a debit to Bond Interest Expense, a debit to Discount on Bonds Payable, and a credit to Cash.

B) a debit to Bond Interest Expense, a debit to Discount on Bonds Payable, and a credit to Bond Interest Payable.

C) a debit to Bond Interest Expense, a credit to Discount on Bonds Payable, and a credit to Cash.

D) a debit to Bond Interest Expense, a credit to Discount on Bonds Payable, and a credit to Bond Interest Payable.

A) a debit to Bond Interest Expense, a debit to Discount on Bonds Payable, and a credit to Cash.

B) a debit to Bond Interest Expense, a debit to Discount on Bonds Payable, and a credit to Bond Interest Payable.

C) a debit to Bond Interest Expense, a credit to Discount on Bonds Payable, and a credit to Cash.

D) a debit to Bond Interest Expense, a credit to Discount on Bonds Payable, and a credit to Bond Interest Payable.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

75

The carrying value of bonds is calculated by

A) subtracting the premium on bonds payable account balance from the bonds payable account balance.

B) adding the premium on bonds payable account balance to the bonds payable account balance.

C) adding the discount on bonds payable account balance to the bonds payable account balance.

D) adding the bonds payable account balance to the bond interest payable account balance.

A) subtracting the premium on bonds payable account balance from the bonds payable account balance.

B) adding the premium on bonds payable account balance to the bonds payable account balance.

C) adding the discount on bonds payable account balance to the bonds payable account balance.

D) adding the bonds payable account balance to the bond interest payable account balance.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

76

A bond issue of $500,000 selling at 100, would require a journal entry including a

A) credit to Cash of $500,000.

B) credit to Premium on Bonds Payable for $500,000.

C) credit to Bonds Payable of $500,000.

D) debit to Bonds Payable of $500,000.

A) credit to Cash of $500,000.

B) credit to Premium on Bonds Payable for $500,000.

C) credit to Bonds Payable of $500,000.

D) debit to Bonds Payable of $500,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

77

A bond issue of $100,000 selling at 98, would require a journal entry including a

A) debit to Bonds Payable for $98,000.

B) credit to Cash for $98,000.

C) credit to Premium of Bonds Payable for $2,000.

D) debit to Discount on Bonds Payable for $2,000.

A) debit to Bonds Payable for $98,000.

B) credit to Cash for $98,000.

C) credit to Premium of Bonds Payable for $2,000.

D) debit to Discount on Bonds Payable for $2,000.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

78

Bonds classified as to the timing of principal payments include all of the following EXCEPT

A) term bonds.

B) serial bonds.

C) debenture bonds.

D) callable bonds.

A) term bonds.

B) serial bonds.

C) debenture bonds.

D) callable bonds.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

79

Island Cove Corporation had the following bond issue:

Date of issue/sale: May 1, 20-A

Principal: $500,000

Sale price of bonds: 104

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Date of issue/sale: May 1, 20-A

Principal: $500,000

Sale price of bonds: 104

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

80

HiLi Corporation had the following bond issue:

Date of issue/sale: May 1, 20-A

Principal: $500,000

Sale price of bonds: 100

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Date of issue/sale: May 1, 20-A

Principal: $500,000

Sale price of bonds: 100

Life of bonds: 10 years

Stated rate: 6% a year payable semiannually on October 31 and April 30

Required:

Prepare the following general journal entries.

a.

The issuance of the bonds on May 1, 20-A.

b.

The first interest payment for 20-A.

c.

The adjusting entry for December 31, 20-A.

d.

The reversing entry for January 1, 20-B.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck