Deck 12: Income Distribution, Poverty, and Discrimination

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/130

Play

Full screen (f)

Deck 12: Income Distribution, Poverty, and Discrimination

1

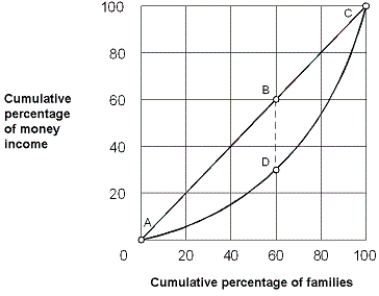

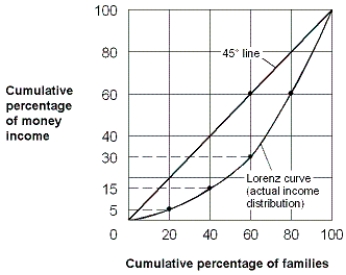

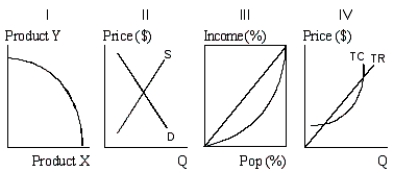

Exhibit 12-1 Income distribution for three countries

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country III, we can conclude that the:

A) majority of the people receive the majority of the income.

B) richest 20 percent of the population received 75 percent of the economy's income.

C) richest 20 percent of the population received 78 percent of the economy's income.

D) richest 40 percent of the population received 78 percent of the economy's income.

E) least-wealthy 40 percent of the population received 78 percent of the economy's income.

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country III, we can conclude that the:

A) majority of the people receive the majority of the income.

B) richest 20 percent of the population received 75 percent of the economy's income.

C) richest 20 percent of the population received 78 percent of the economy's income.

D) richest 40 percent of the population received 78 percent of the economy's income.

E) least-wealthy 40 percent of the population received 78 percent of the economy's income.

richest 40 percent of the population received 78 percent of the economy's income.

2

Exhibit 12-1 Income distribution for three countries

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country I we can conclude that the:

A) richest 20 percent of the population received 25 percent of the economy's income.

B) richest 20 percent of the population received 40 percent of the economy's income.

C) richest 20 percent of the population received 80 percent of the economy's income.

D) least-wealthy 20 percent of the population received 40 percent of the economy's income.

E) richest 40 percent of the population received 25 percent of the economy's income.

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country I we can conclude that the:

A) richest 20 percent of the population received 25 percent of the economy's income.

B) richest 20 percent of the population received 40 percent of the economy's income.

C) richest 20 percent of the population received 80 percent of the economy's income.

D) least-wealthy 20 percent of the population received 40 percent of the economy's income.

E) richest 40 percent of the population received 25 percent of the economy's income.

richest 20 percent of the population received 40 percent of the economy's income.

3

Which of the following statements is true?

A) Income distribution in the United States has gotten progressively more unequal since 1929.

B) The Lorenz curve indicates the degree of discrimination in an economy.

C) The Lorenz curve indicates the degree of income inequality in an economy.

D) The richest 5% of Americans earn approximately half of the nation's income.

E) All of these.

A) Income distribution in the United States has gotten progressively more unequal since 1929.

B) The Lorenz curve indicates the degree of discrimination in an economy.

C) The Lorenz curve indicates the degree of income inequality in an economy.

D) The richest 5% of Americans earn approximately half of the nation's income.

E) All of these.

C

4

Exhibit 12-1 Income distribution for three countries

-Exhibit 12-1 shows the percentage of income received by each population quintile. From this chart we can conclude:

A) Country I has the most unequal income distribution.

B) Country III has the most equal income distribution.

C) Country II has the most unequal income distribution.

D) Country II has the most equal income distribution.

E) Country III has a more equal income distribution than Country II.

-Exhibit 12-1 shows the percentage of income received by each population quintile. From this chart we can conclude:

A) Country I has the most unequal income distribution.

B) Country III has the most equal income distribution.

C) Country II has the most unequal income distribution.

D) Country II has the most equal income distribution.

E) Country III has a more equal income distribution than Country II.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

5

If we compare median family income in the U.S. for families headed by an adult with no more than a high school education to that of families headed by an adult with a bachelor's degree, which of the following best describes what we will find?

A) Median family income for families headed by an adult with a bachelor's degree is approximately 70 percent higher than families headed by an adult no more than a high school education.

B) Median family income for families headed by an adult with a bachelor's degree is approximately 25 percent higher than families headed by an adult no more than a high school education.

C) Median family income for families headed by an adult with a bachelor's degree is approximately 50 percent higher than families headed by an adult no more than a high school education.

D) Median family income for families headed by an adult with a bachelor's degree is approximately 90 percent higher than families headed by an adult no more than a high school education.

A) Median family income for families headed by an adult with a bachelor's degree is approximately 70 percent higher than families headed by an adult no more than a high school education.

B) Median family income for families headed by an adult with a bachelor's degree is approximately 25 percent higher than families headed by an adult no more than a high school education.

C) Median family income for families headed by an adult with a bachelor's degree is approximately 50 percent higher than families headed by an adult no more than a high school education.

D) Median family income for families headed by an adult with a bachelor's degree is approximately 90 percent higher than families headed by an adult no more than a high school education.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following countries has a Lorenz curve that is furthest away from the perfect equality line?

A) Brazil.

B) The United States.

C) Czech Republic

D) All have equal income distributions.

A) Brazil.

B) The United States.

C) Czech Republic

D) All have equal income distributions.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

7

According to the statistics, the distribution of money income:

A) fluctuated widely since 1947.

B) changed significantly in favor of the bottom 5 percent.

C) has not changed greatly since 1947.

D) has not changed greatly since 1929.

A) fluctuated widely since 1947.

B) changed significantly in favor of the bottom 5 percent.

C) has not changed greatly since 1947.

D) has not changed greatly since 1929.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

8

Using the Lorenz curve, the degree of income inequality is measured by the:

A) line connecting all points for which a given percentage of families receives exactly that cumulative percentage of income.

B) distance of the Lorenz curve from the line of perfect equality.

C) flat diagonal line that applies to a perfectly elastic demand curve.

D) number of times the Lorenz curve crosses the line of perfect equality.

A) line connecting all points for which a given percentage of families receives exactly that cumulative percentage of income.

B) distance of the Lorenz curve from the line of perfect equality.

C) flat diagonal line that applies to a perfectly elastic demand curve.

D) number of times the Lorenz curve crosses the line of perfect equality.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

9

The Lorenz curve measures the:

A) distribution of income.

B) effectiveness of government transfer payments.

C) extent to which family incomes are affected by welfare.

D) all of these.

A) distribution of income.

B) effectiveness of government transfer payments.

C) extent to which family incomes are affected by welfare.

D) all of these.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

10

Since 1929, the distribution of income in the United States has become:

A) substantially more equal.

B) slightly more equal.

C) slightly more unequal.

D) substantially more unequal.

A) substantially more equal.

B) slightly more equal.

C) slightly more unequal.

D) substantially more unequal.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

11

The highest fifth of all families receive approximately ____ of the distribution of annual money income among families.

A) 5 percent

B) 10 percent

C) 25 percent

D) 50 percent

A) 5 percent

B) 10 percent

C) 25 percent

D) 50 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following most closely represents the share of total U.S. income to the poorest 20 percent of all U.S. families?

A) 47 percent.

B) 23 percent.

C) 10 percent.

D) 4 percent.

A) 47 percent.

B) 23 percent.

C) 10 percent.

D) 4 percent.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following countries has the most unequal distribution of income?

A) The United States.

B) Czech Republic.

C) Brazil.

D) cannot be determined.

A) The United States.

B) Czech Republic.

C) Brazil.

D) cannot be determined.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

14

One of the main tools used by economists to measure the actual distribution of income is the:

A) Lorenz curve.

B) Golden Rule.

C) MR = MC rule.

D) MRP = MRC rule.

A) Lorenz curve.

B) Golden Rule.

C) MR = MC rule.

D) MRP = MRC rule.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

15

Exhibit 12-1 Income distribution for three countries

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country II we can conclude that the:

A) least-wealthy 20 percent of the population received 75 percent of the economy's income.

B) least-wealthy 20 percent of the population received 25 percent of the economy's income.

C) richest 20 percent of the population received 25 percent of the economy's income.

D) richest 40 percent of the population received 25 percent of the economy's income.

E) least-wealthy 40 percent of the population received 25 percent of the economy's income.

-Exhibit 12-1 shows the percentage of income received by each population quintile. In Country II we can conclude that the:

A) least-wealthy 20 percent of the population received 75 percent of the economy's income.

B) least-wealthy 20 percent of the population received 25 percent of the economy's income.

C) richest 20 percent of the population received 25 percent of the economy's income.

D) richest 40 percent of the population received 25 percent of the economy's income.

E) least-wealthy 40 percent of the population received 25 percent of the economy's income.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

16

A graph that shows the cumulative shares of income received by a family is a:

A) Distribution curve.

B) Lorenz curve.

C) Ricardian curve.

D) Quintlile curve.

A) Distribution curve.

B) Lorenz curve.

C) Ricardian curve.

D) Quintlile curve.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

17

The Lorenz curve shows the:

A) growth of income over time compared to potential growth of income.

B) relative percentage of income going to each of the resources.

C) demand for unskilled versus unskilled labor.

D) actual cumulative percentage of income received compared to a perfectly equal cumulative percentages of income.

A) growth of income over time compared to potential growth of income.

B) relative percentage of income going to each of the resources.

C) demand for unskilled versus unskilled labor.

D) actual cumulative percentage of income received compared to a perfectly equal cumulative percentages of income.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

18

In the United States, approximately what percentage of the total income is earned by the highest 5 percent of the families?

A) 10 percent.

B) 20 percent.

C) 30 percent.

D) 40 percent.

A) 10 percent.

B) 20 percent.

C) 30 percent.

D) 40 percent.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following correctly describes the Lorenz curve?

A) The Lorenz curve shows that the increasing income inequality in the U.S. society is actually good for the economy.

B) The Lorenz curve shows the growth rate in real median family income over time.

C) The Lorenz curve shows the cumulative distribution of family income, ranked from the poorest to the richest families, and compares that curve with the straight line indicating perfectly equal income distribution.

D) The Lorenz curve shows the cumulative distribution of family income, ranked from the richest to the poorest families, and compares that curve with the ideal of having all income go to the richest 5 percent of society.

A) The Lorenz curve shows that the increasing income inequality in the U.S. society is actually good for the economy.

B) The Lorenz curve shows the growth rate in real median family income over time.

C) The Lorenz curve shows the cumulative distribution of family income, ranked from the poorest to the richest families, and compares that curve with the straight line indicating perfectly equal income distribution.

D) The Lorenz curve shows the cumulative distribution of family income, ranked from the richest to the poorest families, and compares that curve with the ideal of having all income go to the richest 5 percent of society.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

20

The poorest 20 percent of the U.S. population received approximately ____ of total income.

A) 5 percent

B) 10 percent

C) 15 percent

D) 20 percent

A) 5 percent

B) 10 percent

C) 15 percent

D) 20 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

21

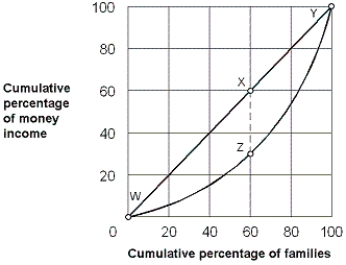

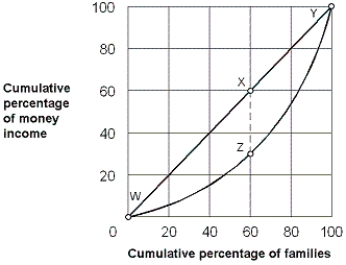

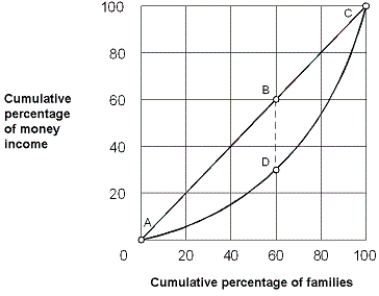

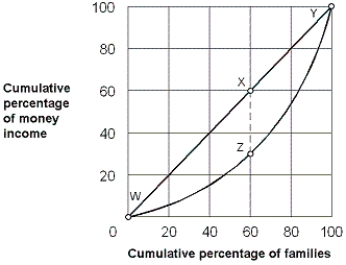

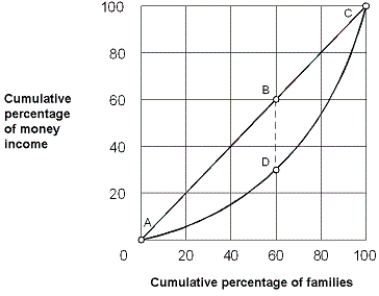

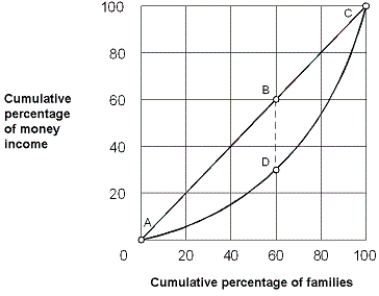

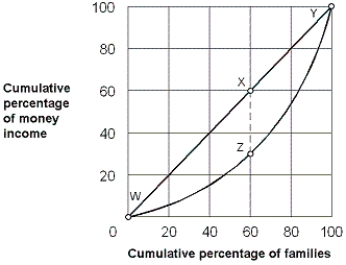

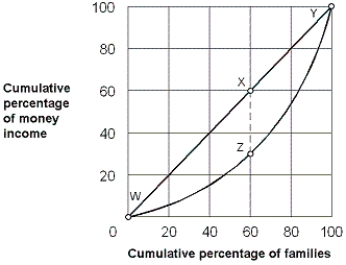

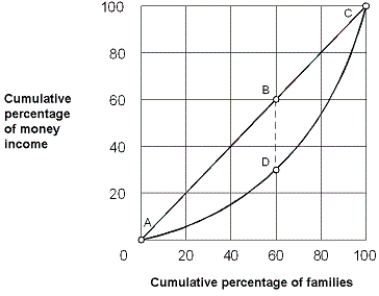

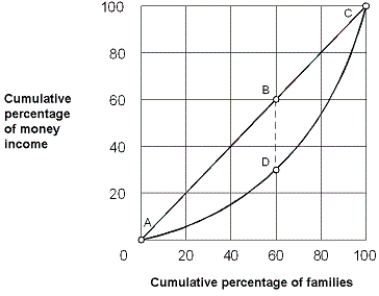

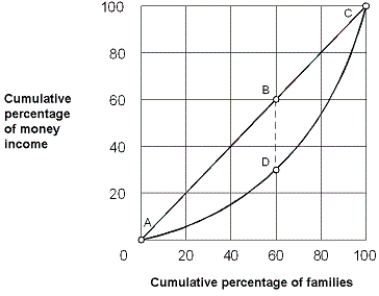

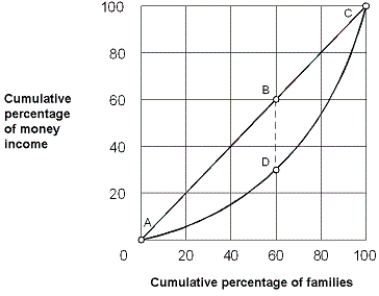

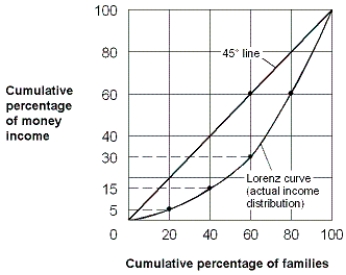

Exhibit 12-4 Lorenz curve

As shown in Exhibit 12-4, 40 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 15

C) 30

D) 50

As shown in Exhibit 12-4, 40 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 15

C) 30

D) 50

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

22

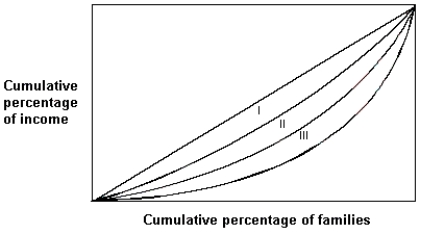

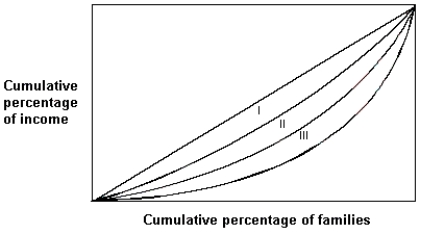

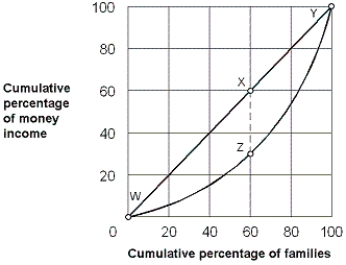

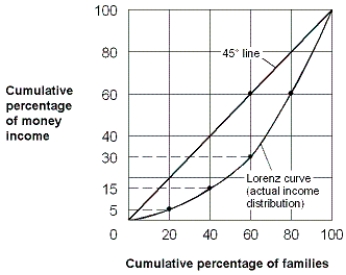

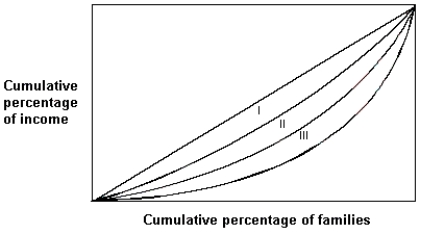

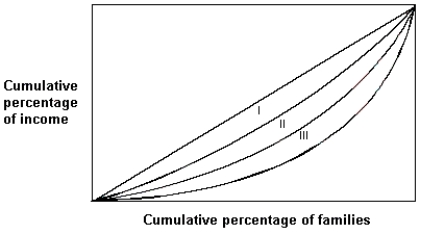

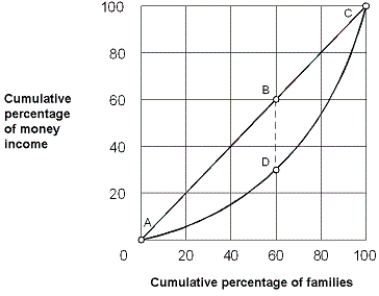

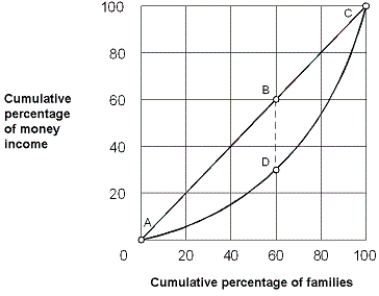

Exhibit 12-6 Lorenz curves

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Of the three countries shown,

A) Country III has the most unequal income distribution.

B) Country II has the most unequal income distribution.

C) Country I has the most unequal income distribution.

D) Country III has the most equal income distribution.

E) Country II has a more equal income distribution than Country I.

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Of the three countries shown,

A) Country III has the most unequal income distribution.

B) Country II has the most unequal income distribution.

C) Country I has the most unequal income distribution.

D) Country III has the most equal income distribution.

E) Country II has a more equal income distribution than Country I.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

23

After 1929 in the United States, as measured by the Lorenz curve, income inequality:

A) increased sharply.

B) remain unchanged.

C) declined.

D) increased.

A) increased sharply.

B) remain unchanged.

C) declined.

D) increased.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

24

Between 1929 and 2005 in the United States, as measured by the Lorenz curve, income inequality:

A) was greater.

B) remain unchanged.

C) was less.

D) increased sharply.

A) was greater.

B) remain unchanged.

C) was less.

D) increased sharply.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

25

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, 80 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

As shown in Exhibit 12-2, 80 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

26

Between 1929 and 2005 in the United States, the Lorenz curve became:

A) less bowed outward.

B) more bowed outward.

C) a straight line.

D) a downward-sloping curve.

A) less bowed outward.

B) more bowed outward.

C) a straight line.

D) a downward-sloping curve.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

27

Exhibit 12-4 Lorenz curve

As shown in Exhibit 12-4, 20 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 10

C) 30

D) 50

As shown in Exhibit 12-4, 20 percent of families earned a cumulative share of about ____ percent of income.

A) 5

B) 10

C) 30

D) 50

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

28

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, 60 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

As shown in Exhibit 12-2, 60 percent of families earned a cumulative share of about ____ of income.

A) 5 percent

B) 15 percent

C) 30 percent

D) 50 percent

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

29

In a Lorenz curve diagram, the 45° line represents:

A) perfect income equality.

B) zero inflation.

C) a negative income tax.

D) an extremely unequal distribution of income.

A) perfect income equality.

B) zero inflation.

C) a negative income tax.

D) an extremely unequal distribution of income.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

30

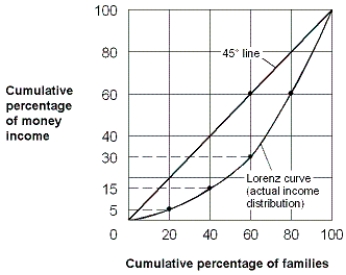

Exhibit 12-3 Lorenz curve for an economy

According to the Lorenz curve shown in Exhibit 12-3, what percentage of total income is earned by the richest 20 percent of families?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

According to the Lorenz curve shown in Exhibit 12-3, what percentage of total income is earned by the richest 20 percent of families?

A) 20 percent.

B) 40 percent.

C) 60 percent.

D) 80 percent.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

31

Exhibit 12-4 Lorenz curve

As shown in Exhibit 12-4, the perfect equality line is drawn between points:

A) W and Y along the curve.

B) X and Z.

C) W and Y along the straight line.

D) W and X.

As shown in Exhibit 12-4, the perfect equality line is drawn between points:

A) W and Y along the curve.

B) X and Z.

C) W and Y along the straight line.

D) W and X.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

32

Exhibit 12-6 Lorenz curves

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Which of the following statements is true?

A) Country I has the most unequal income distribution.

B) Country II has the most unequal income distribution.

C) Country I has the most equal income distribution.

D) Country III has the most equal income distribution.

E) Country II has a more equal income distribution than Country I.

Exhibit 12-6 shows the Lorenz Curve for three countries, I, II, and III. Which of the following statements is true?

A) Country I has the most unequal income distribution.

B) Country II has the most unequal income distribution.

C) Country I has the most equal income distribution.

D) Country III has the most equal income distribution.

E) Country II has a more equal income distribution than Country I.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

33

Economists look at which of the following to get a quick visual expression of income distribution?

A) Gini coefficient.

B) IRS records of how much income each household earned.

C) supply and demand curves for resources.

D) Lorenz curve.

E) surveys of business estimates for MRPs.

A) Gini coefficient.

B) IRS records of how much income each household earned.

C) supply and demand curves for resources.

D) Lorenz curve.

E) surveys of business estimates for MRPs.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

34

A Lorenz curve shows the:

A) number of people in an economy living below the poverty line.

B) percentage of children in an economy who are not receiving adequate nutrition.

C) percentage of the economy's population benefiting from government spending programs.

D) percentage of an economy's total income each part of the population receives.

E) percentage of the population whose income is dependent on sales to foreign countries.

A) number of people in an economy living below the poverty line.

B) percentage of children in an economy who are not receiving adequate nutrition.

C) percentage of the economy's population benefiting from government spending programs.

D) percentage of an economy's total income each part of the population receives.

E) percentage of the population whose income is dependent on sales to foreign countries.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

35

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, the distance between points B and D means that 60 percent of families earn ____ less of total income than required for perfect equality.

A) 30 percent

B) 60 percent

C) 90 percent

D) insufficient information to answer question.

As shown in Exhibit 12-2, the distance between points B and D means that 60 percent of families earn ____ less of total income than required for perfect equality.

A) 30 percent

B) 60 percent

C) 90 percent

D) insufficient information to answer question.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

36

A graph that shows the percentage of the families on one axis and the percentage of income on the other is called the:

A) Budget-distribution curve.

B) Income-consumption curve.

C) Lorenz curve.

D) Marx curve.

A) Budget-distribution curve.

B) Income-consumption curve.

C) Lorenz curve.

D) Marx curve.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

37

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, the degree of unequal income distribution is measured by the area between the:

A) Lorenz curve and the horizontal axis.

B) Lorenz curve and the vertical axis.

C) Perfect equality line and the origin.

D) Perfect equality line and the Lorenz curve.

As shown in Exhibit 12-2, the degree of unequal income distribution is measured by the area between the:

A) Lorenz curve and the horizontal axis.

B) Lorenz curve and the vertical axis.

C) Perfect equality line and the origin.

D) Perfect equality line and the Lorenz curve.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

38

Exhibit 12-3 Lorenz curve for an economy

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Exhibit 12-3 will:

A) move closer to the 45° line.

B) become more bowed outward.

C) lie above the 45° line.

D) shift down and to the right.

If this economy's distribution of income becomes more equal, then the Lorenz curve shown in Exhibit 12-3 will:

A) move closer to the 45° line.

B) become more bowed outward.

C) lie above the 45° line.

D) shift down and to the right.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

39

Exhibit 12-2 Lorenz curve

As shown in Exhibit 12-2, the perfect equality line is drawn between points:

A) A and B.

B) B and D.

C) A and C along the straight line.

D) A and C along the curve.

As shown in Exhibit 12-2, the perfect equality line is drawn between points:

A) A and B.

B) B and D.

C) A and C along the straight line.

D) A and C along the curve.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

40

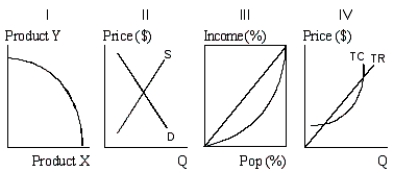

Exhibit 12-5 Economic curves

In Exhibit 12-5, a Lorenz curve is shown in diagram:

A) I.

B) II.

C) III.

D) IV.

E) both I and II.

In Exhibit 12-5, a Lorenz curve is shown in diagram:

A) I.

B) II.

C) III.

D) IV.

E) both I and II.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is an in-kind transfer payment?

A) Medicaid.

B) Social Security.

C) unemployment insurance.

D) Temporary Assistance to Needy Families.

A) Medicaid.

B) Social Security.

C) unemployment insurance.

D) Temporary Assistance to Needy Families.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not included in census income?

A) wages and salaries.

B) property income.

C) cash welfare benefits.

D) in-kind transfers.

A) wages and salaries.

B) property income.

C) cash welfare benefits.

D) in-kind transfers.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following is not counted as income when the official poverty rate is calculated?

A) Medicaid benefits.

B) dividends derived from the ownership of stock.

C) earnings derived from a part-time job.

D) money income derived from transfer payments.

A) Medicaid benefits.

B) dividends derived from the ownership of stock.

C) earnings derived from a part-time job.

D) money income derived from transfer payments.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

44

If 80 percent of the population receives 75 percent of the income,

A) the richest quintile receives 20 percent of the income.

B) the Lorenz curve is the diagonal.

C) income is not perfectly evenly distributed.

D) the poorest quintile receives more than 20 percent of income.

E) people in the middle quintile have the highest incomes.

A) the richest quintile receives 20 percent of the income.

B) the Lorenz curve is the diagonal.

C) income is not perfectly evenly distributed.

D) the poorest quintile receives more than 20 percent of income.

E) people in the middle quintile have the highest incomes.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

45

If official U.S. poverty statistics included in-kind transfer payments the:

A) poverty rate would be close to zero.

B) poverty rate would be lower.

C) government deficit would be lower.

D) top 10 percent of those in the income distribution would be wealthier.

A) poverty rate would be close to zero.

B) poverty rate would be lower.

C) government deficit would be lower.

D) top 10 percent of those in the income distribution would be wealthier.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

46

In an economy where the poorest quintile of the population receives 5 percent of the income, the Lorenz curve:

A) is the diagonal of the box.

B) lies below the diagonal in the box.

C) lies above the diagonal in the box.

D) is the lower right corner of the box.

E) is the upper left corner of the box.

A) is the diagonal of the box.

B) lies below the diagonal in the box.

C) lies above the diagonal in the box.

D) is the lower right corner of the box.

E) is the upper left corner of the box.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

47

Typically, a country's population is divided into how many income groups to find a Lorenz Curve?

A) 1 or 2.

B) 5 or 10.

C) 10 or 20.

D) 25 or 50.

E) 100.

A) 1 or 2.

B) 5 or 10.

C) 10 or 20.

D) 25 or 50.

E) 100.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

48

Of the following demographic groups, which has the lowest poverty rate in the U.S.?

A) Families headed by a female with no adult male present.

B) Families in which the "head of the household" has not attained a high-school education.

C) Families headed by a male with no adult female present.

D) Families in which the "head of the household" has attained at least a bachelor's degree from a college or university.

A) Families headed by a female with no adult male present.

B) Families in which the "head of the household" has not attained a high-school education.

C) Families headed by a male with no adult female present.

D) Families in which the "head of the household" has attained at least a bachelor's degree from a college or university.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

49

The level of money income below which a family is considered poor is called the:

A) bottom 20 percent of the income distribution.

B) poverty income level.

C) guaranteed income level.

D) subsistence income level.

A) bottom 20 percent of the income distribution.

B) poverty income level.

C) guaranteed income level.

D) subsistence income level.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

50

SNAP (food stamps) and Medicaid are examples of:

A) money transfers

B) resource earnings

C) in-kind transfers

D) tax expenditures

A) money transfers

B) resource earnings

C) in-kind transfers

D) tax expenditures

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

51

The largest in-kind transfer program is:

A) Transitory Assistance to Needy Families.

B) Medicaid.

C) Social Security.

D) SNAP (food stamps).

A) Transitory Assistance to Needy Families.

B) Medicaid.

C) Social Security.

D) SNAP (food stamps).

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following is not an in-kind subsidy?

A) SNAP (food stamps).

B) Low-cost rental housing.

C) Medicare.

D) Medicaid.

E) Unemployment compensation.

A) SNAP (food stamps).

B) Low-cost rental housing.

C) Medicare.

D) Medicaid.

E) Unemployment compensation.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

53

When the Lorenz curve moves closer to the diagonal, this shows:

A) the rich getting richer and the poor getting poorer.

B) total income is rising.

C) the distribution of income is becoming more even.

D) the population is decreasing.

E) the prices of goods are rising.

A) the rich getting richer and the poor getting poorer.

B) total income is rising.

C) the distribution of income is becoming more even.

D) the population is decreasing.

E) the prices of goods are rising.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

54

The poverty income level equals the:

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

A) average income of the bottom one-tenth of all income recipients.

B) cost of an economical and nutritional food plan for a family multiplied by six.

C) cost of an economical and nutritional food plan for a family multiplied by three.

D) average income of a family headed by a worker who has been unemployed for six months or more.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

55

The official poverty line is defined as:

A) one-half the average family income.

B) one-third the average family income.

C) three times the cost of a minimal food requirement.

D) two times the cost of a minimal food requirement.

A) one-half the average family income.

B) one-third the average family income.

C) three times the cost of a minimal food requirement.

D) two times the cost of a minimal food requirement.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

56

When the Lorenz curve lies above the diagonal,

A) the poorest 20 percent of the population receive more than 20 percent of income.

B) the richest 20 percent of the population receive more than 20 percent of income.

C) everyone receives the same income.

D) the country's income has been rising over time.

E) it is wrong since it is impossible for the graph to look like this.

A) the poorest 20 percent of the population receive more than 20 percent of income.

B) the richest 20 percent of the population receive more than 20 percent of income.

C) everyone receives the same income.

D) the country's income has been rising over time.

E) it is wrong since it is impossible for the graph to look like this.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

57

For the calculation of a Lorenz curve using quintiles, the:

A) first quintile contains the richest 50 percent of population.

B) first quintile contains the richest 20 percent of population.

C) first quintile contains the poorest 50 percent of population.

D) first quintile contains the poorest 20 percent of population.

E) last quintile contains the poorest 10 percent of population.

A) first quintile contains the richest 50 percent of population.

B) first quintile contains the richest 20 percent of population.

C) first quintile contains the poorest 50 percent of population.

D) first quintile contains the poorest 20 percent of population.

E) last quintile contains the poorest 10 percent of population.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

58

Statistics on families below the poverty line may be overstated because:

A) the poor are primarily children who soon will move out of poverty.

B) poverty in the United States is rich compared to poverty in other nations.

C) the income levels used to measure poverty do not include in-kind transfers.

D) unemployment compensation is a program closed to the poor.

A) the poor are primarily children who soon will move out of poverty.

B) poverty in the United States is rich compared to poverty in other nations.

C) the income levels used to measure poverty do not include in-kind transfers.

D) unemployment compensation is a program closed to the poor.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

59

The official poverty rate for all persons declined sharply between 1959 and:

A) 2000.

B) 1970.

C) 1980.

D) 1990.

A) 2000.

B) 1970.

C) 1980.

D) 1990.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

60

The social security tax is called FICA, which stands for:

A) Federal Investment Corporation of America.

B) Federal Income Contributions to Americans.

C) Funding from Individuals and Corporations in America.

D) Federal Insurance Contributions Act.

A) Federal Investment Corporation of America.

B) Federal Income Contributions to Americans.

C) Funding from Individuals and Corporations in America.

D) Federal Insurance Contributions Act.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

61

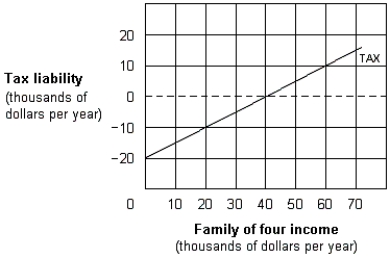

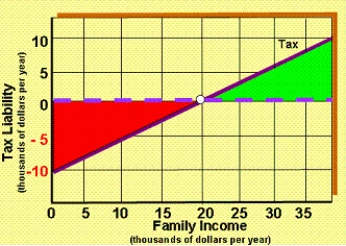

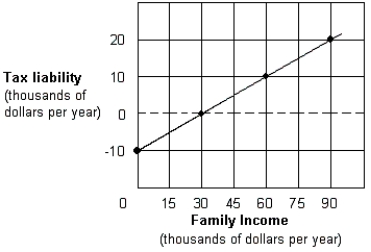

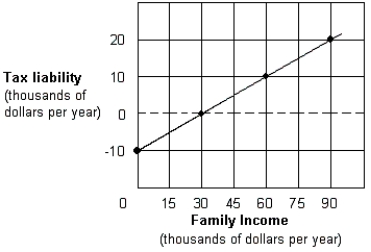

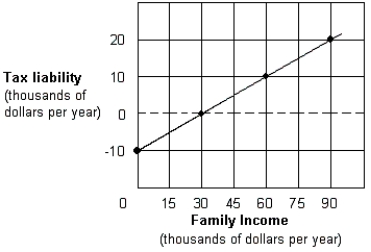

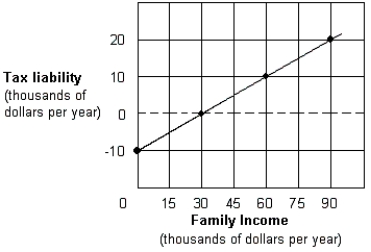

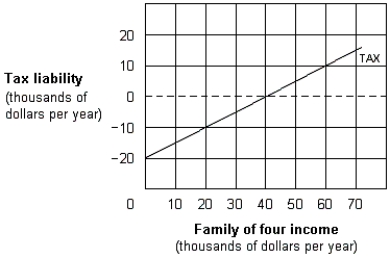

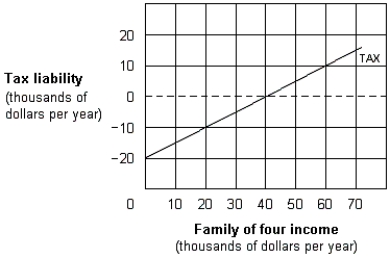

Exhibit 12-7 Negative income tax

As shown in Exhibit 12-7, a family of four pays income taxes at:

A) an income of $5,000.

B) any income between zero and $40,000.

C) all levels of income.

D) any income above $40,000.

As shown in Exhibit 12-7, a family of four pays income taxes at:

A) an income of $5,000.

B) any income between zero and $40,000.

C) all levels of income.

D) any income above $40,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following statements is correct?

A) About 25 percent of the U.S. population earns an income below the poverty line.

B) About 50 percent of blacks earn an income below the poverty line.

C) Since 1980 the fraction of persons below the poverty level has risen sharply.

D) None of these.

A) About 25 percent of the U.S. population earns an income below the poverty line.

B) About 50 percent of blacks earn an income below the poverty line.

C) Since 1980 the fraction of persons below the poverty level has risen sharply.

D) None of these.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

63

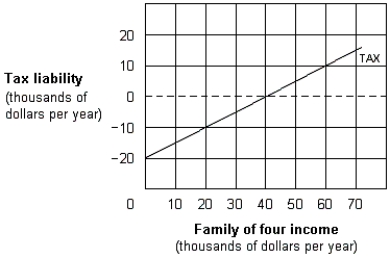

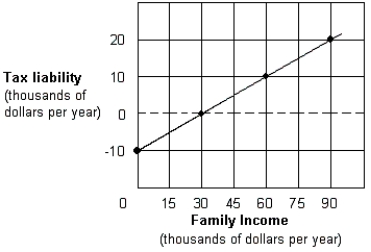

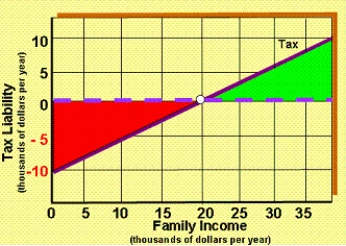

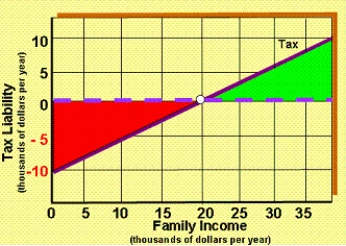

Exhibit 12-9 Negative Income Tax

As shown in Exhibit 12-9, a family of four with an income of $20,000 receives ____ from the government:

A) zero payment

B) the break-even income of $20,000

C) a $10,000 payment

D) a $10,000 tax deferment

As shown in Exhibit 12-9, a family of four with an income of $20,000 receives ____ from the government:

A) zero payment

B) the break-even income of $20,000

C) a $10,000 payment

D) a $10,000 tax deferment

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

64

In the United States since 1970, the poverty rate for blacks has been about:

A) 1−2 percentage points higher than the poverty rate for whites.

B) twice the poverty rate for whites.

C) three times the poverty rate for whites.

D) five times the poverty rate for whites.

A) 1−2 percentage points higher than the poverty rate for whites.

B) twice the poverty rate for whites.

C) three times the poverty rate for whites.

D) five times the poverty rate for whites.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following government programs provides recipients with unrestricted cash payments?

A) Temporary Assistance to Needy Families (TANF).

B) Medicaid.

C) The food stamp program (SNAP).

D) Housing assistance programs.

A) Temporary Assistance to Needy Families (TANF).

B) Medicaid.

C) The food stamp program (SNAP).

D) Housing assistance programs.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

66

The Social Security Act was passed:

A) in 1955.

B) just after World War II.

C) in 1935.

D) in 1964.

A) in 1955.

B) just after World War II.

C) in 1935.

D) in 1964.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

67

The poverty line:

A) separates those on welfare from those not on welfare.

B) equals three times an economy food budget.

C) equals the median income level.

D) all of these.

A) separates those on welfare from those not on welfare.

B) equals three times an economy food budget.

C) equals the median income level.

D) all of these.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

68

Which one of the following examples is a cash assistance program used to fight poverty in the United States?

A) Medicaid.

B) SNAP (food stamps).

C) Home energy assistance.

D) Head Start.

E) Temporary Assistance to Needy Families (TANF).

A) Medicaid.

B) SNAP (food stamps).

C) Home energy assistance.

D) Head Start.

E) Temporary Assistance to Needy Families (TANF).

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

69

Under a negative income tax program,

A) the government guarantees a minimum level of family income.

B) a family must pay income taxes on its welfare check.

C) a family receives a stated amount of money from the government plus its members can keep all income earned through work.

D) the government reduces the welfare payment by any income earned through work.

E) a family's income is lower if its members work.

A) the government guarantees a minimum level of family income.

B) a family must pay income taxes on its welfare check.

C) a family receives a stated amount of money from the government plus its members can keep all income earned through work.

D) the government reduces the welfare payment by any income earned through work.

E) a family's income is lower if its members work.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

70

A negative income tax system would provide all households, including the poor, with:

A) cash payments.

B) incentives to earn income.

C) higher income levels.

D) medical assistance.

E) lower tax bills than it does .

A) cash payments.

B) incentives to earn income.

C) higher income levels.

D) medical assistance.

E) lower tax bills than it does .

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

71

Which of the following statements is true?

A) All people in poverty are on welfare.

B) Unemployment compensation is an example of an in-kind transfer.

C) Temporary Assistance to Needy Families (TANF) is an example of a cash payment made by government to the impoverished.

D) After cash assistance and in-kind transfers are considered the distribution of income in the United States is more unequal.

E) All of these.

A) All people in poverty are on welfare.

B) Unemployment compensation is an example of an in-kind transfer.

C) Temporary Assistance to Needy Families (TANF) is an example of a cash payment made by government to the impoverished.

D) After cash assistance and in-kind transfers are considered the distribution of income in the United States is more unequal.

E) All of these.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

72

Under the negative income tax scheme in Exhibit 12-7, families earning between $10,000 and $40,000 would:

A) receive the maximum negative income tax payment of $20,000.

B) receive payments under the negative income tax.

C) pay no income taxes, but receive no payments.

D) None of these is true.

A) receive the maximum negative income tax payment of $20,000.

B) receive payments under the negative income tax.

C) pay no income taxes, but receive no payments.

D) None of these is true.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

73

Exhibit 12-8 Negative income tax for a family

Under the negative income tax shown in Exhibit 12-8, what cash payment would a family with no earned income receive from the government?

A) $0.

B) $10,000.

C) $15,000.

D) $30,000.

Under the negative income tax shown in Exhibit 12-8, what cash payment would a family with no earned income receive from the government?

A) $0.

B) $10,000.

C) $15,000.

D) $30,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

74

The incentive to work is an ingredient of the negative income tax because:

A) if families do work, they will be eliminated from the program.

B) if families don't work, they will be eliminated from the program.

C) the more income earned in the workplace, the higher the family's after-tax income.

D) the more income earned in the workplace, the higher the payment from the government.

E) the amount earned in the workplace is not subject to income taxes.

A) if families do work, they will be eliminated from the program.

B) if families don't work, they will be eliminated from the program.

C) the more income earned in the workplace, the higher the family's after-tax income.

D) the more income earned in the workplace, the higher the payment from the government.

E) the amount earned in the workplace is not subject to income taxes.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

75

The official U.S. poverty line for a family is calculated by taking 3 times the annual cost of:

A) public housing.

B) basic medical care.

C) utilities and transportation.

D) a minimal diet.

A) public housing.

B) basic medical care.

C) utilities and transportation.

D) a minimal diet.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

76

Exhibit 12-8 Negative income tax for a family

In Exhibit 12-8, consider a family that earns less than the break-even income level. For each $1 of earned income, this family's government payment will be reduced by:

A) $0.10.

B) $0.25.

C) $0.33.

D) $0.50.

In Exhibit 12-8, consider a family that earns less than the break-even income level. For each $1 of earned income, this family's government payment will be reduced by:

A) $0.10.

B) $0.25.

C) $0.33.

D) $0.50.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following government programs provides recipients with in-kind benefits?

A) Temporary Assistance to Needy Families (TANF).

B) Social Security.

C) The food stamp program (SNAP).

D) Unemployment compensation.

A) Temporary Assistance to Needy Families (TANF).

B) Social Security.

C) The food stamp program (SNAP).

D) Unemployment compensation.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

78

Exhibit 12-8 Negative income tax for a family

Starting in 1964, the U.S. government has defined the poverty line as income at or below ________ the amount of money needed to buy a minimum diet for all family members.

A) two times

B) three times

C) four times

D) five times

Starting in 1964, the U.S. government has defined the poverty line as income at or below ________ the amount of money needed to buy a minimum diet for all family members.

A) two times

B) three times

C) four times

D) five times

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

79

Exhibit 12-7 Negative income tax

As shown in Exhibit 12-7, a family of four with no earned income receives ____ from the government.

A) zero payment.

B) the break-even income of $40,000.

C) a $20,000 payment.

D) a $20,000 tax deferment.

As shown in Exhibit 12-7, a family of four with no earned income receives ____ from the government.

A) zero payment.

B) the break-even income of $40,000.

C) a $20,000 payment.

D) a $20,000 tax deferment.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck

80

Exhibit 12-9 Negative Income Tax

As shown in Exhibit 12-9, a family of four does not pay income taxes at:

A) an income of $25,000.

B) any income between zero and $20,000.

C) all levels of income.

D) any income above $20,000.

As shown in Exhibit 12-9, a family of four does not pay income taxes at:

A) an income of $25,000.

B) any income between zero and $20,000.

C) all levels of income.

D) any income above $20,000.

Unlock Deck

Unlock for access to all 130 flashcards in this deck.

Unlock Deck

k this deck